Are you on track for retirement? Big Al Clopine, CPA created a YMYW Quick Retirement Calculation Guide to help you find out. If you’re a little behind in your savings, Big Al also has 3 ways to get caught up. Wondering if Joe contributed anything to this episode?? That would be a yes! We’ve got questions and Joe’s got answers on the differences between the 403(b), 457(b) and 401(a), he clears up the whole 5-year clock Roth IRA thing, and he explains how to do a Roth conversion from a current employer’s 401(k).

Show Notes

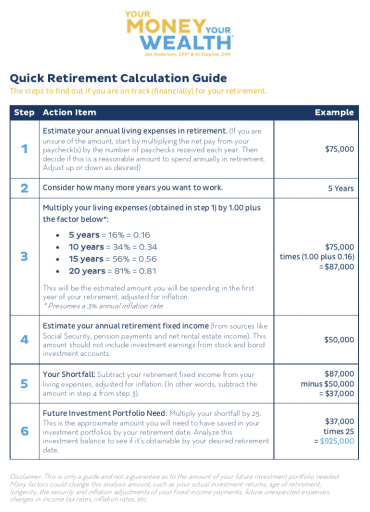

- (00:58) The Your Money, Your Wealth® Quick Retirement Calculation Guide

- (10:16) Big Al’s List: 3 Ways to Recover from a Late Start on Retirement Planning

- (27:35) How Does the 5 Year Clock on Roth Conversions Work?

- (38:01) My company offers a 403(b), 457(b) and 401(a). How are they different? Should I open all 3?

- (47:17) Can I Do a Roth Conversion From My Current Employer’s 401(k)?

Transcription

Have you subscribed to Your Money, Your Wealth® yet? You can, on Google Podcasts, Apple Podcasts, Spotify, Stitcher, Overcast, Player.FM, iHeartRadio, and TuneIn. Or just visit YourMoneyYourWealth.com, click “Subscribe to our Podcast,” enter your email address and you’ll receive our weekly podcast newsletter. Today on Your Money, Your Wealth®: are you on track for retirement? Big Al has his very own retirement calculator to help you find out. If you’re a little behind in saving for retirement, Al also has 3 ways to get caught up. Now, if you’re wondering if Joe contributed anything to this episode, that would be a yes! We’ve got questions and Joe’s got answers on the differences between 403(b)s, 457s and 401(a)s, he clears up the whole 5 year Roth IRA clock thing, and he answers my question about doing a Roth conversion from my current 401(k). Now, with more financial information than should possibly be able to fit in two brains, here are Joe Anderson, CFP® and Big Al Clopine, CPA.

:58 – The Your Money, Your Wealth® Quick Retirement Calculation Guide

AC: I got a surprise for you.

JA: Yeah I heard, you’ve got a new retirement calculator.

AC: Yeah. This is original content by Alan Clopine. (laughs)

JA: All right well let’s see it.

AC: So because we’re about to start up our new TV show season, so I’m trying to come up with some new thoughts because this is season 5. And it’s like how many ways can you have a show to say, “here’s how you figure out if you’re on track for retirement.” So I guess the formula – and people have heard us say this before, but I will repeat it. Like, let’s just say you want to spend $75,000 in retirement. And most people don’t even know what they’re spending. So take a look at your net pay and your net paycheck. Maybe it’s whatever, let’s just say it’s $5,000 every two paychecks – $2,500 per pay and you get paid twice a month, so that’s $5,000 per month is your saving, 12 months, that’s $60,000 is what you’re spending. If you’re married maybe you add your spouse’s to that, and then you’ve got to figure out. “am I spending more than that or less?” In other words, I am I charging up my retirement accounts and my home equity loans? So in other words, I’m spending more, or am I actually saving? Maybe I’m spending less. But you got to start with that figure – what you’re currently spending.

JA: How many people do you think know that number?

AC: Well they don’t. That’s why I’m giving you a shortcut.

JA: (laughs) How many people do you think will follow the shortcut? That’s the problem though. If they would just spend a little bit of time to figure out exactly what that spending is.

AC: So here’s a 10-minute formula. Take 10 minutes of your life to know whether you’re on track for retirement.

JA: Right. That’s all you need.

AC: So I’m giving you step one, which is, figure out your spending by looking at your net pay. Now, if you’re a business owner, this is quite much more complicated. So this is for people that are wage earners, they’ve got net pay, and then they get a sense, “Am I spending all of it or am I saving some of it?” And I’m not counting your 401(k) or your 403(b) because that’s already taken from your gross. I’m talking about your net, what’s left over.

JA: What gets the direct deposit in your checking account.

AC: Exactly. What comes into your checking account, are you spending all of that? Then maybe that’s your average spend. So in our example let’s just say it’s $75,000. Now, when people do that, maybe they’re five years away or 10 years away from retirement, 20 years away. And there’s a problem – that’s inflation. And so I tried to come up with a simple calculator for inflation. You can go online and get all these calculators. So if you’re driving around, stop the car, get your pen out. (laughs) I just used the 3% inflation rate. We use like 3.7% at Pure Financial, just to be more conservative. It’s been closer to 2% the last decade. But anyway, 3% is a pretty good average for the last 100 years. So I’ve used 3%. And here’s how it works: if you’re going to retire in five years from now, your expenses are 16% higher. So let me give you an example. So you take $75,000 times 1.16. That’s 16%. And that gets $87,000. So here’s where you need a pencil is to write down these figures: if it’s five years from now, you’re going to have to at 16% your expenses. If it’s 10 years from now you’ve got to add 34%. If it’s 20 years from now, you have to add 81%. 16, 34, 81.

JA: So 20 years from now, the dollar, is basically what you’re saying, is going to lose 84% of its value?

AC: 81% is correct. In other words…

JA: Or I need two dollars or just about $1,84 to buy a dollar’s worth of goods today.

AC: If you think about something that you’re spending a dollar for today, it’s going to cost you $1.81 20 years from now. 16, 34, 81, five year, 10 year, 20 year. So that’s your factor.

JA: Oh those are going to be household factors soon. 4% rule? We’re going to have Big Al’s Inflation Factors.

AC: Keep repeating it: 16, 34, 81. 5, 10, 20. Anyway. So here’s my example. You figured out that your net pay is $75,000 and that’s about what you’re spending. So you’re going to want to retire five years from now. So you take 75 times 1.16. So you take that 16%, which is .16 for you mathematicians, and you add it to 1. And so you just take 75 times 1.16. If it’s ten years, you take 75 times 1.34 and so on.

JA: Yes, we’ve been there. Let’s just do 1.16.

AC: A lot of people need refreshment.

JA: No, all they’re getting now is just numbers. (laughs)

AC: So anyway. So in other words, five years from now, you’re going to be spending $87,000 to have the same lifestyle at a 3% inflation rate.

JA: Got it. Can we call it 90?

AC: Yeah, we’ll call it $90,000. We’ll round it up.

JA: So $75,000 today, if you want to retire in five years, assume a 3% inflation rate, you need $90,000.

AC: Yeah that’s right. So if you need that, then you look at your Social Security, figure out what that is. And so let’s just say your Social Security and pension plan is $50,000, for example. So you’d need $90,000, your fixed income is going to be $50,000, so your shortfall is $40,000. And here’s the thing that we don’t often talk about is the inflation factor. So that’s why I wanted to throw that in, because if you retire just a few years from now, it can be fairly different numbers depending upon inflation. But using that figure – if you need $40,000, then you take that times 25 – that’s another factor I want you to memorize – and that would tell you, $40,000 times 25 is a million bucks. That’s how much you would need. And then sometimes people say, “well forget about it. It’s impossible. I’m never going to retire,” or “this is hopeless” or whatever. But the truth is, and I just did a little example of somebody that – in my example, I didn’t round – I had $87,000 minus $50,000. So in other words, the shortfall was $37,000 times 35. That’s $925,000 is what you need. If you’ve got $600,000 today – I know that’s a lot, but let’s just say you did – you’d need to save $22,000 a year at 6% and you’d get to $925,000. Interestingly enough, if you have $691,000, call it $700,000 right now. I know you like to round. Then you don’t need to save a penny. If you can earn 6% per year you get to that $925,000. And a lot of times, people are 10 or 20 years out, and they see they need a million bucks and they’ve only got $250,000. But the power of compounding money… Just the rule of 72 means you take 72 and divide it by a number of years and that’s the rate of return that you need to double. And the easiest one is 7%, which is roughly 10 years. In 10 years your investment doubles. So $250,000 becomes $500,000, $500,000 becomes a million. That’s without saving another dollar at 7% over 20 years. So that’s how this can work. So don’t get too frustrated if you’re way off the mark. It depends upon how much longer you have to work and how this can work.

JA: 7%, do you think that’s reasonable? 20 years?

AC: I think it’s reasonable if you have probably a 60/40 maybe 70/30% allocation – a little bit more aggressive, maybe.

JA: Yeah I think you’re right.

AC: However the market, the CAPE ratio is pretty high. So some people would say maybe we’re not going to have as high a return. Nobody knows is the thing. We do know that stocks outperform CDs and bonds over the long term. But we also know that when stocks are high, the future expected return is lower than if stocks are low – then the future expected return is higher. So it’s hard to know exactly. I typically use a 6% in something like this. I think that’s more conservative. Some of you might want to use a 5% and that’s fine. But anyway, this step, if you’ll take this step… I’ll tell you what, if it was just too much, I’m going to write this down. We’re going to put it in our show notes, and so you’ll have the example, you can follow it on our podcast.

JA: Okay. Anything else before we gotta go?

AC: No that’s all I had to say on that one. I want our listeners to do this calculation so they can assess how they’re doing, and in a lot of cases Joe, people are not going to be there. And so later on in the show, I’m going to talk about what to do if you’re behind.

JA: All right. And I’m sure a lot of us are behind so we need to figure out what we gotta do.

AC: I think a lot of us are behind.

Have you already forgotten what 16, 34, 81, 5, 10, 20 is? Luckily, the Your Money, Your Wealth Quick Retirement Calculation Guide is indeed in the show notes for this episode at YourMoneyYourWealth.com – click here to download it. Run your own numbers in and see if you’re on track for retirement. If not, as promised, Big Al’s got some ideas for that too, because it’s time now for Big Al’s List: Every week, Big Al Clopine scours the media to find the best tips, do’s and don’ts, mistakes, myths and advice to improve your overall financial picture – in handy bullet-point format. This week, 3 Ways to Recover From a Late Start on Retirement Planning.

10:16 – Big Al’s List: 3 Ways to Recover From a Late Start on Retirement Planning

AC: This is from our friend Walter Updegrave, who we’ve had on this show before.

JA: Yeah I do remember Walter. Didn’t he scold us?

AC: Yes.

JA: I think you said a disparaging remark. (laughs)

AC: I didn’t know we were on the air. I think he heard it. (laughs) And he hasn’t come back on the show.

JA: (laughs) Yes that is the Walter Updegrave that we were talking about.

AC: I still like him.

JA: Yeah, very nice man.

AC: Yeah. Good smart guy.

JA: He couldn’t figure out our little video conferencing thing when we were trying to get him on the air.

AC: Right, he got a little frustrated. Because it was an audio interview but it also was Skype, so we were trying to see him while we talked to him.

JA: Yeah because we love to look at people when we talk to them.

AC: (laughs) There’s something to body language. Of course our listeners, they don’t know what we like, but that’s too bad. (laughs) But, Three Ways to Recover From a Late Start on Retirement Planning – and I would say these are these are good. They’re not exactly earth-shattering. But it’s important to know because I think a lot of people are behind. So his first point is, start saving your you-know-what off. Start saving your butt off. So save as much as you can. And he goes through some examples, let’s say you’re in your 50s, early 50s, and you can save $500 a month. And you earn a 6% rate of return. That’s a reasonable rate of return, as we were talking about last segment, to calculate. Then in 15 years, you’ll have $145,000.

