During bull markets, it’s relatively easy to adhere to the philosophy of buying and holding for the long-term, but when markets get rattled, it can be difficult to stay the course while your portfolio falls in value. This has been the case recently, as fears around inflation, war, pandemics, central bank policy, and recessions have caused investor sentiment to turn pessimistic and consumer confidence slump.

Being human, most investors suffer from the cognitive bias of loss aversion, which means that the pain of a loss is felt more acutely than the joy from a gain. In other words, most people dislike losing more than they enjoy winning.

Volatility isn’t fun, but you must remember that markets are volatile by nature and that down markets are to be expected. If you’re investing for the long-term, short-term fluctuations shouldn’t concern you much; in fact, bear markets can be the best time to invest. It can be difficult to remember this, though, mainly since there is always something to be “worried” about. But while it’s not fun to watch your portfolio drop in value, you need to remember that “this too shall pass.”

Remember, the reason the stock market offers higher expected returns is that it involves risk. The higher returns are the reward you get for taking on additional risk. That is why stocks have historically provided higher returns than government bonds. But of course, bonds have a role in many portfolios too, and there is a reason to have a diversified portfolio. Stocks provide growth, but bonds and other assets can provide the income and diversification that help smooth out portfolio volatility.

Don’t Try Timing the Market

During times of turmoil, it may be tempting to get out of the market, go into cash, and “sit out” until the storm passes. That’s probably the worst time to get out if you’re a long-term investor. When you’re tempted to panic, a good thing to do is reflect on where you think the market will be five years from now. Most of the time, you’ll probably conclude that the market will be higher and that the current downturn is temporary. With that in mind, embrace the turmoil as an opportunity to invest more. Realize that the prices you see moving on the screen fluctuate more than the underlying cash flow and fundamentals of the companies themselves.

Most investors should avoid trying to time the markets because moving in and out and chasing short-term performance is usually one of the biggest mistakes you can make. Of course, everyone would like to cash out at the highs and avoid the declines, but no one can predict when they will happen. Sure, being on the sidelines might save you some pain and anxiety, but it may also cause you to miss gains when you’re not invested.

Historically, downturns in the market have been followed by an eventual upswing, and being out of the market during those times can hurt long-term performance. The age-old adage applies here: “It’s all about time in the markets, not timing the markets.”

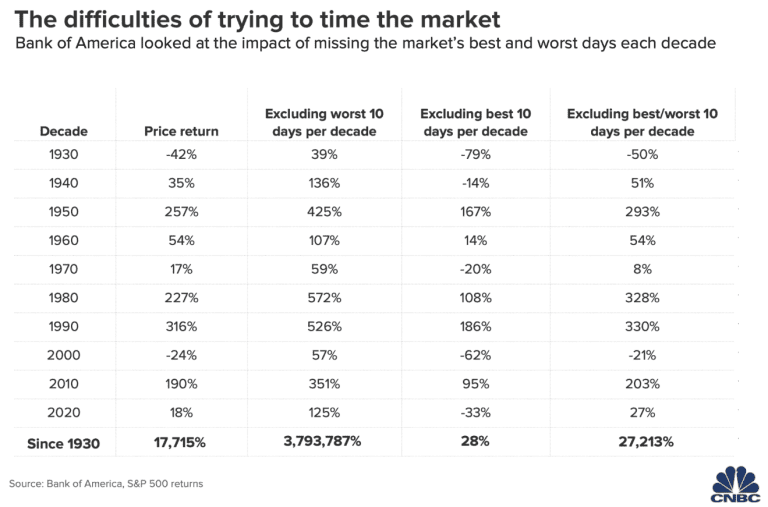

Bank of America released a study in 2021, published on CNBC, showing the importance of staying invested and not timing the markets.

Source: Bank of America S&P 500 returns; https://www.cnbc.com/2021/03/24/this-chart-shows-why-investors-should-never-try-to-time-the-stock-market.html, June 27, 2022.

As you can see, staying invested yielded a cumulative return of 17,715% since 1930. However, if you missed the ten best days per decade, your return would plummet to only 28%. Of course, if instead, you missed the ten worst days per decade, your return would be over 3 million percent, but that sort of perfect foresight is unrealistic.

Unless you have a crystal ball, it’s much better to stay invested because missing out on the best days can be costly. If you sell and are still on the sidelines during a recovery, it’s hard to catch up because missing just a few good market days can hamper or even destroy your performance.

Does Timing Matter?

In reality, the best strategy is to avoid trying to time the market, construct an investment plan, and invest consistently. Furthermore, the answer to the question of the best time to invest is almost always: Now.

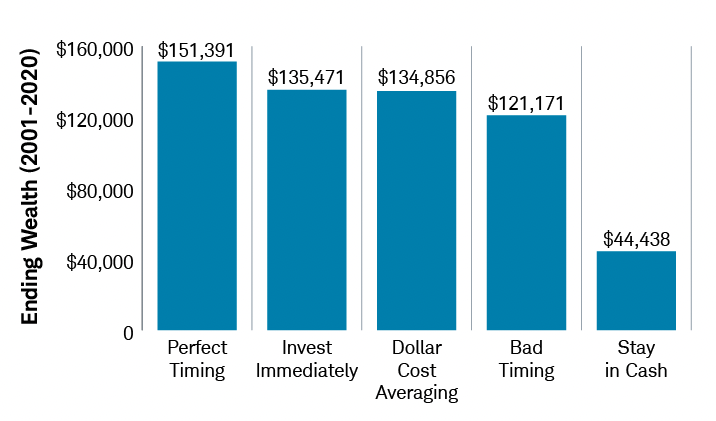

With that in mind, let’s look at another study, this time done by Schwab, that shows how different investing strategies would work. Schwab looked at five investors that invested $2,000 annually in a hypothetical portfolio that tracks the S&P 500® Index from 2001-2020.

The first investor immediately invested his $2,000 at the beginning of each year. The second investor had the worst timing and invested at the high point of the S&P each year. The third investor had perfect timing and invested at the lowest point of the S&P each year. The fourth investor had a dollar-cost averaging strategy and invested equal dollar amounts every month for the year. Finally, the fifth investor stayed entirely in cash. Let’s look at how they fared.

Source: Schwab Center for Financial Research. Invested $2,000 annually in a hypothetical portfolio that tracks the S&P 500® Index from 2001-2020; https://www.schwab.com/learn/story/does-market-timing-work, June 27, 2022.

This graph is eye-opening. We see that even the investor with perfect market timing didn’t do that much better than the investor who invested immediately at the beginning of each year. The dollar-cost averaging strategy ended up almost the same as investing immediately. Even the investor with the worst market timing still had decent results. However, far and away, the worst return was for the investor who stayed in cash throughout the years.

This shows that even if you invest at just the wrong time, you’d still be far better off than if you never invested at all. And if you aren’t comfortable investing a lump sum immediately, a good middle-ground could be dollar-cost averaging.

Conclusion

In the end, staying invested and contributing to a well-diversified portfolio is the best strategy regardless of market conditions. Markets move in cycles, and although there are various indicators purported to show where we may be in the cycle, nobody has a crystal ball to determine when to get in and out correctly and consistently. As a result, there will always be something that will cause you to be concerned about your portfolio, especially if you pay too much attention to news headlines, pundits, analysts, etc.

Remember that your portfolio doesn’t have a chance to rebound once you sell. So stay invested and avoid the lure of market timing. There’s historically been a few great days for the stock market each year. If you miss a small amount of them because you’re trying to time the market, you’ll dramatically lower the overall return on your portfolio.

Focus on time in the market – not trying to time the market.

Data as of June 2022

Intended for educational purposes only. Opinions expressed are not intended as individualized investment advice or a guarantee that you will achieve a desired result. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

YMYW Podcast: Why Is It So Difficult to Time the Market?