I know, I know. You probably read the title of this blog and immediately considered tuning out. But I think your perseverance will be rewarded, because while today’s topic is about taxes, what we’re really talking about is the quality of life in retirement. It’s about living large while paying less to Uncle Sam. And that, my friends, is very exciting indeed.

But living like a king while paying taxes like a pauper requires a basic understanding of how the tax system works.

Income Taxes: A Quick Primer

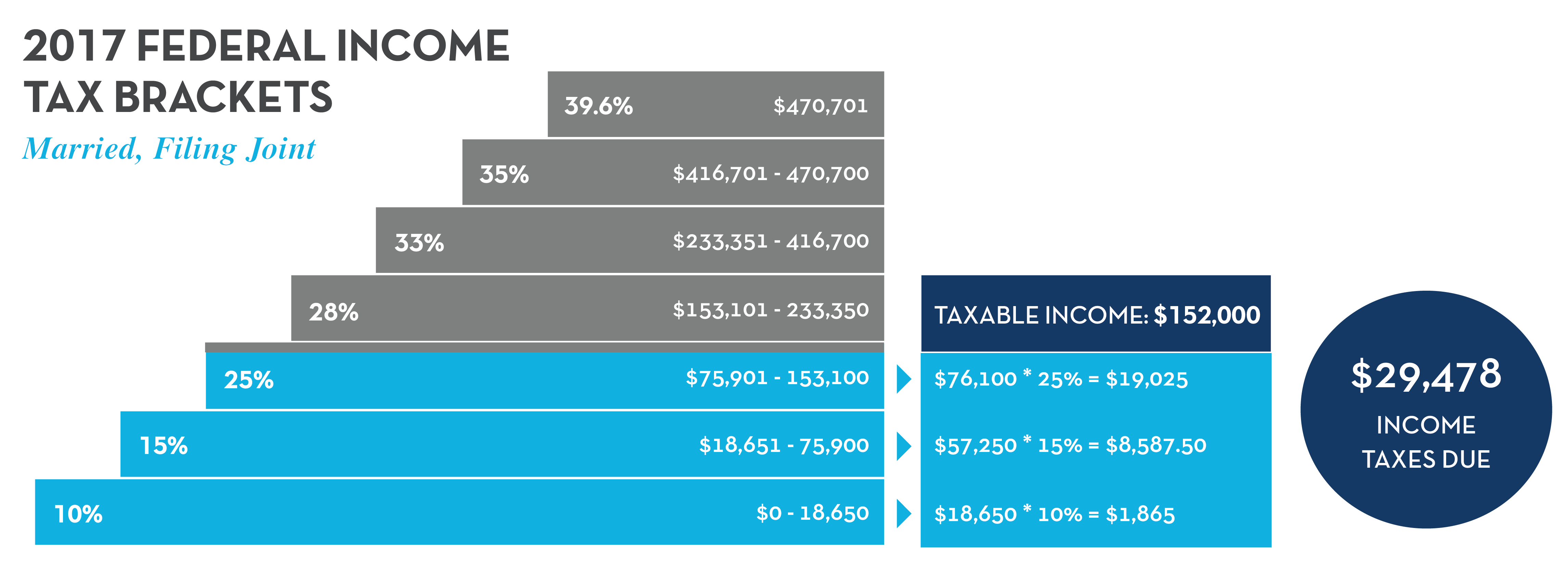

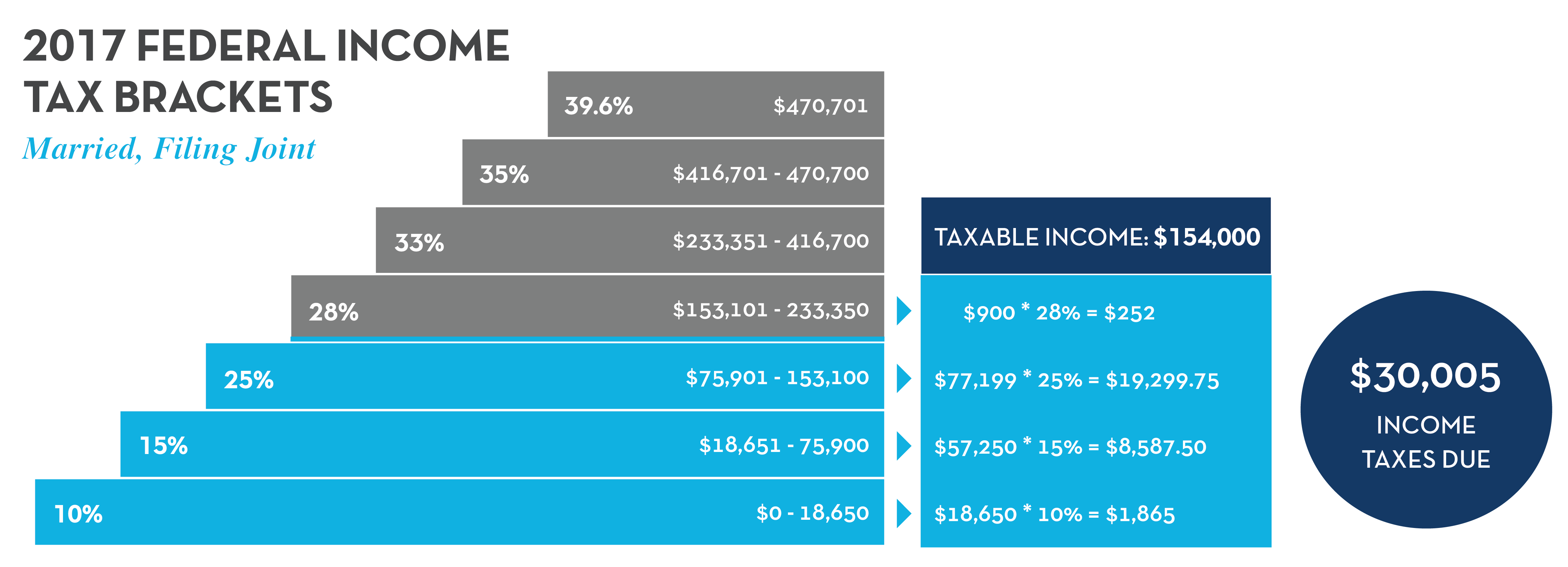

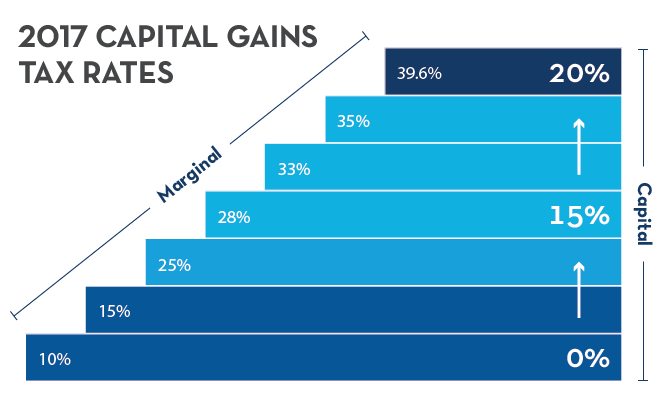

Picture a staircase. Staircases offer great visual depictions for income taxes because rates “step up” at successive income levels. For 2017, the federal income tax brackets are as follows:

Tax rates are progressive, meaning that the higher your income, the higher the rate at which your income is taxed. The brackets listed above refer to federal rates. There are also state taxes, but since these vary widely, we’ll focus on federal income tax for this discussion.

Your taxable income is what’s used to determine your federal marginal tax rate. It’s the money you’ve earned after all deductions and exemptions. This number can be found on line 43 of tax Form 1040.

Example

If you are married filing jointly, and your taxable income is $152,000, then your income would be taxed as follows:

However, if your taxable income in that scenario is $154,000, then your income would be taxed as follows:

As you can see, your income is taxed at marginal rates. This means that even though you’re in the 28% tax bracket, you don’t pay 28% of your taxable income to Uncle Sam. The total blended percentage you end up paying is what’s called your effective tax rate. To calculate your effective tax rate, you divide your income taxes by your taxable income.

It’s important to distinguish between marginal and effective tax rates. For the discussion to follow, the marginal rate is most important.

Watch this video for a breakdown of the new tax law, now in effect for 2018.

Investment Taxation: A Quick Primer

As you move into retirement, it is important to differentiate between short and long-term capital gains, as well as between ordinary and qualified dividends. That is because short-term capital gains and ordinary dividends are considered ordinary income and taxed as such. However, long-term capital gains and qualified dividends are subject to a different, and potentially lower, taxation schedule. These rates become very important as you move into retirement and begin to distribute income from your portfolio. The rates are as follows:

Tax Diversification

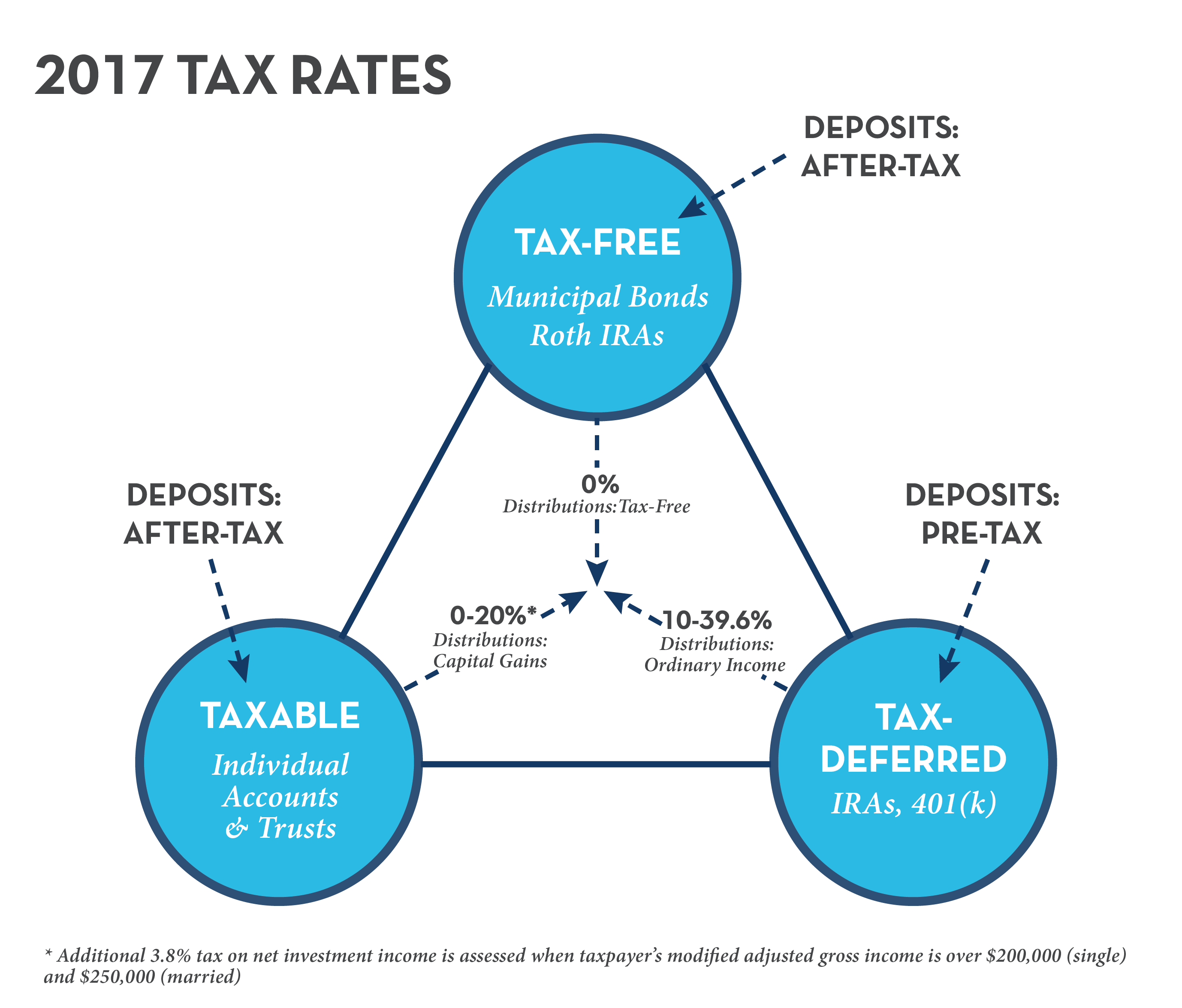

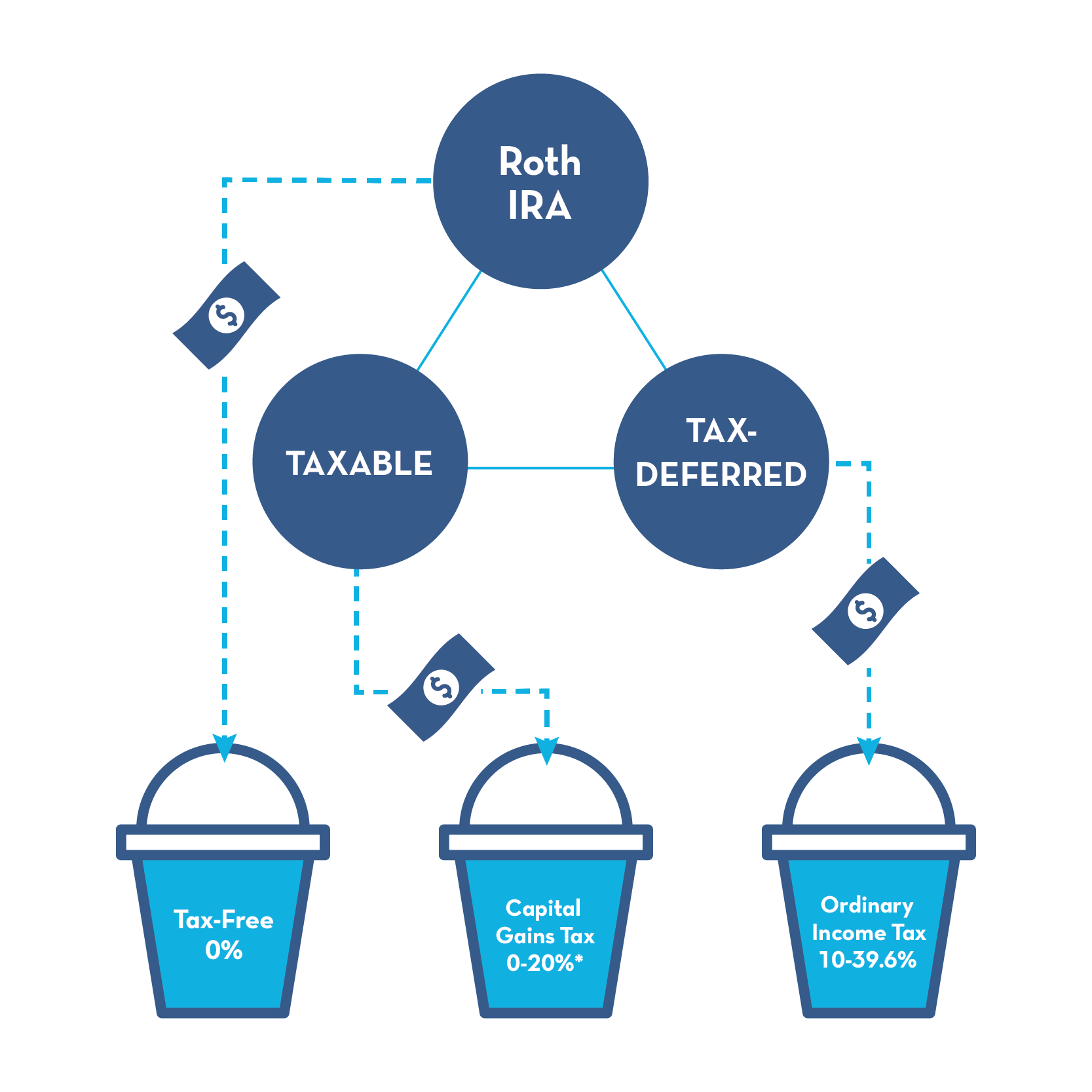

Now that we have a basic understanding of the tax system, let’s take a look at three different sources of cash flow in retirement and how they are taxed.

The first “bucket” includes municipal bonds, as well as any assets held in designated Roth accounts. Municipal bond interest, as well as assets distributed from Roth accounts, are generally free from taxes.

The second source of income in retirement includes dividends and capital gains received from investments held in non-retirement (taxable) accounts. The tax treatment of these assets varies, but careful planning can often result in a lower tax rate for these funds than for ordinary income.

Finally, there are tax-deferred assets, which include anything held in retirement accounts such as IRAs, 401ks, 403bs, 457s and defined benefit plans. The defining characteristic of this bucket is that when you take money out, it’s taxed at your ordinary income rate, which as we saw above can be as high as 39.6%. Income derived from Social Security or pensions, as well as from any work you do in “retirement” could also fall into this bucket.

In addition to higher tax rates, tax-deferred accounts often have cumbersome rules and regulations which reduce your control over how and when you distribute your assets:

- Required Minimum Distribution (RMD) – IRS wants you to deplete the assets before you die

- Income in Respect of a Decedent (IRD) – if you die before assets are depleted, your kids are stuck with the tax bill

In summary, we have three different income buckets, subject to three different methods of taxation. Managing the tax efficiency of your income by drawing from the appropriate bucket at the appropriate time can help increase your odds of success in retirement.

But shouldn’t I defer?

The problem is that the standard advice in the financial services industry has been to defer, defer, defer, and as a result, many people approaching retirement find themselves with the bulk of their assets tied up in the tax-deferred bucket, or as I like to call it, “the ticking tax time bomb.”

Tax deferral can sometimes make sense, but over time your strategy should evolve, and your goal should shift from tax deferral to tax optimization. And by tax optimization, I mean that you should try to pay the lowest possible taxes over the course of your lifetime.

Unfortunately, having the bulk of one’s assets tied up in a tax-deferred pool whose distribution will result in the highest of tax rates just isn’t optimal. Advice to the contrary is inherently flawed, and sadly, I’ve seen people lose 30%, 40%, even 50% of the wealth they’ve worked for and saved, solely due to a lack of planning.

If you take only one of my suggestions, please do the following:

Take as much care protecting and distributing your wealth as you did working for and building your wealth.

That, dear reader, is the key to enjoying your Golden Years, and to leaving the sort of legacy you desire.

So how exactly do I increase my odds of success in retirement?

As you might have guessed by now, one of the keys to a prosperous retirement is to have as much flexibility as possible around which bucket you plan to pull money from.

For example, let’s say you want to live on $125,000 a year. You distribute your first $75,900 from the tax-deferred pool because $75,900 happens to be the top of the 15% tax bracket for married couples filing jointly. You then pull the rest of the money you need from the Roth account (tax-free) and the taxable account, paying 15% in capital gains tax. In that scenario, you’ll be living in a 25% tax bracket, but only paying 15%.

The key to enhancing your retirement is having more of your income taxed at 15%, or better yet, 0%.

Roth IRAs

Now, let’s focus on tax-free income, and more specifically Roth accounts. There are two ways to get money into a Roth IRA – a contribution and a conversion.

Contributing to a Roth IRA

- Contributions are limited to $5,500 if under age 50 and $6,500 if over 50 (as of 2017)

- You need earned income to make a Roth contribution and there are income limitations

Roth IRA Conversions

The second and potentially more powerful strategy is to utilize Roth conversions. This is where you move money from your IRA/401k/403b into a Roth account. The good news is that whatever you convert grows tax-free forever. The downside is that the amount converted is considered ordinary income in the year of the conversion, so you need to do some planning to avoid getting killed on taxes.

Remember, you’re going to pay taxes on your retirement account assets at some point; so the goal here isn’t tax avoidance. The goal is to minimize your tax bill across your lifetime, to shelter future portfolio gains from taxes, and to give you control over your finances in retirement.

Roth IRAs are your hedge against higher taxes and inflation, but conversions must be done strategically over time. For example, it might not make sense to do a Roth conversion in a high-income year because you will have to pay taxes on the conversion at a higher tax rate. Therefore, when planning Roth conversions, you should do a tax projection to determine how much you can convert that year.

I recommend adopting a multi-year Roth conversion strategy based on your current and future tax rates so that over time you’re getting more money in a tax-free environment and paying the taxes on your conversion at a lower rate.

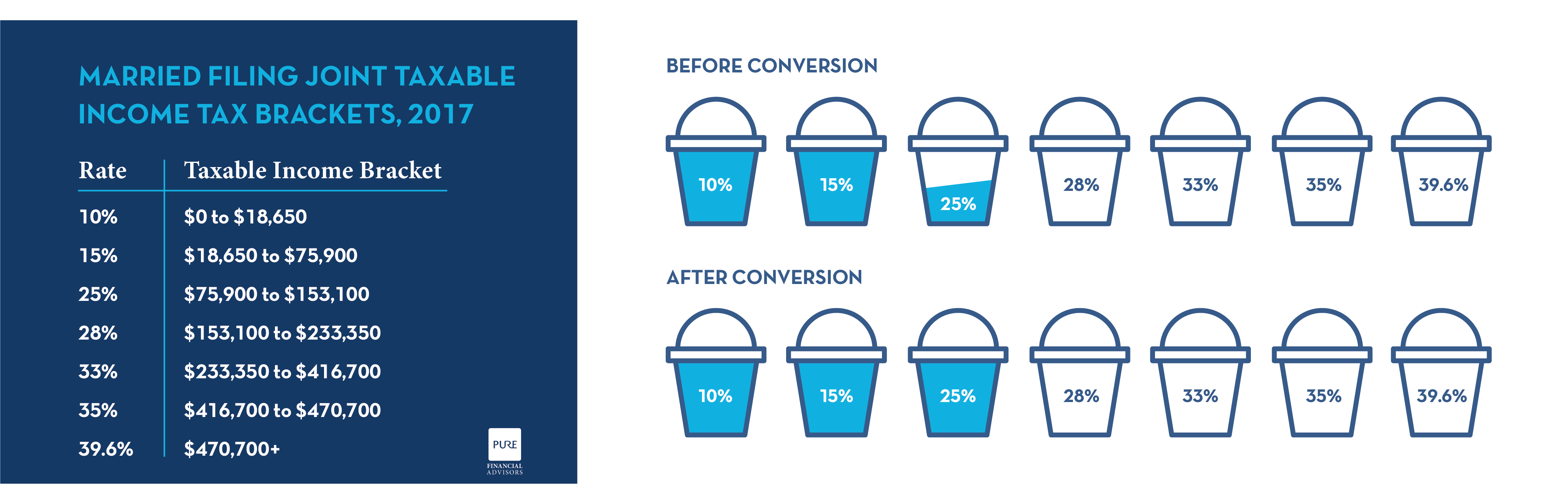

Example – Filling up the Bracket

Let’s say you’re married and your combined income is $145,000, placing you in the 25% tax bracket. If you refer to the tax table for 2017, the income levels for the 25% bracket for married couples are $75,900-$153,100. This means that you can earn an additional $8,100 in income before you would move into the 28% bracket.

- $145,000 + $8,100 = $153,100

Given these facts, you can convert as much as $8,100, paying 25% on the additional income. If you choose to convert more than $8,100, every dollar over would be subject to a higher income tax rate.

Roth Conversions: The Mechanics

Since all future growth is tax-free, the sooner you do a Roth conversion, the better. But if you don’t know your taxable income for the year, how are you supposed to determine the optimal conversion amount?

The IRS has given us a great gift. That’s right, I never thought I’d type those words and you never thought you’d read them, but the IRS has in fact given us a gift. The gift is simply this: if you do a Roth conversion, you have until April 15th of next year (or October 15th if you file a tax extension) to undo all or part of the conversion.

Undoing a conversion is called a recharacterization, which is a fancy word for what is essentially a “do-over.” Therefore, even though you don’t know your optimal conversion amount, you can do a Roth conversion anyway, secure in the knowledge that you can recharacterize all or part of the conversion once you prepare your taxes.

For example, if you initially converted $50,000, but later determined that the optimal amount was actually $40,000, you would simply recharacterize $10,000 of your conversion. That would leave you with the “proper” $40,000 conversion in your Roth, and the other $10K would be back in your IRA as if it had never left.

Roth Conversions: Taking it to the Next Level

Since the IRS is giving us a “gift”, let’s take full advantage of it. Continuing the example above with a potential $50,000 conversion, I’d suggest actually opening up two Roth IRAs and doing two conversions, each for $50,000.

Wait, you’re saying, you only want to convert $50,000, so why in the world would I suggest $100,000 in conversions? Because, I’m not suggesting that you keep $100,000 in conversions, only that you initially convert that amount. The plan is still for you to keep just one $50,000 conversion this year.

What I’m suggesting is that you open up two Roth IRAs for $50,000 each (or $100,000 total) and invest each of them very differently. One Roth will only hold safe investments, such as high-quality bonds. The other Roth will only hold asset classes that have a higher expected return, such as small-cap stocks.

You will eventually recharacterize one of these Roths, essentially pretending it never happened. Depending on your timing, you have as long as 22 months to determine which of the conversions you want to reverse, which means that you get almost two years to watch and see whether stocks or bonds have performed better. Then you take a “do-over” on the asset class that lagged. Think of it like buying tickets on both horses in a two horse race, then getting a refund on the losing ticket.

Just to be clear, I’m certainly not suggesting that you take any more risk than is appropriate for your situation. Your overall asset allocation should remain consistent with your goals and risk tolerance. This strategy isn’t changing that. With this approach, you’re just choosing to hold stocks and bonds in the most tax-efficient manner possible. Yes, stocks are volatile, and your Roth account may fall in value, but those same investments may also fall if held in one of your other accounts. The risk parameter of your portfolio does not change when doing a Roth conversion.

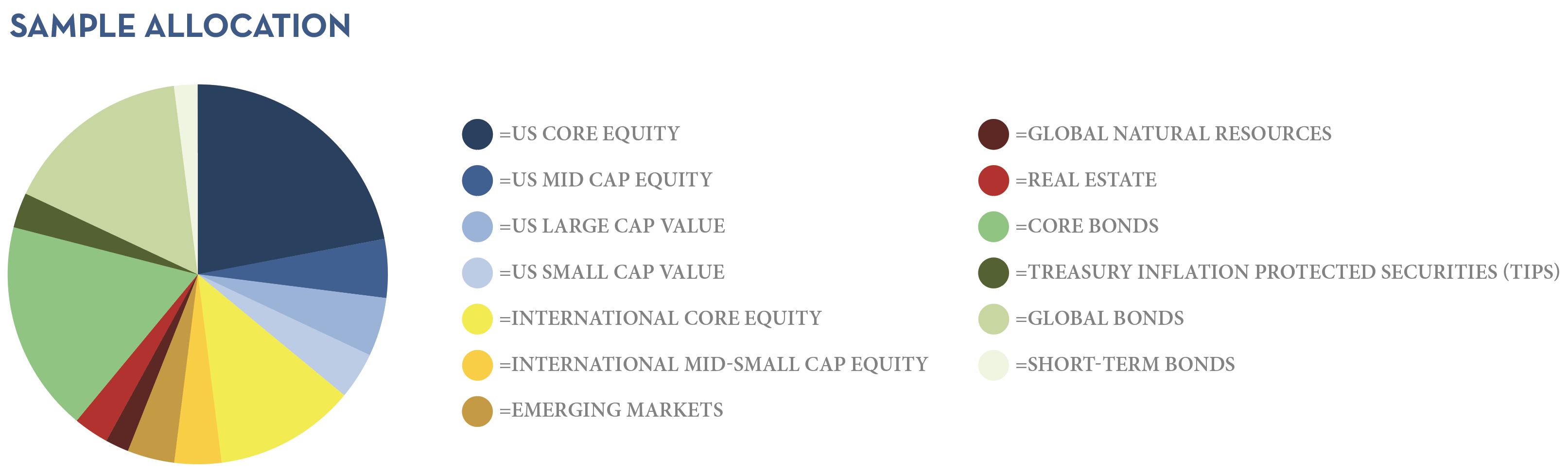

Asset Location

If you’ve stayed with me this far, I’d like to give you one more suggestion regarding your Roth accounts. When I recommend a portfolio to a client, it generally includes 12 to 16 different asset classes.

The future expected returns of these asset classes vary. Those with higher expected returns should go in your Roth because all future growth is tax-free. Conversely, since withdrawals from retirement accounts are taxed as ordinary income, you don’t want to hold growth assets there. Large gains could generate a future tax burden. Instead, safe investments (such as bonds) should go in the tax-deferred pool.

Now you’re probably wondering, what about your taxable accounts? Stocks and other growth assets often make sense here, since any appreciation isn’t taxed until a sale occurs. Plus, when you do eventually pay those taxes, it’s at the special long-term capital gains rate. You can also utilize any capital losses you might accrue to offset capital gains tax. Those losses would be wasted if they occurred in a tax-deferred account.

Importantly, while each type of account will have different investments, your accounts will, in aggregate, ultimately reflect your target asset allocation. That allocation does not change; all that changes is where you hold each investment, in an effort to minimize your tax bill and maximize your after-tax returns.

Conclusion

By combining an effective investment strategy with savvy tax planning, you can end up with more of your money in a tax-free Roth account. Remember, this is money that is going to grow tax-free, that is distributed tax-free, and that isn’t subject to onerous rules or regulations stipulating when you have to take distributions.

That, dear reader, is going to greatly enhance your lifestyle in retirement.