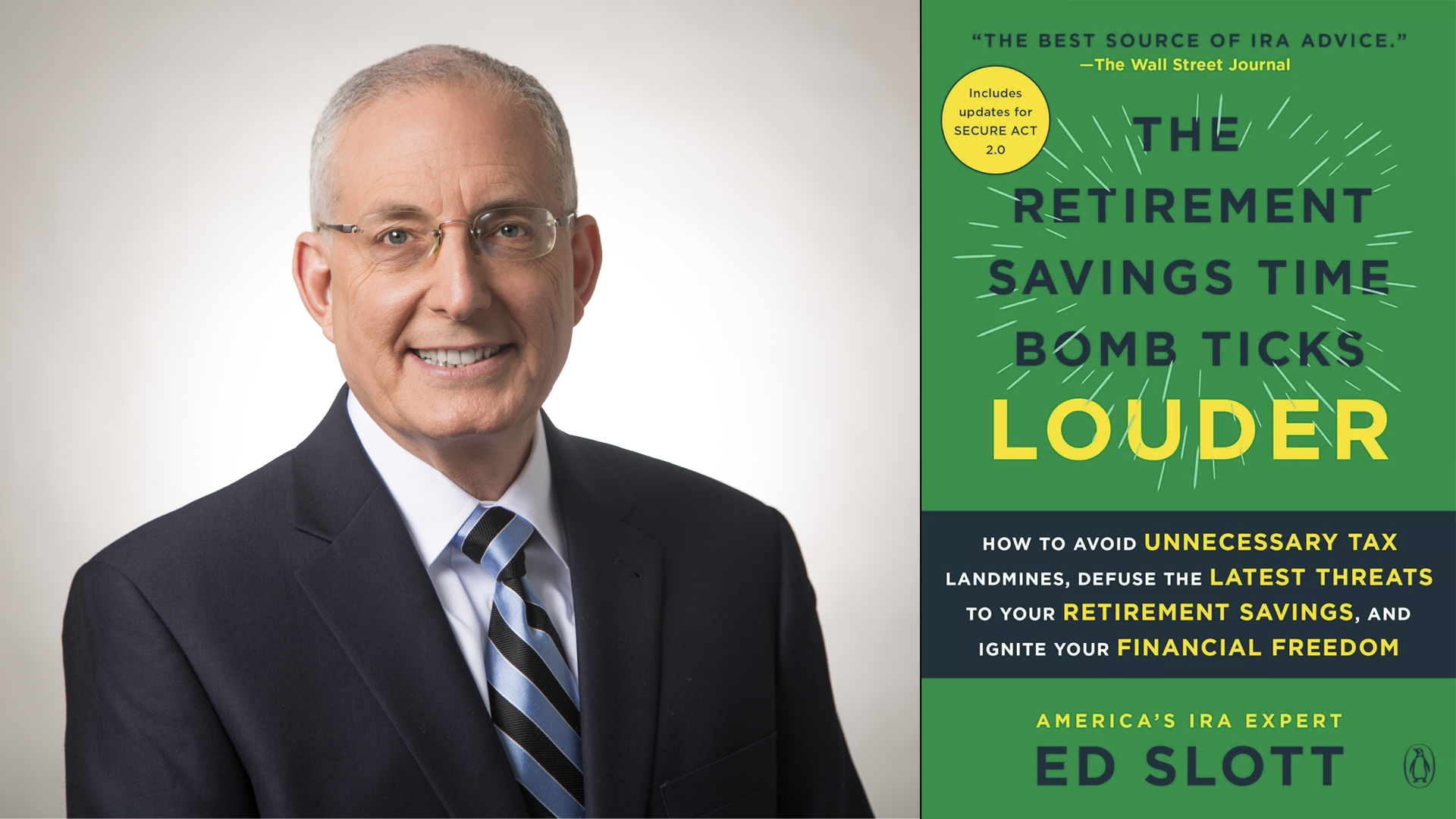

The single biggest retirement planning mistake to avoid, the problem with tax professionals, and answers to some of the most frequently asked retirement questions we get on YMYW: should you name a trust as beneficiary on your retirement accounts? What’s the break-even point on a Roth conversion? What if you don’t have the money to pay the tax when you convert to Roth? Plus, find out the eye-opening amount of money good tax planning can save you! Someone has to be very knowledgeable, entertaining, and special to make it as a guest on YMYW these days. Today “the IRA guru” Ed Slott, CPA from IRAHelp.com joins Joe Anderson, CFP® and Big Al Clopine, CPA to discuss all of these topics, along with changes to stretch IRAs and required minimum distributions from the SECURE Act and SECURE 2.0 Act. Finally, don’t miss your chance to get a free copy of Ed Slott’s latest book, The Retirement Savings Time Bomb Ticks Louder.

Show Notes

- (00:00) Introducing Ed Slott, CPA from IRAHelp.com

- (01:28) SECURE 2.0 Act: Clarity on RMD Rules?

- (04:31) How Golf and Football Are Like Retirement

- (06:25) The Biggest Retirement Planning Mistake

- (09:37) The Value of Ed Slott’s Books

- (14:14) The Problem With Tax Professionals: Short-Term Tax Planning

- (17:36) “I Love Roths Because I Love Tax-Free”

- (20:50) What’s the Break-Even Point on a Roth Conversion?

- (21:45) Can We Trust That Roth IRAs Will Always Be Tax-Free?

- (25:04) SECURE Act: Stretch IRA Changes

- (27:03) Naming a Trust as Beneficiary of Your Retirement Account: Good Idea?

- (32:13) Unnecessary and Excessive Taxes: Why Ed Slott Became the IRA Expert

- (38:22) How Much Money Can You Save in Taxes With Good Tax Planning?

- (43:16) What About People Who Don’t Have the Money to Pay the Tax on a Roth Conversion?

