Twas the Tuesday before Christmas and all through Your Money, Your Wealth®, Joe and Al’s stockings were stuffed with your money questions: first, there’s equal withdrawal, rebalancing last year performance, 3 and 7-year moving average, the CAPE median, and more… so which strategy do the fellas like best for withdrawing money from a properly tax-diversified and properly asset-diversified retirement portfolio? Joe gets in the giving spirit with an epic Christmas rant in response. Plus, the fellas discuss early retirement – specifically, calculating taxes correctly for it, and what part dollar-cost averaging plays in planning for early retirement, as well as spreading SIPC risk, understanding the discrepancy in basis on a limited partnership, the tax advantages of a health savings account or HSA, and listener comments on our discussion of paying off the mortgage in podcast #302.

Subscribe to the YMYW newsletter

FOLLOW US: YouTube | Facebook | Twitter | LinkedIn

Show Notes

- (01:03) Which Retirement Withdrawal Strategy is Best?

- (09:40) How Does a Rollover of Traditional IRA and Roth IRA Funds Work?

- (14:28) Are We Calculating Our Taxes Correctly to Retire Early?

- (19:23) Dollar-Cost Averaging Early Retirement

- (23:20) Is It a Good Idea to Spread SIPC Insurance Risk?

- (27:33) What Accounts for Limited Partnership Basis Discrepancy?

- (32:22) What Are the Tax Advantages of a Health Savings Account (HSA)?

- (36:41) YMYW Listener Comments on episode #302: Should You Pay Off the Mortgage?

Free resources:

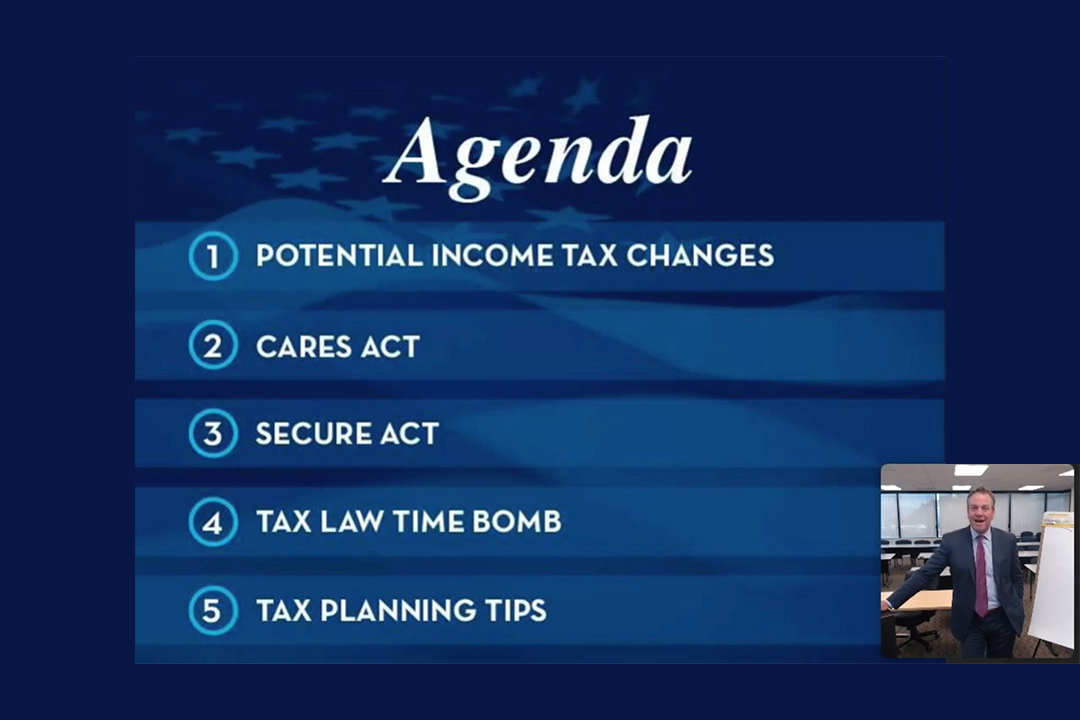

WATCH | YMYW 2020 End of Year Tax Planning Webinar

WATCH | YMYW TV: Tackle Your Taxes

Listen to today’s podcast episode on YouTube:

Transcription

’Twas the Tuesday before Christmas and all through Your Money, Your Wealth®, Joe and Big Al’s stockings were stuffed with your money questions: first, there’s equal withdrawal, rebalancing last year performance, 3 and 7-year moving average, the CAPE median, and more… so which strategy do the fellas like best for withdrawing money from a properly tax-diversified and properly asset-diversified retirement portfolio? Joe gets in the giving spirit with an epic Christmas rant in response. Plus, the fellas discuss early retirement – specifically, calculating taxes correctly for it, and what part dollar-cost averaging plays in planning for early retirement, as well as spreading SIPC risk, understanding the discrepancy in basis on a limited partnership, the tax advantages of a health savings account or HSA, and some vehement listener comments on our discussion of paying off the mortgage in podcast #302. I’m producer Andi Last, and here are the hosts of Your Money, Your Wealth®, Joe Anderson, CFP® and Big Al Clopine, CPA.

Which Retirement Withdrawal Strategy is Best?

Joe: Trying to get through them as fast as we can. But the bag just kind of keeps filling up. “Hello. I have a mega backdoor Roth question wrapped in a whole live indexed annuity. Just kidding. Hope Joe’s head didn’t-” Almost did there my friend, almost did.

Al: Yeah, mine almost did just hearing that.

Joe: Oh God. “There’s a lot of material out there about growing wealth, the accumulation phase, but not a lot of the mechanics of withdrawing money and retirement distribution. I’m interested in hearing your thoughts on how best to withdraw from a portfolio containing multiple investment accounts in retirement, taxable Roth and 401(k). The best discussion on this topic I’ve been able to find so far is from the following.” So’s it’s a little money article in Money Magazine. “The article identifies a handful of options. 1) equal proportional withdrawal; 2) rebalancing; 3) last year performance; 4)3 year moving average; 5) 7 year moving average; and then the cape median.” Oh man, we haven’t talked about cape ratios in-

Al: No, we haven’t.

Joe: – long time.

Al: You wanna get into that?

Joe: Yeah. The Cape 10. “What are your general thoughts on withdrawal strategies, not only among accounts but also from various mutual fund ETF funds within the accounts? Oh and I drive a 2015 Honda Fit I bought used. I’m a cat person. Can’t wait to hear what you think.”

Andi: He drives what I used to drive.

Joe: So he drives a 2015 Honda Fit and is a cat person. He wants to know what I think about him.

Al: He couldn’t drive a St. Bernard in that, it’s too small so that’s why he’s a cat person.

Joe: Yes, without a doubt. Anytime I see someone driving that, I’m like guaranteed there’s like 50 cats in that- his house.

Andi: I’ll have you know I still own a 2019 Honda Fit and I do not own any cats.

Joe: I believe you do, Andi.

Andi: You believe I do own cats?

Joe: Yeah, you got cats all over the place.

Andi: Ok. You make up your own reality, Joe.

Joe: I like my reality sometimes. It’s better than the normal reality of life. So what’s he asking? What’s- he wants our opinion, Al.

Al: So, his comment is correct. There is a lot on growing wealth but very little on distribution strategy, so I agree with that comment. He wants to know what we think. How do we go about withdrawal strategies?

Joe: Yes, we talk about it quite a bit. So let’s just break this thing down, he’s like equal proportionate withdrawal. So that’s number one. So what does that mean? Well, you’re going to take a equal withdrawal from each of the different accounts. I don’t think that’s the appropriate- let’s just talk about tax for a second. If I had that equal amount of money in a Roth IRA, a 401(k) and a brokerage account, how I would want to look at my distribution is first a) this, how much- what is my percentage that is coming out of the portfolio? And then depending on what my tax bracket is I’m going to take money from my 401(k) account out to get me to the top of the 12% tax bracket.

I’m either going to spend that money or I’m going to convert it. So I’m going to max out that 12% tax bracket regardless every single year for ordinary income. I’m either going to convert the money into a Roth or I’m going to spend the money. If I want additional dollars to live off of, that’s when I’ll go to the brokerage account. If I want more money to live off of, that’s when I would go to the Roth account. If I can keep myself in those lower brackets using the 401(k) first, looking at my taxable income- so adding up my taxable income outside of any distributions from retirement accounts, I would fill up that 12% or 22% tax bracket depending on the amount of wealth that I would have. So that’s how I would look at it tax-wise. Would you agree with that, Al?

Al: I agree with that. And the first one mentioned here really has to do with which pool you take the money out, which has nothing to do with these other5. These other 5 figure out which asset you sell inside of the tax pools. So I think you’re perfect, Joe. I think you start with which tax pool to take it out of. Then you figure out which asset to sell within the tax pool.

Joe: Because what do you have to figure out? So first what’s the shortfall of the money that you’re trying to generate? What’s the income? What’s the demand for the portfolio? And if it’s X amount of dollars, then how do you get X amount of dollars with the least amount of tax possible?

Al: Yeah. That’s the whole reason you have a Roth and taxable money so that you can stay out of high brackets. So pay attention to that every single year.

Joe: The whole reason why we’re talking about Roths every damn week, it’s because you can control your taxes in retirement. Then we get questions like this. ‘Listen to you every week while I’m walking my St Bernard in Alaska but doing the dishes. Love it. Love Big Al. Andi, thanks so much for keeping these knuckleheads together. Oh we listen to you on the dinner table.’ But then you ask questions and you’re not even listening. ‘I promise I won’t ask you anything about a Roth.’ Well why are you doing a Roth in the first place? If you- I’ve got a love/hate relationship with these folks.

Al: You do.

Joe: And then the second is to figure out if you need $50,000 a year from the overall portfolio, you need over $1,000,000 in the portfolio. So how much is in a Roth? Versus how much is in a brokerage account? Then how much is in the traditional IRA? Then you have to figure out if I’m gonna keep myself in certain brackets by taking out money from my traditional to my brokerage account for my Roth, then I would just do the calculation and make sure that I have enough safe money in those accounts over the next 10 years so I don’t give a rat about what happens to the market. So I’m saving money in tax. I’m controlling my risk. I’m controlling my fees and costs because I’m using low-cost funds, index funds, ETFs. There’s a rhyme and reason why we go through all these different strategies. So you can’t just listen to one thing and implement that without really understanding what the overall end result is. Thank you for the question. You know what, Al? Let’s say if something happened. Let’s say a big company buys us out. I think our freedom of really talking our mind on this show would-

Al: It would go right away, wouldn’t it?

Joe: We’d we leave right away. First thing on the list is like yeah we’re getting rid of that show.

Al: Those knuckleheads that just say anything they want.

Joe: Because here’s why I love doing this program is that we just talk into a microphone. I don’t know who is on the other side. And we read these questions and we kind of make believe on who these people are. Except for Smitty, he actually gave me a picture now. Now I can picture Smitty driving that bike with that long hair. He’s a bad ass. Love Smitty.

Andi: You haven’t told me the story yet.

Joe: But other people, we don’t know. You know we kind of- but it’s a nice release for me. Because there’s no way I could ever talk this way in the office in front of a client.

Al: I’ve seen you do it.

Joe: Well maybe once or twice. You get fired up and then you know here, we can just talk our mind. We can be honest and we can be free.

Al: That is true. It gives us that freedom, which I appreciate that too. Especially when you go on a rant. Then I can just sort of sit back and listen.

Joe: Yes.

Andi: Those are the entertaining parts.

Al: I know I’m not going to get a word in. So why try?

Joe: Well, I love ya, Big Al.

Al: The same, Joe.

Joe: ‘Tis the season. Merry Christmas. Love you, Andi.

Andi: Love you too guys.

Joe: I wish we could all just hug but then you’d probably give me COVID.

Al: She’s being the most careful of the 3 of us.

Andi: I think I’m making the most careful of anybody in the entire company.

Joe: Yep, she’s very smart.

Al: Have you left your home yet?

Andi: No. I have not left my- I’ve not left this room since March.

Al: What’s that behind you? Is that records? Or what are we looking at?

Andi: Al, it’s 1500 records.

Al: So what number are you on? 750?

Andi: I think I’ve listened to maybe 10 of them.

Al: OK. You can last like another 10 years then.

Andi: Oh yeah. Totally.

How Does a Rollover of Traditional IRA and Roth IRA Funds Work?

Joe: We got Lauren from Florida. “I have a 401(k) at a former employer that is split between Roth and traditional. Can I roll over just the Roth portion into the Roth IRA and leave the traditional portion for the 401(k)? How does the custodian determine which funds are in each portion, Roth and traditional? And what is contribution versus earnings? None of my statements break this down. And what specific funds are in each portion of the account? I want to leave the traditional portion in the 401(k) so I can contribute- so I can continue to fund my Roth IRA using the one and only backdoor strategy.”

Al: Yeah. You knew that was coming.

Joe: I knew it was coming. Okay so Lauren, what I guess on her statement she’s just seeing a balance and it’s saying Roth is this and then traditional is this. But when she’s looking under- into the details of the statement it’s not necessarily breaking things down. The answer is no. Once you roll that money over, unless you do an in-service withdrawal, you could do that. But I don’t know if you’re an active participant of the plan. So an in-service distribution means that you’re still an active participant. If you’re not, can you do a partial rollover? And can a partial rollover go into an IRA? And she just wants the pre-tax- or the Roth component go into the Roth IRA and keep the 401(k) standard. Because if she rolls the pre-tax into an IRA that’s going to screw up the backdoor Roth in regards to the pro-rata and aggregation rules. You need to check with your plan document. But my answer is no. It would be pretty hard to do that. What I’ve seen, especially if you don’t even know what you have in Roth versus traditional and how it’s broken down. But you would have to ask your 401(k) provider because all plans are created a little bit differently. So you would want to start there. But I don’t think Lauren can.

Al: A lot of plans though allow more flexibility once you’re over 59 and a half. So maybe at that age you could.

Joe: Maybe.

Al: But you’re right, it depends upon the plan.

