The first decade of the 2000s was a difficult one for investors.

As the new millennium dawned, the ebullience of the dot com boom turned into a sharp market sell-off, highlighted by the collapse of many previously high-flying tech stocks. By the middle of the decade, markets recovered, but a credit crisis soon ensued, followed by the Great Recession. Newspapers referred to this as the “Lost Decade.” The S&P 500 recorded its worst ever 10-year performance in that decade, which was even worse than its performance during the 1930s depression.1

In retrospect, market declines shouldn’t have been a surprise. After all, if you had visited a fortune teller in 2000 and they told you the following decade would contain:

- Two Wars

- Two Recessions

- A Housing Crisis

- A Credit Collapse

You might have guessed that the stock market would be weak. Perhaps you would have avoided the market completely.

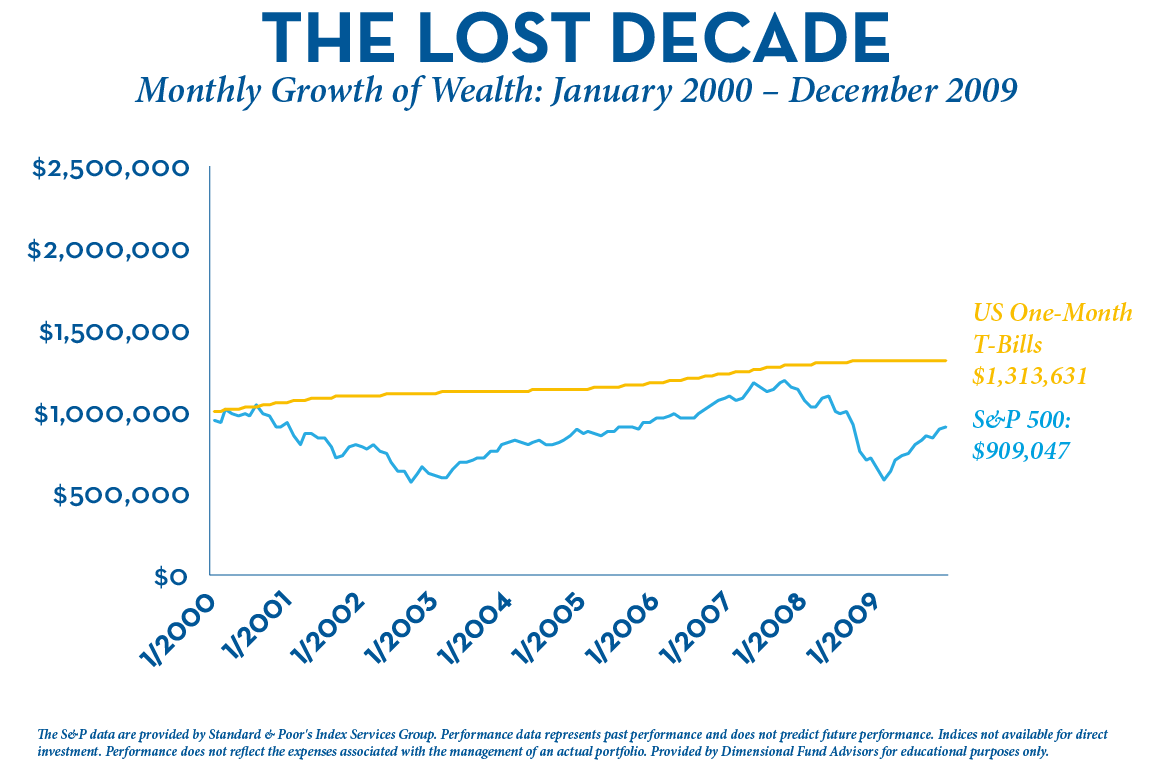

At first glance, avoiding the market appears like it would have been a great idea. After all, as the graph above demonstrates, investors in Treasury Bills beat the S&P 500 during the 2000s, and with a heck of a lot less volatility.

Now, let’s look at the markets more closely.

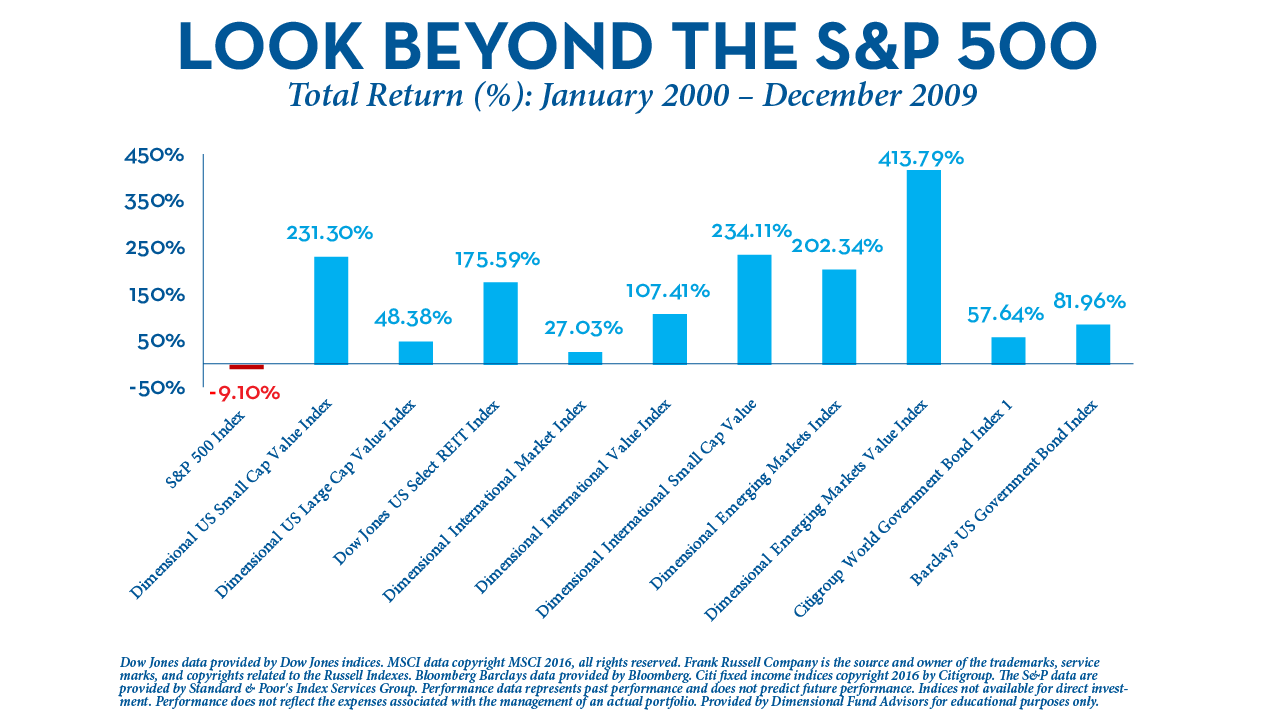

The post-crisis years have been good to investors allocated into large-cap U.S. stocks. This makes it easy to forget why diversification makes sense, but what about the Lost Decade? Back then, while the S&P 500 was limping along to a (-9.10%) total return, other asset classes produced the following total returns:

- S. Small Cap Value Stocks +231.3%

- S. REITs +175.6%

- S. Government Bonds +82.0%

- Emerging Markets Stocks +202.3%

- Emerging Markets Value Stocks +413.8%

So, on closer examination, maybe that decade wasn’t so lost after all.

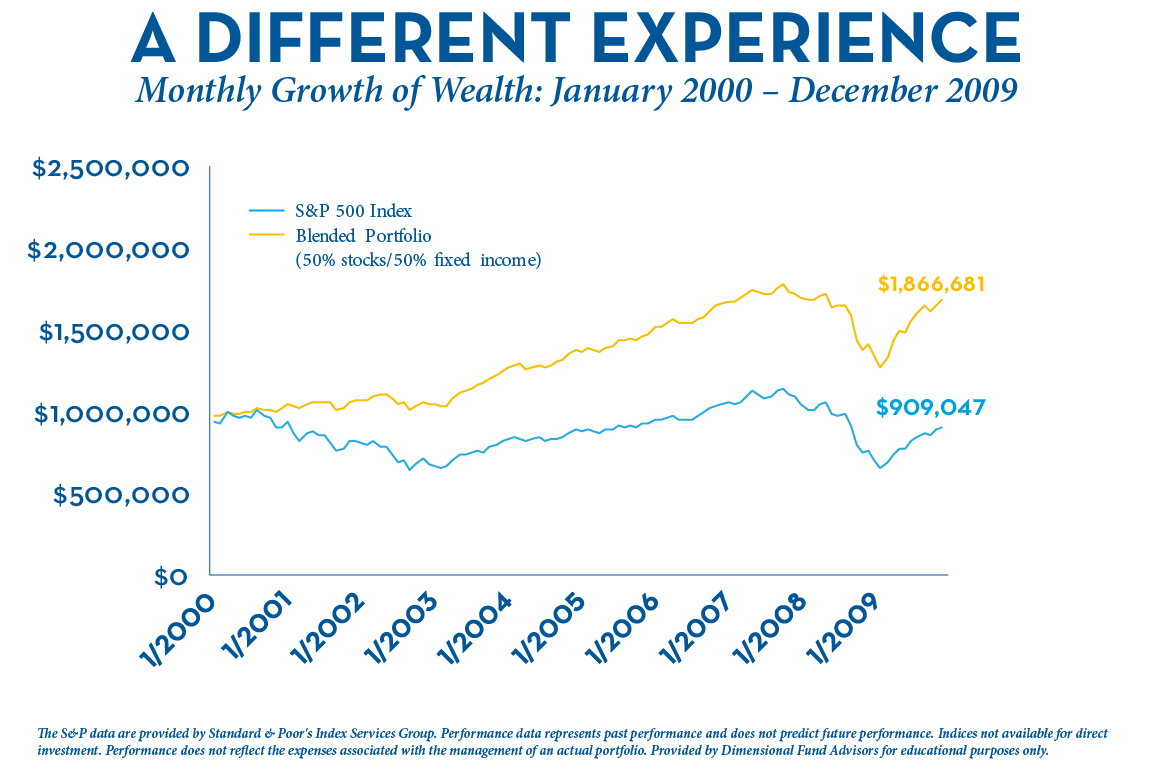

Between January of 2000 and December of 2009, investors in the S&P 500 lost money. In fact, a $1,000,000 portfolio invested at the beginning of that period would have declined to $909,047 by the end of the decade. On the other hand, a globally diversified portfolio of stocks and bonds would have grown from $1,000,000 to $1,866,681.

Consider those two portfolios.

One is owned by an investor still on track to meet their retirement goals.

The other belongs to someone that may have to seriously reevaluate their retirement timeframe and lifestyle.

Which portfolio would you rather have?

What Is Portfolio Diversification?

Put simply, portfolio diversification is selecting investments that when combined reduce the risk of a portfolio. Often these investments will be selected from different asset classes or types of assets. This is often because the investments selected react in diverse ways to different market conditions. While all investments you own may have their ups and downs, they may not be heavily correlated to one another if selected broadly from among a variety of available asset classes, meaning they do not move similarly in response to the same market conditions.

Benefits of Portfolio Diversification

There are quite a few advantages to diversification, not the least of which is minimizing risk. By owning a broadly diversified portfolio, you can reduce the overall risk taken to achieve a given outcome. Conversely, you may also give yourself a chance to capture the returns of assets you would not have owned. Those with multiple objectives for their portfolio (growth and income, for example) may find it easier to achieve their goals with a broadly diversified portfolio than one that is more concentrated. Those with a variety of holdings may also be able to take advantage of tax diversification, making strategic decisions based on their tax situation related to the inherent tax features of the investments they hold as well as what account types they are owned in.

Next Steps To Take

If you think your portfolio could benefit from additional diversification, there are a few steps you can take. First, you should ask yourself what your ultimate goals are for the portfolio since this will largely influence what may or may not be appropriate. Having done so, you can research options to provide additional diversification, which can be an ongoing process. It’s important to realize that you may not be making a change all at once and that many of your decisions may have tax implications you will wish to consider before implementing any specific strategy. If you believe you could benefit from assistance in the process of making or implementing these decisions, consider working with a qualified financial professional.

The past is never a perfect prologue to the future, and the bottom line is that no one can predict the future with absolute certainty. The best we can do is hypothesize probabilities, and then arrange portfolios to perform well across the widest range of outcomes.

So, to me, the important question is this:

If you’re now seventeen years closer to retirement than you were in 2000, can your retirement plan really survive another lost decade?

Can your retirement plan really survive the increased risk that comes from focusing on a narrow subset of the global capital markets?

If not, maybe it’s time to consider the benefits of broad diversification.

1http://www.investopedia.com/terms/l/lost-decade.asp