Over 45 million Americans receive their health insurance coverage through Medicare.

What Is Medicare?

Medicare is the federal health insurance program for people who are 65 or older, as well as certain younger people with disabilities and people with End-Stage Renal Disease. Medicare Part A is hospital insurance that covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Medicare Part B is medical insurance that covers some doctors’ and preventative services, outpatient care and medical supplies. Medicare Part C is a type of Medicare health plan offered by a private companies to provide Part A and Part B benefits, while Medicare Part D is prescription drug coverage.

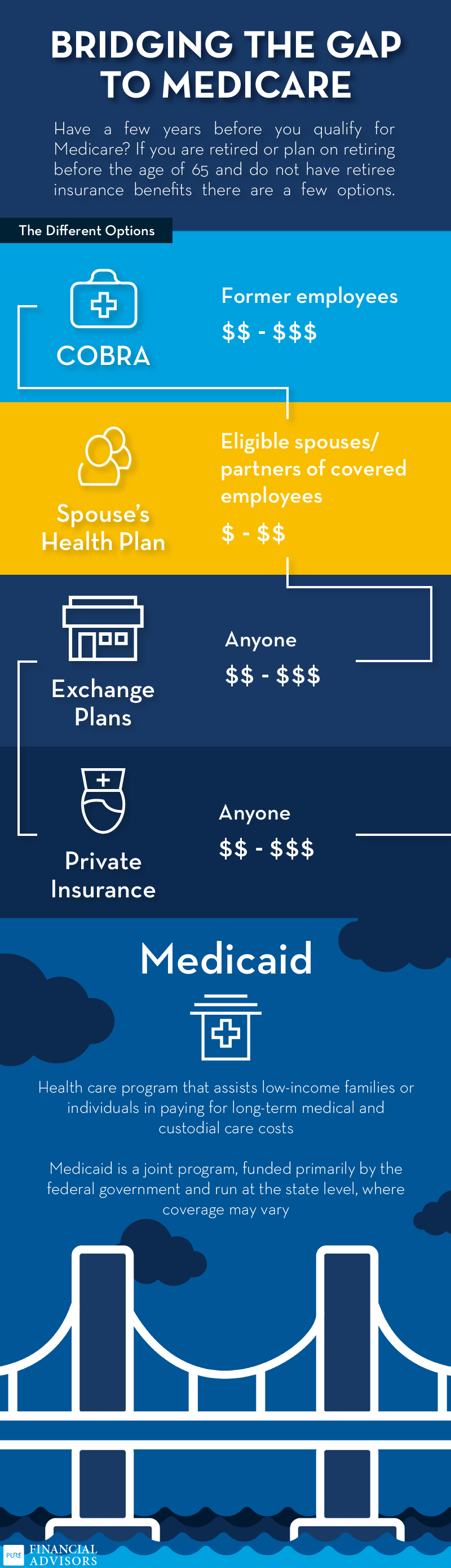

You are eligible for Medicare once you turn 65. At this age, many people are out of the workforce and are no longer receiving health benefits from their employer. But, what happens if you retire early? How can you make sure you are insured without employer health benefits or Medicare?

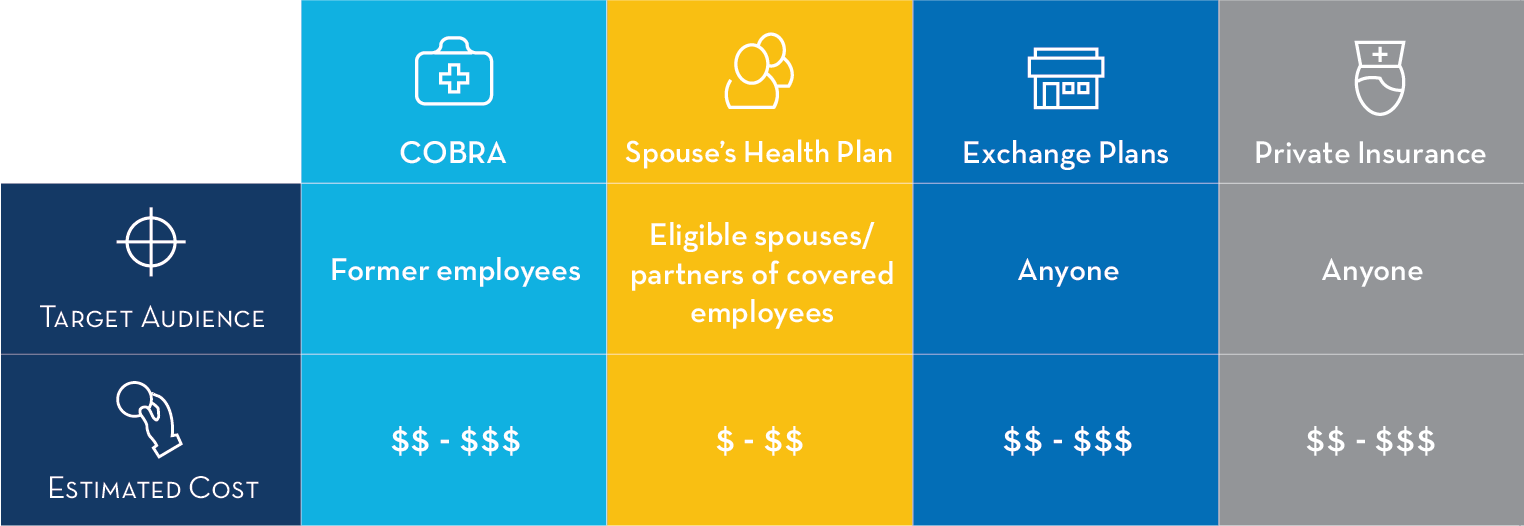

You have a few options for bridging the gap to Medicare based on your individual situation.

Here’s the breakdown so you can figure out the best option for you…

COBRA

COBRA is federal legislation that allows individuals who leave their employer the option to continue their current group insurance coverage under COBRA for 18+ months.

Common Misconceptions About COBRA:

- It does NOT matter if you separated from your employment voluntarily or involuntarily

- Even though COBRA is intended to cover employees that work for a company that has greater than 20 employees in the previous year, your state may have additional protections for individuals that work for smaller companies. Make sure to check this out depending on where you live.

The Cost: When you are an employee, you might pay a portion of your health insurance premium and your employer might help you out with part of it; however, when you elect COBRA you will be required to pay 102% of the full cost of coverage under your previous group plan. Or in other words, you will be required to pay the full amount, plus a 2% fee.

How to Elect COBRA: You have 60 days from the point of separating service from your employer or from initially being notified that you are eligible to elect COBRA benefits.

What happens if after 45 days I have not elected COBRA and I get in an accident? You would still be able to opt-in to COBRA, but you would have to pay your premiums retroactively during initial eligibility.

Spouse’s Health Plan

Eligible spouses (or domestic partners) of employees covered under a group health plan may be able to receive coverage.

Costs: This may be an affordable option, but the specific cost will depend on the amount contributed by your spouse’s employer. Check with your specific plan for rules and costs.

Important Point: If you plan to be on your spouse’s coverage, something else you should consider is that this plan may not be a permanent option if the spouse terminates employment.

Learn more: download the Making The Most of Medicare white paper.

Exchange Plan

Exchange plans are the types of plans you would get at healthcare.gov or at your state’s exchange (California: coverdca.gov).

You can apply during the annual enrollment period at the end of each year, which is November 1 – December 15 for a start date of January 1 of the following year. There are also a few special election periods such as:

- Adoption

- Marriage

- No longer live in your area of coverage

- Lost previous coverage

Medicaid

Depending on your estimated income for the upcoming year, you might be eligible for a subsidy when you purchase an exchange-based plan. If your income is low enough, you may also qualify for Medicaid.

What is it?: Medicaid is a health care program that assists low-income families or individuals in paying for long-term medical and custodial care costs. It is a joint program, funded primarily by the federal government and run at the state level, where coverage may vary.

Private Plans

Private plans have a large variety of options and vary in cost from moderate to among the most expensive options.

“Off-Exchange” Plan

“Off-Exchange” private plans are purchased through insurance companies directly with an agent or broker, rather than going to the health care exchange. Keep in mind that you will need to maintain a qualified major medical plan in order to avoid a tax penalty when you file your return the following year.

Important Point: “Off-exchange” private plans may underwrite applicants which could lead to a premium rate increase or denial of coverage. *Not all options will be considered “creditable” coverage.

Conclusion

When choosing your health care coverage, keep in mind that you must maintain a qualified medical plan in order to avoid a tax penalty the following year. It’s important that you decide on a coverage plan, but make sure to weigh out all your options before. Make sure to pay attention to premiums, what the plan covers and the area of coverage.

For more information on how to bridge the gap to Medicare, check out our three-part video series on “Understanding Medicare.”

When you’re ready to start thinking about your options once you do qualify for Medicare, learn about Medicare basics here >>

Additional Information

Department of Labor COBRA Site: https://www.dol.gov/general/topic/health-plans/cobra

Sources & Disclaimers:

1) http://www.ncpssm.org/Medicare/MedicareFastFacts (2015)

Investment Advisory and Financial Planning Services are offered through Pure Financial Advisors, Inc., a Registered Investment Advisor. The Advisor does not attempt to furnish personalized investment advice or services through this article.