Wrapping up the longest year in history with your questions about means-testing for Social Security, healthcare when one spouse is on Medicare, and how Roth conversions affect your Social Security and Medicare costs, aka IRMAA, the Medicare Income-Related Monthly Adjustment Amount. Plus, the fellas answer more of your real estate questions: can you avoid capital gains when selling a rental property? Should you pay off your rental or keep investing? Is it a good idea to put a home equity line of credit or HELOC on an investment property? And one of the things Joe and Al are good at is hitting nerves, as another listener doesn’t agree with the fellas about paying off the mortgage on your primary residence.

Subscribe to the YMYW newsletter

FOLLOW US: YouTube | Facebook | Twitter | LinkedIn

Show Notes

- (00:52) IRMAA: How Do Roth Conversions Affect Social Security and Medicare?

- (04:08) Means Testing: Should High Net Worth People Take Social Security Early?

- (10:12) Wife’s Medicare vs. Husband’s Medical Benefits

- (15:51) How Do I Avoid Capital Gains When Selling Rental Property?

- (21:10) Pay Off Rental Property or Keep Investing?

- (29:30) Should I Get a HELOC on an Investment Property?

- (34:28) I Don’t Agree About Not Paying Off the Mortgage

Free resources:

LISTEN | YMYW Podcast #226 – Medicare Beginner’s Guide (with Danielle K. Roberts)

Medicare & You: Free download from Medicare.gov

LISTEN | YMYW Podcast #208 – Spousal Social Security Claiming Strategies (with Mary Beth Franklin)

DOWNLOAD | White Paper – Social Security Handbook

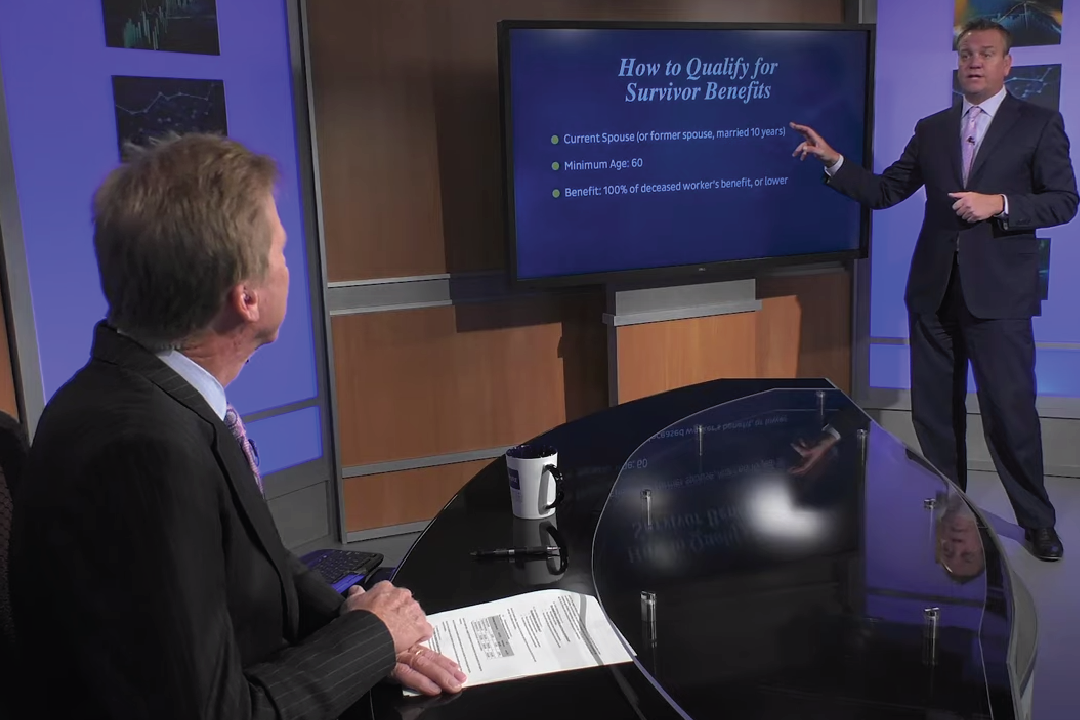

WATCH | YMYW TV – Avoid Social Security Letdown

LISTEN | YMYW Podcast #302 – Should You Pay Off Your Mortgage? First Consider Your Tax Strategy

WATCH | YMYW TV: Get Real About Real Estate in Retirement

Listen to today’s podcast episode on YouTube:

Transcription

Welcome to the final episode of Your Money, Your Wealth® for 2020! We’ll wrap up the longest year in history with your questions about means testing for Social Security, healthcare when one spouse is on Medicare, and how Roth conversions affect your Social Security and Medicare costs, aka IRMAA, the Medicare Income-Related Monthly Adjustment Amount. Plus, the fellas answer more of your real estate questions: can you avoid capital gains when selling a rental property? Should you pay off your rental or keep investing? Is it a good idea to put a home equity line of credit or HELOC on an investment property? And one of the things Joe and Al are good at is hitting nerves, as another listener doesn’t agree with the fellas about paying off the mortgage on your primary residence. I’m producer Andi Last, and here are the hosts of Your Money, Your Wealth®, Joe Anderson, CFP® and Big Al Clopine, CPA.

