Can you convert your health savings account (HSA) to Roth, and do the five-year Roth withdrawal clocks apply? What should you do with money you’d been putting to your student loan debt if you’re part of the student loan forgiveness program? What’s the best way to invest your RMDs, or required minimum distributions? How does IRMAA, the income-related monthly adjustment amount for Medicare, apply to zero-coupon municipal bonds? And finally, strategies for collecting survivor Social Security benefits.

Show Notes

- (00:49) Can I Convert a Health Savings Account HSA to Roth IRA and Do the 5-Year Rules Apply? (Philip)

- (07:49) My Student Loans Were Forgiven. Should We Contribute to Roth 403(b)? (Pete, Winston-Salem, NC)

- (15:37) How Should I Invest Required Minimum Distributions? (Judy, San Diego)

- (22:17) How is IRMAA for Medicare Applied to Zero Coupon Municipal Bonds? (Jimmy)

- (26:40) 62 and Widowed: Claim Survivor Social Security Benefits Until Age 67? (Mark, Burke, VA)

- (30:11) Is Signing Up for Social Security Just Pretty Much Straight Forward? (Michael)

- (32:09) The Derails

Free financial resources:

WATCH | The Debt Ceiling and the Dollar

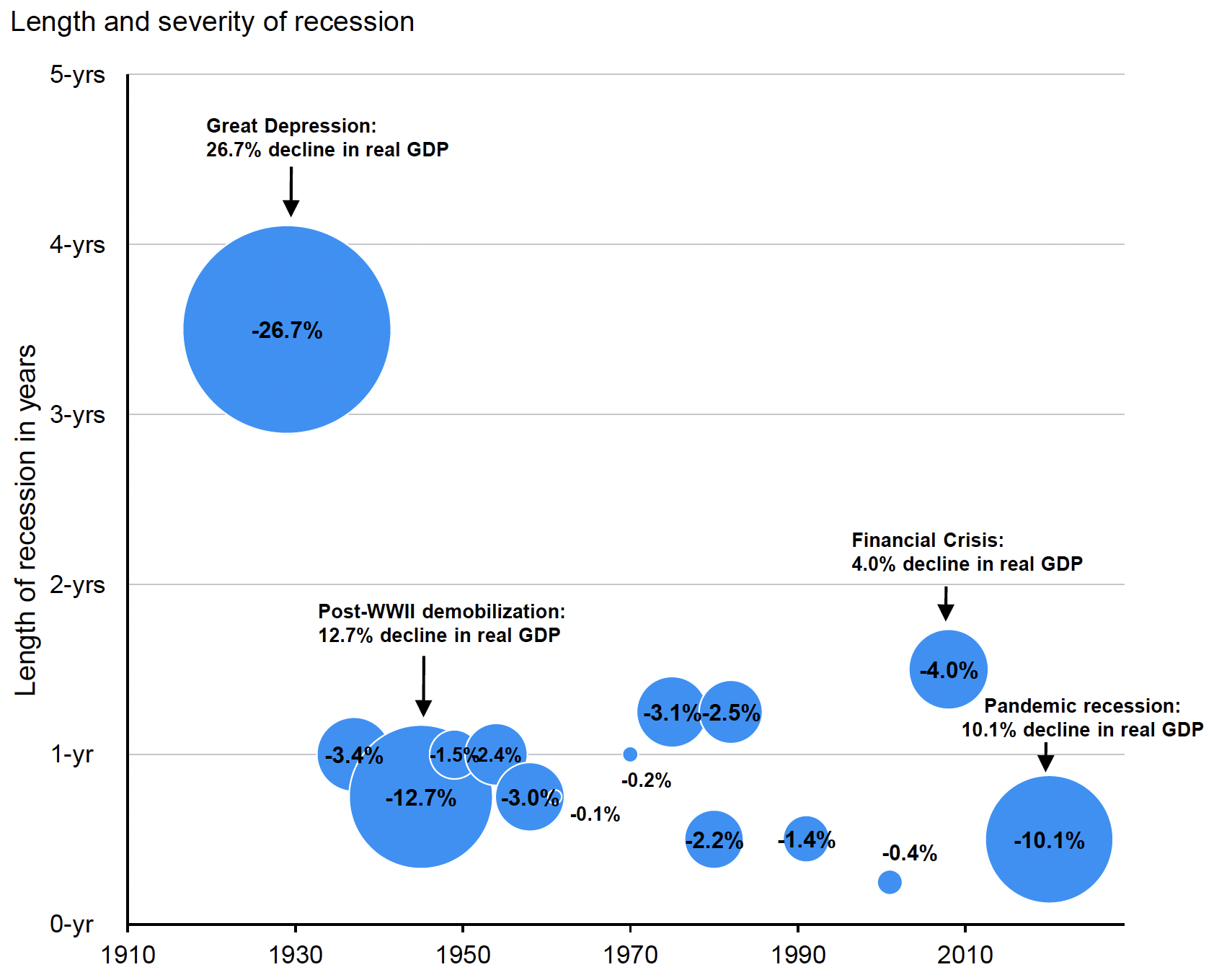

READ | Talking About Recessions

Listen to today’s podcast episode on YouTube:

Transcription

Can you convert your health savings account or HSA to Roth, and do the five year Roth withdrawal clocks apply? A question I don’t believe has ever been addressed, today on Your Money, Your Wealth® podcast 429. Plus, what should you do with money you’d been putting to your student loan debt if you’re part of the student loan forgiveness program? What’s the best way to invest your RMDs – your required minimum distributions? How does IRMAA, or the income-related monthly adjustment amount for Medicare, apply to zero coupon municipal bonds? And finally, strategies for collecting survivor Social Security benefits. If you’ve got money questions, visit YourMoneyYourWealth.com and click Ask Joe and Al On Air to send them in. I’m producer Andi Last, and here are the hosts of Your Money, Your Wealth®, Joe Anderson, CFP® and Big Al Clopine, CPA.

Can I Convert a Health Savings Account HSA to Roth IRA and Do the 5-Year Rules Apply? (Philip)

Joe: Let’s go to Philip, Big Al.

Al: Okay. Sounds good, Joe.

Joe: “Hi. I really appreciate the info provided through your website.” Oh, so he checks out the website. “I’m retired and have a balance in my HSA. I’ve been doing Roth conversions since 2020. Is there a way to convert my HSA balance to my Roth IRA? What are the rules governing such a conversion? Based on your explanation of the Roth conversion 5 year rules, I understand that since my Roth IRA has been open and funded for 5 years, and I’m over 59 and a half, that I have full access to the Roth IRA balance, including conversions and earnings on those conversions irrespective of any 5 year rules. Is this correct? Thanks in advance?” Well, there’s a lot in there.

Al: A couple- couple points to make here. You wanna start?

Joe: Sure. Do you wanna go over the 5-year rule again?

Al: Oh me?

Joe: No, I mean, should we start there?

Al: Oh. Yeah, probably.

Joe: Okay. So 5-year clock, there’s two 5-year clocks. One is based on contributions and the other is based on earnings. So the 5-year clock works like this on contributions, is that you- the money needs to season inside the Roth IRA for 5 years or until you turn 59 and a half, whichever is longer. So if you start a Roth IRA at age 60, you don’t have any access to the earnings until 65. If you started a Roth IRA at age 40, you don’t have access to any other earnings until 59 and a half tax-free. So there’s a 5-year clock, but the 5-year clock starts with the first dollar that hits the first Roth IRA. So most people basically get that rule. So the money has to season in a Roth IRA for 5 years, or 59 and a half. It is a retirement plan, right? So for most people, they get that you have to wait until a certain age to have access to the funds without any type of penalties. So, the 5-year clock with the Roth is a little bit different because it’s irrespective of the 59 and a half, it depends on when you started the overall Roth IRA. If you were over 59 and a half, that rule doesn’t apply. It’s gonna be 5 years after you start the Roth. So like my example was if you started at 60, you don’t have access to the earnings until 65. Now that’s contributions. So there’s a 5-year clock when it comes to Roth IRA conversions. So a conversion is when you take money from an IRA and you convert it into a Roth IRA. You pay the tax on conversion, but then all of those dollars will grow 100% tax-free as long as you qualify as the distribution and that qualification is going to be the 5-year clock, 59 and a half and everything else. But there is a 5-year clock on each conversion that you do if you’re under 59 and a half. Until you reach the age 59 and a half. And then the 5-year clock, we’ll look at, well, do you have any other Roth setters older than 5 years? And then the conversion 5-year clock basically goes away. Did I try to explain it a little bit different this time?

Al: Yeah, yeah. No, it’s, it’s, it’s good. Let me try to recap simply if I can, and that is, if you’re under 59 and a half, the rules are a lot more complicated. Let’s just, let’s just start there, right?

Joe: Correct.

Al: If you’re under 59 and a half and you make a contribution, You have to wait 5 years or 59 and a half, whichever is longer to get your earnings. But you can always get your contribution back-

Joe: I knew where you were gonna go there, I’m just confusing it more.

Al: -even the next day. No, no, not, not at all. And then the 5-year clock when you’re under 59 and a half, when you’re doing a Roth conversion, they want you to wait 5 years before it becomes like a contribution, if you will, to where you can get your money. But when you’re over 59 and a half, it’s much simpler, right? It’s only that one 5-year clock. As long as you had a Roth for 5 years and you’re over 59 and a half, you have access to everything. Your principal, your income, your growth. So I’ll put it that way.

Joe: All right. I like it. I was gonna go when you get access to your contributions, and then it’s-

Al: I- I know.

Joe: Well then it’s just so much. It gets so confusing then.

Al: I know. Yeah. So if you’re listening to this get the podcast transcript and read it 25 times. Then you’ll probably be more confused than when you started.

Joe: Yeah, I liked your explanation a lot more than mine, I gotta say. That’s the first time. Alright.

Al: I’ve heard you do it 100 times, so I’m getting it.

Joe: Yes, I got it. Alright, so now we got the question is, he’s been doing conversions. He’s over 59 and a half. And so he is like, okay, so he qualifies. He’s over 59 and a half. I’m- he’s been doing conversion since 2020. Hopefully he had a Roth IRA prior to that, so maybe he has a Roth IRA for over 5 years. So the 5-year clock really doesn’t apply to him, is what my assumption is.

Al: Yeah. And he actually says that ‘Roth funded for over 5 years’. Correct. That’s, that’s what I was looking for. Yep.

Joe: Oh, alright. And then, so hopefully we answered those questions. Now he’s going, “I have an HSA, health savings account. I convert that to my Roth”- and the answer is no. But why would you want to?

Al: Yeah, you can’t directly, I mean, I suppose you could convert it to an IRA. You’re allowed to do that, and then you could do a Roth conversion from the IRA. But I don’t see a reason to do that, to be honest. Because if the money’s in the HSA, it means you can use it for medical purposes through the rest of your life. Even Medicare premiums the rest of your life. And-

Joe: – tax-free.

Al: -not pay any tax, tax-free. Tax-free.

Joe: It’s like a Roth IRA.

Al: That’s right. It’s like a- Yeah, exactly. And you’ve never had to pay tax on it. Now, if you do need the money for other purposes, you are allowed to withdraw it by the time you reach age 65 and you avoid that 20% penalty. You still have to pay income taxes on it just like any IRA. But so that’s available if you need it for something other than medical. But for most people, as they get older, Joe, the medical expenses go up. So I’m not sure why you’d wanna do that.

Joe: Right. So an HSA is like a Roth IRA, but you just have to use it for certain expenses.

Al: Yeah, and it’s even better cuz you got a tax deduction putting the money in where you don’t with a Roth. And so as long as you use it for medical expenses, it’s triple tax-free as they say.

Joe: So, but you could take the HSA, as long as Phillip is over age 65, he could roll that into an IRA and then if he wanted to then convert it into a Roth IRA. But he would pay the tax on the conversion. So if he keeps it in the HSA, he has access to those dollars tax-free. As long as they’re a qualified distribution.

Al: Yeah, that’s what I would do. I wouldn’t even think about it. But we don’t know completely about your situation, Philip, but I would be hard pressed to figure out why someone would wanna do that.

My Student Loans Were Forgiven. Should We Contribute to Roth 403(b)? (Pete, Winston-Salem, NC)

Joe: Pete from Winston-Salem, North Carolina. “Gentlemen, 40 years old, married, 3 young kids. Drive a Toyota Sienna minivan. Favorite drink is a cheap lager. I make $250,000 a year. I got my student loans forgiven under the public service loan forgiveness program, working 10 years for a nonprofit healthcare system.” Okay, cool. “And my finances set up previously to minimize what we’d have to pay towards my loans each month in the income driven payments. Now we have no longer to worry about that. I’m wondering if I should switch to the Roth 403(b) going forward. We have $230,000 in Roths, $400,000 in a traditional, $10,000 in an HSA and $165,000 in my 457 plan.” 4, 5, 6, 7, 8. So about $800,000, he’s 40 years old. Sounds about right?

Al: Yeah. Let’s see. Yeah. But yeah, we’ll go with that.

Joe: Okay.

Al: That’s about right.

Joe: “But I don’t really have a clear vision on how much money we need in retirement, so I’m having a hard time making projections.” Well, Pete. What you need is how much money that you’re spending, not necessarily how much money that you’re making, because he makes $250,000 a year. He pays tax on that. And he’s saving, I don’t know how much he saves into his 403(b) and his 457. He’s got money in both of them. So is he spending $150,000 and $100,000 goes to taxes and savings? I mean that’s where I think he’s having a tough time getting that vision because you need to figure out, well, what do you need to spend in retirement? And then that can build up your savings plan, and then that will help determine, well how much money that you’ll need in retirement to provide the income that you need and then that will help you with your tax strategy long term as well.

Al: And that’s hard. That’s hard to do when you’re 40 cuz it’s hard to even think about retirement. But I think-

Joe: It’s not that hard to think about retirement, Al.

Al: Can you say that? Okay. But here’s what I was gonna say. At least start with what you’re- what you’re spending right now, and then just project that forward with inflation rates of whatever you choose, 3% or whatever you want to choose. That’s- that’s probably what I would do.

Joe: Let’s see. “I also would like to hear what you think about non-governmental 457 plans. I’ve been maxing mine out for years to minimize my income.” All right, so he is maxing out the 457. “But the risk of losing it if my employer goes bankrupt is a little troubling to me. I work for a large national healthcare system and they seem to be okay financially, and I’d hate to leave a tax advantage bucket unfilled, but I also hate to lose all that money. I also have a related question. If things start to seem dire financially for my employer, could I just immediately quit and take my 457 money out immediately? Obviously it’d be a tax hit, but it’s preferable to losing it. You guys have any experience in this arena? Thanks for all you do, Pete.” Pete must be a doc.

Al: Yeah, I think he is too. So a non-governmental 457 plan needs to be a nonprofit and a lot of the a lot of hospitals are nonprofit, so that’s what I’m guessing too. He’s probably a doc, cuz usually- usually those kinds of plans are for highly compensated people.

Joe: Yeah, well you get school teachers have 457 plans and 401(k)- 403(b)s. He works in a hospital. 403(b), 457. Got his student loans forgiven because he worked in a nonprofit healthcare system for 10 years. Kind of grinded out there, took a big pay cut to grind away and then worked it out where hey, he doesn’t have to pay a student loan. So good for him. But he wants to go part-time in 5-ish years. He’s 45. I got a two-year plan, Al. I’m gonna be 50 here in a couple-

Al: You should’ve- you should’ve gone halftime a couple 3 years ago.

Joe: I know, when I was 45.

Al: Well, I think maybe non-governmental 457-

Joe: I wouldn’t worry too much about it to be honest, but let’s just say something blows up. I don’t know what the rules are to his specific 457 plan, but let’s say he quits. Hopefully they don’t lock up the plan where he could roll that money into an IRA right away. He wouldn’t have to cash it out. When he retires, he could roll that into an IRA and not necessarily have to pay any tax.

Al: I don’t think so. I think most of those are non-qualified.

Joe: You could roll up a 457 plan into an IRA.

Al: I don’t think a non-governmental, I think it’s more like a deferred comp plan.

Joe: Well, depends on the plan document.

Al: Exactly. I guess what I’ve seen on those is either 5 or 10 year payout. You can’t just get a lump sum necessarily. And he does give a true statement, which is, it’s kind of like a retirement plan, and I’m talking non-governmental, non-qualified deferred comp plan. So if it’s something other than that, but I think most of these are, then the thing is it’s not a funded account generally by the employer. It’s just the employer promises to pay you later. And if the employer goes bankrupt, you don’t get that money. So that is the risk. And the younger you are, the more you give pause, I think. But on the other hand, if you gotta retire or semi-retire, maybe that works and you get your 5 or 10 year payout and just do it that way.

Joe: No, I agree with you 100% if it’s a deferred comp plan. Because you have to elect what you’re gonna put in the deferred comp plan a year in advance of, you know, even the money going in, and then you elect your payment of what’s gonna come out 5 or 10 years from now. But this could be a plan that works very similar to an IRA- I mean to a 403(b), where if he wants to roll that money into an IRA, he could potentially, I don’t know. I don’t know exactly what the plan doc is. Sometimes people call retirement plans all sorts of different things, it could be one or the other.

Al: Sure. And- and even if it’s non-qualified, as I’m guessing it is, although I don’t know for sure either without seeing it, but if I am correct, every single plan is different. And so there’s not a lot of ton of rules with the IRS on that. I mean, you have to have some kind of plan document and some kind of distribution plan. But anyway, I guess the main answer is take a look at the plan, see what you have. And just be aware that if it- if it’s what I think it is, a non-qualified deferred plan, you are subject to losing it if the entity in this case, non-profit entity, goes bankrupt.

Joe: All right. Hopefully that helps. One of us knows what we’re talking about. The other one is probably clueless. You’re gonna have to guess on who that is.

Before you make any big retirement decisions, talk to someone who actually does their homework. Scheduling a free financial assessment with one of the experienced financial professionals Joe and Big Al’s team at Pure Financial Advisors. They’ll take a deep dive into your entire financial picture, rather than just spitballing on the fly. From Roth conversions and tax planning to Social Security optimization and investment management, they’ll uncover all the best strategies for your situation. And they won’t try to sell you any products or charge you any commissions, because they’re fee-only fiduciaries who have to act in your best interest, not theirs. Meet in person at one of Pure’s 7 offices in Southern California, Seattle, Denver, or Chicago, or via Zoom right from your couch. Schedule your free assessment now. All you have to do is click the link in the description of today’s episode in your favorite podcast app and go to the show notes, then click the Get an Assessment button and pick a time that works for you.

How Should I Invest Required Minimum Distributions? (Judy, San Diego)

Joe: Let’s go to Judy. “Important stuff. I’m 72. Drive a 2015 Subaru wagon. Drink iced tea, but I cook with wine.” Okay. I cook with iced tea.

Andi: And drink the wine.

Al: I knew you were gonna say that. If you have iced tea, you’ll just cook with it.

Joe: Oh, “I got one mutt dog. Two fuzzy cats. I have a pension that covers my living expenses. I have $150,000 in a Roth, thank you. Been doing conversions and a small brokerage account about $25,000. I have $440,000 in an IRA and I’m starting to take my required minimum distribution soon. So what do I do with the RMD? I’ll give some QCDs-.” So that’s a little qualified charitable deduction. “- and think I’ll have between $25,000 and $30,000 to invest. I’m thinking treasury bills or municipal bonds as they’re not taxed by the state and seem safe for the long term. Do you have any guidelines as to what to look as the economy changes? Is there any guideline for splitting between bonds and stocks? Thank you for your spit balls, humor and being honest about what you know and what you don’t. The knowledge you show off the top of your head is impressive.” Wow.

Al: That must- that must be the part that we know, or at least we think we know?

Joe: Yeah, we don’t know much.

Al: We always qualify it anytime there’s a legal question, we’re just kind of stabbing in the dark.

Joe: Okay. Interesting. So she’s got an RMD, she’s gonna give some of it to charity. And then she’s thinking about, all right, well I have this other dollars. What do I do with it?

Al: Yeah. So by the way, qualified charitable distribution, once you’re over 70 and a half, you’re allowed to give money directly outta your IRA to charity. So it doesn’t show up as income on your tax return. Doesn’t show up as a deduction either, but you avoid the income altogether, which is beneficial for a whole variety of reasons, which I won’t explain right now. But that’s what that is. Once you are RMD age you can do- you can have it count for your RMD and it can be as much as $100,000 if you want.

Joe: So I guess my question to Judy is, is that, you know, it’s interesting, people have- if it’s in a retirement account, they feel comfortable investing. You know what I mean?

Al: Yeah. I do.

Joe: I got a 401(k), I got mutual funds, I got stocks, I got- you know, I’m just picking and choosing, and then as soon as that money is out of their retirement account, it’s like, oh my God, what the hell do I do with this?

Al: Yeah. I think that’s common because now all of a sudden they have access to it and they, they don’t wanna lose it.

Joe: Right. It’s like it feels closer to them or something. It’s not in this shell of a 401(k), like it’s in some sort of tomb. Judy, you can invest the same thing that you are right now in your 401(k). I mean, if you like the investments that you’re currently in, why not have the same strategy? She doesn’t necessarily need the money. I mean, we could get into the tax implications of things. You know, and there’s asset location and there’s certain sophistication we could get into off the top of our head. Money outside of her retirement account is the same as money inside of her retirement account. I don’t think- like is she investing in TBills in her 401(k)? I doubt it.

Al: Yeah, probably not. Now, of course, if she needs access to it, then that’s a different thing. But she hasn’t said that she does.