- (43:50) Ed Slott’s PBS Specials on Retirement

- (46:28) How to Get a Free Copy of Ed Slott’s Book, The Retirement Savings Time-Bomb Ticks Louder

Free financial resources:

LIMITED SUPPLY: 50 people will receive a free copy of The Retirement Savings Time Bomb Ticks Louder, by Ed Slott, CPA, just for having a free financial assessment with Pure Financial Advisors. 10 of those 50 will be randomly selected to receive a copy of the new book, signed by Ed Slott! Schedule your assessment today.

The 7th Annual YMYW Podcast Survey has now ended.

The Final Regulations for Required Minimum Distributions

Guides | Blogs | Educational Videos | YMYW Newsletter

Listen, subscribe, and comment on YouTube

Transcription

Introducing Ed Slott, CPA from IRAHelp.com

Andi: If you Google “who is the IRA guru,” Ed Slott, CPA is the entire first page of results. Ed is the nation’s leading authority on retirement account and tax planning and has authored several popular bestselling books. His new book is called The Retirement Savings Time Bomb Ticks Louder, and it includes the latest retirement planning updates for 2024, including the latest provisions implemented since the SECURE 2.0 Act was signed into law. Ed Slott, CPA, welcome to Your Money, Your Wealth®. Thank you for joining us today.

Ed: Well, thank you for that introduction. I think you took away my secret weapon, low expectations.

Andi: Well, may I please introduce to you the hosts of Your Money, Your Wealth®, Joe Anderson, CFP®, and Big Al Clopine, CPA.

Ed: Thank you.

Al: How you doing, man?

Joe: Ed, it’s great to have you. You know, Al and I, for the last several years, have been doing this show and a lot of ‘em call us The Roth Show. Because, you know, you taught us a long time ago, like 15, 16 years ago, Al and I went to these two-day, 3 day courses that Ed Slott would put on, and he would have an encyclopedia of, I mean, the Bible of the IRA rules and the regs and the planning opportunities that people have. So, for the last several years, Ed, we appreciate all the, the learnings and the teachings, that you have given us and a lot of our listeners.

SECURE 2.0 Act: Clarity on RMD Rules?

Joe: So, but to start things off, something just came out just this week. Finally, we have, some clarity on the RMD rules. It just took them several years to figure this stuff out or what, what’s going on?

Ed: Well, the SECURE Act came out, it was effective, came out the end of 19- effective in 2020. So here, 4 and a half years later, they tell us what the rules are. That’s a problem. I gotta tell you, the SECURE Act, never go by what a tax law is called. I learned years ago that whenever Congress creates a new law, you can almost always bet that whatever they name it, it will do exactly the opposite. Now, how’s that Budget Reconciliation Act turn, turn out like years ago? So when I saw the SECURE Act, I said to myself, hold on to your wallets. And sure enough, they, they changed the rules. People have relied on these rules for decades. Clients that you probably had, you set up the rules and, okay, this is going to be the way it’s going to, no, it’s not. And you talk about the new rules and you talk about the book. Look at this. This is a program we did for financial advisors. Joe talked about the encyclopedia. This is one we just did, 400 page manual last week. And in the middle of the program, I was told, well, they just released the regulations, the rules you’re talking about.

And for some people that don’t know what regulations are, I know what people think they mean. They think they mean like, these are the rules, and technically they are. But the way tax law works, unfortunately, in this country, first you have to go through that, oh, Schoolhouse Rock video when a bill becomes a law. So it becomes a law. We have the SECURE Act. And the way it works is, especially in the tax area, Congress is so bad at writing these things. They’re smushed together at the last minute. Everybody throws in their stuff. You see, the last few tax laws were enacted December 20th, December 29th, you know, then they all run home for Christmas. So the law is so poorly written, it’s not even written in English. Some sentences run on for pages. Some don’t make sense at all. It goes from this side to that side. It goes on and on. Anyway, so the problem is nobody knows what they really mean. So IRS, in defense of them, they have the obligation of creating what we call regulations, which is their interpretation of what they think Congress meant. And that’s what we got recently. And sometimes that’s different than what we thought Congress meant. So another almost 300 pages of rules, 260 pages on the SECURE Act, another 36 pages on SECURE 2.0. The bottom line is, why is it so hard? Why do they make it so hard for people just to take money out of their retirement accounts?

How Golf and Football Are Like Retirement

Al: Yeah, I really like your analogy, Ed. You talk about playing golf. You know, the front 9 is saving. It’s hard enough and complicated enough. It’s nothing like the back 9 where you got to figure out how to withdraw this money without getting killed in taxes.

Ed: That’s right. Actually, yeah, that’s the analogy I always use in my book, but there’s a different one sometimes I use in live programs. I use a football game because it’s a similar thing. Many people understand in football, there’s a first half and a second half. And there’s an old saying in football, the score at halftime is irrelevant. Give me the score at the end of the game. And then I’ll tell you who won. So here’s the thing. This is why retirement is like a football game. Similar to what you said. The first half is all the building, working, saving, accumulation, and investing. But most people think when they get to halftime, they think, wow, I’ve saved all the money I’ll ever need for retirement. They pat themselves on the back. They go in at halftime and they think they’ve, the game’s over. Meanwhile, the IRS comes out, they’re playing the third and fourth quarter. They’re playing nobody. So they win. That’s where all the money is lost or made in the in the third or fourth quarter at the end of the game when you have to take the money out. Remember, it’s not a choice. You must take it out. And that’s when all of these rules we’re talking about it – These are complex rules, and it’s not only have the complexity. These are among the most complex rules in the tax code, the rules around how to get the money out. They’re not only among the most complex, but as you both know, going to the courses, a lot of them are irrevocable. You don’t get a lot of second chances. So you may only have one chance to get this right.

The Biggest Retirement Planning Mistake

Joe: What are some of the biggest mistakes in your career that you’ve seen individuals make in regards to their retirement savings and retirement planning?

Ed: Not playing in the second half of the game or the back 9. That’s the, you know, there’s another, you can make a million analogies. The other one that I’ve seen people use is, climbing up Mount Everest. You’ve probably seen that one, right? Yeah. Most the people that die, die on the way down. Not on the way up. They get up, they put the flag there. In fact, I think there’s a flag from our group there. Somebody put a flag with our- but this guy made it back. So don’t worry about that guy. It’s when they come down, they don’t have a plan, an exit plan. And most people don’t have an exit strategy for getting their money out of their IRAs and 401(k)s. Remember this money, and that’s probably the biggest mistake that people don’t realize, you know, I, I don’t understand it, but again, we’re in the middle of this, so maybe we don’t understand why they don’t understand, but I don’t understand how people don’t realize that their retirement account isn’t theirs. They think it’s their money, but what your IRA is, your IRA is an IOU to the IRS. Most people don’t realize so much of that goes right back to the government if you don’t have plans to have a strategy to get that money out. That’s the number one mistake. Thinking that you’re retired, and you have all the money you need, and you’re done. That’s just half time.

Joe: Yeah, that’s a really good point, because if you look at individuals that approach retirement, they’ll look at their retirement account. It’s $1,000,000, it’s $500,000, it’s $2,000,000, it doesn’t necessarily matter. But then they look at the balance, and they think that “hey, I have $2,000,000.”

Ed: Right.

Joe: You have something significantly less than that.

Ed: I remember a client years ago, when I was doing more client work as an accountant and Andi can relate, yeah, Al, I say Andi, I’m looking at you- Al can relate to that as a CPA, and I remember this guy coming in, and he was so happy, he says, look at this, he brought me his statement, his IRA statement, he says, look at this, I got $1,000,000 in my IRA, can you believe it? I said, what are you looking at? That’s not your money. That’s just temporarily on your letterhead. And he was shocked. I said, what do you mean? No, it’s my money. I saved it. You saved it, but you have a partner on that account. You know, what I tell people is your retirement account may as well be a joint account with Uncle Sam, because that’s essentially what it is.

Al: Yeah, I think sometimes we like to think of it, it’s like a mortgage, right? I mean, you, you’ve got a partner, you’re paying a partner as well, as well as yourself.

Ed: I say that all the time. It’s a mortgage. I say an IOU to the IRS, but it is like a mortgage. And people don’t realize how much of that can be owed back. And now with the new rules, they keep laying on these rules, not only during life, but after death, the beneficiaries are going to get clobbered with taxes.

The Value of Ed Slott’s Books

Joe: You know, you, the new book, The Retirement Savings Time Bomb Ticks Louder, the first edition was, when, when was the first edition done?

Ed: Over 20 years ago.

Joe: 20 years ago.

Ed: And I could do a new edition already. The rules change all the time. It’s not even fair.

Joe: But I think if, because I read the first one. And then if I, when I read this one, I think the concepts in what you’re teaching in regards to the overall planning hasn’t necessarily changed all that much. It’s just the rules and the technical things that people need to know to make sure that they can protect, you know, their overall assets is what the nuances is. But I think if people look at these retirement accounts as a, yeah, you definitely need to save, but then you also want to have the concept of tax diversification, making sure that you have money that’s never taxed versus that’s going to be forever taxed and just really understanding the rules and the laws so that you can keep more for yourself and less up for Uncle Sam. Just education I think is still the key factor here.

Ed: You know, you hit it perfect. That’s exactly what I say at every one of my seminars when I do a lot of consumer programs. I say you want to move your money from accounts that are forever taxed, tax-deferred to never taxed, tax-free. That’s the only safe place. But the reason I wrote this book again, and I said in the title, The Retirement Savings Time Bomb Ticks Louder. First of all, what is the retirement savings time bomb? It’s the tax building up, you know, even as the market goes up and people have seen their balances grow. They still don’t realize a lot of that is going to be lost to taxes because Uncle Sam is a partner on your account. And what do you do? You got to get rid of Uncle Sam. Ask anybody in business. If you got rid of your partner, wouldn’t you have more money? I’m just saying, you know, not that you got rid of your partner. You’d have more. So let’s, how do you get rid of your partner? You buy them out. And you can buy them out now for pennies on the dollar. Tax rates, what an opportunity, are at an all-time historic low. And there’s an urgency. So the reason I say that, you know, the retirement savings time bomb, that tax building up, like the mortgage, that’s- is eating away at your account and why it’s so urgent. I say it ticks louder because we already know in 2026 if nothing is done, taxes are supposed to go back up. That was a temporary deal. Now, I don’t know if they will because I don’t it doesn’t even matter who’s in office. Raising taxes is never popular. So, but even if rates don’t go up, if your balance continues to go up in retirement, they’ll push you even if the rates stay the same in retirement, your required minimum distributions could push you into a higher bracket anyway, so that the window is closing in. You have the rest of ‘24 and ‘25 to take advantage of these incredible low rates. Now, Al, you know this, people waste, you ask about what are some of the biggest mistakes? Wasting tax brackets. You know, when somebody tells me, Ed, I paid no taxes this year, I’m in the 0% bracket. You know what I say? I’m sorry to hear that. That means you didn’t use the 12%. You didn’t use the 22%. You didn’t use the 24%. You, you wasted a golden opportunity. You should be using these brackets every year, because if you don’t max them out, you lose them. You don’t get credit the following year. And every year that goes by that you don’t use these low brackets is a lost opportunity and it costs you money. So now is the time to strike. Plus, I worry another reason about the urgency. Again, maybe Congress won’t do anything about it. The, the, the debt is $34,000,000,000,000 or whatever it is now. It is like a phone number at this point anyway. Actually, it’s more than a phone number because, even with the area code and the one, it’s still more than that. So I worry about how we get, the whole country’s on a credit card. Who’s going to pay this off? And you know who is at most, at highest risk of getting hit with these higher taxes, because that would be the only way to pay it off, raise taxes. The people who are going to get caught in the soup, the people with the most money sitting in IRAs and 401(k)s, because that is untaxed money. It has not yet been taxed. So it’s like a big juicy steak to Congress.