IRMAA: How Do Roth Conversions Affect Social Security and Medicare?

Joe: Rusty writes in Alan, from San Diego. “I’ve been watching your show for years. I heard you repeated suggestions about doing Roth conversions.” Oh. Are you sure? I think we’ve only talked about Roth conversions once, Rusty. “My question is how do Roth conversions affect your Social Security Medicare costs?” Well, it’s called IRMAA. So it depends on how much income you have, Rusty. And then if you do a Roth IRA conversion, you have to be careful or at least to understand with the amount of conversion that you do, creates income on your tax return. And that income is included in a Medicare surtax or surcharge that will increase your Medicare premiums depending on how high your income is. So yes, it will affect Medicare cost. Will it affect your Social Security? It could create more taxation of your Social Security, but it wouldn’t affect the amount that you receive.

Al: Yeah. I agree with all of that. And when you’re talking about your Medicare costs, that really only matters if you are 63 or older and there’s a 2-year look back. So in other words, if you’re 63 right now, your adjusted gross income, modified adjusted gross income, will affect the amount of Medicare premiums that you pay in 2 years from now. So that’s where it affects it. And just to give you an idea at the lowest level and this is for single person making $87,000 or less married couple making $174,000 or less, the premium for Part B is $144 a month. And then if you get above $500,000 single, $750,000 married, that’s at the other end of the extreme, it’s $492. So that’s the range. And there are different points along the way. So when you do your Roth conversion, you certainly want to look at how much tax you’re paying. But if you are subject to Medicare or will be in 2 years from now, you also want to consider that as well.

Joe: Alan, if I have a modified adjusted gross income- so if the tables- let’s say a married couple is $174,000 is what the modified adjusted gross income limit is, and their Medicare premium is $144.60. That’s their Part B premium. And then the next level is $202. $202. So it’s around $60 more.

Al: Yeah that’s right.

Joe: And so if I have an adjusted gross income or modified adjusted gross income of $174,001, that would increase my Medicare premium by $60 per week.

Al: Per month, yeah.

Joe: Per month. So just be very careful there because $1 over will put you right here in the next bracket.

Al: And this is one of the things that we call a cliff. A lot of IRS has graduated schedules, this is a cliff. You go $1 over, all the sudden it’s $60 more per month times 12 months. So just be aware of that.

Joe: OK. Thanks for the question, Rusty.

Means Testing: Should High Net Worth People Take Social Security Early?

Joe: We got Eric calling in, or writes in, from Las Vegas. “Hey Joe, Al and Andi, thank you very much for your great podcast. Doing the dishes have never been more fun.” So Eric is just grinding away in the kitchen.

Al: Yeah, every night he listens to us while he’s loading the dishwasher.

Joe: “I recently heard you mention that high net worth individuals and couples should consider taking Social Security early because it will likely face means testing in the future resulting in a reduction in benefits for those who don’t need it. Would you please elaborate on this strategy i.e. what level of income and at what age? Thank you. Eric from Las Vegas. P.S. I drive-” you know, since he’s high net worth, I’m anxious to see here.

Al: Yeah right.

Joe: “I drive a 2007 Lexus SUV?

Al: Yeah.

Joe: And he’s got a terrier. A Carin? Carin?

Andi: Cairn.

Al: Cairn. Cairn Terrier.

Joe: Oh, it’s like a Toto.

Al: So a Lexus SUV is a nice car. 13 years old though. I mean that could show that he’s frugal. He runs his cars into the ground, which I like that.

Joe: Yeah. All right. So I don’t-

Al: You don’t recall ever saying that? Me neither.

Andi: Somebody else’s show?

Joe: No, no. Here’s what I said is that Social Security- when we talk about Social Security we say ok, well the trust fund is going to be depleted in what 2033 or 2035 depending on what study that you look at. And so what’s the solution for Social Security? And we talk about multiple solutions that could increase the FICA tax. So right now at about $130,000 some odd, or I could probably tell you the exact-

Al: $137,000.

Joe: Okay $137,000. We do not put any more dollars from taxes or FICA taxes into the Social Security trust fund. We still pay Medicare but we do not pay into Social Security which is 6.2%. If you’re self-employed it’s 12.4%. So we could increase the income limit there. That’s one way to do it.

Al: We could. And by the way there’s been proposals to increase that to closer to $200,000.

