Part 1: High-Yield Bonds

We’ve been living in a world of low-interest rates for a while, which means that although they still provide both safety and diversification, it can sometimes be difficult to get the income you want from traditional, high-quality bonds. Because of that, some investors are looking around at alternative income sources to boost their portfolio yields. With that in mind, this article is the first in a series that will look at the pros and cons of various income-producing vehicles to help you determine whether they belong in your portfolio mix.

We’ll begin with an important caveat: Here at Pure Financial Advisors, we believe that the income alternatives we’ll be discussing are best suited as compliments rather than substitutes for high-quality bonds for the vast majority of individuals. So with that warning out of the way, let’s start by looking at our first income alternative: high-yield bonds.

What are high-yield bonds?

The obvious answer to the question above is that high-yield bonds have higher yields than their peers. But the more relevant question is: Why do these bonds yield more? And the reason they yield more is simply that they carry more risk.

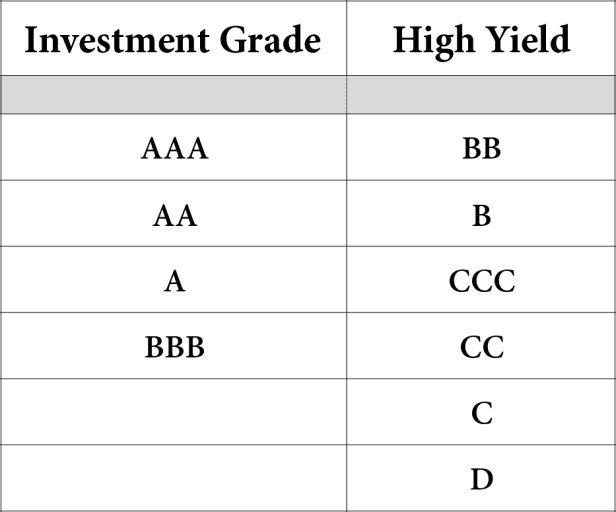

Bonds are issued credit ratings, which work like a FICO score. Here is a table showing bond credit ratings:

The bonds that fall in the right-hand column are backed by less credit-worthy companies or sometimes by emerging market countries or subprime mortgage borrowers. Because they are less creditworthy, they offer higher returns to compensate for their elevated risk.

So why would someone buy high-yield bonds?

There’s no secret here. The main reason investors might consider adding high-yield bonds to their portfolios is to get more income. In exchange for taking on more credit risk, investors expect higher returns. As of this writing, the Barclays Aggregate Index of investment-grade bonds yielded 1.95%, while Barclay’s High Yield Index yielded 4.47%. So, by taking on additional risk, an investor could capture an extra two and a half percent in income.

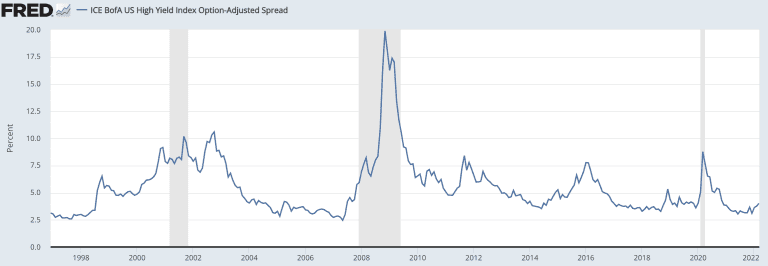

Furthermore, as you can see from the chart above, the exact amount of extra income varies depending on market conditions and tends to spike during times of economic turmoil (2002, 2008, 2020.) As a result, some investors will choose to add more high-yield bonds when they are inexpensive relative to their peers.

What’s the downside, then?

Now let’s talk about risk. For starters, when you buy a bond, you want to make sure that you also get back your principal when the bond matures in addition to the interest payments. The less creditworthy the borrower, the greater the odds you won’t get all of your principal back. That means that you need to be very careful in assessing the credit risk on high-yield bonds.

Furthermore, higher-yield bonds are much more volatile than high-quality bonds due to the greater credit risk. That may not be an issue if you have a lengthy time horizon and are comfortable seeing prices fluctuate, but before investing in high-yield bonds, you need to make sure you have the stomach for it.

One of the benefits of buying high-quality bonds is that they often zig when stock prices zag, but you should be aware that high-yield bond prices can be more closely correlated with stocks than with bonds. High-yield bonds do not provide the same diversification benefits as their higher quality peers. In other words, the chances are that if stocks are down sharply, your high-yield bonds will also be dropping, though perhaps to a lesser degree.

So, how should you use high-yield bonds?

You might compare high-yield bonds to hot sauce for your food: A little bit goes a long way. Generally speaking, the bulk of your fixed-income should be comprised of high-quality issuers. Remember, this is the part of your portfolio that’s supposed to provide safety and diversification. However, for some investors seeking more yield from their bond portfolio, or for younger or more aggressive investors, holding some high-yield bonds could make sense. Generally speaking, this exposure should come in the form of a mutual fund or exchange-traded fund (ETF). Buying individual bonds is a practice best left to professionals.

Check back soon for the next installment in this series, where we’ll look at the pros and cons of using rental properties to generate income.