Is your retirement plan turbocharged? Do you know how to make the most of the money that you’ve worked so hard to save? Joe Anderson, CFP®, and Big Al Clopine, CPA are here to tell you how to turbocharge your wealth. Whether you are in the slow lane with your savings benchmarks or stalled out in reaching your retirement goals, learn the actions you can take to power up your portfolio and grow your wealth!

Turbocharge Your Wealth

- Be a Super Saver

- Rally with Roth

- Run with Risk

- Social Security Brakes

Important Points:

-

-

- 0:00 – Intro

- 1:28 – Turbocharge Your Wealth

- 2:13 – Automate your Savings

- 3:30 – Boost your Contribution Percentage

- 4:50 – Impact of Employer Match

- 6:08 – Catch-up Contributions

- 6:38 – Download: Turbocharge Your Wealth Guide

- 7:30 – True/False: A backdoor Roth IRA is off-limits if you have other IRA assets

- 8:22 – Rally with Roth

- 10:09 – Backdoor Roth

- 11:11 – Down Market Roth Conversion

- 12:50 – Contribute Early with Less

- 14:23 – Run with Risk

- 15:14 – Risk vs Return

- 15:45 – Download: Turbocharge Your Wealth Guide

- 16:25 – True/False: You can increase your Social Security benefits by 50% if you wait till age 70

- 17:55 – Social Security Benefits: Average & Maximum

- 18:34 – Ask the Experts: Can I get around the contribution limits for my retirement account by starting a home business as a side gig?

- 19:36 – Ask the Experts: I plan to delay claiming my Social Security benefits. If my ex-husband claims his benefits early, can that impact mine?

- 21:12 – Pure Takeaway

- 22:37 – Download: Turbocharge Your Wealth Guide

Subscribe to Your Money, Your Wealth® on YouTube!

Transcript:

Joe: Do you know how to turbocharge your wealth? Welcome to the show. The show is called Your Money, Your Wealth®. Joe Anderson, President of Pure Financial Advisors, and I’m with the big man Big Al Clopine. He’s sitting right there. Hey, Big Al.

Al: How you doing? Ha!

Joe: Are you ready to turbocharge your wealth, Big Al?

Al: Of course.

Joe: We’re at the starting line, right? This is our journey to create wealth. 90% want to get on that starting line. They want to get on the block, but 45% are stalling before they get here. They don’t know what to do. They don’t know how to get there. They don’t know where the gas pedal is. Let’s figure it out today, folks. That’s today’s financial focus. [engine revving] 50% of Americans, they don’t know if they should invest in a stock or a mutual fund, and more importantly, they probably don’t even know what a stock or a mutual fund is or how that coordinates in their overall financial strategy. Let’s break this down real simple. Let’s turbocharge your overall wealth. Let’s bring in the big man.

Al: Turbocharging your wealth. All right. What are we gonna talk about today? Let’s start with be a super saver. That’s actually how you win the prize, right? That’s how you retire successfully, live the life that you want to live in retirement. Second thing is rally with the Roth, the Roth IRA. That will get you to the finish line because you’ll have a lot of tax-free income in retirement, stretch those dollars even further. Then we’re gonna talk about running with risk. When should you have more risky portfolios, when should you tone it down, and finally, we want to talk about putting on the brakes for Social Security because if you can wait, if you can delay Social Security, receiving benefits, you’ll get a lot more for the rest of your life, and, Joe, this is kind of a–this will be kind of fun because we’re talking cars today.

Joe: Yeah. We’re talking NASCAR.

Al: Who doesn’t like cars, right?

Joe: Who doesn’t like Natural Light and NASCAR?

Al: Ha ha ha!

Joe: Ha ha! Put those two together, boom, right, you’re creating wealth. Let’s dive in. Automate your savings, right? So if you take a look at your age, if you’re in your 40s, you should have roughly around 3 times your annual income saved. You know, this is a nice, little Fiat.

Al: Yeah. That’s your starter car, right?

Joe: That’s your starter car. You know, you get in there, you got a little bit of a trunk space, not too much, right? You start building some wealth.

Al: I got it.

Joe: But then you hit your 50s, now you’re gonna increase, right? Now you got that nice, little escalade. Kind of good rule of thumb, you want 6 times your annual salary. So if you make $100,000 a year, 6 times that is $600,000 give or take. Now when you hit your 60s, you need that big dump truck. This is Big Al. This is what he drives with All of his money. You need a lot of money here when you hit your 60s because you got to start unloading some of this cash to live off of for the next 30 or 40 years, so this is a good gauge, Al, to see what kind of automobile that you should have given your age.

Al: Yeah. I hope I have a dump truck because I am in that age group, but any rate, let’s talk about how to get there, right? So you want to boost your savings, save more, right? This is not new information but let me show you a little example here. So this is someone that makes $50,000 a year, and we’re assuming a 6% rate of return over 30 years. So if you save 4% of your wages, then you get $167,000 at the end of that period of time. 5%–$209,000– 6%–$251,000. Now the truth is I would like you to save 10% or 15% or even 20%, but this illustrates how if you can just save a little bit more each and every year how it can make a difference in your total savings.

Joe: So one of the things that we would encourage you to take a look at is what are you saving now, right? Does it make sense maybe to bump it up 1%. That’s not gonna kill you, right, and then next year, bump it up another percent or 2% and try to continue to get to that magic 10% or 15% that Big Al was talking about. Now a lot of you might have a match, right? So let’s go back to the 4%, 5%, and 6%. You make $50,000 a year, right, but, let’s say you have a nice employer that’s gonna match you, so they’re gonna match 50% of your employee contribution up to 6%, so that 4%, again, is 2,000, but you add that company match, it’s another $1,000, so instead of 2 grand going in, it’s 3, right? $2,500 is 5% plus 50% of that is $1,250, and so and so forth. You get the gist, but we talked about these numbers. $167,000, $209,00, $251,000. Now if you add that match in, that $167,000 goes to $250,000, right? $200,000 to $300,000, $250,000 to Almost $400,000. Again, it’s just moving that tack over just a little bit more. You add on that company match, now you’re talking real wealth.

Al: Well, you are, and I think most employers with 401(k)s have some kind of match. Sometimes, it’s 3%, 4%, whatever it may be, and your company’s going to match maybe 50%, maybe 100% in some cases that exact amount, so you don’t want to leave that on the table. You want to take advantage of that. Now the great thing about a 401(k) is you automate your savings, right? It just comes out of your paycheck. You don’t even think about it, but some of you don’t really have 401(k)s, so you have to maybe be a little bit more proactive. Maybe what you’ll do is you’ll go to your bank account and have an auto withdrawal every time you get a paycheck into your IRA, right, into your savings account, whatever it may be so you don’t think about it. This is one of the most important rules of saving. Pay yourself first, and the way you pay yourself first and not forget is you automate it so it becomes foolproof.

Joe: Absolutely–who’s the most important person in the room, Al?

Al: yeah. You and I and all our viewers.

Joe: It’s you, right? You’ve got to pay yourself first. Pay yourself first. Now the secure act came about here last year, and we have some increases, so we’re gonna put a little bit more gas. So the total catchup for a 401(k) plan now is $7,500. If we move out to 2025, for people ages 60-63, now that catchup, your full contribution is $10,000, so it’s given us more opportunity to save a little bit more.

Al: They’re allowing us to put more in, which is key because we know that people don’t save enough, so the more savings, ways to save, the better this is going to be.

Joe: All right. You want to turbocharge your wealth? Go to our web site yourmoneyyourwealth, click on that special offer. It’s a guide to turbocharging your wealth. Get it right now. It’s free of charge. It’s our gift to you this week. It’s a lot of fun. Play with the kids, show them the cars. This is what you need to do to turbocharge it. Go to yourmoneyyourwealth.com, click on that special offer, and do it right now. We got to take a break. We’ll be back in just a second The show is called Your Money, Your Wealth®.

Joe: Hey. Welcome back to the show. The show is called Your Money, Your Wealth®. Joe Anderson, Big Al. We’re turbocharging your wealth today. [engine revving] go to our web site yourmoneyyourwealth.com, click on that special offer. It’s a guide to turbocharging your wealth. Who doesn’t want to turbocharge your wealth? Yourmoneyyourwealth.com, click on that special offer. Let’s see how you guys did on that true-false question.

Al: True or false? Well, that’s false. You can do a backdoor Roth as long as you have earned income, right, have money in a nonqualified account that you put into an IRA and then go ahead and then convert that. The problem, though, is if you have IRAs–I’m not talking 401(k)s or 403(b)s, only if you have IRAs– Joe, there are some special rules that make this a little trickier.

Joe: First of all, you need compensation. You need earned income for you to be eligible to put into a Roth IRA. Now if you make too much money, then you’re ineligible to directly put dollars into a Roth IRA as a contribution, and those limits here is $138,000 to $153,000. So it phases out for single–so $153,000. If you make more than $153,000 as a single taxpayer, you do not qualify. Married filers, it’s $228,000. If you make more than $200–roughly $230,000, you do not qualify to do a direct Roth IRA contribution. What else could you do? You could make an IRA contribution. There’s still this compensation rule, so you need compensation to make an IRA contribution, but there are no income rules here, right? Now if you make too much money, you’re not gonna get a tax deduction by putting the money into the IRA, so what a lot of people do is then convert it into a Roth IRA. You would pay tax on any dollar that, right, that doesn’t have basis, if you will, so the backdoor Roth is what is called I’m making a non-deductible IRA contribution and then converting that into a Roth IRA. There is no tax because it’s an after-tax contribution, and what Al talked about is that it works really well when you don’t have any other IRAs. If you have other IRAs, you can still do the backdoor Roth. However, it’s not gonna be a tax-free conversion. You’re going to pay tax on whatever pro rata rules and aggregation.

Al: Yeah. It gets tricky. Basically, the IRS looks at– maybe you have 5 different IRAs. They look at it as it was one IRA, they look at your tax basis Altogether as one IRA, so it’s not quite as good, but if you don’t have any IRAs, that backdoor Roth, putting money into a non-deductible IRA and converting it to a Roth is, is a great way to kind of work around these contribution limits.

Joe: Yeah. So, like, you’re cruising along here, right, and then arrrrr! Right? You can’t make that Roth IRA contribution, so you could just switch lanes, right? We just told you how to do it. You make the non-deductible IRA contribution, and then, boom, you can convert that right into a Roth, so the conversion could be tax-free if you don’t have any other IRAs, or it could be a little bit taxable depending on what other IRAs that you have and the math that is included here. So there’s Always this possibility, so sometimes, people are just like, “oh, I can’t do that,” because they either make too much money or, you know, “what is a Roth, and I don’t get this.” you want to make sure that you’re looking at this because tax-free growth forever is a pretty good deal. You know, looking at conversions, so–and down market, it’s a really good opportunity for you to convert money into a Roth. Now take a look here. Let’s say that you’re in a 24% tax bracket, ok, and you have 100 shares of xyz stock, right, and they’re trading at $100 per share, right? So if I did a Roth conversion, $10,000 times 24%, my tax cost would be $2,400. So I took those stocks, $10,000 worth of stocks, I converted that into a Roth IRA. I have to pay tax on it, and assuming I’m in the 24% tax bracket, I have to pay $2,400 in tax. Market drops, right? So I’m still in that 24% tax bracket, but I still really like these shares. It’s xyz company, it’s a great company, but the market’s down a little bit, right? So the share price is now $80 versus $100, so I’m still gonna convert the 100 shares, ok, but now, it’s only $8,000 because it fell in price. Then I convert it. It’s only gonna cost me $1,900 versus $2,400, right? Then I convert, and All of a sudden, that stock recovers, All of that recovery grows in a Roth IRA that will be forever tax-free, so down market–right now, we’re experiencing some volatility.

Al: Sure.

Joe: Might be a good tax strategy.

Al: Well, it is, and we talk about this. I mean, Roth conversions make a lot of sense for a lot of people, but when it’s a down market, when stocks are cheaper, when mutual funds are cheaper, index funds are cheaper, best time to convert bar none because then when the market does recover, it was cheaper tax dollars to get that in, but when the market does recover, All that future growth is tax-free.

Joe: Let’s talk about saving, right? Starting early is always the key. Let’s look at Jack and Jill, ok? Jill–she’s prudent. She’s gonna start saving at 25 years of age, so she’s gonna contribute $7,500 for 10 years, and she’s gonna stop at 35, and she’s never gonna save again, and let’s assume that Jill gets a 6% growth rate on her money. We got Jack, right? He’s not as prudent as Jill, you know? From 25-35, he’s out there. I don’t know what he’s doing. He’s spending money on cars and at the bars and, you know, trying to find Jill, but she’s studying, and she’s doing what’s right, ok? So he lags off for 10 years, but then he starts saving $7,500, and he starts at 35. Jack is gonna save from 35-65. If you just think of that scenario, you would think Jack has a heck of a lot more money at the end of the day than Jill, but it’s not true, because Jill started early. She saved $7,500 a year for 10 years, $75,000. At 65, she’s gonna have over $600,000. Jack–he had to save $225,000 over a 30-year period. He’s gonna have just a couple of bucks more than Jill. If Jill continued to save All the way through, this number’s going through the roof.

Al: Now I know what happens. A lot of people see a slide like this, and they go “well, wait a minute. I’m 50 years old. I don’t really–I haven’t saved anything.” well, take heart because no matter what you do, no matter what changes you make right now will affect your retirement. Let’s say you’re 60 and you don’t have much saved. Start today, and you will make meaningful changes in your retirement.

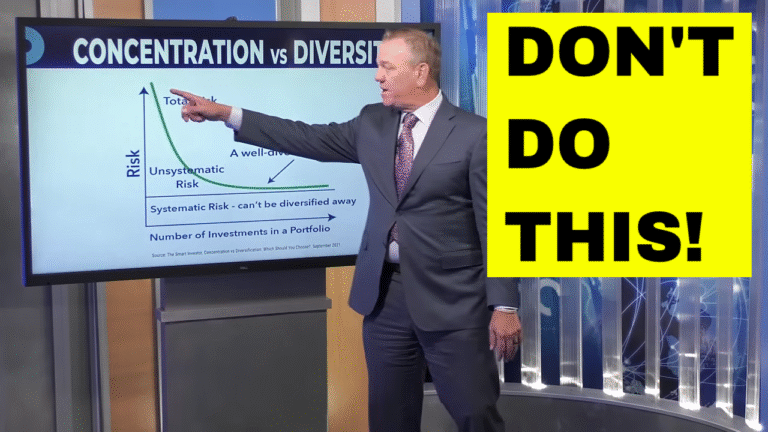

Joe: Then you look at asset allocation, right? So let’s get back to that turbocharge. If you’re in your 30s and 40s, right, you want to probably take on a little bit more risk. You got that fast, nice sportscar. That’s what Big Al bought when he was in his midlife crisis, right? It’s a true story.

Al: Yeah. In my late 40s. You’re right.

Joe: I’m in my 40s. I don’t have this.

Al: I know.

Joe: So then you hit your 50s and 60s, ok? Now then that’s when you got to get the family truckster, all right, because you got to put a little bit slower down. You don’t want to be speeding through traffic, right? You got the kids in the backseat, you got the little “baby on board,” right, so you want a little bit more stability here. So this could be a little bit of blend. You might 4×4– you might want a 4×4 here, right, click it back into two-wheel drive, but then when you hit your 70s, you just need the old tractor, right, something nice, slow, and steady that’s gonna start and get you All the way home.

Al: You know, I’m gonna have to take my Tesla and trade it in for a tractor in a few years.

Joe: There you go. You’re gonna see Big Al in the streets of San Diego right there in that tractor. So if I’m looking at high risk versus low risk, there’s that sportscar again. Equivalent here would be, let’s say, small companies, right. You know, a lot of small companies, they start out, a lot of them fail, but then a lot of them turn into really big companies, and that’s when you get that really big rate of return. The van down by the river, right? Those are corporate bonds. It looks like a milk truck, and then you got a golf cart, right? Those are the government bonds. So we’re having a little fun here, but you can kind of put this in, you know, visualization here. Small companies, really fast, hot, right, and then you got your golf cart just cruising around. Those are your government bonds, and then of course there’s things in between. So if you want more help with this, you know where to go. Go to yourmoneyyourwealth.com, click on that special offer. It’s a guide to turbocharging your wealth. Click on our special offer, yourmoneyyourwealth.com. We got to take another break. We’ll be back in just a second.

Joe: Hey. Welcome back. The show is called Your Money, Your Wealth®. Joe Anderson, Big Al. We’re talking about turbocharging your wealth. [engine revving] if you want to turbocharge your wealth, we got the guide to turbocharging your wealth. Go to yourmoneyyourwealth.com, click on the special offer, download it right there. It is our guide to turbocharging your overall wealth. Let’s see how you did on the true-false question.

Al: True or false? Well, I guess starting when? Let’s say starting at age 62, can you increase your benefits by at least 50%? It’s actually more than that.

Joe: If was gonna say, “hey. I’m gonna give you 76% more if you just wait a little bit”…

Al: Yeah. Almost everyone at 62.

Joe: Almost everyone is still way over here, right, and I get it to some degree. You know, there’s All sorts of different political views you might have, or you just want the cash today, right? It’s like, “hey. I retired. I want a paycheck. You know what? I don’t know when I’m gonna die, so I’m gonna just claim my benefits and run with it,” but there could be a better strategy if you really want to maximize the overall benefit, but if you wait until age 70, once you reach your full retirement age, that’s when it really kicks in because each year that you wait you get an 8% delayed retirement credit. So you wait till 70. Don’t go further than this, right, because you’re not gonna get any more increase in your overall benefit, but it’s a pretty big boost. $1,000, right? That’s your boost, $1,240, of if you take it early, it’s at $700.

Al: Yeah. So do you want a starter car in your retirement, or do you want a sportscar? That’s what happens by waiting. It’s a pretty big difference in the amount you’re gonna get for life.

Joe: Average benefit is $1,800. That’s what the average American gets. The maximum benefit–so if you’re fully funding Social Security–is around 3,600 bucks.

Al: Now this is full retirement age, right? If you wait till age 70, then it becomes higher still. That’s what we’re talking about. Now realize this. It’s not like each year–or you have to do it at 62 or full retirement or age 70. You can start your benefits at any time, any month. It’s just the longer you wait month by month, year by year, you’re gonna get a much higher benefit.

Joe: All right. Let’s switch gears. Let’s go to ask the experts.

Al: This is from Melinda. Oh, that’s a good question. So you’re employed, right? You got a 401(k), and maybe you’re maxing that out, but you would still like to get some more money into a retirement account. If you have a side business that’s profitable–ha–so it has to have profits, right, but assuming it has profits, you can’t double up and have another 401(k), but you could have something called a SEP IRA, simplified employee pension plan, and have a profit-sharing part. Like, in other words, if it was $10,000 of profit, you could probably put in about $2,500, so that does work.

Joe: Yeah. The side hustle, the side gig. It needs to make money, though, right?

Al: Yeah. Well, that’s–everyone wants the side hustle so they can lose money to save taxes.

Joe: So there’s all sorts of different things that you can do if you’re a small business owner. Let’s go to the next question.

Al: This is from Joan. Well, what do you think about, Joe?

Joe: You know what people think, Al, is that–there’s a spousal benefit, and you can claim a spousal benefit on an ex-spouse. First, let’s define spousal benefit. Spousal benefit is going to be half of your spouse’s benefit. So let’s say on my own record my benefit is $600 a month, but my spouse’s benefit is $3,000 a month, so my benefit is $600, but the spousal benefit would be half of hers, so $1,500 a month, so I would take the spousal, right? It actually combines the two benefits, but let’s not get technical. So my benefit would be $1,500. That’s the spousal benefit, right? So you can claim a spousal benefit on your ex-spouse, and sometimes people are like, “my ex-spouse is gonna claim their benefits on my record? Will that reduce my benefit? I don’t want my ex-spouse getting anything from me?” right? But if she takes hers at full retirement age, it doesn’t matter when he takes his as long as–it’s an ex-spouse, so he doesn’t even potentially have to be claiming.

Al: Yeah, exactly, and Social Security is quite complicated. I’m not sure why it’s so complicated, but when it’s a spousal benefit, that means your spouse our ex-spouse, in this case, is still living, right, where you can claim half of their benefit. All kinds of rules as Joe just went. Another one, though, is that if you’re married, to get the spousal benefit, your spouse has to be claiming their benefits, receiving benefit payments. If it’s an ex-spouse, they do not have to be receiving payments. They just have to be eligible age.

Joe: All right. Let’s put a bow on this, Big Al. Let’s turbocharge your wealth, right? Be a super saver, right? We talked about it. Start early. Save as much as you can. Take advantage of the match, right? Try to increase that percentage that you’re saving into your 401(k) or your company plan or your IRA or even just savings or brokerage accounts, you know, by one or two percentage each year or each month or each quarter, whatever’s comfortable because sometimes what we see is that maybe someone’s putting in, you know, $5,000 a year, and then they’re like, “whoa! This year! January, right? Rah, rah! I’m gonna max out my 401(k) plan,” and next thing you know, that $5,000 a year contribution goes to $20,000 a year, and they get that first paycheck, and what do they do? They’re like, “this stinks!” Right? “Where’s my cash?” you know, and then they stop saving Altogether, so I think let’s be smart about it but be a super saver, and then rally with the Roth. We’re big fans of Mr. Senator Roth, right? Tax-free is way better than tax-deferred in my opinion. Never pay taxes again. Figure out how to get that super saving into the Roth IRA, and making sure that you have enough risk but not enough risk depending on where you’re at in life. Are you that speed racecar, or are you the tractor? Well, it depends on what the money’s for and what you need to do. Are you in a race, or are you plowing your field? And then we just talked about Social Security. If you can delay that, put the brakes on a little bit, right, you can get a lot bigger nest egg. All right. You want to turbocharge your wealth? Go to our web site yourmoneyyourwealth, click on that special offer. It’s a guide to turbocharging your wealth. Yourmoneyyourwealth.com, click on that special offer. Download it right now. That’s it for us. Hopefully you enjoyed the show. We had a lot of fun with it. For Big Al, I’m Joe. We’ll see you next time.

IMPORTANT DISCLOSURES:

• Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, LLC. A Registered Investment Advisor.

• Pure Financial Advisors, LLC. does not offer tax or legal advice. Consult with a tax advisor or attorney regarding specific situations.

• Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

• Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

• All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

• Intended for educational purposes only and are not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors.

CFP® – The CERTIFIED FINANCIAL PLANNER™ certification is by the Certified Financial Planner Board of Standards, Inc. To attain the right to use the CFP® designation, an individual must satisfactorily fulfill education, experience, and ethics requirements as well as pass a comprehensive exam. Thirty hours of continuing education is required every two years to maintain the designation.

AIF® – Accredited Investment Fiduciary designation is administered by the Center for Fiduciary Studies fi360. To receive the AIF Designation, an individual must meet prerequisite criteria, complete a training program, and pass a comprehensive examination. Six hours of continuing education is required annually to maintain the designation.

CPA – Certified Public Accountant is a license set by the American Institute of Certified Public Accountants and administered by the National Association of State Boards of Accountancy. Eligibility to sit for the Uniform CPA Exam is determined by individual State Boards of Accountancy. Typically, the requirement is a U.S. bachelor’s degree which includes a minimum number of qualifying credit hours in accounting and business administration with an additional one-year study. All CPA candidates must pass the Uniform CPA Examination to qualify for a CPA certificate and license (i.e., permit to practice) to practice public accounting. CPAs are required to take continuing education courses to renew their license, and most states require CPAs to complete an ethics course during every renewal period.

-