Joe: Right. Or it kicks back in after a certain income of like $250,000 or $300,000 of income.

Al: Yeah that’s Biden’s idea is bring it back at $400,000. So there’s a range where you don’t have it, then it comes back.

Joe: Another way is that they could decrease benefits because right now as is, if they don’t do anything, around 70ish%, 75% of the stated benefits would be able to get paid out. So they need to cover this gap. And so how do they do it? They could do nothing and just say hey we’re going to pay you lower benefits. They could probably push out the age for Social Security. That’s another way to look at it. Or some other experts are saying this could be means-tested. We just talked about IRMAA, stating that from a certain income limit, the higher the income that you go, that Medicare premium jumps up. So who’s to say that the higher the income that you have on your tax return, the lower Social Security benefits that you’re going to receive? Maybe like an added tax. Who knows? Or be phased out or means-tested? That was just an idea that some experts threw out. So when we talk about people that have very large retirement accounts or might have pensions and also have Social Security, we may look at them taking those benefits early. Just the fact that take it while you can get it. Because those would be prime candidates if they were to do a means test or to do something in regards to eliminating some of the benefits for people that have high income. That was just a thought on- it was on a checklist of maybe 6 or 7 different things that we talked about.

Al: Yes I agree with that. It’s been discussed. It has not been talked about recently. And the other things that you mentioned, like raising the dollar amount in your wages to have more Social Security going in or raising the rate from 6.2% to 6.5% or increasing the retirement age from 67 to 68, 69. These are all things that have been done in the past. And will likely continue to be done and is the likely way that Social Security will be fixed. However, in the same breath, sometimes people talk about means-testing. At the moment, no one’s talking about it. So I’m not worried currently. But it’s just something to think about in the back of your mind. So the fact that we said it will likely face means testing, no, I would say it’s unlikely to face means-testing. But it’s possible.

Joe: It may.

Al: It may. It may. It’s not likely though.

Joe: So it depends on how old Eric is. If Eric’s in his 40s and he’s doing his financial planning and he’s high net worth cruising around Lexus in Las Vegas on the Strip with his-

Andi: Cairn terrier.

Joe: Yeah. Looks like Toto.

Andi: Just call it Toto.

Joe: Yeah. You might not want to put Social Security in your financial planning. Just kind of if you get it, it’s gravy. But if someone 62 years old, then absolutely you put it in your overall plan. But then you get all sorts of different types of weird attitudes and personal beliefs and this and that. So-

Al: I think the best idea if you’re of Social Security retirement age, just wait. I mean because if they do bring it in at some point there’ll be a lot of warning. You can take your Social Security before that happens and you’ll be grandfathered in.

Joe: Maybe.

Al: Well I suppose we’re talking about a government. So anything’s possible.

Wife’s Medicare vs. Husband’s Medical Benefits

Joe: We got Bob. Actually, he didn’t write that. He just says “If Joe was 75, his wife is 25, how much money is Joe? Are they happily married?

Andi: And are they happily married.

Joe: The answer- First of all, 75. Well when I’m 75, my wife will potentially be 25.

Al: In your own mind. But for tax purposes, she’ll be much older.

Joe: Yes. That’s a good forecast there. How much money is Joe? I don’t know, what do you think my wife is just going to marry me for my money?

Al: I think so.

Joe: I’m not Big Al, I don’t have a big wallet.

Al: If you’re 75, you gotta have some reason.

Joe: Oh, my golf game. My golf cart.

Al: Like Smitty?

Joe: Yeah. I don’t know. I’ll go down to the Villages, hang out, have a couple of beers.

Al: Marry your caregiver?

Joe: That could happen. All right. “I’m 62 years old, still full employed. My wife is 65, retired and collecting Social Security benefits. She started collecting Social Security benefits at 62. We have health insurance with my job and have used- we have health insurance with my job and have used same all the time and still using it.” I don’t know what that means. “Social Security is deducting around $140 for Medicare. When she goes to the doctor she is using my health insurance that we have using before she started collecting her Social Security. I look into SS rolls, I think SS service shouldn’t be deducting money for Medicare from her checks. If that is correct, can she stop that deduction from her Social Security check while I still work and have health insurance being that we both use my insurance. If that meter isn’t part of your programming, can you maybe direct me to someone that I can get information from?” Absolutely. Because I have no idea. “I follow your episodes on YouTube traveling from and to work riding NY MTA.

Andi: New York MTA. Got it. So he’s in New York.

Joe: Oh God. Subway and bus. That’s the Metro Transit Association?

Andi: Authority.

Joe: Authority. Thank you very much. “I find it very, very educational and entertaining. Thank you. Keep up the good work.” So what he’s doing is that his wife is collecting Social Security and they’re taking the Medicare premium of $140 Part B out of the Social Security check because she’s 65 years old.

