Many investors have put less thought into investing after retirement than they have into planning their investments leading up to retirement. Some investors may even believe that the entire process of investing is something that ends once they have retired, although this is not the case for most.

Almost all investors will have different objectives in retirement that will become more of a priority than the goals they had while accumulating their retirement savings earlier in life. Let’s look at some of the common retirement investment strategies and objectives of those investing after retirement.

New Priorities

Keeping an Eye on Inflation

Many young investors are less concerned with the effects of inflation than those who are at or nearing retirement. There are at least two reasons for this.

First, they have not lived long enough to see first-hand the long-term effects of inflation.

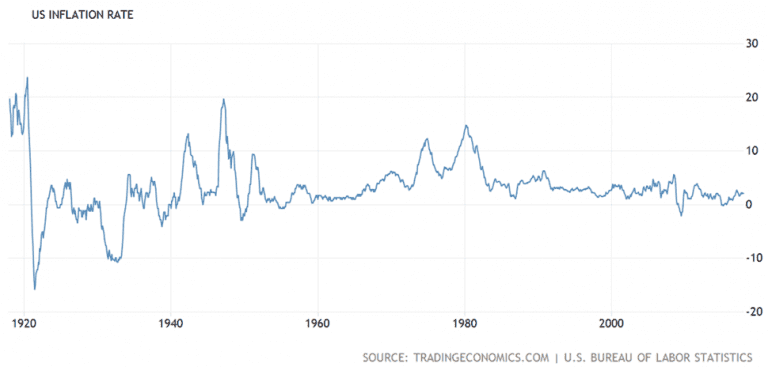

Second, inflation has been relatively low in the recent past, at least relative to other periods of high inflation such as the late 1970s. This does not mean that anyone should assume inflation will remain relatively low throughout their retirement. Rates have fluctuated throughout history and will continue to do so.

This can be an especially critical issue for investors in retirement who frequently increase their allocation of fixed income investments such as bonds. These assets can be particularly sensitive to inflation.

For this reason, many retirement investors will want to carefully weigh the trade-off of the relative safety of fixed income for capital preservation versus the potential of equity investments to combat inflation.

Many investors are increasingly opting to keep a portion of their funds invested in equities even during retirement, partly because we are, in general, living longer. When we retire we will have an even greater need to not only produce income but also to make sure that we are keeping up with the rising costs of goods and services.

Preparing for a Satisfying Retirement – Download the White Paper

Withdrawing Funds for Income

Perhaps the most difficult financial change of perspective that occurs during retirement is the shift from building a balance over time to withdrawing funds for income. This is not particularly surprising considering much of the financial media is largely focused on issues related to the accumulation of wealth.

Many investors who have been successful and comfortable with the process of building their investments over time are a bit apprehensive about the concept of creating an income with their balance. There are many issues to consider as this shift occurs.

How much can you withdraw?

Investors will naturally want to withdraw an amount that allows them to enjoy the balance they have created over time while ensuring it will last throughout their entire retirement.

Many investment professionals use the ballpark withdrawal rate of 4% as a good starting point for estimating a sustainable rate of distribution for a balanced portfolio.

It is, however, important to be disciplined but not dogmatic about these assumptions. Your situation may require adjustment based on aspects including your specific investments and age at retirement.

Those who begin their retirement in a down year may wish to reconsider their earliest withdrawals. Think of any distribution rate as an estimate that you will continually evaluate over time.

How do I measure success over time?

Most investors monitor their rates of return over time to judge their investments, potentially comparing them to a relevant benchmark. This might not be as appropriate for those in retirement. Comparison to a numeric return or benchmark may be less relevant than a goal-based approach.

Goals-based investing is increasing in popularity for those at many stages who base the success of their investments on the degree to which they meet certain life goals. If your choices are a good fit for your needs (income, for example) they may be the right choice for you regardless of how they compare to external measurements.

From which accounts should I withdraw money?

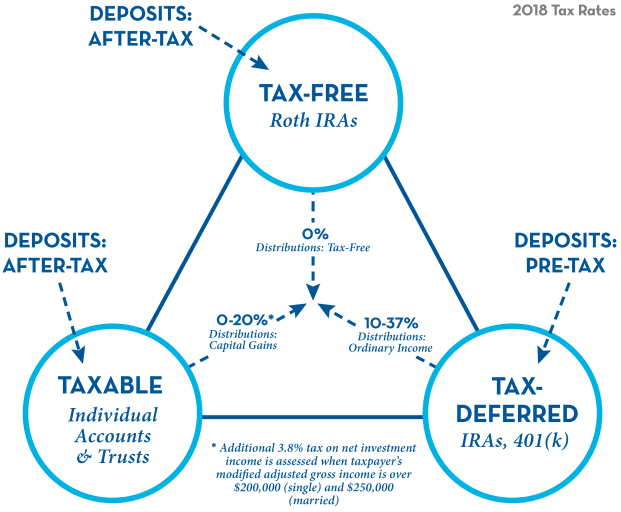

For those who have multiple accounts in retirement, it can be important to determine which to take withdrawals from and in what amounts. In the United States, there are three main “pools” of money. These are taxable accounts, tax-deferred accounts, and tax-free accounts.

An example of each, respectively, may be capital gains on the sale of stocks, your traditional IRA and your Roth IRA. You will want to examine your overall tax situation to determine which account makes sense for withdrawal in each year, with the goal of reducing your taxable income.

Those in high federal tax brackets may be more inclined to take Roth withdrawals, while those in lower brackets may find they get a better deal by withdrawing funds from their tax-deferred accounts.

Take into account not just the federal and state taxes on any withdrawals, but also any effects those withdrawals may have on the taxation of other income such as Social Security or stock dividends.

Leaving a Legacy

Many retirees have objectives for their balances not only during their own life but also during the lives of their heirs. Retirees may wish to see their remaining balance go to family members, charity or multiple recipients. Depending on the recipient, certain decisions may be more favorable from an investment or tax standpoint.

Some investors will change their allocation to be more aggressive than is common for others of their late age if their needs are otherwise met and the funds are ultimately intended to go to their children or grandchildren.

Certain tax issues may influence which assets are sold while alive and which are more efficiently bequeathed to beneficiaries. In general, highly appreciated assets should be inherited so beneficiaries receive a “step up” in cost basis and avoid capital gains tax on the appreciation.

Those who are charitably inclined may wish to directly gift either appreciated assets or their annual required minimum distributions (“RMDs”) from retirement accounts due to the tax favorability of these transactions.

Work with a Professional

As you can see, there are many issues to address when creating your personal investing after retirement strategy. Consider working with a professional to receive guidance with these and other decisions.