Joe and Big Al spitball considerations for a few listener retirement plans, including investing in brokerage and Roth instead of pre-tax, getting tax diversification, taking the pension lump sum or annuity, paying for college education, and calculating a “retirement number” to put your savings on autopilot. Plus, what life insurance “investment” has a purported “guaranteed” 10% return? Do dividend-paying stocks have a higher rate of return than Vanguard funds like VTSAX? Should individual stocks go in a taxable account?

Subscribe to the YMYW podcast newsletter

FOLLOW US: YouTube | Facebook | Twitter | LinkedIn

Show Notes

- (01:03) YMYW Spitball Early Retirement Plan Analysis: Roth, Asset Location, Pension, and College Decisions

- (13:49) YMYW Spitball Retirement Plan Analysis: What is My Retirement Number?

- (21:12) “Guaranteed” 10% Return? What is This Life Insurance “Investment”?

- (28:23) Does a High Dividend Paying Stock Have a Higher Rate of Return Than, Say, VTSAX?

- (30:28) The Market is Crazy. Should I Invest in Vanguard Now?

- (37:16) Comment: Good Topics, Too Much Chit Chat

- (38:24) Should I Hold Individual Stocks in a Taxable Account?

Free resources:

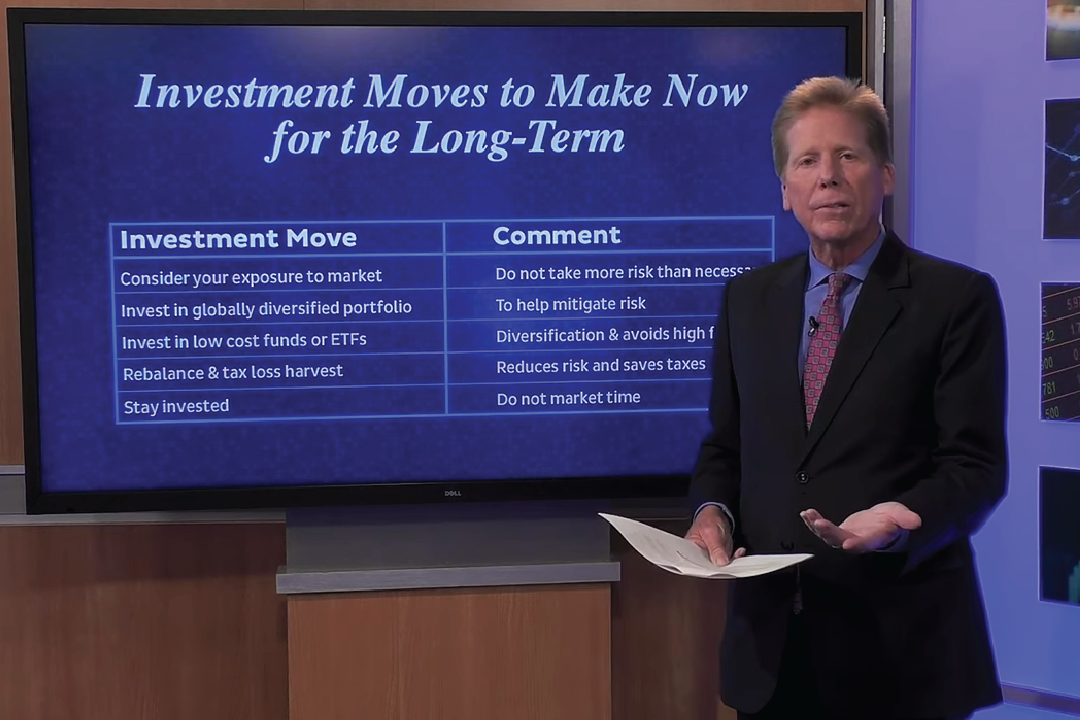

WATCH | YMYW TV Season 6 Episode 2: Investing in Volatile Markets (*all new!)

THE DIY RETIREMENT GUIDE IS NO LONGER AVAILABLE AT THIS TIME!

LISTEN | YMYW PODCAST #257: Why Not Just Go All in On Vanguard’s Total Stock Market Index Fund VTSAX?

Listen to today’s podcast episode on YouTube:

Transcription

Today on Your Money, Your Wealth® Joe and Big Al spit all over your retirement plans. No, sorry this says they spitball ideas for your retirement plans! First, they’ll look at several aspects of retirement for a couple who wants to retire early: should they be investing in brokerage and Roth accounts instead of pre-tax accounts? How should they optimize their tax diversification? Should they take the pension lump sum or annuity? What about paying for kids’ college education? Then, how do you figure out your “retirement number” so you can set your savings on autopilot? They’ll spitball ideas about that, too. Next, what exactly is this life insurance “investment” you hear about on the radio with a “guaranteed” 10% return? Do dividend paying stocks have a higher rate of return than the ever-popular VTSAX? Should you hold individual stocks in a taxable account? And when should you jump into the market, given how COVID-crazy things are right now? I’m producer Andi Last, and here are the hosts of Your Money, Your Wealth®, the shot callers, the spit ballers themselves, Joe Anderson, CFP® and Big Al Clopine, CPA.

YMYW Spitball Early Retirement Plan Analysis: Roth, Asset Location, Pension, and College Decisions

Joe: Brandon from Minnesconsin.

Al: Oh sweet. That’s gonna be near you somewhere.

Joe: Yes sir. “Hey there Andi-” So bear with me folks because-

Al: It’s a book.

Joe: -it’s a book. This is one of the longest emails in the history… And I’m gonna try to go through it fairly quickly. I’m not-

Al: Just kinda paraphrase if you can.

Joe: If I can- kind of skip around a little bit. But I don’t want to miss anything because if it’s important and so on. But trust me I’ve listened to myself sometimes when I’m reading this and it’s like this is painful just even to listen to. “Hey there Andi, Al, and Joe. Best podcast ever. Seriously, it isn’t even close. The blend of you 3 is fantastic. Thank you. Money is supposed to be fun and you folks do an outstanding job of making it so. I find myself laughing, nodding in agreement, and shaking my head from time to time in a good way because of one of the crew’s responses. You guys and gal are awesome. We live in Minnesconsin in the Twin Cities of Minnesota. Shout out to you, Joe. “All right brother. “And have a family cabin cottage on Lake Pepin right on the Mississippi River in Wisconsin. We’ve been married 22 plus years; have 2 kids. The COVID-19 happening had fast-forwarded our early retirement plans and I am for the most part retired at age 47.” Look at Brandon. Look at the big bad wallet on Brandon.

Al: Wow. That was my goal, wasn’t it?

Joe: It was. 47.

Al: 47. And here I am still working.

Joe: Hey, stop with the chit chat Al.

Al: I know, sorry.

Joe: “COVID-19 doesn’t bode well for keynote speaker author trainer guy.”

Al: Probably not.

Joe: I wonder what kind of keynote speaker.

Al: We’re looking for people on our webinars. Maybe he can help us.

Joe: Maybe be a guest. “Yeah my wife, I.T. industry, will retire in the next 9 months or 2 years, for sure by July 1st 2020. I would love your insight on a few questions so here is the info.”

Al: Let’s bring in Sir Paraphrasing.

Joe: I’m going to try. This is where it a little- “Income, wife’s salary annually which usually covers all of our annual expenses is $110,000. Wife maxes out 401(k) each year and health insurance also is covered. Commercial real estate is also $20,000 and will continue in retirement.” So right now they got about $130,000 of income; $20,000 of that is real estate income that will continue.

Al: Got it.

Joe: “Wife will receive a pension of $300,000 to $350,000 with her retirement and has a current option based on the following potential retirement dates. There’s a 50% survivor annuity attached to the pension. It looks like March 1st and July 1st are the dates the pension increases each year deferring payment grows the amount total of about $12,000 to $15,000 a year.” So he can either take a lump sum or an annuity payment roughly $300,000 or roughly $900 a month.” They’ve got zero debt. “One of our best decisions; we love the freedom, independence.” Good for you. No debt.

Al: Like it.

Joe: “Current spending $50,000 a year.” They don’t really spend a lot of money, that’s most living in Minnesconsin.

Al: Even with two homes. Well they’ve got it paid off so that’s why.

Joe: Property taxes alone here would be $50,000.

Al: That’s right.

Joe: “When wife fully retires we plan on traveling. So we would increase our spending to $70,000. However, we have $20,000 income from the commercial real estate. So we’d like our portfolio to provide the additional $50,000 a year for spending in creating memories. We will also be paying $80,000 to $100,000 each for our kids’ college using 529 plan scholarships and pulling from retirement accounts that allow for educational purposes.” So did he tell us how many kids he’s got?

Al: Not that I saw.

Andi: He does. He’s got 2; a 16-year-old and a 13-year-old.

Al: 2 kids. I see it now.

Joe: Got it. “Current portfolio post-tax. So he’s got $360,000 in savings; 401(k) plans is about $1,000,000; traditional IRAs $300,000; Roth IRAs $200,000; $75,000 in 529 plans.” So there we have it. We got a 16-year-old, 13-year-old. So what do they got? $1 point- call it $1,400,000 in retirement accounts- that is pre-tax; $200,000 in Roth accounts; and another call it rounding $400,000 in after-tax, savings and brokerage.

Al: Like it. That makes sense.

Joe: “So here are some questions. Should we stop any pre-tax retirement account savings and invest that money into a brokerage account? This will be the first year we qualify for Roth IRAs because our AGI was too high over the past several years. Since we are heavy in the pre-tax retirement accounts, what do you think?” Let’s see. They got $110,000 of income, they file married; so taxable income I’m guessing- is she fully funds the 401(k) plan; they’re in the 12% tax bracket. Yes, for sure. Jam up on Roth contributions. You’d probably even look at conversions. But any additional savings I would go in Roth or after-tax just because of the tax bracket. I’m guessing that commercial real estate $20,000 annually, maybe there’s some shelter through depreciation there.

Al: You would assume that a lot of that would be sheltered with depreciation. So their tax bracket is not that high. Based upon what we have here. So let’s go with- let’s get the money- more money in the Roth.

Joe: Absolutely. “What would your suggestion for asset location to help provide our desired income and minimize taxes? Our plan is to focus heavily on Roth conversions ladder strategy over the coming years as our income continues to go down. Can you speak to that plan in regards to how much to do each year and the reasons why this may not be the best strategy in our situation?” So asset location I guess- I think you’re confused on some terms here. There’s asset diversification and then there’s asset location. Asset location means how do you invest the Roth accounts, the non-qualifying accounts in your retirement accounts? Tax diversification is more how much money should I have in the Roth accounts versus pre-tax versus after-tax? So if I’m looking at a 47-year old that has $1,400,000 in retirement accounts, that only spends $50,000 a year, I think the strategy is to convert at least of the top of the 12% and then look at the top of the 22% until the tax law changes.

Al: That makes sense and so the top- they’ll be in the 22% currently- well his wife’s working but still the 22% is a pretty low bracket. And certainly, if she retires in a couple of years then you may potentially be in a low bracket for quite some time. So you can convert in the 12% bracket which later will become the 15% bracket, still a really nice low bracket. You can probably get a lot converted. But I wouldn’t necessarily forego the 22% bracket because that’s still a pretty low rate. So that’s where maybe a little planning comes in. You kind of do some math to figure out what’s the best tax rate? But I think if it were me I would be tempted to go up to the top of the 22%.

Joe: If I was Brandon I’d be just taking a simple spreadsheet. And then I would have different columns for my different assets and say well $50,000- and give an inflation factor, that’s the need for the overall portfolio. And so if he’s got $350,000 let’s say- or $360,000 in non-qualifying accounts. So you’re looking at- that’s about 7 years of providing $50,000 of income with no growth on that money. But he also needs to pay the tax on the conversions. So he’s 47, he can touch the money, not until- did he say 457 plan too? I think he does. So he could draw on that at any time.

Andi: He says Solo 401(k) and his wife has a 401(k). He’s got to a traditional 401(k) and wife’s got an IRA.

Joe: I thought I saw a 457.

Al: But the challenge as I see it is there’s only so much money to pay the tax on the conversions, to pay for your living costs and to pay for your kids’ college. So it’s kind of- it’s a balancing act.

Joe: So you’re going to have to look at the total net worth of everything. You know what this case is and he’s not going to like what I’m going about to talk about but debt would be a fairly good option for this individual. Take out a home equity line or something like that just to create a little bit more liquidity. Even though he’s very proud to be zero debt, debt-free. But you have to look at if I get a home equity line with interest rates at 3% that I can utilize some capital versus taking larger distributions from a 401(k) plan to pay for additional expenses and paying a tax at 25% or 28%. Would you rather pay a little bit of interest or pay that much more to the IRS? Especially with the commercial property. Maybe you could lever that up and have the rents pay that note to create some liquidity there. So there’s a lot of moving parts and options and we’re just kind of spitballing here.

Al: And I think you don’t take on debt lightly.

Joe: Absolutely not.

Al: But nevertheless in this particular circumstance because there’s a lot of net worth and low spending, maybe it does make some sense. Because later there’s, I mean a lot later, but later there will be Social Security. And there will be the pension; we haven’t even talked about that. Probably you want to take the lump sum. When you look at how low the monthly payments are. They’re not very high.

Joe: But let’s say 20 years from now they’re still- the living expenses are relatively low and their income is going to be pushing them up into a very high tax bracket due to the required distributions-

Al: Agreed.

Joe: – and then with the Social Security-

Al: Because if you had, say, a $300,000 lump sum pre-tax, now it’s about $1,600,000, by the time they have to take RMDs it’s probably $5,000,000 or above.

Joe: Because it’s like his 3rd question here and then we’ll have to get to a break here, is that “what is your suggestion when it comes to use of the distribution on the pension plan? Go with the lump sum; pay the taxes and the use the remainder to help with the taxes on the Roth conversions?” See good news for you Brandon here when you take the lump sum it’s not going to be fully taxable in the year that you take it. You roll it into an IRA.

And take those distributions out accordingly.

Al: When you need it.

Joe: When you need it. So again when you’re looking at your total net worth of things, he’s already picturing if I take $350,000 out as a lump sum I’m going to pay $100,000, $150,000 of tax, I’m left with $150,000 to help pay the tax. Again, you might want to think about using the equity. Potentially because you have so much net worth but most of it is still qualified and you’re young enough and you’ll have the income that you can create the liquidity that you need to do some planning. But again you could do this without that as well.

Al: And if he does that, which probably should take the lump sum, but then he can’t really take the money out of that without paying penalty. So you have that problem. You could do a 72T election maybe if he needs more income. So there’s a lot of possibilities here.

Joe: The 72T tax election would allow you to avoid that the 10% penalty. But then it jams him up because he has to take his separate equal periodic payment now until he turns-

Al: 59 and a half.

Joe: -60. So that’s additional income that maybe he that needs or not.

Al: Agreed. I think he might need it though. Because especially if he uses his brokerage money for Roth conversion taxes and college. So I don’t know. There’s a lot of math here to be done. So you’re right. We just spitball here are a few ideas to at least think about it.

Joe: I think Brandon did an awesome job. Great saver and low spender. Spend a little bit more. Enjoy it. You’re a keynote speaker. I wonder what he talked about.

Al: Probably talked about saving money. How to save.

Joe: How to kick ass and save a ton of money and retire at 47 with more assets than most. So congratulations Brandon. See? It’s the good folks from Minnesota.

Al: They’re always smart aren’t they?

Joe: They’re a helluva people.

Al: Or I should say they’re usually smart.

YMYW Spitball Retirement Plan Analysis: What is My Retirement Number?

Joe: We got ML out in the Northeast. It’s pretty broad.

Al: That is pretty broad.

Joe: Northeast is pretty big.

Al: We have a general region. I’m imagining Vermont.

Joe: Could be. That’s a good vision. So here we go. “Hello. I love the show and curious if you can help me come up with a retirement number to aim for.” I’m sure we can help you with that, ML. “I want to set aside the necessary amount each month and put it all on autopilot. But I don’t know how much I will spend as I approach retirement nor do I know what our salary will be so far down the road. We are 41 and have 4 kids so I feel that a lot is going on. It’s going to happen from now until then. When it comes to college savings Vanguard has a wonderful page that allows you to input what school you’d like to save for, what you currently have 529 plans, expected returns etc. Vanguard then figures out how much school will cost when your child turns 18 and tells you exactly how much money that you need to save.” So they’re making a little household income Al, $475,000 to $500,000; very healthy income, ML from the Northeast.

Al: Yes, that’s great.

Joe: “My wife will go back to work in about 5 years as a teacher. We will put $3200 dollars a month in all 529 plans, $800 kid per month. Currently, they have $110,000. I maxed out my 401(k) plan; my company matching profit-sharing gets me to the IRS max of $56,000 into the 401(k); currently have about $500,000 in 401(k) plans; I do the maximum Backdoor Roth for my wife and I each year, currently about $200,000 in Roths. I max out my HSA every year. I invest $6000 a month into a taxable account at Vanguard-” but what’s the total amount in that? So you invest $72,000 a year there. “I’ve been saving at this rate for about a year as I resent got a raise. I hope to continue until retirement but who knows what the future brings? Got a number I should aim for? Feel free to send any thoughts on my financial information as well. Thanks advance for your input.” I guess he guess he gets this too and it’s a problem.

Al: You’re in your early 40s and I don’t know what I’m going to spend at 65.

Joe: Exactly.

Al: Or 60 or whenever I’m going to retire.

Joe: Who the hell knows? It’s like I understand retirement planning but- I like what he’s doing, he’s just throwing a ton of money at some accounts. But let’s just look at it like this. I’m going to do some math for you as I’m gonna skip the 529 plans because he already went to the Vanguard-

Al: And did that analysis.

Joe: -and the Vanguard helped him. So he’s got $500,000. He’s saving $56,000 a year there plus $72,000. I’m gonna say he’s saving-

Al: It’s about $130,000.

Joe: I’m going to go $140,000.

Al: $140,000.

Joe: And then he’s 42 years old?

Al: Mmm.

Joe: And 42. So he wants to retire when?

Al: He’s 41 but I’m not sure he says-

Joe: 41. Did he say when he wants-?

Andi: Yes. 41, 4 kids.

Joe: I know. His retirement date? I don’t know. 20 years?

Al: Yeah let’s call it 20 years. I like that.

Joe: 20 years, 7%, future value is $8,000,000. So 4% of that is $323,000 a year. He’s making right now $500,000; take away taxes of about $200,000; plus his savings of $250,000; plus health care; plus this; plus that; he’s probably spending three- let’s say call it- spending with 4 kids is probably $200,000.

Al: Maybe not that high but-

Joe: Not even that because he’s saving $120,000 on top of that. So call it $150,000? With 4 kids? That’s reasonable.

Al: That’s pretty good.

Joe: And if he keeps doing what he’s doing, in 20 years he’s going to have the same living expenses- or he’s going to have the same purchasing power. Or higher.

Al: That’s what I think too. I think- I don’t like rules of thumb but I’m gonna say one anyway, and that is if you can get to saving at least 20% of your income, you should be fine over the long term. And he’s saving more than 20% of his income.

Joe: Exactly. So what we have- to shoot for a number I guess to get 20% or maybe just shoot for- because he’s in a fairly high tax bracket trying to go- because 20% is gross. Maybe trying to go with a 30% net.

Al: You could do that. But I think that’s a really simple calculation, is 20% of $500,000 that’s $100,000. And he’s already saving more than that. So you can do a full financial plan and I can tell you this will probably look pretty good. But-

Joe: But there are so many unknowns and he gets that.

Al: I know. And that’s his problem. He wants a number and it’s almost impossible to say- it depends upon your assumptions.

Joe: Exactly.

Al: All I’m saying is if you save at least 20% of your income, in almost all scenarios you’ll be fine.

Joe: I would agree with that. I would agree with that. I think what- with him is keep saving as much as you possibly can.

Al: And it’s OK to say more than 20%.

Joe: Exactly. If you could save 50% of your net over the next 3, 4 years, then you can be on cruise control.

Al: That FIRE generation, they’ll save 80%, 85%. Financial Independence Retire Early and people are retiring in their 30s. Of course they’re spending nothing. But that’s a choice.

Joe: Well we’ve just had Brandon from Minnesconsin. So he’s 47. And he’s got about $3,000,000. So he’s on his way there at 41. And he retired at 47, but they’re only spending $50,000. He’s got 4 kids that are still pretty young. I can imagine. I don’t have any kids. I have myself.

Andi: That’s enough kid for ya?

Joe: And it’s hard enough to stay afloat.

The DIY Retirement Guide is our Special Offer at YourMoneyYourWealth.com right now but it’s only available for the next few days. This free 48 page guide has steps to understand and plan your retirement income, strategies for choosing a tax-efficient distribution method, tips on preparing for the unexpected, and much more. Click the link in the description of today’s episode in your podcast app to go to the podcast show notes and download the DIY Retirement Guide. While you’re there check out the all-new episode of the Your Money, Your Wealth® TV show on Investing in Volatile Markets. Got questions? Click Ask Joe and Al On Air in the podcast show notes and send the fellas an email.

“Guaranteed” 10% Return? What is This Life Insurance “Investment”?

Joe: We’ve been holding onto this one for a while, I don’t know why…

Al: Well, let’s get to it then.

Joe: We got Bruce, our buddy Bruce from Joisey, writes in. Well, I think he wrote this to Andi.

Al: It looks like it.

Joe: “Andi Last, The Wonder Woman of YMYW, hello. Number 1 Joe, number 2 Big Al, number 3 Andi. Hope Joe is happy with first billing.” I am very much Bruce, thank you. “I’ve been hearing on the radio about an investment that’s not universal life insurance and it “guarantees” 10% return.” And “guarantee” is in quotes. “It must be legal if it keeps popping up on the popular news radio station right?” Let’s see. “From what I found out, in my limited understanding, I think it’s buying somebody’s whole life insurance for higher than the surrender amount but lower than the cash value, it’s guaranteed earnings. I’ve never heard this on your show. Can you check it out?” Bruce, what- you’re going to hear a lot of crap on the radio, especially this show. And what- just kind of be careful when you think- when you’re hearing guarantees. Al and I used to be on a station in San Diego and there was a gentleman that followed us. Wasn’t he on right after us?

Al: He was on right after us. Correct.

Joe: And he would talk about all sorts of alternatives and this is back in 08.

Al: Right. Because the market was tanking and he was actually a really good speaker.

Joe: And so Al and I would be talking the same BS. I mean it’s almost the identical show, probably the same content.

Al: Probably.

Joe: And so he would then come on after us and this is when we would do it live in the studio and he would be in the lobby looking- and then come in. Now we have our studio in our own office, we don’t have to go to the radio station. But then it’s like if you’re listening to guys that talk about standard investments such as stocks, bonds, real estate, you need to get rid of those people because I have an investment that could guarantee X. These are alternatives. And this is what the old multi-rich and billionaires invest in and everything else.

Al: And you should be able to get some of this too.

Joe: I’m gonna make it available to all of you if you call this number or something like that. Bruce, guess where he’s sitting today.

Al: He’s in jail.

Joe: He’s in jail.

Joe: San Diego, somewhere, I don’t know if he’s in San Diego or Southern California. I don’t know where the hell he is. The guy was a punk and our office used to be next to his. He tried to do a lot of things to mimic our firm but offered just really crappy products that were totally filled with conflicts of interest. And I don’t know if they were like Ponzi type but how he marketed them and then like the fees and commissions that were never disclosed and the conflicts of interest that were never disclosed. They basically barred the guy from the industry. But he did get a lot of business.

Al: He did. I remember you and I for quite a while wondered how he could get away with this. Well in fact he didn’t get away with it.

Joe: It’s like- we’re like what the hell is- How can he say this crap?

Al: You’re not allowed to say that stuff.

Joe: And then lo and behold- just be careful of someone’s touting it a 10% rate of return or any type of return on investment. The risk-free rate right now is like 1%.

Al: It’s exactly 1%.

Joe: And so it’s going to probably go lower given where interest rates are. So we called the risk free rate. You know the Treasury.

Al: That’s right.

Joe: And even they have risks. The Treasury could go negative. I suppose. So be careful what- the 10% rate of return especially in today’s environment, it is almost impossible, if not impossible. It is impossible to guarantee that. But to have a consistent 10% return is- it’s a .001% chance that that could ever happen. But I think for an average investor or an individual investor that is not necessarily sophisticated, they hear 10% and they’re like I want some of that.

Al: Because I just went to my bank and they offered me 1%. So 10% looks pretty good.

Joe: Or they could have experience with investing in a diversified portfolio that maybe produced a 10% rate of return or a 12% rate of return.

Al: For a while.

Joe: And then they’re like, “hey this is safer. And I could get a 10% rate of return. Why wouldn’t I do that?” Basically what this guy is selling and it’s like a better financial plan or something like that. I don’t really want to tout this dude or even give himm props, but it- they’re viaticals. A lot of it is what is called a viatical or life settlements. Al, remember the life settlements.

Al: I do.

Joe: And so what a life settlement or a viatical is that let’s say I have life insurance on my life. And Alan says I will pay those premiums for you.

Al: Because I think you’re going to kick the bucket sooner than you do. And the sooner than the insurance company thinks.

Joe: Yes, and I can’t pay my premiums anymore. Or I don’t want the insurance anymore.

Al: And I think there’s an investment here. I think you’re going down. So I go Joe, I’ll buy it from you.

Joe: I’ll buy it from you.

Al: Here. Here’s $100,000, whatever.

Joe: Let’s say my death benefit is $1,000,000.

Al: I’ll pay $100,000 for it and I’ll start making the payments. Because I think this is a pretty good investment for me.

Joe: So then Al takes over my life insurance so he’s got an insured interest on my life.

Al: Which usually isn’t a good thing.

Joe: I know. It’s never a good thing if it’s not your spouse.

Al: Or even if it is your spouse.

Joe: Exactly. And so I die and then Al gets the $1,000,000. So he’s like here. And so what they do is they package these up. So it’s not usually on one life because Al might find a hitman to kill me.

Al: Isn’t it like usually a double-blind trust? So you don’t know who it is.

Joe: Yes. You don’t know who the hell it is and everything else. And so they got certain life expectancies; they pay into these premiums. It’s what they used to call them death bonds. Because you pay a premium and then it’s a bond; a bond is going to mature when that person dies. And so what he’s doing is buying viaticals and selling them or you could buy a viatical on the open exchange if you wanted to. So just you can Google viatical or life settlement. So that is exactly what’s going on in that guy’s world. So if you want that as a diversifier, by all means. But just understand what you’re buying. Of course, he’s not saying that we want people to die because then we get where we’re taking advantage of the death benefit. He’s saying hey I got an alternative that’s going to pay you 10%. Just be careful out there.

Does a High Dividend Paying Stock Have a Higher Rate of Return Than, Say, VTSAX?

Bruce has got another couple of questions here for us, Big Al.

Al: Let’s see.

Joe: He “just realized that some stocks have for example a 5% dividend while Vanguard fund VTSAX only has 1.77. Since Vanguard can double in 10 years, does that mean the stock can sextuple in 10 years or are they calculated differently?” I don’t know where Bruce from Joisey is going from here.

Al: I think he’s asking does a dividend- high-dividend-paying stock have a higher rate of return?

Joe: You’ve got to look at total return, Bruce.

Al: That’s what he’s missing.

Joe: So you’re either going to have capital appreciation of the stock. So let’s say the stock is trading at $10 a share and it goes to $12 a share. It doesn’t produce a dividend. You can have another stock that stays at $10 a share but produces a $2 dividend.

Al: Same same.

Joe: Same same. You’ve got the same total returns.

Al: I think what people don’t understand- if there’s a company that’s paying a 5% dividend every year, their value is going down 5%. Now it may go up because of other factors. But if you just look at that one transaction in a vacuum, the day you declare that dividend, you get the dividend, yes, $100 stock, $5 dividend; but now your stock is worth $95. So you just have part of it in cash.

Joe: And you know how many arguments we’ve got with other people?

Al: I know.

Joe: You are out of your mind. That it’s not how it works.

Al: Because it went up the next day. Well, it might have because the market forces-

Joe: -market volatility.

Al: But if there was no market volatility, that’s the exact mathematics is how this works.

Joe: Exactly. So you’re just gonna take a look at, what is the goal? What are you trying to accomplish? So it’s not like you get the dividend and the stock price stays and then it doubles. So I see what you’re trying to get after there, but just understand that the stock price goes down the same amount as the dividend that is distributed.

The Market is Crazy. Should I Invest in Vanguard Now?

Joe: And then he’s got another question here. “I had funds during the market crash middle of March and thought about it then started to invest.” OK. So this is a request I guess. “Believing the market will get worse due to continued shutdown, I waited for a better price. April, May, June- market is still crazy, still in shutdown; many people are still unemployed; riots happening; and oh yeah, the coronavirus hasn’t been cured. Vanguard funds are almost back to how much they were, meaning I missed the discount. I’m requesting your position on what to do; invest a little more anyway and maybe it can still go down? In the past of course no guarantee, but the downturn didn’t reoccur until months later; what can you make of this economy? Thanks and stay healthy.” All right. Bruce. Couple things with- I like how he talks about Vanguard as a particular investment. That’s just-

Al: You know, the Vanguard one. They got hundreds of them.

Joe: Vanguard is a fund company, mutual fund company that is a very good company. Al and I both like Vanguard, recommend Vanguard to our clients and I personally invest in Vanguard funds.

Al: I do too.

Joe: But it’s a fund company. So when you say Vanguard totally recovered and let’s say he’s got Schwab didn’t. Well, it depends on what’s invested in the Vanguard fund versus let’s say the Schwab fund. So just understand that Vanguard is the grocery store. You can still buy anything you want inside the grocery store. It’s Vanguard, Schwab, TD Ameritrade, whatever, they have their proprietary funds and there are hundreds of these proprietary funds. So just- when you say Vanguard, be more specific to large-cap, small-cap, mid-cap, whatever. Like you did here with your VTSAX fund.

Al: So I’m assuming when you’re saying the Vanguard funds are almost back to how much they were, he’s talking about an equity fund, maybe a U.S. equity fund. Probably large S&P let’s just say.

Joe: Markets tanked, markets came back.

Al: And I was waiting for a good price. And because things are getting way worse and then it ticked up a little bit in April. I thought well it’s going to go back, I’m going to wait. May it went up again; June it went up again. Now where are we in July. Up again. So how do you make sense of that?

Joe: It’s a challenging predicament because if you went to cash- let’s say you went to cash in March, what the hell do you do? How hard would it be to get back in the market today?

Al: Totally hard. Because you probably got into cash after the market tanked because you got worried.

Joe: Because you saw a decline in your balance.

Al: And so then it’s like I’m going to wait because- until it hits bottom then I’m going to buy back and then all of sudden it’s more than when I sold it. And I missed- how do I get back in it? And this whole market timing thing is very tricky. That’s why we don’t recommend it because it’s almost impossible. Because you can say all these bad things are happening. And Bruce you’re right. But will the market respond in kind or accordingly? Not necessarily.

Joe: Because the market responds to- is it good or as bad as expected?

Al: And it’s forward-looking. So it’s- there’s anticipation we’re going to get better. And maybe we don’t. Maybe in 6 months, we don’t, maybe the market tanks again. But that’s why a market can go up in spite of bad things happening. It’s the general consensus is it’s going to be temporary.

Joe: So they’re looking at all right well looking at these new cases.

Al: That’s right.

Joe: Look at bars and restaurants, movie theaters, things like that.

Al: They’re being closed. But then, on the other hand, there’s some positive news and vaccines and treatments and-

Joe: People aren’t dying as much.

Al: Not as much as they were. Right? So maybe we’ll get better. And we got all these- it’s impossible to predict. So we generally say stay invested and don’t worry about market timing. And if you’ve got a lot of money to invest- if you’re nervous about it, just invest a little bit each month; dollar cost average if that makes you feel better.

Joe: Yep. And it’s hard. You’re trying- Bruce, it’s just being patient. But I just read another article about some guy lost- some 30-year-old lost another $1,000,000 in Robinhood.

Al: Oh boy. Yeah.

Joe: Trading options. Doing that. We have almost like this gambling mentality. And it’s boring to see your accounts just- I don’t want to invest and wait 15 years to see- or 10 years to see my account double.

Al: Because I can double my money in 10 days if I pick it right. I can also lose everything.

Joe: So investing should be boring. It should be boring. That’s why this show is really boring.

Al: It’s the worst.

Joe: Did you miss the discount? I don’t know. Well think about it, what’s the goal for the money? Do you need the money 10 years from now? Do you think the market is going to be higher 10 years today than it is now? Well buy now, you’ve got your discount.

Al: That’s the only explanation. I mean it’s- and the answer is you’ll know in 10 years. But the thing is if you look at almost any 10 year period, there are exceptions, but almost any 10 year period the market’s higher than it was 10 years earlier.

Joe: Especially I don’t think it’s ever been lower in a globally diversified portfolio.

Al: I agree with that.

Joe: I think the S&P-

Al: -2000 to 2010 actually went down. That’s really unusual, but a globally diversified portfolio in that same period went up.

Vanguard’s VTSAX, the Total Stock Market Index Fund, is pretty popular. So why not go all in on it? That question has been asked before on this podcast and that episode happens to be the most popular one we’ve ever released. If you missed it or want to relive it, you can find it in the podcast show notes at YourMoneyYourWealth.com. So what do you think, after hearing the fellas doing these retirement plan spitball analyses today, do you think maybe it’s time for you to email them your situation and see what they spitball for you? Or for more than just spitballing, you can sign up for a free two meeting financial assessment with one of the CERTIFIED FINANCIAL PLANNERS on Joe and Big Al’s team at Pure Financial. You can do that in the show notes too. Just click the link in the description of today’s episode in your podcast app to get there.

Comment: Good Topics, Too Much Chit Chat

Joe: Go to YourMoneyYourWealth.com if you got money questions. We will answer those questions right here on the show. We will try not to do so much chit chat, Al.

Al: We got a comment from “Long Time in China.”

Joe: Long Time in China.

Al: When someone complains they don’t give you their name. They just make up a name.

Joe: What do they say? “Good topics, but too much chit chat. It’d be great if the host can stick to the point. The banter is not funny.”

Al: Well China- Long Time in China. We-

Joe: We never claimed to be comedians. We’re just talking about certain topics. If we get sidetracked, we get sidetracked.

Al: Here’s the thing. You can tune in or you don’t have to.

Joe: You don’t have to. There you go.

Al: That’s what we got. We still got 4 stars though.

Joe: I know. He gave us 4 stars-

Al: But not 5-

Joe: Not 5 because we’re not always funny.

Al: Not 5 because we’re not very funny.

Joe: “Decent topics. If they’d just stay on topic.”

Al: “If they would just get to the point. I listen all this time to get the point.”

Joe: “These guys just drive me nuts.” How’re you liking this segment, Long Time in China?

Al: Pretty bad so far.

Should I Hold Individual Stocks in a Taxable Account?

Joe: We got Massi. Is that right?

Andi: Sounds good to me.

Joe: Massi?

Al: Yeah I like it.

Joe: All right. “Is it a good idea to have some individual stocks in a taxable account? Someone just like sends just random stuff.

Al: It can be. If you pick the right one.

Joe: I guess so.

Al: Well let me- let’s go to the tax benefits first of all. There are tax benefits of doing it that way; because with an individual stock, basically, you have dividends on it potentially but there are no capital gains until you sell it. So if you buy a mutual fund or even an index fund, there’s going to be some gains and losses because there are some sales inside those funds, which are taxable. So if you own an individual stock, it is more tax-efficient.

Joe: It’s one of the most taxing efficient vehicles you can possibly own.

Al: But I don’t own any in my taxable portfolio account. And the reason being is I’m not willing to take that much risk on an individual company. So for me I understand it’s a better tax benefit to have those individual securities, but I don’t want to- there’s too much investment risk for my liking. So I would much rather have an index fund or a low-cost ETF or something like that.

Joe: Because you’re still going to get a pretty good tax treatment on it.

Al: That’s right. Because if I went with an active mutual fund, meaning one that the fund manager’s trying to beat an index and so they’re buying and selling all the time, that’s very tax-inefficient. But if I buy an index fund- let’s just say an S&P 500 index fund- that’s trying to mirror the S&P 500- they’re not really buying and selling except when people are adding money and taking money out. So there’s very little capital gains. So I don’t really have much taxation on it other than the dividends which I would have anyway with stocks. So that’s why I don’t really like individual stocks. They’re very tax efficient. But I’m concerned about the investment risk. Now I will say if you happen to pick the right stock-

Joe: How about you could pick Tesla. What’s Tesla up right now? I think it was up 14% today.

Al: If you would have invested in Apple stock in 1980, you picked the right stock. But if you would have invested in the other 2000 that didn’t do as well, you might have been sorry.

Joe: There you go. Last five days, a couple percent.

Al: But anyway that’s always true of stocks. It’s- there’s a lot more risk because it’s a single company. You can do much better than the market. You could do much worse than the market. I’m not willing to have my investment be that big of a rollercoaster. So that’s why I go with index funds and ETFs.

Joe: I’m with you Al. I don’t own any individual stock either. I was thinking about maybe put $2000-

Al: – in something just for fun? What would you pick?

Joe: Huh?

Al: Maybe I shouldn’t ask. Maybe that’s like recommending something?

Andi: I bought one share of a stock a few years ago.

Joe: You did?

Andi: It’s done very well since.

Joe: You have one share of one stock?

Andi: I bought one share and a couple of years later the stock split. So now I actually own 7 shares.

Joe: Wow. You should be a- what do you call it? Analyst.

Al: Well, as they say, the range of returns is much greater with a single stock. You can do much better or much worse than the market as a whole.

Joe: Did you see that email that Brian Perry sent in regards to the people that lost money owning individual stocks versus people that lost money owning ETFs over the last five years?

Al: I missed that somehow.

Joe: Dammit. Because I’m gonna say something that’s probably wrong, but it was- the gist was this- if you own like an ETF, index fund, mutual fund, any basket of stocks over the last five years, 7% of people lost money. If you own individual stocks, around 50% of people lost money.

Al: 50%.

Joe: 50%. So that’s the difference. You can hit a home run. But you can also strike out significantly by owning individual stocks. With ETFs, index funds you’re kind of just hitting base hits.

Al: And I think- I’ve heard that before too and I think Joe, that’s because when you look at indexes just a handful of stocks bring everything else up. It’s just that you don’t know which ones are going to be.

Joe: Exactly. All right folks. That’s all we’ve got for you today. Send in your questions. Thanks so much and we’ll see you next week.

_______

Robots, beer and stupid purchases in the Derails today. Stick around to the end if that’s your kinda thing and you aren’t Long Time in China.

Subscribe to the YMYW podcast newsletter

FOLLOW US: YouTube | Facebook | Twitter | LinkedIn

Your Money, Your Wealth® is presented by Pure Financial Advisors. Sign up for your free financial assessment.

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed

YouTube Music