Michael from FinanciallyAlert.com reached FIRE at age 36 (that’s Financial Independence / Retire Early). He shares his inspiring success story of how being financially alert allowed him to transition from small business entrepreneur to stay-at-home Dad and FIRE blogger with a growing net worth of over $2M – and how he can coach you to FIRE too. Plus, market volatility is back, but Chuck Norris laughs in the face of market dips – and Brian Perry, CFP® has the Q1 market update. It’s tax season and you might not get audited, but watch out for those penalties. And just how much should you have in Roth, tax-deferred and taxable accounts at retirement?

Show Notes

- (01:30) Chuck Norris Facts and Brian Perry on Market Volatility, the Bond Market, and Bond Alternatives

- (18:11) How Michael from FinanciallyAlert.com Got Started

- (27:09) How Michael from FinanciallyAlert.com Can Coach You To FIRE

- (37:21) Tax season filing deadlines and audit chances

- (42:15) How Much Should I have in Roth, Tax-Deferred and Taxable Accounts at Retirement?

Transcription

President Donald Trump’s new tax law has changed a lot of things this year – the tax brackets, deductions and exemptions, capital gains taxes, and more. What’s different, and what stayed the same? We’ve got a handy guide containing Key Financial Data for 2018 – just visit YourMoneyYourWealth.com and click Special Offer to download it for free. You’ll have those changes, plus important tax deadlines, retirement account contribution limits, useful Social Security and Medicare info and so much more, right at your fingertips. Just click Special Offer at YourMoneyYourWealth.com to download it free.

For me, the next level, I want to get to $10 million. It’s not about the money anymore, it’s about growing and becoming the person that I want to be. So finding those people that have already done that, and then going after that. And I want to know that they have the details to back that up. I don’t want to be learning from someone that is just talking about stuff in the ether, so to speak. – Michael, FinanciallyAlert.com

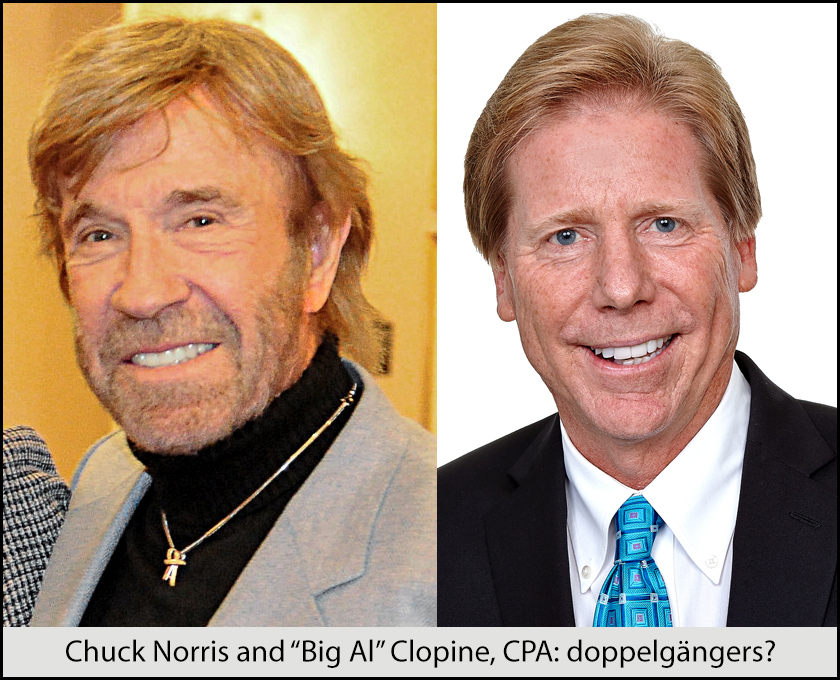

That’s Michael from FinanciallyAlert.com. Today on Your Money, Your Wealth®, he shares his inspiring success story of how being financially alert allowed him to transition from small business entrepreneur to stay-at-home Dad and FIRE blogger (that’s Financial Independence / Retire Early) with a growing net worth of over $2M – and how he can coach you to FIRE too. Plus, market volatility is back and Brian Perry, CFP® has the Q1 market update. It’s tax season and you might not get audited, but watch out for those penalties. And just how much should you have in Roth, tax-deferred and taxable accounts at retirement? Here are Joe Anderson, CFP® and Chuck Norris – uh, I mean, Big Al Clopine, CPA with the answers.

1:30 – Chuck Norris Facts and Brian Perry on Market Volatility, the Bond Market, and Bond Alternatives

AC: Sure. People think I look like Chuck Norris.

JA: (cackles) You are Chuck Norris!

AC: Just because I’m Big Al.

JA: Big Al is like Chuck Norris. So I have this book. And it’s these little Chuck Norris sayings, like Chuck Norris, he only owns number one pencils.

AC: Oh, doesn’t bother with two. (laughs)

JA: (laughs) He doesn’t bother with 2.

AC: Now is he saying it himself in the third person?

JA: This is this is this is real life stuff! Like all of Chuck Norris’ teeth – they’re wisdom teeth. (laughs) I love Chuck Norris.

AC: That means you love me!

JA: I do love you, Al!

AC: You see Chuck Norris when you look at my face?

JA: Yeah, that and Mike Schmidt.

AC: Similar look, right? Schmitty. I got to meet Mike Schmidt a few years ago. Kinda fun.

JA: Yeah wasn’t that at the Stan Humphries celebrity golf tournament?

AC: It was. I sat right next to him. Little hard to get him to talk. (laughs)

JA: What is it called when you look like someone? A doppelgänger?

AC: I… I dunno.

JA: Now see I’m just helping you out here. It’s called a doppelgänger.

AC: OK. Never heard of that in my 60 years.

JA: See? I’m educating you right off the bat. Did you know Alan, all of Chuck Norris’ toes are big toes? (laughs)

AC: (laughs) I figured.

JA: A solar eclipse is the sun’s attempt to hide from Chuck Norris. (laughs) Speaking of Chuck Norris…

AC: By the way, Brian, we’ve been doing these air – and they get funny as you go.