Al: So she must have signed up for it because they don’t automatically take it unless you sign up for it. Right?

Joe: Well it’s- no, you’re automatically enrolled at- well, no-

Al: You are automatically enrolled if you’re taking your Social Security benefits. So that’s what happened.

Joe: Correct. So is there a way for her to opt out of the Medicare Part B because she’s under her husband’s insurance? And I believe if there is a- but I think Medicare is still the primary on that even though it goes to the secondary. Yeah, I have no idea. We need to get what’s- his-name? What’s our Medicare- guys?

Andi: Our Medicare guy.

Joe: Don’t we have a Medicare special- or no-

Al: We have Beth-

Joe: Mary Beth Franklin.

Al: Yeah yeah. Mary Beth.

Andi: She’s got her own podcast now. I could send him there.

Al: We had Medicare gal on one time. I can’t remember her name- we interviewed someone.

Joe: Yeah. Dr. Katy Votava.

Andi: Oh, actually-

Al: Yeah. Doctor Dr. Katy. That’s right. Very good.

Andi: But you know who else? There’s also Danielle Roberts. She was the most recent person that we had on Medicare-

Al: There ya go.

Andi: She was great too.

Joe: Does she have a website?

Andi: BoomerBenefits.com I believe.

Joe: BoomerBenefits.com. There you go. There’s some resources for you. Because I get it. They’re deducting Medicare Part B. I’m trying to think how that works. I would imagine they could opt out because if you don’t enroll right away there’s a penalty. So you get 6 months to enroll and if you don’t then there’s that per month penalty for part B, right?

Al: Yeah. Unless you have a policy or your husband or wife has a policy. I’m guessing you can’t do that. But I don’t know the answer for sure either.

Joe: Sorry. So health insurance, guys, I guess we gotta brush up on that, Big A.

Al: Not our strong suit.

Joe: No, health insurance, Medicare. All right. Well, we’ll brush up on it.

Get access to a number of Medicare and Social Security resources by clicking the link in the description of today’s episode in your podcast app to go to the podcast show notes. There you will find the transcript of today’s episode, our Medicare Beginner’s Guide podcast episode with Danielle Kunkle Roberts of BoomerBenefits.com, and the free Medicare and You guide from Medicare.gov. You’ll also learn how to “Avoid Social Security Letdown” by watching Your Money, Your Wealth® TV, listening to our most recent interview with the “Goddess of Social Security,” Mary Beth Franklin, on Spousal Social Security benefits, and downloading our comprehensive Social Security Handbook. All this good stuff is yours free from Pure Financial Advisors and Your Money, Your Wealth®. You can repay us simply by spreading the YMYW love around: share the podcast and the resources with your friends and colleagues via email or on LinkedIn, Facebook, or Twitter, and of course we welcome your money questions too: click Ask Joe and Al On Air in the podcast show notes and fill up that 2021 email inbox.

How Do I Avoid Capital Gains When Selling Rental Property?

Joe: Zanna, from San Diego. Rosanna Zanna Zanna. Why does it say ‘Ask Joel?

Andi: Oh wow. Because I made a typo.

Al: Even Andi doesn’t know your name.

Andi: Sorry Joel. Uh, Joe.

Joe: I can’t stand that name, Joel.

Al: You’ve been being called that for years.

Joe: I know. Every time I meet a Joel, I just wanted to hit him in the face.

Al: I think it’s endearing.

Andi: I apologize. That was not intentional.

Joe: Yeah, like Zanna, I was taking it out on poor Zanna. All right. Zanna has got a question. “I have a rental I need to sell to finance my retirement. I’m retired with a 30-year-

Al: $30,000 a year I think, income.

Joe: “- $30,000 a year and husband still working at $65,000 year; AGI $50,000; rental was my home until I remarried and has been a rental for 12 years of the last 22. The basis is $165,000; have $40,000 in depreciation. I owe $95,000 on the note and the market range is about $550,000.” You got all that Al?

Al: Yeah. I’m with you.

Joe: Call it $150,000, basis $550,000. She’s going to sell it for $40,000 depreciation. So call it a basis of $110,000. She’s got a note of $95,000. Call it $100,000.

Al: Yeah. Let’s just say it’ll be around a $400,000 gain, just for illustration.

Joe: You got it. Perfect. All right. “I plan to use $100,000 to buy a small retirement home. Is there any way I can avoid or lighten the crushing capital gains I’m likely owe from the proceeds? The remainder will be invested for retirement help. I listen to the podcast. Watch early Sunday TV and get your emails. Finally have a question. You guys are great. Thanks so much.”

Al: Great question.

Joe: All right. Thank you, Zanna.

Al: Well let me-

Joe: Help her out, Al.

Al: Ok, so let me sort of go down the path. So the first thing you do is the crushing capital gains, let’s actually figure out what those really are. So $400,000 of gain, it sounds like Zanna you’re making about $95,000 between you and your husband, so if you sold this on top of that income, most of the gain would be taxed at 15% federal, some at 20%. The depreciation recapture is taxed at 25%. But then there’s the Medicare surtax of 3.8% that kicks in at $250,000. So let’s just-

Joe: $100,000 in tax.

Al: Well let’s just say- let’s say 20% federal and 9.3% state, because it’s California. So 30%- let’s say 1/3, just to be safe. So 1/3 of $400,000 is- Call it $130,000. $130,000 in taxes, let’s just say. So that’s a big number. It is and I get why Zanna, you wouldn’t necessarily want to pay that and maybe it’s $100,000. I’m just giving you a kind of worst case ballparks. $100,000 to $130,000 is the tax. So what are your choices? Well, the most logical choice- the easiest thing actually depending upon the cash flow on the rental you really- you don’t necessarily need to sell it. Why don’t you just refinance? Interest rates are low, you end up with, call it a $200,000 mortgage. You pocket $100,000. If the property pays for itself with the rental income, just keep that going. Use $100,000, no tax, no nothing. That’s the easiest thing to do.

Joe: Yeah, but that’s so risky. Come on. You’re gonna leverage this thing up. You know how many hate emails we got because we talked about like don’t pay off your mortgage or something that Andi put in the title that pissed everyone off.

Andi: I said ‘should you pay off your mortgage?’ which was the question.

Joe: Oh my gosh. Gee.

Al: But, I think with the rental I look at that a little differently. I look at that is like a little business and then what does the cash flow- Does the cash flow cover it and have a lot of cushion?

Joe: Why don’t you do this? Let’s 1031 exchange the rental into the property that she’s going to live in. She rents that thing out. She’s gonna have a little bit of boot, but she can avoid some of the capital gains tax.

Al: Yeah. So let’s- That was my second option. So let’s go down that path. So I don’t know-

Joe: You’ve got 30 seconds.

Al: – I don’t know how much you want to replace, but let’s say you want to buy a property for $400,000. Sell one for $550,000, buy one for $400,000. So the boot, in other words, the gain is $150,000 you’ll pay tax on. Call it 1/3 of that, your tax is $50,000 instead of $150,000. Then you can defer the rest into that property. But you have to rent it out for a while until you move into it.

Joe: But she wants to buy a $100,000 house. So that doesn’t help her. Can’t she 1031 exchange the home that she has now of $550,000 into a property that has lower value? But she just has to pay the boot?

Al: Yeah but all the- In other words –

Joe: It would be all boot?

Al: It’s all boot. It’s because the gain is the $100,000 to be reinvested is lower than the basis, so it’s all gain.

Joe: So it’d be all boot anyway, so it would just be a hassle.

Al: That’s why- me personally, I would just refinance it. If the cash flow worked.

Joe: Zanna, we don’t have any magic for you here.

Al: Unfortunately not.

Pay Off Rental Property or Keep Investing?

Joe: OK let’s see. We got Chris and Shannon calling in or writing in from Colorado Springs. “Dear Joe, Big Al and Andi. I listen to your show while I walk my St Bernard and drive my white 1999 Toyota Camry to work. I’m 52, married. My wife is 50, for tax purposes.” So you got married for tax purposes.

Andi: Or is she 50 for tax purposes?

Joe: My wife is 50 for tax purposes.

Al: And she’s younger for other purposes. Is that how you read that? Because when you’re 50, you get to put more into your 401(k)?

Joe: But besides that she looks 30.

Al: Remember that client we had that one time Joe? Came up to me and said ‘Al, don’t tell Joe but I may be married.’

Joe: I don’t know why he didn’t want to tell me.

Al: I don’t know either.

Joe: It’s like- did he have a man crush on me or something?

Al: Maybe.

Joe: All right. I don’t know, the people- why do you guys write to us? This is crazy. “I’m 52, married. My wife is 50, for tax purposes.” So Ok, let’s continue on. “We have 2 children.” For tax purposes.

Al: And the St Bernards.

Joe: You may get those exemptions. Let’s just keep popping out kids. I have no idea how many we have. Oh Boy. Ok. “We have 2 children and have their college expenses funded with the G.I. Bill and 529 plans. I retired from the Army in 2019 after 29 years and received a pre-tax pension of $110,000.” Well thank you very much for your service, Chris. “I have a new job making $100,000. My wife doesn’t work outside the home. We have $200,000 in taxable brokerage accounts; $70,000 in traditional IRA accounts; and $360,000 in Roth IRAs. In 2020, we maxed my 401(k) and both Roths for a total of $40,000. We converted $23,000 into a Roth in March and we are paying the extra $7000 in taxes through payroll until December. Our only debt is the primary residence with $404,000, 2.875%. They got a rental, about $220,000 there, 3%. Both refinanced in March 2020. We make an average of $5000 a year in rental after all expenses, depreciation to zero for taxes.”

