Market downturns and corrections are completely normal. But when the stock market gets volatile, investors tend to make the wrong moves. Joe Anderson, CFP® and Big Al Clopine, CPA show you the balancing act that can improve your long-term financial outlook even in the face of stock market volatility.

Calculate your FREE Financial Blueprint

Important Points:

- 00:00 – Intro

- 00:38 – Downturns Are Normal: The Stats

- 01:34 – S&P 500 Index Performance Since 1995

- 02:30 – Market Volatility, Balancing Act, Long-Term Outlook

- 02:52 – Four Factors That Impact the Markets

- 03:36 – Benefits of a Down Market

- 04:10 – Time in the Market is Better than Timing the Market

- 07:03 – Calculate Your Free Financial Blueprint

- 08:19 – True/False: VIX is known among investors as the fear index and captures anticipated swings in the market

- 08:51 – Balancing Act: How to Assess Your Portfolio

- 10:50 – Risk vs. Reward: Determine Your Best Asset Allocation

- 12:10 – Portfolio Diversification

- 12:45 – Dollar Cost Averaging

- 13:59 – Asset Location to Pay Less Tax

- 15:22 – Calculate Your Free Financial Blueprint

- 16:18 – True/False: Capital gains offset capital losses dollar for dollar

- 16:47 – Tax Loss Harvesting

- 18:04 – Roth Conversions

- 18:28 – Focus on Your Long-Term Goals

- 19:05 – Capitalize on Compounding

- 19:24 – Transaction Fees & Costs

- 19:43 – Emotional Biases Can Influence Investing Decisions

- 20:48 – Viewer question: What kind of stocks can survive in a tariff-heavy environment?

- 22:52 – Calculate Your Free Financial Blueprint

Subscribe to Your Money, Your Wealth® on YouTube!

Transcript:

(NOTE: Transcriptions are an approximation and may not be entirely correct)

Joe: When the stock market gets volatile, people tend to do a couple of different things. Some good, some bad. Which ones are you doing?

Welcome to the show, everyone. Show’s called Your Money, Your Wealth®. Joe Anderson here. I’m a CERTIFIED FINANCIAL PLANNER®, president of Pure Financial Advisors, and of course I’m with the Big Man. Big Al Clopine, he’s sitting right over there.

Al: Volatile markets. We gotta dive into it today.

Joe: Yeah. When volatile markets happen, there’s a lot of uncertainty in the overall markets and then that gets uncertainty to us and sometimes we do the wrong thing.

Al: Sure Do.

Joe: Look at this market volatility, absolutely normal. So you hear these buzzwords, oh, it’s really scary out there. Oh my gosh, it’s never been like this before. And so our emotions react. But guess what? Market volatility is absolutely normal. We have three downturns of 5% per year on average, looking at one correction of 10% per year. And then we have one correction of above 15% every three years. So what we’re experiencing in a volatile market is just a normal course of action.

Al: Yeah. And you, every time it seems like it’s something different, but it’s kind of more of the same,

Joe: right? I mean, I think that’s it. It’s like this time it’s different. This time it’s different. This time it’s different. Guess what, folks? This time it is not different. And that’s today’s financial focus.

Joe: All right. Let’s go down History lane here. Remember the.com bus we had from what, 2000 through 2002? The Nasdaq, I think dropped about 80% of course. Then we had nine 11. Then war, and then of course GFC, the global financial crisis when our overall financial system almost collapsed. And then you have the housing crisis that lasted. But look, if people went into cash here, they missed this huge run, but then the pandemic hit man, right? Oh, we’re down another 20, 30, 40%. Then you have the 2022 bear market where both stocks. And bonds were down. So you look at volatility throughout history, it’s just a common theme, but the market always tends to go up.

Al: Alright, today we’re talking volatile markets, and as we just heard, it’s normal. It happens all the time. Markets go down, markets go up. We’ll break that down a little bit more, but then what do you do? How do you take advantage of it? Or how do you not get hurt too badly from it? It’s a bit of a balancing act.

And then finally, we’ll kinda look at the long-term outlook. Things that you can do to make sure you successfully get through retirement and don’t run outta money.

Joe: Yeah, I think this is, the theme of you gotta control what you can’t control, right? You have to control, number one, the discipline of the investment strategy that you have, because a lot of this stuff is absolutely out of our control.

Government regulations, for instance, how much control do we have over here? Well, we can vote but we’re not writing things into law. You know, interest rates is just a function of our economy, natural disasters, and then consumer confidence. So some, most of the things that create a lot of volatility, Al, I mean, it’s totally out of our control, but what we can control is our emotions in the strategies that we implement when things go a little bit sideways.

Al: Yeah, and I think that’s this. Is kind of a good reminder of why there is market volatility. There’s all these things that happen outside of our control and what can we do with it?

Benefits of a Down Market

So first of all, there are things that you can, improve your situation by just paying attention. When the market goes down and you are putting money into your 401k or investing, guess what?

You are buying stock and shares at lower prices, buying low. That’s what you wanna do, right? Second thing forces businesses to become a little bit more nimble, to try to figure out how to become more profitable, maybe be more innovative, and then finally investors pay more attention. Actually, several good things come out of volatility, Joe.

Joe: Yeah, absolutely. And staying disciplined within your overall strategy is so key because here is an interesting stat is that this is $10,000 invested. Um, I believe out from 1980. We’re taking a look at, hey, if I had 10,000 invested and I invested every single day in the overall market, I went to bed, I went to sleep rumple still skin woke up, I have $418,000.

That $10,000 grew to $418,000. If I was invested in all the, all days in the market was open. Let’s see if I just missed the five best days. Usually the best days in the overall market happen right after the worst days, so if I just missed the five best days. My four 18 goes to $264,000. If I miss 10 days, 190, 1000, 30 days.

Think about this health. This is 1980.

Al: Right. We’re in 2025.

Joe: Right? That’s many days in the overall markets, and if you just miss the best 10 or five days, you almost cut your profits in half.

Al: And I think, Joe, it’s such an interesting slide to look at because you might might think, I’m not gonna miss the best days.

That would be silly. Well, the best days happen usually right after a crash, which is when everyone wants to sell because they’re fearful. So it’s actually easier to miss the best days than you. Think so the point here is to stay invested.

Joe: It’s almost impossible to time the market. And I wish we had a slide that said, well, how about if I just missed the worst days?

So I knew when those bad days were going to come, and I flew to safety as soon as that market hit and then I got back in. Well, timing the market is easy, not easy to do, but it has been done one side of the coin. So maybe you get out before you think you see the storm, but when do you get back in? Right.

You have to get back in to get these days sometimes when the storm is still around us and that is so hard to do and that creates the discipline that people need to make versus investing on emotion.

Al: Yeah, well said. And I think, as I said, it illustrates the fact that you’re better off in markets like this staying in the market.

And a lot of people also they, they stop their 401k ’cause they think the market’s too risky. This is the best time to invest when stock prices and share prices are lower.

Joe: Yeah. I mean, you hear this, it’s like I, I don’t wanna put good money after bad. Well, no, you’re buying the same really good companies now at a discount.

You loved them at X amount of price. Now they’re 10, 20% cheaper. Why don’t you like those same prices anymore? So just think logically. It’s like, yeah, maybe I wanna put a little bit more money into the overall markets. Don’t worry about the day-to-day fluctuations. Think about the long term and what your time horizon is.

So if you need a blueprint or, or like a, a, a checkup if you will, given where the markets are at, I encourage you to kind of take a look at your situation. Go to your money wealth.com. We have our Financial Blueprint. Take a checkup. Give yourself an idea. Are you still on track? What are the things that you need to do?

Did you go to cash? What rate of return do you need to generate to accomplish your goals? Is it 5% or is it 7%? That will help you determine what strategy that you need to implement. Go to your money wallet.com. Click on that special offer. It’s our Financial Blueprint. Hey, we gotta take a quick break, but when we get back, we’re gonna talk about the balancing act, right?

It gets a little bit scary and nervous out here, but what strategies can we do over here to implement and benefit from this volatile market? We’ve gonna bit.

The VIX

Hey, welcome back to the show, the show is called Your Money, Your Wealth, Joe Anderson and Big Al breaking things down. The markets get a little bit volatile from time to time. What are the ideas and strategies that we have to help you get better results in down markets? Go to your money wealth.com. Click on that special offer this week. It’s our Financial Blueprint. It can help you determine if you’re on track, not on track. What are the strategies that you need to do to help you get that path to financial freedom? yourmoneyyourwealth.com. Click on that Financial Blueprint. Alright, let’s see how you did on that true false question.

Al: VIX is known among investors as the Fear Index and captures anticipated swings in the market. Well, that’s a true statement. So VIX is the volatility index. Right. And it’s kind of a measurement of our fear of what’s gonna happen in the next 30 days when that goes up. We’re more fearful when it’s down. We’re less fearful.

Joe: Yeah. I think a lot of traders use the VIX. They can kind of see cons, what the sentiment is. Yeah. Consumer sentiment. Wow. Look at the VIX. It’s super high. And then. You know, some of this noise though, gets people’s emotions probably on the wrong side of the spectrum if we’re thinking about balancing everything out.

Right. The more media they love to talk about the VIX,

Al: they do.

Joe: You hear it a lot ’cause yeah. Oh, everyone else is freaking out so I should be freaking out. Or you right. They don’t even know what’s really going on to the overall markets and then they hear something, it’s like, oh, maybe I should be more concerned about the markets.

I think the less you handle your money, the more money that you will probably have. Couple things that you need to do to do this. Assess your goals. What’s the money for? Right? If you need to purchase something in the next 30, 60, 90 days. Or maybe even the next two years, three years, probably keep the money sitting safely in cash and CDs if it’s for retirement, 5, 10, 15, 20, 30 years.

Right? Of course, you probably wanna take advantage of volatile markets because the more volatile the market as you’re adding dollars in, the more money potentially you’ll receive. Right? The time horizon. Risk tolerance. Maybe you have a 30 year timeframe in your overall retirement, but you hate the volatility, right?

You just can’t stand seeing your account balance go down. Right. Well, that’s your risk tolerance. Yeah, the sleep factor, we want you to sleep well at night. So if you can’t stand that volatility, maybe it makes sense to go in a lot more conservative portfolio, but just understand the expectations of what that portfolio will produce in a form of a rate of return, and looking at your financial situation.

So there’s risk tolerance, Al, this is how we feel, but then there’s expected rate of return that people actually have to generate. And sometimes these conflict, and sometimes Joe, I mean

Al: we, we have goals. We wanna have the retirement. We wanna go on all these lavish trips and have a boat and a vacation home.

And that’s realistic for some, not so realistic for others. So you gotta look at your situation to figure out what’s gonna work. And of course, you’ve heard about. Once you know what your goals are, what your time horizon is, and risk tolerance, then you can figure out what kind of portfolio is gonna make sense for you from conservative all the way to aggressive growth.

And it’s really no more complicated than aggressive. Growth is more stocks, right? Conservative is more bonds, more CDs, things of that nature. So

Joe: if I’d like that conservative, I, my, my portfolio’s not gonna move very much. So the historic volatility is. Like four and a half percent. So you’re not gonna see a lot of variance there, but your return over time is 6% versus an aggressive portfolio, which is almost 10%.

So it’s very difficult to get a almost 10% rate of return with this type of volatility. it would be great if we could do that, but risk and return are related. If I didn’t, there is no free lunch. So you have to take on a little bit of risk to get the expected return. So I know some people like to sell.

Hey, we can have very low volatility, very little risk with very high returns. There, there is no free lunch that that product or that investment just doesn’t exist.

Al: Yeah, and we talk about risk and return, and they are related, right? The higher the risk, the higher the return. That’s the, that’s the idea.

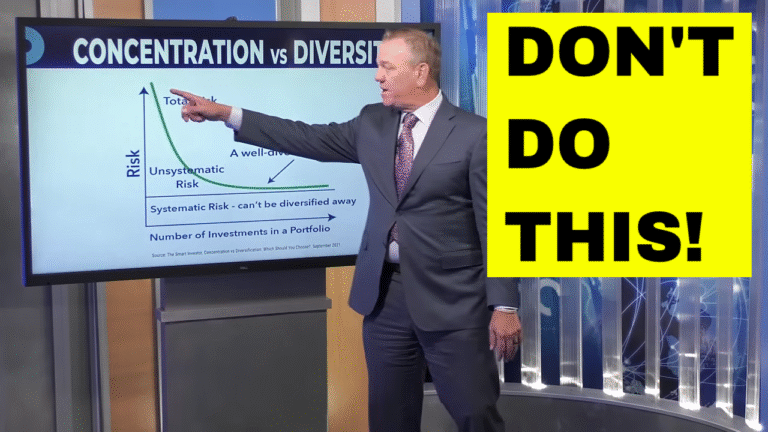

Lower risk, lower return. But think about this. Another way to protect yourself is diversification. You probably heard this a million times and we’re gonna say it yet again. Diversification. Don’t just pick two or three stocks and assume you’re good. It’s a little bit better to invest in ETFs or low cost index funds that have a portfolio of several stocks for each asset class that you want.

Joe: So here’s another strategy that some of you might wanna take advantage of. It’s called dollar cost averaging. So you can do, and, and a lot of us do this right now with our 401k savings. You look at this, you got Rob and Jen. So Rob, he’s gonna invest his $2,000 right away. But then Jen, she’s gonna say, well, no, I wanna do $500.

A month over the next several months to get to that same 2000. Well, if I look at the share price, when Rob invested, it was $40 a share. Okay? So Jen got $40 a share, but she only put $500 in. Now that market is volatile over those months. So the next month, the stock price went to 42, then it dropped to 38, then it dropped to 35.

Well, Rob got invested, right? He’s gonna ride this return up or down. Well, she’s gonna average into those share prices. He’s at 50 shares. At the 2000. She bought 12 and a half shares. The next 500 bought 11.9 shares. The next 500 bought 13 shares, and so on. So averaged in, he has his 50 shares, but Jen actually almost got 52 shares of the same stock because she averaged in.

The reason why she had more shares, of course, is because the market went down at that point. If the market went up, if this was reversed. She would have less shares.

Al: This is such a good illustration. You do not stop your 401k contributions in a down market. It’s actually to your advantage because you’re getting more shares and you have more upside in the future.

Joe: Couple quick things from a tax perspective. In lower markets, you have tax deferred accounts. Your IRA’s 401(k)s, 403(b)sm TSP, whatever that you have, it’s pre-tax. Every dollar that comes outta here, you know you have to pay tax on those dollars at ordinary income rates. You have tax free monies, which is the Roth, you’ll never pay tax on those dollars again, once it gets into the Roth, IRA, so forever tax free.

So this is forever taxable. This is forever tax free. I would much rather have more money here, but I wanna do it strategically because I have to pay taxes first to get it in this little pool of money. So when markets go down, it might make sense to take dollars from here and move it to the tax free account.

For instance, you have a thousand dollars, it drops to $800, 20% drop. You still have the same amount of shares. But those share price dropped 20%. Now I moved those dollars up here. I only pay tax on $800 versus a thousand, but I still have the same amount of shares up here. When those shares recover, guess what?

It recovers in the tax free account, all of that recovery and more. It’s gonna be tax free. So tax strategies in regards to B to markets is a huge, huge opportunity for you really to win this game, go to yourmoneyyourwealth.com. Click on that special offer this week. It’s our Financial Blueprint. It can help you to determine if you’re on track, not on track, or to the strategies that you need to do to help you get that path to Financial Freedom your money wealth.com.

Click on that Financial Blueprint. Alright, we gotta take a quick break, but when we get back, we’re gonna give you some words of wisdom on hot to stick through this volatile markets. It’s a lot easier said than done. Believe me. Anyone that is any dollars invested heats to see those dollars go down. We’re twice as fearful.

To lose a dollar than the joy is to make a dollar. But you have to stay disciplined. We’ve got some ideas for you, so don’t go in.

Capital Gains and Capital Losses

Okay. Hey, welcome back. We’re talking about volatile markets and some tips and tricks that you could potentially do to benefit, from a crazy volatile market. But first, let’s see how you did on that true false question.

Al: Capital gains offset capital losses, dollar for dollar. True or false? Well, that is a true statement. A lot of confusion on this. A lot of people think you only get to deduct $3,000 of capital losses per year. Well, the real way it works is dollar for dollar. You get to take your losses against your gains, and then if you still have extra losses, you get to take $3,000 more against ordinary income.

Joe: Yeah, this is really challenging for a lot of people to do as well in regards to strategy because now when you have a stock that is down, let’s say $20,000, you have a hundred thousand dollars in a mutual fund, it drops to 20,000. In losses, right? You have to sell it. You’re like, well, what are you talking about?

You told me not I should be buying more. Yes, you need to sell that stock and buy something similar. We want you to stay in the overall stock market. So if I have something that’s in the s and p 500, maybe I buy a total US stock market index fund or ETF. So I stay in the market. I take advantage of that loss and now the market recovers, or I have other investments that I wanna sell that are at a gain.

I have this gain of 20,000, well, I have this gain of 20,000, but I had a loss of 20,000. Those will offset dollar for dollar. Zero taxes paid.

Al: Yeah, and it’s really important Joe to think about you actually want to sell your losses at this time for tax. Last harvesting, buy something similar so you’re still in the market.

You can use those losses this year against any other gains. They also carry over. You can use ’em next year for gains and they carry over for your entire life, so there’s no risk of losing ’em.

Joe: Alright, Roth conversions. We already chatted about this. More money in a tax free environment is good for all.

Right, because it’s gonna grow tax free for your life. It’s gonna grow tax free for your spouse’s life. It’s gonna grow tax free for the kids or the beneficiaries. So more dollars that you can get in Roth the better. But in a volatile market, when those stocks are lower, you pay less tax because those share prices are lower.

Bring your investments out over the last 12 months. Right? You’ll probably feel a little bit better than what happens in the market. So long term, Al is I think so key. It is, and I think we forget that. In fact,

Al: I’ve had some friends recently that told me, you know what, my portfolio went down X number of dollars yesterday and the day before, and it’s like.

This, this actually is not really good behavior because you’ll make poor decisions. Long-term focus. We already talked about staying in the market. Things recover. They recover sharply after collapses or or reductions. So you wanna stay in the market.

Joe: Put the phone away when it comes to what the markets did, or especially your portfolio.

Capitalize on Compounding

Alright, because you think about the compounding effect, right? Let’s see if you have interest in dividends. Now those stocks are down and that interest in dividend payment are buying more shares of the same good stocks that you have. So the compounding effect is even greater in volatile market,

Al: and there’s something else to consider is when you’re buying and selling stocks too often there’s a lot of transaction costs.

Now, I know there’s discount brokerages. There’s not, they’re not as expensive as they used to be, but every time you’re buying and selling, there are fees. And furthermore, you’re paying taxes on gains if it’s not in a retirement account.

Joe: Emotional biases. Look at the emotions. This is the emotions that a lot of us have, right?

When, especially when we’re dealing with our money, emotions is the worst enemy of our portfolios. Because the more we worry, the more things that we need to react on, right? If a train is coming down the tracks and we’re on the tracks, we wanna move outta the way, we wanna get the heck outta the way to save ourselves.

That’s the same thing. We think about our money. We have to do something, we have to move. We have to. Buy this or sell this, or we have to get outta the way of this big storm. You almost have to do the opposite, but the emotional biases that we have makes it so challenging to do.

Al: Joe, this might be the single most important thing we’ve talked about today, which is this.

Your brain tells you when a market corrects, it’s time to sell because the market’s not working. I can’t afford to lose any more money. Which is exactly the opposite of what you should be doing. You wanna buy stocks when they’re cheaper. And then of course when the market recovers and it’s going gangbusters, that’s when you wanna buy because the market’s working.

So what have you done? You’ve sold low and you bought high, which is a recipe for disaster.

Joe: Alright, let’s switch gears real quick. Let’s, go to our, bureau questions.

Al: This is from Greg in San Diego. What kind of stocks can survive in a tariff heavy environment? Wow, Greg, that’s like the million dollar question. And Joe, I’m gonna ask you for your thoughts.

Joe: Well, I think this is the, the holy grail, right, is like, all right, well, what stocks should I be buying? And you’ll hear pundits say, well, these sectors or these areas of the overall markets are going to do quite well.

These are going to do quite poorly. You know, but it’s already priced in the overall market. The information is already available. So those companies and those sectors and those stocks are already priced in. So for me to take advantage of the information of the collection of the whole market is very difficult to do.

You could get lucky if you got in there prior to any word of up that came out of any wires. Right. The proper strategy, in my opinion, is to be globally diversified. Have stocks in every single sector, right? Depending on what target rate of return that you’re looking to accomplish. Do you want higher returns, which is no, you need more risk.

So that means more stocks. And guess what that means More companies that are gonna be affected by tariffs. So you have to understand what you’re owning and understand the risk and return relationship. But trying to pick certain stocks or sectors in certain economic environments is very challenging to do ahead of it.

And then it’s very challenging to do, to get out of it or in, you know, depending on where that market flows.

Al: I couldn’t have said it better myself. I think you need to stay invested all the time, globally diversified, and that is the way to go.

Joe: You know, if I’m making a road trip from California to my home city of Minneapolis, Minnesota, I’m going to run into detours, right?

There’s gonna be storms along the way. If I’m driving, I’m not gonna turn around and come back to California. Well, maybe I will, but let’s just assume I really wanna see my family, right? I’m going to find another route. I’m going to stay the course. So just stay the course folks, if you need a little bit more help, go to yourmoneyyourwealth.com. Click on that Financial Blueprint. See where you’re at. See where your deficiencies lie. See where you’re really good. Hopefully that gains a little bit more confidence so when markets get volatile, you have the confidence to stay disciplined with your overall strategy and get to your goals that much more effectively. Hopefully, you enjoyed this show. We really enjoyed doing it. For Big Al Clopine, I’m Joe Anderson. We will see you next time.

IMPORTANT DISCLOSURES:

• Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, LLC. A Registered Investment Advisor.

• Pure Financial Advisors, LLC. does not offer tax or legal advice. Consult with a tax advisor or attorney regarding specific situations.

• Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

• Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

• All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

• Intended for educational purposes only and are not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors.

CFP® – The CERTIFIED FINANCIAL PLANNER® certification is by the CFP Board of Standards, Inc. To attain the right to use the CFP® mark, an individual must satisfactorily fulfill education, experience and ethics requirements as well as pass a comprehensive exam. 30 hours of continuing education is required every 2 years to maintain the certification.

AIF® – Accredited Investment Fiduciary designation is administered by the Center for Fiduciary Studies fi360. To receive the AIF Designation, an individual must meet prerequisite criteria, complete a training program, and pass a comprehensive examination. Six hours of continuing education is required annually to maintain the designation.

CPA – Certified Public Accountant is a license set by the American Institute of Certified Public Accountants and administered by the National Association of State Boards of Accountancy. Eligibility to sit for the Uniform CPA Exam is determined by individual State Boards of Accountancy. Typically, the requirement is a U.S. bachelor’s degree which includes a minimum number of qualifying credit hours in accounting and business administration with an additional one-year study. All CPA candidates must pass the Uniform CPA Examination to qualify for a CPA certificate and license (i.e., permit to practice) to practice public accounting. CPAs are required to take continuing education courses to renew their license, and most states require CPAs to complete an ethics course during every renewal period.