As we continue marching towards a new year, there are several important things to keep in mind regarding your financial planning. These items may or may not make sense for you, but they are topics you should generally evaluate each year.

Maximize Retirement Plan Contributions

It is important to remember that while IRA and Roth IRA contributions can be made up until the tax filing deadline, employer sponsored plan contributions must be made in the calendar year. That means that if you are currently working and hope to maximize your yearly contributions, you need to do so prior to December 31st. With that in mind, now is a good time to review your year-to-date contributions and to calculate how much you are on schedule to contribute. Then, if it turns out you are not on pace to hit your goal (or the annual limits) you can increase the percentage of your paycheck you contribute between now and the end of December.

Consider Roth Conversions

While Roth IRA contributions can be made up to the tax filing deadline, Roth conversions need to be completed prior to the end of the year. That means that if you want to do a conversion this year, you are running out of time to calculate the amount and process the conversion. This is especially important given that:

- There is a 5-year clock for optimal tax treatment of Roth funds

- Taxes are likely to move higher over time regardless of the outcome of the recent election

While it’s important to have a conversion strategy, you also want to be prepared to act tactically. That means that if markets were to sell off sharply, or expectations shift towards sharply higher future taxes, you might want to consider conversions in excess of your strategic plan.

Monitor for Potential Tax Changes

As referenced above, it seems likely that taxes are going to move higher over time, simply because the only other choice to reduce the budget deficit would be to drastically cut spending.

Percent of Spending Cuts Needed to Balance the Budget by 2033

Furthermore, as the law is currently written, taxes are scheduled to move higher in 2026. That means that you have a relatively short window where there is certainty around tax rates, which further adds to the urgency to consider any tax moves that might make sense prior to year-end.

Do you have a long-held asset that you might want to begin selling and paying taxes on? Do Roth conversions make sense this year? Are there any charitable strategies you’ve been considering? Do you have a rental property you’re deciding what to do with? If the answer to any of these questions is ‘yes’, make sure to run a tax projection to see if there are any steps to take prior to year-end.

Evaluate Potential Changes to Benefits

Fall is generally when employee benefits come up for renewal, so make sure to review your available benefits for any changes. Potential changes generally fall into three categories:

- New benefits that your employer previously didn’t offer

- Changes to your existing benefits based on your circumstances or family situation

- Regulatory changes (i.e. retirement plan contribution limits) that give you new options

The Election is Over!

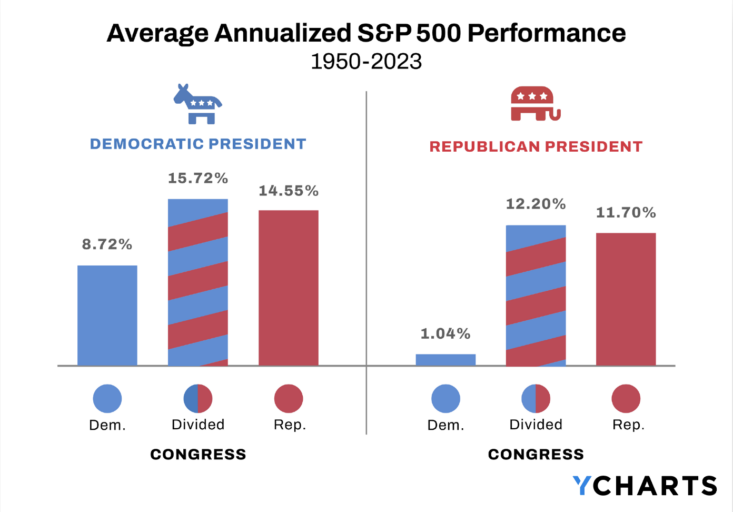

As you can see, there are a number of financial items to consider prior to the year’s end and that’s even before taking into account the recent election. While you might have strong feelings regarding the outcome (positive or negative), it’s important to remember that there is a long-term upward trend in financial markets. The result of this is that the S&P 500 has risen under almost all Presidents, as well as a variety of White House/Congress combinations.

As the chart above shows, since 1950, the S&P 500 has risen during periods when the government was controlled by Republicans, Democrats, or a mixture of both. As always with politics and markets, surprises could occur, but at least based on the historical precedent, it might not make sense to make wholesale changes to your portfolio.

The Bottom Line

It’s the best time to take control of your finances is right now! The future is always uncertain, but at the moment you have visibility into your current tax situation and some possible year-end financial moves to consider. Furthermore, markets have generally risen regardless of who is in Washington or what they do. Identifying an appropriate portfolio mix, shifting that mix over time as appropriate, and tax managing your portfolio and your retirement distributions all play a much bigger role in your financial success than anything emanating from the political arena.

Next Steps:

- Run a tax projection to determine whether Roth conversions make sense this year.

- Review your year-to-date retirement plan contributions and your available benefits to determine if any changes are in order.

- Take a deeper dive into your overall financial situation using our free Financial Blueprint.