More Podcasts

Purefinancial

George in South Carolina wants to retire in 8 years at 53. Does he have enough in his brokerage account to bridge the gap to Social Security? Joe in Massachusetts is saving a staggering $200,000 a year, but will his high-spending lifestyle make a multi-million dollar nest egg look small? The fellas help 26-year-old Jonathan in Florida map out a path to retire in his 40s using his 457 plan, and they spitball on whether early exit strategies for both Kris and Rojo in California are a “green light” or a reality check. Plus, Joe explains why the “Rule of 55” and Roth conversions might be some of the most important tools in your early retirement toolbox.

Are you among the 49% of retirees making the same mistake that quietly costs thousands every single year? The good news is, it can be fixed with a little clarity and some thoughtful planning. Find out what that mistake is and how to avoid draining your portfolio faster than you planned, as Joe Anderson, CFP® […]

Daniel in Texas is 40 and worrying about how to support Mom and Dad if their money runs out. Can he build some kind of financial safety net for them without ruining his own retirement? Jemma’s 82-year-old mom is drawing down her portfolio. Is locking in guaranteed income with an annuity a smart move, or could that create new problems down the road? Plus, “Cookie and Gerry” want to walk away from work before 50 with a big brokerage account and a pension. Are they positioned correctly? How can they avoid pulling the wrong levers at the wrong time? And “Fred and Wilma” are staring at a potential multi-million-dollar ESOP payout. What levers do they need to pull so they can retire at 46 and shout “Yabba Dabba Doo”?

When you’re standing at a major financial crossroads, the timing of your decisions can mean the difference between success and failure. Joe Anderson, CFP® and Big Al Clopine, CPA spitball on the “when” of five retirement decisions, today on Your Money, Your Wealth podcast number 569. We’ll kick things off with a whale of an email: “Fine and Dandy” is 42 years old with a multimillion dollar private equity offer on the table. Should he sell his business now or hold out for a second bite of the apple later? He also wonders if it’s crazy to spend more on his vacation home than on his primary residence. David calls himself an “elderly orphan,” flying solo at 66 and in need of a plan to protect his million-dollar portfolio as he ages. BB and Shell are trying to time their final year of retirement contributions to save as much as possible before moving to a lower-tax state. Should they go Roth IRA or traditional? Joel wonders when to take required minimum distributions from retirement accounts for the maximum tax benefit, and Brian in New York needs a spitball on when it makes sense to have an emergency fund as a retiree, and for how much.

John Q. Taxpayer is in the home stretch of his career, looking for the best way to catch-up and build his tax-free bucket. Meanwhile, a pair of young financial nerds in Omaha are already strong savers, but they’re wondering whether a simple “VOO for life” strategy is enough to help them reach multimillionaire status in retirement. Also, Janine retired unexpectedly. Can her remaining savings support a European retirement lifestyle? From Jonas Grumby’s “glitch in the matrix” tax strategy to the potential tax nightmare of Dolly’s literal sack of inherited gold coins, Joe and Big Al spitball on how folks from different generations with different situations can reach the same ultimate goal: positioning assets today to ensure the most tax-free wealth tomorrow. Plus, the fellas spitball on the “double taxation” trap of retirement plan loans for Pete in North Carolina, and the affordability of 50-year mortgages for Semper Fi in Michigan.

Should Al and Peggy in Illinois keep hammering pre-tax retirement savings, or should they pivot to post-tax Roth for better tax diversification? Which pension option is best for their early retirement plans? Long-term care insurance premiums are going up endlessly for Eloise in Connecticut. Is she walking into an insurance industry trap? How do Eric and Tami in Baton Rouge help their kids with college without blowing up their own retirement, and when do student loans make sense? Finally, should Lana and Sterling harvest capital gains or prioritize Roth conversions before moving to a much higher-tax state? The basic question in all of these is the same: how do you protect your future from rising costs and unknowns that are out of your control?

Pure’s Financial Advisor, Blaine Thiederman, CFP®, breaks down the true cost of long-term care and why planning early can help protect your independence, your future, and your peace of mind. Transcript When people think about long-term care, they often picture something far off in the future or something that only happens to other families. But […]

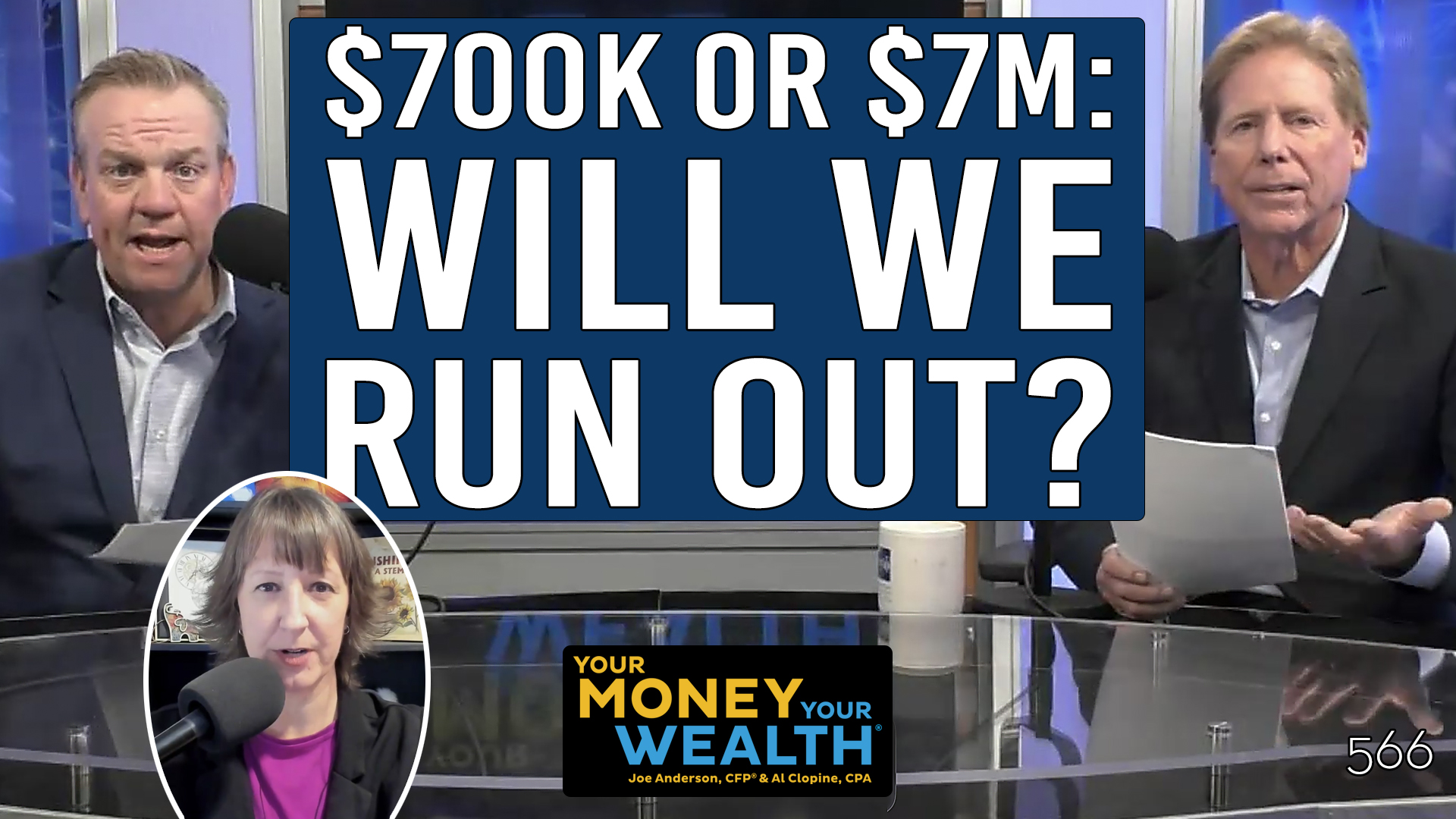

“Mr and Mrs Smith” have nearly $850,000 saved at age 43, but they’re very concerned about retirement. “Lucy and Desi” are 58 and 64 with nearly $7 million saved, but they still lie awake wondering if it’s enough for their high-expense life. “Tony and Carmela” are in a similar boat with millions saved at 61 and 59, but they’re worried their asset allocation won’t get them through their retirement. No matter the numbers, the fears sound exactly the same: will you run out of money in retirement? Turns out overcoming that fear is not about hitting a magic number. We’ll find out what it’s all about, today on Your Money, Your Wealth podcast number 566 with Joe Anderson, CFP®, and Big Al Clopine, CPA. The fellas also spitball Roth conversions, long/short direct indexing capital gains tax strategies for “Juicy Squeeze”, working after retirement for Wendi, and how one confusing word can completely change a retirement timing decision for “Jacques and Johana.”

Lucky Lou is 48, burned out and wants to punch at 50. How should he bridge the gap before pensions and Social Security? Joe Anderson, CFP®, and Big Al Clopine, CPA walk through the Rule of 55, 72(t)s, and the psychological reality of spending down a taxable account, today on Your Money, Your Wealth® podcast number 565. Alexei and Anna are high earners in their mid-20s who want to save aggressively and keep taxes low. Which retirement accounts should they prioritize, and can they afford a downpayment on a house? Jay and Gloria are wrestling with the classic question of whether to save to Roth or traditional 401(k), especially since their state doesn’t tax retirement income. Is taking the deduction now and backdooring Roths the smarter move? Plus, Sleepless in Seattle wants to know, can her 28-year-old daughter afford to buy a condo in a high-cost housing market? Finally, Jennifer in Texas wonders how to invest and withdraw an inherited IRA over the 10-year rule with the least tax damage.

Joe Anderson, CFP® and Big Al Clopine, CPA spitball for YMYW listeners in their 40s who are ready to call it quits at work, become financially independent, and retire early. Can they afford to do it? Peter and Joanna want to retire in the next two years. Burned Out and Ready to Retire wants out of his toxic office. If Maryland Chicken Man never earns another dollar, how much can he afford to withdraw from his retirement accounts each year? And Suzanne in Massachusetts is 69 and needs $60K a year for the next 30 years. Is she all right?

Financially speaking, should Old Bear in Northern Kentucky marry his Honey? How should Sebastian in Virginia navigate the financial aspects of his separation? Plus, Famous Missourians want to know, how much is enough for retirement and when can you take your foot off the gas? Can Paul with the Big Wallet Bridge the long gap between retiring and claiming Social Security benefits? And can Aspiring Adventurer in Oregon retire single at age 58?