JA: Yeah, we haven’t even introduced Brian Perry. Brian Perry is our Director of Research at Pure Financial Advisors. And Alan was talking that he looks like Chuck Norris, so I was giving Alan some Chuck Norris quotes here.

AC: A lot of people mistake me.

JA: Yes. Brian Perry, welcome to the show.

BP: (laughs) Thank you. Great to be here again.

JA: Do you know who Chuck Norris is?

BP: I do. Walker, Texas Ranger. American hero.

JA: Yes!

AC: Also the Total Gym guy. (laughs)

JA: Did you know that Chuck Norris can tie his shoes with his feet? (laughs) All right, well hey – we need to have some comic relief here because that market, the first quarter was a little rocky. I think some volatility, to say the least, there, Brian.

BP: Yeah absolutely, and I appreciate your keeping your sense of humor through it all, and it’s probably a good lesson for investors. Because after 2017 was one of the smoothest rides we’ve seen in markets in, frankly, in history, and was more or less a one-way ride higher. Q1 of 2018 continued that way with a strong January, and then towards the end of that month kind of hit the skids and we saw extreme volatility with multiple thousand point declines in the Dow Jones industrial average, and then recovered a little. And now more recently, we’ve seen intense volatility again and wound up with a down quarter for U.S. stocks.

JA: How did we end up? Let’s go through some of those numbers for our listeners.

BP: Yeah, so as always, it depends on what asset class you’re looking at. Some investors had a pretty good quarter. Emerging markets were up 1.6%, which doesn’t sound like a lot, but it’s a positive return. The flip side is REITs, real estate investment trusts, were down 7.4% in the U.S. But the truth of the matter is, most markets were down anywhere from 1 to 2%. So you had the S&P 500 down just over 1%. You had the bond market – which usually the bond market tends to move a little bit in the opposite direction of stocks, but higher interest rates did that and as well down about 2% on the main bond market index. And then if you look at smaller stocks in the United States, also down in the 1% range. All in all more red than blue.

JA: If you take a look, this does not happen often, this quarter, where you have a broad stock market in negative territory, as well is a safe asset class such as bonds, down as well.

BP: And that’s certainly true over the last couple of decades. What’s interesting is, if you look, there’s definitely a perception that stocks and bonds move in opposite directions, and that’s been true for the better part of the last 15 or 20 years. But over a longer period of time they tend to move more often than not in the same direction, which may come as a surprise to a lot of today’s newer entrants into the markets. And as a rule of thumb, bonds and stocks move in opposite directions when inflation is at low levels and/or investors aren’t concerned about inflation. As inflation begins to tick up – and one of the things we saw that upset markets this quarter was fear of higher inflation – as inflation reaches higher levels, bonds and stocks actually do begin to move more often than not, in the same direction. So I think that investors, going forward, there’s certainly value to the diversification bonds provide, but they don’t want to rely on that too heavily, and they do want to understand that sometimes they do move in the same direction. That being said, bonds generally don’t move down as much as stocks when stocks are falling.

JA: Why does that happen? So as inflation goes up, that means what? The cost of my goods and services that I purchase increase. And so, why would bonds go down as inflation goes up?

BP: Yeah, very simple: for most bonds, and of course there are a lot of varieties of bonds, but for most bonds, you’re receiving fixed coupon payments on a semi-annual basis. And then at the end of your investment, you receive your principal back. The higher the rate of inflation, the less those future payments of interest and the return of principal are worth. And so, bond investors above all else fear inflation, because it eats away at the purchasing power of the dollars they’re going to get back in the future, and those dollars are fixed. That’s one of the reasons sometimes stocks do a little bit better in an inflationary environment. It’s because the argument goes that stocks and the companies behind them have a little bit more pricing power, they can generate profits, they can increase dividends, and you can get capital gains, perhaps, from stocks that will keep pace with inflation. But in the last quarter, we saw fears of higher inflation, which hasn’t necessarily actually shown out yet. Inflation’s a little bit like the bogeyman, where people are always looking for it, even when it’s not there. But that resulted in an uptick in interest rates, which caused bond prices to fall, and then those fears of interest rates going higher earlier in the first quarter actually prompted some of the stock declines as well.

AC: I got a question Brian about bonds because I think a lot of people are concerned about bonds. They’ve gotten a lot of bad press, it seems, the past several months or even quarters. And when you invest in bonds, it’s mainly for some security in your portfolio, yet they go down. But there are some risks with bonds like duration, credit quality – can you kind of go over that and explain that?

BP: Yeah, absolutely. As with anything, when you invest in something, there’s always a risk of loss. Otherwise, you wouldn’t get a return. And there are different sources of ways that you can lose money in bonds. One of the big ones is credit risk, and that’s probably what most people are familiar with is, let’s say they bought an Enron bond or a Lehman Brothers bond before those companies went under – you buy those bonds, the company goes under and they can’t pay you back. Generally speaking, you don’t lose 100% of your investment, but you lose a significant portion of your investment. The problem with credit defaults like that is that you don’t have a choice of whether or not to lose the money. In other words, when the company goes under or the entity goes under, you’re not getting your money back. The other main source of risk in the bond market is interest rate risk, and that’s what you mentioned with duration. Duration is just a mathematical equation that measures how sensitive a bond’s price is to interest rate movements, both up and down. And what happens is that when interest rates move lower, bond prices tend to go higher. And when interest rates go higher, bond prices tend to go lower. The thing of it is, and the longer the duration, and the longer the maturity of the bond, the more sensitive it is to the interest rate fluctuations. The one thing I think it’s important to remember because a lot of people do worry about rising interest rates causing the price of their bonds to fall is that you don’t have to realize losses that are caused by an interest rate movement. And what I mean is, getting back to the credit event, is that once you’ve lost money there, you don’t have a choice. Your bond was worth 100 cents on the dollar, now it’s worth 30 cents on the dollar, and you have to realize that loss at some point. With an interest rate movement, you can choose not to sell the bonds, even if the bond has declined in value, let’s say from 100 cents on the dollar in the marketplace, to now it’s worth 90 cents on the dollar – if you don’t sell, you haven’t realized that loss and you can still wait for the bond to mature at par, assuming that there’s no credit event, and realize your full investment.

AC: Yeah, so clearly, Brian, shorter-term bonds, higher quality, they’re going to be safer, but then you give up returns. So how should people look at bonds?

BP: Yeah, the most important thing is that there is no one answer. There are vastly more bonds available than there are stocks available, but a couple of the common things to consider is, you want to match the maturity of your bonds to your time horizon. What I mean by that is that if you need money, let’s say in two years to fund a child’s education, you shouldn’t go out and buy 10-year bonds. You should buy two-year bonds. And if it’s a longer-term investment, let’s say it’s part of your portfolio for retirement, oftentimes you still don’t want very, very long bonds, because what happens is that, over time, bonds in let’s call it the 2 to 10 year range, or the 2 to 15 year range, provide the vast majority of the returns you can get by going out longer. But they have a lot less of that interest rate risk that we were just talking about. So as a general rule of thumb, most investors are going to want to concentrate, like you said, on those short and intermediate term bonds. Yes, they do sacrifice a little bit of income relative to longer-term bonds, but the give-up isn’t as great as you might think. Over time, the last time around this number was a little while back, so it may not be exact, but about 90% of the return of a 30 year bond could be achieved by keeping your investment under 10 years. So you’re not getting 100% of that return, but you’re getting the vast majority of it, and you’re taking on significantly less interest rate exposure, which I think is a pretty compelling argument in a part of your portfolio that ultimately is designed to be safe, because after all, your bonds are your safe money.

JA: Question, because right now let’s say if I’m looking for income. And I think, traditionally speaking, people would purchase bonds and live off the coupons, and then they would look at other alternatives to try to create income. Well, over the last several years with interest rates as low as they’ve been, they’re looking at other alternatives to try to create income, such as maybe a high dividend paying stock, or maybe preferred stocks. And there could be some confusion. We’ve had Larry Swedroe on, we’ve had all sorts of individuals talking about, I guess, the misunderstandings is the word I’m going to use now, on how some of these vehicles work to create income. “I don’t want to spend any principal. So let me buy some bonds with high coupons, so I’m going to go long because I don’t care, I’ll go 30 years, even though maybe I have a 20-year retirement. I’m going to die. And the kids will get the the the principal balance, I’m going to live off the coupon, and maybe I buy high dividend paying stocks, or maybe even preferred stocks.” What’s your take on preferreds?

BP: I think that the key word in there that you said about preferred stocks and dividend-paying stocks is “stocks.” They’re not bonds. And so I think it’s important that people realize what they’re buying. We talked at the beginning the performance of real estate investment trusts, those are often used as a proxy for bonds by people that want income. They were down 7.5% last quarter. So a lot of times, when people buy the bond proxies, whether they’re preferreds, whether they’re real estate investment trusts, dividend-paying stocks, those companies and those investments are still very sensitive to interest rates. But you’re also taking on stock-like risk. And if you think about preferreds, they’re really a hybrid asset class. They lie in the capital structure of a corporation somewhere in between stocks and bonds, and it’s a very niche market. The entire market is only about $500 billion, which might sound like a lot, but in the context of the capital markets it’s very small. And they’re not very liquid in bad times, and in the financial crisis, the Treasury Department made a very clear delineation between preferred securities and bonds. And what I mean by that is that, with Fannie Mae and Freddie Mac, the mortgage giants, when they were in trouble, the U.S. Treasury came in and effectively saved the bondholders by guaranteeing the principal value on those. But they delineated away from the preferred securities and forced those into bankruptcy. So it’s clear in history, and it’s clear right now I think, that a preferred security is not the same as a bond. That doesn’t mean it’s a bad investment. You just need to know what you’re buying, and that the risk factor is significantly higher than it would be with quality bonds. And if you’re buying preferreds, maybe you’re not taking the investment that you’re putting into those preferreds out of your safe bonds. Maybe you’re taking it out of stocks. Or maybe you’re taking a little bit of money out of your stocks, and a little bit of money out of your bonds to buy some preferreds, because doing that keeps your risk profile relatively consistent. If you’re selling your high-quality bonds to buy preferreds, you’re doing a swap that’s increasing their risk of your portfolio, probably significantly.

JA: I would say now, with the volatility – we’ve had a very low volatile market for years. We’re seeing some enhanced volatility. What would your advice be to our listeners now? Because I think there was some complacency, and a lot of the portfolios that you’ve looked at, analyzed – we see a lot of home bias. A lot of money in U.S. growth companies, because the S&P has done quite well since 2009. What would your advice be now? I mean should people just be status quo? Should they take a look at their portfolios? What do you think?

BP: Absolutely not the status quo, and taking a look always makes sense. A portfolio is something that doesn’t need to be changed constantly, and often shouldn’t be changed, but it needs to be monitored, for sure. And what happened over the last five or six years, like you mentioned, U.S. companies did really well. The U.S. stock market outperformed most international markets, and a lot of investors began with that home bias, where they were overweight U.S. large companies. And then those companies were some of the best performers in a lot of the portfolios we see, are 70 or 80 or even 90% invested in large U.S. companies, which ran into quite a bit of difficulty this quarter. And I think this past quarter was a testament to that international diversification, where while U.S. markets were struggling, you saw emerging stock markets perform positively, and you saw global bonds perform positively as well. And how many people out there do we meet that on any global bonds? And yet while the U.S. bond market was down 1.5%, the global bond market, ex-the United States, was up 1%. So I think that this last quarter was a reminder to investors that, as markets shift, you need to go back in, re-evaluate your portfolio, and reset it or rebalance it like we talk about, back to your strategic allocation, whatever that might be. And that’s really difficult to do. It takes discipline to sell what’s done well and buy what hasn’t done as well, perhaps. But that’s how you reach success over time and how you keep your portfolio aligned with your goals.

