Fritz Gilbert from TheRetirementManifesto.com shares his 10 Commandments for Retirement – well actually it’s 11, but that extra one is important! Plus, Big Al has 10 ways you can pay less in taxes this year, and in future years. And Trump’s steel and aluminum tariffs have set off more market moves, but could they also jack up the price of your Jack and Coke?

Subscribe to the YMYW podcast newsletter

FOLLOW US: YouTube | Facebook | Twitter | LinkedIn

Show Notes

- (01:30) Trump’s Tariffs Set Off More Market Moves – and Pricier Whiskey?

- (10:19) Fritz Gilbert’s 10 Commandments of Retirement, part 1

- (19:10) Fritz Gilbert’s 10 Commandments of Retirement, part 2

- (30:55) Big Al’s List: 10 Tax Efficiency Tips

Transcription

President Trump’s new tax law has changed a lot of things – the tax brackets, deductions and exemptions, capital gains taxes, and more. What’s different, and what stayed the same? We’ve got a handy guide containing Key Financial Data for 2018 – just visit YourMoneyYourWealth.com and click Special Offer to download it for free. You’ll have those changes, plus important tax deadlines, retirement account contribution limits, useful Social Security and Medicare info and much more, right at your fingertips. Just click Special Offer at YourMoneyYourWealth.com to download it free.

“Number five is “try new things.” And we’ve got this cookie jar by our bed, and we just have a notepad there and we just write notes at random, each one of us, and we kind of drop them in the cookie jar. Neither one of us knows what the other one’s writing, but it’s just things that we have thought about in our area, keeping an eye out, things that we can try. And we’re just determined to try as many new things as we can over the next year to see what we like.” “So has there ever been a time where you opened up the cookie jar and read what your wife said and were like, “there’s no chance.” “Joe, you’re bad! No, I haven’t even thought of that. I swear, I’ve never even thought about doing that.” – Fritz Gilbert, TheRetirementManifesto.com

That’s Fritz Gilbert from TheRetirementManifesto.com. Today on Your Money, Your Wealth® he’ll share with us his 10 Commandments for Retirement – well actually it’s 11, but that extra one is important! Plus, Big Al has 10 ways you can pay less in taxes every year. And Trump’s steel and aluminum tariffs have set off more market moves, but could they also jack up the price of your Jack and Coke? Let’s find out – here are Joe Anderson, CFP®, Big Al Clopine, CPA, and Jason Thomas, CFP®.

1:30 – Trump’s Tariffs Set Off More Market Moves – and Pricier Whiskey?

JA: JT! That’s your new nickname, buddy. What do you think?

JT: That sounds pretty good.

JA: There’s a lot of really cool people with JT. You got Justin Thomas. Are you related?

JT: I am not.

JA: You know who he is?

JT: I do not. (laughs)

JA: He’s a golfer. And Justin Timberlake, you know he is.

JT: I do.

JA: Ok. But you know who Jason Thomas is, don’t you?

JT: Yes. (laughs)

JA: That is you. Certified Financial Planner. He’s our financial educator Pure Financial Advisors. Are you ready to have some fun?

JT: I definitely am!

JA: Hey, you been reading anything interesting lately?

JT: Yeah, I’ve been looking at a few different finance-related topics. One of them that kind of caught my eye, you know I’m from Tennessee, or at least I grew up there, I haven’t been back in a while. But the Jack Daniels distillery is in Tennessee, and they of all people have voiced some concerns about the tariff discussions. So I thought this is one of the things out there that kind of has some potential unintended consequences, so maybe kind of going over that would be kind of interesting.

JA: So what are they doing? Ya got some tariffs on whiskey?

JT: We passed our steel tariffs, then the EU has stated that they may threaten to place similar retaliatory tariffs on other American items, whiskey being one of the ones that were mentioned specifically. So the CEO of Jack Daniel’s, or Brown-Forman, the company that owns them, came out and mentioned that that would obviously affect them and be kind of an unintended consequence. And I thought that’s just kind of so interesting in general, how any financial decision we make has a consequence later on, which may or may not be what we want to happen.

JA: Hey, why don’t you explain to the listeners what a tariff is?

JT: Sure. So a tariff is basically a fee of sorts, on exports coming into the country. So if the United States says, “we’re going to place a tariff on foreign goods of some kind,” then that would be an additional cost that would be borne by the consumers. And usually, the purpose of that tariff is to favor domestic manufacturers of a certain item. And I was thinking to myself, of course, I had that company on the mind, so I thought of an alcohol analogy of sorts. We’ve all been to a restaurant and looked at a wine list and it’s always really expensive. It’s way more expensive than you would have in the grocery store. And that’s because there is a prohibition on taking wine from other places into the store, so they can basically charge whatever you want when you’re in the restaurant. The equivalent of a tariff though, to just kind of make an analogy, would be the corkage fee. If they say, “hey, you can bring your wine from wherever you want into our restaurant, but we’re going to charge you 20 bucks to do it,” or whatever it is. Think of that as something very similar to what a tariff does in the world when we’re talking about any other good that comes into the country.

