As of this writing, the Russian invasion of Ukraine has been going on for more than two weeks. And while the two sides have discussed a ceasefire, they have made little headway into resolving the conflict so far. As a result, financial markets have been extremely volatile, and the longer-term economic implications are building.

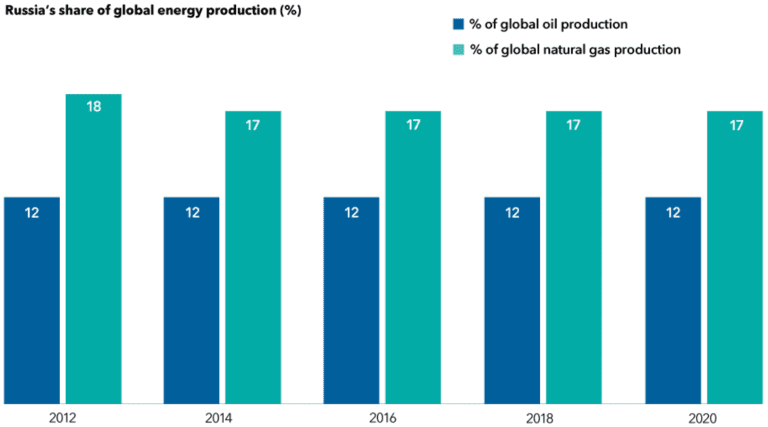

Russia is one of the top three global producers of oil and gas, and recent sanctions have led to a spike in energy prices.

Russia is a Major Energy Producer

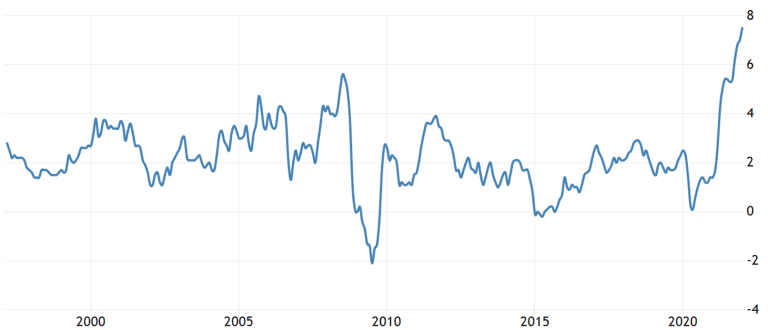

Oil Prices Soar

West Texas Intermediate Crude (6-month data as of March 7, 2022)

In turn, that surge in energy prices exacerbates inflation already at multidecade highs.

Inflation at Multi-Decade Highs

Consumer Price Index (Data as of March 7, 2022)

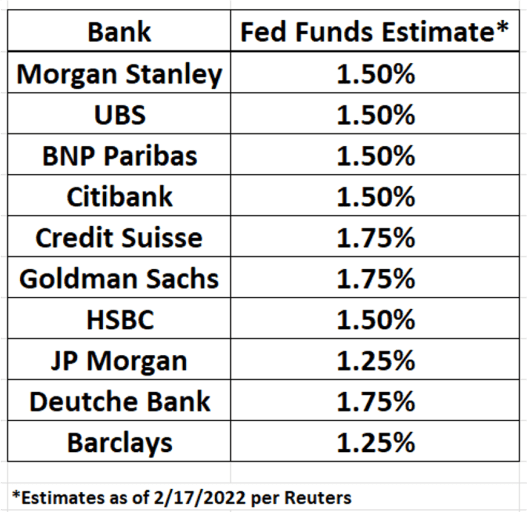

Soaring energy prices and sky-high inflation, combined with the uncertainty surrounding the war itself, is further complicating the job of the Federal Reserve, which is planning to begin raising interest rates at its next meeting. Current Wall Street estimates call for anywhere from five to eight total rate hikes, though the uncertainty around that is growing as geopolitical turmoil spreads.

Multiple Rate Increases are Priced in

Estimates of Fed Rate Increases

Against this backdrop, we suggest you keep a few things in mind:

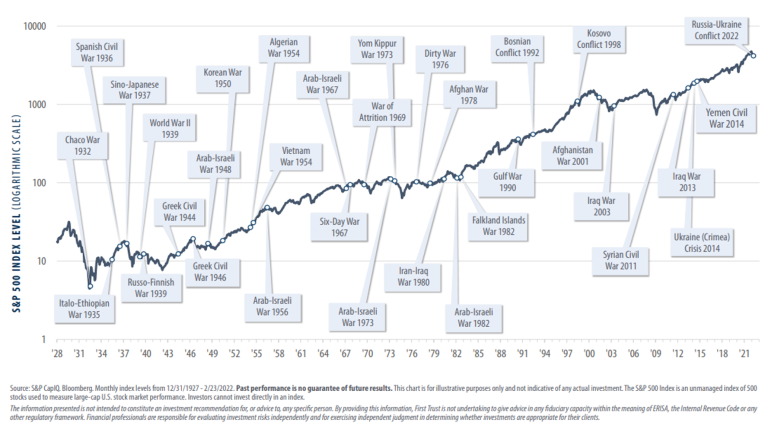

First, as the chart below shows, wars have sadly been too common over the last hundred years. However, as measured by the S&P 500, the stock market has generally recovered quickly.

S&P 500 and Market Shocks

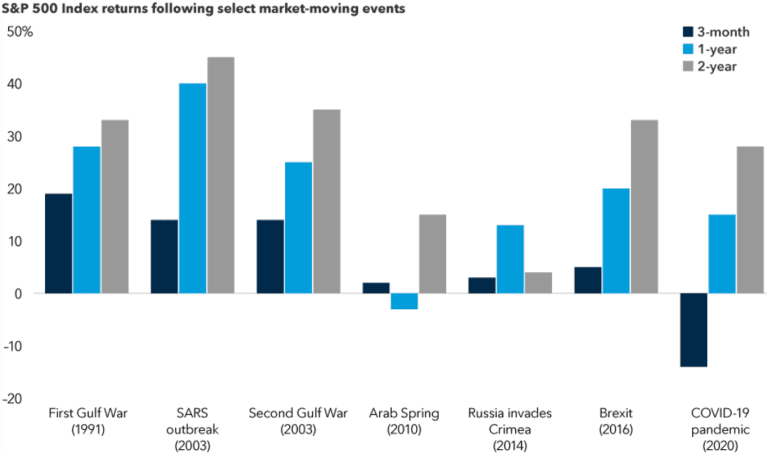

In fact, the S&P 500 has rallied in relatively short order following a host of different market disruptions.

S&P 500 and Market Shocks

Market shocks have often been followed by market gains

Stocks tend to experience a sharp decline most years but often end the year with positive performance despite intra-year declines. Of course, that doesn’t guarantee that 2022 will be a good year for stocks, but it does indicate that the poor start to the year doesn’t guarantee a bad year for stocks.

Additionally, given recent events, it’s easy to forget just how well stocks have done recently, particularly against the backdrop of a global pandemic. The S&P 500 has nearly doubled from its March 2020 lows, and when markets rise that far that fast, they tend to pause for a breather. Of course, the proximate causes this time have been Russia and inflation, but in their absence, something else would have eventually come along and injected volatility into financial markets.

S&P 500: Five Years (As of March 7, 2022)

The start of 2022 has been a good reminder that markets go up and go down, and inflation rises and falls, which is why you should regularly update your financial plan to make sure you can withstand market volatility and still meet your financial goals. Moreover, if the current conflict spreads to other countries or expands to include NATO forces, or if nonconventional weapons come into play, all bets are off.

But in the absence of these occurrences, it seems likely that financial markets will recover and resume their long-term upward trend, though the exact timing of that is, of course, uncertain. In the meantime, market volatility can be used to reassess your asset allocation, rebalance your portfolio, tax-loss harvest your nonqualified accounts, or put excess cash to work while securities are on sale.