Just because National College Savings Month is winding down, doesn’t mean your plans should too! You’ve likely thought about saving for your child or grandchild’s college education, but figuring out where to start can be quite overwhelming. What type of account should you use to save for college? How much should you deposit annually? There are many ways to save, but often times a defined plan will give you more peace of mind and structure when planning for the future. This blog post will break down some of the different types of plans you can choose from and will outline why it’s so important to have a set plan in place.

Before we dive in, it’s important to note that paying for college isn’t what it was forty or even twenty years ago. Three things have gotten exponentially higher over time:

- Tuition– In the past 30 years (1985 to 2015), average tuition and fees at private four-year institutions have risen by 146%. Adjusted for inflation, that is an increase from $12,716 to $31,231 per year. The average cost of attending a public two-year college rose 150%, from $1,337 to $3,347 per year, and the increase for in-state students at public four-year institutions was 225%, from $2,810 to $9,139 during the same time period.1

- Student debt– The average 2015 college graduate with student loan debt will have to pay back a little more than $35,000 after receiving their diploma.2

- Parent Stress- Almost 60% of parents feel some degree of apprehension about being able to save for college.3

Roughly half of Americans have a college savings plan in place. These individuals end up saving almost twice as much as those who save without a structured plan.3

A little planning can go a long way, but it’s always best to start with educating yourself on the various options before you create your plan. We’ll help by weighing out the pros and cons of these two effective, yet very different college savings vehicles: the 529 plan and Roth IRA.

529 Plans

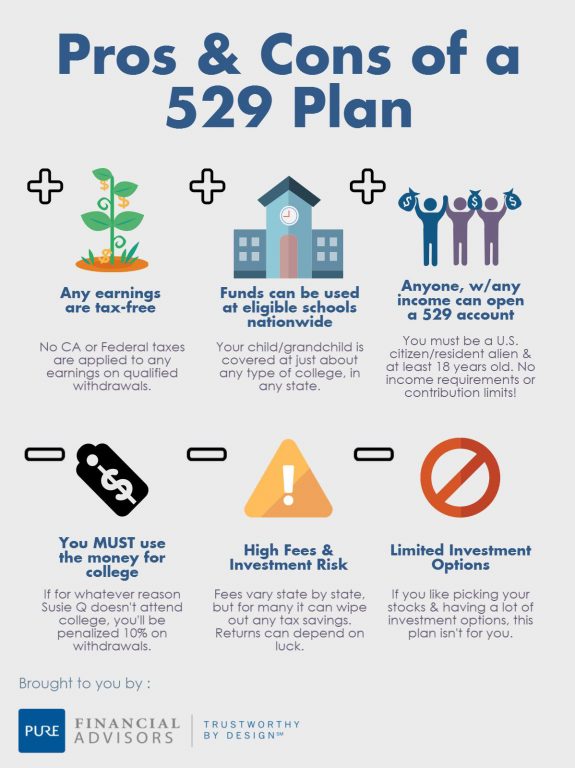

A 529 plan is one of the most widely used college saving plans. It allows families to set money aside specifically for college-related expenses. There are no income level limits, no contribution limits and it can be used in any state. As long as you’re 18 years or older, you can start a 529 plan for yourself or a beneficiary.

Downsides to a 529 plan? The money in this plan must be used for college expenses. If your beneficiary does not attend college, you will be penalized 10% on any non-qualified withdrawals. 529 plans are also commonly associated with high fees and don’t provide many investment options.

Some plan managers recognize this lack of investor flexibility and are changing investment options for advisors and investors. For example, an investment firm in New Mexico recently added five more individual fund options for creating customized portfolios in its advisor-sold 529 plan, according to a recent Investment News article. About $258 billion is currently invested in 529 plans, and with new changes to protect portfolios against increasing fees, this plan is sure to grow in popularity. 4

Important Financial Strategies for Your 20’s and 30’s – download the free white paper.

Roth IRAs

Many people overlook using their Roth IRA as a college savings vehicle. Unlike a 529 plan, if for whatever reason your child doesn’t attend college, any non-qualified withdrawals will be tax-free. So if Sally wants to hit the road instead of hit the books, at least those assets you’ve invested for her education can serve as retirement funds.

It’s important to note that the main reason you should have a Roth IRA is to help you retire, not to fund your child’s education. You would never want to jeopardize your retirement by drawing funds out of an account that is meant to financially support your lifestyle—a lifestyle where the only income you will likely be receiving is from Social Security or your pension. However, if you already have a Roth and there is a surplus of money sitting in this account, this would be one of the best ways to fund your child’s college education.

The Benefits of Roth IRAs

If you withdraw money from a Roth IRA and use it for qualified educational expenses (tuition, books, room & board, etc.) you’ll face no withdrawal penalties. This is because the IRS regards these withdrawals as a return of contribution first, with account earnings coming out next. If you are younger than 59 ½ and own a Roth—or older than 59 ½ but have owned your IRA for less than five years, your Roth IRA’s earnings are taxed at ordinary income when withdrawn. While this is the case, Roth IRA contributions may be withdrawn tax-free at any age. This means if you’ve contributed $50,000 to your Roth, you could withdraw that $50,000 tax-free later on, to use for qualified or non-qualified expenses.

Another benefit of Roth IRA’s is that your child or grandchild has a better chance of receiving financial aid. The Free Application for Federal Student Aid (FAFSA) is filled out by students when applying for financial aid and helps the federal government calculate the Expected Family Contribution (EFC), or how much a family would be able to afford in college costs. While conventional savings accounts are counted as assets on the FAFSA, IRAs are not, allowing your child to qualify for more free money.

The Downsides of Roth IRAs

A Roth might not work for parents who are retirees. This is because you must have a taxable compensation to make Roth IRA contributions. This leads to the other downside of a Roth IRA, which is that it has contribution limits. The annual contribution limit for traditional and Roth IRAs [for 2015] is $5,500 or $6,500 if you are 50 years of age or older (if catch-up contributions are included). Conventional college savings vehicles like 529 plans have no contribution limits (gift limits do apply).

Still unsure what plan to pick? Watch Robert McCullock, CFP® compare the 529 plan to the Roth IRA in this short video. He explains, “If you’re in a high net worth bracket, you have a lot of income and your child is not going to qualify for financial aid anyway, a 529 plan may be the way to go. If you’re in a lower net worth bracket or a lower income bracket, and you are concerned about financial aid, then maybe a Roth IRA could be a good consideration.”

Other Types of Plans

529 plans and Roth IRAs aren’t the only ways you can save for college. Here are a few other ways you can amass enough to send your beneficiary to the University of his or her dreams:

- Prepaid College Tuition Plans

- Coverdell Education Saving Accounts

- Savings or Checking Accounts

- Investments

- Trusts

- & more

If you have a question regarding what type of plan you think you should use, feel free to email us at info@purefinancial.com and we’d be happy to help!