If you own bonds and you’re like most investors, you’re probably frightened by the idea that interest rates might keep going up. After all, everyone knows that higher rates are a disaster for bond owners.

The thing is, though, that prevailing wisdom may not be correct.

What are bond investors really afraid of?

As a bondholder, you face three main risks. The first is that the person you lent money to won’t be able to pay you back. This is known as default risk, and you can minimize this by holding a well-diversified portfolio focused on mostly high-quality issuers.

The second risk you face is that the interest and principal payments you receive will come back to you in dollars that aren’t worth as much as they once were. This is known as inflation risk, and while it is something to be wary of, it can be mitigated somewhat by focusing your bond holdings on relatively short-term maturities.

The third great fear of bond investors is higher interest rates. That is because the value of bonds moves inversely to interest rates. In other words, when rates move lower, bond prices move higher. Conversely, when interest rates go up, as they have at the start of 2022, bond values decline, and bondholders see red ink on their statements as their supposedly safe bonds fall in value.

Should you really be afraid?

For starters, let’s acknowledge that no one likes to lose money, especially on “safe” bonds. But if you aren’t planning to sell your bonds, have you really lost money? Sure, on paper, you have, but how important is that really.

Remember, one of the key differentiators between stocks and bonds is that bonds have a maturity date, and at that maturity date, you know how much you are going to be paid. So, as long as you don’t plan to sell your bonds prior to maturity, you can ignore those mark-to-market losses.

Think of it a bit like a house you plan to live in for thirty years. Do you care what value Zillow places on your home on a day-to-day basis? Probably not. And the more you can take that approach with your bonds, the better off you’ll be.

The key, though, is to identify your investment time horizon and then make sure that the average maturity of your bonds is less than your time horizon. This way, you won’t have to sell your bonds before they mature.

Doing things this way provides one other benefit, and it’s really the key behind why rising interest rates might just be your friend.

Who wants a pay raise?

Pretty much no one has ever gone into work in the morning afraid they’ll get a pay raise. After all, more is better, at least when it comes to your paycheck. So why would it be any different with the paycheck you’re getting from your portfolio?

After all, don’t rising interest rates mean that when you reinvest principal or interest payments, you’ll do so at higher rates? Which means you’ll get more income from the portfolio. Which is really the same thing as getting a bump in your paycheck.

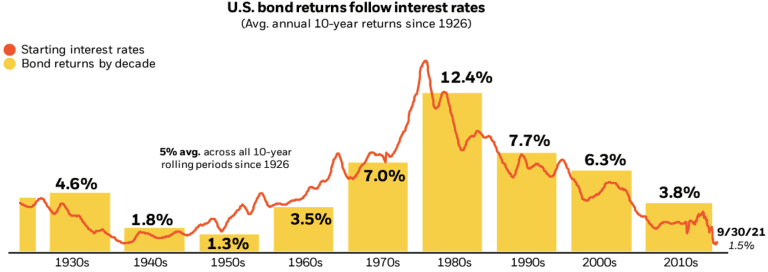

Higher rates equal higher returns

Over time, bond returns have closely tracked starting interest rates, and the higher rates have been, the better bond market returns have been. That means you should hope that interest rates move up since, in the long run, it will lead to more cash flow from your bond holdings and better returns from your portfolio.

It might help to think of the value of your bond portfolio in the shape of the letter “U.” As interest rates move up, the value of your bonds declines.

But eventually, additional income flows in, and interest rates stabilize, leading to a flattening out in the total performance of your portfolio.

The end result is that those higher interest rates that seem so alarming result in a bond portfolio worth more than it would have been if rates had stayed low.

Much Ado About Nothing

In Hamlet, Shakespeare wrote that “Neither a borrower, nor a lender be; For loan oft loses both itself and friend.” Well, with all due respect to the bard, he didn’t understand portfolio theory or interest rates!

Five centuries after Shakespeare’s passing, many investors recognize the need for the relative stability high-quality bonds lend to their portfolios. And while many of those investors have spent a good deal of time fretting about rising interest rates, a deeper understanding of the impact rates have on bond portfolios makes it clear that to quote the bard again, in many ways, fear of rising rates is really just Much Ado About Nothing.