More

He’s 56, she’s 32. How does this 24-year age difference impact retirement plans for “Bonnie and Clyde”, and what strategies should they implement now for the most tax-efficient retirement possible in the future? While Joe Anderson, CFP® and Big Al Clopine, CPA are on vacation, Your Money, Your Wealth® podcast producer Andi Last enlists the help of Pure Financial Advisors’ Managing Director Jake Greenberg, CFP®, ChFC® for a video case study (complete with visual aids!) on YMYW Extra number 6. Into which types of accounts should Bonnie and Clyde save for retirement? How much of their savings should they convert to Roth and when?

Inflation, required minimum distributions, asset allocation, stock market declines, Social Security and Medicare, long-term care and estate planning are important considerations when it comes to retirement planning, and it’s all too easy to make mistakes. After 40-plus years saving for retirement, the last thing that you want to do is sabotage all your hard work […]

Whether you’re a Millennial just getting started, a Gen-Xer juggling life’s competing demands, or a Baby Boomer eyeing the finish line, the stakes are high when creating financial security for your future. Joe Anderson, CFP® and Big Al Clopine, CPA guide you through the financial strategies and goals each generation should implement that can mean […]

We understand the concerns that come with retirement, particularly the fear of running out of money, can keep you up at night. Pure’s Financial Planner, Kyle Stacey, CFP®, AIF®, provides practical strategies to navigate inflation and the rising cost of living. His aim is to help you thrive, not just survive, in retirement. He discusses: […]

Are you equipped with the insights needed to meet your financial goals for the new year? Pure’s Financial Planner, Michael Chipperfield, CFP®, AIF®, reviews five helpful tips to pave the way to success in 2024. Build an Emergency Fund Plan to Pay Off High Interest Debt Track Your Expenses Increase Retirement Savings Revisit Investment Strategy […]

Are you feeling uncertain about meeting your 2024 retirement savings target? Pure’s Financial Planner, Amy Catellino, CFP®, AIF®, shares practical steps and provides an example to guide you through a retirement review process. Build a net worth statement Add up liabilities Add up your income Figure out spending FREE GUIDE | Financial New Year’s Resolutions […]

Will Ron and Candy in Connecticut ever be able to retire, and are Bruce and Selina in Philly saving enough to retire? Plus, are Pebbles and Bam Bam in Kentuckystone missing anything when it comes to using their brokerage account to pay Roth conversion taxes? And Susan in San Diego is 55, spends about $36K a year, and has almost a million saved – can she retire yet? And finally, our buddy Will knows he shouldn’t time the market, but….

Updated for 2023: If you had to retire right now, could you afford it? No matter where you are in life or where you are with your savings, growing your wealth starts with having a plan that works for various stages of your life. In this guide, you’ll get a retirement reality check that will help give you […]

How much will money will you need in retirement, adjusted for inflation? Joe and Big Al spitball on your future dollars, how to calculate the tax on Roth conversions, and the benefits of converting to Roth when financial markets are down. Plus, should retirement savings contributions be half pre-tax and half post-tax? And finally, saving to a 529 plan for your kids, or sending them to Hollywood stunt training camp – which would you do!?

Should retirement living expenses be drawn from your stable value fund, your CD or money market, brokerage account, or FDIC insured bank accounts? Can you even trust the banks after the recent bank failures? What about sequence of returns risk? Which investments are best for long-term retirement savings when you’re early in your career? Joe and Big Al explain why your strategy for retirement savings and withdrawals should be your first step – before you consider investments, asset classes, or sectors.

Taxes are often overlooked in a financial plan, delivering a sucker punch that could cost you tens of thousands of dollars. Are you wrestling with your taxes and getting body slammed – do you even know if you are? Ignore tax strategies and you are losing money that could compound over a number of years […]

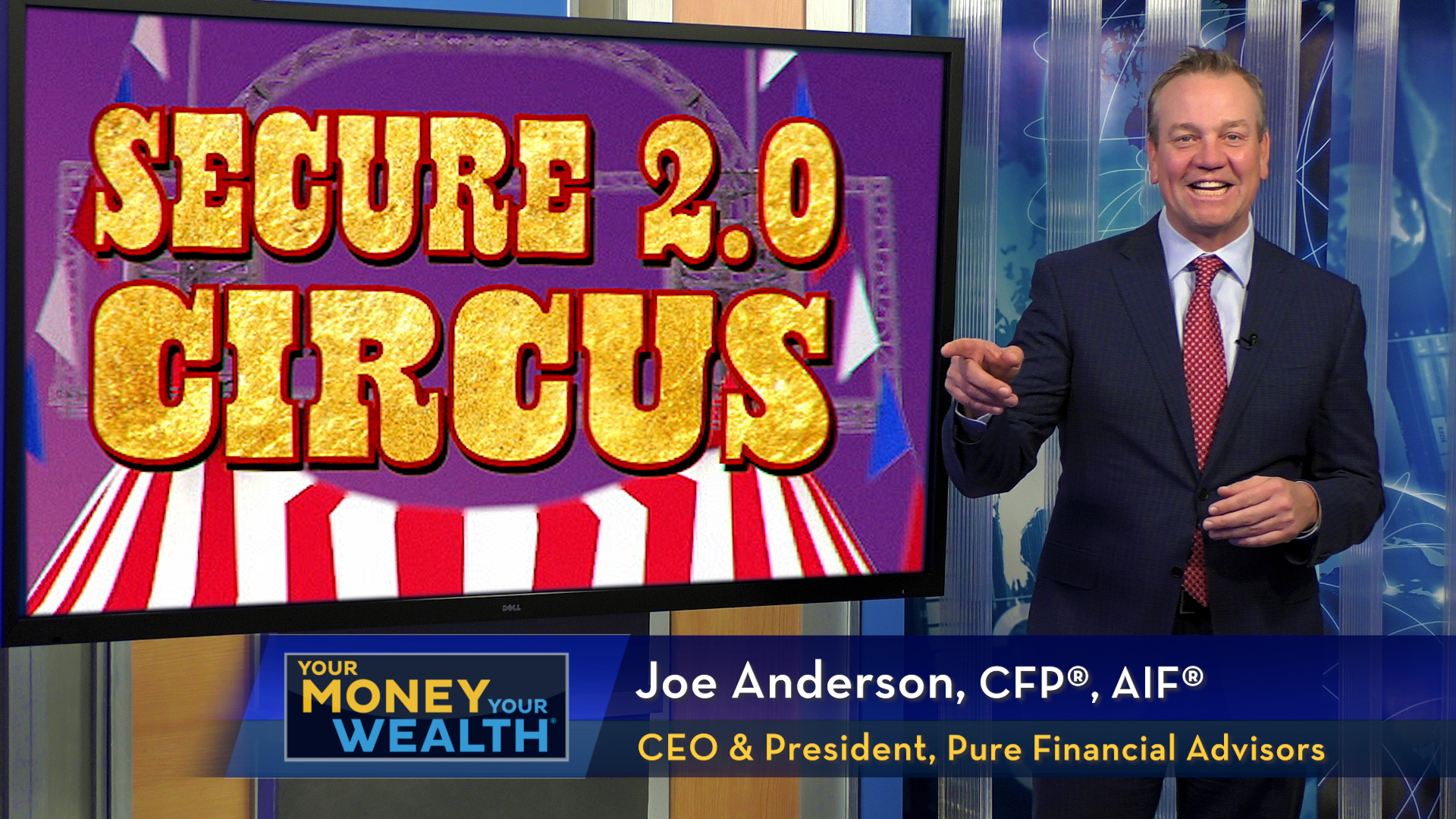

Saving for retirement can be a bit of a three-ringed circus but Joe Anderson, CFP®, and Big Al Clopine, CPA have your ticket to the show! Whether you’re retired, saving for retirement, in the military, or paying off student loans, SECURE 2.0 is a massive shift in investment policy, designed to motivate and enable people […]

In order to retire comfortably at age 60, what should you be doing with your finances when you’re in your 20s? Joe and Big Al discuss a framework for getting started planning for retirement. Plus, if you’re a small business with a SIMPLE IRA plan, is it stupid to save for retirement in a brokerage account rather than a traditional IRA? If you inherited money and promised to donate to charity, should you do Roth conversions? What’s the most efficient way to pay financial advisor fees, and what’s a good strategy for making pre-tax and post-tax retirement contributions?