JA: What’s that going to buy you?

AC: Well if we use a 4% distribution rate, 4% of $145,000 is almost $6,000 of income per year. So not a lot, but better than nothing. Add that to your Social Security. But what if you’re married? What if you could both save $500 a month? Now we’re going to double that. So now we’re about $290,000, so now we’re now or close to almost $12,000.

JA: So this is what age, 50?

AC: 50 and working 15 more years – or maybe 55 and you work till 70. Something like that. And this is completely scalable. What if you could save $1,000 a month? And then it’s $290,000 each.

JA: How about if you could save $10,000 a month?

AC: Well let’s get realistic. Maybe you could. (laughs)

JA: Oh yeah right. That’s why I hate these things. You know what I mean? It’s like, “well all you’ve got to do is save more.” Yeah, I know. There are some people that we know that should be saving a lot more because they make a lot more money. But if you’re just an average Joe, it’s like, “OK, well I’m trying to save as much as I possibly can. I got bills.”

AC: Yeah. On the other hand, you’ve got a car that’s perfectly fine. You can pay it off or you could go out and buy a new car and have a thousand dollar monthly payment. Forget it. You need to save. You save that thousand bucks. Over 15 years, that’s $300,000. If you and your spouse can do it, it’s $600,000. It’s a ton. And what if there were some way – I’m not saying is easy, but a 401(k), you can put $24,500 – that’s about $2,000 per month. So if it’s $2,000 per month, now you’re saving about $1.2 million. And if there’s two of you that’s $2.4 million in 15 years, starting at zero. So I’m not saying these are easy, but these are here to motivate you on the power of saving. That’s the whole point.

JA: Got it. I’m motivated. You know what I really enjoyed was that individual – what was that guy’s name? He retired at like, I don’t know, 25 years old with millions. And he only made $20,000 his whole life. The math doesn’t really work but he saved 1% more per month every single month. That’s something I can shoot for. Because you start talking about these numbers of $500, $1000, $1500, I think sometimes people just gloss over that. They’re like you know what, there’s no way I can afford it. I’m already saving as much as I can. I’ve got to put kids through school, I’ve got a mortgage. There’s a lot of things that stress people out, versus if I said $500 a month and get that thing to $1000 a month, versus saying save 1% extra per month of your income. I think that 1% is a little bit more, “hey, that motivates me.”

AC: Yeah, you can adjust and then you can adjust a little more and then a little bit more. I agree with that.

JA: And then before you know it you’re saving 10, 20% of your income and that’s pretty cool.

AC: Right. He got up to 85% as I recall. And so that’s why he had lots of money. And I think he was 35 not 25, but still, it shows the power of what you can do saving – and of course you’re going to save that much, you’re going to have to learn to live pretty frugal, which then allows you to retire early because you’re used to living frugally.

JA: Yeah, if you’re only spending $15,000 a year, well that’s pretty good. It’s pretty hard to do that but I guess some people can. ‘

AC: You can eat rice and beans and a little bit of lettuce now and again.

JA: People say that, “oh, we’re on rice and beans,” and they make hundreds of thousands.

AC: Right. OK. Second tip: stay in the job longer.

JA: Yes, work longer. Save more, work late.

AC: Planning on retiring at 62? You worked until 66 instead, or plan to retire at 65, work until 68, whatever it may be. Sometimes just a few months make a big difference. And I’ve got a related, different article, but on topic: it says the single most important retirement strategy – it asks this question: saving an additional 1% of your salary for 30 years. Is that better? Or postponing your retirement by three or four months? And it turns out the answer is, it’s the same. Now of course, it depends upon your assumptions. It can be more or less, but three or four months. In one case, if you’re making a huge return, maybe it’s more like six months, but still. Working three to four to six months extra is the same as saving 1% of your pay for 30 years in a row. Even with the compounding of money. And the reason why that happens, as the authors in this article and actually the study mentioned, one, you’re postponing your Social Security benefit. So every month you postpone your Social Security benefits, it gets higher and higher. And if you look at a year’s time, you’re getting between 7 and 8% for waiting. In other words, if it’s a thousand a month, if you wait a year it’s going to be $1,070 or maybe $1,080, depending upon what age you are.

JA: Sure. I think there’s a lot more figures or levers, I guess, that you could pull to really make a successful retirement. You take a look and I think what you’ve said, or what Updegrave is saying, is save more. You could save more money, you can spend less. Well if I’m spending less, hopefully, I can save more.

AC: That’s usually how you save more.

JA: We had the Retirement Answer Man on – he’s like, you can work longer, spend more, save less. And he goes, “Well those kind of suck.” Or you can get a higher rate of return on your money. So there are multiple things that you can look at. But I think, no one really wants to spend less. No one really wants to save more.

AC: It’s not your preference.

JA: Right. And it’s like, “well, do I really want to work longer? But how about if I just save a little bit more and spend a little bit less and get a little bit higher rate of return.”

AC: And work a little bit longer.-JA: It’s like how do you eat an elephant? One bite at a time. So it’s daunting when you when you look at it, but I think for most people if you just take small little corrections it has a long-lasting effect. The equivalent of saving 1% additional per year is only four months of extra work? But I find that kind of… if I think about some other studies that I’ve seen, they talk about like high mutual fund fees. So if you had a 1% higher fee, it’s like millions of dollars. How much is this person making?? (laughs) I would like to see the numbers in that study.

AC: I think this was like an average person making 50 grand. However, a couple more things I want to say, why this works – besides the fact that your Social Security will be higher, you’re saving into your 401(k) longer, obviously you’re saving more, and then your retirement portfolio will grow longer. And then the final thing is, you’ve got less lifespan – although that’s debatable because in a lot of cases people say you work longer you’re gonna live longer.

JA: Right. Exactly. They’ve done that study just recently. The people who retired earlier died earlier. The people that worked longer lived longer. Yeah.

AC: Three ways to recover from a late start on retirement planning. Article by Walter Updegrave.

JA: What does he call a late start? What is his definition of a late start?

AC: He’s answering a question from a from a reader or listener. Here’s the question: “I haven’t made the best decisions when it comes to retirement planning. As a result, my wife and I are in our early 50s and have next to nothing save for retirement. Do we have any hope of a secure retirement?” So this is the question he’s answering. Number three is, be flexible and resourceful. And let me give you some ideas.

JA: A little side hustle?

AC: That would be number one – side hustle. In other words, you have a little side job. Side jobs are more and more common these days, I would say, with our new economy. And so a lot of folks are realizing that they’ve got some skills and they got a little extra time outside of normal work hours where they can make some extra money. And in a lot of cases, if you can sort of take that extra money – because you’re kind of used to living on your regular job – and save it all, or save most of it. Maybe you don’t want to save it all, because it feels like you’re working for no current benefit. But you save half of it or save three-quarters of it or whatever it may be, then that can be a way to go. Another possibility is if you’re a homeowner and you are over 62, you could look into a reverse mortgage. The most loan you could probably get is close to $300,000 so it’s not like it’s millions you can get from it. But if your loan is less than that, you could pay off an existing loan with a reverse mortgage and still get a cash flow from the remaining equity up to that level, and that level, depending upon the kind of reverse mortgage loan you get, can actually increase over time. So that’s a way to go. You can downsize. A lot of people know that they can take their high equity. We live in Southern California, a lot of people have a lot of their wealth in their home. They can sell their family home and move into a condo. Now in San Diego, if you want to live in a condo on the beach, you’re probably spending the same or more than the home that you sold. So just be aware of that. But that’s something you can do. Another thing is sometimes people think about, well maybe it’s time to retire to a lower cost area. San Diego for example, very high-cost area. We have a relatively close neighbor in Phoenix that is much lower cost. Now you got to be able to bear the heat in the summer and that kind of thing.

JA: You could move to Hemet too.

AC: Yeah that’s like Phoenix in terms of the summer. It’s pretty hot. (laughs)

JA: Temecula.

AC: Yeah true but at any rate, there are other low-cost areas, so it’s a matter of just kind of thinking what your options are. And I think you said it well – it’s not so much that you do all or nothing. It’s like you might think about all of these things. You might try to save a little bit more, you might want to make sure your investments are engineered for your goals instead of maybe you’re not earning enough return or maybe you’re taking too much risk to make this work out. Maybe you work a little bit longer, maybe you get kind of a side hustle so you’ve got some money to save there. Maybe you think about downsizing your home or relocating if that’s something that is – maybe your kids have moved to another location is cheaper and you want to be near the grandkids. There are all kinds of ways. There’s actually not really one answer that fits anybody. It’s usually a combination. It’s pretty hard for someone who’s saving zero to all of a sudden save $2,000 in their first month.

JA: It’s impossible. There’s no way. That’s why I hate these articles. “I’m 58 years old. I don’t have any savings. Help.” You’re 58! If you haven’t saved in the past, how can all of a sudden you switch? It has to be either. There’s not enough income and they’re making minimum wage.

AC: Yeah. And to make a change like that on a dime, something would have to scare the heck out of you. So let’s think about a health thing – you have a heart attack. All of a sudden you get religious about eating properly. But you’re 55 and retirement is ten years from now? What’s the event that’s going to say, “All right. I’m going to completely change my life around!” It doesn’t happen.

JA: And that’s the problem though. Because you have to have a heart attack for you to stop going to McDonald’s. I tell myself every New Year’s resolution, I’m going to stop smoking, stop drinking so much, I’m going to get a better diet, I’m going to lose 50 pounds, I’m going to start saving some money, everything else. Guess what. Next year? Nothing. And then finally you have that heart attack. It’s like, “oh man, I knew I should have done something but I didn’t.”

AC: And then you do it, because you have you have to. There’s no choice. (laughs)

JA: Well, if you want to stick around… (laughs) even there I’ve seen people – my cousin is like, oh my gosh, very obese. Probably drinks too much. Sells pull tabs at this dive bar and eats like fried cheese, smokes Saratoga cigarettes and pounds Bud Lights all day.

AC: That could have been your life. (laughs)

JA: (laughs) Potentially could have been. Then she has a heart attack and you’re like you’ve gotta ease up on the diet, you probably shouldn’t be smoking. OK, that sounds good. Five days later, back on. So that added another five minutes to her life.

AC: Yeah that is true. And since we’re on the topic, I think a lot of people place, in my opinion, this just my opinion, a little too much reliance on some of these heart pills and high blood pressure pills and cholesterol pills, when actually, if you just cleaned up your life, you ate the right food and exercised, it would actually be better. But people think we got all these pills, I don’t need to change anything – I’ll just take them.

JA: That’s awesome. I can’t wait. (laughs) I’m not gonna change anything, just gonna take the magic pill. Or you know, there’s something that’s sold out there that you can just put some salt on your Big Mac. (laughs)

AC: Yeah. Well, I think that was banned because we haven’t seen that in a while, but I do remember that. This guy got up there, he was just one of these pitchmen. He goes, “can you believe this? You sprinkle this on your cheeseburger and it’s healthy!” (laughs)

JA: (laughs) Yes! “You want to lose weight? All you have to do is use our magic dust!”

AC: “I had six cheeseburgers yesterday and I’m fine! I lost two pounds yesterday!” (laughs)

JA: Remember that? They would play those commercials during our show. So at the break we’d hear these commercials and we would come back from break and be like, “Are you kidding?” Yeah, I wish we had that magic dust for our portfolios! All you have to do is save five dollars, throw some dust on it and it turns to a million!”

