Most of you know putting money in an IRA is a great tool for saving for your retirement. But there is a whole other level of strategies and tools you can use beyond the basics that can help you maximize your IRA to its full potential. We will be covering IRA investment strategies, IRA contributions, minimizing your taxes on IRA withdrawals, buying real estate with an IRA, conversions, rollovers, the list goes on! Feel free to start at the top or skip to a certain section by clicking on the chapters below.

CHAPTERS

IRA Investing Rules & Don’t Make These Mistakes!

IRA Contributions

How to Pay Less Taxes on IRA Withdrawals

Buying Real Estate with an IRA

Convert Your IRA to a Roth IRA

Advanced IRA Strategies: NUA, RMDs, Stretch IRAs, & IRA Beneficiaries

IRA Investing Rules & Don’t Make These Mistakes!

How much do you really need to have a comfortable retirement? How much money do you actually have saved? When is the last time you looked at your nest egg?

These are all questions that have probably popped into your head at some point and we are going to help you answer them right now. We will cover IRA investing rules, strategies that could change the landscape of your overall retirement, and some IRA mistakes to avoid.

When it comes to finances you need to understand where your nest egg falls and what type of strategies you can do right now to create the income that you need long-term.

As a refresher:

IRA accounts are Individual Retirement Accounts. This means that the account owner alone is the owner of the account. Although a spouse or other party may be the beneficiary of the account after the initial owner dies, there are no joint owners. Even if more than one beneficiary is listed and the account owner dies, they would divide the account, so that each person has their own inherited individual account. This is a prominent issue to understand before proceeding with our discussion. Unlike certain group retirement accounts, such as pensions that pool assets together, an IRA balance belongs to the account owner alone.

Are you ready to find out if you are prepared for retirement?

People’s Confidence Versus What They Actually Have Saved

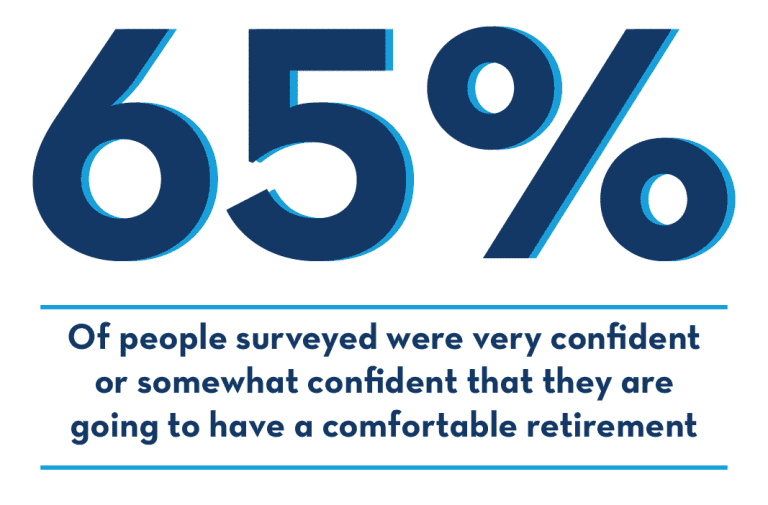

The Employee Benefit Research Institute conducted a study that found a drastic disconnect between what people feel in regard to the confidence of how comfortable they think they will be in retirement versus reality. This is pretty frightening.

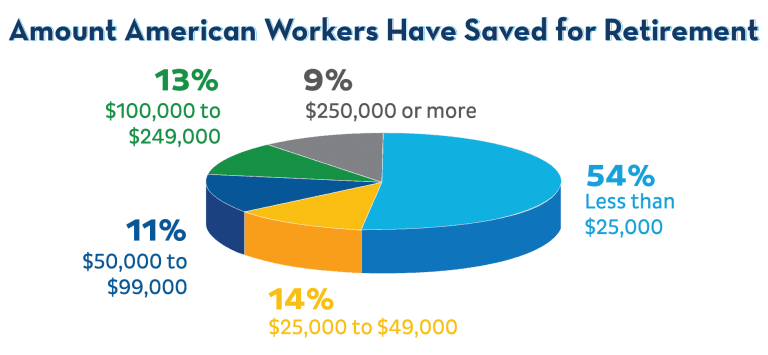

65% of the people surveyed feel very confident or somewhat confident that they’re going to have a comfortable retirement. But 54% of those people surveyed have less than $25,000 dollars saved…

Let’s rephrase… Half of the people surveyed have less than $25,000! Yet, 65% of the people think they are going to have a comfortable retirement.

This is where the disconnect happens. You need to start looking at your overall investment strategy and how much money can you save. Look for where can you find that last dollar to make sure that you can have a comfortable retirement. So, let’s get rid of the surveys. This is all about you and how you can use your IRA to the best of its ability.

Make Sure You…

Have Earned Income

You or your spouse must have earned income to contribute to an IRA. That means you need to have a salary, self-employment income, or something that you’re paying Social Security taxes or self-employment tax.

Spousal Income

If you are not working – maybe you are retired or not working for whatever reason and your spouse is working – you can use your spouse’s earned income.

Pay Attention to Age Restrictions

Age does indeed matter when it comes to IRAs. You need to be under 70 ½ years old to contribute to an IRA. However, you can be any age to contribute to a Roth IRA (but there are some income limitations). Check out this episode of Your Money, Your Wealth® that goes deeper into these topics.

Don’t Make These Mistakes!

Don’t Miss Out!

Something that a lot of people miss, is that if you have a 401k you can also contribute to an IRA and a Roth. Also, if you have an IRA plan that you are contributing to, you can also max out your 401(k) plan.

Don’t Mix Up the Age Limits for Different Types of Accounts

- IRA contributions are limited to age 70 ½

- 401(k)s have no age limit (You can continue to contribute to a 401(k) plan as long as you are still on the payroll)

- Roth IRAs have no age limit

Don’t Forget to Take Advantage of the Spousal IRA for a Non-Working Spouse

This happens all the time because once you have retired, you are in the mindset that, “I can no longer contribute to IRAs, Roth IRAs, etc.” If your spouse is still working and has enough earned income, you can still contribute to a regular 401(k) or Roth IRA at virtually any age (except IRAs, as we said before, you can only contribute up to 70 ½).

Don’t Forget to Take a Required Minimum Distribution (RMD) at Age 70 1/2, or Not Take Enough

At age 70 ½ you are required to start taking required minimum distributions (RMDs) and if you don’t – the IRS gets a bit upset. In fact, they will penalize you 50% of what you should have taken. AND, you still have to take the RMD and pay tax on it.

Say you have an IRA at Vanguard, TD Ameritrade and Fidelity. You could satisfy the required minimum distribution requirement on one IRA account by adding up all your IRAs and taking the RMD based on that one account if you don’t want to touch the others. Alternatively, you could also take any combination from those three IRAs as long as the total adds up to your RMD.

However, if you have multiple 401(k)s, 403(b)s, or a mixture, you have to take a required distribution for each of those different accounts. That is where the mistake of not taking enough usually occurs.

Don’t Pay Unnecessary Penalties on Early Distributions

If you are younger than 59 ½ with an IRA and you are pulling money out, then you are going to pay not only the income tax but also a 10% penalty (some states have an even higher percentage penalty).

SEPP

However, there are ways around these penalties. For example, if you are under 59 ½ with money in an IRA there is something called a Tax Election 72T or Separate Equal Periodic Payment (SEPP). This means you have to take the same amount of money out of the account every year until you turn 59 ½, or five years, whichever is longer.

One last note: if you have a 401(k) plan and you separate service at age 55, you can take distributions from that 401(k) plan at age 55 and avoid the 10% penalty. Note that it is not age 59 ½ in this case – it’s 55 years old. The trick is that you have to be separated from service from that employer at age 55 in order to take advantage of this rule.

Don’t Roll a Low-Cost Basis Company Stock from Your 401(k) into an IRA

This is a big mistake that we see people make all the time. Let’s say you worked for a company that’s been around for a while and you got stock 20 or 30 years ago when the cost basis was really low. Now, the cost basis is very high and usually, when people retire they will take their 401(k) and roll it to an IRA because IRAs generally have more investment choices.

However, they miss a key strategy called Net Unrealized Appreciation (NUA). You could actually take that company’s stock out of your 401(k) and put it into your brokerage account (a non-retirement account), pay ordinary income tax only on your cost basis. All of the gains that occurred in the 401(k) will be taxed at a capital gains rate instead of as ordinary income when you sell that stock. We will discuss more on Net Unrealized Appreciation later.

Don’t Forget to Educate Your Children About Stretch IRA Rules

When you and your spouse pass away, and your children are the non-spouse beneficiaries of your IRA, they have the ability to stretch it over their lifetime potentially – if they know how to do it.

You want to be very careful and make sure that you sit down with your children if you have large IRAs. Oftentimes, when children see the balance when they inherit it (say you have a million dollars in your IRA), they can potentially cash it out, but it would be taxed as ordinary income rates. Instead, what they could do is stretch out that tax liability over their life expectancy.

Keep in mind that the account still has to stay in your name, so it’s not as easy as it might sound. We will use John Smith as an example. If John, were to die, it would say “John Smith Deceased on 01/01/2000 for the Benefit of My Children”. Then the children are a beneficial owner and they could take it all out at once and blow it or they could stretch out their tax liability over their lifetime. It’s a very important decision, so make sure that you understand the laws when it comes to passing IRAs to the next generation. We will discuss Stretch IRAs in much greater detail towards the end of this article, or you can click here to skip to that section.

IRA Contributions

There are several IRA contribution rules that you need to be aware of. We will be discussing how to make contributions into your IRA account, limitations on contribution amounts, income limits, different account types, and strategies that many IRA account owners can employ. Before we get too far into the weeds, let’s start by clearing up some of the more complex topics we will be addressing.

IRAs are Extremely Popular for Several Reasons

Individual Retirement Accounts allow retirement savers to take control of their retirement savings, choosing whatever investments best suit their needs from the custodian they’ve selected, or even delegating that activity to a professional asset manager. They provide additional legal protections against judgments and liens beyond what is afforded by taxable accounts. IRAs also offer investors the opportunity to consolidate assets that may have previously been in multiple retirement accounts from prior employers.

What are IRA Contributions?

When you contribute to your IRA, you are putting in new money. This differs from rollovers that might be moved from other retirement plans such as your:

- 401(k)

- 403(b)

- Other plan types

- Conversions (which occur when money that is currently held in a traditional IRA are changed to Roth status)

For this discussion, we’re addressing the IRA contribution rules in which IRA holders can place new funds into their accounts. Let’s dive into the available types of IRA accounts.

Traditional IRA Contributions

Those investors who are within income limitations for the tax year (these change annually based on filing status) may wish to contribute to a traditional IRA. A traditional IRA is tax-deferred, meaning that contributions occur with pretax money. Unlike your 401(k) or 403(b) at work, where this will occur on your behalf as a pretax deduction from payroll, you will make your contribution to the account and then receive an adjustment on your tax return for the contribution. This means that your taxable income after adjustments is lowered by the amount of the contribution.

Unlike deductions such as mortgage interest or gifts to charity, you do not need to itemize to take adjustments – also known as “above the line” deductions. If you could benefit from tax savings in the current year by contributing, you can do so without itemizing and still take the standard deduction when filing your return.

You can make contributions each year until you reach the age of 70 ½ when you will no longer be able to contribute, but you will begin required minimum distributions or “RMDs.”

Contribution Limits and “Catch Up” Amount

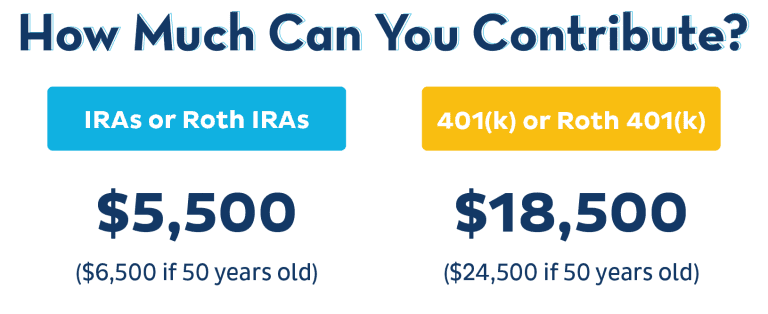

Before proceeding to with additional options for IRA contributions, you should know that there are contribution limits and they often change annually. For 2018, the IRA contributions max limit is $5,500 plus an additional $1,000 if the account holder is 50 years old or older. To clarify, it is 50 years old or older. The year you turn 50, you are eligible for the catch-up amount.

The contribution limits are among all IRA account types and all IRA custodians. Let’s bring back our example man – John Smith. John is an investor under 50 whose contribution limit for 2018 is $5,500 (he is not yet eligible for the catch-up contribution of $1,000). He can make a contribution for $5,500 to one traditional IRA at one custodian or instead, several smaller amounts totaling no more than $5,500 at multiple custodians. However, he cannot contribute $5,500 at one custodian and $5,500 at another custodian.

Like this rule, John can divide his contributions (if otherwise eligible for both accounts types) between traditional and Roth IRA account types, but he cannot exceed the total limit of $5,500 for the year between the two. Many investors make the mistake that their contribution limit is per IRA type, but this is not the case.

As we discussed previously, in order to make contributions, you must have earned income like wages or self-employment. Those with only investment income would not qualify to make IRA contributions. The exception being if they are a non-working spouse, in which case, a contribution can be made on their behalf. The non-working spouse can receive a contribution to their own account without meeting the requirement to have earned income. It is not an additional contribution to the account of the working spouse.

ROTH IRA Contributions

Roth IRAs allow investors to contribute after-tax money to the account to eventually withdraw not only their own contributions but any growth that has occurred tax-free.

Assume an investor contributes $50,000 to their Roth IRA during their life and eventually, the account grows to a balance of $250,000. The entire amount of withdrawals would occur free of income tax. Unlike traditional IRA accounts, the investor does not receive an adjustment to their income in the tax year the contribution occurs. They are investing “after-tax” money. They may choose to do so because their current tax liability is low, or they assume the growth in the account throughout their lives may exceed the value of the adjustment they would have received to contribute to a traditional account.

Some investors also recognize the advantages of tax diversification and view their Roth account as a means to provide additional flexibility in retirement. Someone with non-qualified or regular taxable funds in addition to tax-deferred and tax-free savings (a traditional and Roth IRA, for example) may have a great degree of flexibility in choosing which accounts to make withdrawals from during retirement.

Like traditional accounts, Roth IRAs have contribution limits and income limits which can change annually. Those who find themselves above the income limit for a direct contribution in the current year should read on to find out how a non-deductible IRA contribution might potentially lead to an indirect Roth contribution for the year.

Non-Deductible IRA Contributions

Investors whose income is above the limits to contribute to a traditional or Roth IRA, or whose eligibility is impacted by the ability to contribute to an employer-sponsored retirement plan, can still opt to make a non-deductible contribution to a traditional IRA. To confirm, this is a traditional IRA just as the first account type we discussed, not a separate account type. You would not open a “non-deductible IRA” at your custodian of choice, but simply make a non-deductible contribution to a traditional IRA.

IRS Form 8606

You will not get a deduction for your contribution, but you still need to report it. You do this using IRS form 8606. This is done to keep track of the “basis” in the IRA to determine how future withdrawals are taxed. If you made your maximum contribution for 2018 of $5,500 for someone under 50 years of age as a non-deductible contribution, those funds may grow to a larger sum in the future when you retire and begin taking distributions. You will not be taxed on the amount you contributed (your basis in the account) but you will be taxed on any growth experienced in the account. This tax will occur at your ordinary income rate.

How to Determine Your Account Basis

Determining the amount of your basis when a full distribution occurs is easy. It’s the amount of your non-deductible contributions into the account. Someone whose $5,500 contribution grew to $10,000 would have taxable income of $4,500 (the growth they have experienced) but would not be taxed on their contribution of $5,500. This is a simple example since we are discussing a single contribution that grows to a specific amount followed by a full distribution. Most real-world experiences are more complex. Many investors make non-deductible contributions in multiple years and later take partial rather than full distributions from the account in retirement.

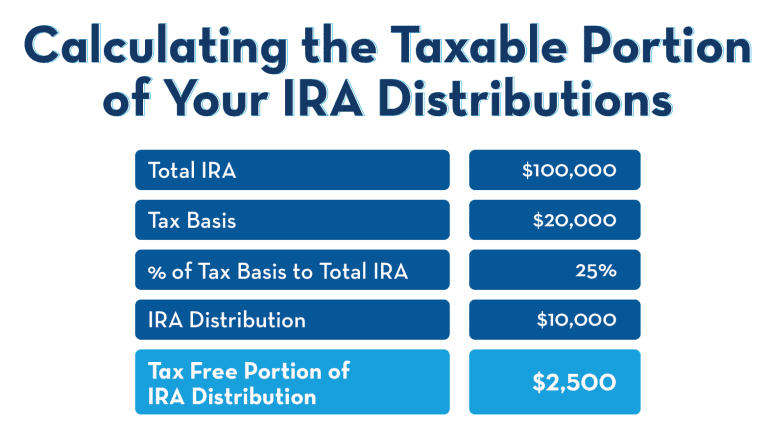

When you take a partial distribution, the amount that is taxable will be proportional to the amount of gains in your account. If you have a $100,000 in an IRA with $40,000 of “basis” (you made $50,000 of non-deductible contributions over the years) then 60% of your withdrawal for the year would be taxable, while 40% would be considered basis. For example, a $10,000 withdrawal would generate $6,000 of tax. Going forward, your IRA account now has $4,000 less basis than it did the year before. This will, of course, impact your calculations in subsequent years.

Does that process seem complex to you? You’re not alone. Many investors find non-deductible contributions and the rules surrounding distributions challenging. You should consider discussing the implications of non-deductible contributions as well as reporting requirements with your financial planner or accountant before making them. Whatever you choose to do, be aware that it is your responsibility to substantiate if requested by the IRS that your IRA contains non-deductible contributions. Otherwise, the entire amount could be considered taxable income. Since many investors hold their accounts for years or decades before making withdrawals, this can be a record keeping and tax preparation challenge.

Indirect or “Back Door” IRA Contributions

Those whose incomes are too high to qualify for a direct Roth IRA contribution may still be able to get new funds into their Roth by a little-known process called an indirect or “backdoor” Roth contribution. This strategy involves a two-step process where funds are initially contributed to a non-deductible traditional IRA and then converted to Roth status. This can occur within the same tax year, allowing those whose incomes would otherwise prevent direct Roth contributions to still get additional funds into their Roth.

What Investments Are Available for an IRA?

An important distinction is that an IRA is not necessarily an investment at all – it’s a shell that you can put investments into. Think of a Roth, Traditional IRA, 401(k), or SIMPLE IRA. These are just retirement accounts and you pick the investments that you want to invest in. Those investment choices inside your retirement account are going to determine your rate of return depending on what you pick.

The most common investment options for traditional accounts would be stocks, bonds, mutual funds, ETFs, cash, CDs, etc.

Whereas if you want to invest in hard assets like real estate, precious metals, or cryptocurrencies you would most likely do so in a self-directed IRA.

However, as a real estate investor for over 30 years, “Big Al” from the Your Money, Your Wealth Show, doesn’t necessarily recommend owing real estate inside of a self-directed IRA. The main reason being that the tax cuts that are available when you own real estate outside of a retirement plan are not necessarily available if your property is held in your 401(k) or your IRA. To learn more, click here to skip down to the section about the pros and cons of holding real estate inside a self-directed IRA.

Determining strategies for your IRA as well as contextualizing those decisions within your overall financial plan can be challenging. Often many investors find information online to be incomplete, out of date, or insufficient to address their specific situation. Consider working with a professional to assist you with this and other related financial topics.

Now that we have covered how to contribute to your IRAs, let talk about what you can do to lessen your tax burden when you want to pull that money out in retirement.

Pay Less Taxes on IRA Withdrawals

Keep in mind that the sooner you start investing money in your IRA, the better results you will have due to a little thing called “compound interest”.

Let’s go through an example to better understand how this works.

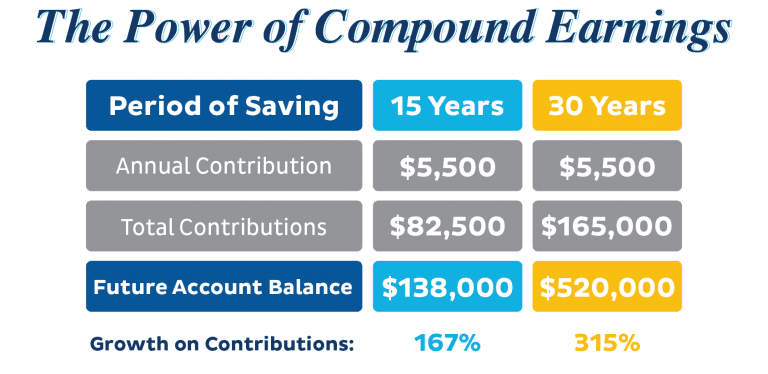

Remember John? We are going to compare the results of John putting away $5,500 per year for 15 years versus 30 years, assuming a 7% annualized rate of return compounded. If John contributed the max to his IRA for 15-years, the total amount contributed would be $82,500. Now, if John contributed the max to his IRA for 30-years, his total amount contributed would be $165,000.

Look at the future account balances. After 15 years, John has $138,000. After 30 years, John has $520,000.

It’s amazing how much more he received on the compounding of earnings for those extra 15 years. John also saw growth of over 300% on his contributions!

Moral of the story is – The earlier you start saving money the more money that you’re going to have by the time you reach retirement.

Where to Put Your Money

Now it’s time to come up with a game plan of how much money you need to save on a monthly or annual basis to get to your nest egg where it needs to be.

First, look at how much money you need to save on a monthly basis.

Then you look at what rate of return do you need to generate on those monthly savings.

An easy way to do this is to plug your numbers into this Quick Retirement Calculator!

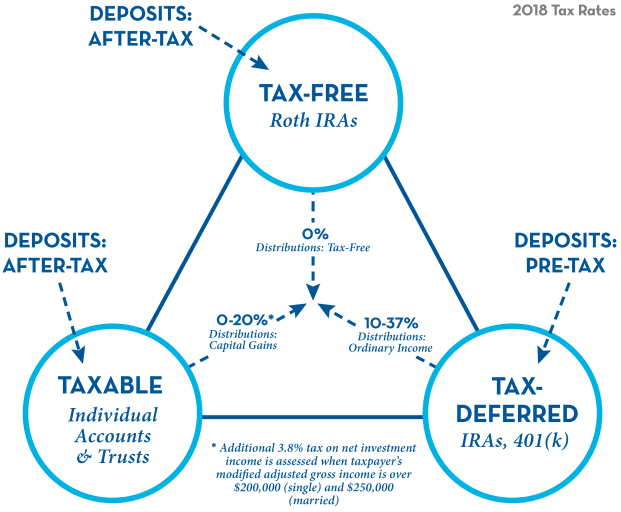

But more importantly, where are you going to put these savings dollars? In a tax-free account, in a taxable account, or tax-deferred account?

Common advice for many of us when we started saving money at an early age was to put everything in tax-deferred accounts: such as traditional IRAs, 401(k)s, 403(b)s, TSPs, etc. An advantage of tax-deferred accounts is that you get a tax deduction, but when you start withdrawing the money as your income – it will all be taxed at ordinary income rates.

Why Diversification is SO Important

When developing your game plan, you have to understand compound interest. The earlier you start saving, the more money you are going to have. Although, if you just put everything into tax-deferred accounts, you are going to be blindsided and trapped in potentially a big tax time hole because everything in those tax-deferred accounts will be taxed as ordinary income.

This is where diversification comes into play. Diversifying your investments into different kinds of tax-efficient accounts helps you mitigate your tax burden once it comes time to take distributions. The goal really is to:

“Live like a King, pay taxes like a pauper.”

An example might help drive this home.

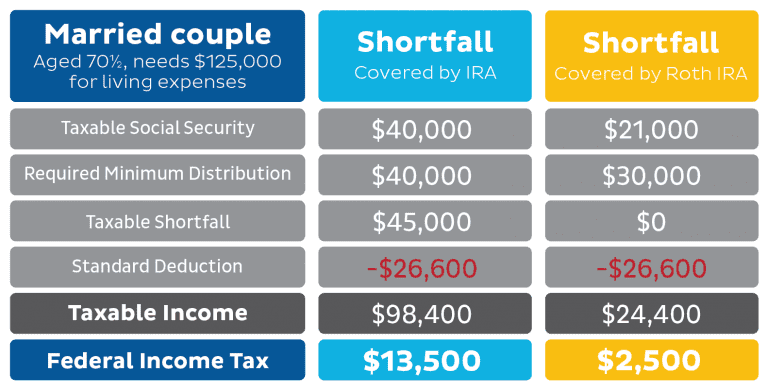

This couple, both age 70 ½, needs $125,000 for living expenses in retirement.

Light Blue Column

If all of their money is in an IRA it will all be taxable once they retire. Their taxable Social Security and required minimum distribution (RMD) are both $40,000. They still need another $45,000 to cover the shortfall and that money is going to come from their IRA. They also have a standard deduction of $26,600 and their taxable income comes to $98,400. They will have to pay Federal Income Taxes of $13,500 in this situation.

Yellow Column

Now, if the same couple converted some money into a Roth IRA, over time they don’t have to pull all of their resources out of their regular IRA. In this example, their taxable Social Security is less at $21,000 and their required minimum distribution (RMD) of $30,000 is lower because they have less in a regular IRA. They can take their shortfall from the Roth so that isn’t taxable. Finally, their taxable income is only $24,400 which means they only owe $2,500 in Federal Income Tax. That’s a lot lower! They are still living off of $125,000 total but are only paying $2,500 versus $13,500 in taxes. That is the power of Roth conversions.

You can’t control the stock market or interest rates. But taxes are one of the few things you have some control over. By doing some planning and diversifying with different types of accounts you can minimize your tax burden and make your retirement accounts work for you.

Buying Real Estate with an IRA

Many investors wish to purchase real estate, but is it possible to do so with an IRA account? What are the advantages and disadvantages of doing so?

Pros

The best advantage of using IRA funds to purchase real estate for most investors is the availability of the funds. Many people who invest in real estate don’t just consider themselves investors. They self-identify as “real estate investors,” with a specific interest in that asset class. Many of these investors have little or no holdings in other asset classes such as stocks and bonds, either because they are less experienced in those asset classes or prefer certain attributes of real estate.

The real estate bug is real – and for good reason. Many who own real estate have seen their personal residence appreciate substantially or receive rental income monthly from income properties. As we will see below, owning real estate in an IRA often lacks some of the advantages that direct ownership in an individual’s, trust or entity name may provide.

Cons

Loss of Tax Advantages

One of the main draws for investors who purchase real estate is the ability to benefit from tax advantages. There are so many real estate related tax advantages that the topic would easily warrant its own article. There are, however, a few common tax advantages that we can discuss, each of which would be lost if the property were owned in an IRA.

Exemption of Capital Gains

- When you have a gain in your personal residence, you may be able to exclude up to $250,000 ($500,000 for married couples) from taxation assuming certain use and ownership requirements are met. This can mean that if a married couple were to sell the property that they purchased for $500,000 for $1,000,000 (net of fees such as real estate commissions) they would pay no tax on the gain. This often means that many owners will pay no capital gains tax on the sale of their primary residence, despite substantial profit. If the same property was held in an IRA, the full value of any gains would eventually be taxed as ordinary income to the owner or their eventual beneficiaries.

Step Up in Cost Basis

- Those who inherit a property that has substantially appreciated in value may be able to receive a “step up” in cost basis. This means the cost for tax purposes will be considered the value on the decedent’s date of death as opposed to their initial purchase date. This can be substantial for properties owned by the deceased for extended periods of time. It also allows those who inherit the property to sell without paying capital gains taxes on the appreciation experienced during the ownership period of the property during life. If the heirs received the same property inside an IRA account, there would be no “step up” in cost basis. All withdrawals from a traditional IRA account, including those inherited, will be taxed as ordinary income.

Depreciation

- Those who own income properties often benefit from taking depreciation over the usable life of the property. This strategy can offset some of the income received from rent. Even though that rent is taxed as income to the recipient, it is often substantially offset by depreciation – leading to a greater net return after-tax for the owner. There is no similar advantage to depreciation within an IRA account.

Section 199

- As of 2018, Section 199 may affect those who have passive income (including real estate) and meet other requirements that can allow up to 20% of their passive income to be excluded from tax. This is a complex topic that you should address with your financial planner or accountant if you receive income from real estate. The bottom line for this discussion is while the provision can be applied to individually owned properties or those owned within entities, such as trusts or LLCs, it is not available for properties held inside an IRA account.

Deductions

- Many costs associated with property ownership are useful tax deductions. One common example is mortgage interest, which brings us to our next topic of discussion.

No Leverage

You will not be able to finance any property that you directly own inside an IRA account. Your purchase must be made with cash. Since the ability to use leverage is one of the greatest advantages of real estate investment in general, owning property inside an IRA account may not make sense for many investors. Joe and Big Al actually talked about this on the Your Money, Your Wealth® podcast with Cubert from AbandonedCubicle.com who shared his plans for using real estate, including AirBnB and VRBO vacation rentals, on his path to reaching financial independence by the age of 46.

Concentrated Position

Buying real estate directly can mean an extreme concentration not only in one asset class but in a specific asset. Let’s use an example account balance of $500,000. An investor who holds their IRA at a standard brokerage firm can purchase several different assets within a variety of asset classes (stocks, bonds, cash equivalent investments, and other items) achieving a broad asset allocation and potentially reducing their overall risk.

In many parts of the country, if the same $500,000 balance that bought a diversified portfolio was instead used to directly purchase real estate, it would buy only one property. This portfolio has no diversification, not even within the asset class of real estate.

In California, where this article is being written, there are many areas where that same balance would not be sufficient to acquire any available options.

Placing an excessive amount of your portfolio in a single asset class can mean taking on substantially more risk than would be the case in a balanced portfolio containing a variety of asset classes selected to meet an investor’s needs. The absence of other assets can also lead to difficulties when the investor reaches the age that Required Minimum Distributions or “RMDs” are required.

Required Minimum Distributions

All investors in traditional IRA accounts will have Required Minimum Distributions or “RMDs” the year they turn 70 ½. An RMD is an amount that is required to be withdrawn from the account by IRS regulations. In the first year, the amount is 3.65% of the value of the account as determined by the closing balance for the last year. The percentage withdrawal requirements go up each year according to an IRS table. We will show you this table in the next section.

If the property represents all your IRA holdings, where would you get the funds for the RMD? You cannot easily sell a small percentage of the property. There are ways to get around this issue, but they are not easy or convenient.

The IRS allows your RMD to be withdrawn based on the value of all IRA accounts you own from whichever account or accounts you desire so long as the total required minimum distribution for the year is met. This means that if you have two different IRA accounts, each worth $500,000, the IRS will require you to take a required minimum distribution based on $1,000,000, but it can be withdrawn entirely from one account, split down the middle from both accounts, or in whatever other proportion the investor prefers. If one of the IRAs in question holds real estate, the investor could opt to withdraw their entire RMD from the other account that holds assets that are easier to liquidate such as stocks, bonds, mutual funds or other investments. However, this brings us back to our previous disadvantage of concentration.

Even if you were comfortable having half of your retirement account in a single asset as described in the above example, this proportion would not be maintained if required minimum distributions were able to be withdrawn only from the other IRA assets listed above. Eventually, as more RMDs are taken and the amounts increase each year, the IRA that only holds property would no longer represent 50% of total holdings, but potentially a much larger amount. This can also create complications with the required minimum distributions of your eventual beneficiaries.

Beneficiary Issues

While a spouse can inherit the IRA of their deceased spouse and take required minimum distributions on their own timetable according to their age, this is not the case for non-spouse beneficiaries. Assume that the beneficiary of your IRA is your child. They may have required minimum distributions once inherited even if they have not reached the age of 70 ½. There is a different IRS table for beneficiary IRAs, also known as Decedent IRAs, Inherited IRAs or Bene IRAs (where Bene is short for Beneficiary).

Fractional Sale is Difficult

All the issues surrounding required minimum distributions listed above are just a few possible examples of how fractional sales are difficult. If you have a million dollars in a mutual fund, you can sell any amount you like to purchase other investments or make a distribution, discretionary or required minimum if of applicable age. If you have a property worth the same amount, this is not easily done

Costs of Custodian

When you wish to purchase a non-standard asset such as a physical item within your IRA, you must use a special custodian to do so. The fees associated with this custodian may be higher than you are used to paying for other account types, especially if your other investment assets are held at discount or self-directed firms that often have low or no annual fees. Be sure to clarify all fees including annual maintenance fees with your custodian before investing.

Contributions and Distributions

When you place funds into your IRA account you are contributing to the account, but you are subject to certain limits on the annual amount in addition to limits on your income.

When you take money out you are making a distribution that is subject to limits including those associated with your age and the use of the funds if an exemption is desired for any penalties.

This is no difference when real estate is held inside an IRA. If you need to make a substantial repair to the roof, this can be considered a contribution to the account. Likewise, if you rent a room out for the summer, the use of the funds outside the account can be considered a distribution subject to tax.

Alternatives

If you’ve considered the issues above but would still like to receive additional exposure to Real Estate, there are alternatives that you may wish to also consider.

Own Real Estate Outside of Retirement Savings

- Investors who can purchase property outside the IRA would receive the tax deductions and financing opportunities so that more practical assets could be held within the retirement accounts. This assumes that the investor’s overall asset allocation goals can be achieved with the funds held in retirement and non-qualified taxable funds by arranging the purchases of various assets in the most advantageous accounts.

Own Properties Through REITs

- A REIT or Real Estate Investment Trust is a pooled investment in real estate allowing the investor to have a fractional ownership interest in one or several properties. Some REITs are private and some are publicly traded, but most can be purchased for minimum balances that are quite flexible, especially compared to direct ownership of real estate. Most REITs can be purchased with taxable funds or within IRA accounts. One of the biggest advantages of REIT ownership is the ability to achieve diversity within real estate. Numerous REITs are available that focus on commercial real estate, residential real estate, mortgage debt, specific geographic or intended use, or other niches that may be of interest to investors. Those who purchase non-publicly traded REITs should make sure to confirm their fees as well as any restrictions on when liquidation can occur.

Consider Other Asset Classes

- This recommendation doesn’t mean to not consider real estate, but to look at the need behind the need and examine all options. For example: Are you primarily interested in real estate for income? If so, look at all asset classes that can be used to generate income. Are you interested in capital appreciation? Look at all asset classes that may be a fit for this goal.

Real Estate is popular with investors for a reason. There are numerous advantages to real estate relative to other asset classes. Hopefully, by reading this article, there is a greater likelihood that you will own your properties in such a way that you benefit from these available advantages.

Convert Your IRA to a Roth IRA

Rollovers

Those who have reached their maximum contribution amounts may wish to invest further in their IRA accounts. If balances are available in 401(k), 403(b), or similar plans at previous employers, you may be able to roll those balances over to your IRA account. This can provide additional flexibility and investment options beyond what may be available in your group plan.

There are several advantages to potentially roll the money into an IRA.

- You have more investment choices

- In general, you have full control over the money in your IRA

- Consolidation and simplification

One of the biggest advantages of a rollover is if you have several IRAs and maybe a few 401(k)s, you can put everything in one IRA so that it is a lot easier to manage. Many people think that they should roll their employer pension plan to an IRA when they retire; which in many cases is a good idea. However, there are several pros and cons of rolling your 401(k) to an IRA.

Reasons to Keep Your 401(k)

- 401(k) fees may be low

- Penalty-free access at age 55

- Institutional investments may be available

- Potentially better protection from creditors

Reasons to Roll Your 401(k)

- 401(k) fees may be high

- More investment choices possible

- To consolidate & simplify

- Roth conversion advantages

Conversions

For those investors who wish to have additional Roth savings beyond the amount they can contribute, conversions may be an option to increase those balances faster. Funds held in deferred account types, such as traditional IRAs, can be converted to Roth status. The amount of the conversion will be included in your taxable income for the tax year in which the conversion occurs.

An investor who has a relatively low balance in Roth savings, but a substantial traditional IRA may choose to convert a portion of their account to increase the amount they have in Roth savings. Since the amount of the conversion will be included in taxable income, it often does not make sense to convert an entire account in one year since it may push the investor into a higher tax bracket. The amount of conversion that makes sense for you will depend on several factors including your current year earnings as well as what you expect your earnings in future years to be.

You don’t have to make your decision all at once. Converting a modest amount each year (if it makes sense) might be the best option for investors with large deferred balances. The good news is that you have a lot of flexibility. There are no longer limitations on the income of those who wish to convert. You can convert an unlimited amount in any year from traditional to Roth status independent of your income level.

For more information on this topic, check out our blog on How to Convert Your IRA to a Roth IRA!

Advanced IRA Strategies

Net Unrealized Appreciation (NUA)

There is a little-known strategy that could save you thousands of dollars in tax called “Net Unrealized Appreciation”. Have you heard of it before?

Net Unrealized Appreciation, or NUA, is when you have a highly appreciated company stock in a 401(k). With this strategy, you can actually pull those dollars or in other words, pull that stock, out of the 401(k) and transfer it to your brokerage account (a non-retirement account). You do pay ordinary income taxes on what you paid for the stock (aka your cost basis), yet all of the gains become taxed as capital gains at the time you actually sell the stock. This can potentially save some people thousands of dollars in taxes.

Net Unrealized Appreciation Strategy (NUA) Quick Facts

- Distribute company stock to your brokerage account

- Ordinary income taxes are due on the cost basis

- Capital gains taxes are due on net unrealized appreciation, upon sale

This is often missed because when you have company stock inside your 401(k) plan from a company that you have worked at for a long period of time, there will be some appreciation within that overall stock.

Instead of selling that within the retirement plan, you can get that money out of the plan as fast as you can once you retire so that when you sell that stock it is taxed at a lower rate.

With this strategy, you can get more diversification. This is just another phenomenal reason why you want to start looking at your retirement accounts when you get to retirement. You will need to decide if you want to keep it in the plan, roll it out, if you keep your company stock, are there Roth provisions in the plan, etc? There are multiple decision points that you have to make when you look at rolling money out.

Example

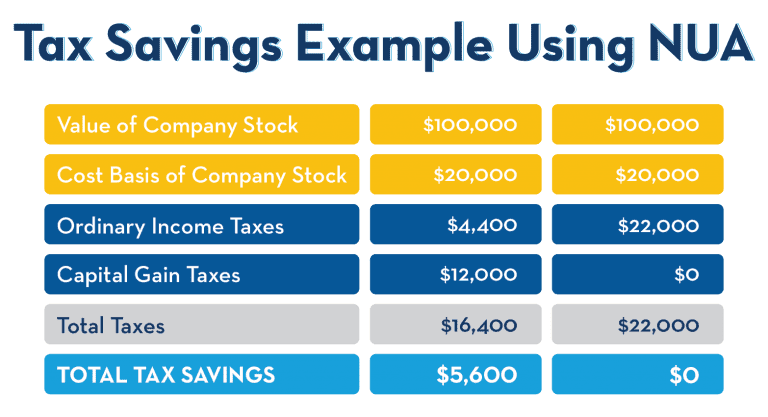

This can be quite confusing so let’s look at an example.

Back to John Smith here. John has $100,000 of company stock and we will assume he is in the 22% marginal Federal tax bracket. The middle column shows John using an NUA strategy.

John distributes his cost basis out to his non-retirement account. His cost basis is $20,000 and so he needs to pay ordinary income taxes of about $4,400. His capital gains when he sells the stocks is about $12,000 so John’s total taxes equal $16,400.

Now, let’s compare it to NOT using the NUA strategy.

When he pulls that money out the tax is $22,000. In this example, John has a tax savings of $5,600 by using the NUA strategy.

RMDs

When RMDs Start

The required beginning date for your Required Minimum Distributions (RMDs) is April 1st the year following the year you’d turn 70 ½. Keep in mind, that this means your first year you will be taking 2 RMDs.

It is extremely complicated. Most people think that at 70 ½ they have to start taking money out of the account, but that’s not necessarily true depending on when your birthday falls. It’s the year after you turn 70 ½.

For some people, that might make sense depending on what income level they are at the year that they retire. For others, it might make sense to push into the following year because you could be in a lower tax bracket. And still, for some, it might make sense to take it in that year. It all depends on your tax bracket.

How to Calculate Your RMD

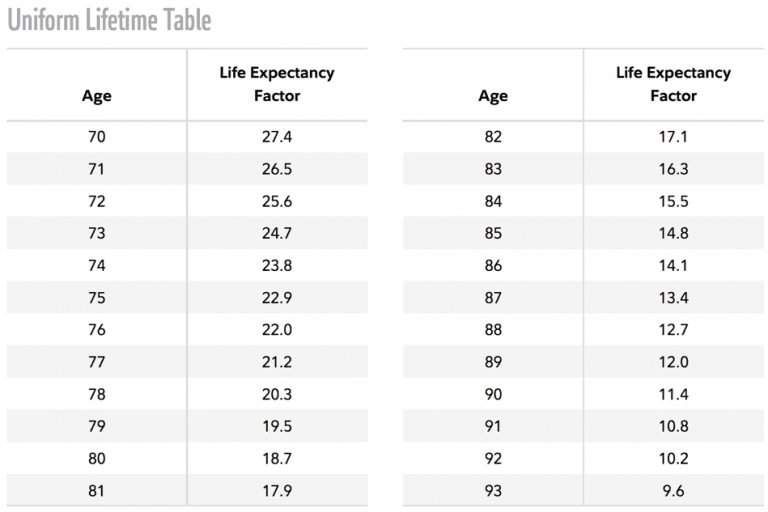

At 70 ½ years old, you are going to look at the balance of your IRA (or IRAs) at the prior year-end, December 31st, and then you have to go to this table to figure out the factor.

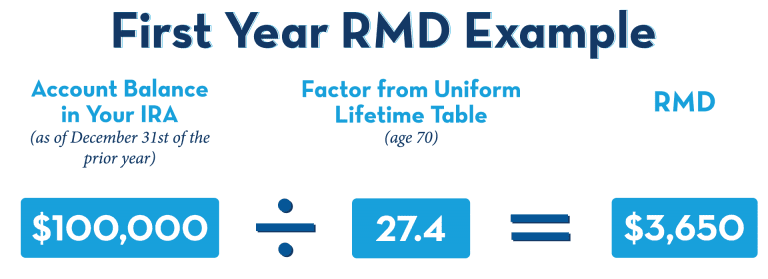

In the example below, John Smith had an account balance of $100,000 in his IRA on December 31st of the prior year. Since he turned 70 this year, he divides by the Life Expectancy Factor of 27.4 from the chart above. His RMD would be $3,650 in Year 1.

But it doesn’t stop there. Each year you age, the percentage increases as well (see chart above). Why? Since you received a tax deferral on that account for years, the IRS wants their money now, so they require you to start pulling the money out. They don’t care if you need the money or not. It starts out slow because the IRS wants their tax money. The “factor” increases every year because each year as you age more dollars have accumulated, which means more money has to come out, which means more in taxes.

What If I Have Multiple IRAs?

When it comes to IRA plans, many people might have three or four different IRAs. It doesn’t matter! You can pull one required minimum distribution out of four or five.

Let’s say you five different IRAs and the aggregated combined total of those is the $100,000 we used in the example above. You could take one of those IRAs and pull the RMD from that one and leave the other four alone.

If you have multiple 401(k) plans – it’s a different story. Maybe you have worked at four or five jobs and never consolidated. The rules are different with 401(k) plans. You have to take an RMD out of each of those retirement accounts.

- IRAs: You can take your RMD out of one account, or a combination of several IRAs adding up to your RMD amount.

- 401(k)s: You have to take the distribution out of each 401(k) or 403(b) that you have.

The RMD Penalty You Want to Avoid

If you don’t take enough of an RMD, there is a massive penalty. It’s one of the most egregious penalties in the tax code.

That penalty is 50% of the required distribution that should have been taken. If you miss your RMD, decide not to take it, or if you make a mistake – it’s a 50% tax penalty. Here’s a video to help explain…

Will RMDs Continue for My Beneficiaries After I Pass Away?

Unfortunately, RMDs don’t even stop when you pass away. Your spouse, kids, or other beneficiaries that inherit your IRA are going to have to continue to take required minimum distributions, although there are different rules.

There are spousal rules for when your spouse inherits your IRA and then there are non-spousal rules for when your kids or anyone other than your spouse inherit it.

Spousal Beneficiary

If you are married and your spouse passes, there are two options. You could keep the retirement account in your spouse’s name or you can decide to roll it into your own name.

Reasons to Keep the IRA in Your Spouse’s Name

- If you are under the age of 59 ½, you would want to keep it in your deceased spouse’s name because you will have full access to the money without a 10% penalty.

- If you decide to combine and consolidate and you are under age 59 ½, you have to wait until you are 59 ½ to have access to the money without that 10% penalty.

Reasons NOT to Keep the IRA in Your Spouse’s Name

- A reason not to keep it in the spouse’s name is if the spouse was older than you. For example, if you are 60 years old and your spouse was 70 and you kept their IRA in their name, you will have to take an RMD when your spouse would have reached age 70 ½. In this case, you probably want to consolidate.

When your IRA goes to a non-spousal beneficiary – it MUST stay in the deceased’s name.

Let’s say you’re only 25 years old and you’re thinking that you can take this inherited IRA, put it in your own IRA, and then wait till you are 59 ½. The IRAs says “No way! This was an inherited IRA, so you have to start taking distributions right now!” There is an opportunity to stretch that over your lifetime, but this strategy is very often messed up. Instead, the IRS allows you to put the inherited IRA into a Stretch IRA.

Stretch IRAs

A Stretch IRA means it has to stay in the deceased’s name.

A quick example:

“[Name of Deceased] ([Date of Death]) FBO [Non-Spouse Beneficiary’s Name]”

John Smith is deceased on August 1st, 2018 for the benefit of (FBO) the non-spouse beneficiary named Janice Brown.

The stretch IRA will stay in the deceased’s name. Now that Janice is the beneficiary, she can do whatever she wants with that money, but she has to take a required distribution based on her life expectancy.

How to Set Up A Stretch IRA

The thing is, you have to die first to get a Stretch IRA, so you need to educate your kids on what a Stretch IRA actually means.

Beneficiaries for Your IRAs

We can’t talk about IRAs without bringing up the topic of beneficiaries – no matter how morose or uncomfortable. After you have spent a lifetime saving in your IRA and you pass, you want to make sure that whatever remains goes where you want it to. But if some of the necessary steps are missed it can be very messy.

Name a Beneficiary (& Contingent Beneficiary)

This is the most important step. Take the time to clearly name your beneficiaries. This isn’t something that you can keep putting off until later. If you don’t name your beneficiaries, then your IRAs can go to your estate which is probably the worst place your IRA could go. If you were over 70 ½ it goes through intestate, which is a whole other topic, you lose the stretch capability of the plan, and end up paying more money in taxes then necessary. Always make sure you have named your beneficiaries and even have contingent beneficiaries if your primary predeceases.

Changing Spousal Beneficiary After a Divorce

After a divorce, many people forget to change their ex-spouse as their beneficiary. In some cases, it depends upon the state you live in. Some states have the ex-spouse remain as the beneficiary, but in other states – like Arizona for example – it is presumed that you have revoked that beneficiary statement because you are divorced. If that is in fact, what you want to do you need to go right back in and re-name your ex-spouse as your beneficiary. Every situation is different but be aware of the beneficiary laws in your state and the actions you need to take to ensure your IRAs go where you specify.

How to Manage Your Beneficiaries

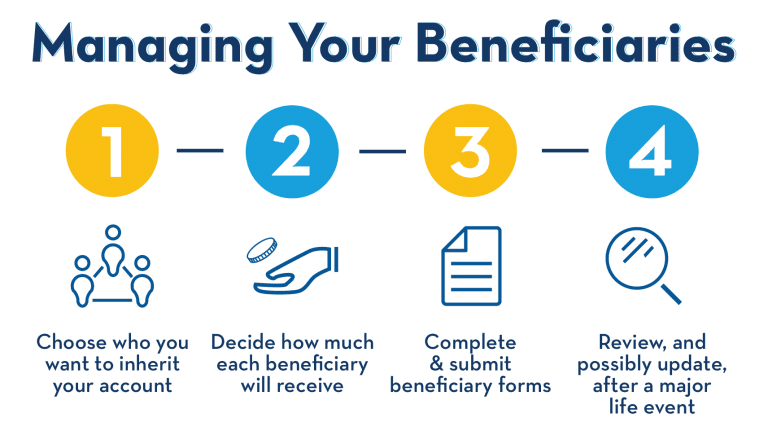

It might not seem complicated, but these steps are often missed.

-

Choose who you want to inherit your account.

Typically, your beneficiary might be your spouse, or if you’re not married, maybe a child, niece, nephew, brother, sister, mother, father, whatever you want. Make sure you name that beneficiary and also make sure that you have a contingent beneficiary because if your primary beneficiary passes before you do, then it goes to no one.

-

Decide how much money each beneficiary will receive.

You don’t just have to have one beneficiary you can have many beneficiaries. Maybe you have four kids and you want each of them to inherit 25 percent. The amounts you designate do not have to be equal either. It is completely up to you how you want to delegate your IRAs.

-

Complete & submit beneficiary forms.

This probably doesn’t take you more than 5 minutes to fill out, but it is missed all of the time. Make sure you speak with your custodian or financial advisor to make sure you have completed all of the necessary forms.

- Review and update after major life events.

Make sure you review your beneficiary statements periodically because things change. Your family may change, your beneficiaries, your parents may be no longer be living, etc. Be sure to review your beneficiary statements any time there is a big change in your life.

Conclusion

That was a LOT of information. Not only did you learn some very advanced IRA strategies, but also how to avoid some of the major costly mistakes people make. If you would like to talk through these strategies and how to apply them to your personal situation, meet with one of our CERTIFIED FINANCIAL PLANNER™ professionals who will help you create your comprehensive financial plan.