In our previous blogs we have covered the basics of Social Security, let’s move on to some Social Security and retirement strategies that can help you maximize your benefits.

When Should You Start Taking Social Security Benefits?

One of the most important decisions that you’ll have to make as a retiree is the choice about when to start taking Social Security benefits. Unfortunately, there are no easy answers, since it depends entirely on your personal financial situation.

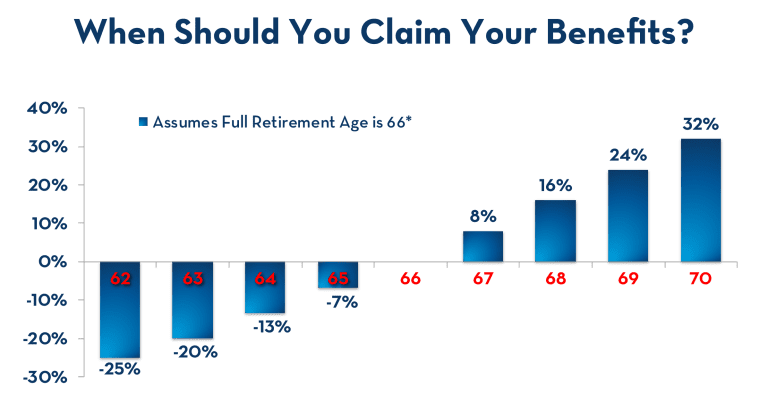

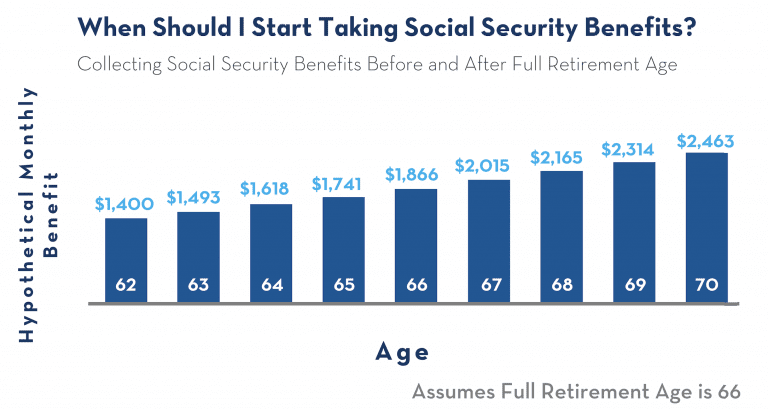

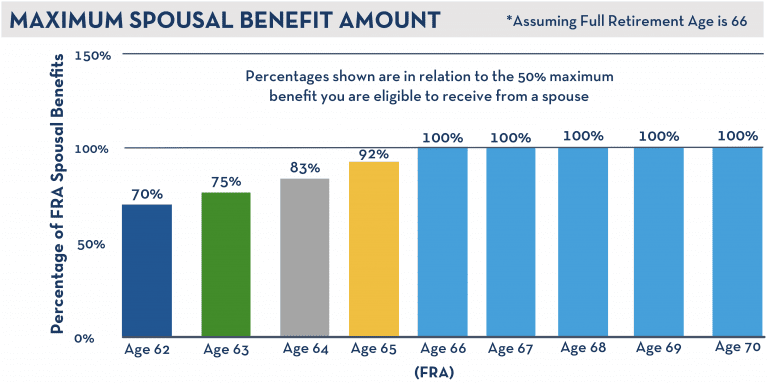

Retirees typically have three choices: to file for benefits before their full retirement age (FRA), in which case they will receive a smaller check for longer; to claim benefits at their full retirement age; or to wait longer to accumulate more credits. This chart illustrates how your benefit would be affected at different ages.

Many Americans are forced to claim early benefits because they need the income, but if you can afford it, delaying Social Security benefits could mean collecting significantly more over the course of your life.

A good general rule of thumb is this: If either you or your spouse expects to live past the age of 80, you’re better off waiting to claim as long as possible to receive a larger benefit. If, for health or family-history reasons, you don’t expect to live that long, you may be better off claiming a smaller check sooner.

If you want to collect early, consider these points first.

Among other things, you need to consider your current health, your family history of longevity, and, if you are married, the age difference between you and your spouse.

One extremely important consideration that could directly influence you not to collect early, is whether or not you are actually retiring. Are you collecting the benefit because you can? Or are you collecting the benefit because you’re actually retiring and need the income?

- Working: Will you work, even part-time, before FRA?

- Longevity: How is your health? Is there an expectation of longevity?

- Spouse: Are you married? If so, what is the age difference between spouses? Whose benefits can the spouse collect?

Example

Ultimately, it’s a very personal decision that you may want to discuss with a financial professional who can help you run the numbers and make the right decision.

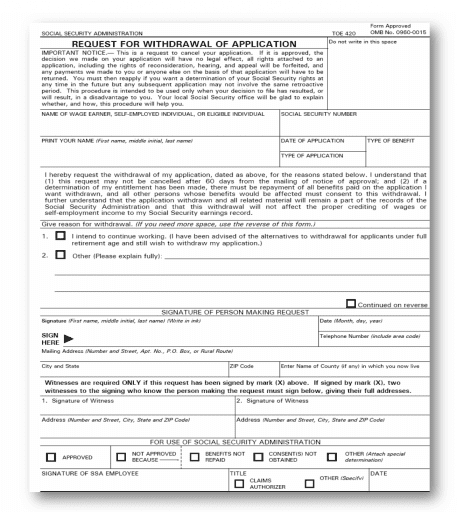

Can You Change Your Mind?

If you start collecting benefits prior to full retirement age and then find yourself returning to work and having your benefits withheld, you can consider a Withdrawal of Application. This essentially allows a do-over. You need to repay the SSA everything you received to date, along with any family benefits paid on your work history, and then you can subsequently apply as if it were your first time applying. The SSA has recently restricted the use of the Withdrawal to within 12 months of collecting benefits and will only allow one withdrawal per lifetime.

Spousal Benefits

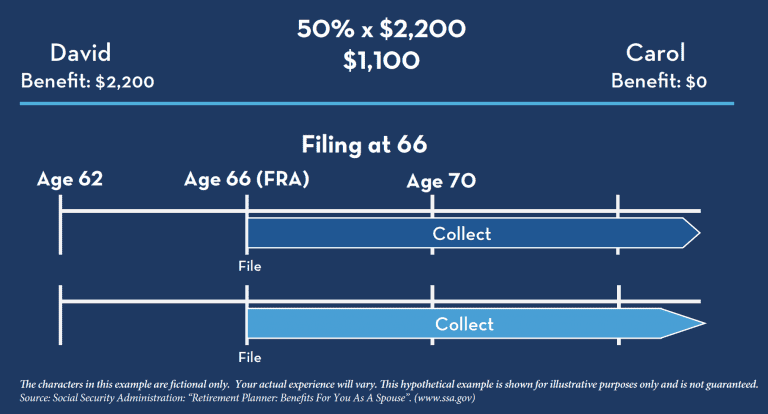

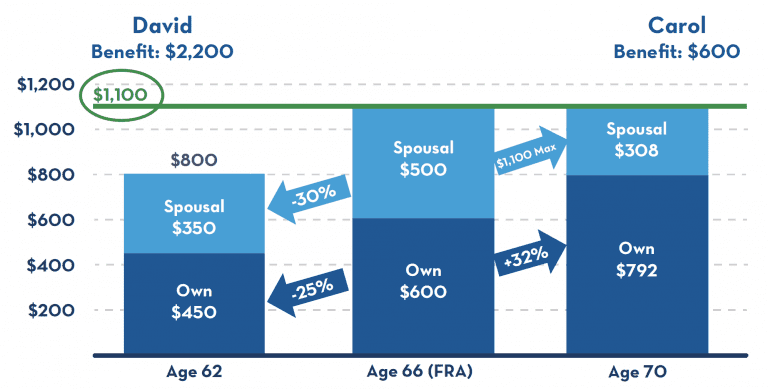

Let’s say Carol stayed home and raised the family while David worked. In this case, Carol would have benefits of $0 because she didn’t have her own working record. The calculation for this would be easy as she would be entitled to 50% of David’s benefit, and could collect spousal benefits of $1,100/month (assuming David filed at Full Retirement Age as shown in the example).1

Based on when Carol collects those benefits can impact the total she takes home. If she collects spousal benefits before Full Retirement Age (FRA), her spousal benefits will be reduced. On the other hand, she is not rewarded for waiting beyond FRA. Spousal benefits do not receive delayed retirement credits, so there is really no reason to wait beyond FRA to collect that benefit.

So how does this all work?

If Carol collected her own benefit at FRA, she would receive $600 and if she collected at age 62, that would be reduced by 25% to $450. If she waited until age 70, the $600 would increase by 32% to $792.

Now let’s add spousal benefits to the equation, it becomes a little more complicated. It is important to note that your own benefit and spousal benefit are NOT aggregated, but rather coordinated.

Carol’s spousal benefit at their core is worth $1,100. That means if she collects her spousal benefits at FRA along with her own, she’ll add an additional $500 of spousal benefits to her own $600 for a total of 1,100 (50% of David’s benefit). If she takes the spousal benefit at age 62, her $500 will be reduced by 30% to $350 for a benefit total of $800. On the other hand, if he waits until age 70 for both benefits, her spousal benefit will only be enough to get her $1,100 (her maximum spousal benefit). In this case, she would add $308 to her own $792 for a total benefit of $1,100. It is important to note that you cannot file for a spousal benefit unless your spouse has already filed for their individual benefit as well.2

Survivor Benefits

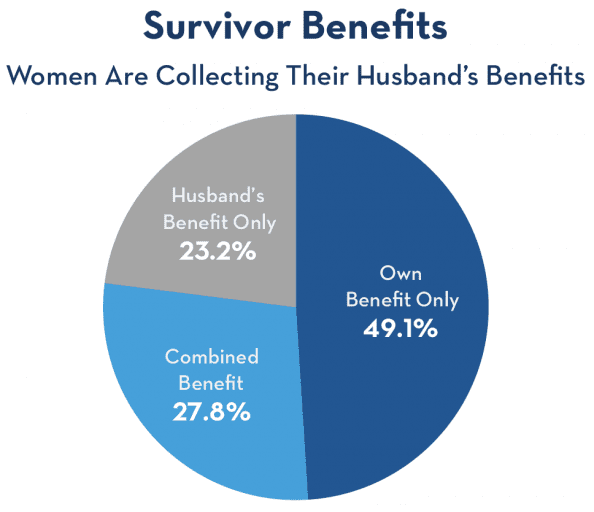

Now let’s talk about survivor benefits and why they’re an important part of the decision. Over half of all the women collecting benefits today are collecting benefits all or in part based on their husband’s work history. So, the decisions David makes will likely impact Carol’s benefits even after he’s gone.

This hypothetical example is shown for illustrative purposes only and is not guaranteed.

Source: Social Security Administration (www.ssa.gov)

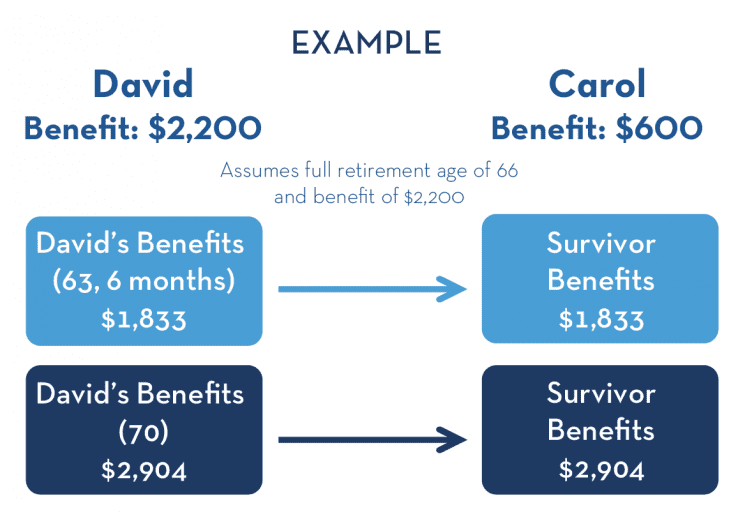

Unlike spousal benefits, survivor benefits are tied directly to David’s collection decision. That means if he collects at age 62, he leaves Carol with significantly lower survivor benefits than if he collected at age 70. This is one reason it is important to factor in difference in age between spouses.

EXAMPLE

Let’s take a look at David and Carol, a married couple planning out their Social Security benefits. David is the higher wage earner, and they both have an FRA of 66.

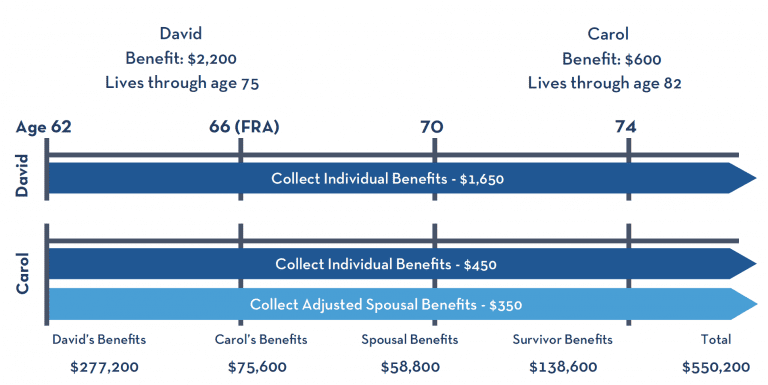

Collecting at Age 62

If both collected at 62, David would receive his own monthly benefit of $1,650 ($2,200 reduced by 25%). Carol would receive her own monthly benefit of $450 ($600 reduced by 25%) in addition to the $350 spousal benefit ($500 reduced by 30%) until David passed away at age 75. When David passes away at 75, Carol would be eligible to receive $1,650 for survivor benefits (her previous benefits would stop since the $1,650 is greater than the $800 she was collecting). At the end of the day, they receive $550,200 back from Social Security throughout their lifetime.

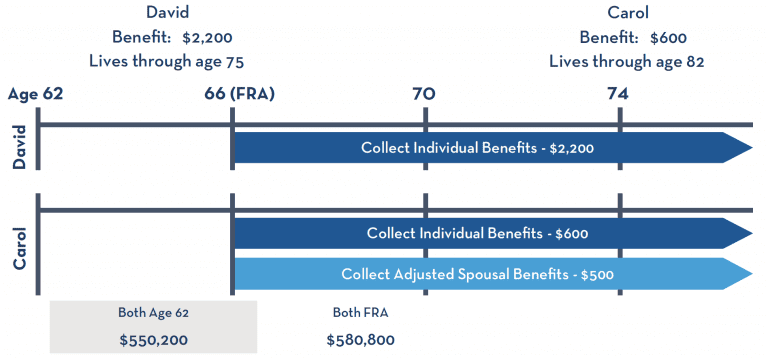

Collecting at Age 66

Had Carol and David both waited until FRA, David would receive his own monthly benefits of $2,200. Carol would receive her own monthly benefits of $600 and an additional $500 of spousal benefits. When David passes away, Carol would be eligible to receive $2,200 as survivor benefits.

Even though they received benefits for a lesser period of time, because they received higher amounts, they actually received $580,800 back, about a $30,000 difference from collecting at age 62.

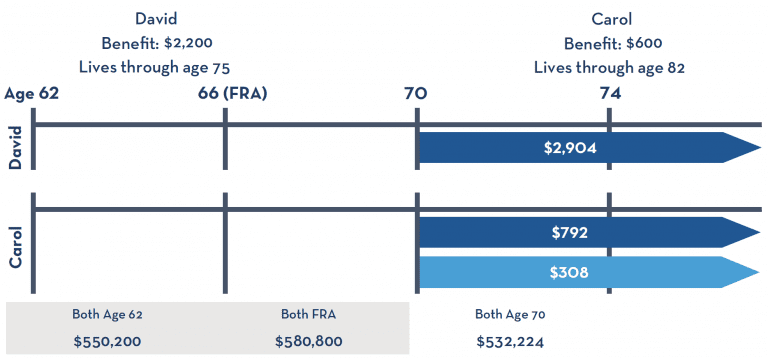

Collecting at Age 70

Had Carol and David waited until age 70, they would have only received $532,224. When you don’t have the longevity (David in this case only lives until age 75), waiting to age 70 may not always be in your best interest. That is why it is suggested that you consider strategies that provide the greatest amount of benefits and flexibility regardless of the span of retirement.

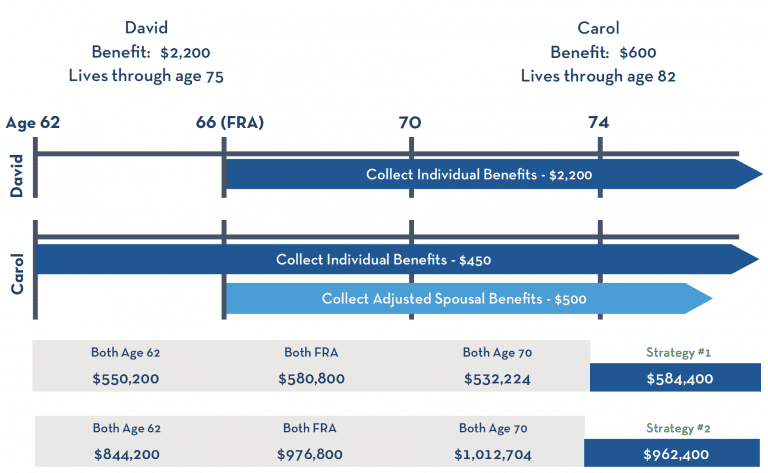

Large Difference in Benefits

What if the lower earner, in this case Carol, started collecting at 62, but David had waited. Since David has not filed, Carol would only receive her own benefits (no spousal).

In the scenario shown here, Carol begins collecting her reduced benefit of $450 at 62. David decides to file for his individual benefits at age 66 ($2,200) and in turn, Carol is now eligible and begins receiving an additional $500 in spousal benefits. Because she is FRA when she begins the spousal benefits, that portion is not reduced. At the end of the day, by using the strategy shown above, David & Carol collect $584,400 from Social Security throughout their lifetime.

Now let’s add some longevity to the mix. David lives to 85 and Carol to 92. This strategy no longer provides the largest amount of benefits. The best option for David & Carol, in this case, would be to for both to begin collecting at age 70, where they would collect almost $50,000 more throughout their lifetime opposed to the strategy above. Both collecting at their FRA worked out to be slightly higher as well, however, Carol would have missed out on 4 years worth of checks.

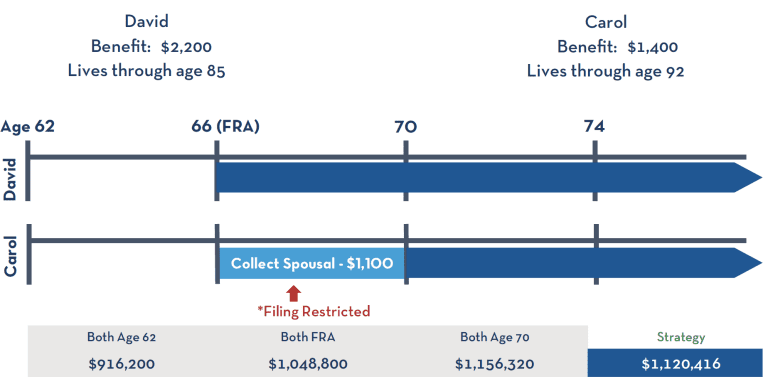

Small Difference in Benefits

Here is another option that can be considered when you have a couple where the spousal benefits are lower than their own. David decides to collect his benefit at his Full Retirement Age. This gives Carol the choice of collecting her own benefits of $1,400 or her spousal benefits of $1,100. If she chooses to collect her spousal benefits, she must file a restricted application, and her own benefits will continue to grow until age 70 when she can switch to her increased benefit of $1,848. As you can see, David and Carol both start collecting at age 66, but notice the difference Filing Restricted made as opposed to filing off her own record, a difference of almost $72,000.

However, this strategy does not work if Carol collects benefits before FRA, because the SSA will automatically compare the individual benefits and the spousal benefits and pay the higher. It is only when you file at FRA that you have an option to choose which benefits you want.

Also notice that if they both wait until age 70 to collect, this will maximize their Social Security throughout their lifetime ($1,156,320), about $36,000 more than the strategy shown above.

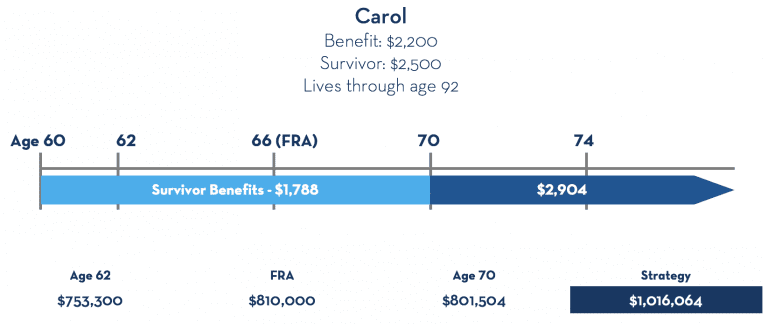

Widow

Another time to potentially switch between benefits is when a widow is entitled to survivor benefits and has a good size benefits of her own as well. In this case, Carol might compare her own benefits to her survivor and just collect the highest, but the best way to maximize her benefits would be to start collecting one and then switch to the other at age 70 so it grows 8%/ year for 4 years.

Here she is collecting survivor benefits at 60. While she received a reduced survivor benefit, she allowed her own to grow all the way up to age 70. At 70 she began collecting her own benefits of $2,904 (132% of $2,200). Using this strategy could boost her lifetime income by around $200,000! Using this strategy, she collects just over $1 million throughout her lifetime!

Divorced

If you have been married for at least 10 years, are currently unmarried and both you and your ex-spouse are at least age 62, you may be eligible for spousal benefits under the same rules as we discussed earlier. If your ex-spouse has passed away and you are unmarried (or your current marriage started after age 60) and at least age 60, you may be eligible for survivor benefits.3

Whether you plan to take your benefit early, at full retirement age, or delay, be sure to consult with your financial advisor as this is a very important decision. If you would like to learn more about the specific process of How to Apply for Social Security, click here.

Is Social Security Considered Income? >>

Sources

1 – Source: Social Security Administration: “Retirement Planner: Benefits For You As A Spouse”. (www.ssa.gov) https://www.ssa.gov/planners/retire/applying6.html#&a0=0

2 – Source: Social Security Administration: “Benefits for Spouses”. (www.ssa.gov) https://www.ssa.gov/oact/quickcalc/spouse.html

3 – Source: Social Security Administration: “Retirement Planner: If You Are Divorced” (www.ssa.gov) https://www.ssa.gov/planners/retire/divspouse.html

Joe Anderson, Alan Clopine and Pure Financial are not affiliated with or endorsed by the Social Security Administration or any other government agency. Intended for educational purposes only. Not intended as individualized advice or a guarantee that you will achieve a desired result. Before implementing any strategies discussed you should consult your tax and financial advisors.