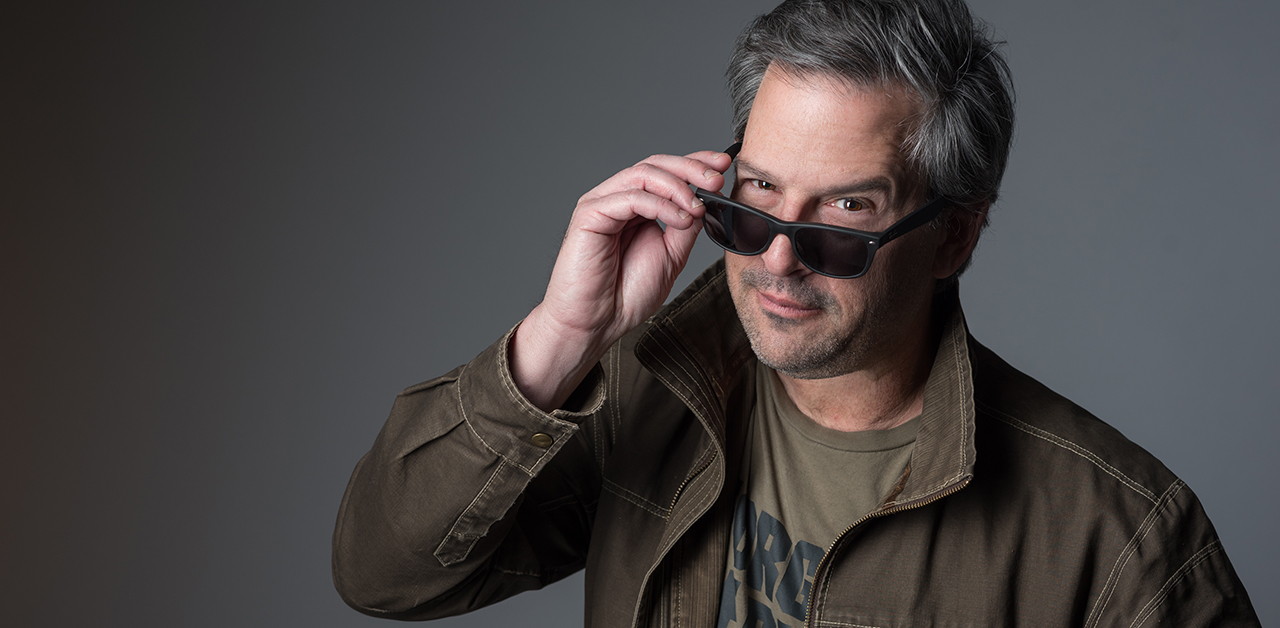

Can risk revolutionize your work? Best selling author, entrepreneur and co-host of the Bad Crypto Podcast, Joel Comm, talks about his new book, The Fun Formula: How Curiosity, Risk-Taking, and Serendipity Can Revolutionize How You Work.

Show Notes

- (01:20) Should I Quit My Corporate Job to Be a DJ?

- (08:33) Joel Comm on The Fun Formula: How to Revolutionize How You Work

- (21:31) Redefining Retirement (and Joe and Al’s Teenage Jobs)

- (28:22) Should I Save to My 401(k) or Pay Student Loan Debt?

- (33:33) 529 Plan Qualified Education Expenses: Do I Need to Submit Proof to the IRS?

Transcription

Life, as an adult, is an ongoing process of learning to walk. Trying things and knowing that sometimes we’re going to fall down. And then we’re gonna go, “huh, what didn’t work that time? What could I have done differently? Who is in my sphere of influence that maybe isn’t healthy for me? Who do I need to be hanging out with? What do I want to do?” If you want to play it safe and have an average life, an average existence, then don’t take risks. But you’ve got to try if you want to try and do something profound. – Joel Comm

Inspiring words from entrepreneur, New York Times best-selling author and eternal 12-year-old Joel Comm. He brings The Fun Formula to Your Money, Your Wealth® today and explains How Curiosity, Risk-Taking, and Serendipity Can Revolutionize How You Work – which just happens to be the title of his latest book. Plus, Joe and Big Al discuss whether you should you quit a high paying job at age 23 to follow your dreams of being a DJ, whether you should save for retirement or pay off student loan debt, and whether you have to prove to the IRS that money from your 529 education savings plan went to education expenses? And for show and tell, the fellas share what little Joe and little Al did for cash back before they became the self-made men and podcast hosts they are today, Joe Anderson, CFP® and Big Al Clopine, CPA.

01:20 – Should I Quit My Corporate Job to be a DJ?

JA: We have Joel Comm on the show today. He’s got this interesting podcast too, the Bad Crypto podcast. If you’re interested in Bitcoin – that’s just taken a dive.

AC: Well it went up, and it went down.

JA: He wrote, like 10 social media and marketing books. He’s a blockchain enthusiast.

AC: You think blockchain is going to revolutionize the world?