Andi: Tax purposes.

Joe: Yeah. I’m just doing everything for tax purposes. “We are considering two options for 2021 through 2028. 1) We invest $10,000 a year through the 401(k) to get the 5% match and throw the rest at the rental taking two breaks to fund a donor advised fund along the way. With the house paid off, we would receive around $15,000 a year after expenses based on current rents. 2) We leave the rental on autopilot and keep maxing out our funds. I would like to retire at 60, live off the cash from the pension, rental, and/or the funds at about $140,000 a year and turn on Social Security at age 69 and 67 when we will re-evaluate our needs from the funds. Without giving advice, would you pay off the rental or keep investing? Thank you Chris and Shannon.” We’re going to go long, Andi, so just FYI.

Andi: All right.

Joe: What do you think, Al? Pay off the rental to get another $10,000 of cash? So you just got to look at- he’s got $220,000. He pays $220,000 off to increase $10,000. So $10,000 into $220,000 is what?

Al: That’s 5%.

Joe: So that’s 5% that you would receive cash-on-cash if you paid off the debt with assuming rents stay the same. Or does it make sense do you think that you would throw $220,000 over the next several years to get a higher rate of return than 5%? I don’t know. I like paying off the debt. It’s just looking at the numbers of what you think the markets are going to do. But if you feel that the rents are a little bit more stable, a little bit more secure. I’m not sure where the rental is. But here’s what I don’t understand, Al.

Al: Right. What?

Joe: His pension’s $110,000 and he’s making another $100,000. So he’s like making $200,000 plus. And he’s saving $40,000.

Al: Well, I had wondered that too.

Joe: The guy was grinding I suppose in the Army for years.

Al: Right. And now he-

Joe: 29 years, servicing our country, protecting us from foreign enemies and domestic alike or whatever that saying is. And then so he gets his pension of $100,000? And then he goes he gets civilian job another $100,000. Now he’s making $200,000.

Al: Doubling up.

Joe: Double up. And still, he’s saving $40,000.

Al: So you know I’ll weigh in. Chris. I think- I don’t mind either option or maybe a hybrid between the two. But here’s a couple high level thoughts. The rental, the debt’s at only 3%. That’s not terribly high. So I’m not over anxious to get that paid off just as quickly as possible. And of course the thing about you get the rental paid off, you got better income, but you don’t have any liquidity from your rental itself unless you finance it. If on the other hand you keep the rental on autopilot, keep maxing out your savings then you’ve got a lot more liquidity and I think perhaps a lot more flexibility. But honestly I don’t think it’s one or the other. I think maybe a hybrid. I think maybe you pay a little bit extra on the rentals each month but I don’t think I would pay it off. I like the idea of continuing to kind of max out the retirement accounts because-

Joe: He’s giving up that fixed income, Al. His pension’s $100,000 and then his Social Security is probably going to be another $30,000 some-odd. The wife is going to take the spousal benefit. So you should say my wife ‘for tax and spousal Social Security benefit purposes’.

Al: Right.

Joe: So she’s gonna get another $15,000, so that’s $45,000. So their fixed income is going to be $155,000, $160,000 I’m guessing, once they claim Social Security. He wants to live off of $140,000. Their fixed income is going to pay their expenses. So I would much rather have the liquidity. I would save into a brokerage account and things like that where they could always pay off the mortgage if they want to. But if they want to- it just gives them a lot more flexibility given the rates that are so low.

Al: Yeah I agree. I think we’re saying the same thing. No I like that too.

Joe: Okay, thanks a lot Chris and Shannon, for tax purposes.

YMYW episode 302 was called “Should You Pay Off the Mortgage? First Consider Your Tax Strategy” so that was for tax purposes too, and boy did it generate a bunch of strong opinions – got another listener comment on that topic coming up a little later. If you missed the excitement, you’ll find a link to that episode, and a number of other relevant discussions Joe and Big Al have had about real estate investing, in the podcast show notes at YourMoneyYourWealth.com. Real estate investing in retirement might be something you want to consider, so I’ve also thrown in Al’s 10 Tips for Real Estate Investors and the YMYW TV Episode, Get Real About Real Estate in Retirement. Click the link in the description of today’s episode in your podcast app to get there.

Should I Get a HELOC on an Investment Property?

Joe: I get confused with the- when you put the titles in there sometimes, Andi.

Andi: That’s because you don’t print in color.

Joe: I know. I’m trying to save the color printer. “Hello Team. Good news Joe, this is not a Roth conversion question.” God, they’re catching on, Al. They are catching on.

Al: They are. They’re listening.

Joe: We got “Great job to all of you that are involved and continue to keep up the show going with quality sound, even though you’re working from home.” I don’t know about this show, Chip.

Andi: We’re doing our best.

Joe: We’re doing our best here. “My question-” So he didn’t say his name was Chip. How do I know his name is Chip?

Andi: Yes he did.

Joe: Where? It says “Hello team.”

Andi: At the very end of it.

Joe: Oh, at the end of it.

Andi: Yes. And then-

Joe: So then you put his name in the front of it-

Andi: You got it.

Joe: – and then it’s like- ok, got it. All right. “Hello team. Good news, Joe. This is not a Roth conversion question. Great job to you-

Andi: – all-

Joe: – all-” I was just trying to- that was a pregnant pause, Andi.

Al: I get it.

Andi: I see.

Joe: “- all those involved in continue to keep up the show going.” So just FYI people, when you write in, just say ‘hey, this is Chip from Maryland’. When you write into a radio show, you put your name first versus saying ‘Love the show. Love, Chip’. Because I’m gonna-

Andi: Joe, when he filled out the form, the first thing he had to put in was his name. And then he had to put in the rest of the information and then he asked his question. So he already put all the information in the form he fills out when you go to Ask Joe and Al on Air at YourMoneyYourWealth.com.

Joe: Got it. Never seen the form, never been on the website. “My question, I’m in the process of getting a $100,000 HELOC to use towards an investment property. The max I plan on spending on said property is $115,000 with the target purchase price of $100,000 or less. In addition to a 457 and Roth IRA, neither factored into this investment, I have a brokerage account of $50,000 and holding $30,000 cash both of which I- $30,000 cash, both of which I’ll be comfortable assessing-

Andi: -accessing.”

Joe: -accessing”

Andi: adding to.

Al: He wouldn’t mind investing either one.

Joe: I understand. Got it. Sorry. “The HELOC rates currently are 2.75% and the terms are 15/15. Any thoughts on the best way to go about purchasing? Being a cash buyer or try to get the best deal? Put 25% down and leave the option to build a rental portfolio? I’m not sure I could put down the down payment and refi to a traditional as I’m looking at it right wouldn’t meaning having my primary mortgage in the HELOC, then the rental property mortgage. Would the bank see this as overextended? Big Al, is there an index card formula you like best when assessing a possible property? Thank you all and stay healthy. Love Chip.” There’s a lot there. So he- do I pay cash? Do I take a HELOC out and pay cash for it? Do I put a down payment and then maybe refinance later? What’s the numbers, Al? What are you gonna look at?

Al: It’s a great question. So in terms of straight numbers, the less you can get down, the more you can finance. As long as your property is appreciating, you will end up much wealthier. You’ll build wealth that much quicker. There’s a huge caveat though and that is that the less you put down, the more you finance, the more at risk you are and sometimes properties turn downward. And if you’ve got a lot of properties with a lot of debt, it’s can be a domino effect. I’ve seen it others, it happened to me during the Great Recession where I lost a few properties. I had too many properties and not enough equity even though on paper I had plenty of equity. But when the Great Recession hit and the properties went down, you couldn’t get rents to cover the mortgage. So that makes it tricky. So if you’re trying to be a little bit more conservative, all cash, or more cash. Now you will probably get a better deal by investing all cash and you can close more quickly. So that is something. But you’re gonna to reduce your rate of return. It works better if you use other people’s money i.e. the bank. But there’s just- you just have to be careful about too much borrowing. But I do have a rule of thumb for you and that is when you’re buying a rental property, look at the value of the property and look at how much it would rent for per month. And your goal is to get as close to 1% as you possibly can. So $100,000 property, you’re hoping it would rent for $1000 a month. I know that’s hard to do, but you’re trying to get as close to that ratio as possible then you’ve got a likelihood of cash flowing.

Joe: All right, great advice, Big Al.

I Don’t Agree About Not Paying Off the Mortgage

Andi: I have a request.

Joe: Yeah. What’s up.

Andi: I would like you to do Greg’s question at the very end.

Joe: Greg’s question from the very end. OK. Pay off mortgage?

Andi: Actually, it’s not a question. It’s a comment and I want to get you guys’ take on his comment.

Joe: OK. “Hi Big Al and little joe.” What the f-?

Al: I like him already.

Andi: Look, even lower case.

Joe: What a- All right. “I listened to your podcast about paying off your home and I have to disagree with you. I know my answer is based on emotion but hear me out.” No, I don’t want to hear anything you’ve got to say, Greg. “In 2006 I paid off my home. I was 35 at the time. I live in a great middle-class neighborhood and a lot of my neighbors were small business owners like myself. They all told me I was crazy. I should take the money out and buy all kinds of toys.” What kind of neighbors are telling you to take money out and buy toys?

Al: I don’t think I’ve ever heard a person say that in my life.

Joe: Joe, you paid off your mortgage? You should be buying toys.

Andi: Get that $70,000 golf cart.

Al: And trailer, get a boat.

Joe: Right? I don’t know. Buy some G.I. Joes.

Al: Oh, you like those kinds of toys.

Joe: I don’t know. I don’t know what the hell he was talking about. “Then 2008 hit and things went really bad for everyone. My business took a huge hit and it took until 2010 to get back to even. Most of my neighbors lost their homes and their businesses.” Yeah, because they’re all buying toys; are probably not very fiscally responsible. “It was a horrible time.” Yes, we all lived it. “But I lived through it without too much fear because I didn’t have that mortgage on my back. I know you can do all the math to show why you shouldn’t pay off your house, but I sleep better and now I have a good chance to weather the storm. Sometimes the boring safe play is the best play in the long run. Thanks for the beautiful- Thanks, Greg, from beautiful wine country in Temecula, California.

Al: Was he referring to another podcast that we talked about this?

Andi: Yes. Two episodes ago.

Joe: Yeah. Well, we talked about, does it make sense or not?. And then we talked about I think emotionally most people would not want to have a mortgage; but financially sometimes a 30-year fixed mortgage at 2.75%-

Al: Pretty cheap money.

Joe: – is pretty cheap money. You just said in our last conversation-

Al: I did.

Joe: – was like lever up buddy, just let’s use the bank’s money.

Al: Within reason though.

Joe: And then Greg from Temecula, he’s like oh he’s cringing.

Al: Yeah but see – so you use the bank’s money to buy appreciating assets, not toys, not things that are going to go down in value.

Joe: True.

Al: That makes no sense at all. And by the way, Greg, I don’t necessarily disagree with you. In fact, my mortgage is paid off too.

Joe: Look at the big wallet on Big Al.

Al: Can you say that?

Joe: You should see my bank account too, by the way. I paid off my mortgage and I got millions in the bank.

Al: And I’m not about to go lever up again.

Joe: No?

Al: So I like not having to mortgage myself.

Joe: Yeah. I agree with you. It’s looking at- financially speaking it makes sense to hold a mortgage at a very low rate, as long as you have predictable income. And you got time.

Al: And so if you borrow the money and use it to invest in things that are going to appreciate more than your interest rate, it’s just dollars and cents.

Joe: It’s arbitrage.

Al: It makes sense to have a mortgage. Now, but there’s risk there. That’s what we just talked about, there’s risk. And when you get to a point where your mortgage is low enough and you’ve built enough, you don’t necessarily need to have a mortgage.

Joe: Right. I mean some people are not that great with debt to begin with. And so- I remember early in my career I did a lot of debt consolidation work with clients just to figure out cash flow to fund retirement accounts. So they had credit card debt, car loans, and things like that and then they had a home and had equity. And it was like it would make sense if you refinance, just jam all the debt into a home equity line or just refinance your mortgage at a lower rate. It would free up let’s say $3000 a month so you could either take that and aggressively pay off the debt or you could use the $3000 a month and put it into your 401(k) plan.

Al: Or a lot of people did that and bought more toys.

Joe: They did. They bought a truck.

Al: in worse shape.

Joe: Exactly. So it’s like I’m done doing this, because you can’t handle it. It’s like crack. Oh my God. So no Greg, I think Al and I both agree that sure, if you want to pay off your house and sleep better at night because that debt worries you and you’re a small business owner, your income is unpredictable. Some years are boom, some years are bust. Who knows? And so it’s like let’s get that monkey off my back. Let’s pay it off. And then now take that extra cash that I was going to pay down a mortgage and pay into a savings account, brokerage account or your retirement accounts. The numbers still work as long as you save it.

Al: But I would never ever borrow on my home equity to fund vacations, to fund like a nicer car, to fund whatever, toys, as he says, a boat, something like that. To me, that money is somewhat sacred and you may need it later on in retirement. So I don’t- I completely agree with this premise. I mean you don’t want to borrow money to- if you can afford it and if you have predictable income, you can borrow money to buy assets that appreciate like other rental properties and end up in a better spot. But there’s a risk in doing that.

Joe: Risk and return are related, right?

Al: That’s right.

Joe: So then it’s like, what’s your overall goals? Greg is like I’m a small business owner. I don’t need to spend a lot of money. Wine country here in Temecula.

Al: I’m happy.

Joe: I’m happy. I’ve got a beautiful house. It’s paid off. It’s mine. So God bless you. Good for you.

Al: Great.

Joe: Just the ‘little joe’ comment kinda pissed me off, but, oh well-

_______

Subscribe to the YMYW podcast newsletter

FOLLOW US: YouTube | Facebook | Twitter | LinkedIn

Your Money, Your Wealth® is presented by Pure Financial Advisors. Sign up for your free financial assessment.

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

Podknife

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed