Retirement can be an exciting, yet daunting adventure. You have received an income for most of your life and now you will have to live the next 20-30 years without a direct income from employment. And how does Social Security play into the equation? Is Social Security considered income? How is it taxed? Even though the rules may seem confusing, we will lay out the answers to all of your questions regarding Social Security income.

Social Security and Income

What is Social Security? The Social Security Administration (SSA) oversees a number of benefit programs; however, we’re only going to discuss retirement benefits. In the simplest terms, Social Security is a government-sponsored retirement benefit designed to replace some of your income while you are retired.

If you’ve worked and paid taxes on your income, you’ve been paying into Social Security for most or all of your career. As a retiree, you can look forward to reaping those benefits for the rest of your life.

When the government came up with Social Security back in 1937 they never intended it to make up 100% of someone’s income when they retire. To learn more about how Social Security started and who is eligible, check out our blog on “How Social Security Works”.

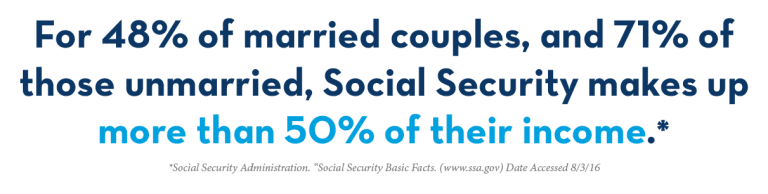

But don’t be fooled by that statistic. If you take a look at the average person in retirement, 48% of married couples and 71% of those unmarried, have more than 50% of their income coming from Social Security.1

It is an extremely important decision and there are many rules, so you want to get it right.

Can I Work and Receive Social Security Benefits?

One of the most common questions about Social Security is whether or not you can work while collecting benefits. The answer is yes.

You can work and collect Social Security at the same time. One of the benefits of continuing to work is that you will be able to increase the benefit you earn later in life.

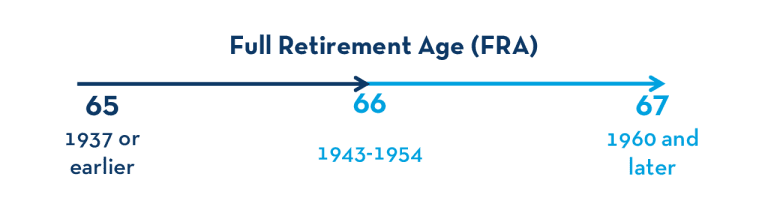

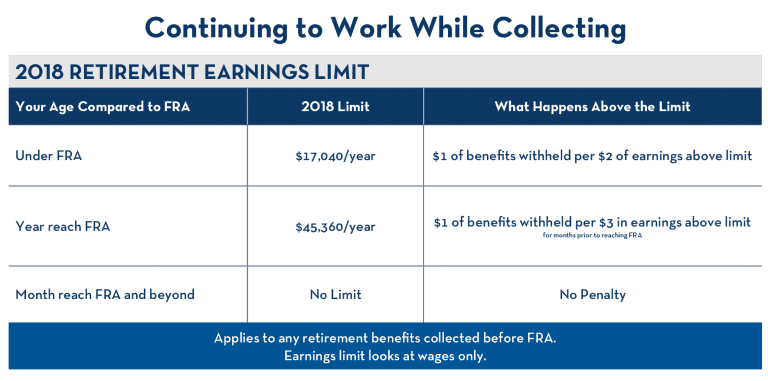

Here’s the kicker, though. While you are working, the Social Security Administration (SSA) will reduce your benefit by the amounts shown in this chart until you reach your full retirement age (FRA).

Source: Social Security Administration “Cost-of-Living Facts”. (www.ssa.gov)

https://www.ssa.gov/news/press/factsheets/colafacts2018.pdf

Once you reach your full retirement age, the SSA will recalculate your benefit and give you credit for any benefits that were withheld. Usually, this results in a higher monthly payment.

Depending on how much you are earning while you work, you may also be able to replace one of your lower-earning years with a higher amount, thus boosting your benefit check even more.

Starting with the month you reach full retirement age, you will start receiving benefits with no reduction, even if you keep working.

Keep in mind that you must pay Social Security and Medicare taxes as long as you are earning income.

Can I Collect Benefits Early?

Social Security benefits are intended to be supplemental retirement income. The SSA really wants you to be retired when you collect them. Therefore, they will penalize you for collecting early if you are not actually retired.

Remember figure 1 above? If you collect benefits early, you will be subject to an annual earnings test which looks exclusively at salary. Prior to full retirement age, if you earn more than the threshold amount ($17,040 in 2018), you lose $1 of benefits for every $2 earned over the threshold. Now keep in mind, this is on top of already reduced benefits.

For the year in which you reach full retirement age, a different rule applies. The threshold is $45,360 in 2018. And the rule is that you lose $1 in benefits for every $3 in earnings over the threshold. Once full retirement age is reached, there is no threshold, so you can earn any amount after that with no reduction in benefits.2 This applies to all retirement benefits – individual, spousal, child and survivor – collected before full retirement age.

Are My Social Security Benefits Taxed?

While we all wish that retirement meant retiring your worries about taxes, unfortunately, that is not the case. Some people have to pay federal taxes on their Social Security benefits if they have substantial income from other sources, like wages, investment income, rental income, or any other income that is reported on their tax return. Social Security didn’t use to be taxable, but now it is in some cases.

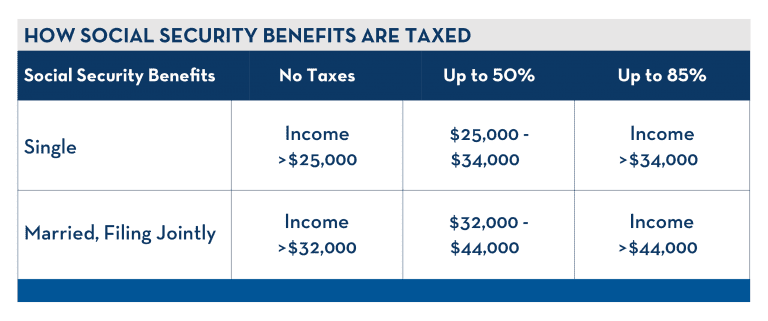

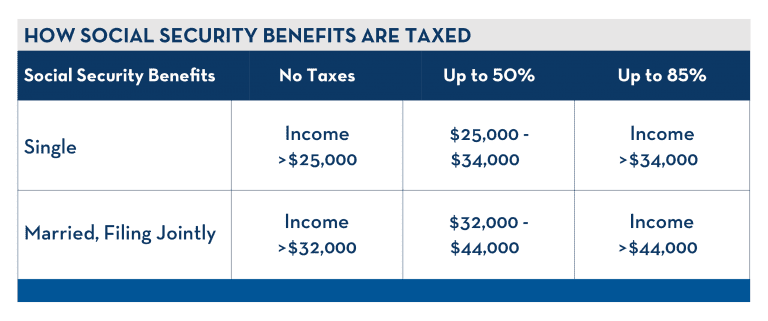

This chart shows the income limits above which you’ll have to pay taxes on your benefit. If you are married and filing separate returns, you’ll almost certainly have to pay taxes on your benefit.

The tax rate you’ll pay depends entirely on your overall income bracket since Social Security is treated like ordinary income.

However, according to IRS rules, you won’t ever have to pay taxes on more than 85% of your Social Security benefits.

How Am I Getting Taxed?

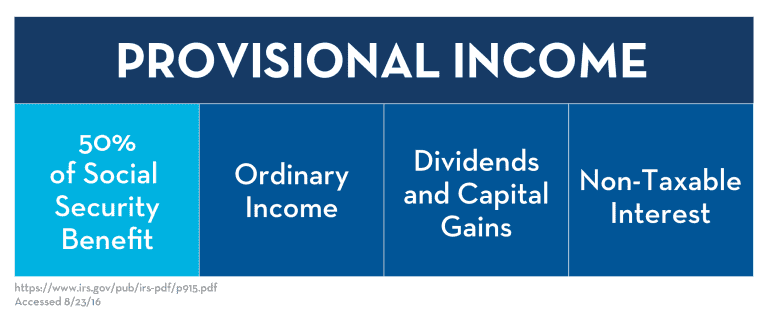

Taxation on your benefits is key when you’re looking at your retirement income strategy. This is not adjusted gross income, this is based on provisional income.

Provisional income is your adjusted gross income with some add backs and they add back half of your Social Security benefit. It’s the income that the SSA uses to calculate the taxation of your Social Security.

If you’re making less than $25,000 for singles or $32,000 for couples, or if you’re filing a joint return, they’re not going to take anything back from you in taxes (see Figure 2).

This taxation rule came to be under the Reagan administration, signed in 1983. At the time it was estimated to affect 1% of the population. Of course, it still upset many people, but the income limits were indeed high enough to only affect the 1%.

However, the problem is that they never accounted for inflation. Now, just about everyone that has a little bit of assets are paying taxes on their Social Security. They are doing the same thing on the Medicare side. Meaning, you have to look at how all of this is going to be taxed and if there are ways to avoid it.

Get the Most out of Your Benefits and Reduce Your Taxes

One strategy that can help you maximize your income while reducing taxes is to take as much income as possible from sources that are excluded from your provisional income.

Keep in mind that taxes are just one piece of your overall financial picture and it’s important not to let your concerns about taxes overshadow other important issues. If you’re worried about the effects of taxes on your retirement income, it’s worth contacting your financial advisor who can review your circumstances and provide some specific suggestions.

The Breakdown

If your provisional income is between $25,000 and $34,000, for single, or $32,000 and $44,000, for married couples, 50% of your Social Security benefits are going to be subject to tax. Then 85% of your benefits are subject to tax if your income is over $34,000 or $44,000.

The good news is that 15% of your benefit is tax-free. For those of you that are living in California, where we are located, you will not be taxed from the state because California does not recognize Social Security income as taxable income. That means it would be tax-free on your state return. Each state is different so make sure to check the rules for the state you reside in.

7 Changes to Social Security that You Need to Know

How Can You Maximize Benefits?

Even under the current rules, couples should coordinate their claiming strategies to maximize their benefits!

In fact, making the most of your benefits is more important than ever, and couples will still be able to benefit from a range of claiming strategies.

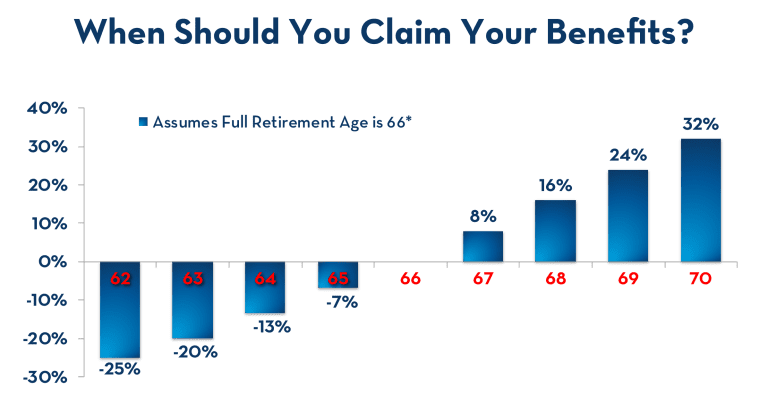

It may make financial sense for at least one member of a couple to delay claiming benefits until age 70 if at least one member can expect to live to age 80.

When you consider all of the options—one spouse claims early, one delays, they both claim on time, etc.—you’ll see that there are hundreds of possible combinations to consider.

If both spouses are in good health and at least one can expect to live until age 80, they are likely better off letting the higher-earning spouse delay filing to collect delayed credits.

No strategy can be right for everyone. As with most things in life, details matter. Factors like age differences between you and your spouse, taxes, and life expectancy can all affect your overall outcome. Understand that the key to choosing the right Social Security strategy is to plan carefully and look holistically at your entire financial picture.

How Social Security Works >>

Sources & Disclosures

1 – Social Security Administration. “Social Security Basic Facts”. (www.ssa.gov)

2 – Social Security Administration. 2018 Fact Sheet. https://www.ssa.gov/news/press/factsheets/colafacts2018.pdf