Now that Trump has been elected into office, what changes can we expect with regards to our taxes? Will these changes be beneficial or detrimental, and to whom? In this special episode of “Your Money, Your Wealth,” Joe and Al cover which tax proposals could affect you and key year-end tax saving strategies that are commonly overlooked.

Important Points:

1:14 “We haven’t had major tax reform in over 30 years. We have a Republican president, Republican House and Senate, so in 2017 tax reform is almost certain. Are you prepared to do everything you can before December 31st? That’s the financial focus today.”

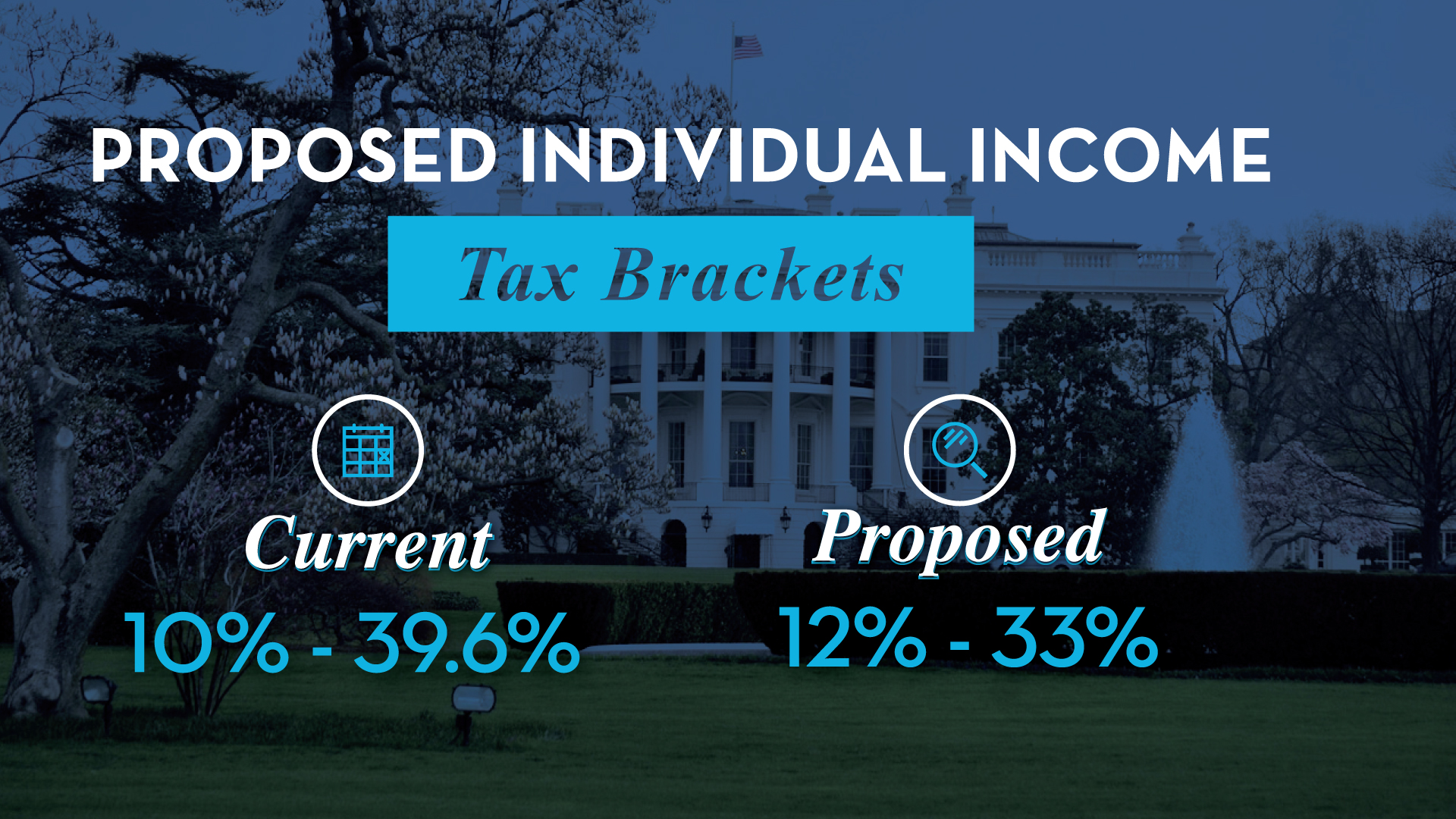

1:49 “When you take a look at what they (Trump’s Administration) are trying to do, they want to simplify the tax code. Right now we have seven different tax brackets – it goes from 10% all the way up to 39.6%. What they’re trying to do from a marginal tax bracket federally, is breaking it down to three [tax brackets].”

2:21 “There’s a lot of planning that you need to make sure you understand before making any big moves.”

3:06 “Today we want to talk about some year-end tax planning moves that you can make and should be considering, particularly in regards to some of the new proposals which we’ll get into as well.”

4:09 “When you have an asset like a stock, bond, mutual fund or piece of real estate and you hold it for at least a year and you sell it at a gain, you pay a special long-term capital gains rate.”

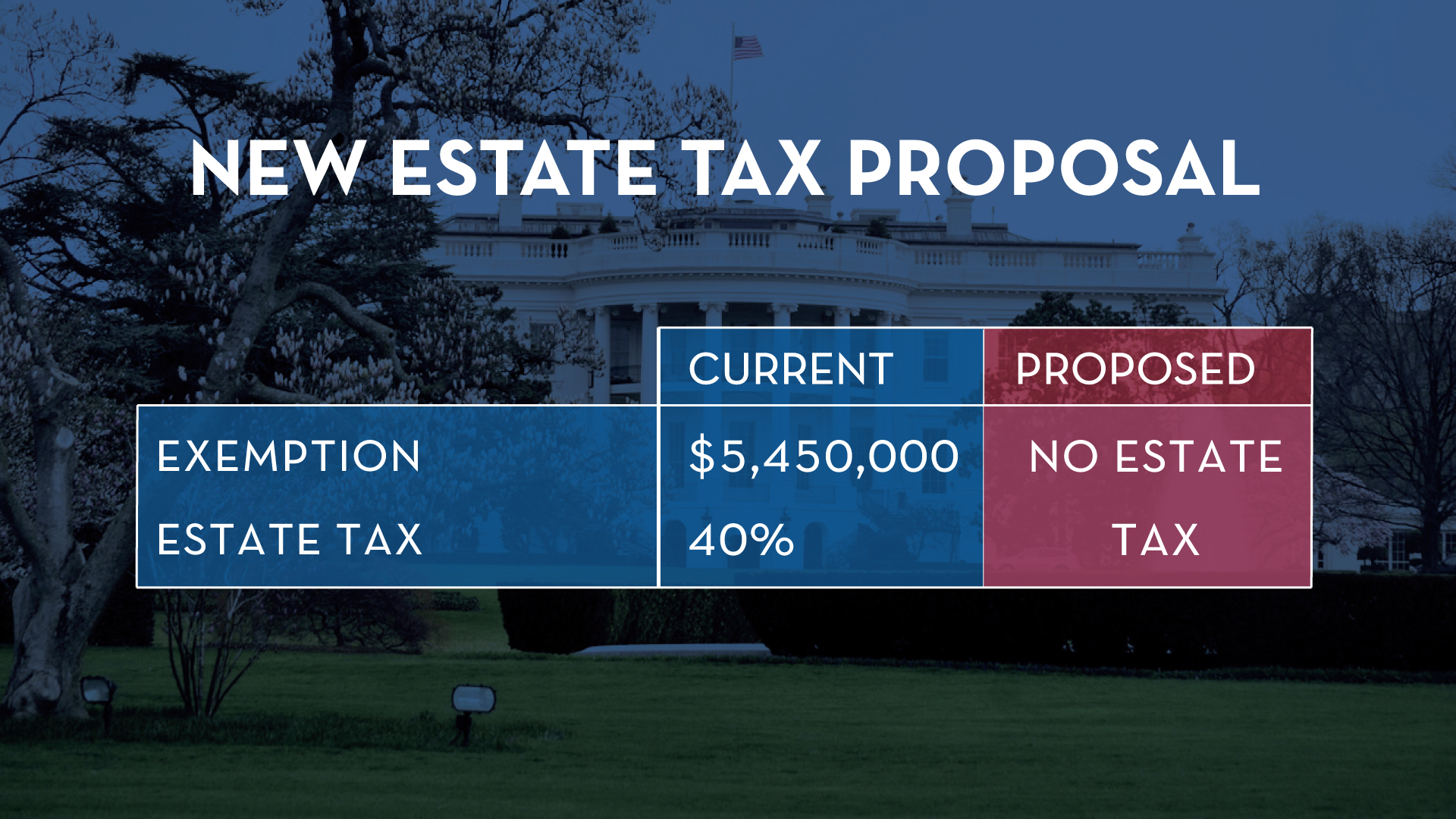

4:20 “Right now that rate is 0% for some taxpayers, 15% for other taxpayers, 20% for others as well. Interestingly enough, Trump wants to keep those rates the same but what could be quite a bit different is estate tax planning and the way capital gains will interact with estate taxes.”

5:09 “A lot of you have capital assets, and those assets are taxed at a capital gains rate. With the exemption of the estate tax, potentially the step up in tax basis on those capital assets might go away.”

5:53 “The reason we have a step-up in [cost] basis is because of these estate taxes – so if the estate tax goes away, there really isn’t reason to have the step up in taxes anymore.”

8:58 “[True or false?] The stock market can predict if an incumbent will win the presidential election.”

9:52 “It’s very difficult to predict anything but what you can control is taxes. We have a round table discussion coming up.”

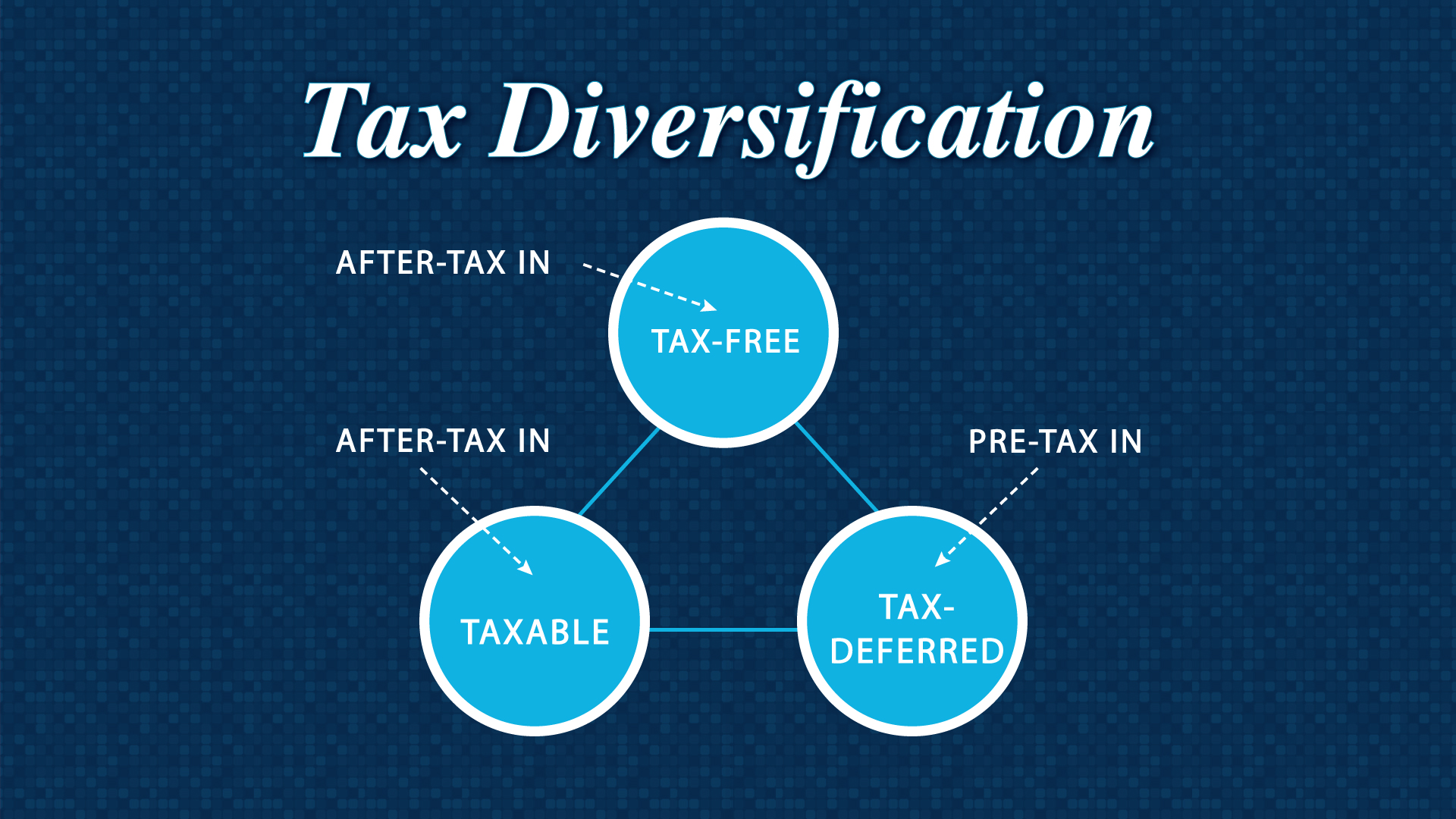

10:07 “We’re big components of something called tax diversification. It’s controlling the things that you can control and taxes is one of them as long as you understand how your investments are taxed.”

11:35 “We do know one thing. The future of tax rates is uncertain.”

12:29 “When we take a look at tax diversification, there are three different pools of money that you can invest in – tax-deferred money which is the 401(k)s, IRAs, what we just discussed, then you have taxable money which is taxed at a little bit lower rate (capital gains rate), but I think one of the best pools is tax-free. The best gift the IRS has ever given us is the Roth IRA.”

13:59 “The real area where you can make a major impact on your retirement and your ability to generate income during retirement in a very tax-efficient manner is by doing Roth conversions. That’s by moving money from your IRAs, 401(k)s, 403(b)s into your Roth but the caveat there is that once you do the conversion, right now you have to pay the tax.”

16:29 “It’s understanding where taxes are today, understanding where they will potentially go in the future and making sure that you have a strategy in place to reduce those taxes.”

17:05 “Something else you want to consider before December 31st is charitable contributions.

17:20 “There’s a way to take future years’ contributions and deduct them in the current year – it’s called a donor advised fund.”

18:10 “We are talking about this and many other strategies at our tax seminar coming up [Register at puretaxclass.com].”

20:34 “The stock market is not Republican, it’s not Democratic. It doesn’t matter who the president is.”

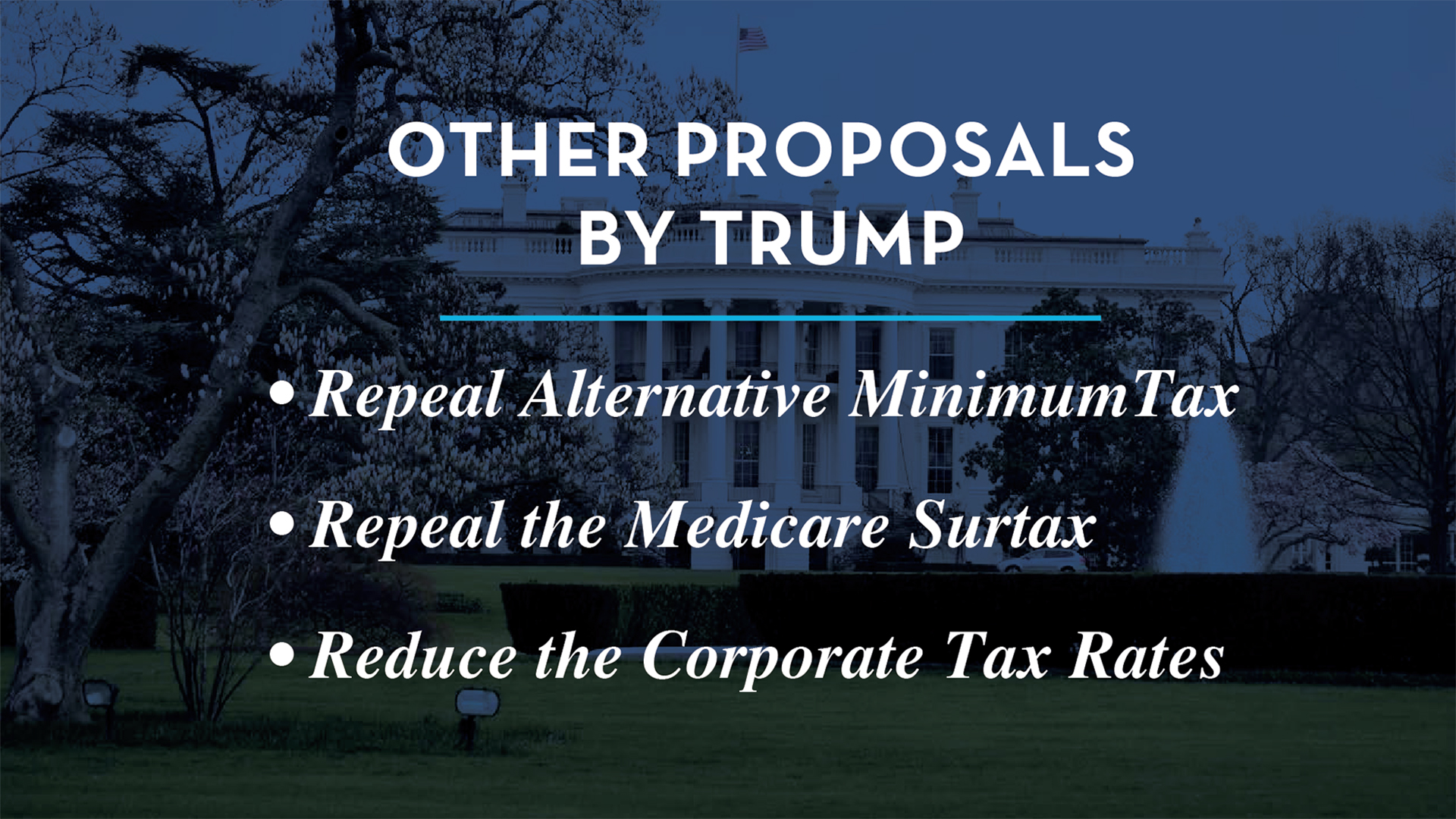

20:58 “Here are some other proposals by Trump, which are repealing alternative minimum tax, which is a big one…repealing the Medicare surtax…”

21:38 “Repealing alternative minimum tax will help those generally who make over $200,000 of income or more.”

23:07 “When it comes to corporate taxes, this [reducing the corporate tax rates] is going to affect a lot of corporations.”