Most investors hold bonds for safety, diversification, and income. In fact, you’ve probably read or been told that you should hold stocks for growth and bonds for safety. There is logic to that advice; bonds have historically been much less volatile than stocks and historically have provided ballast during stormy markets.

That concept might leave you wondering: What the heck is going on with bonds this year?

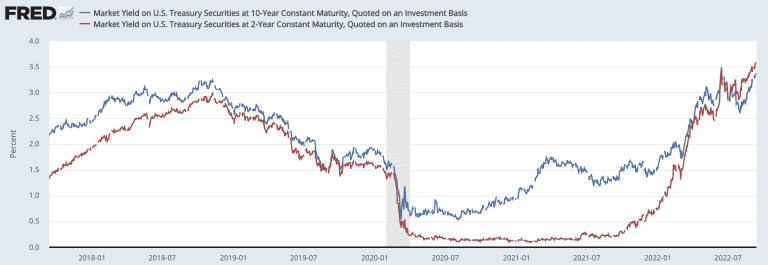

The chart below shows that interest rates have spiked in 2022. At the start of the year, the 10-year Treasury was yielding around 1.60%. Flash forward eight months, and as of this writing (9/13/2022), that yield has doubled to more than 3.40%.

10-Year Treasury

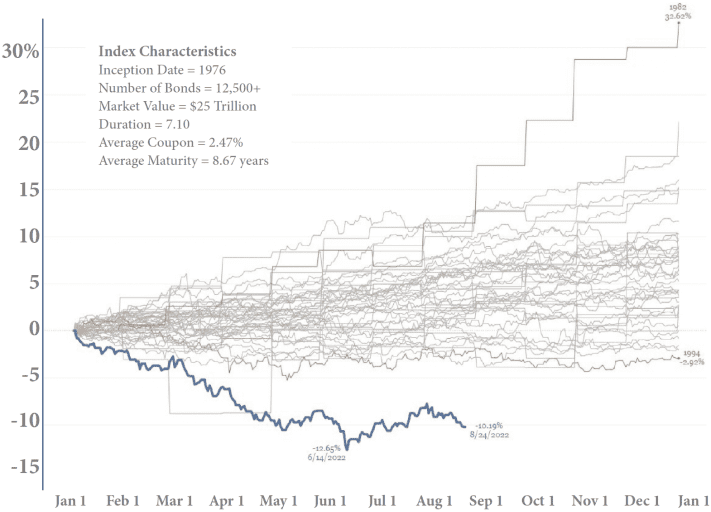

The good news is that those higher yields will produce more income for investors, making bonds more attractive in the long run. As you may have already realized, the bad news is that bond market performance has been bad. Of course, that isn’t news at this point. But the graphic below illustrates just how poor the bond market has done in relation to its historical averages.

Barclays Aggregate Index (yearly performance since 1976)

Year-to-Date Total Return for the Bloomberg U.S. Aggregate Index

The dark blue line represents 2022, and you can see just how much of an outlier the year has been. It’s not just that bonds rarely post a negative year; it’s that even when they do, in the past, that performance has only been negative one or two percent. Losses in 2022 have been more than 10% for the main bond market index. For context, a similar relative move in the stock market compared to its historical averages might be something on the order of an 80% or 90% decline!

While 2022 has been painful, the bright side of seeing it put in context is to emphasize just how unusual these declines are. And while that doesn’t provide a guarantee of future performance, history, as well as the enhanced yields bonds now offer, do provide hope for a better path ahead.

Short and Long-Term Bonds

While longer maturity bonds have seen their interest rates soar, shorter-term bonds have seen even greater increases. For example, as the chart below shows, the yield on the 2-year Treasury has gone from just above zero to more than three percent in the last twelve months.

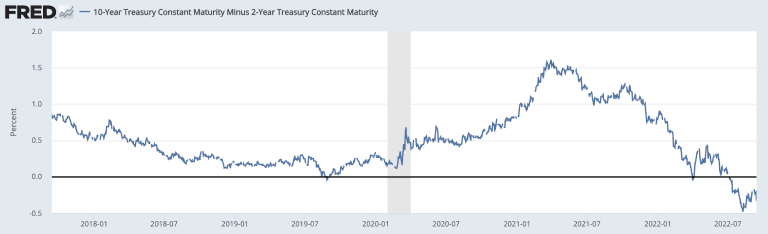

The result of this increase in short-term interest rates is that the yield curve has inverted. This simply means that investors can currently get more interest for holding shorter-term bonds than they can for owning longer-term bonds. This situation is not unprecedented but somewhat unusual. Generally, it indicates that market participants expect a slowdown in the economy and a drop in interest rates in the months or years to come.

While only time will tell if the bond market’s forecast is correct, a scenario in which the economy slows and interest rates decline would be good for bond investors. However, regardless of the timing, as with any difficult market environment, the current decline in bond prices will eventually moderate, particularly since it is so out of line with previous historical events. That fact, combined with the higher yields now on offer, points to a brighter future for the bond market, following an extremely difficult start to 2022.