We would like to take this opportunity to update you on the recent stock market volatility. Stocks started 2018 with the wind in their sails, and investors watched as stock indexes continued 2017’s nearly vertical trajectory. Then, after closing at another record high on January 26th, markets reversed course.[i] Stocks slid during the final week of January, and the sell-off accelerated into February, with thousand point declines on the Dow Jones on Monday, February 5, and then again on Thursday, February 8th.

These declines can be unnerving, particularly in the face of sensational headlines and rabid news coverage. With that in mind, here is a brief explanation of recent market movements and what can be blamed for the cause.

Causes of Recent Market Volatility

What causes stock market volatility? The truth of the matter is that no one knows, in advance, when and how markets will move up or down. The best we can try to do is to craft a narrative that fits the underlying pattern, but which may or may not be correct.

With that being said, the proximate cause of recent market volatility appears to be increasing concern about inflation. These concerns have led to a rise in interest rates, with the yield on the 10-year Treasury rising from approximately 2.40% at year-end 2017 to a closing level of 2.82% on February 8, 2018. Higher interest rates are often viewed as bad for stocks, so the result has been a stock market selloff.

Additionally, recent market movements seem to have been exacerbated by forced selling from hedge funds and other institutions engaged in strategies with monikers like “risk parity.” These strategies are essentially “short” volatility, which means that they are dependent upon markets remaining calm.

When volatility does increase, these strategies often need to quickly move in or out of positions. Unfortunately, the more markets fall, the more out of alignment these strategies become, and the more they need to sell. This self-perpetuating aspect, combined with the fact that most of these strategies trade via computer algorithms, is likely at least part of the reason for the very sharp market fluctuations we’ve witnessed in recent days.

Putting Recent Market Moves into Perspective

First of all, it is important to remember that volatility in the financial markets is the norm, not the exception. The year 2017 was an aberration, in that markets were unusually calm. In fact, until recently, the S&P 500 had gone more than 400 days without losing over 5%, the longest such span since the 1950s.[ii] But the fact of the matter is that since 1980, the S&P 500 has experienced an average correction each year of approximately 14%.[iii] The key takeaway is that while recent volatility has been exaggerated, markets do fluctuate. Continued volatility, both up and down, should be the expectation, not the exception.

With that being said, it’s also important to keep market moves in perspective. Yes, the Dow has experienced multiple 1,000 point plus declines in February 2018, with a 500+ point gain thrown in for good measure. But it is really important to remember that the upward movement of stock indexes over time means that the actual impact of a given point movement is far less impactful than it would have been ten, twenty, or thirty years ago. So yes, the 3% or 4% swings we’ve experienced have been meaningful, but not nearly as much as the absolute point movements might lead you to believe. Remember, you should focus on percentages if you want to gain a better understanding of market performance.

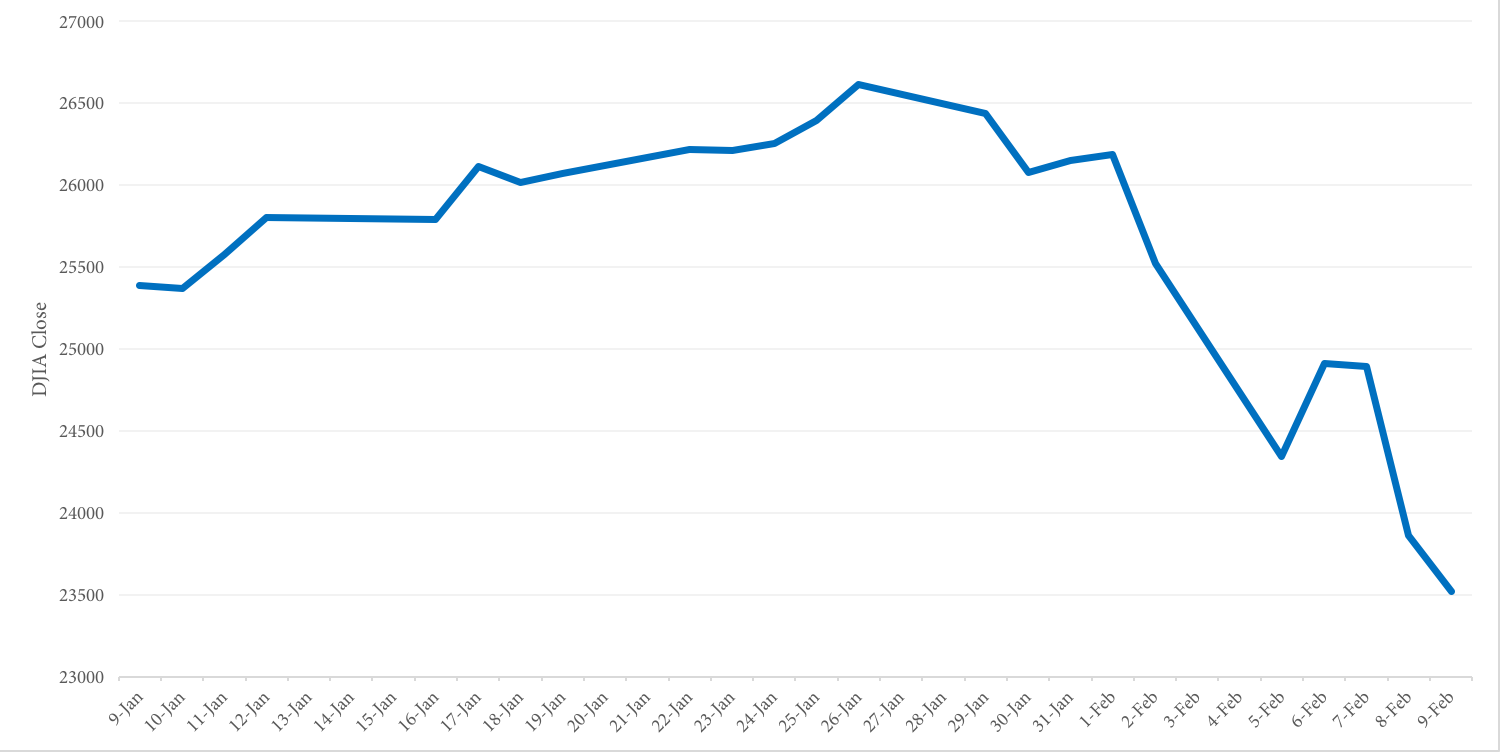

Time also has a way of putting market movements into perspective. The chart below is a one-month look at the Dow Jones. As you can see, from this view the recent market decline looks relatively severe.

Historical Dow Jones Industrial Average Data – 1 Month

Source: DJIA Data from 1/9/18 through 2/9/18. https://tradingeconomics.com/united-states/stock-market

Now let’s look at a chart of the Dow over the past 25 years. From this vantage point, recent volatility appears as barely a blip following an 8-year run higher.

Historical Dow Jones Industrial Average Data – 25 Years

Source: DJIA Data from 1992-2018. https://tradingeconomics.com/united-states/stock-market

In the grand scheme of things, this recent market decline has not been that impactful. More importantly, given proper asset allocation, even severe bear markets (which to date this emphatically is NOT) need not derail you from meeting your financial goals.[iv]

Actions To Take

Establish Your Financial Goals Before You Invest

Do you need money tomorrow? How about the near future? If you’re someone that needs money now then you shouldn’t look towards investments to generate a quick dollar. Why? Markets perform better over time. When you do short-term investing you might as well take your money to the casino because there’s no way to time the market. Sometimes you win big, but most times you’ll leave down if you don’t have a long-term investment plan. Take it from one of the best investors of all time, Warren Buffett, who says “It’s not timing the market; it’s time in the market that will make an investor successful.”

Are you trying to save your money to make it last for years? Do you need money to last through your retirement and create income when you’re not working? Then this is where investing becomes a key strategy. You need to invest to grow wealth and beat the rising dollar we call inflation. Define your goals, create objectives and then invest towards meeting those goals.

Set an Investment Roadmap

Now that you have set your goals, find out how much money you need to save to accomplish them and establish a timeframe. What you come up with is your target rate of return that you will seek from your investments. This will also help you determine the amount of risk you are able to take within your portfolio so you don’t panic when the market shifts and your portfolio drops. Your portfolio will go down, it’s inevitable. However, when applying the right strategies, it will go up too. Historically, when looking at markets over a period of time, they perform well.

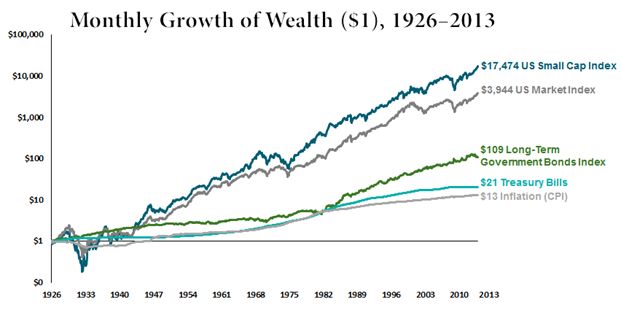

Let’s look at how capital markets have rewarded long-term investors from 1926 – 2013. During this period our economy went through major struggles including the Great Depression and the Great Recession, but when you look at the big picture, you can see that the markets have gone up in spite of volatile swings.

9 Investment Pitfalls All Investors Should Avoid – Download the Free White Paper

The graph below illustrates this period of time and shows why you shouldn’t react to every event. It’s evident that the longer time an investor spent in the market, the better their portfolios performed.

In US dollars. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results. US Small Cap Index is the CRSP 6–10 Index; US Market Index is the CRSP 1–10 Index; Long-Term Government Bonds Index is 20-year US government bonds; Treasury Bills are One-Month US Treasury bills; Inflation is the Consumer Price Index. CRSP data provided by the Center for Research in Security Prices, University of Chicago. Bonds, T-bills, and inflation data © Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield).

How Pure Financial Advisors Manages Portfolios in Volatile Markets

Our approach to investment management remains consistent. We understand that markets sometimes move higher, as they have over the past several years, and sometimes move lower, as they have in January and February of 2018. As such, an important part of our role is to remove emotion from the decision-making process and instead focus on a rules-based approach.

Control the Things You Can Control

- Control market risk: We review your financial goals to determine how much money you should have in stocks versus bonds. Our advisors make sure you are holding the right types of stocks and bonds that will help you reach what you’re trying to accomplish and allocate your assets so your portfolio is diversified to mitigate risks.

- Rebalance your portfolio: As markets have risen over the past several years, we have continued to opportunistically rebalance portfolios. We seek to rebalance on an account-by-account basis when a position deviates more than 20% above or below its target allocation. We help you maintain a consistent allocation that you created when you set your financial roadmap. This disciplined approach ensures that our clients maintain the asset allocation that their planning process indicates is most likely to achieve their goals.

- Utilize tax planning strategies: One of the largest expenses individuals have in retirement is the amount of taxes they pay on their income. Our advisors make sure that you have a diversified tax strategy as well as a diversified investment strategy. Having the appropriate amount of money in tax-free type accounts vs tax-deferred accounts, 401(k)’s. If you can control the tax on the distribution you can take less risk with the portfolio and have the same wealth.

- Tax loss harvesting: When appropriate, positions in taxable accounts are systematically tax loss harvested, and these losses can serve to reduce future tax liabilities. Keep in mind though, that given the upward trajectory of markets over the past several years, many positions still have significant gains despite the recent selloff.

- Planning opportunities: As always, financial planning drives everything we do, and market volatility can sometimes provide additional opportunities. For example, some clients may find that recent market declines have made Roth conversions more attractive since the taxable impact of a conversion would be based on reduced market values.

In conclusion, we understand that market volatility can be emotionally challenging, but rest assured that this is a natural part of the financial cycle. Your asset allocation and financial plan take into account the certainty that markets move both up and down. And while we do not have a crystal ball and cannot tell you where markets will be tomorrow or next year, we are confident that our planning based, rules oriented approach to building and managing globally diversified portfolios remains the best available approach.

We want you to feel comfortable in your financial journey, so if market fluctuations cause you to question your risk tolerance or financial priorities, please don’t hesitate to contact me, your advisor, or any other member of our team.

Sources & Disclosures

[i] https://www.thebalance.com/dow-jones-closing-history-top-highs-and-lows-since-1929-3306174

[iv] Diversification and asset location do not guarantee positive results. Loss, including loss of principal might result.