Joe: And they’re getting a lot more flexible too with the Roth provisions in the overall plan. Because usually when you take a distribution from 401(k) plans that have a Roth provision, it’s pro-rata. So if it’s 50% Roth, 50% pre-tax, you take $1 out, you’re going to get a half tax-free, half taxable. So if you’re trying to segregate from a distribution or a rollover from the 401(k) just to say I want the Roth money to go on and keep the 401(k) money in the 401(k), that might be challenging. I don’t know if she’s retired or not, but what you could do is this, you could roll over the Roth component-

Al: Oh, you know what? It says the 401(k) at a former employer-

Joe: Oh, then just roll the 401(k)- so put the money into the Roth, roll it out of the 401(k) plan. Put it into the Roth IRA. And then put the other money into a rollover IRA. And then from the rollover IRA, move that into your current 401(k) plan. That will solve your problem.

Al: There you go. If you have one.

Joe: If you have one. If you don’t, just keep it in the plan. But she’s working, she’s got earned income to make the IRA contribution to do the backdoor. If you want to isolate the Roth component, that’s one way to do it. Instead- I don’t think you could do an in-service distribution from a plan and say I only want the Roth money to come out. Keep the IRA balance in. It’s up to the plan doc. But I’m saying no. But a better way to do it is to roll the money out, move the Roth money into the Roth, the traditional- or the pre-tax, into an IRA. Make sure it’s a rollover IRA and then rollover that IRA into your current 401(k) plan and then that isolated everything. Perfect. All right. Hopefully that helps.

We’re only a week away from the end of the year, have you done everything you can to reduce your 2020 taxes? If you missed our live YMYW 2020 End of Year Tax Planning webinar, you can watch it in the podcast show notes at YourMoneyYourWealth.com, download the 2020 Tax Planning Guide, and watch “Tackle Your Taxes,” the latest episode of YMYW TV. Click the link in the description of today’s episode in your podcast app to get to the show notes, access all these free financial resources, along with the episode transcript, and share all this stuff with anyone who will benefit from it! And if you are left with more money questions, click Ask Joe and Al On Air there in the show notes and send ‘em on in. We’re still working a backlog of emails, so the fellas will have plenty of answers to those questions in 2021.

Are We Calculating Our Taxes Correctly to Retire Early?

Joe: I got a email here from Karen from Florida. “Hello Big Al, Joe and Andi. Love the podcast and appreciate the information you provide. My husband and I live in Florida and are planning to early- planning to retire early in our 40s with a portfolio of $1,700,000. We are considering the following drawdown strategy and are wondering if we’re calculating the taxes correctly.”

Al: Okay.

Joe: I guess that’s why you get first billing there, Big Al.

Al: Yeah, it’s a tax question.

Joe: Tax question. Because I don’t know anything about taxes. Apparently. Let’s see here. She’s got a- let’s see- 457 plan, $24,000 a year she wants to take from there. Because they’re retiring in their early 40s or mid 40s or late 40s.

Al: Early in our 40s.

Joe: Early in our 40s. All right. So like me, early in my 40s.

Al: But you’re still working.

Joe: See I’m still grinding away.

Al: You are no longer in your 40s.

Andi: Mid 40s.

Joe: I am very much early 40s.

Andi: Okay.

Al: You’re not even sure.

Joe: “Brokerage is $30,000 a year. Approximately $20,000 give us- give or take long term capital gains. And then 403(b) to Roth conversion $48,000 a year.” Are you following any of this, Al?

Al: Yeah. So she’s giving us her income. So I already have a correction because the next line it says “total taxable income $92,000.” First of all, what she means is total adjusted gross income, not taxable income. Secondly, if you add those 3 numbers together, you get $102,000, not $92,000. So besides that, we’re on track.

Joe: She’s got it dialed is what you’re saying-

Al: So far so good with those couple caveats.

Joe: Okay Karen. So your gross income is $102,000, not $92,000 minus $2400 federal exemption. It’s not an exemption.

Al: It’s a standard-

Joe: It’s a standard deduction.

Al: But she got the right idea.

Joe: But close enough.

Al: Yeah.

Joe: So total $67,600, under $80,000 therefore long-term capital gains tax will be at zero, minus $20,000 capital gains. What do you think? Is she-? “Am I doing this right? Is the sequences or the calculation correct? Thanks so much.”

Al: Her concept is right. So her math is a little off, but her concept is right. So I’m just going to use her numbers. Even though they didn’t add up right. So if taxable income is $67,000. And she’s married, so we know that they are in the 12% tax bracket because you can make up to $80,000 and still be in that 12% tax bracket. So $67,000. Now if $20,000 of that $67,000 is capital gains, we also know that there’s no capital gains tax at all. There’s no federal capital gains when you are in the 12% bracket. So that would be a correct statement. In other words, just subtract the $20,000 from the $67,000 and now you’re left with taxable income of $47,000, of which roughly the first $20,000 is at 10% and the balance is at 12% and that’s how she did this calculation and that is correct.

Joe: I’m trying to pull up my calculator, my HP12C on my-

Al: Are you gonna check her math?

Joe: – on my phone. No no no. What I was trying to figure out here is $1,700,000. So her distribution rate- I mean she’s kind of taking a lot out of the portfolio. At $102,000.

Al: Yes she’s taken $54,000 I guess. Because the other part’s a conversion.

Joe: Got it.

Al: $54,000’s okay.

Joe: Still a little high for 40s.

Al: Yeah, see we talk about the 4% rule, which is originally when you start retiring at age 65. If you retire at age 40 or 45 you might want to think more like 3% distribution rate. Some people might even say lower. But I think that’s a safer place to start as an approximation.

Joe: So she’s close, 3% is $51,000.

Al: Yeah.

Joe: But she’s taking $24,000 a year from- oh, 457, there is no 10% penalty so you can pull money from a 457 plan at any age. Then the brokerage account is $30,000. Then she’s doing the conversion of $48,000 a year.

Al: Yeah.

Joe: OK. So $54,000 plus tax. So $53,000. So she’s pulling $5500 from the overall portfolio. So she’s all right. But we’ll see how her math works out.

Al: Well there’s a math problem. However, the concept is right. Check your work. Check your math.

Dollar-Cost Averaging Early Retirement

Joe: We have one “Dear Joe, Big Al and Andi, love the show. First the important stuff, Brian from Albany, New York.” Welcome Brian. “Got no pets, 2015 Dodge Minivan. And this is not a Roth conversion question.” Appreciate that very much, Brian. “I usually listens in the morning while getting ready for work or while paddling my kayak on the local lakes and rivers.”

Andi: Well that’s different.

Joe: That’s cool. In Albany, New York, he’s probably pretty frigid to be on a kayak right now.

Al: I would think so.

Joe: “Two simple questions about my 401 as I’m planning to retire as early as 2021 and no later than 2024. First, I’m a huge fan of dollar cost averaging investments. Should I do the same thing in reverse when I start to draw down my 401(k)? For example, should I take a distribution once a month versus quarterly or annually?” Interesting thought there Big Al.

Al: Yeah. What do you think about that?

Joe: Well let’s first answer- well let’s explain what dollar cost averaging is.

Al: Yes.

Joe: Is most of you that are saving inside a 401(k) plan or any type of retirement plan on a monthly, weekly, semi-annual basis, are dollar cost averaging.

Al: Whether you know it or not.

Joe: Yes. So some other people will dollar cost average if they get a lump sum. So let’s say you just received an inheritance of $100,000. Instead of investing the $100,000 today, you’re like I’m gonna put $1000 a week into the overall market and try to average out the cost. So I don’t want to buy at the high. You know that’s why people do that because they’re thinking if I lump everything in right now, I know for a fact tomorrow the market’s going to implode. So-

Al: And I’m gonna be pissed.

Joe: Yes. Right. So instead of saying I’m going to put the $100,000 in the market, I’m slowly going to put the money in. Because if the market goes up 10% or down 10%, I’m taking the average of the dollars that are going into the market. It kind of smooths out the ride if you will. So he wants to say- So he’s asking the question, should I reverse a dollar cost average when I’m taking the money out? So should I take my distributions out monthly, quarterly, annually? And I got some answers for Brian, but let’s see what his second question is. “Is it okay to have a 401(k) converted to an IRA at Vanguard where I have an investment account and Roth accounts? I will have well over the SIPC insurance limits on the 401(k) and IRA conversion alone and substantial monies in other accounts too. I’m thinking of setting up my 401(k) to IRA account at Fidelity for extra protection. Does that make sense? Or am I worried about- ?” Yeah, you are a worrywart, Brian. For someone that kayaks in the winter, this guy is way too worried about some stuff that may never happen.

Al: I agree with that one.

Joe: So we- if you look at the studies, dollar cost averaging it helps people’s emotions. It will calm their nerves because if they invest today and the market tanks tomorrow they’re like ‘dammit, I should have invested tomorrow’.

But if you look at the research, if you should be invested, you should be fully invested. Dollar cost averaging is fine, but if you have a lump sum, you should invest it. You will make more money because of the time value of money that the money is fully invested. So we’re not big believers in dollar cost averaging. Not saying that we wouldn’t help our clients implement that, if they are a worrywart like Brian.

Is It a Good Idea to Spread SIPC Insurance Risk?

Now he’s worried about SPIC insurance, Al.

Andi: SIPC.

Joe: SIPC.

Al: So that’s where you get $500,000 of protection at a brokerage firm. So what if Vanguard goes bankrupt?

Joe: The likelihood of that happening is zero.

Al: I agree.

Joe: He doesn’t own Vanguard stock. Vanguard is a private company.

Al: I know, but what if they abscond? What if there’s fraud? Or who knows? I mean it’s so unlikely with a company of that stature. I wouldn’t worry about it.

Joe: And also he’s owning companies too. Even if Vanguard had financial issues or troubles, another company would come in and take them over. Unless there was fraud. Right. But the security- I don’t know. Have you ever heard- I’ve been in this business over 20 years I’ve never heard of a claim. You know what I mean?

Al: Yeah, on a brokerage company? Yeah me neither.