Is that anything like Santa Claus and his magic dust? By the way, that guy Joe and Al mentioned who suggested saving an extra 1% per month was Millennial Money founder Grant Sabatier (whose name I mangled in that episode), who side hustled his way to a million bucks in just 5 years. I’ve included a link to Grant’s very funny interview in the show notes for this episode. Grant has a new book coming out in a couple months and will be back on Your Money, Your Wealth® when it comes out, so make sure you’re subscribed to the podcast so you don’t miss it. Now it’s time to dip into the email bag, with financial questions courtesy of Advisor Insights from Investopedia, and you, the Your Money, Your Wealth listeners. Joe and Big Al are always willing to answer your email questions! Just send ’em to info@purefinancial.com

27:35 – How Does the 5 Year Clock on Roth Conversions Work?

JA: This is from Susan. She goes, “Hi, my husband is 62 years old and this year he did a Roth conversion. In one of your seminars, you had mentioned that there is a five-year clock on Roth conversions for distributions. Is this true if one is over 59 and a half, or is it just if you’re under 59 and a half?”

AC: So, there is a difference.

JA: Sure. There are two five year clocks. It gets a little bit confusing.

AC: Yeah. And there’s a variation on one of the clocks if you’re over 59 and a half and under 59. I’ll start with the easy one – you like to do the complicated one – which is simply this: if you’re over 59 and a half and you do a Roth conversion, you have access to those funds immediately. You don’t have to wait five years at that point. If you’re under 59 and a half, you do you have to wait five years to get those conversion dollars.

JA: So there are multiple variations here. So let’s do it real simply first because I think when people hear of a five-year clock, all the five-year clock means is that they want you to season the money in the Roth IRA for five years before you start taking money out of it. The purpose behind it is that if I do a Roth IRA contribution – let’s start with contributions. So you put $5,000 into a Roth IRA as a contribution. You can always have access to the money that you put in as the $5,000 because it’s FIFO tax treatment – first in, first out. So if I’m 40 years old, I put it in, I can take it out the next year, no harm no foul.

AC: Now you cannot take out the growth – income growth. You’ve got to wait 5 years or 59 and a half, whichever is longer.

JA: Yes. So that’s where it gets a little bit confusing because you always have access to the principal but anything that that principal grows to, you have to wait until 59 and a half or five years, whichever is longer.

AC: So let’s say I put $5,000 in a Roth IRA, I start that at 25 and I do it for five years. So I got $25,000 by 30, and I need that money. I need $25,000 for a down payment on a home. I could pull that out, even though I’m not 59 and a half.

JA: Correct. Because that is the principal amount that you put in.

AC: Now the $25,000 grew to $30,000. That extra $5,000 growth, I’ve got to wait until I’m 59 and a half to get that.

JA: Because it is a retirement account. So you have to wait to 59 and a half to get the money out tax-free. So how about this, then let’s say you’re 65 now. You put $5,000 and it grows to $6,000. Well, you’re over 59 and a half. You would think, “hey, I have full access to these dollars.” The answer’s no. You only have access to the contribution. Unless you established a Roth IRA more than five years ago.

AC: Right. So when you’re over 59 and a half, you can get at your growth as long as you have a five-year clock from your first Roth.

JA: Yeah. So if you don’t have a Roth IRA, never established one ever before, and you are 60 years old – 65, 70, I don’t care how old you are – you’re over 59 and a half. It doesn’t matter, you have no access to the growth until five years happens after the first dollar that hits your first Roth IRA.

AC: Yeah. So in other words, go ahead and do a small contribution or do a small Roth conversion, even if you’re in a high tax bracket to start your five-year clock.

JA:: You got it. Now, where it gets confusing is that maybe I established a Roth 15 years ago. I put $100 in. I don’t even know where that account is, now I another one. All right, well still, you put a contribution in 10, 15 – it doesn’t matter. You don’t have to have ongoing contributions. You established a Roth IRA ten years ago at Vanguard, you open up another Roth IRA at Merrill Lynch. It doesn’t matter. The IRS doesn’t care about custodians, it doesn’t care about anything like that. They just want to know it’s in a shell of a Roth IRA. So, that’s the five-year clock on contributions – hopefully, that was clear.

AC: Yeah, and that’s the easier one. (laughs)

JA: I know! Now you’ve got conversions. The conversion five-year clock works like this: if I’m under 59 and a half – I’ll start with that one. Because each conversion now, will have its own five-year clock if you’re under 59 and a half. That is not true with contributions. Contributions, you put money in, as long as you establish that one, each additional contribution doesn’t have its own five-year clock. Conversions do. So it’s like, “well, what the hell are you talking about?” (laughs)

AC: (laughs) So wait a minute. So I did a conversion at 25, 26, 27, 28, so I did five conversions for $25,000. So I can pull the first one out in five years, $5,000, but I gotta wait another year for the next one and then 2 years for the next one and 2 years for the next one.

JA: And here’s the reason for that, is that if you’re under 59 and a half and you do a Roth IRA conversion, you are paying taxes on that dollar. So I convert $10,000 into a Roth. I pay taxes on the $10,000. Now the money is sitting in a Roth IRA. Here’s what happened before, is that people then would take the distribution from the Roth IRA as a conversion amount and it was there was no 10% penalty. They avoided the penalty by doing a conversion and then taking a distribution the next day.

AC: So the IRS said, “wait a minute, let’s make you wait five years before you can actually get this money.”

JA: So you have to wait five years with each conversion dollar. Now, if you’re over 59 and a half, and if you’ve never established a Roth IRA, you convert the money. You have access to the conversion dollar, but you still have to wait five years to get any of the growth. So it’s five years, 59 and a half for contributions, and that’s on the first dollar that hits the first Roth IRA. Now conversions, each conversion has its own five-year clock until you turn age 59 and a half, and then from there, then you look at the first dollar that hits the first Roth to see if it’s seasoned enough. If you’re doing a conversion and you’re taking the money out the next year, or three years or four years, don’t do it anyway. It doesn’t make any sense. The reason why those laws are in place is because people take advantage of the law. It loopholes. “Oh here, I can avoid a 10% tax penalty. I’m broke. I’m going to do a conversion, then I’m going to take the money out. I already paid the tax, I’m fine paying the tax, but I don’t want to pay that additional 10% penalty to the feds, and another, what, 3 or 4 to the state of California? Two and a half, whatever. Rounding. California, they’re a little greedy. (laughs)

AC: (laughs) I know you like to round. So I’m going to boil this down in a real simple manner. And I’m basically only talking to those that are over 59 and a half. Because this is a retirement account, by the way. So that’s what this is supposed to be used for. So you’re over 59 and a half, if you have had a Roth IRA for at least five years and you’re over 59e and a half, all dollars are available for you to pull out without penalty. And I think that’s the most important thing. Establish your first Roth to get the five-year clock going, then when you’re over 59 and a half, you can pull anything out – contributions, conversions, growth, interest, whatever.

JA: The purpose of a Roth IRA is what, Alan?

AC: It’s a retirement account that you use for retirement, and it’s tax-free.

JA: So it’s used to create tax-free income in the future. If used properly it’s a very powerful tool. But if you’re just looking to put money in and take money out and put money in – don’t waste your time. It doesn’t make any sense.

AC: Right. But life happens. That’s why we have to have these conversations.

JA: Well don’t pull it from the Roth. Pull it from anywhere else.

AC: (laughs) Your credit cards?

JA: I don’t care. Do that. Steal it. (laughs)

AC: Wow! (laughs) Better than pulling from the Roth IRA?

JA: People blow out of these Roths and they don’t really understand the true consequence of it. For instance, I met a very intelligent individual. He’s done very well for himself, and he moved to San Diego, where we’re taping this, because he’s like, “hey, this is a really nice place. I’m finally able to afford to live in San Diego.” He had a bunch of money outside a retirement account, has a bunch of money in a retirement account, and then he had maybe I would say 10% of his liquid net worth was in Roths. So what he did is bought this condo in San Diego for maybe half a million bucks. So he had $400,000 of cash. He had other investments that were outside of retirement accounts, so he put $400,000. He wanted to pay all cash, and he took another $100,000 from the Roth to buy the home. And I’m like, “you know how hard it is to accumulate $100,000 into a Roth? And then you’re just blowing it out?” And he’s only 60. How about if that $100,000 over the next 10, 15 years compounded tax-free? That’s $200,000, $250,000 that you could really start doing some cool planning. So be careful if you have Roth IRAs. Understand what you’re doing before you start taking large distributions. Because you can only put $5,500 into them per year – $6,500 if you’re over 50. You have to qualify to put money in as a contribution given income limitations. So if you make too much money, potentially you can’t even make a contribution. If you do a conversion, you have to pay tax to get it in there. So you want time to have this thing blossom for you. It’s like you plant an apple tree and the next year you’re looking for apples. You chop it down because it doesn’t bear fruit!

AC: This thing sucks, I’m not watering this thing!

JA: Right. So there’s our Roth contribution/conversion chat for the week.

So don’t cut off your tax-free apples to spite your retirement tree I guess is the lesson there. You can get answers directly from Joe and Big Al just like Susan did – just email your money questions to info@purefinancial.com Susan mentioned she heard about the Roth 5 year clock at one of our live classes – if you’re in Southern California, you can attend too! Visit the Learning Center at YourMoneyYourWealth.com to see dates, times and locations for our free Lunch ’n’ Learn events or our retirement classes in San Diego, Orange County or Los Angeles. Learn financial strategies for turbulent times so you can make informed decisions in retirement. Sign up for a free Lunch ’n’ Learn or a two-day retirement class in the Learning Center at YourMoneyYourWealth.com Now, how about answers to some more financial questions?

6. My Company Offers a 403(B), 457(B) and 401(A). How Are They Different? Should I Open All 3?

JA: I love answering these questions. Because we could talk about “what are the five ways to boost your retirement.”

AC: I got “three painless ways to retire richer.” (laughs)

JA: You know what? I would much rather go to sleep. Because I think these are practical.

AC: A lot of people tell us they like the questions, they like it when we give examples – when it’s real life stuff. So I’m with you.

JA: All right here’s one: “the company that I work for, they offer a 403(b), 457 and 401(a) retirement plans. Which one is the best plan? Or is it wise to open all three accounts? I have a 401(k) plan with a different company that I worked for and contributed 6% of my salary to this plan. I also have a Roth IRA and I make the maximum contributions every year. I have an emergency fund, about $140,000 in Vanguard’s mutual fund managed by a financial advisor.” So this is again one of those questions where they get a little bit confused when it comes to IRA, 401(k) – what does an IRA pay or what’s the difference. But with this, there’s a little bit of a twist. Because 403(b)s and 457s and 401(a) plans all have a unique twist to them. Do you know what the twist is? I’ll quiz you.

AC: Not entirely. I’m gonna be educated by you. (laughs) Ask me about a Roth.

JA: Andi, do you know? Our producer has no idea either. So this is going to be a learning. Everyone is going to have some learning time right now.

AC: I think a 403(b) has numerous investments. I think the 457 is annuities, I’m not sure what the 401(a) is

JA: (laughs) Oh my god that was awful. That was not even close.

AC: Could be totally off.

JA: Totally off! All right. So 403(b), 457 and 401(a) plan – I am guessing this individual works for a hospital, first of all.

AC: OK. Why do you say that?

JA: Because 403(b) plans are offered by nonprofits, usually universities or higher education or hospitals. If it was just 403(b) and 457 plan I would probably lean more towards education – universities or high school.

AC: We have seen that with professors and things.

JA: But 401(a) plans, that’s a little bit different. It’s a unique type of plan there, and it really depends on how the plan document is set out. But let me just tell the difference between all three. 403(b) plans are almost identical to a 401(k) plan for all purposes of this radio show. You can go pretax dollars, you can go Roth dollars, $18,500 is the contribution limit, $24,500 if you’re over 50, multiple investment opportunities there, depending upon, big hospitals, you’re going to look at big boys like Fidelity and things like that. If it was a school district, let’s say this individual was an elementary school teacher, the likelihood of it being a larger plan is probably lower, because what happened back in the day is that a lot of these insurance companies went into schools and said, “hey, we can set up this 403(b) plan for you.” They called them TSAs, which was a tax-sheltered annuity. And I think that’s why you look at, “hey, 403(b)s are annuities” – not necessarily, a very small component of 403(b)s today that I see that are actually annuities, because I think more people are getting a little bit more educated.

AC: So that’s a good way to say it. So a 403(b) is pretty similar to a 401(k) – it’s the nonprofit’s version of a 401(k). And usually, there are several investments that you can pick from.

JA: Yes, low-cost options, index funds, whatever. There’s probably some high-cost options and so on. 457 plan is a deferred comp plan. So 457(b) is a deferred compensation plan. And what’s cool about 457 plans is that, let’s say if I had the opportunity to have a 403(b) and a 457 plan – you can contribute to both. So the contribution limits are the same. $18,500 plus another up to $24,500, so another $6,000 is the catch up if you’re over 50. So say I’m over 50 and I have both of these plans available, I could shelter roughly $50,000 pre-tax a year.

AC: And so that’s unusual, because most companies, you can’t really do that without the kinds of plans.

JA: Exactly. We have a 401(k) plan here at Pure Financial Advisors. Al, you can put in $24,500.

AC: Because I’m over 50.

JA: I can only put in $18,500 and same with Andi here, because we are young, attractive people. (laughs)

AC: Yes. And I’m the wise one. (laughs) But I don’t know the answer to this question. So deferred comp. Explain that to me.

JA: The cool thing about 457 plans – there is no 10% penalty. So sometimes people will have a 457 plan, and let’s say they retire a little bit earlier. You have access to those dollars, you pay tax on it, it’s a pre-tax plan. It grows 100% tax-deferred, but there’s no 10% penalty on the way out.

AC: What kind of investments are in the 457?

JA: Same same same.

AC: So you pick.

JA: Yes. Let’s say you’re going to pick your own investments for the most part. This is generalities. So it’s all plan specific of course, and that’s a caveat. But if I’m looking at a 403(b) and a 457 plan, in most cases you’re going to see mutual fund type accounts, lower cost, higher cost. It’s all the full gamut.

AC: So let me ask you this. Is there a reason you would pick one over the other if you wanted to just one?

JA: 457, you have more flexibility to get the money out without a 10% penalty if you’re under 59 and a half.

AC: Right. Both have the same ERISA protection.

JA: Correct. And it depends. Now 403(b) plans could have a match, 457 plans may not have the match, so you want to look there.

AC: So look at the match, obviously that’s an important one.

JA: But then here’s the kicker of them all with the 401(a) plan. A 401(a) plan is usually established through a hospital or something like that, nonprofit, and they’ll do a match – say 6% – but you have to elect your contribution election like right when you get hired. Sometimes it’s after-tax, so your contributions could be an after-tax contribution because if they have a 403(b), 457 plan, those both could be pre-tax. So the 401(a), I’ve seen after-tax 401(a) plans, so the company is matching 6%, 4%, but I have to elect at certain time frames. With a 401(k) or 403(b) in this instance, you could say, “well, I want to put 10% of my salary this paycheck and zero next paycheck.” You have a lot more flexibility. 401(a)s you don’t.

AC: Can you change it each year or are you locked in?

JA: It depends on the plan doc. In most cases, you have to elect and then you’re stuck with that election. And if it’s an after-tax contribution, the cool thing with those is that you could take those after-tax contributions and convert those into Roth IRAs each year. Because if it’s after-tax, it goes into the plan, let’s say you put your 6%. You make $100,000, $6,000 to make it easy. Well, I put the money in, I could potentially roll those dollars out each year, depends upon the plan, and then put those contributions into my Roth IRA. So with this situation, I don’t know what her overall plan is, but you want to look at the flexibility of the plan. You probably, of course, want to take a look at the investments. But I would imagine if they have a 403(b), 457 and 401(k), the sponsor is probably Fidelity, so you’re going to have the same options.

AC: Can you do all three if they’re available?

JA: Yeah. Absolutely.

AC: So someone that’s over 50. So $24,500, $24,500, so that’s $49,000. And then same limits for the 401(a)?

JA: No, 401(a) is going to be different and it’s plan specific. But usually, I just see anywhere from 4 to 6%. But some other plans could have something a little bit more. I don’t know the IRS regs off the top of my head in regards to 401(a) plans. I’m just going off of experience.

AC: We don’t see them that often.

JA: Yeah, very rare. Unless you just specialize I guess in hospitals, you would probably see them every day. So I’m sure someone’s listening to me that specializes in those plans and calling me a total you know what.

AC: (laughs) Well they’re thinking you’re smarter than me because of my answer.

And they’re all smarter than me, but being on this show, I learn every day! If you’d like more free financial education, we’ve got a Learning Center crammed full of educational videos, white papers, webinars and more – check it all out at YourMoneyYourWealth.com, and get ready for season five of the Your Money, Your Wealth TV show, coming to KFMB TV in San Diego and to our website at the end of August – check it out and see just how young and attractive Joe really is! Now ya’ll have been able to get your questions answered, now it’s my turn!

47: 17 – Can I Do a Roth Conversion From a Current Employer’s 401(k)?

JA: We got a live question! In studio question!

AC: Our producer, Andi.

JA: What say you, Andi?

AL: So, I hear you guys talk about Roth conversions ALL THE TIME. Every single day of my life.

JA: It’s a lot of fun.

AL: It is.

AC: And you still work here?

AL: And I still work here, and I have a 401(k) here. I’m wondering about doing Roth conversions from an existing active 401(k).

JA: Yes. The answer is yes if the plan allows. And so the rule change…

AL: Does our plan allow? (laughs)

JA: We’ve got to stretch this thing out, here. I can’t just say yes and move on. (laughs) So Alan, what was the tax law change that was in 2012?

AC: Yeah if I had to guess, somewhere in there, around 2012 is where the Roth – no, I think is before that – the Roth option was available, or supposed to be available for 401(k) plans.

JA: No that was ’06, that’s the Pension Protection Act of ’06.

AC: What are you thinking of?

JA: Well they changed the law, because Tipper was signed in 2005, that allowed Roth conversions starting in 2010 for anyone. Prior to 2010, you had to have an adjusted gross income of under $100,000 to do a Roth conversion. So then after 2010, the floodgates opened. They’re like, “do a bunch of Roth IRA conversions.” So people were doing conversions. But then it goes full circle to Andi’s question. She’s like, “well hey, I have an existing 401(k) plan. This is my only retirement plan that I have. If I had an IRA I could do conversions with that. No big deal. Why mess around with my 401(k) if I had an IRA that I could convert, but if I have a 401(k) and let’s say if I worked for an employer for a while. And those are my qualified assets. I would like to convert some of that.” And you couldn’t unless there was a provision in the plan that allowed you to do an in-service withdrawal. So you would have to do an in-service withdrawal from the plan, put it into an IRA, and then do a conversion. And then prior to The Pension Act of ’06 I think changed the rules too. Because to do a Roth conversion in the past, it had to touch an IRA first. It couldn’t go from 40(k) to Roth IRA. So it would have to go from 401(k) to IRA, IRA to Roth IRA. That law changed to go 401(k) to Roth IRA. But if I don’t have access to the money because it’s locked up in this plan and there was no Roth provision in the plan, so what the hell do you do? So, 2010 came about. This is a nice history lesson about the Roth. (laughs)

AC: Wow, this is right off the cuff. (laughs)

JA: I have no life, I swear to God. So in 2010, you can do the conversions now. So two years later I believe was 2012. Don’t quote me on this, but 2012 – because a lot of people complained, they were like, “hey, I want to do a Roth conversion, this is great. I have an adjusted gross income, now that doesn’t matter. But all my money is bunched up in the 401(k) plan of my employer and they don’t allow an in-service withdrawal. So what do I do?” So the IRS came out and said, “you know what, you can do an inter-plan conversion. So here’s the problem with IRS regulation and plan documents: the plan document will supersede IRS regs. So IRS will say, “yes, you can do it, but then it’s up to your plan document, the 401(k) plan that was established by your employer, to say yes we’ll do it or not. Sometimes with those plan employers, they either don’t know the rules or the laws, or they just use the third party like us, like Paychex. I don’t know why the hell we use – no offense the Paychex, but we’re a $2 billion firm that uses Paychex for our 401(k) plan how ridiculous is this??

AC: They do a great job. (laughs)

JA: I love you Paychex. I love you. (laughs )

AC: (laughs) Nothing bad to say.

JA: But anyway, with that it’s just a template. So they go here’s a simple template or whatever, and a lot of those templates probably won’t allow it. Even though the law says you can. So here was the problem with doing an inter-plan conversion is that you couldn’t re-characterize. So let’s say you have a 401(k) plan, you have money in a 401(k) plan. That plan has a Roth option in the 401(k) plan and you say, “hey, I want to move $5,000 from my 401(k) plan to the Roth option in the same plan. Please let me do that.” Sure you can do that by law. Now the $5,000 is in the Roth component. You’ll get 1099 from the 401(k) provider, you pay tax on that $5,000. But the problem was that you couldn’t re-characterize. So once you did it you were stuck. And some of the planning that we’ve done over the last 10 years was a lot of re-characterizations on Roths, but it doesn’t matter today because the laws change and you can’t re-characterize anyway. So the answer to your question, IRS regs allows anyone to do a Roth conversion, inter-plan. However it’s up to the plan doc, and if I were to guess, our plan doc would not allow it.

AC: Now I’ll go back to – our plan does have a Roth option.

JA: Yes. But I don’t think you can convert into it.

AC: Well I don’t know, because the Roth option is a newer thing. So I think we have a newer template, so we may have that. I’m not sure. Now I will I will say, if it’s an old 401(k) that you have, that’s easy – from another employer, you just roll that into an IRA, do your Roth conversions that way. Very simple.

AL: Thanks, guys. I appreciate it.

JA: Yeah, any other questions?

No, that covers it for now.

JA: Thank you, Andi, for her wonderful question and great skills today. Big Al Clopine, wonderful job. My name is Joe Anderson we’ll see you next week. Thanks for listening.

_______

Well, that was like drinking from a firehose! You can ask Joe and Big Al your money questions live and in person too – email info@purefinancial.com, or call and leave it in a voicemail at (888) 994-6257 and I’ll call you back and put you on the show! Subscribe to the podcast at YourMoneyYourWealth.com – or you can find us on the brand new Google Podcasts app for Android, for you iPhone users we’re on Apple Podcasts (which used to be called iTunes, where you can still find our ratings and reviews,) or on Spotify, Stitcher, Overcast, Player.FM, iHeartRadio, TuneIn, or wherever you listen to podcasts. Listen next time for more Your Money, Your Wealth, presented by Pure Financial Advisors. Get a free financial assessment at PureFinancial.com

Pure Financial Advisors is a registered investment advisor. This show does not intend to provide personalized investment advice through this broadcast and does not represent that the securities or services discussed are suitable for any investor. Investors are advised not to rely on any information contained in the broadcast in the process of making a full and informed investment decision.

Listen to the YMYW podcast:

Amazon Music

AntennaPod

Anytime Player

Apple Podcasts

Audible

Castbox

Castro

Curiocaster

Fountain

Goodpods

iHeartRadio

iVoox

Luminary

Overcast

Player FM

Pocket Casts

Podbean

Podcast Addict

Podcast Index

Podcast Guru

Podcast Republic

Podchaser

Podfriend

PodHero

podStation

Podverse

Podvine

Radio Public

Rephonic

Sonnet

Spotify

Subscribe on Android

Subscribe by Email

RSS feed

YouTube Music