Many people envision the beach, a cabin, or a cruise ship when they think of retirement. For some, that cruise ship turns into the Titanic! Learn from Joe Anderson, CFP® and Big Al Clopine, CPA the financial, social, and physical solutions that will help you confront retirement’s biggest challenges.

Download your Retirement Readiness Guide for free:

Important Points:

- 00:00 – Intro

- – The Four Hard Truths of Retirement

- – Financial Truths and Solutions

- Market Volatility

- Inflation

- Unpredictable Expenses

- Insufficient Social Security Benefits

- Taxes

- 06:13 – Download the Retirement Readiness Guide for Free

- True/False: The cheapest state to retire in is Texas

- 01:46 – Financial Truths and Solutions

- Homeownership Costs

- 08:34 – Health Truths and Solutions

-

- Longevity

- Health Issues

- Long-Term Care

- Medicare

-

- 11:36 – Download the Retirement Readiness Guide for Free

- True/False: Seniors aged 65 and over spend over four hours a day, on average, watching TV

- 12:55 – Less Energy: Truths and Solutions

- Boredom

- Identity Crisis

- Loneliness

- 15:30 – Find Your Purpose

- Viewer questions: What’s a reasonable balance of stocks to bonds in retirement to keep up with inflation?

- Viewer questions: I’m collecting Social Security now, if I work part-time will that reduce my benefit?

- Download the Retirement Readiness Guide for Free

Subscribe to Your Money, Your Wealth® on YouTube!

Transcript:

(NOTE: Transcriptions are an approximation and may not be entirely correct)

Joe: When you think about retirement, what do you think of? A lot of times people think about the beach or maybe in a cabin, or how about that cruise ship? But for some, that cruise ship turns into that Titanic. We’re talking hard truths today on your money or wealth. So welcome and sit back and learn how to confront them.

I’m Joe Anderson, president of Pure Financial Advisors sitting with Big Al Clopine. He is sitting right over there.

Al: Good morning Joe. I’m getting ready for retirement.

Joe: Alright.

Al: Gotta wear the vest, get rid of that suit.

Joe: We’re gonna confront some hard truths here.

Al: I think so.

Joe: There’s hard truths and then there’s solutions.

Al: Yes,

Joe: as long as we know the solutions, we can help you out. Look at this stat folks, almost half of people as they get into retirement, it’s like, wow, this is harder than I thought. I thought retirement was gonna be rainbows. But for some it’s not. There’s hard truths that we gotta confront. That’s today’s financial focus. Life is less enjoyable. Oh, we’re just talking all great things here this morning, but here’s the hard truth. Financially, I’m not working anymore. I’m on a fixed income. When my father or my uncle retired, he is like, Joe, I’m on a fixed income. So they’re always thinking about their finances. How about health? As we age, of course we’re going to have health issues at some point. Less energy. Wow. I’m just sitting around watching tv. We gotta get out. And then also connecting. We need to make sure that we’re still connected. Al Let’s kind of get through these and help people confront ’em.

Al: Okay? Retirement hard truth.

All right, here’s what we’re gonna talk about. Finances. Gotta get them under control. You gotta be healthy, right? And we gotta have social circles. So Joe, let’s get into the hard truth.

Financial Truths and Solutions

Joe: Alright, we’re talking hard truth market volatility. S and P 500 has dropped 10% or more in almost half the year since 1980, Big Al. How do we confront that?

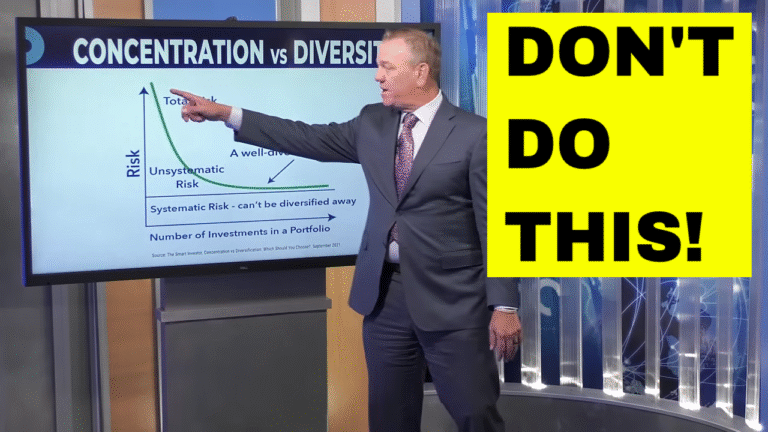

Al: and it’s kind of surprising, but the market does that. It’s not unusual. So what do we do? We diversify globally, diversified, low cost, ETFs, investments. We also have an emergency fund, and then we rebalance as appropriate.