The Problem With Tax Professionals: Short-Term Tax Planning

Al: Yeah, I think part of the problem is that a CPA, in general, CPAs as, as tax practitioners, they’ll look at one year at a time. Not two or 3 or 4 or 50 or whatever, right? And so they, they make the, they, they don’t want you to do a Roth conversion, which is taking money out of your IRA, 401(k), converting it to a Roth. Yes, you pay the tax, but then that future principal growth income is forever tax-free for you, your spouse, your beneficiaries, which is a pretty good deal, especially when we have low tax rates. But the CPAs are looking at one year, why would you pay more tax than this year than you need to?

Ed: Right. Yes. You’re preaching to the choir. I mean, you hit it perfectly. That’s- but it’s the CPA and I’m one and you’re one. So we could talk, but most CPAs is like we were trained. We would train from our first year in college. Never pay a tax before you have to. Always defer, defer, put it off, defer, right?

That’s the way hard, hardwired into that. In fact, if when you were a kid and your mother told you to do something and you said, not now ma, I’ll do it later, you would have been an accountant. Because you were trained to put things off. Well, as I told you earlier, over the years I’ve become, I’ve become a recovering accountant, because just like you said, Al, I see the long-term benefit of paying some tax now to have more later. You know, saving money, exactly what you said Al, saving money year to year just means, the bill is growing. I’ll give you a better example that maybe people can relate to. You get a $3000 credit card bill in the mail or something, right? It doesn’t say you owe $3640. It does somewhere. What’s the number you see? The minimum payment. It says, oh, you only have to pay $41. Well, that’s a deal. I thought I owed $3000. I pay the $41. I’m in, you know, I’m on, on easy street. But what happens? You find out in about 3 months at 27% interest rates or whatever it, they are on these cards, that maybe this paying the minimum was a bad, was a bad move. It’s the same thing we’re talking about here. Just taking out the minimum, the, the problem is growing. You can’t ignore that.

Joe: You know, it’s funny as, as I think about, as you’re telling these stories and analogies, it’s bringing me back to a client conversation that had several million dollars in a retirement account that was not going to be spent for her or her husband. And so it was 100% in equities and stock. And she’s like, hey, I really want to grow this to the next generation. It’s like, okay, well, if you continue to do that strategy, I, yeah, I agree. The investment philosophy is fine, but you need to put that into a Roth and do that, not necessarily in your IRA. Because the more accumulation that you have or whatever rate of return that you’re generating, all you’re doing is accumulating a higher tax bill because of the growth that’s in that account is all subject to income tax. And I think once people start realizing that correlation is like, all right, well here, does it make sense now to start moving some dollars into the Roth IRA and letting that compound, you know, at those higher expected returns if they want to take that risk.

“I Love Roths Because I Love Tax-Free”

Ed: I love Roths because I love tax-free, and I’m sure Al would say the same thing. Al, you’ve dealt with clients, right, as a tax advisor?

Al: Yep.

Ed: And I have too, and I’ve had, I’ve been saying the Roths since they came out. You know, I was all on the bandwagon for that. But as you know, when it first came out, nobody wanted to pay the tax. But I had, but I mentioned it to all the clients. But I had a few clients that actually listened to me. Did you have a few clients that actually listened to you?

Al: And I think that if I recall that first year, you could do a Roth conversion to pay the tax for 4 years. Yeah. Yeah. So people did that, but not too many, right?

Ed: Not too many. But the people that did over the years came back to me. Not one person ever came back to me and complained about paying the taxes upfront. Why? Because year after year, they saw just, you know, just like Joe was saying, they were looking at their statements now in a Roth. And when they realized, wow, this is all my money. I don’t have to share it with anybody. I have no partners. Uncle Sam is out. I bought him out. And they love it. And I did that too. I didn’t, I wasn’t able to do it myself until 2010. If you remember when the Roths first came out, if your income exceeded $100,000, you couldn’t convert. In 2010, as usual, Congress needed money, so they say, well, let’s do away with that rule. Maybe we’ll get, get some revenue in from people who want to convert. And they got a boatload of money in from people like me. I converted everything. I begged people, if you went to my seminars, I said, take that deal. That was the deal of the century. In fact, Al, you’ll like this. I remember speaking to the account group, AICPA, and I told them, you know, you should have taken the deal. This is years later. I took the deal. In 2010, I say to accountants until I said I converted everything and then I threw out to the group. I said I converted everything to a Roth. How much tax did I pay in 2010? And they said, well, you didn’t tell us the bracket, the rates. I said zero. I paid zero. Don’t you guys know that? That’s why I begged you to take that deal. I paid zero. That was the deal. Congress needed money so desperately. They said, anybody who converts in 2010, no tax, you can pay half of it in ‘11 and half in ‘12. In other words, they gave everybody an interest free loan to build a tax-free savings account. That was the deal of the century. In fact, I brought some numbers. When, when that happened, the market, and I didn’t know this about the market at that time, but the market, it closed at the end of 2010 about $11,000. It’s up around 4 times that now. All of that growth in my Roth and anybody who did it, all tax-free, don’t have to share it with anybody. Now, in fairness, I didn’t realize we’d have one of the great boom rushes, but look what happens. I mean, that’s why I say anybody who did the Roth, nobody regrets it that I know of. Do you find the same thing, Al?

What’s the Break-Even Point on a Roth Conversion?

Al: Yeah, I would say so too. I mean, we get the question all the time about tax brackets and breakeven point, which, when you look at accounts on a net of tax basis, the breakeven points stay one and there’s really is no breakeven point. But we get that question a lot, but the people that do the Roth IRAs are very happy that they did, especially as time goes on.

Ed: They watch their statements, and when you remind them, that’s, you keep 100% of that. You don’t have to share that with anybody. They still can’t even believe how good it is. Matter of fact, they’re so worried about how good it is, now they ask, will, you think Congress is going to kill this deal? It’s too good. I’m, my money’s just growing income tax-free. And even after the SECURE Act, we talked about, it’s 10 years more tax-free after death to the beneficiaries, income tax-free. I mean, it’s just all piling up, all for you, and none for Uncle Sam.

Can We Trust That Roth IRAs Will Always Be Tax-Free?

ed: So, do you get that question a lot? Basically the question is this, “Ed, can I trust the government that they’ll keep their word that Roth IRAs will always be tax-free?”

Al: We get that question, and I would ask it right back to you. What do you say?

Ed: Oh, my answer to that question when it’s asked like that is always, no, you cannot trust the government as far as you could throw them. We have a saying, you may have heard it Al in, among CPAs, tax laws are written in pencil.

Al: Right. That sounds right.

Ed: But, cause they’re always changing. Like here, we see all changes and everything, but what people don’t realize, and I’m going to give you a secret here. And you know what Benjamin Franklin said about secrets. Three people can keep a secret if two of them are dead. But I’m going to give you a secret now. Congress, they love, I mean love, love, addicted, love, Roth IRAs. Why? Because lucky for us, they’re the worst financial planners on earth. They’re so short sighted, they only see the revenue coming in up front. They don’t think that ever costs anything. So they love Roths because the only money that can get into a Roth is already taxed money. So that started when the floodgates opened, like I just talked about in 2010, and they saw all this revenue come in. They couldn’t believe it. So over time, as you saw, they enhanced the Roth, the Roth 401(k), and recently with SECURE 2.0, they went all in on Roth. I call it Rothamania. They said, oh, let’s have SEP Roth IRAs, simple Roth IRAs, matching contributions to a Roth 401(k), catch up contributions to a Roth 401(k). Let’s mandate it. 529 rollovers to Roth IRA. We want everything. Roth, Roth, Roth. It brings in money. That’s the way they look at it. Lucky for us, we should take advantage of that short sightedness, because they only work in budget cycles, so they only see the money coming in up front. We just have to be safe is my point. I think, you know, I don’t think they’re going to kill the golden goose. They may trim around the edges, but if they go too far and kill the golden goose, there goes their revenue.

Al: Well, I think you bring up a good point because our politicians are always focused on the right what’s in front of them, the fiscal year or two or 3 or 4 that are right in front of them. Maybe not 20, 30 years down the road.

Andi: Just want to jump in here real quick to say thank you to everyone who has completed the 7th Annual YMYW Podcast Survey so far! We appreciate all your great ideas to help make Your Money, Your Wealth your top personal finance podcast. A few people have said “Bring back guest interviews,” so hopefully you’re enjoying this chat with Ed Slott, CPA. If you haven’t had your say yet, you have until August 30th to complete the survey! Answer 18 questions about the Your Money, Your Wealth® podcast and you’ll be in the running to win a $100 Amazon e-gift card. Click the link in the description of today’s episode in your podcast app to go to the show notes and access the survey and the secret password. US residents only, no purchase necessary, survey and giveaway close and winner chosen at 12pm Pacific time on August 30th, 2024. Now let’s hear more with the IRA Guru Ed Slott, CPA:

SECURE Act: Stretch IRA Changes

Al: Let’s talk briefly about SECURE Act 2.0, stretch IRA for most people is no longer available. And why does that make Roths even more important?

Ed: Well, the Roth is important because like I said, it’s growing income tax-free. So what they did actually in the original SECURE Act and which was in effect in 2020, before that, remember I said they upended the tax planning we were all telling our clients to do and that was, you know, for 20 years, people relied on that. Something called the stretch IRA, which is no more for most people. That was the ability of people to, for people to leave their IRA to their children or grandchildren, and they could stretch out or extend distributions, deferring the tax based on their age, for 20, 30, 50, 70 years, if you had a 10-year-old beneficiary. And that was a great system. But for some reason, Congress didn’t like it anymore. So in the SECURE Act, they eliminated it and replaced it with a 10-year rule. They said, nope, we want all our money in 10 years. That’s it. So what they did, all they did, is incentivize people like us, that are educating other people, to help people do the better planning they should have been doing all along. So they, in essence, they, not in essence, they downgraded IRAs as a wealth transfer or a state planning vehicle, which is exactly what they want. They said, so IRAs shouldn’t be a wealth transfer. You know, it shouldn’t go out to kids and grandkids for 50 years. We want to put an end to that. So we’re ending it. All right. So now we know IRAs are a lousy asset, actually a horrible asset to leave to the next generation. So now we’re forced to look for better solutions, Roth IRAs, even life insurance, anything tax-free, charitable planning, anything to get this money out at today’s low rates.

Naming a Trust as Beneficiary of Your Retirement Account: Good Idea?

Joe: A couple questions that we get. What about naming a trust as the beneficiary of your retirement account? Good idea or bad idea?

Ed: It was before the SECURE Act, but the SECURE Act destroyed, I mean, two words, not good. That’s what I wrote in my book, two words, not good. I’m not saying don’t name a trust. But because of the 10-year rule now, the whole point of naming a trust, what I actually, what I say in my book and in all my seminars, because people don’t even really understand why should you name a trust? I always tell people, why, why are you naming a trust if they would come in here? And I would say, and the first two reasons you give me don’t count. Because the first reason would be the attorney said so well, that doesn’t tell me why you should do it. So then the next reason is well, to save taxes. No, in fact, trust taxes are much higher. It will cost you more. I’m looking for another reason. And the only reason you would name a trust for any asset, including an IRA comes down to 1 word. Control. You want control because you don’t want your kids blowing or squandering the money. So my answer when people ask, should I name a trust or when do you name a trust as a beneficiary? When you don’t trust, because if you trusted them, you wouldn’t need a trust. So they should have called it a don’t trust. That’s when you need a trust. When you don’t trust. But what if you don’t trust. I had clients come in many times. I remember this one guy came in. He had I think it was $3,000,000 in his IRA. He was a regular worker. He was shocked. He came in, he was retiring and he says Ed, I can’t believe it. I don’t know how this even happened. You know, I worked at this big company for 40 years. My 401(k), I rolled. I got $3,000,000 in this IRA and I don’t even need it. And I want to leave it to my kids. This was the years that we had the stretch IRA. And he says, I want to leave it to them, my kids, but I don’t want them blowing it. I worked too hard for this money. So those are the kind of people that worry about the kids blowing it. Well now, so he would have been a good candidate for a trust and we did that back then. We said name a trust because the trust could just pay out these little distributions. You could get the stretch IRA then through a trust. So little minor distributions for 30, 40, 50 years while the whole account was accumulating, growing. And it was protected for the beneficiaries and from them, the clients were always worried. Will my kids blow it? Because, you know, I have a rule, which you probably agree with. No one is as careful with their money as the one who earned it. Not the beneficiaries, certainly, and that’s what they’re worried about. They would always say, well, what if my kids get in trouble? They make mistakes, they squander it, addiction problems, marriage, divorce, bankruptcy, lawsuits. The number one concern they would have, they would always tell me some version of this, they would say, it’s not my kids I worry about, it’s the ones they marry. And that is a real concern for some people. They don’t want, especially if the kids aren’t even married yet, they don’t want all their money going in a divorce to somebody they don’t even know. These are reasons to name a trust, but it doesn’t work anymore because of the SECURE Act. Not leaving an IRA to a trust, because if you want control, remember after 10 years, all of that money has to pour out into the trust. And the only way you can control it is by keeping it, having the trust retain it. But if the trust retains it, you pay tax or the trust pays tax at the highest rates in the land, trust tax rates. So I ask clients, I say, all right, so you’re so worried about the kids blowing it, you’re going to give half of it to the IRS just to protect it so the kids don’t blow it. That doesn’t make any sense. So if you need to have a trust because you’re worried about control, don’t leave an IRA to the trust. Leave a Roth IRA to the trust. It eliminates the trust tax problem. Pay the tax now. Excuse me. Or do the same thing with life insurance. Permanent life insurance. Take down the money from the IRA and I don’t even sell life insurance. I’m a tax advisor. I don’t sell stocks, bonds, funds, insurance, annuities, as you guys know, from my programs. But in case people don’t know and I mentioned life insurance, oh the horror, permanent life insurance, you know not term insurance. So it pays to get money out again. Same theme at these lower rates. These rates are historically low. Get it out while rates are low. And pay the tax and then put the money into life insurance and leave the life insurance to the trust. It gets you the control you want. And it’s the most flexible asset to leave to a trust because you don’t have any of these complicated tax rules You don’t have the RMDs. Who are the beneficiaries? Does the trust qualify? Oh, and there’s no tax. So that’s a big deal.

Unnecessary and Excessive Taxes: Why Ed Slott Became the IRA Expert

Joe: Ed, why did you pick IRAs to be the world’s expert? Tell me the back story here.

Ed: Alright, it’s a long story, but I’ll try and shorten it up. As probably, Al has a similar story. Al, you had regular tax clients? You did tax returns and business accounts?

Al: I did.

Ed: Yes, that’s what I had. So I would talk to people and I was doing, I realized long ago, even in my 20s, that this is a fool’s errand that not to put down anybody who does that. But, in my early years of doing in my, when I first went into my own practice, this thing was happening. I would, the clients would come in, they’d be sitting at this desk, they’d been in this place for 40 years, 40, yeah, 40, over 40 years already. And they’d come in and I’d look at their stuff and right away I was the bearer of bad news. I would say, looking at them, sitting right there saying, oh, you know what you could have done? Too bad, you should have done this. This whole what I could have, should have, giving all the bad news. I said, what am I doing? And then next year, the same thing. You know, unfortunately, a lot of CPAs that just do tax preparation are really just history teachers. We tell you what already happened. We’re looking backward. You can’t change anything. So I just give them the bad news and it hit me then. I should be looking ahead. There’s a big difference between doing tax planning and tax preparation, helping people do their taxes. That’s like just filling out the forms. The cards are already in. The facts, you can’t change anything. In fact, lots of times around tax season, a lot of the media, they want to do interviews around tax season. And they always ask the same question. I always answer it the same way. They say, Oh, Ed, what can people do now to save taxes? I said, Oh, here’s an answer. Nothing! That book is closed. What are you going to do now? Without a time machine, you can’t go back and change anything.

So, at that point, I started going proactively. I said, what can I do to really save people money? And I picked up, actually this book, which still reminds me what a good choice I made. These two books from 1980, Estate Planning After the Reagan Tax Cut and Building an Estate Planning Practice. In 1981, this tax act, and I’ve gone through these books and I keep them there as a reminder that was a good decision to be more of a tax planner an estate tax planner. Cause I said, Okay. Where can I increase my value and do the better job rather than tell everybody what they should have done? Who wants to hear that? Which people still do, the average tax preparer. Oh, you missed that one. Oh, thanks for telling me now. So I realized there would be big value if I could save them a- not a, you know, $300 contribution deduction, but maybe $300,000 in taxes or $1,000,000 over their lifetime with estate planning and tax planning looking ahead. So that’s what I did. I went out and this is obviously in the 80s before the internet and all of that. So I used to advertise in the local papers and I was doing these estate planning seminars and, so I was getting clients, but, you know, back then, by the way, we don’t realize how good we have it now, you know, today, the estate exemption, the federal exemption is over $13,000,000 a person. That’s insane. Back then it was, it was, the biggest deal was when it went to $600,000 and they thought that was fantastic and even then though, if you had a house and an IRA or a 401(k), then most people didn’t have 401(k)s and they were just starting. But if you had an IRA, you are subject to possibly a 55% estate tax plus income tax. You could lose 70%, 80% of your money. So I said to myself, this is an area to get into. I could save people a fortune in taxes, more than they’d ever make in the market. And then it hit me. So I was looking, what’s the angle here?

It hit me in 1986. We had the Tax Reform Act of ‘86, a watershed event, a giant. It was so big. Al, you may remember this, but to, to show you how big it was, they renamed the tax code to the tax, the Internal Revenue Code of 1986. To show you how big it was, the former name was the Internal Revenue Code of 1954. That’s how big this was, and when IRS finally wrote the regulations, like they’re still doing now for all these rules, that’s where we had all these IRA rules. And I was a member of my state society of CPAs doing seminars because it always helped me learn about it and meet people. And these rules came out, pages of rules. And I was working with somebody, another CPA, to prepare a seminar to teach accountants about the new rules. And I remember him saying to me, look at all these rules on just how to get money out of an IRA. They’re so complicated that nobody’s going to ever understand them. And they have, they’re going to affect everyone. That was my epiphany. I said, wait a minute, it’s complicated and they’re going to affect everyone. So I made a bold prediction then in my early 30s then. And I said to myself, you know what, this could be something because I predict in 30 years, anybody still alive will be 30 years older. I was bold. I was out there. I know.

Al: And I think you got that one right.

Ed: Yeah. All these accounts started blowing up and people needed this area as a specialty, didn’t even exist. There was no specialization and IRA tax plan didn’t exist, but it’s a big deal now. But you know what? It’s still not widely known by most professionals and most accountants and the balances are much higher. So there’s much more risk now and people need to have advisors and tax planners that address this or they’re going to lose a ton of their money to unnecessary and excessive taxes. So that’s how I got into it, you know by doing the seminars and realizing this is a market that didn’t have a name yet.

How Much Money Can You Save in Taxes With Good Tax Planning?

Joe: Someone reads the book, how much money do you think that they could save in taxes over their lifetime?

Ed: A hundred- depending on their balances, obviously, but hundreds of thousands or millions, you know, people say, look at the market every day. Well, don’t look today, but look at the market every day. and they say, oh, I made $10,000. I made $20,000. I made $100,000. You can make millions in good tax planning. Most people don’t see it. They don’t think it’s much, but that’s money that you would otherwise lose. If somebody told you you’re going to lose $1,000,000, unless you do that. They would probably do something, do some of the good planning I talk about in my book, and I’m sure you mention all the time on your program, because we seem to be saying the same thing, they could save a fortune in taxes and that’s more money that they can use in retirement and will go to their beneficiaries and if you do it right, all tax-free.

So this whole thing that we’re talking about comes down to one big giant bet. And the bet is, do you think future tax rates will go up? And I think the answer is yes. You know, I asked a group, Al, this same question. I always ask advisors and consumers. I always ask them, do you think taxes will go up? And about half the room raises their hands. And then I ask this question. All right, I get that. How many of you think taxes will go down? Nobody raised their, raises their hands. And then I say to them, but that’s the same question I just asked you! If they’re not going down, they’re not going to go up, but even if they stay, I mean, you know, this is higher math, you know, but that’s the whole bet. If you think future taxes are going to go up, the Roth bet or getting the money out of the IRA and putting it into other tax-free vehicles or even doing charitable planning, that will pay off big time for you and your beneficiaries.

Al: Yeah, when you think about it, you think about all the, all the taxes you pay in retirement, pulling the money out of the accounts, extra income, extra adjusted gross income causes all kinds of extra income on Social Security, on real estate earnings, on and on and on. Then you add in, you pass away. Now the marriage penalty because now you’re on the survivors on the single brackets, and now you when they the survivor passes away, the kids have to take the money out in 10 years, many times in their high earning years, and then if the estate tax deduction becomes a lot less as planned in 2026, that there’s all kinds of reasons to do this right now for the next two years, while we know tax rates are lower.

Ed: Yeah, you got to take advantage of low tax rates. In fact, in my book on page 28, I give the history of tax rates from the 16th amendment 1913 when our current system started till right now 2024. The reason I do that is because some people, most people, look, nobody wants to pay taxes before they have to. Everybody, you know, everybody hates taxes, but you can use these rates to your advantage. So many people don’t realize that these are the good old days. So I put that chart in there and a lot of the- and I highlight in the chart the years people like me and maybe some of most, most of the people who are worried about this, the baby boomers, they seem to have the most money now in IRAs. The years, the baby boomers were born, 1946 through 1964. And I remind people by showing them that chart. I do it in seminars too, that the top federal tax rate for 1946 through 1964, the top federal tax rate for each of those years exceeded 90%, that’s 9-0. You’re not hearing me wrong, exceeded 90%. Except for the last year, 1964, when they dropped the top rate down all the way down to only 77%. And they tell me, I don’t know, because I was 10 years old then watching the Beatles on Ed Sullivan, but they tell me when they dropped the rate down to only 77%, the whole country did a happy dance, because it was only 77%. Well now, that’s more than double today’s top tax rate. So you need to take advantage of the opportunity of a lifetime to bring down these IRA balances. If anything, Congress, with the SECURE Act, the Insecure Act, I should say, encouraged us to trim these balances now. Get them out at the low rates and build up in tax-free vehicles to protect against the uncertainty of what future higher tax rates could do to your standard of living in retirement.

Joe: Yeah, I think it gives people a lot more flexibility.

What About People WhoDon’t Have the Money to Pay the Tax on a Roth Conversion?

Joe: What do you think about people that don’t necessarily have the money to pay the tax? Would you ever recommend someone paying tax out of the IRA to do a conversion?

Ed: Oh generally not and remember a lot of things I’m saying are for people with larger balances. If you have the money to pay the tax, maybe you’re not in a big tax situation. It’s not for everybody. But the more you have in your IRA, the more is at risk. That’s why I said earlier the people at the highest risk are the people that save the most for retirement. It’s always that way with tax law, you know, it always seems to come down that our tax system is a penalty on savers.

Ed Slott’s PBS Specials on Retirement

Joe: When’s the next PBS special?

Ed: I don’t know. We’re still working on that. I did that for 15 years, but I’m happy to say that over 15 years, they tell me my show, which is the same theme. I, you know, I feel like I did the same show 15 times, you know, just saying different things, updating it for laws. But it was the same thing we’re talking about now, you know, get this money out, build tax-free, keep more of your hard-earned money, save a fortune in taxes. But they tell me over the 15 years, my show is, in the top 5 pledge drive shows of all shows of all time. And I mean all shows, you know, more than the big fancy concerts and all of that they have on there. Now it doesn’t mean, I’m not saying that the show is great. What they judge, I shouldn’t even say this on here, but what they judge as a top show is one that brings in the most donations. So I could be juggling on there, if it brings in a lot of money they say, that’s a top show. (Laughter) But it realized, what they realized, this resonated with people that have saved for retirement and feel like they’re double crossed now.

Joe: You know, Al and I used to do some large tax seminars. so we would get several hundred people. I think the biggest one was probably 500 people. And then, Ed, you were my motivation. So I would watch the PBS special the night before. And then I would watch it in the morning as I’m eating breakfast. Before I go on stage, I would steal all your jokes. So I was, yeah, I was living vicariously through, through Ed Slott, for many presentations that we did.

Ed: You can take all the jokes. I’m like Doritos. I’ll make more.

Al: Well, thank you so much, Ed, for joining us today. It’s been, just so nice. I mean, we have admired you forever and now a new book and going over the SECURE Act 2.0, which I must say is one of the more complicated Acts, but they’re all complicated, every single one of them. And just like you say, I mean, the last one, it took 4 and a half years to get the, the regulations out.

Ed: I know, it’s crazy, but you guys are doing a great job. Just talking with, just with this conversation. Imagine how many people must be thinking, “You know what? I’ve got to do something about this.” I hope so.

Joe: Yeah, we used to give your book out. And there was like mayhem, people were rushing to the, to the desk to get Ed Slott’s book. And now, Andi, where did they get this? And are we giving these away? What’s, what’s the giveaway? What are we doing?

How to Get a Free Copy of Ed Slott’s Book, The Retirement Savings Time-Bomb Ticks Louder

Andi: The new book is called, The Retirement Savings Time Bomb Ticks Louder, How to Avoid Unnecessary Tax Landmines, Defuse the Latest Threats to Your Retirement Savings, and Ignite Your Financial Freedom. We have a VERY limited supply available for FREE for Your Money, Your Wealth® listeners. Here’s what you need to do: schedule a free financial assessment with one of the experienced professionals on Joe and Big Al’s team here at Pure Financial Advisors. After a comprehensive review of your entire financial picture, we’ll send you a copy of Ed Slott’s new book for free! We’ve only got 50 copies, so schedule your financial assessment ASAP by clicking the free assessment link in the description of today’s episode in your favorite podcast app. When you have your assessment, don’t forget to request your free book! 10 randomly selected listeners will receive a copy signed by Ed Slott! US residents only. Click the free financial assessment link, schedule yours, and get a copy of The Retirement Savings Time Bomb Ticks Louder, courtesy of Your Money, Your Wealth!

Joe: Ed, such a pleasure. Thank you so much.

Ed: This flew by. This was fantastic. You know, like I said, you’re preaching to the choir. You’re doing great. You know, for all the people that listen to you. The thing is, I hope they listen.

Joe; I doubt it. I think my mom will listen.

Ed: Yeah, my mom doesn’t listen anymore. So we’re down to one listener, I think.

Ed: All right. Thanks, everybody. It’s an honor to be on this show. I appreciate it.

Andi: Thank you so much, Ed.

Joe: Thanks, Ed.

Al: Thanks, Ed.

Andi: Visit IRAHelp.com to learn more about Ed Slott, CPA, and to buy your own copy of The Retirement Savings Time Bomb Ticks Louder.

Help us grow YMYW: leave your honest reviews and ratings for Your Money, Your Wealth in Apple Podcasts, and all the other apps that accept them. And, we’re making the entire Your Money, Your Wealth® back catalog available on YouTube for the first time, so if you love to binge, and you want to hear what we were doing on the show way back in 2017 and earlier, why not subscribe to our YouTube channel, turn on notifications, and leave a comment or two! You’ll also find the video of this entire interview on our YouTube channel.

Your Money, Your Wealth is presented by Pure Financial Advisors, a registered investment advisor. This show does not intend to provide personalized investment advice through this podcast and does not represent that the securities or services discussed are suitable for any investor. As rules and regulations change, podcast content may become outdated. Investors are advised not to rely on any information contained in the podcast in the process of making a full and informed investment decision.

_______

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed

YouTube Music

IMPORTANT DISCLOSURES:

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

• Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, LLC, a Registered Investment Advisor.

• Pure Financial Advisors LLC does not offer tax or legal advice. Consult with your tax advisor or attorney regarding specific situations.

• Opinions expressed are not intended as investment advice or to predict future performance.

• Past performance does not guarantee future results.

• Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

• All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. As rules and regulations change, content may become outdated.

• Intended for educational purposes only and are not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors.

CFP® – The CERTIFIED FINANCIAL PLANNER™ certification is by the Certified Financial Planner Board of Standards, Inc. To attain the right to use the CFP® designation, an individual must satisfactorily fulfill education, experience and ethics requirements as well as pass a comprehensive exam. Thirty hours of continuing education is required every two years to maintain the designation.

AIF® – Accredited Investment Fiduciary designation is administered by the Center for Fiduciary Studies fi360. To receive the AIF Designation, an individual must meet prerequisite criteria, complete a training program, and pass a comprehensive examination. Six hours of continuing education is required annually to maintain the designation.

CPA – Certified Public Accountant is a license set by the American Institute of Certified Public Accountants and administered by the National Association of State Boards of Accountancy. Eligibility to sit for the Uniform CPA Exam is determined by individual State Boards of Accountancy. Typically, the requirement is a U.S. bachelor’s degree which includes a minimum number of qualifying credit hours in accounting and business administration with an additional one-year study. All CPA candidates must pass the Uniform CPA Examination to qualify for a CPA certificate and license (i.e., permit to practice) to practice public accounting. CPAs are required to take continuing education courses to renew their license, and most states require CPAs to complete an ethics course during every renewal period.