Joe: She says her pension covers her fixed income.

Al: Well, you never know whether she’s gonna have something special that she wants to do. Go on a vacation.

Joe: Sure, sure.

Al: Buy a boat. Buy a cabin in the mountains. I don’t know. But anyway, yeah, it’s the same money whether it’s inside or outside of your retirement plan. But the how you figure out what to invest in is based upon what your goals are, what you want to have happen with the money, what sort of rate of return that you need to meet with your goals, right? So that’s- you don’t really think of these in silos. In other words, you don’t have one investment strategy for your non-retirement assets in a different one. You kinda look at these collectively, figure out how you should invest for- to get the rate return that you want. Then once you figure that out, now you actually can pick and choose, right? You might, if you got Roth IRA, you might wanna put your stocks in there because stocks grow more than bonds over the long term, and they’re tax-free, by the way. And you might wanna put your safer money in your IRAs because if they grow there, then you’re just gonna have to pay more ordinary income taxes. That’s asset location. But, I think the question is, what should I invest in? And the answer is you have to look at this globally with everything to figure out what investments are appropriate for you based upon what your goals are.

Joe: You don’t have to sell the investment in an RMD. You could take the investment out of the retirement account and put it into a brokerage account. So if you’d like the mutual funds that you currently have in the IRA, you don’t have to sell it and reinvest it, first off. So just take your distribution and put it in your brokerage account. Or if you’d think, I wanna be a little bit more- because she’s asking us questions about timing the markets too.

Al: Yeah, she is.

Joe: It’s like, well, what do you think about the economy? What- so already she’s thinking that she wants to have a different strategy with this money. And I think what you and I are both saying maybe in a different way, is that you have to have one strategy based on the assets that you have, no matter what account it’s in, and make sure that you invest it globally.

Al: No, that’s exactly right. And, and I guess to kind of take on that second question, which you’ve already alluded to, it doesn’t really matter what the market is. You gotta look at what your goals are, what rate of return you need to decide what the allocation should be, in good markets and bad. And if you need a 5% rate of return, then don’t shoot for a 10% rate of return. It’s just gonna be a lot more volatile than you need. So have the most conservative investment portfolio possible to meet your goals and then your well set up for good markets and bad markets.

Bad markets indeed. The financial headlines lately are pretty concerning. Is the US about to breach the debt ceiling limit? What does that mean for the value of the dollar? Are we headed into a recession? If you’re anxious about the impact these frightening events could have on the economy and your money, you need to check out today’s podcast show notes. We’ve got new free resources by Pure Financial Advisors’ Executive Vice President and Chief Investment Officer Brian Perry, CFP, CFA to help you ignore the hype and put recessions, the debt ceiling, and the dollar into practical context. Click the link in the description of today’s episode in your favorite podcast app to check out these helpful free resources in the podcast show notes, just before the transcript. Then, if you’ve got questions, click Ask Joe and Al On Air there in the podcast show notes and send them on in.

How is IRMAA for Medicare Applied to Zero Coupon Municipal Bonds? (Jimmy)

Joe: You wanna go with zero coupon man?

Al: Sure.

Joe: All right. We got Jimmy calling in again. He’s got a question for the team on IRMAA and how it’s applied to zero coupon municipal bonds. “Let’s say I’m 55-“

Al: So is that a- is that for real or maybe not?

Joe: I don’t know. Let’s just, hypothetically- I’m 55.

Al: Okay. Well, if I were-

Joe: I mean, and he is talking about IRMAA, which is 10 years from now.

Al: Got it.

Joe: Okay. “-and I buy today, a newly issued California zero coupon bond with a 20-year maturity.” All right, so now I know where he is going with this. “Also assume I hold it till maturity and redeem it when I’m age 75. What happens when I reach 65 and I go on Medicare? I understand IRMAA requires me to add back the imputed municipal bond interest, but when and how much?”

Al: That’s enough.

Joe: That’s enough. Then he breaks it down in like 15 different steps. We could do this-

Al: Yeah, yeah, yeah. So this is Jimmy. Do we think we might even know Jimmy?

Joe: I don’t know. I don’t know Jimmy.

Al: That’s- Well, anyway, so Jimmy, so here’s the way that this works. It’s a- it’s a fairly complex calculation, but yes. So when you buy a zero coupon bond, let’s just say you buy a $10,000 bond and it pays zero coupon interest, which means you don’t actually get it currently. But the way that you make profit is you pay $5000 for a future $10,000 bond or whatever the numbers are, doesn’t matter. So in that particular case, you invest $5000 and whatever period of time in the future, you get $10,000 back. So that extra $5000 that you got, that’s interest. And what the IRS thinks of it is called imputed interest, which means- imputed interest means even though I didn’t really get it, I’ve gotta pay taxes on it. Now, in this case, it’s tax-free municipal bond, but when it comes to IRMAA-

Joe: You gotta look at modified adjusted gross income.

Al: Yeah, income related monthly adjustment amount. I always have to write it down cause I always forget exactly what that stands for. But what it means is depending upon what your modified adjusted gross income for purposes of Medicare, there’s all kinds of different ones, which you have to add back your tax-free interest among other things. You’ve gotta figure out your imputed interest on that bond in every- in that year to figure out what your- you know what, what the modified adjusted gross income is. Which then determines how much you pay for your Medicare payments starting at age 65. Usually the brokerage firms calculate that for you and put it on your 1099. But essentially it’s kinda like that extra $5000 of interest income, you have to take a piece of that each year, and it’s not the same each year, which makes it way more complicated. But yeah, you gotta add it in year by year, by year by year. And in this particular case, what the- what your IRMAA is in when you’re age 63. Because you do a two year look back, affects your age 65 when you start Medicare. So that’s the quick answer. If you wanna learn how to do imputed interest, then have fun. I’ll just put it that way. It’s an algebraic calculation with the exponents.

Joee: And so to dumb this down just a bit. So a normal bond is a loan. So let’s say $10,000, I’m going to invest in a bond or I’m gonna loan it to an individual or a corporation or whatever. And I’m going to receive interest for that. So maybe I get 5% interest, and I’m gonna receive that interest payment each year, and at the end of the term of the loan, I get my $10,000 back.

Al: Yeah, that’s the norm, right?

Joe: A zero coupon bond is that there’s no coupon. There’s no interest payment. So it’s basically I’m buying that $5000- or I’m buying a $10,000 bond that matures in 10 years, but I’m only paying $5000 for it. So at the end of- so I’m not receiving any interest payments, but at the end of the 10 years, then it comes to maturity. But then it grew to that $5000, and then that’s where this whole imputed interest comes about. So thanks Jimmy for that wonderful question. It’s just so stimulating.

62 and Widowed: Claim Survivor Social Security Benefits Until Age 67? (Mark, Burke, VA)

Joe: Well, hey, welcome back. We got Mark from Burke- Burkey, Virginia?

Andi: Burke.

Joe: Burke. Burke. Never heard of Burke. “Good day. Joe, Al, Andi. I’m from San Diego-” But it’s Burke, VA?

Andi: That’s what it claimed.

Joe: Okay. But he’s from San, he’s from San Diego.

Al: Maybe originally.

Joe: Born and raised. “-with a brief 3 year stint as a kid in Bemidji-” Wow.

Al: You know where that is?

Joe: I do know where Bemidji is.

Al: In Minnesota?

Joe: Uhhuh, don’t you know? “-where my dad coached at BSU.” Okay. Huh. Very interesting. “Marine Corps career moved me all over and ended up in Northern Virginia.” Oh, that’s where he is at Burke. “Some quick details. Retired from USMC after 25 years and now working for the federal government to support the Marines in the DC area. Driving a VolvoS40 T5, 2009. Married, two kids, grown, out of the house. Bourbon. Love it. “Moving on. All right. “I have Social Security question for you. My sister was widowed 11 years ago. She’s now 62. She’s still working, doesn’t plan to retire until 67, at which time she will draw her own Social Security benefit. Is she eligible now to apply and draw Social Security under her husband’s name as a survivor benefit until she begins drawing her own at age 67? Thanks for the podcast. Been listening for 6 years now.”

Al: Wow.

Joe: “Sempre Fi. Mark.” 6 years.

Al: That’s a long time to listen to our share.

Joe: Wow, Mark. Thank you. Long time listener.

Andi: That’s like before me.

Joe: Oh, wow. That’s a long time. Well we’ve been doing it for 15.

Al: 15.

Andi: Yep.

Al: So you missed the first 10.

Joe: You missed the first 10, Mark.

Al: Those were practice years.

Joe: Go to the archives. Oh God. That’s a long time. Okay. So you could claim a survivor benefit. As early as 60.

Al: Correct.

Joe: But there’s an income phase out. So she’s working.

Al: Yeah. I’m guessing she won’t get to keep any of it until she gets to full retirement age, which at that point looks like she’s gonna collect her own anyway.

Joe: Correct. So yeah, she’s eligible for the survivor benefit, but it’s the same phase out. If you have earned income, if you’re working and you’re collecting Social Security benefit for every couple dollars that you make, they take a buck back and so on and so forth.

Al: And that starts at about $20,000 of income, the first $20,000 ish you get to keep. Get to keep all the Social Security, but once you make more than that, you start giving it back.

Joe: So it depends on how much money that your sister’s making, but the old rules is, sure. I mean, well, if- she wasn’t working at all, she could claim the survivor benefit and switch back to her own, depending on which is the higher benefit and vice versa. So we would just have to look at the numbers. What is the survivor benefit? What’s her benefit gonna look like? You know, how long does she really wanna work? What is their other assets? And then is it possible for her to retire maybe a little bit earlier? Given the fact that she does have a survivor benefit that she could draw a little bit of cash flow from.

Al: Yeah, that- that’s a good point. So, so maybe, excuse me, maybe she could and still be fine. But if you do take it early also it’s gonna reduce your future benefit as well.

Joe: Yeah. So, okay. Hopefully that answers your question.

Is Signing Up for Social Security Just Pretty Much Straight Forward? (Michael)

Joe: Here’s a question for you. “Hello, please. LOL. Is signing up for Social Security just pretty much straightforward?”

Andi: I love this one.

Joe: What the hell kind of question is that? “Help. Please.” He’s drowning in the Social Security hell.

Al: So go online, type in ssa.gov. That’s the Social Security website. They’ve got all kinds of resources on how to sign up or just call ’em.

Joe: Just go to the office.

Al: Just call ’em or go to the office. And it’s- is it straightforward? Yes. But-

Joe: There’s nuances.

Al: -there’s lots of nuances that you need to be educated or you need to find someone that can help you.

Joe: All right. Well, I think that’s it for us. Thanks, Andi. Another wonderful job.

Andi: Thank you.

Joe: All right, Al. We’ll see you next week and we’ll see everyone else at the same time I see Big Al. So have a wonderful week everyone. We’ll see you next time.

Andi: Al’s back in Hawaii, bartending with Zeke and minivans in California in the Derails, so stick around. Help new listeners find YMYW by leaving your honest reviews and ratings for Your Money, Your Wealth in Apple Podcasts, and any other podcast app that accepts them.

Your Money, Your Wealth® is presented by Pure Financial Advisors. Click the “Get An Assessment” button in the podcast show notes at YourMoneyYourWealth.com or call 888-994-6257 to schedule your free financial assessment, in person at one of our seven offices around the country or online, a time and date convenient for you, no matter where you are. Chances are, one of the experienced financial professionals at Pure will be able to identify strategies to help you create a more successful retirement.

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

The Derails

_______

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

Podknife

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed

IMPORTANT DISCLOSURES:

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

• Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, LLC, a Registered Investment Advisor.

• Pure Financial Advisors LLC does not offer tax or legal advice. Consult with your tax advisor or attorney regarding specific situations.

• Opinions expressed are not intended as investment advice or to predict future performance.

• Past performance does not guarantee future results.

• Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

• All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

• Intended for educational purposes only and are not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors.

CFP® – The CERTIFIED FINANCIAL PLANNER™ certification is by the Certified Financial Planner Board of Standards, Inc. To attain the right to use the CFP® designation, an individual must satisfactorily fulfill education, experience and ethics requirements as well as pass a comprehensive exam. Thirty hours of continuing education is required every two years to maintain the designation.

AIF® – Accredited Investment Fiduciary designation is administered by the Center for Fiduciary Studies fi360. To receive the AIF Designation, an individual must meet prerequisite criteria, complete a training program, and pass a comprehensive examination. Six hours of continuing education is required annually to maintain the designation.

CPA – Certified Public Accountant is a license set by the American Institute of Certified Public Accountants and administered by the National Association of State Boards of Accountancy. Eligibility to sit for the Uniform CPA Exam is determined by individual State Boards of Accountancy. Typically, the requirement is a U.S. bachelor’s degree which includes a minimum number of qualifying credit hours in accounting and business administration with an additional one-year study. All CPA candidates must pass the Uniform CPA Examination to qualify for a CPA certificate and license (i.e., permit to practice) to practice public accounting. CPAs are required to take continuing education courses to renew their license, and most states require CPAs to complete an ethics course during every renewal period.