How statistically and practically difficult is market timing? What factors should you consider when choosing large-cap value funds? Should a $100,000 inheritance be invested in tax-deferred, taxable, or tax-free accounts? Plus, Backdoor Roth vs. Roth conversions; rules, limits, and strategies for 401(k) and IRA contributions; moving retirement money between custodians like Vanguard and Fidelity; and some negative but very entertaining listener comments.

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

Show Notes

- (00:51) Factors to Consider When Choosing Large-Cap Value Funds? (Craig, Seattle – voice message)

- (08:24) Asset Location: Where Should I Invest a $100K Inheritance? (Clint)

- (13:08) Why Is It So Difficult to Time the Market? (Marc, Massachusetts)

- (20:46) Should I Do a Backdoor Roth? Can I Stay in Lower Tax Brackets? (Jon, VA)

- (25:54) How to Move Retirement Funds Between Custodians Like Fidelity and Vanguard? (Michael, Jacksonville, FL)

- (27:50) 401(k) and IRA Contribution Rules, Limits and Strategy (Gregg, Memphis, TN)

- (32:20) Should Military Contribute Only to Roth Accounts?

- (33:51) Comment: Could Be Good With New Hosts (Great Show No Joke)

- (35:21) Comment: Good Subject Matter Bad Execution (Keewee42)

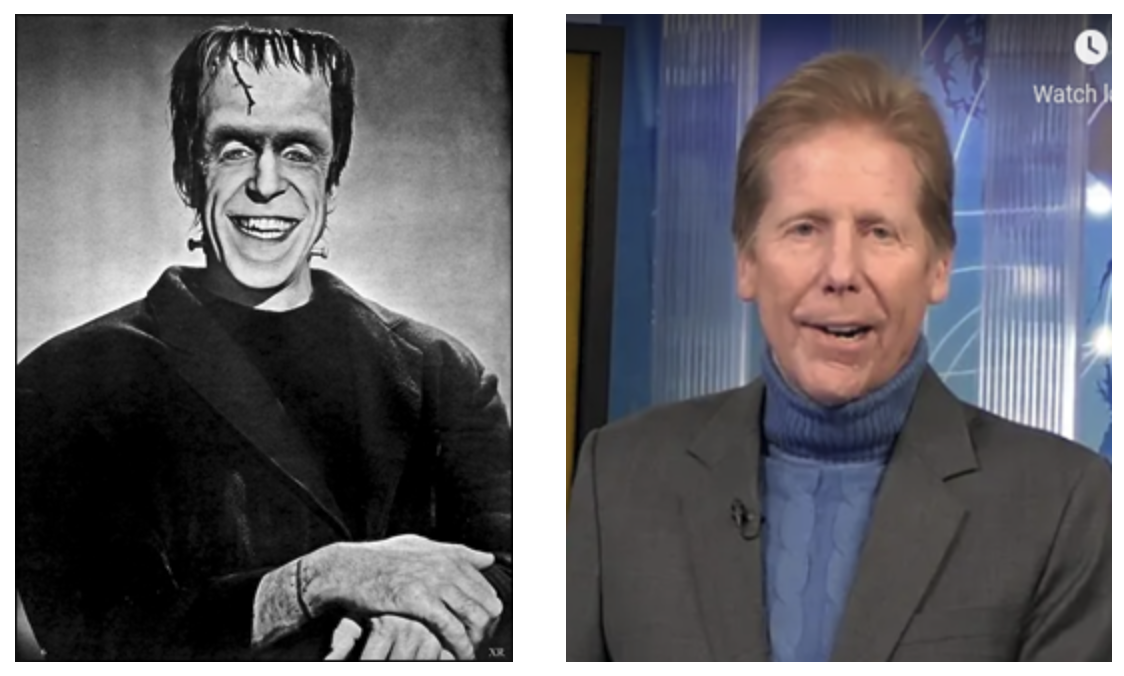

- (37:02) Comment: Al looks like Herman Munster (Scott)

Free financial resources:

WATCH Joe and Big Al answer questions from the YMYW podcast – on video!

LISTEN | YMYW Podcast #340: Where to Locate Assets for Tax Efficiency Without Compromising Growth?

LISTEN | YMYW Podcast #337: Does This Asset Location Strategy Lessen RMDs and Taxes While Maintaining Portfolio Growth?

LISTEN | YMYW Podcast #272: Asset Location: Where Should You Hold Retirement Investments?

WATCH | Asset Allocation vs. Asset Location

Listen to today’s podcast episode on YouTube:

Transcription

Today on Your Money, Your Wealth® podcast 368, Joe and Big Al are asked to provide a simplistic way of framing how difficult it is, statistically and practically speaking, to time the market? Let’s see if they succeed. Plus, Backdoor Roth vs Roth conversions, rules, limits, and strategies for 401(k) and IRA contributions, moving retirement money between custodians like Vanguard and Fidelity, and some negative but very entertaining listener comments. But first, should a $100,000 inheritance be invested in tax deferred, taxable, or tax free accounts? And what factors should be considered when choosing large cap value funds? Visit YourMoneyYourWealth.com and click as Joe and Al On Air to send in your money questions. I’m producer Andi Last, and here are the hosts of Your Money, Your Wealth®, Joe Anderson, CFP® and Big Al Clopine, CPA.

Factors to Consider When Choosing Large Cap Value Funds? (Craig, Seattle – voice message)

Joe: We got a voicemail. Can we play that?

Craig: “Hey, guys, this is Craig up in the mountains outside Seattle. I called you before still drinking the Jameson Caskmate stout. Try it if you haven’t yet, anyway, so I’m pretty heavily weighted toward value in my overall portfolio. Very high risk tolerance. Mostly small cap value. But my second largest exposure is large cap value. And right now all of that is in VTV across my Roth IRAs and my brokerage accounts. Looking at where I can increase exposure to large cap value and diversify away from just VTV. And so I’m looking at Invesco’s RPV. I’m looking at spiders large cap value fund SPYV, I believe. And then looking at Vanguard’s VONV and VYM. VYM is their high dividend yield, large cap value. VONV is their pretty vanilla one. 98% of VTB is already in VONV. So I would be doubling up there, which is fine. There’s a reason I’m in VTB. But really looking at what factors you would recommend I look at more than others as a total amount of assets. Is it PE? Is it the amount of overlap I have? Just wondering how to evaluate it and make the right decision. All right. Thanks a lot.”

Joe: All right. Thanks, Craig. FYI, We have a new office in Seattle.

Al: We sure do.

Joe: Maybe you can stop by with some Jameson. We can have a shot.

Al: We’re going to have to go up there just for that.

Joe: He is just loading up and he’s asking for advice on what fund to pick, which we don’t necessarily do. Maybe we can give him some guidance. He’s in a large cap value mutual fund or ETF, and he’s also in some small cap. He’s looking for more exposure to large cap value. He names a bunch of different funds and was looking at, Hey, how do I get more exposure to the same asset class that I’m already in? And I’m already in basically an exchange traded fund that maybe covers all of the large cap value funds. Now you have to look at how the fund is structured, I think.

Al: If I take a step back, I would say small cap value historically has been the highest performing asset class. If you look back 100 years. You may have a decade or two of underperformance. Are you really willing to risk that based upon; well we don’t know about your age and your investment horizon and that sort of thing. It’s why we generally recommend a globally diversified portfolio.

Joe: But he’s not asking that.

Al: I know, but

Joe: Now you’re given advice or your unsolicited advice. He’s asking, what should he do if he’s looking for another value fund?

Al: I’m suggesting that’s not the right approach. However, answering that question I can tell you what we at Pure Financial look at. We look at the size of the fund and the age of the fund. We don’t necessarily want a brand new fund with not a lot of assets because it makes it harder to trade and get fair pricing, number one. Number two, as we look at the expense ratio inside the fund itself. Number three, obviously as you look at the investment strategy. If the investment strategy is the same as what you already have, then what’s the point of getting another fund.

Joe: I think that’s the point. But one of the things our valued funds that we use with our clients, is probably different than what he’s doing through Vanguard or through Invesco. This is a market cap weighted fund. You can look at the price earnings ratio, which he asked for. We look at book to market ratios to define value. What that means is that a company has a book value. If you look at their assets and liabilities minus their liabilities and everything else that they have. Then there’s a stock price. You have the book value of the company versus the actual price.

A book to market. Usually in a value fund or value stock is that the book value is worth more than the actual price of the stock because by definition, value companies are potentially distressed or they’re out of favor for some reason. They’re more risky and over time you achieve a higher expected rate of return because you’re taking on that risk. If you’re in a market cap weighted ETF. What that means is that the most exposure you’re going to have is the largest funds. The really big value type funds are;

Al: Berkshire Hathaway, Johnson and Johnson, UnitedHealth, J.P. Morgan.

Joe: Berkshire is 3% of this overall fund. Berkshire Hathaway is a pretty big company. The bigger the company, the safer the company. You probably want to look at do I want to do a market weighted or do I want to do pro rata rated? There’s different ways on how they structured the overall ETF. That could give you maybe a little bit of juice. I think it’s a redundant strategy. If you’re going to look at this ETF, that’s large cap value versus another one that’s large cap value. In most cases, you’re investing in all those stocks. There’s just going to be a ton of overlap.

Al: To me personally, if you’re going for a high octane, I still would do more diversification and I would load up a bit on emerging markets because those are foreign companies in emerging countries. Those tend to have an even higher expected return over time. Although, in the last decade, neither one of these asset classes has done that well. Does that mean in the next decade they’ll outperform? Maybe, maybe not. That’s why we don’t necessarily recommend loading up on just one or two asset classes. Like the last decade, large company growth has been the best and the US has been the best performing asset class. If you were small value and that’s all you had, you missed a decade of growth.

Joe: Large growth is now getting crushed. The big companies are just getting hammered.

Al: Yes, they are

Joe: It’s so hard to predict. I like the fact that you’re buying broad based index funds that are low cost, but you don’t need six large cap value funds, you just need one.

Al: I agree with that.

Joe: It’s just going to be a ton of overlap and you’re not going to get any diversification there. If you want small value, large value, that’s great. But then like Big Al said, now we’re giving advice that you probably should broaden it out. But with all these fund choices, they’re all fine. I don’t see anything wrong with any of them. If you want to get more like in the weeds with this stuff, you just want to look at how that fund is structured. Look at book to market ratios, you can look at price to earnings ratios. I’m sure there’s a thousand other ratios that you can look at, but there’s going to be small, subtle differences there.

Asset Location: Where Should I Invest a $100K Inheritance? (Clint)

Clint writes in. In an email to Andi.

Andi: Clint has learned that if he wants to get a question answered, he can just email it directly to me. Unfortunately, that means that all the questions are being directed to me as well.

Joe: Go to YourMoneyYourWealth.com and click on Ask Joe and Al on the Air and we will answer them.

Al: Or email Andi directly and we will still answer them.

Joe: “Hi, Andi. I recently received an inheritance of $100,000. I’ve been a letter carrier since 1993 and have both Roth and traditional versions of the TSP. I currently have a combined $300,000 invested. I have a current TSP loan of $35,000 at 2.5% for my residential home down payment that I made in 2017. I max out my Roth each year at $6,500, but fall short of maxing out the traditional. I probably invest closer to $6,000 in my traditional TSP. My first thoughts are using my inheritance of $100,000 to first pay back the TSP loan, the $35,000. Increase my traditional contributions to max out my traditional TSP. I will probably work another 20 years.

I also recently refinanced my mortgage to 15 year, 1.9%. Where would you invest $100,000 inheritance? Thanks.” I think our man Clint is right on track. That’s exactly what I would do. Pay off that loan that’s in the TSP. Max out the TSP. Max out your Roth IRA. Refinance at 1.9%, 15 year. I would keep a couple of years in cash.

Al: Emergency funds.

Joe: Then the rest I would invest exactly how you’re investing in the TSP. What’s your fund choice? What do you like? What are you in? You could pick almost the identical funds. Of course, they’re going to have different names. You could pick some index funds that you would invest right into a brokerage account that mirrors or gives you broader diversification. It’s funny Al, is that people know how to invest in a 401(k) to some degree.

Al: There’s limited choices, so you pick a few.

Joe: I guess you check a box and it comes out of my paycheck then I have my 401(k). But then they get cash and they’re totally confused on what to do. This is so common. What is the difference between investing in a 401(k) versus investing in a brokerage account? Nothing besides the tax. It’s the same thing, isn’t it?

Al: Yes and the other flavor of this type of question is a lot of people, once they get an inheritance, they want to know how to invest that without thinking about anything else. It’s like, no, this is now part of your overall assets, your net worth your liquid assets. You look at this as a whole and figure out what the right investments for you to make. In a case of this, if you didn’t already have assets out of retirement account and it’s just the TSP, but you’ve got a Roth and a traditional version of the TSP. Now you’ve got assets in three different pools, if you will. You got the tax deferred, which we call tax. Then you got the tax free, which is the Roth. Then you got what we call taxable, which is the non retirement account. Now you can sort of pick and choose once you figure out the right investment strategy. Put your higher performing assets more the stocks in the Roth because you’re not going to pay taxes on that. Put your safer assets in the traditional TSP because if that grows fast, you’re going to pay more taxes. Then in the non retirement accounts put whatever’s left right, which will generally be a little more stocks.

Joe: Congrats, I think he’s on the right path. Pay down the debt, save more. You got 20 years. You already have $300,000 saved. If you can crank up that savings even more. I think Clint’s in a really good spot.

Al: I would agree. I definitely would pay off the TSP loan, get that out of there.

Properly locating your assets between your taxable, tax-deferred, and tax-free accounts has the potential to improve your returns on your investments by reducing how much tax you pay. Get our free guide on Why Asset Location Matters and listen to our previous asset location discussions in the podcast show notes at YourMoneyYourwealth.com. Access and share all these free financial resources, and ask Joe and Big Al your money questions by clicking the description of today’s episode in your podcast app to go to the show notes.

Why Is It So Difficult to Time the Market? (Marc, Massachusetts)

Joe: Marc, from Massachusetts writes in “Joe and Big Boyyy Al. Can you provide a simplistic way of framing how difficult it is statistically and practically speaking to time the market. One way of trying to imagine this is comparing the perceptive loss of a predicted market decline against…”

Andi: “compensatory and consistent ascension patterns.” Wow.

Al: We’ll have to have Andi help us on this.

Joe: I’m not reading any more of this.

Al: Andi, why don’t you read it.

Andi: “If someone perceives a 50% market decline, they need to time their exit at the pinnacle of the loss in their entrance back in within one year of the compensatory ascension, or roughly within the three years of the returning to market mean value. All this compresses dramatically as the decline shallows, for instance, you have to be more accurate if faced with a suggested 25% decline with your exit and entrance back in. In other words, I was hoping you could complete the MadLib. One should only exit the market if they predict a X or greater decline and should ensure their reentry timeline does not exceed X. I feel confident that Pure Financial gets a lot of calls at a variety of different market decline levels. For instance, a 25% S&P 500 decline may induce 10% of your clientele to call. I’m not sure if you can speak to that action as well.

I’m open to hear how all of these mental gymnastics make no sense to do and how we should all lead a simple life like you, Joe. Still driving my Mazda CX5, lost my billions on a bad options deal. My miniature dachshund helped ease my pain from this.” Thanks, Marc in Massachusetts.

Al: Marc, I think you answered your own question. You’ve lost billions from making bad option deals, so don’t worry about it. Just do this simply globally diversified, stay invested. There’s been all kinds of studies that show that it beats the market timers. Not always. There are certain people that are very savvy in investing and can figure this stuff out or have ways to figure it out. However, I will tell you that sometimes the biggest gurus that get this right year after year after year, 20 years later lose year after year after year and they end up in the same place or worse than just staying in the market.

Joe: We’re going through some extreme volatile markets right now. There’s panic and there’s fear. When your car goes out of control, what do you do? You grip a little bit harder and you try to make the right decisions and try to straighten out the car. But if you’re from Minnesota, like me and all of a sudden you fishtail you got to turn into the fishtail. What do most people do?

Al: It seems like the opposite of what you should do. You want to turn the other way.

Joe: Exactly. People turn the other way and they end up spinning out and crashing. Because you’re turning into the opposite. You almost have to do the opposite of what your emotions are, what you instinctively think that you should do. With everything else in life. If I want to learn how to play the guitar, I need to practice and work hard at learning how to play the guitar. The more work that I put into it, the better I’m going to be. My golf game is awful, but I practice and I have coaches and I have everything because I want to be a lot better. The more effort I put into it, sometimes the worse I play. It’s almost the same as the market. But the market, the more people that start playing with their money or they start moving stuff around and especially if emotions come into play. It’s almost the opposite effect. The more you work, the worse you potentially do. Everyone hates hearing this. Sometimes you need to stay the course. Sometimes you’ve just got to let things ride out as long as you have the right investment strategy and philosophy. If you’re in individual stocks that could really blow you up. But if you’re globally diversified, as Al said, low cost, tax managed, rebalanced, manage the risk in making sure that your portfolio is based on your goals, then I think why try to time the market?

Al: With a globally diversified, low cost, index funds or ETFs type investments, your probability of success is greater, to me, than if you’re trying to time the market. That’s been shown time after time, after time with studies. My last time, just as a personal story, that I tried to time the market was right before the Gulf War, and that was in the early 90s, and the market went down a bunch and I thought, Oh, this isn’t this doesn’t look good I better get out. I waited and waited and waited to get back in, and the market went up and up and up and up. Then I went to a financial planner who said, Oh, you’re a market timer. I didn’t know that’s what I was and I said, I guess. What are you supposed to do? I was just a young CPA. Anyway, what I learned was to have a globally diversified portfolio, you have to have the right portfolio. If you’ve got three stocks, then you’re taking a ton of risk. But if you have 2 to 5 to 10 to 15 index funds that have different stocks within them, and you have the right allocation based upon your goals, then just stick with it. When the market declines, then buy more. When the market goes up then sell a little bit. You’re constantly readjusting to keep your portfolio, which causes you to do the right things at the right time, which is buy low and sell high. We want to do just the opposite. Just like your analogy on driving in the snow.

Joe: There are some people that can time markets. There are some people that have made billions and billions and billions of dollars being able to do it. Those are so far and few between.

Al: Don’t you think that in many cases, that tends to reverse over time?

Joe: You look at Bill Miller, he beat the S&P 500 for X amount for 20 some odd years in a row and then all of a sudden it completely imploded. Peter Lynch was one of the most famous mutual fund managers.

Al: I’ve read his book and I thought, OK, that’s how you’re supposed to do it.

Joe/Al: Beat the Street.

Joe: Beat the Street with Peter Lynch. There’s hedge fund managers. There’s a lot of private funds and things like that. That’s such a small percentage. Marc from Massachusetts that writes like a professor. I know he was messing with me because there was no way that I could.

Andi: Yeah, what is compensatory ascension?

Joe: I have no idea. Anyway, Marc, good luck to you. He’s already blown himself up. Hopefully he learned from that.

Al: Maybe you have learned and maybe you can figure out the holy grail of investing. In our way of thinking, it’s a sure-er thing. There’s no guarantees in investing, but you have a greater chance of success in our way of thinking with a globally diversified portfolio. Stick with it. When stocks go down., take your safe money and buy a little bit more to stay in balance. When stocks go up, sell a little bit to stay in balance. You’re constantly buying low and selling high, which is the opposite of what most of us do.

Should I Do a Backdoor Roth? Can I Stay in Lower Tax Brackets? (Jon, VA)

Joe: We got Jon from Virginia, he writes in. “Hi Joe and Big Al, I love your show. Listen regularly. I’m 53. I have no debt and recently retired. I was a franchisee of one fast food restaurant that I sold in December for $5.3 million.” What do you think, what kind of fast food?

Al: Good question.

Joe: There’s no vegan fast food, is there?

Al: Not really. I don’t go to them much. If I have to go to fast food, I probably would go to a Mexican place to get a bean burrito.

Joe: Like Chipotle? Is Chipotle fast food? Or is that fast food fresh.

Al: It’s pretty fast.

Andi: The marketing has worked on you.

Al: You don’t drive through, but it’s pretty fast. It depends on the line.

Joe: Got it. “I have money invested, but my question is about 401(k) money. Due to the sale of the business, I recently had to close down my company 401(k) plan and transfer my 401(k) money to an IRA with a local investment company. I had $733,000 in my 401(k) when I moved it to an IRA. I met with my advisor today. Due to my age I may want to consider doing a backdoor Roth conversion. Tax free growth and no RMD sounds great, but I’m having trouble swallowing the tax that would be due if I did this. Taxes would be somewhere in the $330,000 range. Is this a smart thing to do or should I do it in smaller amounts so I could stay in a lower tax bracket? I’m not sure what my income will be in the years ahead other than I do have a couple of rental properties and we’ll bring in roughly $35,000 of income. What is your opinion on this backdoor Roth? Does this make sense for me to do?

Al: First of all, I don’t think he means backdoor Roth. I think it means Roth conversion.

Joe: If his advisor is giving him that advice. Saying we’re doing this backdoor Roth and it’s going to cost you $330,000 in tax, you should fire your advisor.

Al: True. If the advisor is telling you to convert the entire thing and go ahead and pay the$330,000 then also fire the advisor. Either way.

Joe: Either way is good John. John hit the lottery; he’s got his fast food restaurant.

Al: He sold it and got a big payoff.

Joe: $5.3 million and then he has a 401(k) plan of $700,000. If I take $700,000 into 5.3, that’s a pretty small percentage of his overall liquid assets. Even though it’s a big number and he’s 53 years old. He’s got 20 years before he’s forced to pull any of this money out.

Al: I totally agree. He may have more than that because they keep changing the RMD age later and later. John, the concept is to figure out the appropriate tax bracket to convert up to, maybe it’s 12%, maybe it’s 22%, maybe it’s 24%. That’s where you need to do a little analysis. Convert to that level this year, next year, the following year and so on. Get this done slowly over time so you’re not paying maximum taxes.

Joe: You can slowly bleed this thing out. If they change the law, then you can reevaluate. John, a backdoor Roth is when you make an IRA contribution and then you convert that IRA contribution, but then you have to be careful of Pro-rata rules and aggregation rules. Since you rolled your 401(k) into an IRA. It sounds to me that you don’t have any earned income you might have had for last year, so you could have done a backdoor Roth if you kept the money in a 401(k) and you made an IRA contribution. I’m assuming because you sold this in your ordinary income was probably X amount of dollars that you probably didn’t qualify for a regular Roth IRA contribution. So A. you could have made a nondeductible IRA contribution and converted it. That would have been a tax free transaction. Even though it’s only $6,000 or $7,000, that’s the backdoor Roth. Since you rolled your money, 401(k) dollars into the IRA, it blew up the pro-rata rules. Now you have $733,000. But to be honest with you, it’s not that big of a deal. I would just start slowly converting the $733,000 out.

Al: You say your rental property is $35,000 of income with the standard deduction and depreciation, let’s assume you got zero taxable income. I don’t know if you’re married or single, but pick a bracket, and I would be comfortable maybe with you even going up as high as the 24% bracket. But you don’t have to go that far, probably because it’s not like you have a fortune in the IRA, number one. Number two is you have almost 20 years to do these conversions, don’t pay any more taxes than they need to.

How to Move Retirement Funds Between Custodians Like Fidelity and Vanguard? (Michael, FL)

Joe: Michael, from Florida writes in “When I retire, is there any way to move funds in my Roth 401(k) to my Roth IRA? Or do I have to sell the funds? The 401(k) is with fidelity and would like just to move my funds to Vanguard Roth. If not there, could I move the particular funds to my fidelity Roth?” Good question. He’s got a 401(k) that has funds. He doesn’t want to sell the funds.

Al: He’d like to do an in-kind rollover.

Joe: I don’t know the plan document and what company that you work for, but I’m going to say no.

Al: I think in most cases with a 401(k), they send you a check, right?

Joe: Yes they send cash unless you have company stock, they’ll send company stock. That’s the problem with rollovers. Sometimes the company drags their feet and then all of a sudden you have money sitting in cash for 2-3 weeks because you’re waiting for the rollover check. The rollover check comes and then the check is going to be made out to the custodian for the benefit of you. But it could come to your house and then you’ve got to take that and bring it back to the custodian or your Vanguard account.

Al: Then you’ve got to buy the same thing.

Joe: You got to buy the funds

Al: Buy the funds that you want to buy. It’s a bit more of a hassle than probably it should be, but that’s the way most 401(k) plans are.

Joe: If you’re 401(k) at Fidelity, I would talk to them. Maybe you have a brokerage link that might be able to do some, some different things with your plan document. It’s all up to your company. It’s plan specific. It’s not under the 401(k) rule, it’s under the plan rule. I know there’s some plans that allow securities to get transferred out.

401(k) and IRA Contribution Rules, Limits and Strategy (Gregg, Memphis, TN)

We got “Hi Joe, Big Al and Andi. I absolutely love your podcast and it has been inspiring me to start the CFP® program.” All right! “Your listeners will be envious of me cruising the Memphis streets in my flashy 200,000 mile, 2008 Honda Odyssey minivan coming home to sip a 7 & 7 next to my German Shepherd labrador retriever by the fire.” You can just picture that couldn’t ya. A nice little minivan cruising the streets. Sippin a 7 & 7, a little Seagram’s. “My sister asked me a question that I cannot find the answer to. I know that the only people more knowledgeable than the internet are you guys, and I’m hoping that you can help.

She is single, turning about 50 this year and leaving her current job in March for a job that pays her almost four times her current salary. She was covered under a 401(k) plan under her current job. Her new job won’t allow her to participate in their 401(k) plan until six months of employment, which would be September. Her new salary will significantly exceed the $144,000 limit that allows her to contribute to a Roth IRA. I know that there are no limits on salaries that allow you to deduct your traditional IRA contributions if you’re not covered by a 401(k). In this case, though, she is only covered by a 401(k) for part of the year. Is she allowed to make a deductible IRA contribution this year? What would be the limits for her 401(k) contribution in IRA contributions is here. Joe, my buddy Jake in Bolivia, who wrote in before, and I are ready to hit some golf balls with you at 13,000 feet.” Oh, that’s cool.

Al: I think your golf ball would go a long way there.

Joe: I’m just waiting on your phone call. All right brother, I’m down.

Andi: You’ve got to go to Bolivia.

Joe: I’d love to. 13,000 feet. That’s how high Bolivia is?

Al: Yeah, there’s some mountains down there.

Joe: Or is Memphis 13,000 feet?

Al: No, definitely not.

Joe: This is complex. You know what, I have no idea what the answer is. I would say,

Al: Let me answer one question, Once you have even $1 going into an employer 401(k) or retirement plan, you are an active participant for that year end of story. I don’t care that she wasn’t covered for six months. You can’t do anything pro-rata. She is an active participant for that year. End of story. Even though you didn’t make a contribution to your 401(k), your employer did a little tiny profit share of a couple of dollars. You are an active participant for that year.

Joe: She could still fully fund the 401(k) plan.

Al: Yes, for sure.

Joe: She got September, October, November, December. She would just have to crank up the percentage of what is going in.

Al: That’s right. I don’t know, did she have a 401(k) in her prior job? You can’t double up on 401(k)s. Let’s say you put $10,000 in one 401(k), you can only put another $10,000 in the other one or $26,000, depending upon your age over 50 under 50. I guess it says she’s turning 50.

Joe: Got it!

Your retirement contribution strategy is probably completely different than the one for Gregg’s sister. Schedule a free financial assessment with one of the experienced financial professional on Joe and Big Al’s team at Pure Financial Advisors. They’ll take a close look at not only your current financial situation, but also your specific retirement needs and goals, your tax liability, your ability to tolerate risk, and many other factors, to help you develop a comprehensive financial plan to reduce your taxes and make the most of your retirement. Click the link in the description of today’s episode in your podcast app to go to the show notes and click Get an Assessment to schedule a no cost, no obligation financial assessment at a time and date that’s convenient for you.

Should Military Contribute Only to Roth Accounts?

Joe: Let’s see. “I’m advising my daughter in the Marine Corps to invest only in Roth. Pay taxes now. Tax rates will probably go up. If she can keep her taxable retirement under $40,000 and her Social Security will be tax free also. The only problem I see is the cost of housing, renting or buying may be too expensive.” Is there a question here?

Andi: I think the question is, is that a good idea?

Joe: Sure, it’s a great idea.

Al: I like it too. Generally, when you’re being paid lower amounts. Marine Corps in general, you’re being paid a lower amount than other types of jobs let’s say in corporate America business. Then you want to have the money going into a Roth. I guess the problem is maybe with a Roth, there’s no tax deduction, so there’s less take-home pay and the take-home pay might be hindrance and housing. I think that’s what the inference is. Maybe.

Joe: If everything is in Roth IRA and the compounding effect of that and your daughter is putting a ton of cash. I don’t know how long she’s going to be in the Marine Corps, but maybe she gets a pension?

Al: It’s a great strategy and the fact that her take home pay might be a little bit lower. The amount of tax savings you have in low tax brackets is fairly minimal. So, yeah, I would do that all day.

Comment: Could Be Good With New Hosts (Great Show No Joke)

Joe: We got a couple of really good reviews here, Big Al.

Al: We did.

Joe: Yeah, we got another 1 star.

Al: Really?

Joe: Yes.

Al: What’d they say?

Joe: It says “great show. No joke”.

Andi: That’s the name of the person who wrote in.

Joe: Oh. “The hosts sure laugh a lot at their own jokes. Unfortunately, it’s not funny at all and distracting.”

Al: Hmm. Well, that’s probably true.

Joe: I think our jokes are hilarious.

Al: You can always go to a different podcast.

Joe: Great show. No joke. Well, I guess it’s not a great show.

Al: No, it’s terrible.

Joe: It is awful. I think our jokes are hilarious.

Al: Yeah, we laugh.

Joe: I mean, we like to have a good time. Laughter is key to life.

Al: It improves your quality of life, and it’s just good for your stress level, all that.

Joe: At least we don’t go on so many tangents as before.

Al: Yeah, because of Andi. She keeps us straighter.

Joe: Yeah, what was that comment; It was like the show’s nonsense because we just talk in circles and we did.

Al: We did. I agreed with that comment.

Joe: We listened to these with open arms and open minds. We’re here to improve.

Al: I think in the earlier days you would say something and then I would repeat it. Then you would repeat my repeat because we didn’t really know how to do this.

Comment: Good Subject Matter Bad Execution (Keewee42)

Joe: Here’s another great review, 1 star. “Was excited for some deeper dive personal financial podcast, but hated the write in questions. And also how they dismissed the questions. Example lowest tax deeds to retire in with IRAs, et cetera. Answered by just reading five laws property in sales tax, which sounded like it came from Forbes with no further analysis. That was probably you Big Al.

Al: I probably pulled out my list. Well, here you go.

Joe: I got nothing on this. Let me just pull out Forbes, let me read.

Al: Let’s see what they say.

Joe: Florida, you just read off some states.

Al: I don’t think and that doesn’t surprise me, that I might have pulled out a Forbes article. However, I don’t think I would have answered states to retire with an IRA with property taxes. That has nothing to do with an IRA. I’m not that brain dead yet.

Joe: “Some general advice with a few minutes of questions at the end would help. But the folks just had a bad attitude about the people writing it. I get it. Those long paragraphs are irritating, but it’s part of it. Change your format.” All right. We’re going to change the format.

Al: No more laughing, no more questions.

Joe: A couple 1 stars. We got to pick up our game Big Al.

Al: Yup

Joe: We just gotta practice reading, get rid of the Forbes articles and I think we’re golden.

Comment: Al looks like Herman Munster (Scott)

Spotlight: where are they now?

Al: We got one that just sent a picture, it said Spotlight, where are they now? There’s a picture of Herman Munster from the Munsters TV show that I watched as a kid and then there’s a picture of me. It’s like, Oh, I never thought of myself as Herman Munster.

Joe: I don’t think you look anything like that. Oh I think he was just… because when you were Ron Burgundy for a couple of weeks

Al: Oh yeah. Right, right, right.

Joe: Herman Munster wore a turtleneck.

Al: He wasn’t in this picture. I don’t have two little pins sticking out of the side.

Joe: And your head is not nearly as big as Herman’s.

Al: It’s not flat.

Joe: No. I don’t know.

Al: I don’t think so.

Joe: I don’t know.

Al: Anyway, yeah, I don’t really see the resemblance. But apparently our listener did.

Andi: You look much more like Chuck Norris.

Joe: Yeah, Mike Schmidt, Chuck Norris and Ron Burgundy.

Al: As long as I wear the turtleneck.

Joe: Yes

Al: I tried to bring that back last December but it didn’t really catch on.

Joe: Well, thanks for your reviews. Good, bad or ugly? It’s all good. We like your comments. We like your questions. We’re here to improve. We’re here to make your lives a little bit easier when it comes to your finances. Our goal is really to help people make sense of all this crazy stuff.

Al: It’s complicated.

Joe: We want to have fun while we’re doing it so we’re not going to change anything.

Al: That’s how we do it. If you don’t like that, then there’s thousands of other podcasts. Go for another one.

Joe: Thank you, Andi. Thank you, Big Al. We’ll see you guys next time. The show is called Your Money Your Wealth®.

_______

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

Podknife

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed

You can check out that Big Al vs. Herman Munster comparison at the very bottom of the podcast show notes by clicking the link in the description of today’s episode in your favorite podcast app.

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

Listen on Apple Podcasts | Google Podcasts | Stitcher | Player FM

Your Money, Your Wealth® is presented by Pure Financial Advisors. Sign up for your free financial assessment.

IMPORTANT DISCLOSURES:

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

• Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, LLC, a Registered Investment Advisor.

• Pure Financial Advisors LLC does not offer tax or legal advice. Consult with your tax advisor or attorney regarding specific situations.

• Opinions expressed are not intended as investment advice or to predict future performance.

• Past performance does not guarantee future results.

• Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

• All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

• Intended for educational purposes only and are not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors.

CFP® – The CERTIFIED FINANCIAL PLANNER™ certification is by the Certified Financial Planner Board of Standards, Inc. To attain the right to use the CFP® designation, an individual must satisfactorily fulfill education, experience and ethics requirements as well as pass a comprehensive exam. Thirty hours of continuing education is required every two years to maintain the designation.

AIF® – Accredited Investment Fiduciary designation is administered by the Center for Fiduciary Studies fi360. To receive the AIF Designation, an individual must meet prerequisite criteria, complete a training program, and pass a comprehensive examination. Six hours of continuing education is required annually to maintain the designation.

CPA – Certified Public Accountant is a license set by the American Institute of Certified Public Accountants and administered by the National Association of State Boards of Accountancy. Eligibility to sit for the Uniform CPA Exam is determined by individual State Boards of Accountancy. Typically, the requirement is a U.S. bachelor’s degree which includes a minimum number of qualifying credit hours in accounting and business administration with an additional one-year study. All CPA candidates must pass the Uniform CPA Examination to qualify for a CPA certificate and license (i.e., permit to practice) to practice public accounting. CPAs are required to take continuing education courses to renew their license, and most states require CPAs to complete an ethics course during every renewal period.