More Posts

Q: I’m worried markets will turn more volatile next year. Should I sell? A: It’s important to accept that market selloffs are a regular occurrence. Let’s acknowledge that no one likes seeing markets fall and their portfolio balances decline. But the reality is that market selloffs are a normal part of being an investor. In […]

“Inflation is raging. There might be a recession. Markets are volatile. An election is on the horizon. Several banks have failed. We might hit the debt ceiling. Russia is still invading Ukraine. China might invade Taiwan.” The list goes on and on, a litany of troubling headlines. It’s enough to keep you up at night. […]

Many investors have put less thought into investing after retirement than they have into planning their investments leading up to retirement. Some investors may even believe that the entire process of investing is something that ends once they have retired, although this is not the case for most. Almost all investors will have different objectives […]

Retirement is something that’s fairly easy to put off and worry about later, especially when you are young. After all, everything will sort itself out in the end, right? Well… what if it doesn’t? What’s your plan then? That’s the problem with that strategy — often life won’t work out the way you planned. And […]

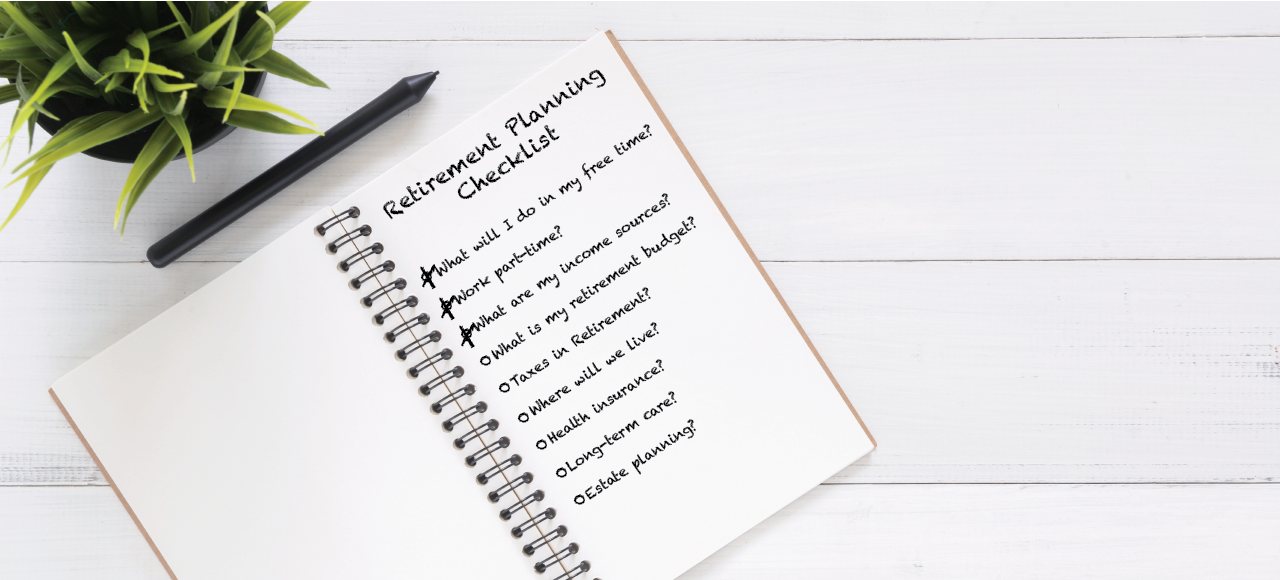

As you approach retirement, there are many issues to consider. This retirement planning checklist will help you get on the right track for a secure retirement. Plan for Free Time Sometimes the non-financial aspects of retirement are a greater challenge than the monetary issues. While you can have a realistic assessment of where you are […]

Choosing appropriate retirement investment strategies can be a challenge even for investors who have been successful building their wealth for years. A shift in strategy from building a balance to investing for retirement income can require different strategies. Here are some common ways you can determine what the best investments for retirement income are for […]

There are several benefits of retirement planning that range from both financial to personal and psychological. Let’s look at seven common reasons why planning for your retirement can work for you. 1. Peace of Mind This is by far one of the most important benefits of retirement planning. Planning ahead not only reduces your stress […]

According to a recent survey by the Transamerica Center for Retirement Studies (2017), paying off debt and saving for retirement are formidable competing priorities for many Americans. In the study, 66 percent of all workers cited paying off debt as a financial priority, and saving for retirement was listed as a priority by 57 percent […]

Are annuity contracts a good fit for your retirement? As with so many financial decisions, the answer is, “it depends.” It depends on your age and your needs. Let’s dive into understanding annuity retirement pros and cons to help you decide if an annuity is the right solution for a portion of your retirement income. […]

Those who are unmarried have unique financial circumstances that should be considered. Differences in Retirement Planning for Those Who Are Unmarried Should Be Examined. It’s easy to assume we’re all using the same playbook. Why would saving and investment differ for those who are married vs those who are single? Shouldn’t we all save early […]

Despite the importance of financial planning, two-thirds of Americans do not have one. Saving for retirement is similar to exercise in one respect. Most of us recognize its value but believe we can put it off until some point in the future. Just under half of Americans say they are saving enough. In fact, this […]

Many retirement savers find themselves with less than they would prefer. Perhaps they have saved less than they expected. Maybe they have saved but have not experienced the returns had hoped for over the course of building their assets. Some approaching retirement recognizes that they may have underestimated the lifestyle they would like to achieve […]

Which documents should you collect for easy access to prior to retirement? You should assemble all your important financial documents in a central location. This could be a digital password protected folder, a physical file cabinet or folder. Regardless of how you decide to gather your documents, you’ll save yourself a lot of hassle in […]

There are two types of standards that financial advisors are held to: the fiduciary standard and the suitability standard. What’s the difference? The fiduciary standard holds a legal requirement that advisors must put their clients’ interest before their own. The suitability obligation, on the other hand, only details that the advisor has to reasonably believe […]

A quick snapshot of the retirement crisis we’re approaching. As thousands of baby boomers reach retirement age each day, there never has been a more important time to review your financial plans and make sure you’re prepared. What Is The Retirement Crisis? Many Americans are unprepared financially for retirement, to such an extent that the […]