More Posts

If you looked at your statements late last year, you know that 2022 was tough for investors. The stock market, as measured by the S&P 500, declined nearly 20%. S&P 500 – 12 Months (as of 1/24/2023) However, what made 2022 an unusual year was that even as stocks were falling, there was almost no […]

Most investors hold bonds for safety, diversification, and income. In fact, you’ve probably read or been told that you should hold stocks for growth and bonds for safety. There is logic to that advice; bonds have historically been much less volatile than stocks and historically have provided ballast during stormy markets. That concept might leave […]

The first eight months of 2022 have been tough for investors. Stock indexes around the world have declined by double digits, while historically safe bonds have suffered their worst performance in decades. Eventually, markets will resume their upward trend, but unfortunately, no one knows exactly when that time will come, and furthermore, no one can […]

Do you know how a bear market versus a bull market can impact your portfolio? It is crucial to put the market activity into perspective to keep from making emotional decisions that can be difficult to recover from over the short or even long-term. In this guide, you’ll learn about some bear market strategies to help you […]

From the rise and fall of the individual stocks to get-rich-quick tales of crypto currencies – many people are looking for a short-term solution to a long-term planning problem… and playing the retirement lotto. Financial professionals Joe Anderson and Alan Clopine discuss ways to avoid the retirement lottery and they guide you through strategies for […]

As of this writing, the Russian invasion of Ukraine has been going on for more than two weeks. And while the two sides have discussed a ceasefire, they have made little headway into resolving the conflict so far. As a result, financial markets have been extremely volatile, and the longer-term economic implications are building. Russia […]

How do you feel about investing beyond our borders? In today’s global interconnected economy it is almost impossible to avoid international exposure. Now more than half of the worlds’ market capitalization lies outside of the United States, investing globally offers the opportunity for improved portfolio diversification and long-term growth. Financial professionals Joe Anderson and Alan […]

In today’s global interconnected economy, many people are invested in stocks from around the world and don’t even know it. Now that more than half of the world’s market capitalization lies outside of the United States, why would you want to limit your investments to U.S. equities? In this guide, you’ll learn about how investing in companies around the globe that […]

When you first learn about investing you are told to diversity – to spread out your risk. But if you invested in bonds, certificates of deposit, or put your money in a savings accounts lately you could be losing money. Now and for recent history, the return has been near zero versus 5% historically. So […]

Having a balanced portfolio is crucial when it comes to investing. Bonds are an essential part of that, playing a crucial role in keeping an investment portfolio diversified. Bonds act as a stabilizer because of their fixed income, limited volatility, and tendency to rise in value when the market is under stress. Understanding the basics […]

What are the prospects for inflation right now? Is higher inflation likely, or is it possible that weaker economic growth is a bigger risk? If higher inflation does come about, what does that mean for market returns? We answer some of these important questions about inflation and its impact on investors. In this guide, you’ll learn […]

Question: I’m concerned the market is overvalued and I want to sell my highest-valued tech stocks now. I’m not retiring for another 3 or 4 years. Do I reinvest in stocks when the prices come down or invest in something less risky now? Laura, Mira Mesa Watch the full episode, Stress-Test Your Retirement Plan Make sure […]

True/False Question: It’s best to stop contributing to my employer’s retirement plan during a recession and wait until the market recovers. Watch the full episode, Stress-Test Your Retirement Plan Make sure to subscribe to our channel for more helpful tips and the latest episodes of “Your Money, Your Wealth.”

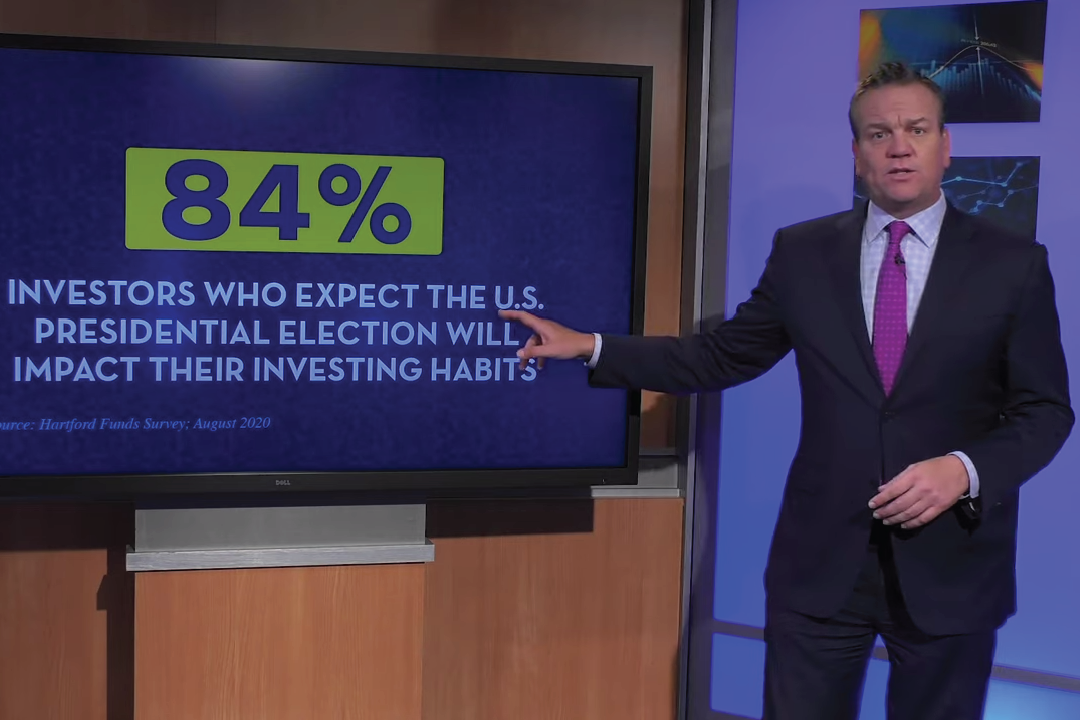

The U.S. Presidential campaigns are full of threats claiming that if one side or the other wins, the market will dip or surge. Does the party of the person who becomes the commander-in-chief really drive the market in one direction or the other? Financial professionals Joe Anderson and Alan Clopine take a historical look at […]