Are you getting close to retirement but aren’t sure if you will have enough of an income stream to enjoy your time in retirement? Financial Experts Joe and Al explore ways to produce more income with the largest asset many retirees own: their home. American College Professor, Wade Pfau, takes a look at the pros and cons of selecting a reverse mortgage and highlights why this tool no longer deserves a bad reputation. A reverse mortgage isn’t the right choice for everyone but Joe and Al explore other options such as downsizing to a less expensive home, mortgage options, alternatives to cash and possible tax consequences.

Important Points:

(1:03) – Median Net Worth & Home Ownership Rates

(1:56) – Banking on Your House in Retirement

(3:32) – Downsizing for Retirement

(5:34) – Section 121 Tax Exclusion

(6:35) – Proposition 60 (California)

(7:37) – True or False? Most baby boomers prefer to downsize to a smaller home during retirement.

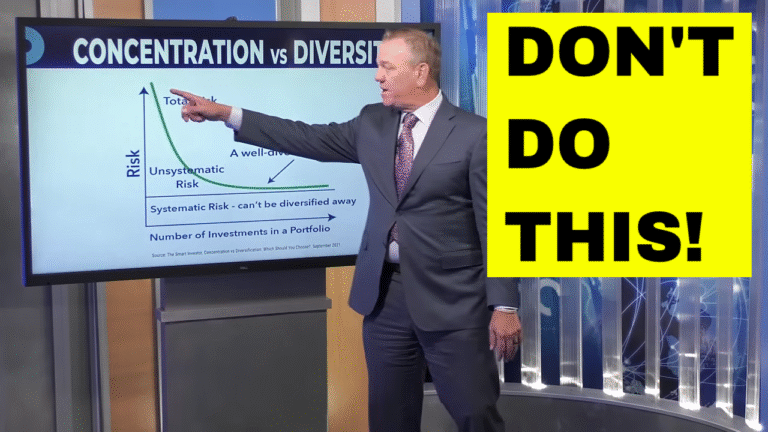

(9:04) – Potential Mortgage Solutions

(9:45) – Tax Consequences: When You Borrow from Your Home

(10:10) – Reverse Mortgages

(10:45) – Interview with Dr. Wade Pfau, Professor of Retirement Income at the American College

(16:32) – True or False? Retirees 62 years-old or older can take a reverse mortgage without going through counseling.

(17:58) – Cons of a Reverse Mortgage

(18:58) – Making Money from Your Home

(20:18) – Email Question #1: If my home goes under water after I secure a reverse mortgage, will I or my children have to pay for the additional debt?

(20:58) – Email Question #2: Does it make sense for me to get a reverse mortgage to increase my cash flow so that I can delay claiming my social security benefits?