More Podcasts

Pure’s Senior Financial Advisor, David Cook, CFP®, AIF®, provides insight into key risks of retirement and how to manage them. Outline 00:00 Intro 1:26 Why is Risk Management so Important? 3:35 Types of Risk Management 20:20 Risk Management Strategies 24:25 Asset Allocation 26:44 Diversification 28:09 Tax Diversification 35:37 Risk Management Process 36:07 Retirement Risk Zone: […]

Risk management investing strategies: is selling rental property and buying a variable annuity to reduce sequence of return risk and interest rate risk a good idea? Do small-cap or emerging markets have better risk-adjusted returns against market volatility? Should eREITs (non-traded real estate investment trusts) be in your retirement investments? Is RPAR Risk Parity ETF a good inflation hedge? Should you be tax gain harvesting in declining financial markets?

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

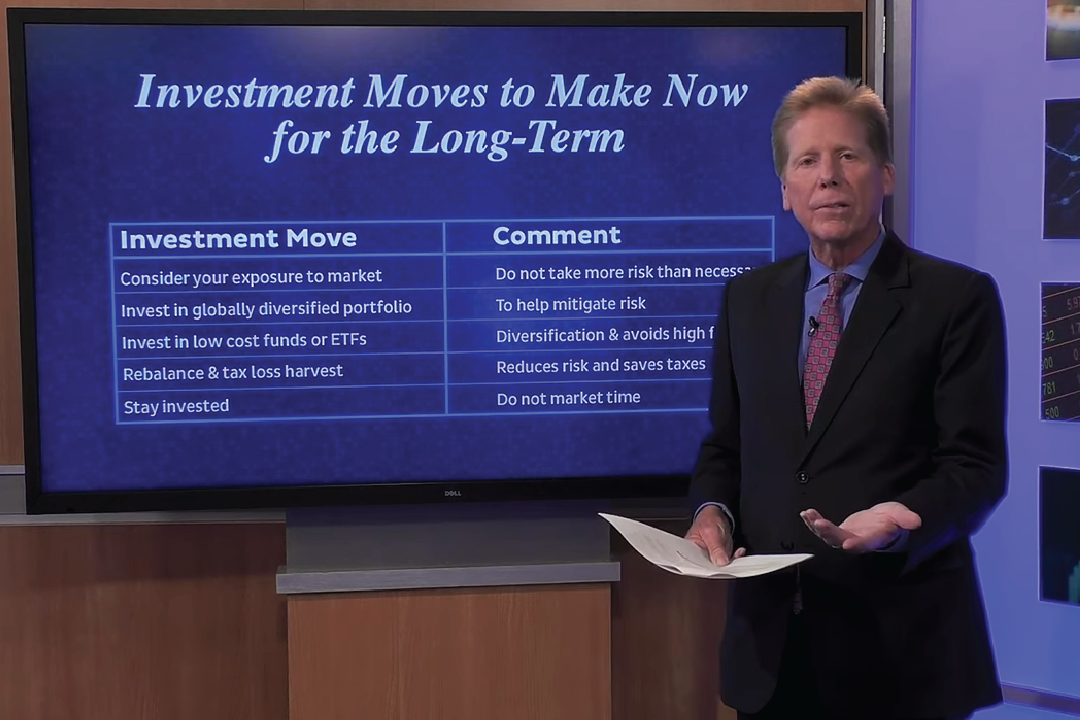

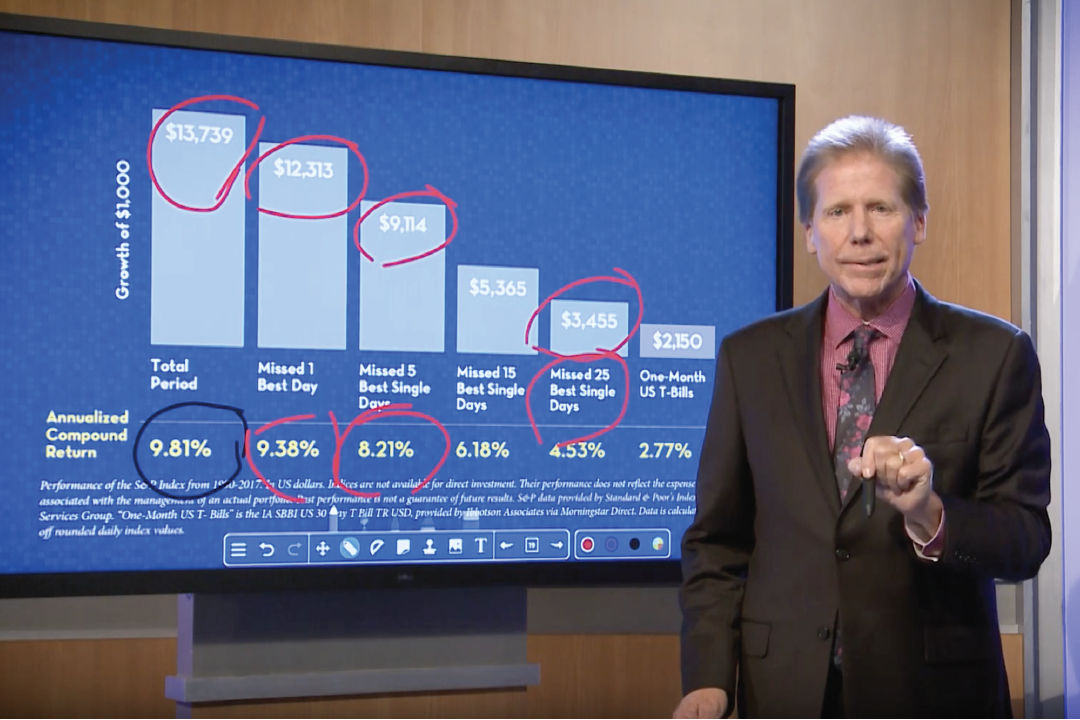

When the markets have large swings – up and down – investors often make mistakes that can jeopardize their entire retirement plan. Financial professionals Joe Anderson and Alan Clopine provide a long-term view of how the markets respond in good and bad times. They also give you the tools you need to take the emotion […]

For many people planning for retirement, risk is often a dirty word. But risk can be good. It can help bolster your retirement funds if it is managed properly. Financial professionals Joe Anderson and Alan Clopine guide you through risks that can help increase your retirement funds and ones that can keep you from meeting […]

Jonathan Clements (founder, HumbleDollar.com, former Wall Street Journal personal finance writer) on portfolio rebalancing, reducing risk and doing a Roth conversion. Plus, Joe and Big Al answer your money questions: when is the best time to get into the market? When is the best time to retire? Can you start a Roth IRA for your […]

Economist Dr. Allison Schrager, author of An Economist Walks Into a Brothel and Other Unexpected Places to Understand Risk, explains how the risk management techniques of surfers, prostitutes, magicians, and soldiers might relate to our own investing and retirement planning. Plus, does it matter which assets you withdraw first from your retirement portfolio? Joe and Al dive deep on this […]

Has your financial advisor, retirement account custodian or the brokerage firm where you hold your investments asked you for a “trusted contact person?” In this video, Matt Horsley, CFP® of Pure Financial Advisors explains what a trusted contact person is and how Pure Financial is helping to safeguard our clients’ finances. Transcript: Recently your financial […]

Todd Tresidder of FinancialMentor.com shares the surprising ways to reduce risk and increase returns as outlined in his new book, The Leverage Equation: How to Work Less, Make More, and Cut 30 Years off Your Retirement Plan. Joe and Big Al answer your money questions on real estate investing, buying a house with your 401(k) money, […]

In putting together a finical plan for retirement, it is critical to understand what risks can help grow your retirement funds and which ones can derail your financial plan. The last thing you want in retirement is to be forced back into going to work. Pure Financial Advisors’ experts Joe Anderson and Alan Clopine explore […]

Plenty of risks threaten retirement, and today we focus on managing risks from longevity, inflation, sequence of returns, taxes, interest rates, and lost opportunity. Plus, Professor Jamie Hopkins from The American College and the New York Life Center for Retirement Income talks about how our risky investor behavior needs Rewirement (which happens to be the title of […]

Risk Management is a term most frequently associated with large businesses due to its crucial importance for corporations. However, risk management activities are just as vital when it comes to personal finances. In this video, Pure Financial Advisors’ Robert Canavan, CFP® explains why risk management is important in your personal, professional, and investing life. Blog: Why […]