Updated February 16, 2018

Market volatility is normal. A number of things affect the market making it a living, breathing and always changing entity. Issues happen, events occur and people react in different ways – all changing how the market will perform. Concerns about rising interest rates, higher valuations, inflation and political uncertainty, among many other worries, make investors jittery. This causes all of these events to affect how the market will perform. As markets go up or down, people tend to get emotional and make mistakes with their money. Don’t react to every event. It won’t get you anywhere. Here are a few tips on how to handle a volatile market so you’re better prepared when the next big drop or spike hits.

Establish Your Financial Goals Before You Invest

Do you need money tomorrow? How about the near future? If you’re someone that needs money now then you shouldn’t look towards investments to generate a quick dollar. Why? Markets perform better over time. When you do short-term investing you might as well take your money to the casino because there’s no way to time the market. Sometimes you win big, but most times you’ll leave down if you don’t have a long-term investment plan. Take it from one of the best investors of all time, Warren Buffett, who says “It’s not timing the market; it’s time in the market that will make an investor successful.”

Are you trying to save your money to make it last for years? Do you need money to last through your retirement and create income when you’re not working? Then this is where investing becomes a key strategy. You need to invest to grow wealth and beat the rising dollar we call inflation. Define your goals, create objectives and then invest towards meeting those goals.

Set an Investment Roadmap

Now that you have set your goals, find out how much money you need to save to accomplish them and establish a timeframe. What you come up with is your target rate of return that you will seek from your investments. This will also help you determine the amount of risk you are able to take within your portfolio so you don’t panic when the market shifts and your portfolio drops. Your portfolio will go down, it’s inevitable. However, when applying the right strategies, it will go up too. Historically, when looking at markets over a period of time, they perform well.

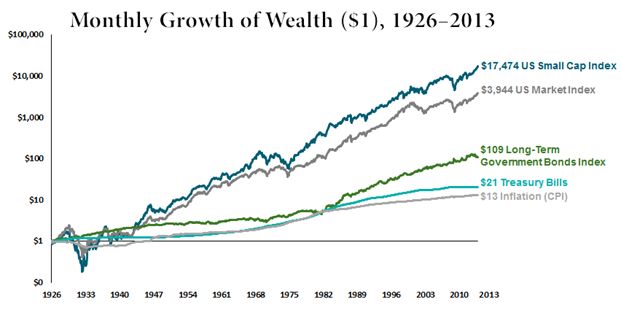

Let’s look at how capital markets have rewarded long-term investors from 1926 – 2013. During this period our economy went through major struggles including the Great Depression and the Great Recession, but when you look at the big picture, you can see that the markets have gone up in spite of volatile swings.

9 Investment Pitfalls All Investors Should Avoid – download the free white paper.

The graph below illustrates this period of time and shows why you shouldn’t react to every event. It’s evident that the longer time an investor spent in the market, the better their portfolios performed.

In US dollars. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results. US Small Cap Index is the CRSP 6–10 Index; US Market Index is the CRSP 1–10 Index; Long-Term Government Bonds Index is 20-year US government bonds; Treasury Bills are One-Month US Treasury bills; Inflation is the Consumer Price Index. CRSP data provided by the Center for Research in Security Prices, University of Chicago. Bonds, T-bills, and inflation data © Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield).

Control the Things You Can Control

- Control market risk – Review your financial goals to determine how much money you should have in stocks v bonds. Hold the right types of stocks and bonds that will help you reach what you’re trying to accomplish. Allocate your assets so your portfolio is diversified to mitigate risks.

- Rebalance your portfolio – when the market goes down, purchase more stocks. When the market goes up, sell and buy more bonds. Maintain consistency of allocation created when you set your financial roadmap.

- Utilize tax planning strategies – One of the largest expenses individuals have in retirement is the amount of taxes they pay on their income. You want to make sure that you have a diversified tax strategy as well as a diversified investment strategy. Having the appropriate amount of money in tax-free type accounts vs tax-deferred accounts, 401(k)’s. If you can control the tax on the distribution you can take less risk with the portfolio and have the same wealth.

- Pay attention to fees – buy low-cost indexes.