JA: I do believe that blockchain is pretty significant, yes.

AC: Can you describe what it is?

JA: It’s a ledger. (laughs) Anything else?

AC: (laughs) It’s an electric ledger? Yeah, you are correct. You wanna expound?

JA: No. That’s all I know. (laughs)

AC: (laughs) It’s a bunch of accountants in the back room keeping a ledger. Except electronically.

JA: Pretty much. The Fun Formula – he wrote that book. That’s what we’re gonna talk about.

AC: We need to have more fun.

JA: I know. This is too much.

AC: This is gonna be exciting.

JA: So, “How Curiosity, Risk-Taking, and Serendipity-” Have you ever seen that movie, Serendipity?

AC: No, but serendipity. So when I went to college at UCSD, it took me four and a quarter. So I went one extra quarter.

JA: Failure.

AC: And I think the most significant learning thing was I learned the word serendipity. I thought that was a great word. And I’ve always tried to live by serendipity.

JA: Really? I thought it was, um… I don’t even know what it means then.

AC: I knew you didn’t. (laughs)

JA: It’s like happenstance, right? Isn’t it? Right place right time?

AC: Yeah. It’s kind of like serendipity is whatever comes your way, you kind of flow that direction.

JA: Ah, some secret forces?

AC: So that’s why I’m here with you. You showed up serendipitously.

JA: Yes, serendipity. Our relationship is very serendipitous.

AC: It still is.

JA: I don’t know if that’s good or bad. We’re going to jump in the email bag. This is courtesy of Advisor Insights from Investopedia, our good friends there. Can I say, good friends, even though I’ve never met them? They sent me some socks.

AC: Well that’s probably your best friend.

JA: Here we go. I have not screened these, so I have no idea what’s coming. Is that okay with you?

AC: I’m good with it.

JA: This is the one Andi wants me to read. “I’m 23 years old and tired of working in the corporate American job every day.”

AC: Yeah that’s a pretty old age to be burned out. (laughs) It only gets worse.

JA: I know. “I work in audit.” Well that tells it all. He’s an auditor. I used to live with a guy that worked for Price Waterhouse Coopers as an auditor. I think every Friday there was like a going away happy hour for somebody. He’s like, “it’s awesome. Everyone quits at least once a week.” It’s a grind I guess. “I work in audit making about $68,000 a year, but I don’t feel a sense of fulfillment from the work that I’m doing. I want to pursue my passion of working as a DJ full time and start an events company that focuses on weddings and corporate events. I’m planning on leaving my job around May of next year to avoid paying back to signing bonus they gave me.” And currently, he’s got about $95,000 in cash and investments saved “and plan to have about $125,000 by the time I leave next year. I currently live at home rent-free and I have no car or student loans” because I take my bicycle everywhere. (laughs) I ad-libbed. “I also currently own the majority of the equipment I need to require to start the business. What kind of financial obstacles should I be aware of by taking this leap of faith? Is it wise to leave my paycheck and pursue my own business?”

AC: It’s a good question. 23 years of age and you’re burned out. And I actually worked also…

JA: As a DJ?

AC: Not a DJ, I’m not that social.

JA: “Ladies and gentlemen! We’re gonna do the chicken dance! Line up!”

AC: “The Macarena!” No, I didn’t do that. But I was an auditor, surprise surprise. (laughs) That’s like a destiny of a future CPA.

JA: Here’s my advice to this young gentleman. He’s making $70,000 bucks a year. He works as an auditor. You’re probably in the office at 9 and you’re leaving the office at 5. You’re not doing DJ gigs from 9:00 to 5:00. You do DJ gigs at night and the weekends. So don’t quit your job. Start your DJ business, work your tail off and do a couple bar mitzvahs, couple weddings, maybe a school dance, and then see you enjoy it.

AC: And see if it works.

JA: You’re living with your parents.

AC: See if you can make money.

JA: Yes make a couple of bucks. Don’t give up the $70,000, are you crazy?

AC: So anyone that talks about, like doing a side hustle, do the side hustle first, make sure it works before you say sayonara to your employer.

JA: Yeah. He might be awful.

AC: Might be. I mean he’s an auditor. He’d be like me!

JA: Exactly! You went down the path of auditing…

AC: And now you wanna be a DJ!

JA: Yeah just pack up, move to Vegas, maybe the Encore Beach Club.

AC: “For my next number – but first, I just saw this balance sheet. It was really sexy.”

JA: So, no. You’re 23. You’ve got $70,000 at 23? That’s a ton of dough!

AC: Plus I would say this because I am in the same profession, there’s a lot of directions that you go. You don’t have to be an auditor your entire career.

JA: Right. Five years, save some cash. You do the DJ biz on the side. You know, he should just read this book by Joel Comm, New York Times bestselling author that we’re going to have on the show here in a couple of minutes. Joel Comm is BadCryptoPodcast.com, FunFormulaBook.com, JoelComm.com.

AC: Lots of ways – and that’s C-o-m-m, by the way.

Pay off student loan debt or save to your 401(k)? Do you have to prove to the IRS how you spent your 529 plan? Answers to these questions coming up later in the podcast. If you’ve got a question about your finances, leave us a voicemail at (888) 994-6257. That’s (888) 994-6257. If it’s a good one, we’ll put you on the show live so Joe and Al can answer it for you in person! If you’d rather just email your question, you can do that too – send it to info@purefinancial.com. Now we’re joined by entrepreneur, New York Times bestselling author several times over, Bad Crypto podcast host, brand influencer, futurist and eternal 12-year-old Joel Comm, talking today about his new book, The Fun Formula: How Curiosity, Risk-Taking, and Serendipity Can Revolutionize How You Work.

08:33 – Joel Comm on The Fun Formula: How to Revolutionize How You Work

AC: Joel, welcome.

JC: Thanks…

JA: We are working right now and we want to have a lot more fun.

AC: Yeah how do we have more fun with this job, because isn’t that what life’s all about, right?

JC: Well, I think it’s about two things. It’s about the people in our lives, and it’s about the experiences that we have and that we share. It’s not about money and it’s not about who gets the most toys. You can’t take it with you, this is very true. So I think it’s about bringing value to the world around us and having a life that’s fulfilling, personally.

AC: So what are some practical things folks can do to try to have more fun in their work life, and maybe their outside of work life?

JC: Well, I think not being afraid to explore your natural curiosity. When we’re kids, we just play. We explore, we try things, and there’s this magical sense of wonder about the world. And then we get old and jaded. We become adults and responsibilities set in and harsh realities of the world. Of which, by the way, I believe there’s way more good in this world than there is bad. We just need to not tune into the news too much, otherwise, we get depressed. But I think being childlike in some form and staying in touch with that part of us – that there is that wonder, that we get to explore and try things and take some risks, being willing to fail. Because I think that’s where the greatest lessons actually come from. We learn when we figure out how not to do something.

JA: Well I think that’s a lot easier said than done, right? If I take a risk, yeah, the best thing in life is right after fear, right? If you conquer some fears and you take a risk and you achieve that. What are some practical ways some of our listeners can break through some of that fear, or try to have more fun or take that risk? Because, as you probably well know, everyone says they want to take a risk but most people don’t.

JC: Yeah, but nobody ever accomplishes anything really great without taking a risk.

JA: Absolutely agree with you.

JC: Anybody who’s ever done anything profound in their lifetime, the people we look up to, the heroes – and I’m not talking about moms and dads and teachers, those are heroes as well. But people who don’t take a risk, hey if you want to play it safe and have an average life, an average existence, then don’t take risks. But you gotta try if you want to try and do something profound. And I think it begins, having more fun begins with taking that risk and saying, “you know, I don’t know what’s going to happen, and I can’t control the outcome, but I’m going to feel alive. And whatever happens, come hell or high water, I’m going to learn, I’m gonna experience. There are people that are going to go on this journey with me,” and I think it’s that moment – it’s the Carpe Diem, Seize the Day – because we don’t know how long we have. None of us do. And we all know people that have left their earth suits and this planet prematurely, earlier than we think anybody should go. And we’ve got people that are planning for the next few decades. And 30 years from now when I leave this J-O-B that I really don’t like but I’m being responsible, I’m going to do – fill in the blank. And the most tragic thing is when that blank never gets filled in. So why wait for tomorrow when we have today?

AC: Yeah I think we all know people that sit there at work and they have calendars and they count the days that they can retire. And sometimes some government employees, it’s not days, it’s months or years, or even decades. I think that’s what you’re saying. You’re saying if that’s your existence, there’s a little bit more to life than that.

JC: Well you’re missing out on the here and now. You’re missing out on the experiences you could have now. You’re missing out on the opportunity to fall on your face and learn from it. And that’s what we do so well as children. As long as we’re not stymied by parents or teachers or siblings or society, we try things. We experiment. We start by crawling and then we walk. And as we’re learning to walk, guess what happens? We fall. And life, as an adult, is an ongoing process of learning to walk. Trying things and knowing that sometimes we’re going to fall down. And then we’re gonna go, “huh, what didn’t work that time? What could I have done differently? Who is in my sphere of influence that maybe isn’t healthy for me? Who do I need to be hanging out with? What do I want to do?”

JA: Is there a specific formula? What is the Fun Formula? What is the formula that I gotta follow to do this?

JC: First of all, it’s not mathematical, it’s more philosophical. But there are really three components to it. We addressed two of them – the first is curiosity, and that is allowing ourselves to let our creativity take hold of our imagination and we explore. Number two risk-taking. You have to be willing to put yourself out there, which means you have to be willing to fail. And that’s how we learn. Number three is really more faith-based to me, it’s about trusting the process. Some call it serendipity, but I believe that there are right times, right places to take the right steps that move you towards the action that is going to move you forward. And you really can’t put the cart before the horse. I’ve done that before. You just end up with hoof prints up and down your back. But when you’re patient and you learn to wait for the right timing, to take that risk in conjunction with that timing, I think that’s where the magic happens. I mean how many of us are doing what we thought we would be doing when we were teenagers or even young adults? But life has a way of handing us twists and turns, and, “oh, you know, I’ve got a skill for broadcasting, and maybe that could be an avenue for me to channel my talents and abilities and maybe I’ll have fun doing that.” But it’s paying attention to that which is in us, and listening to those who know us. To say, “you know, I think you might really be good at” whatever that thing is, and being willing to take that risk.

JA: I think this is a good lesson for people of all ages. A lot of the individuals that Al and I work with are transitioning into retirement, let’s say. A lot of people that listen to this show are either retired or maybe close to retired, or looking to save money or figure out a way to create wealth. But I think the longer that someone can work and generate income, the more wealthy that potentially they could be, and your definition of wealth could be all sorts of things. But if they follow your simple formula, to say, I want to continue to work or be productive and have a lot of fun doing it, and taking the risk of doing the things that I’ve always wanted to do, I think that’s really powerful. Someone could get out of the 9 to 5 job that they hated for the last 20 years, they’re transitioning, they’re 60, and they could do something now – start their own business, or do what their passion really lies but they’ve always been afraid to, or maybe they didn’t have a path to go down, or get a kick in the ass and say, “maybe now’s the time to do it. Why don’t you put forth some effort and figure it out?”

JC: And I think now is always the time to do it. Wherever you are in life. There are people reading my book that are high school students, and it’s kind of the, “Oh the places you’ll go” mentality, and then full spectrum – entrepreneurs or people working jobs, people running their own business, and then, as you’re saying, retirees – “what do I do now?” And so today is all we have, right? Yesterday is gone, tomorrow is a blank check that we may never get to cash, so it’s the here and now. What I really discovered as I was writing this book is I looked at my successes and my failures. I kind of reverse-engineered and I realized that the successes actually took the least amount of effort. The failures are the ones that sucked more time, energy, and resources from me. And so there is something to that about pursuing that about which we are naturally passionate, and being willing to go with the flow and take that risk. And I know that’s really hard for some people to do that, because we were taught, “here’s how you become a responsible productive adult.” But that’s not the same for everybody. And I’ve been flying by the seat of my pants now my whole adult life, I’m 54 and I’m not going to change now. I figure if it’s not broke, don’t fix it.

JA: What made you write the book? What encouraged you? What made you take this risk?

JC: It’s really a great question. In thinking about what the next book was going to be, I noticed that there is a message that is unfortunately prevalent in society right now, and it’s this “hustle and grind” notion that says – you know, we all agree that hard work is virtuous. But somewhere in there, some marketer got a hold of it and said that ten times the hard work must equal ten times the virtue. And that’s simply not the case. There is something to be said for working smart as opposed to working hard. I probably work less – what I call, what we think of as work – than most people I know. Because I believe if you can tell the difference between your work and your play, you’re probably doing one of them wrong. But if we’re doing that which triggers our curiosity and our creativity, odds are we’re going to have fun doing that. Turns out that might be the best venue for us to be plugged in – where we provide the greatest value, based on who we are and what we know.

AC: I was thinking as you were talking, I was kind of going back to my youth, and I wanted to be a baseball player. (laughs) But that wasn’t going to happen. I’m not that good at it.

JC: That does happen.

AC: And then I started playing guitar in college and I wanted to follow James Taylor and be a singer-songwriter. And I wasn’t that good. So there’s one thing about pursuing your dreams, but you also have to be realistic.

JC: Yeah, this notion that you could be whatever you want, I think is a lie. I’m never going to be a Michael Jordan. I just can’t jump, I can’t shoot, even from the free throw line. Doesn’t matter how hard I work, I’m never going to be that person. But I do believe we can achieve things that are beyond what we believe we’re capable of. And it should be something aligned with what we’re passionate about. You guys seem like you’re having fun doing what you’re doing. Am I wrong?

JA: It’s all a show. Acting. (laughs)

AC: I’m having fun, I don’t know about you. (laughs)

JA: I’m miserable, Joel. Absolutely miserable. I gotta read your book. (laughs) Hey Joel, where can people get the book? Where can people find you?

JC: All the places that quality books are sold. Amazon, Barnes and Noble, Books-A-Million, you name it. And if they go to FunFormulaBook.com, they can claim a number of free bonuses. They could also find me online, JoelComm.com or any social media site @JoelComm.

JA: And I guess I have to ask too, you have a podcast too, The Bad Crypto Podcast?

JC: Yeah, in fact, we just celebrated our first birthday of The Bad Crypto Podcast yesterday. I’m here in Denver and my co-host Travis Wright, who lives in Kansas City, Missouri flew in, and we actually had people drive and fly in from all over the country to hang out and enjoy food and drinks in celebration with us for our first birthday, and I just love talking blockchain and Bitcoin and crypto in a way that’s fun, that makes it easy for people to understand instead of being over their heads. We don’t want to be too techie-nerdy, just the right amount.

JA: Well it’s pretty hard with that topic, but you guys do a wonderful job at that. So maybe next time we have you on the show we can get in the nitty-gritty on the blockchain.

JC: I would love to, It’s always fun.

JA: So BadCryptoPodcast.com, you gotta check that out, or just check out JoelComm.com.

Thank you so much to Joel Comm! Y’know, following the Fun Formula is how I ended up living in Australia married for 11 years to a fella I met on the internet. True story! I’m not doing any of those things now, but the Fun Formula also led me to producing this podcast, so win-win. For a transcript of this interview and links to all the resources Joel Comm mentioned, check out the show notes at YourMoneyYourWealth.com. Speaking of authors and their books, in the next couple weeks, we’ll be joined by Meb Faber of the Meb Faber Show podcast, author of the forthcoming book, The Best Investment Writing, Vol. 2 and Marc Levinson, author of The Economist Guide to Financial Markets, now in its 7th edition. Don’t bother setting reminders or anything, just have the episodes download directly to your device by subscribing to the podcast at YourMoneyYourWealth.

21:31 – Redefining Retirement (and Joe and Al’s Teenage Jobs)

JA: You know, when you look at retirement Alan… what are people redefining? They’re looking at retiring earlier? I’m just trying to sneak a look at your notes. (laughs)

AC: (laughs) Looking over my shoulder. Well I’ll tell you Joe. This is Bankrate.com. They produced a survey – and I know how much you like surveys – because it’s based upon how people are feeling at that exact moment. But the main survey question, they had some other ones, but basically, it’s when do you want to retire? What’s the ideal age to retire? And it turned out it was different ages depending on how old you were. But the average or the median of all the people in the survey said Americans think that 61 is the ideal age to stop working. 61 years of age which, coincidentally, is my age. I’m out of here. After the show I’m done. (laughs)

JA: What do you think?

AC: Well, but then you look at the baby boomers, which I am. They said the ideal retirement is 64 to 72.

JA: So who are they surveying when they said the ideal age is 61?

AC: All kinds of ages.

JA: It was across the board. All ages. And they’re saying yeah, 61. As you get closer to 61, they’re saying no, it’s not 61, it’s more like 70.

AC: Yeah, because I’m not ready. Let’s go a few more years. But when you’re 25, you’re imagining, “I can’t work past 50.” And when you’re, I would say, 35 to 40, everyone says they want to retire by 50. And then when you’re 45, they say 55, and then it’s like 10 years. And then by the time you get to 60, maybe it’s like five years. But it’s always five years. 61 – 66, 62 – 67, and so on. And that’s not the only question they asked. What age to start saving for retirement? This is all across the board, what do you think they came up with?

JA: Should be 12.

AC: You’re actually not too far off – 22. So that’s pretty early, that’s right after college.

JA: It is. I graduated college at a different age.

AC: Well you were later. Late bloomer. (laughs) How about the age to buy your first home?

JA: I don’t know. Depends on where the hell you live. We live in Southern California, I would say the age to buy your first only California it’s gotta be, I don’t know, late 30s early 40s?? (laughs)

AC: (laughs) Anyway, the national average is age 28. I bought my first home at 27. And you were a little bit later. (laughs)

JA: You’re an overachiever, Al.

AC: How about the age to open your first credit card?

JA: That’s probably way too young – 17? 18?

AC: Well they said 22, which is good, because if you’re opening a credit card at 17 and you’re living at home, you have no idea how this works, how debt works and all that stuff.

JA: I had a credit card at 18. Because I was plowing snow, and I was a foreman of this landscaping company, Alan. And I was in charge of like, I don’t know, there was like seven guys. Most of those guys were in their 50s. And I was 17 and I had my gas card. I was a very responsible young man.

AC: How did you get that job?

JA: ‘Cause I’m a badass! No, just a hard worker. And then you got these 50 year olds that were probably half-alcoholics. They were mowing lawns for a living, it’s not like they were at Harvard. (laughs)

AC: They’re looking like, “Oh I think this 17 year old is better than that 50 year old.”

JA: They didn’t know I was 17. I guess if they looked at the application, but I was pretty mature for my age and I probably looked a little bit older.

AC: So wait a minute, wait a minute. So you were mature for your age, but yet you were still late bloomer?

JA: I was in college, because I was working hard labor trying to make a buck.

AC: Because you paid for your own college.

JA: I paid for my own college.

AC: Alright. Well that changes everything.

JA: So I left the good home state of Minnesota and I went to Florida, University of Florida. And I took a year of community college to get in state residency. So I got some credits at Santa Fe Community College. I worked two jobs. I worked as a bartender at Howl at the Moon Saloon.

AC: OK. And there’s no shoveling of snow.

JA: Not anymore. I was shoveling snow in Minnesota. So I think I did that… I graduated high school at 17, so I did that from 18 to 19, then I moved to Florida at 19, I lived in Orlando. That’s when I worked at a Golf Country Club. And then I also was a bartender/bouncer at this piano bar.

AC: Bouncer? I can see you as a bouncer, you’re a big guy. If I was a bouncer they’d just push me over. (laughs)

JA: (laughs) So yeah. Then I got my in state residency, and then from there then I moved to Gainesville, Florida and then I went to University of Florida.

AC: And I think your parents decided they weren’t going to pay for college.

JA: No because I left because I wanted to get the hell out of the cold. So I moved to Florida and they were like, “you’re done. If you’d go to the University of Minnesota we’d pay for it.” And I said thanks but no thanks. Packed up my stuff and left.

AC: And you made it work. You’ve been a self starter ever since. From 17 years of age.

JA: Right there.

AC: What were you doing at 15? You must have been doing something responsible?

JA: 15, I was going to get married. (laughs) I did get married on the playground in sixth grade with Beth Georges. (laughs) No, I was selling t-shirts at 15. I was a sophomore in high school. I was selling my t shirts and sweatshirts.

AC: When I was 15 – I actually started at 12, I started selling golf balls on a golf course. Of course, they didn’t like me doing that. (laughs) And I did get kicked off. So my whole business went down. I was having the best day ever, I made $8 in like 30 minutes – which for a 12 year old way back then, it was a lot of money.

JA: And then they were like, “wait a minute, where did you get these balls??”

AC: And I could always tell, the people as they came up, because I was on hole number 8 or something. The people that came up, you could tell by how they were dressed. “Oh these guys are going to go for the nice Titleist,” and then this guy would come up walking, didn’t have a cart, jeans on, old safari hat, and I thought, “OK, he’s going to go ten for a dollar.” I had ten for a dollar, they were kind of nicked up and stuff. And sure enough, I was usually right. (laughs)

JA: (laughs) So you were profiling back in the day?

AC: Well I didn’t act on it. I just hd a hunch that they would probably want a certain type of golf ball. Got it.

I’ve got a few more e-mail questions here, Big Al. Let’s do this one. “I am 25 years old and currently putting about $6,000 per year into my 401(k). Between my wife and I, any extra income golds goes towards the principal payment of $90,000 of student loans.

28:22 – Should I max out my 401(k) contributions for a certain number of years to boost the size of my 401(k) while I’m still young, instead of putting it towards the extra principal payments of the student loans?

Or should I continue to put the extra income towards the student loan principal, and keep my 401(k) contributions the way they are?

AC: All right, I will tackle that, then you can agree or disagree. So I think the first thing I would want to know is what kind of match the 401(k) plan has. So if $6,000 per year is going to give you the maximum match, then that could be a pretty good amount. But if you can put a little bit more in and get even more match – because when you do a match, in other words, you put in a dollar or you put in a couple of dollars, and then the employer puts in a dollar – something like that. So you always want to contribute, in my opinion to your 401(k) enough to get the match. Now the question though is, should then I put more into the 401(k), or should I pay off the student debt? So I guess for me personally, I don’t necessarily like to make black and white decisions, I kind of look like to look at this holistically. I would say in general, I would favor that argument. In other words, I would go up to the match and then I’d probably use the rest of the payments to pay of principal on the student loan. But I think I’d want to look at this in a bigger picture before I actually said that definitively.

JA: I love where this guy’s head is at, because it’s looking at, there’s something to be said about starting saving early. And if you can save a lot of money at 25 years old, that’s going to go a very long way for his retirement. So at 25 most people aren’t thinking about maxing out there 401(k) plan – especially if they have this looming $90,000 of debt over their head right. And so I can see while he’s juggling, he’s like, “All right, well what the hell do I do here? Do I save into my 401(k) plan or should I just keep chipping away at this debt?” Well I think one of the things we’re missing here is his human capital. So $90,000 of debt – what occupation is he in? Is there room for a lot of growth? Is there a potentially high income within the occupations that him and his wife are in? Then I would look, man, if I was that, I would max out the 401(k), continue to pay there, and then as my income increased, I would take that increase in income and then chop off the $90,000.

AC:Yeah. So I would probably do the opposite. But I would probably go to the match, use the rest to pay off the student debt, but then as I got raises or bonuses, maybe I might apply some of that each so that I’m making progress on either one.

JA: Yeah. So I guess it’s there’s a ton of ways to slice this thing.

AC: Yeah there is. Either one is good.

JA: I guess I have to take a look at, I’m next to a CPA. So I’m surprised you haven’t asked, “Well what’s the interest rate on the student loan?”

AC: Well I’m assuming it’s probably 6%, I don’t know.

JA: And then you have the argument, “well, do you want to guaranteed 6%? All you gotta do is pay the loan.” I’ve heard that a million times.

AC: I wasn’t gonna go there. I know, right. I think that the point is you want to do both. And so if you listen to people like Dave Ramsey, I know exactly what he would say – he would say…

JA: Who is Dave Ramsey?

AC: He’s a national talk show host that you know very well. (laughs) He would say get a thousand dollars into an emergency fund first, and then pay off all debt before you go back to the 401(k).

JA: I totally disagree.

AC: I don’t agree with that either.

If you’re a bit older than 25 and wondering about paying off debt or saving for retirement, our own financial educator Jason Thomas, CFP® has written a blog post on the topic, with the pros and cons of each – you’ll find a link to it in the show notes for this episode at YourMoneyYourWealth.com. Like Joe, I’m a Gen Xer, and my first job was also selling t-shirts and sweatshirts too – hand-painted ones, in my case. But then I started in radio when I was 20 and I’ve never looked back. So for me, retirement will be when I can no longer sit up to this microphone. What about you, what’s your ideal age for retirement? Download Big Al’s Quick Retirement Calculation Guide to see how much you need to get from here to there – there’s a link to it in the show notes as well. Take 10 minutes and find out if you’re on track for the rest of your life. Now let’s get back to answering those email questions – send yours to info@purefinancial.com or you can call (888) 994-6257.

We got an e-mail from Todd. He’s a TV viewer. “I watch YMYW” I love it how people are catching on! YMYW – Your Money, Your Wealth – every Sunday morning and it either reinforces my understanding of my investments or I learn something new. So thank you.” Boom. “Question to Big Al.” Awesome. Off the hook. “My daughter will be heading to college in two years and her 529 plan looks great.” How does a…? Did you dress it up? (laughs)

AC: It means it has a lot of money in it I think. (laughs)

JA: 529 plan looks pretty good today. Yesterday doesn’t look so great. (laughs) :But she also has her tuition waived to Cal State or UC school – CalVet, his wife was retired military. So thank you very much, wife, for your service. “So tuition might not even be that expensive, so most of her great, looking good 529 plan will be used on other expenses. My question is regarding 529 qualified education expenses. Do I need to submit proof (receipts) to every penny used from the 529 plan for qualifying expenses to the IRS?” Before you answer that Alan. Couple of things are going on here. (laughs) So first of all, let’s explain the 529 plan. I think how they work, because some of them look pretty great. (laughs) His looks really great. So I don’t know how you get a great one and you get a not so great one, but we can start there – 529 plan is a section in the IRS code that allows what?

AC: Yeah, it allows an individual to put $15,000 in for anybody that they want to. Usually it’s your child or your grandchild. And it’s tied to the gift tax limitations, Joe. So $15,000, but you can actually do five years all at one time.

JA: Isn’t the gift tax exclusion a little bit higher than 15?

AC: No it’s 15.

JA: Isn’t it 18?

AC: No, it’s 15. Trust me.

JA: All right, you’re the CPA. (laughs)

AC: I just looked it up to make sure I was tight. (laughs) It was 14 last year, now it’s 15.

JA: It was $13,500, it was 12, it was 10. OK.

AC: So yeah. So 15 grand.

JA: Feels like it should be more now.

AC: It feels like it, but you can do five years all at one time. So that’s $75,000 per recipient if you want to just put a nice big lump sum in just to get it growing. And so the idea is it goes into this plan, which by the way, the plans are sponsored by a state, and every state has a different 529 plan. And if you live in California, you don’t necessarily have to pick California’s plan. You can pick Nevada’s plan or Michigan’s plan or Florida’s plan. It also doesn’t matter what state you go to college in, at least with regards to California. Some states, like I think Pennsylvania maybe is one of them, if you live in Pennsylvania and you have Pennsylvania 529 plan, you actually get some state tax benefit. So anyway, it’s not true in California which is where we’re at. So in the way that you pick it, in California because there’s no particular benefit, is who’s got the best investments that you would like to invest in. Bcause some are lower cost Vanguard type funds, and some are more expensive funds that may have a little bit of drag on your return.

JA: Yeah but I think now, if I were to take a look at most of the 529 plans, the genie is out of the box a little bit.

AC: It is. There’s been a lot of discussion about fees.

JA: “You can do this one 529 plan and pay all these loads and huge fees.” They’re all very competitive. There are certain states, sure, that probably have maybe a little bit better fund family. Utah’s a pretty good plan.

AC: When my kids were younger I used Nevada. They’ve got a pretty good plan.

JA: California actually has a decent plan. So it really depends on what you’re trying to accomplish. But like you said, California, it doesn’t matter, you can pick any state that you want. So if you’d like Fidelity, if you like Vanguard, if you like American Funds, T. Rowe Price, whatever, you can just look at the state and pick it from there to make it easy, consolidation, whatever.

AC: Yeah. So you get this money into the 529 plan and then it grows tax free as long as it’s used for qualified education expenses in the future.

JA: And that’s the million dollar question. What qualifies as a qualified educational expense?

AC: Well that is the million dollar question, and we’ll get to Todd’s question here in a second. But a little bit more background. So first of all, tuition counts. That’s logical, that makes sense. Rom and board. So that counts – so you’re living in the dorms and you’re on the meal plan. So that would count.

JA: How about if I just have an apartment down the street?

AC: And you’re buying your own food? Not necessarily. Technology items – so like if you need a computer, laptop, Internet service, that would be qualifying items. And then books and supplies, as you mentioned. These are all qualifying expenses and that’s it. But there’s a bunch that you think might qualify but actually don’t. Like for example, transportation and travel – like if you’re if your son or daughter goes out of state and they gotta fly to the location – the airline tickets are not part of this. So you can’t get reimbursed for those. Student loan repayments. That does not qualify either. General electronics like cell phones, that would not qualify. Sports and fitness club memberships, even though it might be part of what’s offered at the school, and health insurance does not qualify. So anyway, what qualifies, essentially, is tuition, room and board, technology like computers, and books and supplies.

JA: So I take the money out of my 529 plan…

AC: OK. So the question is, do I need to submit the receipts to the IRS to prove that it’s qualified tuition expenses. The answer is no. You absolutely do not have to submit any receipts, it does not get attached to your return, but you need to have the receipts if the IRS audits you – they will ask for it then. But to actually prepare the return and submit the return, there’s no submission of any receipts required, so you just keep them.

JA: So when you’re taking distributions, I’m going to have $30,000 taken out of this very good looking 529 plan (laughs) And then you spend the money as you see fit, as a qualified educational expense. And then from there you just kind of keep your records. Make sure that you’re fairly tight with it. And then if, upon audit, if they’re looking at, “you took this distribution, was it qualified? We would like to have verification of that.”

AC: Right. Now let’s let’s take it next step further, which is to make sure that the expense is going to be qualified when you actually if you get audited. It’s best to pay the institution directly if you can. Because then it’s obvious that that money went from the 529 plan to the college, that would be good. Or if you’re just withdrawing the funds and putting them in your checkbook, make sure you immediately write those checks, so it’s pretty clear that money went for those deductions. You wouldn’t necessarily want to say, “you know what, I need $30,000 this year, I’m going to put it in my checking account, and then over the course of the year I’ll just draw out $30,000.” That gets co-mingled and the IRS sometimes gets a little nervous about that. So that’s if you want to make sure that the deduction sticks on an audit.

JA: It sounds like a lot of work. I would…

AC: I know what you would do. You got that CPA that does anything. (laughs)

JA: Yeah, his name is Big Al Clopine! (laughs) I mean come on! It’s like if you’re not taking the $30,000 and buying an Escalade for the kid, the kid’s going to school, I’ve saved money in this beautiful, gorgeous 529 plan.”

AC: Well to be honest, it depends on the IRS agent that you get.

JA: I also believe too, and you know what, I’ve been doing this now 19 years and about 11 months.

AC: Yes. And how many 529 audits have you seen?

JA: (laughs) Zero.

AC: Yeah actually, me too. (laughs) So it’s not like this comes up very often.

JA: And I think in almost 20 years of doing this, I’ve set up many, many 529 plans and yeah, I’m just trying to think of the last time with the distribution if there’s any issues with it. I haven’t.

AC: Yeah. Now a couple more things to be aware of. If for example your daughter doesn’t need the funds, you can then transfer them to another beneficiary, if you have another kid, or even yourself or your spouse or grandkids.

JA: Right because the 529 plan rules under the new tax reform has changed. Where those 529 plans also will cover K through 12. private, elementary schools and a whole bunch of stuff. The law is widening. And so I think for those of you that have saved into a 529 plan, it is so rare – because most people can’t even save for retirement. One third of grown adults don’t have a nickel.

AC: Yeah I don’t I don’t think we’ve ever had a client that had too much in their 529 plan.

JA: Right. So congratulations Todd, you win the 529 savings award for this week. What you get is probably a copy of this recording in your email box. (laughs)

AC: Which is very valuable. (laughs)

JA: So thank you Todd for that question. That’s it for us folks. Want to thank, of course, our lovely producer Andi Last. Big Al Clopine, wonderful job today.

AC: And Joe Anderson.

JA: Yes I am. That’s me. All right. We’ll see you guys next week, have a wonderful week, show is called Your Money, Your Wealth®. We’ll see you again real soon.

_______

Special thanks to our guest, Joel Comm. You can get his new book, The Fun Formula: How Curiosity, Risk-Taking, and Serendipity Can Revolutionize How You Work at FunFormulaBook.com

Subscribe to the podcast at YourMoneyYourWealth.com, Apple Podcasts, Google Podcasts, Stitcher, Spotify, Overcast, Player.FM, iHeartRadio, TuneIn, that weird stage fright/Beyonce thing, or whatever app you happen to use for your podcasts. Send your money questions to info@purefinancial.com, or call (888) 994-6257, and listen next week for more Your Money, Your Wealth, presented by Pure Financial Advisors. For your free financial assessment, visit PureFinancial.com

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

Podknife

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed