In this season premiere of “Your Money, Your Wealth,” Joe Anderson and “Big Al” Clopine show you how to stick to your financial resolutions by executing key saving strategies and providing tips for staying on track. Find out why “paying yourself first” is so important for any individual hoping to retire one day. The two close off the hour answering listeners’ email questions. Stay tuned for an all new episode next week.

Important Points:

2:30 “We’ll get into resolutions on this show, and particularly in regards to finances.”

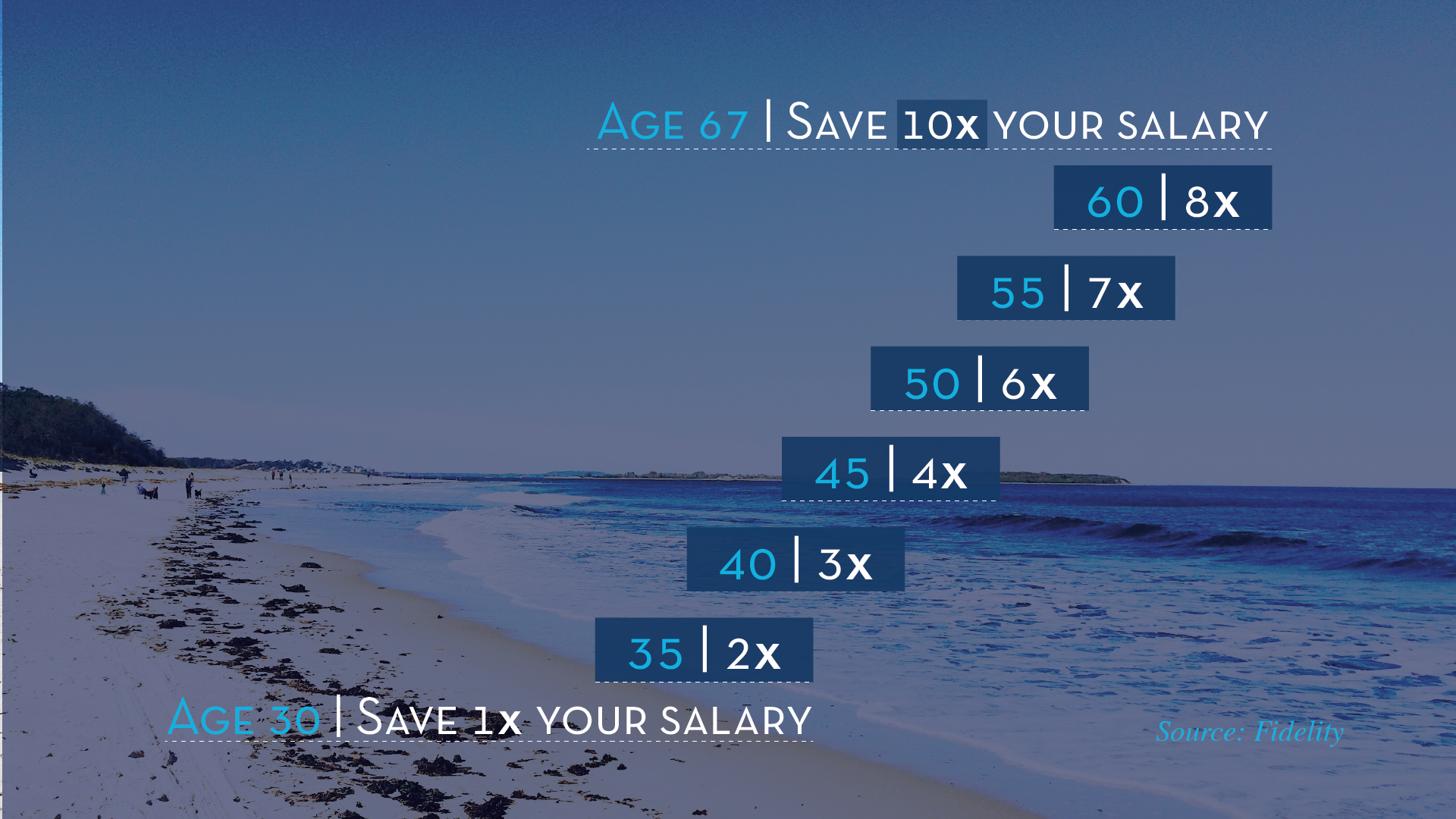

2:39 “When you’re talking about finances, saving for retirement, or any goal for that matter, you should quantify that goal. How much do you need to save in total and how much do you need to save each month?”

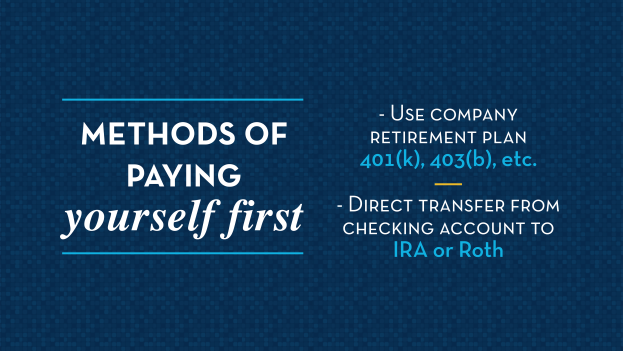

2:54 “Automate that savings plan…if you don’t pay yourself first, you tend to spend the money and have nothing left to save.”

3:30 “Holding accountability is by far one of the key components here. You want to make sure you set a goal and are held accountable for it.”

5:31 “Let’s take a look at if you’re in your 20’s, 30’s, 40’s or 50’s, what is the game plan here?”

9:44 [True or false?] “If you wait until age 70 to claim your Social Security benefits you will receive on average 75% more money than if you began your distributions at age 62.”

10:32 “It really pays to wait.”

11:02 “Is this a good time to buy gold?”

13:22 “If you get anything out of this show, this is it: pay yourself first. The most successful and wealthiest people figure this out.”

16:20 “There are a lot of individuals, in every range of net worth, that have credit card debt.”

18:37 [True or false?] “You can roll an inherited Roth IRA from your parents in your personal Roth IRA after you pass away. The answer is absolutely false. Joe, why is that?”

21:47 “You might have a great strategy but you have to execute the strategy to be successful.”‘

25:08 “This question comes from Linda in Coronado: ‘I’m almost 50 and only have about $180,000 in retirement funds. Should I pay off my credit cards, my car or fund my Roth IRA/401(k) this year? I only have enough money to select one of them to fully fund.”

26:21 “The time value of money is key; the sooner you start saving, the less you have to save to have that nest egg at the end of the day.”