Joe: You’re owning individual securities in the mutual funds that he owns or ETFs or whatever that he has.

Al: So I think that’s an important point that’s missed. It has- actually Vanguard is just holding your securities. They don’t own your securities. They’re yours. Right. It’s kind of like a safety deposit box. They’re the safety deposit box. They don’t have access to your- what’s inside and unless there is fraud. If there was fraud on that level of Vanguard, this whole world would be in trouble.

Joe: I would- I would- I don’t know, maybe we get someone that knows a hell of a lot more than we do about this stuff. I get it. Brian apparently has some cash. He’s well over the limits. Well, well over. I’m surprised you didn’t start with that one.

Al: That means it’s well over $500,000.

Joe: So it’s a couple of million bucks.

Al: But I want to go back to the dollar cost averaging because he actually asked should he do that in reverse. I think he’s saying should he take the money out monthly, quarterly, annually. My answer is I don’t care when you take it out. The key there is that you just rebalance your investments to how they should be. So stocks have outperformed, you take money from stocks. If stocks have underperformed, you take money from your safe money, like bonds for example. So that every time you take money out, you’re back in balance. So that’s all you have to think about there.

Joe: I agree with that. I would look at it like this too Brian, is that depending on what your distribution is, how much money that you’re looking to create from a retirement income standpoint, just make sure that you have probably 7 years of income that you have in safe money. What I mean by that is- or maybe even 10 years to make the math simple since he’s got well over the SIPC limits- let’s say he wants $50,000 of income from the overall portfolio. $50,000 times 10 is $500,000. Just make sure that you have $500,000 in very safe money, bonds, treasuries things like that. So if the markets do plummet, you’re pulling from that safe money. If the markets are high, then you just kind of rebalance. You would take dividends or interest or dividends or capital gains from your overall stocks. So I think Brian needs just a little bit more help on how he should be constructing his income. And then from there maybe that calms his nerves on everything else he’s worrying about. I was going to say something. I’m not going to say it.

If, like Brian, you need a little bit more help, you’re worried about uncertainties and risk, maybe now is the time to make a New Year’s resolution to get that help from a financial professional. Make sure you’re considering ALL the different aspects of your financial plan and goals, how they all work together, and that you’re doing everything you can to keep and safely grow every last dollar available to you. Click the Get An Assessment button in the podcast show notes at YourMoneyYourWealth.com to schedule an online meeting with a CERTIFIED FINANCIAL PLANNER™ from Joe and Big Al’s team at Pure Financial Advisors. It doesn’t matter where you are in the country. Did I mention this financial assessment is free? It doesn’t cost anything at all, and it’s very likely that they will be able to identify and implement financial strategies that can help you. Click the link in the description of today’s episode in your podcast app to go to the show notes and get your free financial assessment from Pure Financial Advisors.

What Accounts for Limited Partnership Basis Discrepancy?

Joe: Cyd from Tennessee. “Hey guys. Well 2 guys and a gal. This is hubby and me from Tennessee.”

Andi: Remember that Joe?

Joe: Yes I do remember hubby and me. So did you put the Cyd from Tennessee?

Andi: She actually answered it- or she put that at the bottom.

Joe: Oh and then you put it at the top.

Andi: I did not include it- well, actually she did. “Thanks for your insight, Cyd. Hubby is Ron with 2 dogs, Dexter male lab and Ngoni female Shepherd.”

Joe: Cyd. Ok. Hubby’s Ron. Got it. Hubby and me from Tennessee. Such a beautiful rhyme.

Al: It is. I’m marveling at that.

Joe: Sounds like a song. All right. Let’s see what hubby and me from Tennessee has to say this time. “We have an investment that is a limited partnership that trades publicly. The partnership is Brookfield Infrastructure Partners, BIP. We get an annual K-1 from them and then report the income tax purposes. We do our own taxes.” Of course you do. “We bought this investment in 2017 and every quarter received distributions that I haven’t been paying close attention to. But come quarterly in 3 buckets, a partnership distribution, an interest distribution and a dividend distribution. Note the dividend distribution happened only one time in December 2017 and replaced the Partnership distribution. Maybe a reporting error? Earlier this month, we sold a portion of this investment. That has been the only transaction since the purchase. When the account settled using Vanguard’s brokerage, I noticed the cost basis by the broker was lower than the cost basis I have when purchased. Broker cost basis $32 a share; purchase cost basis $36 a share. Can you please help me understand the discrepancy? Does the partnership distribution change the equity cost basis? Thanks for your insight. Cyd. Hubby is Ron with 2 dogs, Dexter male lab and Ngoni female shepherd. FYI, I sent a question back in April on holding bonds to maturity as a way to provide fixed income. Great discussion.” Of course.

Al: And she references-

Andi: She’s actually given us a plug so that people can go back and listen to the other great conversation.

Joe: Such a good conversation. You remember that, right Al?

Al: Oh big time. Yeah. What are we? We’re at like 300 now right?

Andi: By the time this airs, it’ll be like 305 or 306.

Al: Oh wow. Okay.

Joe: Al, what’s going on with their basis? Is it a mistake by the broker? Or is it a mistake by hubby and me from Tennessee?

Al: It’s neither. Let me explain. So when you invest in a limited partnership, think of that as an entity that has its own tax basis for when they buy the property or whatever the investment is, usually a property. It has its own basis inside of the LLC or limited partnership, I guess it’s a limited partnership. When you buy into it, you’re not necessarily buying for that same exact price. So that gives rise to what accountants like to call inside and outside basis. That’s way too complicated. Don’t worry about that term. But here’s what you do. Your cost basis is correct. So by the time you put it on schedule D, which is where you show capital gains, there’s a column where you can put adjustments to the broker basis. And that’s where you put the difference and just make it come to your cost basis. That’s why it happens. There’s a different basis inside a partnership versus outside. That’s what’s going on.

Joe: Inside and outside.

Al: You like that, right? Inside outside basis. When I first heard that Joe, 25 years ago I thought, what the heck are you talking about?

Joe: That’s how I feel right now, 25 years later.

Al: I know. Now you’re going to have- 25 years from now you’ll be able to explain it.

Joe: If I’m talking about inside and outside basis in 25 years, please shoot me.

Al: Well we’re going to have to have Cyd right back and then she’ll ask it again.

Joe: If I’m on this show in 25 years, something definitely has gone wrong in my overall financial plan.

Al: If I’m on it in 25 years- can you imagine? That’s going to be- I don’t know. That might be a little rough.

Joe: What did you say again, Joe? Yeah I remember that from hubby and me. Damn- inside, outside. What? Are you outside?

Al: Only the accountants listening understand what that means, inside outside basis. But who cares? Just fix it on the schedule D.

What Are the Tax Advantages of a Health Savings Account (HSA)?

Joe: Got Shana from Houston. Shana or Shayna.

Andi: It’s your call.

Al: I like Shana.

Andi: I didn’t call her to find out how she pronounces her name.

Joe: Shana.

Andi: Might be Shana.

Joe: Shana.

Al: Could be, but-

Joe: S-h-a-n-a. Sha- Shana. All right. “Thank you Joe and Al for your expertise through the years. I have implemented a lot of your advice and I’m grateful for you both. Thank you Andi for keeping these 2 in check. LOL. 30 year old single female’s been maxing out my HSA for 4 years now. I keep hearing about the investment saving and advantages but don’t quite understand. So can you give me a brief overview on the HSA account and its tax savings and the advantages to invest within this account? Thank you.” All right, Shana. HSA, Al. What do you got?

Al: Well, HSA, that’s a health savings account that’s only available if you have a high deductible insurance policy, which I don’t have those numbers in front of me. But the typical health insurance policy that you have, that you think of is not HSA because there’s like there’s a $40 office visit and you get $750 and then they’re paying like 80% of it. Blah blah blah blah. But let’s say you’ve got a high deductible plan.

Joe: You’re really tight on it, on insurance.

Al: I think I’m- why you asking a CPA about insurance? But let me tell you- let me now move on to the tax part. I’m tight on that. So the tax part is- assuming you have a high deductible plan, which I was explaining- I’m assuming you have one- talk to your H.R. department to see if you do. Then if- let’s see, you said you’re single, so you can put-

Joe: $3500.

Al: $3550 in and you get a tax deduction, which is really cool. And then you can use that money for medical expenses and you don’t ever have to pay tax on it. In fact, the growth on it and the income on it, you don’t ever have to pay taxes on it either as long as it’s used for medical. So if you qualify, if you have a high deductible health insurance plan, it’s a great idea to do it. Because not only do you get a tax deduction, but you never pay tax on that because if you use it for medical.

Joe: Right. There’s a couple of different types of accounts that you can open up within the overall health savings aspect of it. So you’ve got the high deductible insurance part. But then you have the savings plan that you’re putting in your $3550 and let’s say you’ve maxed that out over 4 years and say you’ve got $15,000 in it. You could use a standard like checking account, like an interest-bearing account that has no risk. So it’s just almost like a money market account. Or you could invest it actually in mutual funds if you wanted to. You just have to take a look at your HSA provider and find that the savings account aspect of the health savings account.

Al: Easy for you to say.

Joe: I was gonna say a curse word. Yes. But we would probably say just keep it in the money market account just in case you have- but she’s 38. She’s young and healthy. So probably no need.

Al: I think you invest it. I mean why not?

Joe: But you cannot have a health savings account once you reach age 65, because then you’re Medicare eligible. But if you have a lot of money in the health savings account you can still use the health savings account for medical expenses. Or you could roll it into an IRA if you wanted to as well. So but yeah it’s a triple tax advantage.

Al: I like it if you qualify.

Joe: Tax-deductible, tax-deferred, and then tax-free coming out.

Al: Triple triple threat.

Joe: Like a triple threat. I had some real cheesy-ass insurance agent trying to sell me on the HSA- the Triple Trifecta.

Al: That’s what he called it?

Joe: The Trifecta.

Al: This is what you want, Joe, you want the Trifecta. Let me explain.

YMYW Listener Comments on episode #302: Should You Pay Off the Mortgage?

Joe: Al, we got- we got some like fired up people on this podcast. We got a few- I don’t know, when was that show?

Andi: The mortgage one?

Joe: About paying off your mortgage.

Andi: That was about 3 episodes ago now. Yeah.

Al: Ok.

Joe: Carlos, he writes in “My mortgage is paid off. Don’t waste your time sending me information about mortgages.”

Al: Sorry.

Joe: Well I got that email, I’m like what the hell are you talking about, Carlos? Calm down. Slow your roll, bro. I’m not trying to sell you a mortgage. It was like our podcast newsletter. You’re the one that subscribed.

Al: We should’ve combed through our mailing list of what, 20,000 people? Pulled his name out?

Joe: I didn’t know Carlos’ mortgage was paid off. What are we doing? We’ve got our crack marketing team needs to button their stuff up here. I bet he gave us like a 1-star review. We got a couple 1-star reviews.

Al: Yeah.

Andi: Yeah that’s true.

Joe: How many total 1-star reviews we got now?

Andi: 7.

Joe: 7.

Al: 7.

Andi: But we’ve also gotten 160 5-star reviews so-

Al: Oh. But is the 1-star because we talk nonsense and-

Joe: I don’t know because now we’re talking about mortgages. Then we got Don. He wrote in too. He goes “Yes, without a doubt debt is a thief. Your house is not just an asset. It’s your home.” Really?

Al: Boy. I bet he’s a minister.

Joe: Oh my gosh. “Life brings ups and downs. When a crisis comes, and it will, you don’t need another crisis.” Doom and gloomer.

Al: Thanks for the advice, Don.

Joe: Oh man. “Borrowing on your home is just a way of making a crisis into a disaster. So only foolish people or unlearned people borrow on their home. Remember 2006 through 2011 when 3,000,000 people lost their homes because of poor advice from financial planners like you?

Al: He didn’t say ‘like you’. That’s what he meant though.

Joe: “I believe history is going to repeat itself again within the next 2 years as it has lasted 100 plus years and unfortunately people that have listened to advisors that would suggest they borrow on their homes won’t be around when this disaster hits.” Wow. This really struck a chord with Don. “The tax deduction never outweighs the benefit of you owning your home.” I wonder if he sounds like that too. Do you like my impersonation of Don?

Al: Yeah. That’s why I think he’s a minister.

Joe: “You will only realize 25% or 30% back. You will still leave 70% of the home to the bank if your home is not paid off. Pay off your loan-”

Al: “- as early as it can.”

Joe: Don.

Al: Repent. Repent.

Joe: I’m with you. I’m with ya. Happy holidays.

Al: I don’t think we disagree with any of this. I mean so first of all Don, it’s very hard to buy a home with cash. So most people-

Joe: People have a little debt.

Al: – particularly in San Diego, they don’t have $500,000 or $1,000,000 lying around, so they have to borrow. But if you’re talking about someone in retirement. Yeah. If you can get that debt paid off, go for it.

Joe: I don’t think we ever said take out a bunch- of- you know- and buy life insurance. That’s-

Al: Yeah, we’ve never said that. I mean there might be one case in 1000 where we- because of Roth conversions and taxes- we might say it because someone has a huge pension. They can afford it.

Joe: Right. They have $200,000 in fixed income.

Al: But in general Don, I agree with your comment. Why would you borrow against your home? Why create that stress if you’re in retirement? Now for the rest of you- and we’ve seen this problem- is they will go ahead and they pay off their mortgage with every cent they have and then they retire with no mortgage and no cash. It’s like well you can’t eat your house for dinner. At least, as far as I know.

Joe: Don, there’s a disaster coming and it’s a crisis. He said crisis like 6 times in this email.

Al: He did.

Joe: Yes, without a doubt. Debt is a thief. All right Don, relax. Happy holidays everyone. Thanks for listening once again. We’ll be back again I don’t know, next week? Andi’s on vacation so I don’t know.

Andi: That’s alright, you won’t notice I’m gone. The show will continue as if I was still here.

Al: Magically.

Joe: Wow, while she’s gonna be grinding away on vacation. Yeah. All right. So OK. I guess you’ll see us next week. The show’s called Your Money, Your Wealth®.

_______

Merry Christmas, Happy Holidays, and thank you all for being part of the quirky, fun YMYW family.

Subscribe to the YMYW podcast newsletter

FOLLOW US: YouTube | Facebook | Twitter | LinkedIn

Your Money, Your Wealth® is presented by Pure Financial Advisors. Sign up for your free financial assessment.

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

Podknife

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed