More Posts

Should Al and Peggy in Illinois keep hammering pre-tax retirement savings, or should they pivot to post-tax Roth for better tax diversification? Which pension option is best for their early retirement plans? Long-term care insurance premiums are going up endlessly for Eloise in Connecticut. Is she walking into an insurance industry trap? How do Eric and Tami in Baton Rouge help their kids with college without blowing up their own retirement, and when do student loans make sense? Finally, should Lana and Sterling harvest capital gains or prioritize Roth conversions before moving to a much higher-tax state? The basic question in all of these is the same: how do you protect your future from rising costs and unknowns that are out of your control?

“Mr and Mrs Smith” have nearly $850,000 saved at age 43, but they’re very concerned about retirement. “Lucy and Desi” are 58 and 64 with nearly $7 million saved, but they still lie awake wondering if it’s enough for their high-expense life. “Tony and Carmela” are in a similar boat with millions saved at 61 and 59, but they’re worried their asset allocation won’t get them through their retirement. No matter the numbers, the fears sound exactly the same: will you run out of money in retirement? Turns out overcoming that fear is not about hitting a magic number. We’ll find out what it’s all about, today on Your Money, Your Wealth podcast number 566 with Joe Anderson, CFP®, and Big Al Clopine, CPA. The fellas also spitball Roth conversions, long/short direct indexing capital gains tax strategies for “Juicy Squeeze”, working after retirement for Wendi, and how one confusing word can completely change a retirement timing decision for “Jacques and Johana.”

Pure’s Financial Advisor, Blaine Thiederman, CFP®, breaks down the true cost of long-term care and why planning early can help protect your independence, your future, and your peace of mind. Transcript When people think about long-term care, they often picture something far off in the future or something that only happens to other families. But […]

Lucky Lou is 48, burned out and wants to punch at 50. How should he bridge the gap before pensions and Social Security? Joe Anderson, CFP®, and Big Al Clopine, CPA walk through the Rule of 55, 72(t)s, and the psychological reality of spending down a taxable account, today on Your Money, Your Wealth® podcast number 565. Alexei and Anna are high earners in their mid-20s who want to save aggressively and keep taxes low. Which retirement accounts should they prioritize, and can they afford a downpayment on a house? Jay and Gloria are wrestling with the classic question of whether to save to Roth or traditional 401(k), especially since their state doesn’t tax retirement income. Is taking the deduction now and backdooring Roths the smarter move? Plus, Sleepless in Seattle wants to know, can her 28-year-old daughter afford to buy a condo in a high-cost housing market? Finally, Jennifer in Texas wonders how to invest and withdraw an inherited IRA over the 10-year rule with the least tax damage.

Joe Anderson, CFP® and Big Al Clopine, CPA spitball for YMYW listeners in their 40s who are ready to call it quits at work, become financially independent, and retire early. Can they afford to do it? Peter and Joanna want to retire in the next two years. Burned Out and Ready to Retire wants out of his toxic office. If Maryland Chicken Man never earns another dollar, how much can he afford to withdraw from his retirement accounts each year? And Suzanne in Massachusetts is 69 and needs $60K a year for the next 30 years. Is she all right?

Financially speaking, should Old Bear in Northern Kentucky marry his Honey? How should Sebastian in Virginia navigate the financial aspects of his separation? Plus, Famous Missourians want to know, how much is enough for retirement and when can you take your foot off the gas? Can Paul with the Big Wallet Bridge the long gap between retiring and claiming Social Security benefits? And can Aspiring Adventurer in Oregon retire single at age 58?

Joe Anderson, CFP® and Big Al Clopine, CPA spitball business development company (BDC) funds for Edward in Illinois before diving into buckets of cash, T-bills, decumulation, and Roth conversion timing for Pebbles and Bam Bam. Plus, the fellas help 34 year old Keith in Connecticut figure out if he’s actually on track, whether he’s taking too much risk, or just worrying too much. They also spitball on the six-figure annuity gain that Gus in Philly’s 95-year-old dad has amassed. Finally, why yelling “never pay an advisor” on the internet doesn’t necessarily magically turn MYGAs into the perfect investment for everyone.

David wants to know if he and his wife (ages 47 and 53) are actually on track for retirement – without realizing they’re creeping toward that .01% crowd that David swears he is not part of. Mia and Jessie from Seattle want to retire and still pick up a dream lake house with a combined ten million dollars saved. Can they pull it off? Yosemite Sam from Allen, Texas, wonders if he should wipe out the lake house mortgage or keep that low-rate loan to hang on to more flexibility as he approaches retirement. Joe and Big Al also spitball on whether Todd and Margo should shift more into pre-tax accounts to leave their corporate jobs at age 50, and whether early retirement at 55 plus a $500,000 beach home is in the cards for Birdie and Bogey from Williamsburg.

McDreamy Dempsey wants to know if converting to Roth in the 37% tax bracket ever makes sense, and Gary in La Crosse warns Joe Anderson, CFP® and Big Al Clopine, CPA about Roth conversion “lag” and when it DOESN’T make sense to convert, today on Your Money, Your Wealth® podcast 558. Plus, Wine Guy and Gal in Northern California want a spitball on whether they should protect their ACA subsidies or keep converting to Roth before Medicare kicks in. Then it’s the classic question for Robert in Napa, Luke and Lorelai in Indiana, and Phil and Claire in California: should they save for retirement in their traditional pre-tax accounts, or their post-tax Roth accounts? Different needs and situations, same big question: which strategy gives you the smarter tax outcome?

George in Torrance wants to know the smartest way to deal with the giant UGMA account set up by his kids’ grandparents. Suzanne in Detroit has a twist on the new 529 plan to Roth rollover rule. “Homer and Marge” need a spitball on whether they can build huge 529 plans for college savings and still retire early. Plus, Bill in Chicago just inherited a $950K IRA and needs a withdrawal plan before he triggers a tax explosion. Aaron in Cincinnati wonders whether maxing out his health savings account every year as part of his overall pre-tax contributions is a good idea. Carl in Western Maryland has questions about the required minimum distribution age and HSA rules, and wonders whether those who make the tax code are on drugs! And finally, Marc wants to know how to avoid the tax kaboom from $the 4 million sitting in his traditional IRAs at age 73.

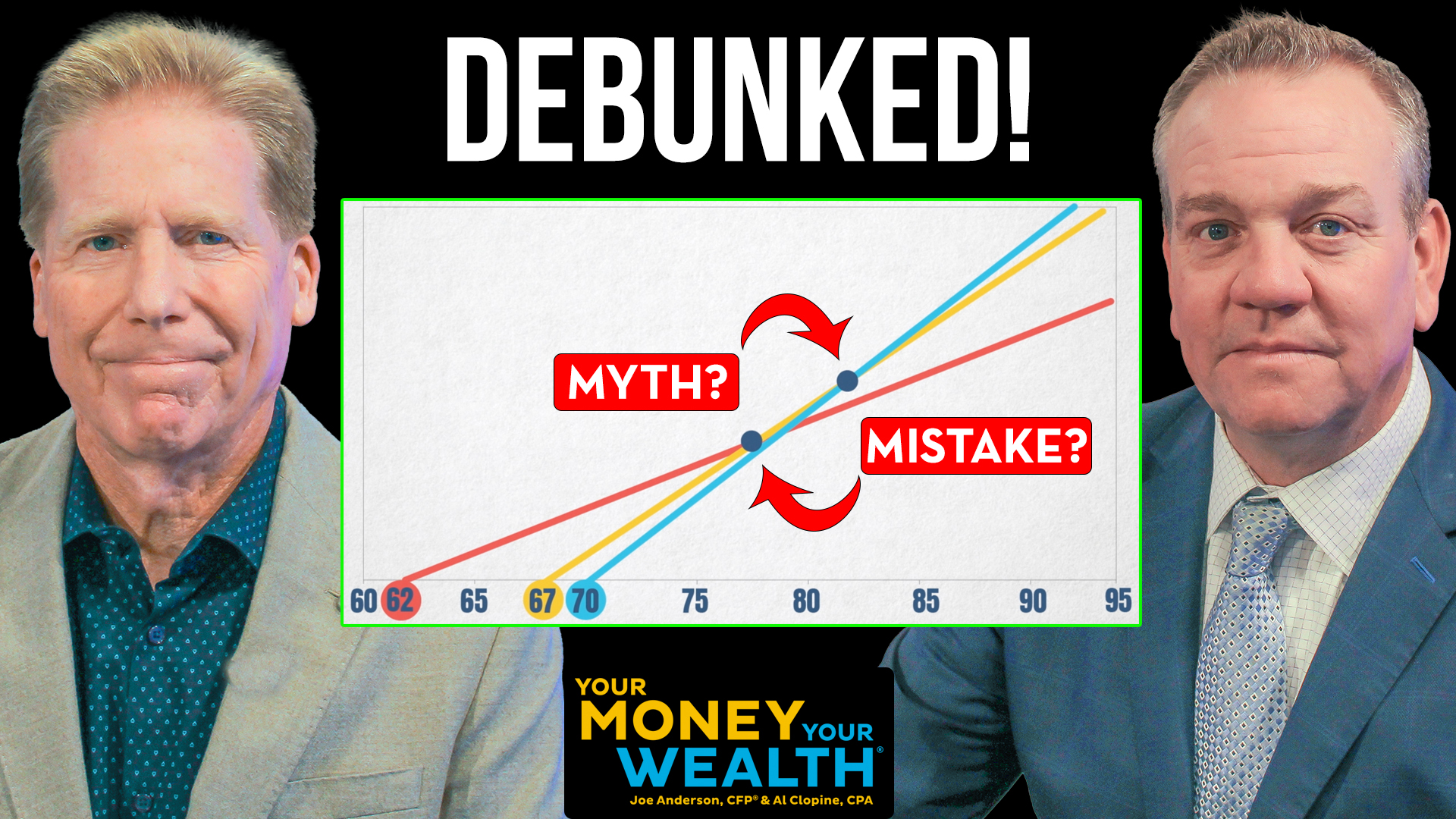

You’ve heard the phrase, “if it sounds too good to be true, it probably is”? Not everything you see online is good advice, especially when it comes to personal finance tips from self-proclaimed “finfluencers”. Joe Anderson, CFP®, and Big Al Clopine, CPA, expose what’s hype, what’s harmful, and how to protect your retirement from bad […]