Updated March 2, 2018

In an era of low-interest rates, I’m often asked: “Why would anyone own bonds?” Fear of owning bonds continues to remain prevalent as headlines scare people into thinking we’re in a so-called “bond bubble.” Yes, they may provide lower expected returns than equities, but bonds are an important piece in your portfolio.

Here are 4 reasons why bonds still may make sense for many investors:

1. Bonds sometimes rise when stocks fall:

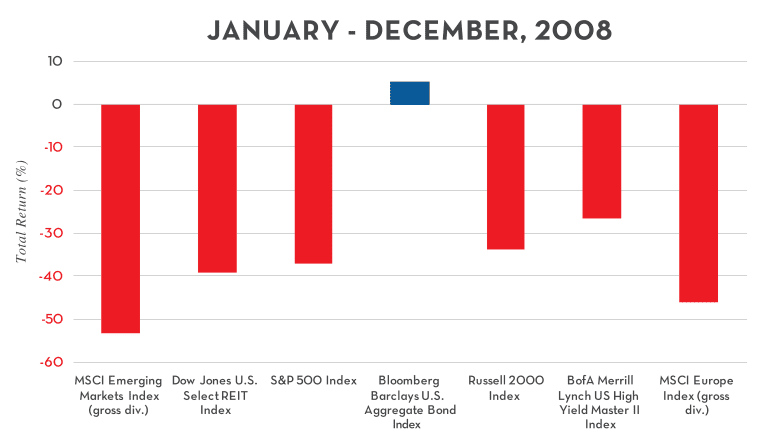

Investment folks refer to this as “negative correlation,” but the bottom line is that high-quality bonds are one of the few investments that might zig when stocks zag. Remember 2008, when shell-shocked investors opened their statements or logged onto their accounts only to find a blizzard of red ink. The one exception was high-quality bonds, which generally posted positive returns that year.

Source: Dimensional Fund Advisors

2. Bonds can be sold for portfolio rebalancing purposes:

I agree with the conventional wisdom which states that the best time to buy stocks is when they’re on sale. However, in the 2008 example, where would the cash have come from to buy cheap stocks if an investor was already fully allocated to that asset class? Selling a stock that’s down 35% to buy one that’s fallen 40% might make sense, but it’s hardly a formula for rapid wealth accumulation. Personally, I’d much prefer liquidating some bonds that are up a couple percent and using those proceeds to buy beaten down stocks.

3. Bonds are great for meeting Required Minimum Distributions (RMDs):

Raise your hand if you like paying taxes! Ok then, assuming your hand isn’t in the air, tell me how you would feel about this scenario: You have reached age 70 ½, and now it’s time to take RMDs from your retirement accounts, but you don’t need the money. You have other income from Social Security benefits and your pension.

Well, whether you need the money or not, the government doesn’t care. They force you to take distributions regardless, and then you have to pay taxes on these distributions at your ordinary income rate.

Single Filers – 2018

| Taxable Income | Tax Bracket (2018) |

| Up to $9,525 | 10% |

| $9,526 to $38,700 | 12% |

| $38,701 to $82,500 | 22% |

| $82,501 to $157,500 | 24% |

| $157,501 to $200,000 | 32% |

| $200,000 to $500,000 | 35% |

| $500,000 and over | 37% |

Married, Filing Jointly – 2018

| Taxable Income | Tax Bracket (2018) |

| Up to $19,050 | 10% |

| $19,051 to $77,400 | 12% |

| $77,401 to $165,000 | 22% |

| $165,001 to $315,000 | 24% |

| $315,001 to $400,000 | 32% |

| $400,001 to $600,000 | 35% |

| $600,001 and over | 37% |

Want to make this scenario really painful? Let’s go back to 2008, and the stocks in your IRA are down 35%, and you know it’s time to be disciplined and hold steady. But you can’t legally do so. Instead, you’re forced to lock in a 35% loss, take out an RMD that’s taxed at say 25%, (we’ll use this as an estimate for federal and state together; your situation may differ) and then you put whatever’s left over in a drawer for later use. Let’s say, hypothetically, you’re RMD was $65,000. In this scenario, you would need to liquidate stock that 6 months ago was worth $100K, and then you pay taxes on the $65,000 and wind up with $48,750. That’s right, your net worth just got cut in half, and you didn’t even need the money!

If this ever happens to you, even just one time, I’ll bet you’ll become convinced that maybe; just maybe, it would be nice to have some bonds in your IRA to fund future RMDs.

9 Investment Pitfalls All Investors Should Avoid – download the white paper.

4. Bonds can provide steady income:

Yes, yields on high-quality bonds are pretty darn low. Yes, you probably aren’t excited about 2% or 3% or whatever you can earn on your bonds. Honestly, two percent doesn’t excite me either. In fact, I’ve yet to meet the person who’s told me they’d rather buy bonds than go skydiving!

But bond yields, though low, are almost always higher than the return on cash (which admittedly isn’t saying much while many cash investments are still paying close to zero). Here’s a different way of looking at it though. Let’s compare bonds at 2% or 3% to the bank I recently saw offering 0.07% interest. If that doesn’t sound like much of a difference, consider this: At 2%, a portfolio doubles approximately every 35 years. At 3% it doubles approximately every 24 years. At 0.07% it doubles approximately every 991 years!

On a historical time scale, that’s the difference between doubling money you invested during the Clinton Years, versus doubling money you invested on your way from France to Jerusalem to join the First Crusade.

But what if rates go up?

Before concluding, I’d like to address one final aspect of the “Why own bonds” conundrum. Many prognosticators are forecasting higher interest rates down the road, and many investors fear that the value of their bonds will disintegrate if rates increase.

Setting aside for a moment the rather abysmal track record of interest rate prognosticators, there are two important points to consider before deciding whether to buy bonds.

1. Are there bond strategies that are relatively insulated from a potential rate increase?

The answer to this is yes, there are. A fuller explanation will be the subject of a future blog post, but for now, suffice it to say that matching bond maturities to your financial investment time horizon, focusing on relatively short maturity bonds, adding a measure of credit risk to your bond portfolio, and utilizing a bond ladder are all techniques potentially well suited to navigating a rising rate environment.

2. Are rising rates really that bad for bond investors?

- Even when bonds do fall in value, the decline has historically been relatively muted in comparison to many other asset classes. For instance, 1994 was the worst year for bonds in the past three decades, yet major bond indexes only fell approximately 3%. Not great, but hardly Armageddon.

- Not all bonds are created equal. In fact, some bonds may actually do well when the Fed is raising rates.

- And finally, it’s self-evident, but it bears repeating – if interest rates move higher, the yields on your bond portfolio will eventually move higher too. And higher yields equals more cash flow equals happier retirement.

Don’t Be Afraid of a “Bond Bubble”

To recap, there are a number of reasons bonds still make sense as part of a well-diversified portfolio for many investors. Bonds often provide negative correlation, rising in value when stocks fall. At times, liquidating bonds instead of stocks can be a good idea when it’s time to rebalance your portfolio. They’re also useful to have in your IRA to fund future required minimum distributions, and bonds almost always provide a higher return than cash. Certain bond investing strategies can provide some insulation from interest rate increases, and ultimately, rising rates don’t have to be bad for bond investors.

In Conclusion

Bonds investing has its perks. Your goal may be to provide steady income, balance a portfolio to reduce volatility, or simply to receive a more favorable return than cash. Many investors should consider how bonds can help them achieve their financial goals.