Many established investors are familiar with the advantages of portfolio diversification, although those relatively new to investing may ask themselves, “What is portfolio diversification?”

Like many things in life or in finance, portfolio diversification is easier to understand than to implement effectively. Investors often make mistakes that can prove costly and impede their long-term financial goals.

You’ll learn from this post several important aspects of portfolio diversification including why you should practice this strategy and how to strategically diversify your investments.

What is Portfolio Diversification?

Diversification can be defined as “the act of, or the result of, achieving variety.” We strive for variety in many areas of our lives including our meals, vacation locations, and film selections. In these cases, we do so for enjoyment or intellectual curiosity, but we can also pursue variety through diversification in our investments for reducing risk. When an investor holds a variety of assets rather than a single asset or several similar assets, they are reducing their risk through diversification.

When effectively implemented, a diverse portfolio will help reduce volatility over time. This has the advantage of smoothing your ride along the way since the various assets you hold will not necessarily fluctuate with one another or react identically to events in the economy.

It’s important to understand that diversification does not necessarily produce a higher return but will often provide the greatest likelihood of producing the highest return for a specific amount of risk taken. Think of diversification as lowering your ceiling while simultaneously raising your floor. In exchange for the loss of maximum upside, you gain a smoother experience and a greater expected return for risk you have accepted.

How Does Portfolio Diversification Work?

All investments involve some type of risk. While returns are not predictable, we know that two different investments will have different performance, even under the same market conditions.

Some investors try to concentrate on specific assets or asset classes, however, by doing so, they may be exposing themselves to more risk than necessary. They’ve put all their eggs in one proverbial basket.

If you’ve made the decision to invest in the market in general, you’ve accepted systematic risk. This is the risk that the market overall may fluctuate. You can, however, use diversification to reduce your unsystematic risk. This is the risk associated with specific investments rather than the market in general.

How to Diversify a Portfolio

To achieve meaningful diversification, you will want to have investments that reduce overall portfolio risk. Simply choosing different investments until an arbitrary number is met will achieve diversification, but not necessarily of the important kind that will reduce your portfolio risk. To achieve this objective, we will want to have non-correlated assets. Put simply, this means that they do not react identically to the same events.

A change in interest rates may affect bond and stock prices differently. Political instability may be bad for stocks but good for certain hard assets or commodities. When the investments you own do not react or move similar to one another (they are not heavily correlated) you will ultimately reduce risk in your portfolio.

Primary Components of a Diversified Portfolio

Let’s look at a few common asset classes that are the building blocks for your portfolio and how each of them might fit together to achieve diversity and reduce risk.

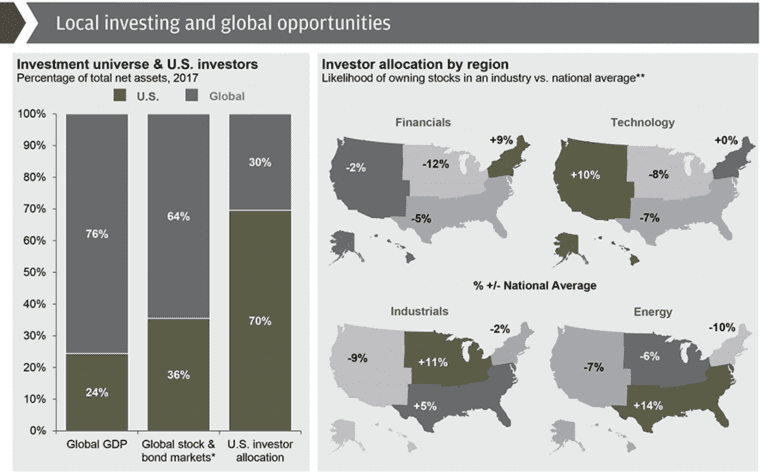

Stocks provide several benefits to investment portfolios by taking an equity ownership position in the companies you choose to buy stock in. Stocks allow the possibility of substantial growth over time as well as potential income in the form of dividends. They are also an excellent tool to combat inflation over extended periods of time. Investors can select from diverse types of stocks from large or small companies, domestic or international companies, and from a variety of industries. Investors often fall into the trap of regional or industry bias; owning too much of what they themselves know. Try to step out of your immediate area of knowledge and make sure you’re taking advantage of stocks from all available geographic locations and industries.

Bonds are an important part of investment portfolios, especially for those seeking income. They also provide a stability that can offset some of the volatility investors must accept in their stock holdings. A wide variety of bonds are available to investors from numerous issuers who wish to seek funds in the capital markets. These include:

- Federal government

- Municipalities

- Corporations

Beyond the selection of various issuers, you can also diversify among credit quality and maturity date. This is also a good point to mention that many investors are very aggressive with their bond selections and conservative with their stock selections. They have only the highest yielding (and thus highest risk) bonds and only the name brand stocks whose underlying business they are familiar with. Be sure to take risk where you are getting well compensated. This might mean selecting less high yield options in your bond allocation but including smaller companies in your stock allocation. By doing so you may be able to receive a higher expected return for the same level of risk you are already taking.

Cash (and cash equivalent investments such as CDs or Money Market Accounts) diversify a portfolio and accomplish several goals for the investor. Cash provides stability and liquidity. Your principal value is protected, and you can access these funds quickly. Some financial planners prefer a cash allocation inside investment accounts while other planners prefer clients keep an emergency fund as a separate account outside their investment portfolio (a bank savings account for example), while investment accounts are fully invested without a cash allocation. There are advantages to each strategy that you should discuss with your own planner.

Alternative Assets, or “Alts” as they are often known, can be anything other than the asset classes we’ve discussed thus far. They include but are not limited to:

- Real Estate

- Commodities

- Fine Art

- Private Equity

- Managed Futures

- Or anything else that doesn’t fall into one of the “standard” asset classes we’ve discussed

Some include real estate and commodities as standard assets along with stocks, bonds, and cash and others consider them alternatives. The specific decision of how to label these assets is less important than how they may provide additional diversification. Be careful in your selection of alternatives. Many are potentially difficult to liquidate and can potentially carry high fees or transaction costs.

From a practical standpoint, it may be difficult for some investors, especially if just beginning with a small balance, to achieve full diversification among and within the asset classes described above. You may not necessarily own each asset class directly but rather through a mutual fund or other professionally managed product that gives you exposure to multiple investments from one or more asset class. You’ll want to ensure that you have appropriate diversification if you own assets directly or indirectly through a packaged product or separate account that is managed by someone else. The key point for those using funds or other products is that owning several funds that do the same thing may provide little diversity. It’s not the number of lines on your statement that determines if you have meaningful diversity.

How Do You Know If Your Portfolio Is Properly Diversified?

A portfolio that is properly diversified will meet a few basic criteria.

- It will have a variety of asset classes

- Diversity within those asset classes

- Include investments with a variety of risk profiles

When you have a variety of asset classes, it means that you have a few distinct types of assets. Instead of an all-stock portfolio, for example, you might have stocks, bonds, real estate, cash or even more asset classes.

You will also want to have variety within the asset classes you’ve selected. The portion you have allocated to stocks, for example, should not be one stock or even the same types of stocks but a mixture. Perhaps, include various market capitalizations and industries. The bond portion of your allocation might have a mixture of maturities and credit qualities.

A lot of investors are surprised that it may be appropriate to hold investments that are higher in risk than their own risk tolerance would likely indicate. This is because you can meet your risk tolerance by deciding how much you’d like to have of higher and lower risk assets, not necessarily by choosing only assets that match your risk tolerance. A conservative investor nearing (or even already in) retirement may be an appropriate candidate for an aggressive growth stock fund, but perhaps not a large amount relative to the size of the overall portfolio. This viewpoint has been more widely adopted in the recent decades as retirees are living longer and will need to pay even greater attention to the effects of inflation on their portfolio.

Is It Possible to Diversify a Portfolio Too Much?

It is certainly possible to diversify your portfolio too much, resulting in excessive transaction costs or unnecessary complication. Effective diversification is not about owning as many assets as possible but instead, it’s about building a portfolio that meets your investment needs by giving you the best shot of meeting your goals while taking the least risk possible. This can be accomplished by selecting appropriate investments in the right proportions that are not heavily correlated to one another. This may not be many investments (strategic quality, not quantity).

Investments that are added to your portfolio that do not reduce overall risk may be a poor fit. Your specific goals and circumstances will determine an appropriate allocation for your situation.

Diversification vs. Concentration

Managing a portfolio effectively is in some ways about striking a balance between concentration and over-diversification. Investors will have to take risks by definition, but they should take risks they are getting well compensated for and use diversification to reduce risks that do not provide adequate compensation. Think of the situation we all face in our daily lives at work or at home of multitasking vs concentrating on tasks. There are advantages to both strategies, each of which has a place. Stuffing envelopes while making a customer service call is an effective multitasking strategy, but I’m not sure I want my physician reviewing his credit card transactions during surgery.

Will Portfolio Diversification Make Me More Money?

Diversification does not necessarily make an investor more money. It does help to provide the greatest rate of return for risk accepted. Those who are willing to take unusual risks may, in fact, receive unusual returns. (Unusually high or low.) They may be taking more risk than they need to for these returns, which means that if one is attempting to make money in the long term with consistent growth, a diversified strategy has a better chance of producing effective results.

We all know someone (or maybe we are that someone) who has done well with a concentrated investment. It’s very tempting to go “all in” for “the one” but even if an investor is successful with a concentrated strategy, it is extremely difficult to manage this type of strategy for any extended period.

Wrapping Up

No matter how you choose to diversify your portfolio, the effects of diversification can be a benefit to you. Reducing risk and smoothing out your returns will not only potentially increase your portfolio’s long-term performance, but also increase your satisfaction with the experience along the way. This is important in keeping you disciplined enough to stay invested long enough to build the balance necessary to reach your goals. While many investors are comfortable developing and implementing strategies themselves, many would prefer guidance along the way as they build their portfolios or consider implications related to the other areas of financial planning on your investments.

A qualified professional such as a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional can assist you in making portfolio decisions. They can also help you address where your investments are located within your overall financial plan, taking into consideration not only your investments needs but also concerns regarding tax, estate planning, retirement planning and general issues such as budgeting. You may benefit by having someone in your corner to ensure you have appropriate information to make decisions as well as the discipline to implement them and remain focused over extended periods of time.

If you have any more questions about portfolio diversification and how it can benefit you, the financial advisors at Pure Financial can help. Book an appointment to talk with an advisor today!