Joe: You think inflation stuff when you’re working, when you get that paycheck every year, A lot of us get a cost of living adjustment when we receive our paycheck, but when you’re retired, you have to look at inflation.

And inflation kind of hits us even harder because the cost of goods and services are going to continue to increase. So a hundred thousand dollars in 25 years. At 2% is gonna be $164,000. That’s, it’s almost doubled here. 3%, 2 0 9 4%, 2 67. So that compounding of inflation now, it just erodes the purchase power of the dollar.

Al: And when you’re on a fixed income, you gotta combat it. you do. And I think that’s one of the things that people forget most when they talk about retirement planning. So you gotta budget. For inflation, you gotta figure it at an inflation rate because if you’re spending a hundred thousand dollars today, it’s gonna be something different and tomorrow, and then you gotta inflate your savings to cover that. Increased cost as well.

Joe: Things always happen in life. There’s always things that are unpredictable. Home repairs, that air conditioning goes out. We’re in summertime. It’s a hundred degrees out here. Boom. Air goes out. I guess you could still live, but it much more comfortable with a little air conditioning, loss of spouse, dead on interest. Adult children, they’re coming back into the house. Oh my goodness. So there’s always things that could come in, disrupt your overall retirement strategy.

Al: It’s true. And boy, that adult children, I mean the baby boomers, maybe we were a little soft on our kids and some of us are still paying phone bills and the like. So, you gotta make sure you cover that too.

Joe: Talking from experience there, bud.

Al: A little experience.

Joe: Got it. Alright. Here’s the hard truth. Social Security, average Social security is about $2,000 a month. Might not cover all your expenses bud.

Al: It may not be enough. And so what do you do? Social Security, we know we can take it from anywhere between age 62 and age 70. If you need the cash at age 62 and you’re not working, take it. It’s easy, but if you don’t necessarily need the cash right away, look at a break even analysis maybe, which is usually around age 80. How’s your health? But consider your spouse too because of spousal benefits and survivor benefits.

Joe: Alright, taxes. Here’s another hard truth. A lot of times people will think they’ll be in a lower tax bracket once they hit retirement, but that may be true for some, but not all. Let me explain what I’m talking about here. As you look at these different pools of money, you got tax free and you got taxable and you got tax deferred.

What does all this stuff mean? Tax deferred accounts, that’s your IRA and 401k, 403(b), TSP, SEP simple, Keough, whatever pre-tax, you get a nice tax deduction going in, gross tax deferred, but what? When you pull those dollars out to spend, you’re taxed on it. So understand what taxes are going to be on your distribution.

So for years, people thought I’ll be in a lower tax bracket in retirement. That’s true for most, but not for you. Potentially. If all of your money is sitting in a tax deferred account and you wanna replicate your paycheck because this is taxed, just like my paycheck is, it’s ordinary income. So if I’m pulling a hundred thousand dollars out.

I am taxed at ordinary income rates at that a hundred thousand. If I pull a hundred thousand dollars, let’s say, from my Roth IRA, it’s 0% tax. If I have a taxable account or brokerage, it’s favored from a capital gains rate. So understanding the tax on your investments is key.

Al: So what do we do? There’s a lot to do there in terms of figuring out what your taxes are gonna be, but then also consider you may not have withholding anymore, so you may have to make estimated payments, right? And then age 73 or age 75, for some of you, that’s when your required mineral distributions kick in. You gotta make those payments. Otherwise there’s big penalties. But consider this. You retire, maybe your income is a little bit lower for a while before Social Security. Why not do some Roth conversions?

Take money outta your retirement account, convert it to a Roth, pay the tax on it, but all future income growth principle is tax free.

Joe: Are you ready for retirement? Go to YourMoneyYourWealth.com. Click on that free guide this week. It’s our retirement readiness guide. There’s a lot of things that you need to be prepared when you approach retirement. There’s hard truths. Retirement sometimes is not as rosy as we wanna paint those pictures, right? So you wanna make sure that you’re happy, get ready for retirement. It’s not always about the dollars and cents. It’s about your mental and social wellbeing. That’s what we’re gonna talk about when we get back. So don’t go anywhere.

Joe: Hey, we’re talking about the cold hard truths of retirement. Go to YourMoneyYourWealth.com. Click on that Retirement Readiness Guide. It’s absolutely free. You can download it right there on your computer. No cost, no obligation. Just get the retirement readiness guide. It will help you get ready for retirement. Go to YourMoneyYourWealth.com. Click on that special offer this week.

Now let’s see how you did on that true false question.

Al: The cheapest state to retire in is Texas. True or false? A lot of us think it is Texas because there’s no state taxes, but that doesn’t turn out to be true when you consider. Other kinds of taxes like property taxes and sales taxes, cost of living, right? Insurance. A cost of food. it’s not the most inexpensive state.

In fact, Joe, it’s actually West Virginia.

Joe: West Virginia Mountain Mama.

Al: Yeah. Six 50.

Joe: Six 50. Still a lot. 1.5 in California. And that’s the state we live. And I’m, I guess I’m moving to West Virginia. What, six 50? What’s the average balance of someone’s retirement account? It’s significantly less than that. It’s a lot less than that.

So where, are we going? That’s why we’re doing this show. Got it. That’s a hard truth right there, folks. Alright, let’s get back into it. Home ownership, hard truth. Even if mortgage is paid off, right? Everyone likes to have that debt paid off. When they approach retirement, there’s still costs. Property tax, home maintenance, insurance.

How do we confront that?

Al: you gotta budget for this, right? You pay up their mortgage, you think you’re done. No, you’re not done. You got all kinds of other costs. So make sure you budgeted for that, you’re saving for that, and then, you know, take a look at your home. Maybe you don’t need as much space as you have.

Maybe you consider downsizing, right? Maybe you relocate. Maybe you take some of that excess money and use that for what you want to do in retirement, like travel, longevity,

Health: Truths and Solutions

Joe: hard truth. It’s a good hard truth though for some, if you make it a 65, right? Life expectancy is 85. You got 20 more years to live. If you make it to 75, you’re gonna get to 87.

You make it to 85, you’re going to 92. So longevity, the good and the bad. The good is we’re living longer. The bad is we’re

Al: living longer, so we gotta plan longer, right? And of course, this is the average, right? Some people don’t make it that far. Other people live longer. So you actually have to plan for a little bit longer than these ages.

Joe: Health issues. Guess what? 92% of us, only 8% is not gonna have some sort of issue. We’re gonna have to face something. It could be minor, it could be major, but just understand this is a hard truth. We gotta be prepared.

Al: Yeah. So what do we do? I think we already know, right? We gotta exercise more. We all know that.

Let’s just get up and do it though. We gotta eat better. We gotta eat proper, not so many processed foods, not so much fast food. And then let’s stay educated as we learn more about proper foods and exercise so we can keep up to date. It’s hard though. It is

Joe: hard. Yeah. You get a little bit older.

Those love handles are so hard to get rid of. They’re so easy to put on. are you speaking from experience? I am speaking from experience. Yeah. it’s tough. It’s like over the weekend you gain three pounds. It takes you six weeks to get the three pounds off.

Al: Seems to be true, right? Yeah.

Joe: It’s just like this cycle, but you gotta continue to do it. Alright. What’s another hard truth? Long-term care. 70%. that’s better than 92%, but 70% of us we’re going to need some sort of long-term care. Again, it could be pretty minor or it could be a very long time, really depending on what happens to us.

So we gotta confront.

Al: Yeah, so to confront it. And I will say right off the bat, long-term care may just be a few days. We’re not necessarily talking, everyone needs years and years of it, but look at whether you need long-term care insurance. Maybe you already have it. you can have in-home care, of course, assisted living.

You gotta figure out how to pay for that somehow.

Joe: Alright, let’s talk Medicare. All right, part A is free. You, we’ve already paid through it through, our payroll tax, but part B does cost us something. So estimated monthly premium for Part B is 185. So this adjusts depending on how much income that you have, but just understand that there is a cost for Medicare Part B.

Al: Yeah. And I think a lot of people forget that the health insurance part, you will be paying for that. And it doesn’t necessarily cover everything. You got premiums, you got deductibles, you got go copays.

Joe: Yeah. And they also don’t cover hearing aids. My mother, she just got hearing aids and they are quite expensive.

Dental care, physical

Al: exams, eye exams. I will say, based upon my mom’s life, it’s more so each year you get older, there’s more and more doctor’s appointments. So what do you do? research the plans right? So get a, supplemental, a Medigap plan, or maybe you go Medicare, C, which replaces A, B, and D.

So consider the best way to do this for you.

Joe: You wanna get educated, go to YourMoneyYourWealth.com. Click on that special offer. It’s our retirement readiness guide. If you are not ready for retirement, this will help you get ready. It’s a great guide that will walk you through everything that you need to know to get ready for retirement your money, or wealth.com.

Click on that special offer. It’s free of charge. You can just download it right there. Start reading and get ready when we get back. A lot of other things to consider as you approach retirement. It’s the hard truth we’re talking about folks don’t go anywhere.

Hey, welcome back. We’re talking about the hard truths about retirement. Retirement’s great. It’s a good goal. but you have to understand that everything is not rainbow and roses. There are some hard truths that you gotta confront. Before we confront anymore, let’s see how you did in the true false

Al: question. Seniors aged 65 and over, spent over four hours a day on average watching tv. True or false? Joe, I am afraid that is true in four hours. That’s not that bad is it?

Less Energy: Truths and Solutions

Joe: That seems like a lot to me, but there’s positives. You could binge watch this show. For four hours and then you’re done. You got your quota for the day. all right, boredom one year. That’s the average time when someone retires and they’re like, oh my gosh, what did I do?

Al: I am bored. How do you confront that? get out there. Do something. Get a part-time job. You know, watch the kids volunteer you. Hobbies, all those things you wanted to do that you didn’t have time for travel. There’s all kinds of stuff out there, but make sure you get out and do it part-time job.

Joe: Jack, who wants to do that? I retired.

Al: I know, but you need some volunteer. You need something to get you going in the, I dunno.

Joe: I like hobbies. You like that one? Not there.

Al: Maybe travel a little bit. You don’t like travel? It’s your only one would be hobbies.

Joe: I don’t wanna get in planes. I’ll volunteer maybe a part-time job. I work at a golf course or so.

Okay. Alright. Alright. Another one. Loss of identity without work. This is a big one, right? It. It doesn’t matter what career that you have, no matter what job that you have, it seems like when you retire, you’d lose that sense of purpose. You lose the responsibility that you have to do, even though you probably hated it while you’re doing it nine to five, Monday through Friday.

But Monday comes around after a year. You take a year, then you’re bored, and then you’re like, oh, I lost kind of my identity. You go to a cocktail party, what do you do? Nothing.

Al: so what do we do about that? if you can phase in your retirement, great. Now, not everybody can, but if you can kind of work part-time or maybe you consult right after you retire for a little bit, maybe you wanna learn some new skills, reinvent yourself, maybe even get a coach to help you through this process, because for a lot of people, this can be a little stressful.

Find a retirement coach. Yeah. Are you a retirement coach?

Joe: I’m we. I’ll help you. Where do you find a retirement coach? I, is that like a retirement counselor? I guess? Is that a financial planner? I, it could be. Either. Either. I don’t know. That wasn’t always my pet peeve when financial planners called themselves retirement coaches.

Good coach. I’m gonna coach you through this. Okay. All right. Let’s go hard. Truth. 48% of adults, 65 and 74 live alone half.

Al: That’s a pretty big number. That’s a big number. So what do we do about that? okay, let’s make a list of context to move in with me. Surely. Come on, I got an extra room. Hang out with young people.

Actually, that’s a good one, Joe, because I think the tendency, you know, you get older, you hang out with your own group. But you, when you hang out with younger people, you’re more energized. I can say that for myself because I’m like the oldest person up here.

Joe: You sometimes, yeah. If you’re hanging out with older people as you age, you know, then you’re gonna run outta friends at some point because they’re gonna move on. Alright.

Find Your Purpose

Find that purpose here. All right. Set goals, create a structure, right? Routine. I think sometimes when people are in their careers, they have a very strict routine. Me personally, I have a very strict routine that I do during the week. I get up early, you work out, you do this, right?

You have that routine. But once you’re retire and you lose that routine, you gotta create that structure, I think, and set your goals to find that purpose. You gotta continue learning. I don’t care what you learn, but use that brain, right?

Al: And then consult or mentor others or find a mentor, find that advisor that, that retirement coach to mentor you.

This is probably what the most important thing we even talked about all day is. It’s not just about money, it’s about what’s the rest of your life? What’s the next chapter? What do you wanna make it be? Because it can be glorious, but make sure you have a purpose to keep you going every day.

Joe: Alright, let’s switch gears. Let’s go to our viewer questions.

Al: Alright, this is from Katie in Seattle. What’s a reasonable balance of stocks to bonds in retirement to keep up with inflation? Katie, it’s a great question and it probably has a thousand different answers. It depends upon your personal situation, but just very generally. 60% stocks, 40% bonds works for a lot of people.

Joe: You wanna build a portfolio very specific to the demand of the portfolio, how much income that you need, right? How much risk are you willing to take? How much needs to come from the portfolios, how you probably want to structure it. So, you know, you probably, you know, in most cases people take the least amount of risk to get the maximum return to accomplish their goals.

So I don’t know what that portfolio means. But just shooting from the hip. 60 40. That sounds good. 70 30, 50 50.

Al: Pretty good.

Joe: All good? Yeah. But I think you just want to take a step back. This is where people run into problems, is that they’re just picking a portfolio maybe from their neighbor or a coworker, and they invest that same way.

That has nothing to do with their specific goals, or they don’t understand actually what’s in the portfolio. And so as you see volatile times, or when the market corrects a little bit, that portfolio’s gonna move and it might move too much. On the downward, or if the market goes up, it might not move up as much as you anticipated.

So education, I think, is key to understand what that expectation is of that portfolio so that you can stay disciplined in that approach. So I would never just say, all right, 60 40 and go for it. You probably need to back up a little bit and do a little homework.

Al: Yeah. And I will underscore that you invest to your own goals.

We know people in their eighties that are a hundred percent in the stock market. Why? Because it’s for their grandkids. They’ve got plenty of time, right? We know people in their seventies or sixties or fifties with a much more conservative portfolio. So it depends upon what you need from that portfolio.

Alright, let’s go to the next one. This is from Jim in San Diego. I’m collecting social security now. If I work part-time, will that reduce my benefit? Jim, it may now, once you reach full retirement age, which is phasing into age 67. Yeah, no, you, don’t. You can work and still get your full benefit, but when you’re younger than that, Joe, you may not get all your benefits.

Joe: So if you do go back to work, once you claim your benefit, they might reduce it. You could also pause it. So if you don’t necessarily need those dollars anymore. But sometimes people like to double dip. It’s like, Hey, I wanna retire. Retire early. I’m gonna claim my social security benefit. And then, oh, guess what?

I’m gonna work a part-time job. And that part-time job makes 50, 70, $80,000. I’m just throwing numbers out there now. It could definitely reduce your benefit if your part-time job pays you $10,000. Then I think you’re safe. But just understanding what those thresholds are, how much income that you have coming in from the employment and what your benefit is and when you claim it.

All of those coming together to understand what the benefit is moving forward. Alright, that’s it for us. If you want more help, you know where to go. Go to YourMoneyYourWealth.com. Click on that special offer this week. It’s our Retirement readiness guide. Are you ready for retirement? Get ready with that.

Guide YourMoneyYourWealth.com. Click on that special offer for Big Al Clopine, I’m Joe Anderson. We will see you all next time.

IMPORTANT DISCLOSURES:

• Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, LLC. A Registered Investment Advisor.

• Pure Financial Advisors, LLC. does not offer tax or legal advice. Consult with a tax advisor or attorney regarding specific situations.

• Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

• Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

• All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

• Intended for educational purposes only and are not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors.

CFP® – The CERTIFIED FINANCIAL PLANNER® certification is by the CFP Board of Standards, Inc. To attain the right to use the CFP® mark, an individual must satisfactorily fulfill education, experience and ethics requirements as well as pass a comprehensive exam. 30 hours of continuing education is required every 2 years to maintain the certification.

AIF® – Accredited Investment Fiduciary designation is administered by the Center for Fiduciary Studies fi360. To receive the AIF Designation, an individual must meet prerequisite criteria, complete a training program, and pass a comprehensive examination. Six hours of continuing education is required annually to maintain the designation.

CPA – Certified Public Accountant is a license set by the American Institute of Certified Public Accountants and administered by the National Association of State Boards of Accountancy. Eligibility to sit for the Uniform CPA Exam is determined by individual State Boards of Accountancy. Typically, the requirement is a U.S. bachelor’s degree which includes a minimum number of qualifying credit hours in accounting and business administration with an additional one-year study. All CPA candidates must pass the Uniform CPA Examination to qualify for a CPA certificate and license (i.e., permit to practice) to practice public accounting. CPAs are required to take continuing education courses to renew their license, and most states require CPAs to complete an ethics course during every renewal period.