JA: So let’s talk a little bit more about what this tariff plan is.

JT: It’s 25% on imported steel and 10% on imported aluminum. So if you’re a manufacturer of either of those things abroad, that would have a substantial effect on your business, trying to bring your goods to the United States.

JA: And so what they’re trying to do is to protect the steelworkers here in the United States and aluminum manufacturers and makers here in the U.S.

JT: Exactly. It’s a protectionist move like most tariffs are. Now in general, that’s only step one though, because of course, if you charge a tariff, what can we see as the next step? Well, maybe everyone else does. Which means that if that happens, then that is one aspect of what is often called a trade war. And that can raise prices for everyone. In general, a free market without tariffs benefits all parties involved, if everyone plays by the rules. That’s not always the case and that’s some of the criticism that is leading the current administration to want to impose these types of tariffs. But if everyone does it, then everyone is paying more.

JA: So going back to full circle with the article that you read, the whole trickle down effect, I guess. How’s that going to affect me having a Jack and Coke?

JT: Well, it could increase the cost of your Jack and Coke, or maybe take it even a step further than that. Maybe some of the smaller off brands that they also produce might not be as economically viable anymore. Maybe some smaller companies that can’t compete are no longer able to do so. Maybe they don’t have as much political clout to fight things from a legislative standpoint or are not economically viable enough to survive in general. So it’s not just a matter of potentially paying more for the same goods or services, not only you, but people elsewhere also, but it’s also potentially making those products less viable if the tariffs are severe enough.

JA: It’s funny, because we’ve been living in a quite volatile market, and it just seems like all sorts of news, no matter good, bad, or indifferent, it’s triggering the markets a little bit more violently than we’ve seen in quite some time. And I think it always boils back to understanding the information that you are receiving, and diving in a little bit deeper to see how that’s going to affect you and making sure that, A, first of all, the market already knows, in a sense. All the information is readily available, so they act fairly quickly on that information, and sometimes they overreact. And then I think that trickles down to the individual as well. As the market overreacts, I think the human, or us retail investors, tend to overreact too. And we might be doing the wrong things at the wrong time.

JT: Particularly in the current environment, there is so much speculation. But I think people have kind of accepted a certain amount of political and Information volatility. and therefore it doesn’t necessarily translate into market volatility. because it’s just kind of a new normal.

JA: With this whole Trump bump that people were talking about last year in the overall markets. There have been statistics looking at Bush and Barack when their first year was actually higher than Trump’s. So you get the media involved, and they like to sell things. And basically it kind of screws people’s perception, I think, and also their ability to make really good decisions. Because if you look at January alone, Jason, you probably know the statistics well. How much money that flowed into equity mutual funds? It was an all-time record of individuals buying stocks in January. January was a phenomenal month. And then we had a little bit of a hiccup in February, and there were more outflows in the S&P 500 SPY ETF in history. It’s like these people think that, “I’m just going to buy an S&P 500 mutual fund. And I’m diversified, and I’m going to hold it for the long term.” And I think that just is not reality because so much information is out there. If it’s tariffs, anything else, whatever information comes out, it seems like people will still consistently react the wrong way.

JT: Yes. And one of the things that is potentially troubling about that observation is that when you’re talking about market value, perception is, to a degree, reality. If people think that something is is on the upswing, then that will alter the course of whether it is or not. Or the reverse is certainly true. So you can have those things, that have an initial effect, which you might want to call it a bubble or you just want to call it exuberance, or whatever term you want to use. But they create real effects in the world that are beyond just the initial perception. And that can lead to momentum, or that can lead to whatever the opposite of momentum, kind of cooling off. So I don’t think that those kind of marketing points about how the market is doing are unimportant, they certainly have an effect, which is really interesting, because not all of the information that is having an effect is necessarily relevant or quality information.

Coming up next week on Your Money, Your Wealth®, we’re joined by Robert Farrington of TheCollegeInvestor.com – how did he become a millennial money expert, and how is he helping Gen Y start investing for their future? Visit YourMoneyYourWealth.com to subscribe to the podcast so you don’t miss a minute. While you’re there, catch up on 16 money tips and mind tricks from Erin Lowry of BrokeMillennial.com, and learn the seven secrets for a happy, successful retirement. Too busy to listen or if you just prefer to read your podcasts, transcripts are available. Check it all out at YourMoneyYourWealth.com

10:19 – Fritz Gilbert’s 10 Commandments of Retirement, part 1

JA: I got Fritz Gilbert on the line. Fritz is back with us. He’s been on before. Awesome guest. He’s got TheRetirementManifesto.com. Fritz, welcome back to the show, my friend.

JA: I got Fritz Gilbert on the line. Fritz is back with us. He’s been on before. Awesome guest. He’s got TheRetirementManifesto.com. Fritz, welcome back to the show, my friend.

FG: Hey thank you, Joe. I was excited to hear from you and we’re 92 days away from retirement so we’re getting into the final innings here, and it’s great to catch up with you, I appreciate it.