JA: Were talking to Brian Perry, he’s the Director of Research at Pure Financial Advisors, he’s a Chartered Financial Analyst and a Certified Financial Planner. Any parting words my friend?

BP: Only to keep it in perspective. The market has been more volatile recently and that does, like you said, follow a period of extreme calm, and complacency can lead in. The point moves are large. When you see the Dow fall a thousand points there is certainly a sticker shock element to it. But keep in mind, percentages are what matter, not point movements. And as the stock markets have gone up over time, the levels have increased, and so the point movements have to increase commensurately.

Visit YourMoneyYourWealth.com and click on the show notes for this podcast episode and decide for yourself if Chuck and Big Al are doppelgängers. You know, market volatility means nothing to Chuck Norris. He doesn’t care if the markets plunge. He was the one that told them to plunge. You might not be so brazen! How will you manage market volatility and risk, and what will be your sources of income in retirement? Southern California, you have the chance to learn from Brian Perry and the rest of the Pure Financial team in person! Our two-day retirement courses and our free monthly Lunch ’n’ Learn events can give you the tools and confidence you need to help you plan for the retirement you’ve always dreamed of. For dates, times, and locations for our Lunch n Learn events and retirement classes in San Diego, Orange County or Los Angeles, just visit The Learning Center at YourMoneyYourWealth.com, or call (888) 994-6257.

18:11 – How Michael from FinanciallyAlert.com Got Started

AC: I know, hot box, right? But we’ve got a great guest.

JA: We do, he’s live in studio.

AC: Yeah, live, Michael, how are you doing?

MH: Great, great.

JA: Michael is part of the FIRE movement. Which is cool.

AC: Yes which is very exciting. That doesn’t mean firemen. That means financial independence, retire early.

JA: So what, Michael you retired at 36 years of age?

MH: Yep it was 36 years old.

JA: So tell our listeners here – 36, totally financially independent. You live in San Diego. So it’s not like you’re living in South Dakota.

AC: Are you implying it’s cheaper out there.

JA: Yes, it is a little bit cheaper in South Dakota than it is here in San Diego. So tell us a little bit about your FIRE story?

MH: Sure sure. So, where I kind of started it off was, when I was growing up, I was pretty fortunate in that I had some uncles that had actually so-called FIREd, or basically retired early. And it was something that I just thought was kind of normal because it was so close to me. But lo and behold, I realized it actually wasn’t. So I was really lucky in the beginning just to be able to be exposed to that idea. And so when I was growing up, I’m like, “oh this is cool. He’s home with his family, we get to go to different places and do different things. That’s kind of what I want to do.” So the funny thing was, actually, I wanted to retire even before I started working, which is obviously a bit silly (laughs) but it was always in the back of my mind that I wanted to retire early. So when I got out of school, I decided that I wanted to start a company. Problem was, I didn’t know how to do anything, so I didn’t have any company to start.

So what essentially I did was, I went to work for a company for good year, year and a half. And from there, basically, I was doing I.T. work. And what happened was, during the dotcom boom, things were great. I got a decent paying job right out of college. And then all of a sudden, 9/11 happened. Everything just basically imploded from that point. So my company that I was working for, basically started laying off people left and right, and about after the sixth round of layoffs, I was like, “do I want to stick around or not?” So basically, I got a couple of my friends in my office, I’m like, “do we really want to stick around here for the seventh round of layoffs?” and they’re like, “no, let’s let’s go head out and do something.” So that’s kind of how we started, by basically leaving, starting our own company, and basically grew it from the ground up for about 10 years or so.

JA: What kind of IT company was it?

MH: So, we did basically I.T. integration and support. So basically, outsourced managed I.T.. So if someone has a desktop issue, a server issue, they would call us, we’d go out. In the old days basically we go out and drive our cars over, climb under the desk, plug in ethernet cables, and it kind of grew from there – hired on staff, got more complex with networking and servers and whatnot.

AC: How big a company? How many employees or how many clients?

MH: So, in the beginning it was just a few of us that started it out and we had a home office. But by the time we finished, we had about 13 employees or so.

JA: So walk me through the process. So you and a few buddies said, “we’re going to open up our own shingle.” How did you market that? How did you start marketing your business, how did you get clients? Because I think a lot of younger individuals want to start their own business, but they don’t really understand the true mechanics of how to be successful building a business – which you have.

MH: Sure yeah and I’ll be pretty honest, a lot of it was luck to a certain extent. Obviously, the timing of things worked out. But a lot of it was through referrals. So basically we do one job, we do a good job. Someone refers us to someone else. And that was kind of like the initial engine that really got things going.

JA: So you give up a high paying job to start your own business. That first year, were you in the black?

MH: Actually, ironically, we were. And what happened was the company that we were with essentially had a division of I.T. and that was essentially us. So we left and at first, they were a little upset, obviously, that we were leaving. But we said, “hey, we understand, we don’t want to stick around because obviously, the situation’s pretty dire for the company, but we’ll make you a deal. We’ll give you guys 50% of all the revenues for the next year and a half, and if you want us to transition your clients.” And they were like, “no, no, no, we don’t want to.” “Okay well that’s fine, we’ll go out and get our own clients,” and we had some referrals just personally that we had in place, but that was nothing to get us in the black. Ironically, once we left, a month and a half later, we get a call from our former company, saying, “hey, we just want our clients to be serviced, you guys take them. No need to pay us the 50%.”

AC: Without paying the 50%! Wow!

MH: So that actually landed us in the black, which was nice. So obviously, that was pretty fortunate in the beginning. And from there it just kind of snowballed. But we definitely made a lot of mistakes along the way.

JA: So ten years in the making. And then you finally say, “I’m done, I want to sell it,” or was there an offer on the table that you couldn’t refuse?

MH: Yeah, so along the way, we had a couple unsolicited offers from companies. And for me, I always wanted to kind of grow the company to the next level. Some of my partners were basically very happy in this lifestyle business where they could just work few hours and make a decent income, go home. But that wasn’t necessarily where I was at. And we were all very good friends, kind of like family, but we had very different ideas in terms of how to run the business, so that didn’t necessarily mix. So when we had a secondary offer to be bought out, or merged with another company, I said, “Hey, here’s an opportunity for us to keep the company intact, and at the same time pull out equity,” which was really important at the time that we did it, because cloud computing was becoming such a big thing back then. And so what happened was, instead of us investing all of our profits that we had produced already and put it into new infrastructure, we were able to merge with another company, use their infrastructure because they are a large national company, and kind of go from there.

JA: And then you get a check and said, “now I want to be a stay at home dad and start blogging financial literacy to the public”? Tell me a little bit more about the transition from selling the company, getting out of that line of business, and doing what you’re doing now.

MH: Sure. So yeah, it was never necessarily the intention to retire early right at that time.

JA: You didn’t hear Your Money, Your Wealth like 10 years ago and say “this is a dream of mine?” (laughs)

MH: (laughs) Maybe I heard it in the back of my head, subliminally absorbing it.

AC: He would’ve turned it right off. (laughs)

MH: But yeah, essentially what happened was, my daughter was born right around the time that I transitioned out of the company that we sold to. I stayed with the company for a year and a half, and at that point, my daughter was a year older so, and I said, “you know what, I’m going to take a pause and spend some time with her.” And that’s kind of what really gave me the catalyst to really jump off at that point, and figure out what I wanted to do next. And for a year I did a lot of exploring. I decided, “OK, do I want to do the whole early retirement thing, do I want to go back to work, do I want to start other business right away?” And what I really ultimately realized was that I’m never gonna get this time back with my kids when they’re young. And so I was like, “well, why don’t I just take a few years off, see how it works financially. I think I can do it with the base that I’ve created thus far.” And that’s kind of how it started, and it just kind of snowballed from there. The reason why I started the blog though, was to kind of keep my mind active. I was changing diapers during the daytime, feeding bottles. (laughs) Transitioning from running a business and having employees, and then all of a sudden going 180 to feeding kids. It was a big transition, so the blog was a way to keep my mind active, have a little side project.

Whether you’re 36 or a bit older, if you’re approaching retirement, it’s a good idea to make sure you’re prepared for it. Learn how to control your taxes in retirement, and how to protect yourself against market volatility, increased longevity, rising healthcare costs and Social Security uncertainty in retirement: visit the white papers section of the Learning Center at YourMoneyYourWealth.com and download our free Retirement Readiness Guide. You’ll learn strategies that’ll make your money last a lifetime, and it won’t cost a thing. Download the Retirement Readiness Guide from the White Papers section of the Learning Center at YourMoneyYourWealth.com.

27:09 – How Michael from FinanciallyAlert.com Can Coach You To FIRE

MH: Sure and that’s a great question because I think what listeners should probably understand is that I had a small business. So it wasn’t like I was making gobs and gobs of money, and it wasn’t like even when I exited I got some big fat check. I mean, it was a decent sized check, but it wasn’t like big enough to just basically go retire on the beach. But what did allow me to retire early was that I was doing that saving along the way – I was saving proximately 50% with my wife for a good chunk of probably 7 or 8 years or so. And we lived a pretty comfortable lifestyle, but we were able to still save that money because we didn’t necessarily feel the need to continually upgrade certain things.

JA: Were you saving that because you thought, “well man, this business is going to blow up”? (laughs) And you just wanted to make sure that you have a safety net? Was there some fear involved? Because Al and I hear these stories, it’s like, “man, how the heck can you do it?” But I think there are two sides to the FIRE movement – you can either work at a 9 to 5 and have a good paying job and then just try to save the hell out of every penny you can. Or you can do what Michael did, and say, “I’m going to take on a little bit more risk here. I’m going to build a business.” And what we find is that the most successful people, who have the most money or are the most wealthy either inherit it or build a business.

AC: Yeah, or real estate. I would say that’s what we find. However, not everybody has a business.

JA: Or has the guts to build it or the know how.

AC: Or want to go out and buy real estate. So to me, it’s really interesting to find people that actually kind of did this just through saving. And so you were kind of on that path already at 50%, but then selling this business, sounds like that was kind of the catalyst to kind of move you to the next level.

MH: Yeah, it was definitely helpful. I also did invest in real estate along the way as well. And that’s something where, once I got beyond a general savings and I was starting to put money into the 401(k), I had to figure out different avenues to make my money work for me. So I started doing a lot of research on investing in real estate. Again, back to my relatives that basically had retired early, a lot of that was through real estate. So I kind of already knew real estate was a great vehicle to build wealth. And so during the upturn in 2005 to 2008, I saw all these things going crazy, everyone and their mother was a real estate investor at that time. And you know, the good thing was I was a numbers guy, I was looking and I’m like, “well, this is not really cash flowing.” So I was really patient. I waited a long time. I waited for the entire crash, and then I kind of jumped in. And even then, I still made some mistakes. The first house I purchased that was supposed to be a rental, I couldn’t rent out. (laughs)

AC: Also on your website, you’ve referenced that you read 139 personal finance books so tell us about that. That must be part of this journey to where you got well-educated.

MH: Absolutely, yeah. I really started reading a lot when I was younger, probably in my teens, and really wanted to understand how money worked. Because I saw for myself, even though I had uncles that were well-to-do and had retired early, my own family wasn’t necessarily in that category. And I saw how money had some negative aspects composed of it. And so I really want to understand how you could use money as a tool. And so that’s kind of where I started the journey, reading and feeding my mind all these different principles how to make money work for you. And that’s where I really got the idea to start saving early myself.

JA: What’s your personal favorite?

MH: What really I think sparked it was the Rich Dad, Poor Dad because it really told a great story in a very simple way. And from there, obviously, there’s a lot more technical books but that was really the impetus to turn on the switch in my head, like, “wow, I can make this work.”

AC: Yeah that was, to me, such a good and popular book in the early 2000s I think a lot of people read, including myself, and I was already a real estate investor. But I got fired up even more that point. But yeah, that’s fantastic. And one of your principles too is giving back, and so explain that. Because some people, when they think about giving, they think, “well, maybe I’ll wait till I’m retired or have a lot of money.” But you made that as part of your practice throughout.

MH: Absolutely yeah. And the funny thing is a while back, while I was growing my wealth, I didn’t necessarily give as much as maybe I could have. But what I realized along the way, actually by reading a number of these books, there was one kind of common thread – and that was really about giving back once you kind of get to a place of having freedom. And that really resonated with me at a certain point, and I started doing it. And the funny thing is, the more I did it, the more wealthy I felt. And it wasn’t really about the money anymore. It was about kind of giving back and trying to grow this ecosystem. And that morphed into the blog itself. Sharing ideas, trying to spark other people’s awareness that there are other possibilities than what the popular media will tell you.

JA: The blog is what, FinanciallyAlert.com?

MH: Yep.

JA: So you have your net worth on there, you have your debt, you’re just gettin’ naked!

AC: I got it right here, it’s right in front of me.

JA: So your net worth snapshot, a couple million bucks. Five streams of income. What made you say let’s just be public about it, let’s do it?

MH: Sure. Yeah, it took me a while – it took me a good half year to figure out if I actually wanted to do that or not. And the reason why I did that was because when I was in my own search and trying to figure out, what are the numbers, what’s really working, I love to see the numbers. Like I said, I’m a numbers guy. So I think a lot of times, the details are what matters, and I want to basically go and find the people that have what I have. For me the next level, I want to get to $10 million. It’s not about the money anymore, it’s about growing and becoming the person that I want to be. So finding those people that have already done that, and then going after that. And I want to know that they have the details to back that up. I don’t want to be learning from someone that is just talking about stuff in the ether, so to speak. (laughs)

JA: Right. Show me the money.

AC: Yeah, because in my generation it wasn’t talked about. It was pretty secret. Still is, actually. I don’t know about yours, Joe. (laughs)

JA: (laughs) I’ll show you my net worth statement.

AC: Yeah, OK. I don’t want to see it. (laughs)

JA: So you’re offering coaching. Tell us about that. Where can people find out a little bit more and say, hey, I want to get involved. I guess financial independence retire early doesn’t necessarily mean you have to be 20, 30, or 40 to do this. You can be any age. Because some people in their 60s might have to work until their 80s so retiring a little bit earlier than that.

AC: Yeah like if I could retire at 70 that would be pretty cool. (laughs)

JA: Right. Tell us about your coaching.

MH: Yeah absolutely. The coaching is all about taking someone, and if someone’s just starting out, helping them, giving a bullseye, and figuring out, “OK, Financial Independence, Retire Early is a target that you can shoot for.” It doesn’t necessarily mean that you’re going to stop working. Even for me, even though I say retired early, It’s a little bit silly in the word, because most people that retire early actually never just sit on the beach. You get really bored after a while, and you want to be able to grow and contribute. So most people go back to doing some sort of work or project or business. So really helping the people I think kind of set a goal from the early stages in their 20s, when they’re young professionals. That’s kind of my target is the young professionals, so that they have the options and the psychological freedom of hitting FIRE when they’re at a younger age, and basically having the option to work if they want to or not. There’s a huge psychological shift once you count up those numbers.

JA: Huge. Something that has to trigger in someone’s mind for them to save 50, 60, 70% of their income, you know what I mean? If they’re married, both spouses need to be on board on that. And for you to be able to coach that, or at least maybe – you’ve got to be part doctor – just to get in their mind. Because with you it sounds like you had influences with your uncles. “I’m surrounding myself with people that are successful and that’s what I can strive to.” But there’s a lot of people that don’t necessarily have that influence. And I think it’s awesome what you’re doing is try to give that influence to help people out to achieve this.

MH: Absolutely. And you’re perfectly correct. And that’s part of the coaching is to basically give them that other perspective, help to share that, and give them that support system, because they may not have had those relatives. In fact most people haven’t had those types of people in their lives. And so to give them that additional perspective, and that support system, so that they know it’s possible, and they know that thinking outside the box is OK. And give them that little push – that’s what the coaching is about.

JA: It’s FinanciallyAlert.com. You gotta check out his blog. He’s doing a lot of great stuff. Thanks for joining us Michael.

MH: Thanks for having me.

We’ve heard great stories of financial independence and early retirement from the camper van flipper Grant Sabatier, real estate moguls Andrew Fiebert and Joel Larsgaard, bloggers extraordinaire Jamila Souffrant, Chris Mamula, Fritz Gilbert, and now Michael from Financially Alert. Are you ready to take that job and shove it yet? If you missed any of these great interviews, you can feed your FIRE by listening to them or reading the transcripts at YourMoneyYourWealth.com. Subscribe to the podcast, get our podcast newsletter, watch clips and full episodes of the Your Money, Your Wealth TV show, and take advantage of a huge learning center full of webinars, articles, white papers and much more. It’s all available at YourMoneyYourWealth.com.

37:21 – Tax season filing deadlines and audit chances

AC: Joe, you know, we’re in tax time. And you may not know, the tax season ends April 17th this year. April 17th, because April 15th is on Sunday and April 16th is called Emancipation Day in Washington D.C. So we have until April 17th to file our taxes timely. And if you can’t get to them, then you simply need to file an extension. And a lot of people that can’t file, or for whatever reason, if they forget the extension, and they owe on their taxes, they have to pay a 5% penalty per month for the amount of taxes due.

How about if they file an extension but still don’t pay? Is it still 5%?

AC: No, it’s half a percent. And either way, extension or not, there’s the half a percent penalty, there’s the 5% penalty, and then there’s interest rate at 3%. So I guess the point, what you’re supposed to do is either file your return, or file your extension by April 17th, and make your payments with the extension, or with the return.

JA: So, example: I file an extension before April 17th.

AC: Right. Even by midnight of April 17th works if you do it electronically.

JA: So if I paid my tax due, let’s say, $1,000 in tax, I don’t pay it on April 17th, I pay on May 1st. So is that then 25 basis points interest, or would they charge me the full half a percent for that month?

AC: Half a percent for any part of a month.

JA: For any part of a month? So if I pay April 18th it’s a half a percent?

AC: That’s correct. It’s a half a percent. If you don’t file an extension, then pay April 18, it’s 5% penalty

JA: So I pay it in June so I got April, May, June. If I pay it June 2nd, do I pay the full five% or half a percent on all of the month of June?

AC: (laughs) You would pay for 30 days after April 17th to May 17th, and then you’d pay another 5%.

JA: Oh, so it’s 30 days?

AC: 30 days. Yeah, that’s how they calculate that. By the way, that maxes out at 25%, but still, why have a 25% penalty when you don’t need to?

JA: Exactly.

AC: At least file your extension, if you have no money, file your extension. So the penalty is half a percent, not 5%.

JA: So if you wait three months because that’s when your bonus comes in or something like that, so then it’s a point and a half.

AC: Because sometimes people think, “I’m not going to file a return because I can’t afford to pay my tax.” At least file the extension. Now, of course, better yet, pay your taxes. (laughs) But at least file your extension. I want to talk quickly about IRS audits, because you’re less likely to be audited.

JA: They’re going down again.

AC: Yeah, in 2017 it was one out of 160 individuals got audited. That’s less than 1%, for you math buffs. Now 2010 was the peak. It was one in 90 individuals, so now it’s 1 in 160. So you have a less likely chance to be audited. But before you start deciding to be a little more aggressive on your return, I will tell you, the audit percentages do make a difference, based upon your income levels. For example, in 2017, those that had income of a million dollars or more, there’s a 4.4% chance of being audited. Not a .8 or .7%, a 4.4% chance. And even that’s down, because even in 2015, it was 9.6%. So almost 10% of taxpayers with more than a million bucks used to get audited even just a couple of years ago. If you want it in percentages, .62% is the overall. Anyway, get your taxes done by April 17th, which turns out to be my birthday.

JA: Yes!

AC: So as you file your return, say happy birthday Big Al.

JA: There you go. Big Al’s birthday right there, he’s a CPA, and that’s the reason why he’s a CPA.

For more on taxes, check out the “Ask Pure” section of the Learning Center at YourMoneyYourWealth.com for videos on tax efficiency tips you should know, tax reduction strategies for high income earners, tax deferral strategies and much more. If you can’t find the answers to your questions at YourMoneyYourWealth.com, call (888) 994-6257 for your chance to have Joe and Big Al answer them live during Your Money, Your Wealth®. Whether it’s about taxes, retirement, investing, Social Security, or how market volatility will affect your retirement, there’s a pretty good chance these fellas can give you the insight that will help you make better money moves. That number again is (888) 994-6257. If you’d prefer to email us, you can do that too – send your questions to info@purefinancial.com, just like Harry did:

42:15 – Email: How Much Should I have in Roth, Tax-Deferred and Taxable Accounts at Retirement?

JA: Hey I want to get to an e-mail real quick. This was sent from Harry from Albuquerque. So we got fans in Albuquerque, Big Al. It goes, “Joe and Big Al, I’m 55 years old and have a pension and 401(k). The vast majority of my 401(k) balance $450,000, is in the pre-tax bucket, with very little in the after-tax or Roth buckets. Currently, I have all three options in my workplace 401(k). I max out my contributions per year $24,500 and then some. Currently 10%, 6%, 2% to pre-tax, Roth and after-tax respectively. What final percentages should I shoot for in each of the three buckets you guys talk about, Roth, tax-deferred and taxable, by the time I want to retire in about 7 years which would be age 62? Thanks”

AC: Yeah, great question. And that’s really a question that we should be asking ourselves. Because, if you don’t think about it, you tend to end up with all your savings in a pre-tax retirement account, and you’ve got no flexibility. No tax diversification. And so the ability to have money in a Roth IRA allows you to have much more flexibility in how you design your retirement income strategy and you can make it more tax efficient. And I guess I would say, the most correct answer, although it takes a little bit of effort, is to look at your retirement expenses, what your retirement needs are, and calculate how much income you need from now. To give a little example, let’s just say it’s $100,000 a year, and making it very simple, not even worrying about deductions. Just make it super simple, just say, “OK, you want to spend $100,000 a year and you’re married. And the top of the 12%t bracket, that’s a pretty low bracket, is $77,000. We’ll call it $75,000 for easy math. So that means about three-quarters of your income should come from the regular 401(k) and about one quarter should come from the Roth IRA, or money outside of retirement. And so then you just back up those numbers to see how much that you need in each pool to make this happen. Because what you don’t really want is, you need $100,000 and it’s all in the pre-tax 401(k). So now some your income is taxed at a higher tax bracket.

JA: Right. So if all of the money that you’ve saved is in just the standard 401(k) plan, you’re pulling out the $100,000. You pull the $75,000 out, that’s going to be taxed at 12%, and then you pull out the other $25,000 to get you to the $100,000, well then that’s going to be taxed at 24%. (editor’s note: he means 22%.) But then you have to pay the tax on the $25,000 at 24% and you’ve got to pay tax of 12% on the $75,000. So you’re going to have to be pulling more dollars out just to pay the tax on the full $100,000. Makes sense?

AC: You do. That’s correct.

JA: So what Al and I have talked about for years on this show, and what Harry from Albuquerque was alluding to, he’s like, “OK, I understand that I probably want to have some diversification to pull dollars from different types of accounts on how they’re taxed.” So Al is saying, we’ll pull $75,000 out, roughly, to keep you in that low bracket. But any other additional dollar that you would like to spend in that given year, it would be nice if you had money in a Roth IRA because if those dollars come out, you will never be in that higher bracket. You’ll never be in that 24% tax bracket. You would always be then in the 12% bracket, given that example.

AC: That’s right. One correction. 22 percent.

JA: I’m sorry, 22%, then it goes to the 24%. Thank you. Still just getting my arms around the new tax code.

AC: (laughs) It’s brand new. January 1st, 2018.

JA: So here’s some… misnomers?

AC: No. Please.

JA: Or misconceptions? (laughs)

AC: Please get this right for our friend Vinnie. (laughs)

JA: (laughs) Vinnie! I’m sorry, brother! So here is some misunderstandings?

AC: You can say that. That works.

JA: Let’s say that I’m in a certain tax bracket today. I’m in the 22% tax bracket today, and it looks like I’m going to be in the 22% tax bracket in my retirement. Well then, having a Roth IRA is a wash. Because I’m going to pay 22% now and have the money grow, and then when I pull it out I’m saving 22% on the back end. And that is, to me, just not a very good statement to say.

AC: And I agree with you. So you start. What’s the advantage if you’re in the same tax bracket?

JA: Because it’s all about the diversification that you have in regards to your distributions. Because let’s say if I convert monies in that 24% bracket. But if I can keep myself in the 12% tax bracket in retirement, that’s a huge delta. Does that make sense? Because now I have diversification. We don’t live in a bubble. The mathematics don’t work that way in real life. That’s all spreadsheet B.S.

AC: Yeah. That’s assuming your life is always the same every year. And here’s where it falls apart is, all of a sudden you’re in this 22% bracket or 24%, whatever bracket you’re in, doesn’t really matter. But then you have a year where you want to buy a car, and you don’t particularly want to get a car loan. So where do you get that money from? You get it from your IRA, your 401(k). And now your higher still tax bracket. Let’s say you’re married, and your spouse passes. Now you’re single. Now you’re actually in the higher bracket just because, even though there are the same tax rates, you hit these higher brackets sooner. And then there’s the fact that, it’s the same if you always spend the same amount each year. But what if you invest things in the Roth IRA that have a higher expected rate of return?

JA: Right, we’re not even talking about growth. So if I do a conversion, and all of a sudden I have growth over the next 15 years, all of that growth is all mine. It’s all tax-free to me. If I keep it in the retirement account, all of that additional growth that’s in the retirement account is going to be taxed at ordinary income rates.

AC: Yes. And you will pay ordinary taxes on it. It’s also it’s a better asset to pass to your kids because they get it tax-free. So there’s a lot of reasons.

JA: There are no required minimum distributions in a Roth.

AC: Right. So you have flexibility.

JA: So it can compound tax-free forever. Well, you do have to take required distributions when a non-spouse beneficiary inherits it.

AC: Yes. So when your kids get it they have to take a required distribution, but you don’t. So as long as you or your spouse are alive, it can grow tax-free for as long as that occurs.

JA: So I guess to truly answer the question of what percentage do you want, I wish it was easier.

AC: I do too, because you can’t just say 75% in the pre-tax, 25% in the Roth. It depends.

JA: Right, you have pensions and Social Security.

AC: When we look, it’s all over the board depending upon your circumstances, and sometimes when advisers that are even savvy enough to talk about Roths, and their clients go to them, “how much should I have in the Roth?” They go, “oh, 25%.” Where’d you get that?

JA: Well, it’s a round number. Sounds good. (laughs)

AC: Or, “how much should I convert?” “$100,000.” “Where’d you get that?” “Uh, because that’s a good number.” (laughs)

JA: I would go a step further, Harry, and anyone else that’s listening, that does have the ability to put pretax dollars in, or Roth dollars, but also the addition of after-tax dollars. Because you can put above and beyond the defined contribution limits of the $24,500 in a standard 401(k) plan, if the plan allows it after-tax contributions. You could get up to over $50,000 dollars of contribution in that particular plan. Now, if you wanted to go pre-tax, only $24,500 would be pre-tax, but the additional $26,000 (I’m rounding) would be after-tax within the plan. So now you have $50,000. Let’s just say $25,000 pre-tax, $25,000 after tax. One year, if you wanted to save that much money in that given year. What you could do then is that $25,000 of after-tax, you could convert that directly into a Roth IRA. Now we talk about your backdoor Roth IRAs? I mean, this is the back garage door of Roth IRAs! (laughs)

AC: This is the dump truck version. (laughs) It’s got some big amounts there!

JA: It’s a large amount because you can’t contribute $25,000 into a Roth IRA, it’s only $5,500 or $6,500 if you’re over 50. So here, you are doing an after-tax contribution up to that $50,000 limit. It’s a little bit more than that, but then you could convert that directly into a Roth. Now you can really have something here. I’d much rather have dollars in a Roth IRA than I would in an after-tax account because the after-tax account is still going to be subject to capital gains rates. If it’s in a Roth, it will never, ever be taxed. So if you do have the ability to put after-tax dollars in your 401(k) plan, I would highly suggest you take a look at that, just to figure out exactly what is the appropriate strategy for you, because I’m telling you, the most important investment you can make is an investment for yourself. All right that’s it for us today, for Big Al Clopine, I’m Joe Anderson, thanks for listening. We’ll catch you next time on Your Money, Your Wealth.

_______

So, to recap today’s show: It’s tax time, and your chances of being audited are low, but your chances of paying penalties if you don’t file and pay your taxes on time are rather high. The answer to the question, “how much should I have in Roth, tax-deferred and taxable accounts,” like so many things, is “it depends.” Call (888) 994-6257 to get a free assessment of your personal financial situation. Market volatility is back after years of calm, but Chuck Norris – he doesn’t watch the market, the market watches him. Our job is to be like Chuck Norris and stay the course, not letting fear and greed guide us. Chuck Norris had to ask what “fear” meant.

Special thanks to our guest Michael for sharing his inspiring story of financial independence and retiring at age 36. For more about Michael and his FIRE coaching, visit FinanciallyAlert.com

Subscribe to the podcast at YourMoneyYourWealth.com, Apple Podcasts or iTunes, where you can check out those kind ratings and reviews, or on your favorite podcatcher. Gotta love it. If you’ve got a burning money question for Joe and Big Al to answer live on Your Money, Your Wealth, just email info@purefinancial.com, or call 888-994-6257! Listen next time for more Your Money, Your Wealth, presented by Pure Financial Advisors. For your free financial assessment, visit PureFinancial.com

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

Podknife

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed