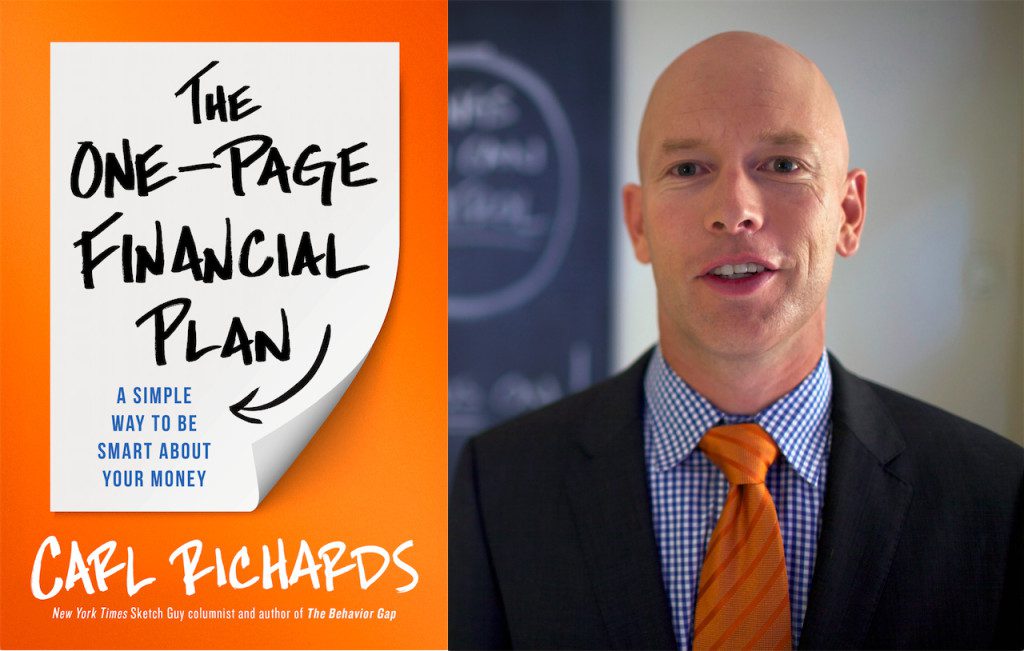

Creating a financial plan not only takes considerable time and patience, but also an understanding of where you are and where you want to be. In the process of creating a plan, many end up throwing their hands in the air sighing, “I don’t know where to start.” Carl Richards, author of The One-Page Financial Plan, has heard this countless times as a CERTIFIED FINANCIAL PLANNER™ professional and financial guru. Richards brings a fresh, personable perspective to creating a financial plan, focusing more on simplicity and individual values rather than arbitrary data and confusing financial jargon. The book contains ten chapters, each chapter serving as a stepping stone to maintaining an effective financial plan.

1. Ask WHY money is important to you.

This is the starting point. Before you can create your financial plan, you must know why you’re planning. Richards explains that when he and his wife sat down to really think about why money was important to them, they finally decided that the answer was that they wanted the freedom and time to start a family. Richards explains, “Recognizing what really matters to you is the first step toward making financial decisions that are in sync with your values.” Once you figure out the root of what money means to you, you’ll better understand what you’ll want out of your financial plan.

2. Guess where you want to go.

What lies between unclear goals and extreme financial certainty is “I don’t know what to do, so I will do nothing.” Richards explains that uncertainty is inevitable but we must create concise goals in order to keep us on track. “Once we’ve accepted that a lot can happen between now and the future, financial planning boils down to making the best guess we can about what goals will help us live the life we want.” Don’t worry about getting it “right,” he says. You’ll most likely end up tweaking your goals in the future.

3. Get really clear about your current location.

To Richards’ surprise, “–most people don’t have a clear understanding of their current financial location.” He explains, “In many ways, assessing where you are today is one of the simplest aspects of financial planning. All you have to do is tally up your assets and liabilities.”

4. Budgeting as a tool of awareness.

“Budgeting is important not only because it reminds us not to spend so much on gasoline or takeout, but also because it helps us cultivate the awareness we need to save and spend in accordance with our values. Creating a budget forces us to face the reality of how we spend. It allows us the opportunity to see the gap between what we say is important to us and how we spend our money.”

5. Save as much as you reasonably can.

Save, save, save. “If you didn’t start early, start now. Don’t worry about what you did or didn’t do already; just start. Your ability to move forward will be greatly improved if you don’t spend too much time dwelling on the past.” In this chapter, Richards gives 4 universal tips for saving, regardless of your values and goals.

6. Buy just enough insurance—today.

Everyone’s situation is different. For many people, life insurance isn’t a concern and isn’t necessarily needed at that time. Richards advises making sure to choose the right plan and beware of scams. “Only by separating economic need from emotional loss can you determine which life insurance plan is right for you. Otherwise, you’ll buy whatever the insurance salesperson is offering, and it may cost you in other areas of your financial life.”

7. Borrow and Spend Wisely.

“Once you’ve identified the debts with the highest interest rates, you can pick them off one at a time. When you’re done with one, go to the next. While you’re going through this process, I can’t emphasize enough how important it is to avoid the trap of continuing to use your credit card. If you can’t pay the balance off every month, you’re preventing yourself from saying ‘Yes’ to whatever it was you decided was most important to you.”

8. Invest like a scientist.

1) Diversify your portfolio. 2) Keep your costs low. 3) Recognize the correlation between risk and reward. These are three scientific principles to follow according to Richards. Many people become frustrated with the stock market and view it as a scam. However, the stock market has done quite well in the past ten to fifteen years. So why have so many people’s attempts at investing ended in failure while the market is booming? “Because they’re confusing investing with speculation,” Richards says. Speculating or trading is a completely different animal from investing.

9. Hire a “real financial advisor.”

Whether we like it or not, emotion is involved in each investment we make. This can prevent us from making the best choices and can hinder our ultimate success. Richards explains, “Your financial advisor is the only one standing between you and the ‘Big Mistake’ of buying high and selling low. You’re hiring them to do what you can’t: make unemotional decisions about your portfolio.” Asking the right questions and understanding what your goals are will help you find the best financial advisor suited for you.

10. Behave, for a really long time.

The last step in creating your financial plan is to set up guardrails that will establish a path for yourself, “a wide path with room to maneuver will help ensure that you never stray too far from what’s most important to you,” Richard says. He gives four rules for setting your plan in place and watching it grow.

Key Takeaways

Creating a comprehensive financial plan that suits your specific situation doesn’t have to be a long, drawn out, confusing and complicated process. With his One-Page Financial Plan, Carl Richards, CFP® explains how determining why you’re planning, where you want to be and where you are now can focus your priorities. From there, budgeting, saving and insuring, along with wisely borrowing, spending and investing according to those priorities gets you on the right path. Finally, hiring a real professional and having the discipline to stay on the path you’ve created will increase your chances for success.

Carl Richards recently joined Joe Anderson and “Big Al” Clopine on Your Money, Your Wealth. Listen here