JA: Last time you were on the show you were sitting in your car because you didn’t want the dog to bark. Are you sitting in your car in your driveway right now? (laughs)

FG: I’m actually sitting in my truck. I bought a new truck because we bought a fifth wheel as part of our getting ready. So yeah, I’m sitting in the exact same place but I’m in a different vehicle this time. I’m now in my F250. So yeah, it’s kind of a little sound studio here and the dogs are removed. So yeah, it’s kind of my little secret place to do a podcast, it works pretty well.

JA: Oh that is too funny. So what, June 9th is the drop dead date? That’s your retirement date?

FG: That’s it. Yep, that’s my last day and off we go. So I’ll be 55 years old, and we’re heading to the next adventure. So we’re excited about it.

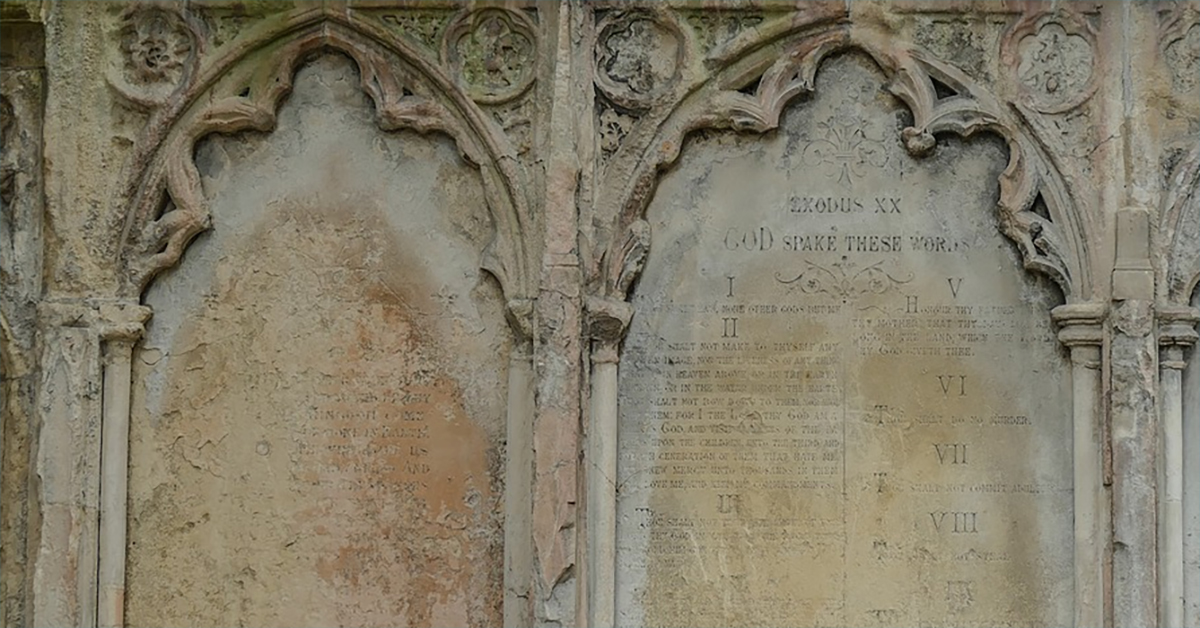

JA: So you came up with ten commandments of retirement. I want to talk to you about the Ten Commandments.

FG: Well I’ll tell you what I did. I think an important thing as you’re getting ready for retirement, based on what I’ve read, this is my first time, hopefully my only time of doing this, but a lot of the stuff I’ve read said that the best thing that you can do as you’re getting ready for retirement is to really spend some time and think about what your life’s going to be like after retirement. So these 10 commandments were really just kind of my self-reflection on the things that I wanted to make sure I focused on after I retire. So that’s kind of what led to the post and I had fun with it, I’ve gotten some really good response and it has been a popular post. So yeah I’d love to talk about it.

JA: You’re retiring really young, 55. I suppose that this whole FIRE movement is going on, financial independence, retire early, where people are saving 95% of their income. But you did something maybe a little bit different. It’s still aggressive, but you made a plan and you said 55 is my number. June 9th is your date, so congratulations, but you’ve got a long way to go. I mean you’ve got a long life ahead of you. You’ve got to start planning now what you’re going to do with yourself?

FG: Yeah, let’s hope I have a long life ahead of me, but you know you never know, and not to be morbid, but part of our whole thought process was, look, we know we’re healthy now. We like to get outside and do stuff, hike mountains, do whatever. And if we had a chance to make this happen a little bit younger age than normal, then that’s that many more years that we had a pretty good chance of being healthy and able to do the things that we love to do. So it really was driven by what’s more important to us, to have a little bit more money and work a few more years, or to capture those couple of years of freedom while we knew that we could enjoy them. So that was really what drove us to make the decision to jump on a little bit early.

JA: So the Ten Commandments. Let’s hit number one.

FG: OK number one, have an attitude of gratitude. And I think this really goes to the core of it. Obviously, anybody probably listening to this radio station or anybody in the western world – we have material wealth beyond almost anybody else in the world. And I think it just becomes too easy to get comfortable with what we have, and not realize how thankful we really should be for what we have. And then you take that to a guy and his wife they’re going to retire at age 55, even more so. To get the opportunity to retire, let alone retire young, be thankful for that. Enjoy every day. Have a great attitude about it, and just be positive and be thankful, because we got a lot to be thankful for. And it’s a good reminder so I made it number one.

JA: You are the happiest person alive, aren’t you?

FG: (laughs) Not always. I’ve always been upbeat. I’m always a glass half full. We all go through mood swings. I mean of course you do, right? But I think a lot of how you go through life and how you experience things is dependent on how you think about them, and how you look at them, and that’s something we can control. So I’ve always tried to keep a positive attitude, and there’s no doubt in my mind that it leads to a lot more enjoyable life. So, we all have our ups and downs but I do try to focus on the up.

JA: It’s definitely contagious my friend, it’s definitely contagious. Let’s go with commandment number two.

FG: OK. This one is actually, did you see what I did with the post, I actually made it a 1A, I snuck 11 commandments in. And these are both tied because I couldn’t decide which one was more important to me. So 1A was, give with a generous heart. And it really was about, hey look we’ve been blessed with a lot of things to be thankful for, and let’s not be selfish with it. Let’s recognize there’s a lot of people that are in worse shape than we are. And don’t be stingy with your stuff. Yeah, you could save another 10% or whatever. Or you could save whatever your saving, maybe a little bit more, and give a little bit more away. We try to focus on being generous, supporting things that we believe in, give a big tip to the waitress. How much does it cost you to give a 40% tip or something to someone who’s struggling, and she crushed it on your table. Just think how much joy you can bring somebody for a little amount of money – and just view money that way. Money is not that important. Be generous with it.

JA: Without question. You’ve seen the studies. The people that give a little bit more tend to be a little bit happier.

FG: And conversely, I’m sure you know some people, I know some people obviously, people that are like really self-absorbed, and really – you know the type I’m talking about. Those type of people, not coincidentally I guess, they can sometimes be pretty miserable people. And I think there’s a correlation.

JA: (laughs) I definitely believe you’re right there. Let’s go with the next commandment.

FG: OK. The next one is to pursue your passions. And really I guess, this one, Joe, goes to the fact that, hey, you’re finally done working, you’ve got your freedom. Take advantage of it, don’t sit around and watch TV. Live your life while you’re able to live it, doing the things that bring you excitement. And it’s not easy. I wrote a post last week about the 100 days to freedom, and I was talking about how since we were four years old and went into pre-K for half days or whatever, we’ve had somebody telling us what to do for 50 plus years. Well now for the first time in our lives, we don’t have to have somebody telling us what to do. We don’t need to earn the money anymore. Shame on us if we don’t find something to do that gives us that excitement, that drive, that we no longer have to commit our time to earning a paycheck. Go out and do something you really want to do. And okay, it’s not necessarily easy to find something that you have a passion for, but shame on us if we don’t go out and pursue it and try to find some things that we really enjoy.

JA: Without question. I’ve been guilty of this, where I was so focused on work, my career, the company, and everything else, where you don’t really think about anything else, and then all of a sudden it’s like, well what happens when this is not here? And I think that’s why a lot of retirees, they don’t necessarily plan for what it’s going to look like when you don’t have those responsibilities when you don’t have your co-workers that you can maybe grab a beer with. Because the phone might stop ringing because your social circles might disappear. So finding that passion is so important.

FG: Yeah. And I think, if you talk to people that have gone through the retirement transition, I’ve been interested in it for a while, and some of the guys I’ve talked to, and women I guess too, but people that have retired before me, it seems like those people that are running right up until the end, and then BOOM they’re retired? I mean literally, they are getting off a plane back from Brazil on the couple days before they retire type of thing – those types of approaches to retirement can be kind of disruptive because you haven’t really started trying to ramp up. So I kind of view it like, start building some ramps into retirement while you’re still working. And then, when the road kind of comes down to a halt on your working years, you’ve kind of already started building the road for your retirement years, and there’s some overlap. We probably added a 2 or three year overlap. I started my blog, we’re doing some other stuff, I bought a drone, we play around with stuff. Trying to start developing those interests because I don’t think you have to wait until you retire. And I think you’re better off if you don’t wait. So that’s what that one is all about.

So have you written your own Retirement Manifesto yet? If you need to flesh out the financial details of your retirement a little better, we’ve got a guide for that! Visit the White Papers section of the Learning Center at YourMoneyYourWealth.com and download our FREE Retirement Readiness Guide. You’ll learn little-known secrets about controlling your taxes in retirement, creating income to last a lifetime, how to make the most of your retirement investing strategy, and much more. Learn 7 plays to help you get retirement ready, despite the uncertainties we may face with market volatility, rising healthcare costs and the future of Social Security. It won’t cost you a dime, so download the FREE Retirement Readiness Guide from the White Papers section of the Learning Center at YourMoneyYourWealth.com

19:10 – Fritz Gilbert’s 10 Commandments of Retirement, part 2

JA: Hey welcome back to the show, the shows called Your Money, Your Wealth®. Joe Anderson here, Certified Financial Planner, talking to Fritz Gilbert. He has a great blog called TheRetirementManifesto.com and we’re talking about the Ten Commandments of Retirement. Fritz, what’s the next one?

FG: Keep the balance. I’ll tell you the story here. This was sad.t I took a Dale Carnegie course early in my career, I was like 24 years old. It was like an eight week class or something. In like week six, we noticed that this guy that had been in the class – pretty small class, 10 or 15 of us. And I’ll call him Bob – but Bob wasn’t there, and we said to the instructor, “hey, what happened to Bob?” Turns out that Bob committed suicide the night before. And somehow our instructor knew Bob – they must have had some kind of connection, because he said, “let me just tell you something about Bob,” he said, “life is like a wheel, and you’ve got all these different things in your life that are like spokes. You’ve got your family, you’ve got your religion, you’ve got your job, you’ve got your finances, you’ve got your whatever. And those are all spokes in the wheel. It’s important to keep your spokes about the same length.” He said, “Bob had some spokes that were really out of whack,” and he said, “if your spokes aren’t the same length, your wheel doesn’t turn very well.” And that stuck with me more than anything else I learned in that class, to the point where when I’m writing my 10 Commandments of Retirement, it’s number three, because I still remember Bob and the impact that had on me 30 years ago. So keep balance, life’s all about balance.

JA: Definitely. Everything is – almost correlated, right? You’ve got to find a passion, because if everything is work, well there’s no balance there, because then when we do decide to retire, it’s like oh, now I’m going to try to find – so finding that balance throughout, which is an awesome analogy – keeps the wheels going. Speaking of rolling, what’s the next one?

FG: Next one is, make no obligations, and basically, my point on this: I’ve known a lot of people who, as soon as they retire, they start getting calls. “Hey, will you come do consulting for us?” or whatever, obviously your network’s alive, blah blah blah. And I’m just, again, these are my self-imposed guidelines. I am kind of telling myself, “look, take 12 months off and don’t commit to anything. Really take time to kind of detox, decompress, and figure out what you want this next phase of your life to be. Don’t get sucked into just continuing to work, because your phone started ringing.” So that’s kind of, hey, take a break. Force yourself to take a break, and don’t take on obligations for at least 12 months. That’s what I’m trying to do there. And part of what I’m going to do instead of those obligations is the next one, number five is, try new things. And my wife and I have just been coming up with as many ideas as we can, of doing things that we haven’t done before. I might have mentioned to you guys last time when we talked, we got this cookie jar by our bed, and we just have a notepad there and we just write notes at random, each one of us, and we kind of drop them in the cookie jar. Neither one of us knows what the other one’s writing, but it’s just things that we have thought about in our area, keeping an eye out, things that we can try. And we’re just determined to try as many new things as we can over the next year to see what we like, see what we have a passion for. And like you say, so many of these things go together, there’s a lot of overlap. But I think it’s too easy to get stuck in a rut, and we’re really going to try to break that and just try as many different things as we can over the next 12 to – well, hopefully, the next 20 years. But we’re going to start our retirement with that type of mindset.

JA: So has there ever been a time where you opened up the cookie jar and read what your wife said and were like, “there’s no chance.”

FG: (laughs) Joe, you’re bad! No, I haven’t even thought of that. I swear, I’ve never even thought about doing that. So no, I’ve not looked at a single thing, and as far as I know, I don’t think she’s looked at mine. But I don’t know, maybe she has. Maybe she’s pulling mine out and it’s all hers and I’ll find out after we retire.

JA: (laughs) Exactly. What’s the next one?

FG: Next, you guys will like this being in San Diego, you have a very health oriented culture out there. I live in north Georgia in the mountains right by the start of the Appalachian Trail – but this is about taking care of your body. And there’s so much evidence that there’s a lot of things we can’t control. But if you really focus on fitness, especially as you get into your 50s and 60s, you can add years of productive, healthy, enjoyable life. And I think back to a neighbor I had at one of the homes that we lived along the way. The guy was like 73 years old, he was still running ultra-marathons. Great guy, the best guy you’ve ever met. Really, really just full of life, and he made an impression on me, and he ran like five days a week. And the guy’s in his 70s! And I ran a half marathon with him, and I’m like man, I teased him at the time, I said, “Joe, I’m going to keep track of our time,” and I said, “when I’m 73, my goal is to beat your time in the half marathon.” There’s no reason to ever stop taking care of your body. And when you retire, you’ve got even more time to do it. So it’s more important than it’s ever been, because you’re getting older, and you’ve got more time to do it. So make it a priority. We joined a gym. We’re taking spin classes, my wife taking yoga, whatever. We’re finding different ways, and hiking, and things like that – mountain biking. Anything you can do that keeps you physically active. Man, it’s never more important in your life than when you’re right on the cusp of retirement.

JA: Yeah. And you got to keep at it too. My mom turned 69, and so she does a little bit of workout, and then all of a sudden she’s sore, and then a month goes by, then she’s like I gotta get back to doing it. You got to take it slow, too. But you have to be consistent with it because with any age it’s really difficult to be committed to getting healthy.

FG: And I think part of that is just you’ve got to build it into a routine because you’re right. You stop for a week and it’s – and I’m sure with your mom being 69, my dad’s 83 and he still walks every day. But if you stop at that age, think about how much harder it would be to restart than if you’re talking in your 40s or 50s? It doesn’t get any easier. So it becomes almost more important just to make it part of your routine and just be consistent with it.

JA: What’s next on your list?

FG: Number seven, we’re getting close the end here, is stay flexible to change. I think one thing that I know, is that I don’t know what retirement is going to be like. I have expectations, but I know I’m probably wrong, because you can never experience what that’s going to be like until you’re really there. So this is just a reminder to myself, “Look, things might not be the way you’re expecting them to be. That’s ok. Be flexible, go with the flow, figure out what you can do, and try new things, change, move along, go with the current and be flexible to it. Be optimistic, be open to it, enjoy it and don’t get stuck in your ways.

JA: That is a lot easier said than done, because I have clients, not mentioning any names, that are in their 70s and 80s. And it’s difficult to change. When you have been successful for so many years of doing things a certain way, but guess what, the world changes around you, and if you don’t adapt and change, that’s when things get on the other side of the coin.

FG: Yeah, and these are aspirational goals, these are a reminder. I actually cut it out, I’m holding the piece in my truck in my driveway. I’m holding a cut out of the Ten Commandments summary from the post and I’m actually going to hang this my office here at the cabin, and and I’m just going to kind of have it there and kind of refresh my memory with it, because yeah, people get stuck in their ways. Oops, I quit exercising, I got a bad attitude, all these things are are intended to be reminders of the way I want it to be. Let’s not kid ourselves. We all fall short of where we want to be, and being flexible to change, your right. People always resist change, it’s just human nature. And this is just, accept it, go with the flow. We’ll see how it works out. I’ll keep you posted.

JA: Yeah definitely. What’s next?

FG: OK, the last three I’ll summarize them quickly, but they’re important. Number eight is cherish friends and family. I think everything I’ve read is relationships, especially as you mentioned earlier, you lose all the work relationships. Relationships in retirement are one of the key criteria they found to people that have a really enjoyable retirement, it’s because they’ve really fostered these relationships. And the natural evolution in life is, hey, your friends die, your friends move away, you get stuck in your little world, and you don’t go out as much as you used to go out. Don’t let that happen, really foster friendships, find ways to connect with people. And obviously, cherish your family. So that’s that’s number eight. Number nine, hey, let’s not forget – this is life. Let’s enjoy it. So it’s have fun. Pretty simple. Let’s keep it fun. We’re free, we’re not working anymore. Shame on us if we don’t go out and have a little bit fun with life. That’s what we’ve worked a long time to get here. Let’s not lose perspective and get miserable, what are you kidding me? These are the best years of our lives. We finally have our freedom, we still have our health. Go out there and have some fun.

JA: What is your idea of fun?

FG: We’ll find out. What we’re doing right now, we’ve got the first six months planned. We’re going out with our camper. We got mountain bikes, we’re going to be doing outdoor stuff, we’re going kayaking. To us right now, that’s what we think is going to be fun. I love to fly fish, so I’m going to be out fly fishing – it’s all outdoors related, physical activity. That’s what we think is going to be fun. I’ll tell you another one we’re doing, my wife has always wanted to go cross-country on a train. So I’m like, “you know what? Let’s do it.” So our daughter lives in Seattle, so we’re going to call Amtrak this weekend, and we’re booking the tickets in August to go cross-country on Amtrak, because we’ve never done it before and it sounds fun. So it’s being open to things that you want to do that you think might be fun. Well go ahead and do them, try them. You just don’t know. It’s kind of like trying new things. But just remember whether you have fun with something, it’s your choice at this point – you don’t have a boss telling you what to do. Try to pursue things that you think are going to be fun in your life. Keep it uplifting.

JA: Right, what’s the worst thing that can happen? You’re not working, you’re with the people that you enjoy being with. You can make it whatever that you want to. What’s the last one?

FG: OK the last one is the most important in my mind, it’s keep eternity in mind. We talk about what’s our legacy going to be and things like that. And I don’t really go spiritual on my blog, it’s more about personal finance in retirement. But I think it’s important think about longer term things like eternity and the spiritual side of life is a really important aspect. And I don’t judge others, I don’t care what they choose to do, that’s none of my business. But for me, it’s something that’s important, and I want to live my life long Christian values that are important to me, and I just encourage people to think about their own spiritual needs and beliefs, and live accordingly. It’s one of the most important things in our life. So take care of it.

JA: The Retirement Manifesto – it’s so good to talk to you, Fritz.

FG: You guys got the life of Riley, you’re living in San Diego, Southern California. Beautiful people, beautiful climate, you got great jobs, you got your podcast, what’s not to love? That’s great.

JA: You can find Fritz Gilbert at TheRetirementManifesto.com.

Fritz is absolutely right, we’ve got it made here in Southern California. But it’s easy to get sidetracked by the beautiful climate and beautiful people – you need to do a bit of financial planning, so you can follow those Ten Commandments in retirement. What will be your sources of retirement income? How do you manage risk and protect your assets? What about market volatility? Our two-day retirement courses and our free monthly Lunch ’n’ Learn events can give you the tools and confidence you need to help you plan for the retirement you’ve always dreamed of right here in So Cal. For dates, times and locations for our Lunch n Learn events and retirement classes in San Diego, Orange County or Los Angeles, just visit The Learning Center at YourMoneyYourWealth.com or call (888) 994-6257. That’s (888) 994-6257.

Time now for Big Al’s List: Every week, Big Al Clopine scours the media to find the best tips, do’s and don’ts, mistakes, myths and advice to improve your overall financial picture – in handy bullet-point format. This week, 10 Tax Efficiency Tips.

30:55 – Big Al’s List: 10 Tax Efficiency Tips

AC: I actually wrote these myself – there’s a blog on our website at PureFinancial.com if you want more information. So let’s get right into it.

Number one is take advantage of your employer sponsored retirement savings plan. So if your employer has a 401(k) or 403(b) or 457 something like that, you can contribute up to $18,500 pre-tax annually. This is for 2018. It went up a little bit. Now if you’re 50 or older, there’s a $6,000, what they call a catch up. And so you can actually do $24,500. Realize that this is money that comes out of your pay. It goes directly to your retirement account. You get to generally invest it how you want to, and your employer may have many investment options, or they may have just a few, you’ll need to check with them. A very nice thing about these plans is, many employers offer a match, which means that if you put in a dollar, they’ll put in a dollar, and they’ll often do a 3% match or a 4% match or 5% match, 2% sometimes, it depends upon the plan itself. But you definitely want to contribute at least up to that match, because why not. If you’re putting in a dollar, your employer’s matching it $2 are going into your account, and that money is going to be available for your retirement. I realize that many of you may not be able to completely contribute the max of $18,500 or $24,500, but try very hard to at least contribute up to your employer’s match whether it’s 3% 4%, whatever the number is. And then after that I would say – and I know it’s difficult, because in Southern California or across the country for that matter – life is expensive, but try to add another 1, 2 or 3% of your gross pay each year as you get raises. So maybe you’re 4% this year, maybe try to bump it up to 6% next year, 8% the year after. A really good goal would be to get up to about 15 or 20% of your gross income into the into the plan itself. If you do that year after year, you’re going to be alright for retirement. Now if you’re starting later, if you’re starting, let’s say in your 50s or 60s, you may have to kind of jumpstart that, even a little bit more. But remember this: the earlier you start doing this, the better. But even if you’re 60, 65, you can improve your retirement situation by starting today. So I would tell you don’t procrastinate.

Number two here is Roth IRA contributions, and a Roth IRA, if you don’t know, this is, I think, one of the greatest gifts the IRS has given us maybe in the last couple of decades. You can contribute $5,500 per year to Roth in 2018 or $6,500 if you’re 50 and older. This would be subject to earned income. So you have to have salaries, or self employment income. But even if you don’t, let’s say you’re retired and your spouse is working, you can utilize your spouse’s earned income to contribute to your own Roth IRA. So if you have earned income available to you, don’t miss out on this. This is a pretty good deal. Now you don’t get a tax deduction, but once the money goes into the Roth IRA, that initial contribution, your principal, future growth, income, are all 100% tax-free upon withdrawal at retirement. Now realize that in general, you need to be at least 59 and a half years of age, and own your Roth IRA for at least five years to be able to withdraw fully out of the Roth. There are exceptions. They get kind of complicated. I won’t go to them right now, but that’s your saving for retirement. Now not everyone can make a Roth IRA contribution because there are income limitations. If you’re single and your adjusted gross income for 2018, as long as it’s below $120,000, then you can fully contribute to your Roth. If it’s over $135,000 as a single person, you can no longer make Roth contributions, and in between those two amounts is a phase-out period, where you can do a partial. For married couples, the phase-out period is $189,000-$199,000. But if you’re over those amounts don’t worry because there is something called a backdoor Roth, or Roth Two-Step.

So if you’re phased out of making Roth contributions because your income is too high, the Back Door Roth allows you to contribute money in kind of a tricky way. With this method, you contribute $5,500 to your traditional IRA, or $6,500 if you’re 50 and older, and then you turn right around and do a Roth IRA conversion. And then you don’t end up paying taxes on that conversion because you never got a tax deduction in the first place. So this is kind of a workaround. We actually thought that this might go away with the new tax law, But it’s still there. So take advantage of that.

Now there’s something else related to Roths, which is called Roth conversions. And this is the fourth tip for you to minimize taxes. You can take money out of your IRA, your 401(k) your 403(b). You can convert it to a Roth IRA. Now yes, you’ll pay taxes on that conversion. But whatever that grows to, like let’s say you convert $50,000 in one year, and yeah, you’ll have to pay taxes on that $50,000. But it grows to whatever – $100,000, couple hundred thousand, whatever the number is, down the road for retirement, all that money that’s in the Roth will be 100% tax free. You never pay any taxes on that future growth and income. And if the account outlives you, your spouse can get it tax free, or your kids can get it tax free. So it’s a great benefit. What you might want to think about is, look at your current tax bracket, see where you’re at right now, look at what your retirement tax bracket might be, and then figure out if it makes sense for you to convert now. Not necessarily everybody should convert, if you’re in a very high tax bracket, but you’d be surprised – there’s probably more opportunities for you than you might know. You might want to take a look at my blog for a little bit more information on this one.

Tax loss harvesting – this is another one. This is where if you have money outside of a retirement account and you invest it, you’re trying to make money, but as you know, the market doesn’t always go up. So when it does go down, and it tends to be temporary, although temporary can be years, in some cases. But when the market does correct, you have an opportunity to sell an investment at a loss, and take that loss on your tax return. That loss can be used, dollar for dollar, against other capital gains. So if you have a $10,000 capital loss, and in the same year have a $10,000 capital gain, those two will offset and you won’t pay any taxes. And in many cases, in a down year, you might want to take advantage of all the losses that you can, because you can carry over those losses in future years.

Now let’s get into charity, for those of you that are charitably inclined. Something that’s not a new idea – bunching charitable donations. Taking a whole bunch and putting them in one year, instead of spread out over several years. The reason is because the standard deduction for 2018 is a lot higher. For single people it’s $12,000. Married people is $24,000 and there’s limits on some of the things that you can deduct. So many people are not going to be able to itemize their deductions, which means their charitable donations won’t help them from a tax standpoint. Now if you do, let’s say 2 or 3 or 4 years all at one time in a particular year, you might have enough contributions to get over those limits. That’s what bunching is. Of course if you do that, I bet your charity is going to be knocking on the door, because they see this big donation and they think you’re going to do it each year.

So I got a workaround for that which is our next strategy which is using a donor advised fund. So this is where you can set up an account with a custodian like T.D. Ameritrade, Schwab, Fidelity whatever. You put the money into the account, and then you get a tax deduction in that year you open the account. It’s not the year charity gets those dollars, so you get to dole that out as you want to. So this can be a way to take advantage of bunching charitable donations. Or it could be a good thing if you’re in a very high income year.

Better yet, with your donor advised fund, or any charitable donations for that matter, is to donate appreciated stock. You can give your stock outside of retirement that’s gone up in value. You can give it directly to charity. And that manner, whatever it’s worth on the day that you donate it is your tax deduction. And you don’t have to pay the tax on that gain. So that’s a pretty good benefit, and the charities are happy doing this, because they’re nonprofit – when they sell the stock, they don’t pay any tax at all.

Another strategy, this is brand new for 2018, is you might want to think about becoming an independent contractor if you’re an employee, because there’s a new 20% deduction on small business income. So for sole proprietorships, partnerships, LLCs, S-corporations and the like. So if you all of a sudden are an independent contractor making $100,000 as an example, you might get a $20,000 dollar tax deduction. If you have basically the same job and you’re an employee there’s no tax deduction. now, not everyone’s going to qualify. This is a very complicated area of this new law. So just be aware that you’re going to need to do some planning here. Now, if you’re already a small business, then make sure you understand how this works, because this could be a big tax saver for you.

The final item I want to talk about is solar power, which we thought maybe it was going to get out of the law, but it actually got extended with recent tax legislation. For 2018, 2019, you can still take the 30% tax credit on the amounts that you invest the invest in solar power. So $30,000 for solar power means a $9,000 tax credit. And remember, a tax credit is way more valuable than a tax deduction, because that comes off your taxes dollar for dollar. A tax deduction, you simply reduce your taxable income.

So to kind of summarize, there’s a bunch of things that you can do with retirement plans, with Roth IRAs, with donations, with tax loss harvesting. We got this new 199A 20% deduction for small businesses. Don’t forget solar power. There’s a lot more things, but that’s all I had time for this segment.

JA: That’s it for us today, thanks for listening. For Big Al Clopine, I’m Joe Anderson. The show is called Your Money, Your Wealth, we’ll see you next time.

_______

So, to recap today’s show: There are plenty of things you can do to reduce your taxes – you just need to know what they are! Visit PureFinancial.com/blog and look for 10 Tax Efficiency Tips You Should Know – read ‘em, and then you will know. Trump’s tariffs may be playing a bit of havoc with the markets, but market volatility is here to stay – don’t let it mess with your financial strategy. And retirement isn’t all about financial strategy, there’s a softer side of it too. Special thanks to our guest, Fritz Gilbert, for sharing it with us. Follow along on his retirement adventure at TheRetirementManifesto.com

Subscribe to the podcast at YourMoneyYourWealth.com, through your favorite podcatcher or on Apple Podcasts on iTunes, where you can also check out our ratings and reviews. And remember, if you have a burning money question for Joe and Big Al to answer on Your Money, Your Wealth, just email info@purefinancial.com, or call 888-994-6257! Listen next week for more Your Money, Your Wealth, presented by Pure Financial Advisors. For your free financial assessment, visit PureFinancial.com

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

Podknife

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed