With volatile markets comes the question of how to protect against inflation. Some of these are going to relate to things you can do in your portfolio and some are going to be more general about your overall finances.

First of all, why do you want to protect yourself against inflation?

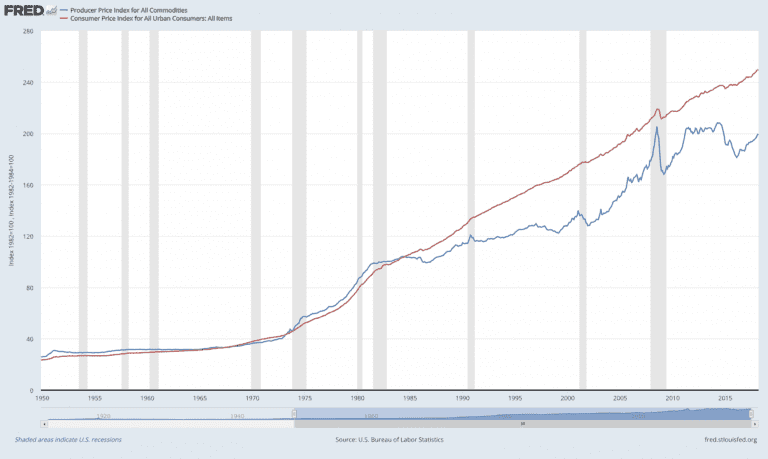

Well, throughout the course of your life, you probably noticed that the cost of living has increased. The government measures this in a variety of ways, including the Consumer Price Index (CPI).

Many people think that the CPI and the government statistics actually understate the rate at which cost of living increases. However, in the long run, the CPI level has increased about 3.5% a year. That may not sound like much but over the course of a 30-year retirement, you can actually see your cost of living double more than once.

In other words, if a standard of living used to cost $100,000, it can cost $200,000 or more by the time that you enter into your 80’s or 90’s.

How can you protect yourself against inflation and maintain the same standard of living throughout your retirement?

Well, here’s seven ways.

1. Consider What Kinds of Bonds You Own

Many investors, particularly as they near retirement and enter into retirement, will want some bonds in their portfolio.

Bonds provide the anchor and the stability of a diversified portfolio. However, another word for bonds is fixed income, and the reason investors use the term “fixed income” is that the coupon payments in bonds are generally fixed.

For example, if you invest a $100,000 in bonds and get $5,000 a year in income, maybe that’s a good return today and helpful for your retirement goals, but what about in 10 years or 20 years down the road? Will that $5,000 still provide you with the same lifestyle? Perhaps $5,000 isn’t enough.

Now with bonds that income is often fixed. So how can that be mitigated? This can be done in a couple of ways.

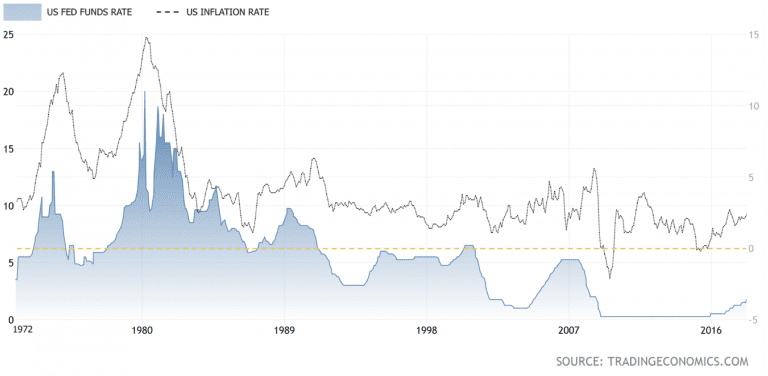

First of all, you can focus on short-term bonds. By focusing on shorter-term bonds, you have less exposure to future inflation. This is due to the fact that when those bonds mature you can go out and buy new ones. What happens when inflation is rising is that interest rates tend to go higher as well.

Picture yourself in retirement and instead of a 30-year bond, you own a 4-year bond. Inflation is rising, your cost of living is increasing, and so are interest rates. In four years, when your bond matures, you take the proceeds and you go out and buy a new bond at a higher level of interest. This generates more income which will now cover your expanded cost of living.

That’s the beauty of short-term bonds as opposed to being locked into a very long maturity bond.

2. Treasury Inflation Protected Securities (TIPS)

The second thing you can do with your bond portfolio is to focus on Treasury Inflation Protected Securities, otherwise known as TIPS. TIPS are, simply, government-backed bonds issued by the United States Treasury that have an inflation protection component. These are some of the safest securities in the world because since they are issued by the United States government they’re free from default risk. Effectively, there’s no risk that the government won’t be able to pay its bills.

Even better, TIPS have an inflation rider, which adjusts the value of your principal along with the Consumer Price Index. TIPS aren’t perfect, of course, if interest rates increase, the value of TIPS, just like any other bond, can temporarily fall. However, if you want pure protection against both inflation and any risk of credit default, TIPS may be something to consider adding to your portfolio.

3. More Aggressive Types of Bonds

Finally, within the bond space, some more aggressive types of bonds, such as high yield bonds, emerging market bonds, and the like, may provide more protection against future inflation as opposed to higher quality bonds. The reason for this is simply that the yield or the income generated, by a high yield bond is greater than that provided by a high-quality bond.

Higher income will provide greater protection against the future cost of living increases. Of course, there’s a downside and certainly, the recommendation would never be to load up entirely on high yield or more aggressive bonds.

As the name implies, a high yield bond provides higher income but also carries greater credit risk. Remember that the role of bonds in a diversified portfolio is to protect your portfolio. Bonds provide that anchor giving you the ability to take a more aggressive stance in other parts of your portfolio with your growth assets.

If you get too aggressive in your bond portfolio maybe you have more inflation protection. What you’re doing away with is that core value that bonds provide for giving you stability within your portfolio.

4. Have Stocks in Your Portfolio

Moving from bonds to stocks can also provide a great hedge against future inflation.

Stocks provide inflation protection in two main ways. The first is that stocks often pay a dividend whereas bonds, generally, pay a fixed amount. Specifically, if you invest in bonds today, your cash flow never increases.

Dividends are different.

As companies grow their profits, over time, the dividends can also increase. If a company earns more, they may pay more in the way of dividends. Those increasing dividends lead to higher cash flow in the future, which could potentially increase your spending power and maintain or even enhance your standard of living; even if inflation is rising.

Imagine a scenario in which a company is growing their dividend by 7% a year. That’s not an unheard-of rate of growth. If your dividend starts at a $100,000 investment, it provides $3,000 a year in income.

If it’s growing at 7% a year, then over the course of a decade you’ve effectively doubled your cash flow. You started with $3,000 in income from those dividend-paying stocks. Now you have $6,000 in income. That growth of your income can provide your hedge against inflation or maintain your purchasing power and standard of living.

Growth of Stocks

The second inflation fighting component that stocks provide is growth. Over time the stock market, in general, tends to move higher. Picking any one individual stock may or may not lead to a good outcome. Broadly diversified portfolios tend to move higher over time, albeit in a volatile manner. Yet, that growth and perch in your portfolio can lead to more purchasing power.

You could invest a few hundred thousand dollars in the stock market and over the course of 20 years, it could grow to half a million dollars. That’s more wealth that you now have to maintain your standard of living comparable to what you are living today, even if inflation has increased in the interim.

5. Natural Resources & Commodities

The fifth way to protect yourself against inflation is via natural resources and commodities. This area is a bit tricky.

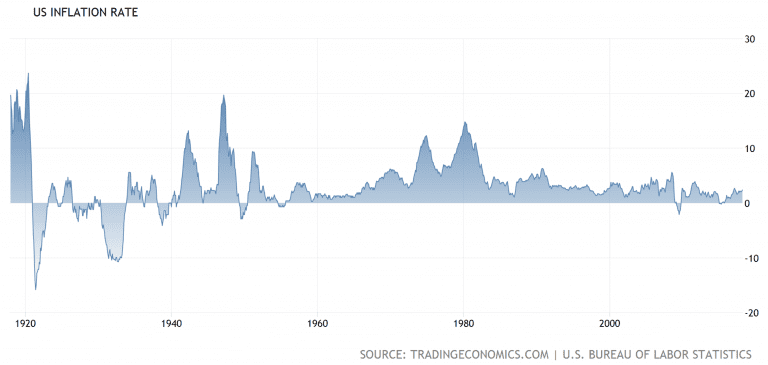

In general, there’s a belief that commodities increase in inflationary environments. There is a kernel of truth to that.

If you remember the 1970’s, inflation was at very high levels due in part to the energy crisis. Oil prices spiked, gold prices went up, and inflation was at very high levels. When there’s a commodity-driven inflationary environment – yes – commodity prices will increase. However, it would theoretically be possible to have high levels of inflation with relatively muted commodity prices.

Furthermore, if you look at commodities themselves, the long-term after an inflationary turn of commodities are quite poor. In some cases, zero over many decades and even over a century.

Commodities can be difficult to invest in. There are different ways to do it. Futures are an option, but that carries a lot of leverage risk and the possibility of total loss.

Sometimes exchange-traded funds (ETFs) can invest in raw materials and commodities themselves. But the problem is that it’s not pure exposure. In other words, when you invest in an ETF in order to get exposure to commodities, sometimes the movement in price in the value of the ETF doesn’t correspond to the movement of the price of the commodities themselves. This is due to technicalities in the way that the futures markets and commodities actually work.

Possibly a better way to get exposure to this area of inflation protection is through natural resource producing companies. These are your Exxon Mobil’s or your British Petroleum’s in the energy sector or are BHP Billiton in the metals sector. By buying the stocks of commodity producers, you may be able to take advantage of the inflation hedging protection of commodities while still having a company that’s actually producing something and hopefully generating profits.

6. Real Estate

Real estate can be a great inflation hedge. Over time depending on the part of the country that you live in, you may have noticed that home prices have increased dramatically since the 70’s, 80’s, 90’s and so on.

Certainly, there are blips along the way and sometimes sharp declines such as we saw in the mid-2000’s, but over time real estate prices have tended to increase more or less in line with the rate of inflation. In some areas even at a greater rate than inflation.

Plus, if you own rental real estate you may get rising rents in an inflationary environment. That ability to increase your future cash flow gives you an inflation hedge if your cost of living commensurately increases.

Maybe it’s owning physical real estate that works for you. Maybe it’s owning publicly traded securities, or a real estate investment trust (REIT), maybe that’s the security that you own to get that real estate exposure. Even then hopefully you’re getting the same benefit of real estate with those rising cash flows in the future.

7. Expenses

The seventh and final way to protect yourself against rising inflation is not on the investment side but instead on your expense side.

The big danger of inflation isn’t some arbitrary number in the economy, it’s that the money that you have to spend every month increases. What if you could lock in some of your expenses?

In fact, you can.

One of your biggest expenses in retirement may be real estate, your mortgage on your home, or other fixed loans such as a car payment. Fixing the rate of interest on your liabilities is a way to hedge against inflation because you are no longer are subject to rising expenses.

If your mortgage is fixed or your car loan is fixed you know, with certainty, what your expenses are going forward regardless of the inflationary environment. At least on that part of your spending.

If you believe or are concerned about heading into an inflationary environment or just want to give some certainty around your spending levels in retirement, and you have a floating rate debt of any kind, fixing it so that you have some certainty around your future expenses might make sense for you.

Summary

Those are seven ways to protect against inflation. Of course, there are other ways as well, but these are seven main areas.

Protect Yourself Against Inflation By:

- Appropriately investing in your bond portfolio by keeping a relatively short maturity

- Buying some Treasury Inflation Protected Securities (TIPS)

- Sprinkling in more aggressive fixed income, but doing that – if at all – in a very cautious manner

- Investing in stocks, which over time have potentially growing dividends and also capital appreciation to protect against inflation

- Investing in natural resource producing companies that can take advantage of commodity price inflation and pass that through to you in the form of profits

- Purchasing real estate whether publicly traded securities or physical real estate

- Fixing any liabilities to the degree possible to get certainty around your future expenses

Incorporating these seven steps can help you control your spending down the road and match any future expense increases with income increases as well.

Doing that will give you a better sense of whether or not you have enough money for retirement and what your retirement income and expenses will look like.

Ultimately, doing that will give you more certainty about your future and more comfort and peace of mind in retirement as well as a higher probability of retirement success. If you would like to learn more about inflation, market volatility, and investing check out this blog.