Choosing the pension lump sum or monthly payment: let it ride, roll it, or annuitize it? Plus, spitball analyses involving the 72(t) tax election, a donor-advised fund, 529 plans, and early retirement. Also, is growth on after-tax 401(k) contributions tax-free? How much of the portfolio should be in tax-free, taxable, and tax-deferred accounts? How does income from tax-deferred accounts impact Medicare premiums?

Subscribe to the YMYW newsletter

FOLLOW US: YouTube | Facebook | Twitter | LinkedIn

Show Notes

- (00:57) Retirement Pension Spitball Analysis: Let It Ride, Roll, Or Annuitize? (Randy, WI)

- (08:03) Retirement Pension: Lump Sum or Annuity? (Cathy)

- (18:11) Retirement Spitball Analysis: 72(t), Donor Advised Fund, and 529 Plan (SoonToRetire)

- (31:00) How Can We Retire Early? (Jordan, Hesperia, CA)

- (38:35) Is Growth on After-Tax 401(k) Contributions Tax-Free? How Much Should Be in Tax-Free, Taxable, and Tax-Deferred Accounts? (Joe, Aston, PA)

- (43:43) How Does Income From Tax-Deferred Accounts Impact Medicare Premiums? (Steve)

Free resources:

LISTEN | YMYW Podcast #307: How to Choose Your Pension Options and Retirement Withdrawal Strategy

WATCH | Educational Video: Should I Take the Lump Sum Payout From My Pension Plan?

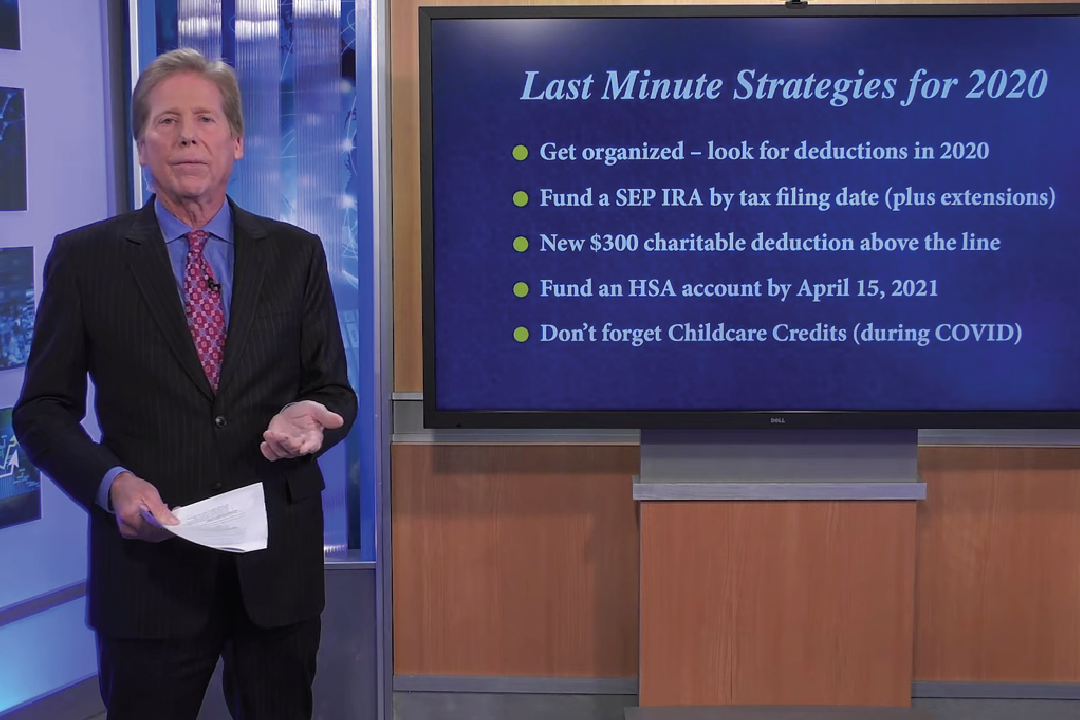

WATCH | YMYW TV S.7/E.3: Avoid Costly Tax Filing Mistakes

Listen to today’s podcast episode on YouTube:

Transcription

Today on Your Money, Your Wealth® podcast #316, the retirement plan spitball analyses continue. Should Randy in Wisconsin let his pension ride, roll it, or annuitize it? Should Cathy take her retirement pension as a lump sum or monthly payment? The fellas also spitball on SoonToRetire’s plans involving the 72(t) tax election, a donor advised fund, and 529 plans, and they help Jordan in Hesperia decide if he can retire early. Plus, Joe in Aston PA wants to know, is growth on after-tax 401(k) contributions tax free, and what percentage of the portfolio should be in tax-free, taxable and tax-deferred accounts? Finally, how does income from tax-deferred accounts impact Medicare premiums? Steve would like to know. Click Ask Joe and Al On Air at YourMoneyYourWealth.com to get a spitball analysis of your retirement plans. I’m producer Andi Last, and here are the hosts of Your Money, Your Wealth®, Joe Anderson, CFP® and Big Al Clopine, CPA.

Retirement Pension Spitball Analysis: Let It Ride, Roll, Or Annuitize?

Joe: We have Randy. He writes in Alan. “Hello, YMYW team. I live in Wisconsin, drive a 2018 Chevy Colorado 4X4 pickup truck.” Yeah, you got to have a pickup truck in Wisconsin.

Al: You know, I think that’s the perfect vehicle for Wisconsin, don’t you?

Joe: Yeah, I think so.

Al: Take your dogs in the back and anything else that you want to-

Joe: Kegerator. Something like that.

Al: Kegerator? Well, I suppose.

Joe: He’s got a 6 year old beagle mix, Cooper, who is also a Packers fan.

Al: How do you know Cooper-?

Andi: Cooper’s a Packers fan?

Joe: That just shows you the intelligence of Packer fans, they’re beagles.

Al: The beagles are all rooting for the Packers.

Joe: Yeah, you know, since I am from Minnesota, I can say that.

Al: You understand it?

Joe: I do. All right. Is it hot? Is-

Al: It’s pretty hot.

Joe: She’s got a hot box today.

Al: She’s got the heat up for us.

Joe: Okay. “My wife and I-” just to keep us limber here.

Al: Yeah, right.

Joe: “My wife and I have a globally diversified, age-appropriate portfolio of Vanguard index funds and bond funds totaling $1,300,000. At this time, only $30,000 is in a Roth, with the remainder $1,270,000 in pre-tax money. We will convert some of that pre-tax money once my wife goes part-time. We have one year worth of expenses in savings. Since I’ve recently turned 55, I can roll over my $77,000 cash balance pension plan at a previous employer, which is currently guaranteeing a 3.79% interest rate. My wife is 58 and will go part-time till 62. We probably won’t draw on our retirement assets until I retire in 10 years at 65 and possibly defer our Social Security until 70. Our home will be paid off before I retire.” Sounds like Randy’s pretty dialed in here.

Al: I think he doesn’t really need our help, does he?

Joe: I don’t think so. “My option for the $77,000 cash balance pension plans are: do nothing and let it ride at 3.79% for up to the next 10 years, roll it over to my current IRA, or annuitize it now or in the next 10 years.” All right, so he’s got some options. So he’s got a cash balance pension plan that the previous employer gave him. And usually with those plans, you could take the lump sum, roll it into the IRA that he suggested, or he can take a lifetime income stream from it. And that’s what annuitize means.

Al: Right. Which is the same as any retirement plan. And annuitize is like you receive monthly payments generally for the rest of your life.

Joe: Right. You can have $100,000 lump sum or we’ll give you $2000 a year for the rest of your life.

Al: Whatever it is.

Joe: All right. “3.7-“ I’ll continue- “3.79% is a very good guaranteed return. I know over the long run, I’ll earn more in the stock market. The math tells me to roll it over. Am I nuts for wanting to take it out of the plan with that guaranteed return? What do I need to consider if I leave it in the cash balance pension plan? The previous employer is a strong financial company. I’d love to hear your spitball, back-of-the-napkin conversation on this. Your loyal follower, Randy.” OK, one thing Randy didn’t give us, Alan. What is the annuitization? Because he’s got two guarantees here, right? He’s going to get a 3.79% roll up on the overall pension that he’s receiving. So he could continue to keep it in the plan. He could roll it out into an IRA. Then he has no guarantees for the income later. So he’ll have to create the income on his own. Or he keeps it in the plan for the next 10 years at close to 4% guarantee and then annuitize it. But what I don’t know what the annuitization is. What’s the income tax?

Al: Yeah, right. So that- correct. So that would help us answer this question if we knew what the income was now- if he annuitized it now versus 10 years from now. We know what the lump sum is and we know what the rate of return is. So at least we’ve got part of the equation.

Joe: Right. The biggest.

Al: So based upon what we know, though, what would you- what’s your spitball analysis?

Joe: Well, it’s $77,000 out of $1,300,000.

Al: Yeah, I guess it’s not that big a deal.

Joe: You know what I mean? So I like- I would keep it in the plan and I would use that as a bond option because bonds are paying almost nothing. So- what is that? $77,000 into $1,300,000. So what, 5%? 6%?

Al: Yeah, you couldn’t do that in your head?

Joe: Sh- It’s early, Al. And this studio is like 200 degrees.

Al: Too hot to think.

Joe: Yes. And I’m telling you, I’m not good at math.

Al: It’s under 7%. It’s probably about 5%. Because if you take $70,000 into $1,000,000, that’s 7%, just to give you a little frame of reference.

Joe: Got it.

Al: So I agree with you, Joe. I think bonds are not paying very much right now and to get a guarantee of 3.79%, that’s pretty good.

Joe: Yep.

Al: So I think I would use this cash balance plan as part of my bond. Like, let’s say, for example, I wanted 70% stocks and 30% bonds. Well, this would be part of the bonds. And to make up the rest of the 30%, I would go into the rest of the portfolio.

Joe: Absolutely.

Al: And there’s no reason to create income right now, Randy, you don’t really need it. But 10 years from now or whenever you retire, it’s like, OK, well, let’s look at the options and make the best plan at that point based upon what the income stream is.

Joe: Right. Because the second phase of this, Randy is going to have to make another decision in 10 years to say, do I annuitize it in 10 years? So OK. Then you look at- oh, let’s see if you can do this in your head, Alan-

Al: What the monthly payment will be? Well the $77,000 will probably be $100,000-

Joe: It’s gonna grow to $110,000.

Al: Yeah, say $100,000. OK, $110,000 is what you get.

Joe: Right. So he’s going to have $110,000 in that cash balance plan in 10 years. So then you have to figure out, what is the annuitization rate? What are they going to give you from a pension?

Al: Probably be $5000 or $6000 a year. Wouldn’t you- if you had to guess?

Joe: Yeah, maybe-

Al: Something like that.

Joe: Maybe a little bit more than that, because-

Al: Because you’re getting return of capital.

Joe: You got it. So then you could add that on top of your Social Security and then that- little beer money, walking around money, something like that. The more guarantees that you have in retirement, depending on what the guaranteed rate they’re willing to give you is the key. So some things to ponder on, Randy. Hopefully you like that little spitball. And thanks for being a loyal follower. A follower. They’re following us.

Al: Apparently.

Joe: Kinda freaks me out.

Al: Do you ever have to look over your shoulder?

Joe: I will now, big Randy in his pickup truck with his beagle dog rooting for the Packers.

Andi: Chasing ya.

Retirement Pension: Lump Sum or Annuity?

Joe: Cathy writes in, “Joe, Big Al, been listening to your show for a year or so now. Love it.” Love you, Cathy. “I’m 53 and single. I have a financial question for both of you. When I looked in my shoebox the other day, I found a pension account from a previous employer with $53,000. I could take a lump sum or alternatively, I could take a single-life annuity starting now for $200 a month. If I don’t do anything with it, it’s been growing interest, for example, 1.1% for the year 2021.” So she’s got a pension. She found it in the old shoebox, Al.

Al: Yeah, I’d say keep digging. What else you gonna find?

Joe: What else you got? Right?

Al: Right? Maybe some gold coins or something.

Joe: All right. 53. She takes it now. She could either take a lump sum. $53,000, roll that into an IRA or she could take $200 a month. She doesn’t do anything with it like it has been, it grows at a very low interest rate. 1.1% is what she’s thinking. “I don’t need this money now, but I may need to secure some basic income needs in the future. I like the idea I have an annuity to secure basic income needs. However, I’m not sure if this is a good idea. I calculated the monthly payment against the lump sum, which comes out to around 4.7% now. If I wait until 65 to take the annuity, it comes out to 6.2%. Since annuity gives me a lifetime income I compare it with the 4% withdrawal rule, and it looks better.” Well, yeah, the 4% burn rate is- ideally you don’t touch the principal. In the annuity, you’re touching principal and interest.

Al: Yeah, that is a difference, the 4% rule basically allows your lump sum or principal to grow. That’s the whole idea. So in other words, the payment is higher each year because it’s 4% of a higher number.

Joe: So you have $100,000. You’re taking $4000 out. And you’re anticipating, let’s say, the market 7 out of 10 years goes up. So let’s say it grows at 6% on average, you’re taking 4%, the 2% combats inflation and taxes. So at the end of the day, you still have the $100,000.

Al: And plus every year you get a raise.

Joe: Or you could get a demotion if the market goes down.

Al: You could in certain years. You bet.

Joe: “However, I’m still not sure about this since the balance earns a very low interest that is tied to some bond, seems losing money considering what the market’s done if I leave this account there untouched until 65.

What are your thoughts about this money? Should I take the lump sum and invest in an IRA or take the monthly payment or leave it there. Appreciate and love the show.” Um, OK. What do you think? Do you wanna take the lump sum or do you want it to- is there a follow-up email or what is this?

Andi: Yeah, that’s from Cathy as well.

Joe: Should I read the follow-up email?

Al: Yes. She’s got different options it looks like.

Joe: Oh great. “Hi. Forgot to detail the options that I can think about. Leave it there untouched. Ok, you’ve already said that. Let it grow to earn the low interest rate. Wait till retirement to take the single life annuity. Take the lump sum of $53,000 now and invest it in a target date fund deferred tax by rolling it to an IRA. For this option, do I lose access to the money before 59 and a half penalty-free? Take the money of $200 a month and invest it in a target-date fund, in a taxable account. Which one would you do? Any other suggestions you might have? Thank you.” All right. So-

Al: You’ve got 3 choices.

Joe: She waits until retirement. And so instead of taking the $208 at retirement, it’s something a lot higher than that. I don’t know what that number is.

Al: Well, let’s- I don’t know if she’s doing it on the $53,000. Let’s assume she is. $53,000, 6.2%. Divided by 12 months. That’d be $273 per month, roughly, maybe.

Joe: So she could take $208 now or $273 at 65.

Al: I think so. That’s what I’m guessing.

Joe: $53,000 now or $57,000 in the future. Something like that. If it’s growing at 1.1%, it’s tied to some bond index. We don’t know what that is.

Al: So what would you do if you were Cathy?

Joe: How old is she?

Al: 53.

Joe: And she could get $208 right now?

Al: Yep.

Joe: OK, $53,000. Do you think Kathy has longevity? Let’s assume she does.

Al: Yeah, I would say so. Sure.

Andi: She’s single. She doesn’t have a man in her life, so she’s probably got longevity.

Al: She probably would have told us otherwise because she’s liking the annuity.

Joe: If you have longevity, the annuity probably will work out for you. So let’s say you take the annuity now at $208 and let’s say she lives until age 95, which is, what, 40 years from now?

Al: Yeah, call it 40. 93?

Joe: OK, I’ll just go 40 years and she’s doing that a month and she gets 6%. Future value of that is $414,000. She’s single. I don’t know if she’s got kids, does she want to pass it? But she wants to spend the money so she’s not going to invest it. She’s going to invest in a target-date fund until she retires at age 65 you think?

Al: Or if she just takes the lump sum at 6% for 40 years, let’s see what she ends up with-

Andi: And she does want to know if she can access the money before 59 and a half penalty-free if she takes the lump sum.

Joe: No.

Al: She cannot.

Joe: It’s an IRA.

Al: $545,000 if she takes the lump sum at 6%.

Joe: OK, so she takes the lump sum and then she grows it at 6% until 93, it’s $540,000 versus the $208.

Al: In other words, or she takes the $208 and invests each of those payments. And the reason why-

Joe: Or you could reverse that and take the present value of that, the lump sum is going to be worth more.

Al: You could. You could.

Joe: So I could take $208 to age 93 and take the present value of that of some discount rate.

Al: And the reason why we’re ending up with the lump sum being better is we’re using 6%. Now if you’re going to put it in a CD and earn less than .1%, then you’re better off taking the annuity.

Joe: Yep.

Al: So me personally, I would take the lump sum. Because I think that over the long term that I could probably earn 6%, which would work that out to be a better deal. That’s me personally. Cathy, it depends upon your ability to invest and your ability to weather the ups and downs in the market and all that sort of thing.

Joe: Right. But if you like the idea of a fixed income stream, then that trumps it all.

Al: It does.

Joe: Because then you’re looking at what’s my internal rate of return on the $208,000 over-? Because there are variables that you don’t know. What’s your life expectancy? You take the annuity payment and all of a sudden you get hit by a bus in a couple of years. Well, you’re single, so you’re going to take the single life. And so now it’s gone. If you take the $53,000, you can at least pass it on. But if it’s only growing at that rate- usually the lump sum and the annuity payments is almost identical from an internal rate of return standpoint. So what we would look at is, what are the other fixed-income options or available fixed income sources? Do you have other pensions? Do you have- what’s your Social Security benefit? What is your other retirement accounts, non-retirement accounts? What’s your lifestyle? Things like that, to really dial it in. But if you want the fixed income and you like some beer money and, well, travel money or whatever, by all means, just make it simple. Just get the $200 a month and call it good. But then you get the $53,000 and I’ve got a target-date fund. I don’t know, you take some money out of there. The break-even on that without any growth is 21 years. So you put- just put $2500 into $53,000 is what, 21, 22 years.

Al: That’s true.

Joe: If you don’t grow the money at all. So you’re 55, so that’s 75.

Al: Another factor here is what’s your mentality on if you have $53,000. I know it’s in an IRA and it would be- you’d have to pay a penalty, but if you’re the kind of person that at 59 and a half, you’re liable to pull it out and spend it, then you might be better to take the annuity, protect yourself. If you’re the kind of person that’s like, well, I don’t really need it because I got Social Security or I have whatever then- and I can just let this grow, then I kind of like the lump sum, but that’s- But yeah, I agree, Joe. It’s kind of a personal thing. And it’s not- we’re not talking about a lot of dollars, so it’s a little bit more personal for what Cathy would like to do.

Joe: So here’s the internal rate of return, so if I got 208 times 12, $2500. And let’s say 42 years- discount rate inflation, call it, what, 3%. Present value is $59,000 versus the lump sum of $53,000. It’s almost identical.

Al: Yeah. As you said, it usually works out that way.

Joe: So whatever preference you want.

Read the episode transcript, watch Joe and Big Al discuss the pension lump sum vs annuity question, and listen to a previous YMYW discussion on the pension topic by clicking the link in the description of today’s episode in your podcast app to go to the show notes at YourMoneyYourWealth.com. If you still want the fellas to spitball about your pension options, or any other money questions you may have, click Ask Joe and Al On Air in the podcast show notes and send them your situation. And hey, If you haven’t told anyone about YMYW yet, what are you waiting for? Also want to welcome to all the new listeners that have been emailing and telling us they’ve just discovered Your Money, Your Wealth® on YouTube, Apple Podcasts, Google Podcasts and Spotify, among others! We’re glad you found us!

Retirement Spitball Analysis: 72(t), Donor Advised Fund, and 529 Plan

Joe: We have an email. “Team, I love your show. I’m 52, planning to retire in 13 months, at 53 and a half. My wife and I have a net worth of $2,200,000 with $275,000 of that being our paid-off home. We have no debt and drive a Toyota and a Ford pickup truck. We’ve worked hard, live below our means, and are looking forward to traveling and enjoying our grandchildren in a relatively low-cost area. The rest of our assets are broken down as follows: $1,700,000 retirement accounts, $100,000 in high yield savings account, $85,000 in a brokerage account, and $50,000 in a real estate syndicate deal.” What do you think about a real estate syndicate deal, Al?

Andi: What does that even mean?

Al: It’s like a real estate investment. It can be good. It depends upon the underlying real estate. It may be great. It may not be. I don’t know from looking at this.

Joe: He’s got “$85,000 in dividend-paying stocks. Average 6%.”

Al: Not bad.

Joe: “The rest in growth stocks like Tesla.”

Al: Yeah. Yeah, that is a growth stock.

Andi: Did you say growth or gross?

Al: Oh, growth.

Joe: It’s definitely growth.

Al: Yeah, it shoots up in value, sometimes when we don’t even know why.

Joe: “Our goal is to build our current non-retirement assets $245,000 currently to $300,000 to $350,000 before leaving my job.” So he’s got $100,000 in cash, $85,000 and after-tax brokerage. So that’s close to $200,000. I don’t know where he’s getting all-

Al: Oh and the real estate syndicate.

Joe: Oh, and the syndicate. The syndicate.

Al: He’s part of the syndicate.

Joe: He’s part of the syndicate. I forgot.

Al: By the way, I would not count that as your non-qual. That’s an illiquid investment.

Joe: It’s tied up forever. Hey, do you think I could get out of the syndicate? No.

Al: Probably not.

Joe: Come back next year. “We also have added $75,000 to our retirement accounts during this time.” All right. OK, so let me restart this. “Our goal is to build our current non-retirement assets $245,000 currently to $300,000 or $350,000 before leaving my job. We will also be adding $75,000 to our retirement accounts.”

Al: So he’ll have a couple of million dollars, let’s just call it that.

Joe: “I have also received a small pension from my military. $15,000 per year along with free health care. My wife works with the school system and will be able to maintain her low-cost health care when she leaves her job, likely in a year or so after I do. We have proven that we can easily enjoy a lifestyle of $75,000 per year, having tracked every dollar of our expenses for the past 5 years.”

Al: I can’t even say that. Might track a week.

Joe: Oh my God, I can’t even track what the hell I spent today. I’ve tracked every dollar, every penny. For 5 years, Alan.

Al: He’s been anticipating this retirement. He wants to get his expenses right, which I admire.

Joe: “The plan is to move $1,500,000 into an IRA upon leaving my current job next year, placing $600,000 into a bond fund and the remaining $900,000 into a stock market index fund within the IRA. We will draw $60,000 per year, that’s a 4% distribution rate, using a 72(t) tax election to avoid the early withdrawal penalty from the bond fund and replace that money on good market years from the index funds.” So he’s doing a little 72(t).

Al: That he is.

Joe: “During severe and extended year market downturns, we will use our non-retirement accounts to live off of. I would also like to set up a donor-advised fund of about $40,000 from my brokerage accounts, on the first year of retirement to fund our grandchildrens’ 529 plans we created, make church and other charitable donations, and fund a small non-profit I’ve started. The remainder of the money from our 401(k) and 403(b) will be rolled into the new IRAs that will do Roth conversions from- to set up legacy accounts to eventually pass to our adult children and grandchildren. Again, love your show and would love to hear your thoughts on my plan. SoonToRetire.” OK, so that’s-

Al: That’s the plan.

Joe: That’s the plan for SoonToRetire.

Al: Do we like it? Do we have an idea?

Joe: I don’t think it’s going to work.

Al: Why do you say that?

Joe: A couple of things.

Al: Well, there’s a couple of mistakes in here.

Joe: Sure. Well, first of all, he’s going to do a 72(t) tax election at 53 and a half on his retirement accounts at $1,500,000. So he’s planning on taking a 4% distribution of $60,000. So he believes that he can do a 72(t) tax election that will give him 4%, at 53.

Al: That’s going to be a lot lower than that.

Joe: It is going to be half that. I don’t have a calculator in front of me to tell him- because there are 3 ways to do a 72(t) tax election, or SEPP it’s also called, a separate equal periodic payment. And what the IRS allows individuals to do is to take money from a retirement account, an IRA specifically, under the age of 59 and a half and it avoids the 10% penalty.

Al: It does not avoid income tax, but avoids the penalty.

Joe: And so there are a few ways that they can do it.

Al: And it’s not any amount you want. It’s a calculation-

Joe: It’s a calculation that the IRS has figured- It’s like an RMD. It’s a requirement. It’s not like, you know what? This year I want to take out 2%. Because I don’t need the full 5%. No, they’re going to penalize you and tax you on the additional dollars that you have.

Al: I think that’s a good way to say it. It’s like a required minimum distribution. So it’s a specific amount that has to come out each year.

Joe: And there is the RMD method. So you calculate it at age 53. I’m guessing at age 53, it’s going to be somewhere close to 2%, not 4%.

Al: I’d say 2%, 2.5%. Maybe. Somewhere in there, yeah probably 2%.

Joe: And there’s an amortization method. And I forget the third off the top of my head. As you all know, we don’t prepare for these shows. So but you have to take the same amount of money out of the account until you turn 59 and a half or 5 years, whichever is longer.

Al: Longer, correct.

Joe: So that’s the basis of it. So he’s like, all right, I’m going to take 4% out of my retirement accounts because I know about the 4% rule so I can take $60,000 out of the retirement accounts. I’ll use 72(t) tax election. I’ll pay tax on the $60,000 and not necessarily pay any penalties. So that’s flawed. He’s got to run a calculation. And then he’s going to come up with the other $15,000 from cash or his non-qual.

Al: No, that’s the military pension.

Joe: Oh, the military pension. OK, we’ll give them the $15,000 so there’s the $75,000.

Al: Yeah, yeah.

Joe: So there’s- Andi might be able to even just look it up, just do a 72(t) tax election calculator and put in $1,500,000 at age 53 and see what comes up.

Al: See what happens.

Joe: Then he’s going to do a donor-advised fund. And he’s going to fund a 529 plan with the donor-advised fund.

Al: No he isn’t. Can’t do it.

Joe: So a donor-advised fund Al, is charity. A 529 plan, even though he thinks it charity-

Al: He feels like charity to your grandkids. Those good-for-nothing parents, they can’t even fund college. So I got to pull out my own charity to pay for that. No, that doesn’t- that’s a family-

Joe: It’s a gift.

Al: Yeah, it’s a gift. It’s a gift.

Joe: Not a charitable gift.

Al: I like the 529 plans, but that’s not from a donor-advised fund. And by the way, so donor-advised fund, you take $40,000, you put it into this fund. The year that you put it in the fund is the year you get a tax deduction. So do that while you’re working. So that makes some sense. But realize that those dollars, whether in that year or future years, it doesn’t matter when they go out, they need to go to charity, need to go to a charity, a 501C(3) charity.

Joe: And so what do you think about his little family foundation, which is very charitable, which is very nice that he’s setting up a little family foundation. He might want to give to, you know, some cause. But I don’t think the donor-advised fund really likes monies to go to your own foundation.

Al: Yeah, there may be some limitations there, too.

Andi: Tell me again what numbers you want for the 72(t)?

Joe: There you go.

Andi: $1,500,000,

Joe $1,500,000. And he’s 53 years old.

Andi: He’s 53? Beneficiary age?

Joe: I don’t know.

Andi: So it’s showing your maximum 72(t) distribution is $69,540 per year, that’s at an interest rate of 2.36%. And if the beneficiary is 45 years old.

Joe: Oh, I’m going to have to recalculate that. Well, maybe-

Al: It seems-

Joe/Al: – high.

Joe: That does seem high.

Al: Because I always think of it more like an RMD, like you said. Well, maybe he’s done the calculation.

Al: Maybe. Anyway, so the 529 plan that needs to be funded, that can be funded with your non-qualified account, but not through a donor-advised fund. Donor base fund’s only for charity.

Joe: Correct.

Al: So and plus, I think, you know what? I think here’s a better idea. Why don’t you- if you’re only making $15,000 a year and with the standard deduction, your taxable income is minus $10,000. Why not do a $90,000 Roth conversion for a few years and then you pay the tax out of your non-qualified account. It won’t be that much. And the $60,000 you need, just pull that out of your non-qualified accounts. You could probably do that based upon what he said maybe about 3 years before they kinda- I think you want to leave $100,000 just for emergency. You don’t want to go through all your non-qual to do that.

Joe: Here’s really, really simple, simple, simple, easy, easy. SoonToRetire. This is what you do. You put all your- he’s cranking $75,000- him and the wife- are cranking $75,000 per year into the retirement accounts. And he’s also trying to get his non-qual up to about $300,000 dollars. So move all of your retirement accounts, the $1,700,000 that you have in retirement accounts. Put that into your 401(k) plan. Because you’re retiring at 53 and a half. There is no 10% penalty if you- oh, he’s got to retire at 55.

Al: That doesn’t work.

Joe: So he needs to work another year and a half.

Al: See that could be- if you can hang on until you’re 55-

Joe: If you can hang on a year and a half, because-

Al: – then you can pull it out without penalty and you could take out any amount you want.

Joe: Right, and the 72(t) kind of gets a little funny because if the market blows up on you, you still have to take that-

Al: – percentage based upon the balance.

Joe: Correct. Even if you don’t need it, maybe go back to work or whatever. I hate the 72(t) tax election. I like talking about it, but I don’t necessarily like it in practice.

Al: Well it’s very inflexible.

Joe: It’s super unflexible. I think there’s one year back in 2000 when the Nasdaq blew up, the dot-com bust. Is that they came out with another way- ok, well, we’ll let you calculate it one more time because everyone lost your shorts in the dotcom world. They won- or they won. Well, basically it was like the lottery.

Al: Won the lottery.

Joe: These dotcom stocks went through the ceiling. And so it’s like I’m going to retire. And then they did a 72(t) tax election and then the dotcoms are blown up and now they still have to take a certain percentage out. It’s like, I’m just draining my overall retirement account at a very young age. So I like where he’s at. He’s probably on. I would just want to fine-tune it just a little bit. I think he’s got plenty of assets to live off, $75,000 a year. The money makes- I mean, the numbers make sense.

Al: I agree with that.

Joe: I would just double-check the 72(t) tax election just to absolutely make sure that you know what you’re doing there. And just understand gifting. And when you get into charity, I know it’s not a lot of money. It’s like $40,000 out of his $2,000,000 where he’s getting to. You just got to be careful of what you’re naming things. Go to the 529 plan and you would have to do a donor-advised fund. Those are two separate things. So a great question, SoonToRetire. You’re on your way. Thank you very much for the question. Good job.

How Can We Retire Early?

Joe: Jordan from-

Andi: Hesperia.

Joe: Where’s that?

Andi: California.

Joe: I understand it’s in California.

Al: It’s next to Victorville. It’s in the high desert above San Bernardino. Palm Springs.

Joe: OK. “Joe, Al and Andi. Just found your podcast last week, and I’ve been binge listening since with our Boston terrier, Brixham. I’m 29, my wife’s 37. I’m a foreman for a grading and-

Andi: – excavating-

Joe: “- excavating-” thank you- excavating company. Grading and excavating.

Al: Excavating. Yeah.

Andi: They move dirt around.

Joe: Yes, gravel, right?

Al: Or dirt.

Joe: “We are currently debt-free, including our home worth $350,000. We drive a 2017 Toyota Tacoma and a 2014 Subaru Impreza.” Right?

Al: Yeah, I think that’s right.

Joe: Pretty close. I think we had another listener, that drives a Subaru Impreza. “I make $120,000 a year, my wife stays at home with their 3-year old.” All right, Jordan. Good for you. “We have $110,000 in retirement accounts. $50,000 in a 401(k) from my wife’s former employer, $30,000 in my work 401(k), $30,000 in my Roth, and just started a Roth for my wife. My work just started offering the Roth 401(k). Should I start contributing to that and roll both of our normal 401(k)s into Roth IRAs? Should I roll over just enough to keep me in the 22% tax bracket and the rest of the following year? Or do this slowly over time?” Isn’t that slowly over time Al?

Al: Yeah.

Joe: Ok. “Our next goal was to build up a bridge account for early retirement and start saving for a few rentals. Any retirement suggestions for someone my age? Thanks for your time. Let’s have some Coors Lattes- or 6 soon.” Jordan’s my kind of guy. So yes. Jordan, let’s talk about this. He’s got $120,000- or $110,000 of income and he’s fully funding his 401(k) plan? Does it sound- something like that? Is that right?

Andi: I don’t think he says. They have $110,000 in retirement accounts.

Al: Contributing, I don’t know if fully.

Joe: Let’s just say he’s maxing it out. So that’s- I’m going to round- $20,000. So that’s $100,000. He’s got a standard deduction of $25,000. So that makes his taxable income $75,000. So here’s what I would do, Jordan. I would fully fund the 401(k) because you have $110,000 dollars in that 401(k). I would continue to fully fund the 401(k) plan to get my taxable income to $75,000. And then you have $30,000- or $50,000 of your wife’s old former employer. You could do $5000 conversions in the 12% tax bracket and you could do that over time. Or you could go to the top of the 22% tax bracket and bust it all at once. Either way is fine. Because I know that tax rates are probably going to go up. But I don’t think conversions are a big deal for him, even though- because he’s young. I would stop putting money into the 401(k) plan if you’re not going to do conversions and just do pure Roth. One of the two. If you want to make it a little bit more complicated, you could fully fund your 401(k) plan, convert all your wife’s out. She would have compounded- because she’s older.

Al: Yes. Her RMDs are going to start earlier.

Joe: She’s going to get the RMDs sooner, all that type of stuff and they want to bridge the gap. Maybe he wants to retire early. They’re going to have access to that money. It’s still FIFO tax treatment. So all Roth money is still available. So, yeah, you could start maneuvering these dollars around to get most of it into Roth over a few short years. Then it’s compounding tax-free to you. And then with the additional dollars that you have, start building the real estate portfolio. I like that idea too.

Al: Yeah, no, I’m with you. I agree. So, Jordan, you’re at age 29, so presumably, your income will go up even more. You’re in a low tax bracket now relative to maybe the future, number one. Number two is tax brackets are lower than they’re going to be. The top of the 22% bracket is-

Joe: $160,000ish-

Al: $160,000, $170,000, I guess about $170,000 for a married couple. So in other words, what we’re saying is you have a lot of room to convert whatever you want to convert. And so I might just bite the bullet and do a bunch of it on a go-for-it basis. I would be doing the Roth side of the 401(k) because the deduction isn’t as important to you. But yeah, can you imagine getting- having, ultimately $200,000 in a Roth 401(k) while you’re 29? What that’s going to be? And then you keep adding to it? That’s, that’s phenomenal.

Joe: I would do the math, Jordan. You have $110,000 in retirement accounts. If you bite the bullet that will bite you in the ass.

Al: Well when I say bite the bullet, I mean over two years.

Joe: I would- you could even do it longer. But who knows what’s going to happen to tax rates, right?

Al: Yeah. I know.

Joe: So I would look at it like this. Maybe you do a little bit this year. Well, you know, $10,000, $15,000. So the tax bite isn’t that bad. Next year you do a little- and then as soon as- because 2025 is when the tax rates are supposed to expire, where they going to go back and increase on you. So instead of the 22% bracket you’re going to be in the 25% tax bracket, given current tax law today. I- we don’t know what the new administration is going to- what rates are going to happen there. But given current tax rates, maybe you do $10,000, $15,000, you have 5 years or 4 years now. So maybe you do $20,000, $25,000, $20,000 or something like that. You don’t have to get it all out, but if you do $25,000, $30,000, you get it all out. And then that tax bite would be maybe a little bit more manageable that you would have to come out of pocket to pay the tax each April, even though it’s the same rate.

Al: And I guess the other factor related to that is you don’t really mention how much you have in savings to pay the tax. So that’s a factor here. And I think another factor is you mentioned that your wife is home with your 3-year old, and I’m assuming maybe eventually she’ll go back to work and your income will be even higher. So now is definitely the time to be thinking about this, whether you want to do it more quickly or more slowly over time. The idea is to get money into the Roth because you’re young and it’s going to grow tax-free.

Joe: Yep. Yeah, I agree wholeheartedly there. Ok buddy, I look forward to seeing you with a cooler of Coors Lattes.

Crack open a Coors Latte now, ‘cause Joe and Big Al are in Season SEVEN of the Your Money, Your Wealth TV show, can you believe it? Check out the latest episode, on Avoiding Costly Tax Filing Mistakes, and download the 2021 Tax Planning Guide from the podcast show notes at YourMoneyYourWealth.com. Preferably you want to do this before you dig through that shoebox of receipts – and pensions, apparently – to file your taxes for 2020. Y’know, tax day is April 15, so time is of the essence. Watch the show and download the guide by clicking the link in the description of today’s episode in your podcast app.

Is Growth on After-Tax 401(k) Contributions Tax-Free? How Much Should Be in Tax-Free, Taxable, and Tax-Deferred Accounts?

Joe: We got Joe writes in from Aston, PA.

Al: Suburb of Philadelphia.

Joe: Of course. You didn’t know that? “I have some after tax-money in a 401(k) from 25, 30 years ago.”

Andi: You missed the beginning part.

Joe: I have some after-tax-

Al: No, above.

Andi: Above his name.

Al: “Hi Andi, Big Al, and Backdoor Joe.”

Joe: I thought that was a totally different question.

Andi: No, this is actually how he formatted his email. He did his intro first and then he said his name and his suburb.

Joe: OK, let me- I’m sorry.

Al: Go back.

Joe: I thought that was just maybe like a little- like just a quick question there. “Hi, Andi, Big Al and Backdoor Joe.” Oh boy, don’t call me that the local ___. Long time- first time. I drive a 2009 Honda CRV and have a dog, YorkiePoo. Joe, type of dog, not the name.

Al: That’s not the name of it. Just so you know.

Joe: I do get confused and I just did get confused earlier.

Andi: With the CavaPoo and yeah this one’s a YorkiePoo.

Joe: Nutmeg. I thought Nutmeg was a dog. Like a type of dog, not the name of the dog.

Al: Turns out it was the name.

Joe: Yep. Yorkie Poo.

Al: OK, so back to Joe’s question.

Al: So, well, what the hell’s the name of the Yorkie Poo?

Al: We don’t know. He didn’t say that because he didn’t want to confuse you.

Joe: Got it. But now I’m just annoyed.

Al: How are you going to be able to fall asleep tonight? I wonder what he named his Yorkie Poo.

Joe: I don’t know. I’m gonna track him down. I’ll ask Andi with her Google Earth. “I have some after tax-money in a 401(k) from 25 to 30 years ago. At the time, the 401(k) plan offered the option of pre-tax and post-tax contributions and not fully understanding the benefits of either, I then placed money into both. Is the growth of the money tax-free like it would be in a Roth 401(k) in the after-tax dollars? My statement lists the contribution plus growth as after-tax money, but I’m thinking that only the contributions would be tax-free. Second question-”

Al: You want to answer that one?

Joe: Yeah, he’s right.

Al: That’s correct. And that’s the difference between putting into the Roth side of your 401(k) where the growth would be tax-free or put it the after-tax and then it’s only the contributions are tax-free.

Joe: “Second question. Could you give us a hypothetical target for the percentage of assets you would like to see to have in one’s brokerage account, Roth IRA and/or 401(k) and pre-tax 401(k)? Your podcast is awesome, and I look forward to many more years of financial info and laughs. Sorry for not asking Roth conversion questions. Stay healthy and safe. Thanks, Joe.” Can you give a hypothetical target, Alan?

Al: Well, we interviewed a person to work for us one time and we asked a simple question. We gave him a case, how much should you convert? And we got a very succinct answer. 50%. I said, how’d you get that? He didn’t have an answer.

Joe: Sounds like a good number.

Al: It seems like about right up.

Joe: It’s impossible. There’s no hypothetical target. It’s not like a 60/40 split of stocks and bonds. It’s not like you’re looking for a target rate of return. It has to do with how much money that you’re spending, how much other fixed income that you have, like your Social Security benefits or your pensions or real estate income. So then that helps devise the strategy to determine how much that you should have in the 3 pools.

Al: And it’s based upon what your income needs are, what your tax brackets are. For example, if you’re going to be in a very low tax bracket in the future and you’re in a high tax bracket now because you’re working, then probably don’t do a Roth conversion at that point, maybe do it later. But if you retire at age 72 and already have your required minimum distributions, you might be in a higher bracket. There’s so many variables there. Yeah, I totally agree. There’s not a formula here. Like 1/3, 1/3, 1/3.

Joe: It would be nice.

Al: I mean, if I could if I have-

Joe: – a magic wand.

Al: – magic wand, I do 100% Roth. But let’s do a realistic magic wand. 1/3, 1/3, 1/3. But to get there may be completely the wrong answer for you depending upon your circumstance.

Joe: Correct. I think that would be a good, very hypothetical target, because usually what we see is 90%,10%,10%.

Al: Yeah. Or even nothing in the Roth.

Joe: 90% pre-tax. You got some cash reserves, maybe a couple of bucks in the Roth. So we’re trying- we’ve been trying to educate over the last several years to talk more about Roth. So people start thinking about it. And I think we’ve done our job because now we get Roth conversion backdoor, front door, side door-

Al: It’s almost all we get, right?

Joe: – Roth questions every second of my life. Now, I hate the Roth. I’m kidding.

How Does Income From Tax-Deferred Accounts Impact Medicare Premiums?

Joe: Steve writes in, Alan.

Al: Yes.

Joe: “How does income from tax-deferred accounts impact Medicare premiums?” Tax-deferred accounts is ordinary income.

Al: Correct.

Joe: Medicare premiums are based on how much ordinary income you have.

Al: Correct. So this is for- what is this? This is for 2021. And it’s based upon your income in 2019. So these are the current rates. Which is if you’re single and you make income-wise $88,000 or less, you’re in the lowest Medicare costs. Doesn’t get any lower than that. If you’re married and make less than $176,000, you’re in the lowest Medicare cost, which happens to be for this year, $148.50 for part B premium. And there’s no cost for Part D income adjustment. So that’s the lowest. Now, if you have lots of income from a deferred account because you’ve saved millions, then you might pop up into higher categories. But you just have to have to look at what your income is. Look at the chart to figure out how much your Medicare premium is going to be. And there’s a 2-year look back. So what you’re making this year will affect your Medicare premiums in 2023.

_______

Stick around for the Derails at the end of the episode for the update on Joe’s back, and his place in the desert.

Subscribe to the YMYW podcast newsletter

FOLLOW US: YouTube | Facebook | Twitter | LinkedIn

Your Money, Your Wealth® is presented by Pure Financial Advisors. Sign up for your free financial assessment.

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

Podknife

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed