More Short Episodes

The word “taxes” may not be on the top of everyone’s list of favorite things to address. But, with some forward-looking preparations, managing your taxes does not have to be burdensome with the help of this tax planning guide. In this guide, you’ll learn… Important Tax Deadlines Retirement Account Limits & Roth IRA Income Limits […]

Pure’s Senior Financial Advisor, Bill Hodapp, CFP®, CPA, AIF®, offers guidance on organizing your finances. He covers managing debt, avoiding missed deadlines, and reviewing your investment strategy so you can gain actionable insights to improve your overall financial health and planning. Outline 00:00 Intro 00:18 Personal Finance Goals 2:32 Creating a Budget 4:48 Review and […]

The best investment strategy is one you can commit to long-term while achieving your goals. Pure’s Financial Advisor, Brian Wolff, CFP®, AIF®, offers practical steps to optimize your portfolio in 2025. By applying these ideas to your plan, and you’ll be on track for a more effective, streamlined investment approach. Transcript We all want better […]

Did you know that tax planning and strategy implementation needs to occur prior to December 31st? Most tax strategies are only available during the tax year, so don’t wait! This tax checklist covers the important tax items that you need to collect and strategies you might want to implement before the year-end. This checklist includes: […]

A year-end financial planning checklist is a must for understanding your retirement plan, optimizing investments, and reviewing tax strategies. Pure’s Financial Planner, Phillip Chinothai, CFP®, AIF®, discusses five ways to keep you on track: Review Your Investment Portfolio Maximize Retirement Plan Contributions Review Roth Conversions Plan for Tax Deductions and Credits Update Your Financial Plan […]

Updated for 2023: When it comes to your taxes, do you feel overwhelmed? Having the right tools and strategies to limit your tax bill can help reduce that anxiety. In this guide, we’ll help get you informed and share some strategies that can help you with end-of-year tax planning. In this guide, you’ll learn… Important Tax Deadlines Tax […]

While no one knows what the future holds, there are ways you can prepare for life’s uncertainties during retirement to try to limit how blind spots impact your savings. Pure’s Associate Advisor, Alex Valles, CFP®, covers the top three: healthcare, inflation, and taxes. FREE GUIDE | Retirement Blind Spot Guide Transcript On your road to […]

Deciding who will inherit your estate is a big decision and an important part of life planning. Smart estate planning helps protect families with young children as well as helping your heirs from overpaying on taxes. Pure’s Financial Planner, Dean Heimbach, CFP®, AIF®, covers four key steps to get you started on your estate plan: […]

Are you wrestling with your taxes and getting body slammed? Taxes are often not part of many people’s financial plan, an oversight that can cost you tens of thousands of dollars if it isn’t. Taxes can knock you out – you have to know the moves to keep away from a TKO. Most people are ready to […]

The tax deadline (April 18) is quickly approaching and it’s that time of year to prepare for your tax return. Pure’s Financial Planner, Scott Huband, CFP®, AIF®, takes you through a quick checklist to make sure you have all the right documents and deductions. FREE GUIDE | 2023 Tax Planning Guide Transcript Tax season is […]

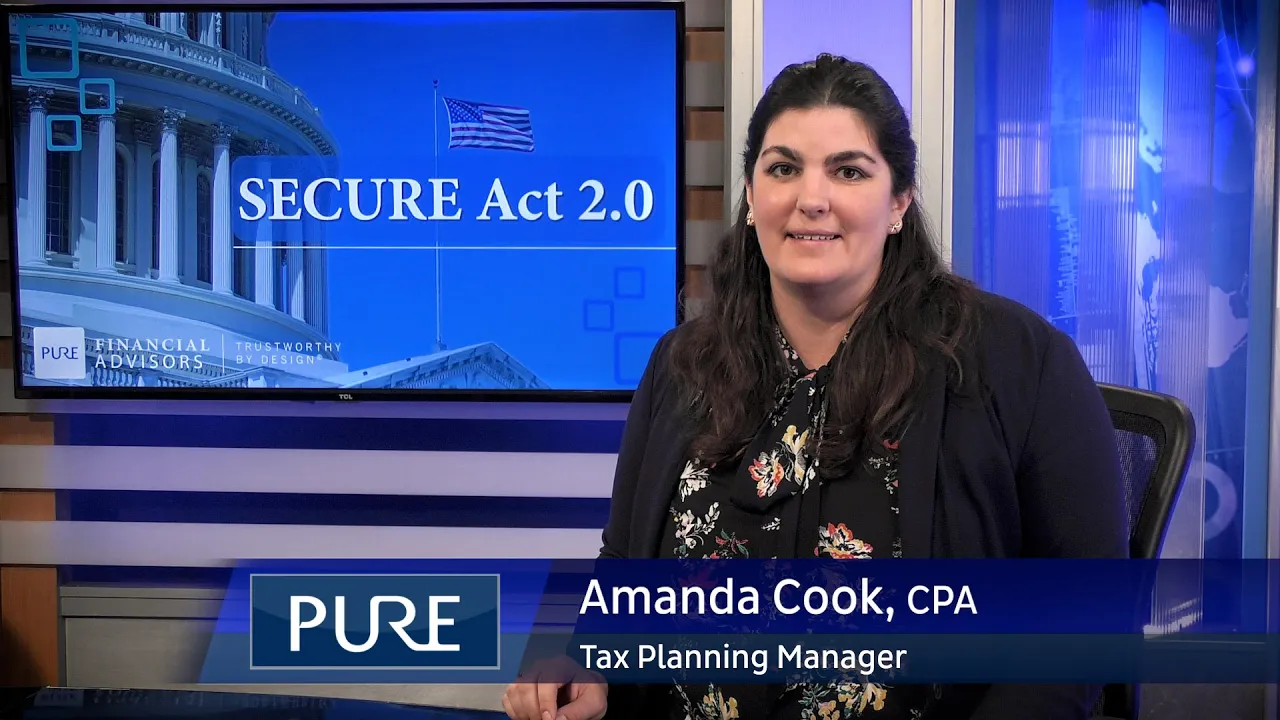

Retirement savings and available tax breaks have changed substantially with the SECURE 2.0 Act of 2022. It’s part of the $1.7 trillion omnibus budget bill that became law in December 2022, and it contains about 100 different provisions that may affect you. Amanda Cook, CPA, Tax Planning Manager at Pure Financial Advisors, provides a very […]

With the start of a new year, now is a great time to focus on ways to improve your finances in 2023. Pure’s Associate Advisor, Michael Chipperfield, CFP®, AIF® talks about plans and strategies to improve your financial health. FREE GUIDE | Financial New Year’s Resolutions: Tips for Getting Your Finances in Order

Are you a mutual fund investor? Learn about how capital gain distributions may impact you and your taxes. Senior Financial Planner, Nathaniel Ritchison, CFP®, AIF® provides an overview of capital gains and potential strategies for mutual fund investors. FREE GUIDE | End of Year Tax Strategies Transcript The pain being felt by investors could get […]