With the November elections fast approaching, the news cycle is ramping up on what to expect. And while that often involves a nonstop flow of doom and gloom prognostications, as investors, we often stress that the key to success is to remove emotions from the mix and focusing instead on the facts. With that in mind, this seems like a good time to take a closer look at what history tells us we might expect as we head towards November.

Did Investors Make Money?

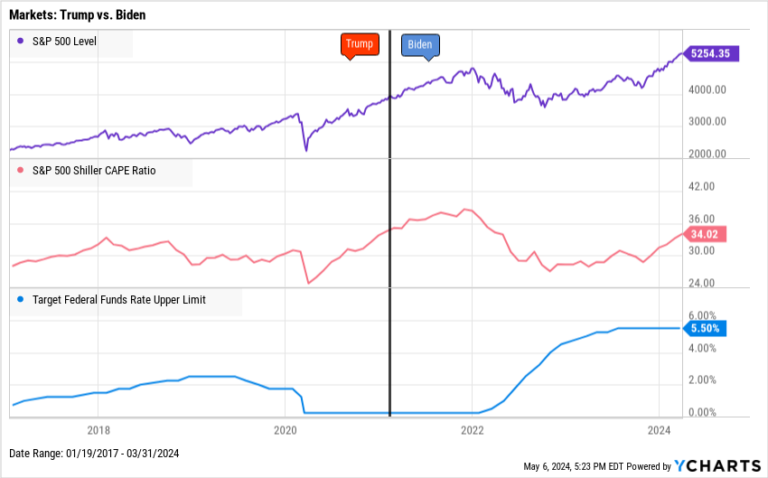

Let’s not bury the lead. What most investors care about is: can I make money if a candidate wins the election? The 2024 election is unique in this regard, as we have real world examples on what happened when each candidate was in office. As you can see from the chart below, the S&P 500 generally rose during both the Trump and Biden administrations, though not without some volatility.

Presidential Elections Impact the Markets

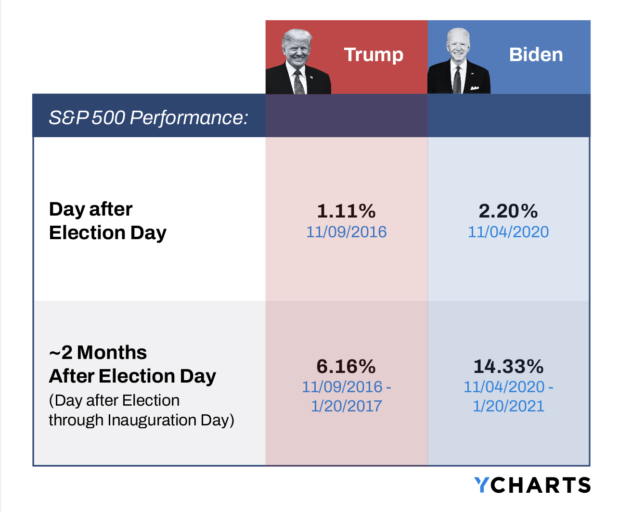

In fact, stocks increased not only during both presidential terms, but also in the immediate aftermath of the elections and during the “lame duck” period between the election and inauguration day.

How Did the Market React to Trump’s

Election vs. Biden’s Election?

So, at least based on what happened in the recent past, it doesn’t appear obvious that either a Trump or Biden presidency will spell doom for stock market investors.

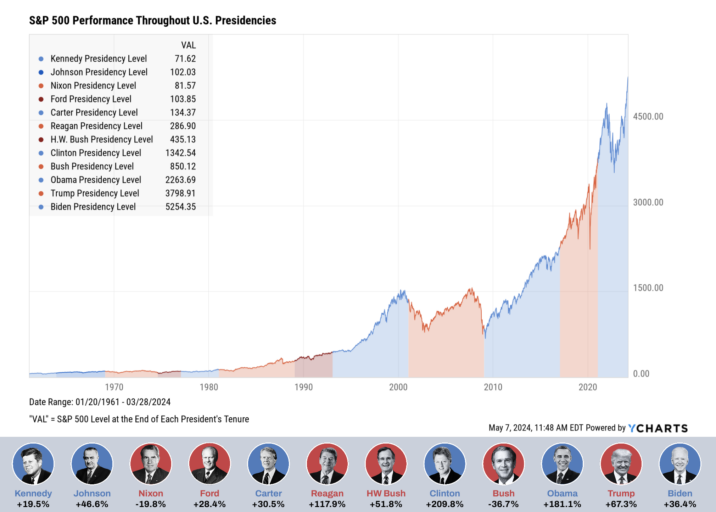

But, what about the longer-term track record? Do markets tend to suffer under either Democrat or Republican leadership?

Is Market Performance Better Under Republicans or Democrats?

It turns out that stocks generally do well regardless of what party is in office. That makes sense, given that the president is just one variable in the mix that determines stock markets. Plus, there is a general upward trend to markets over time.

How Did Markets Perform Under Different Presidents?

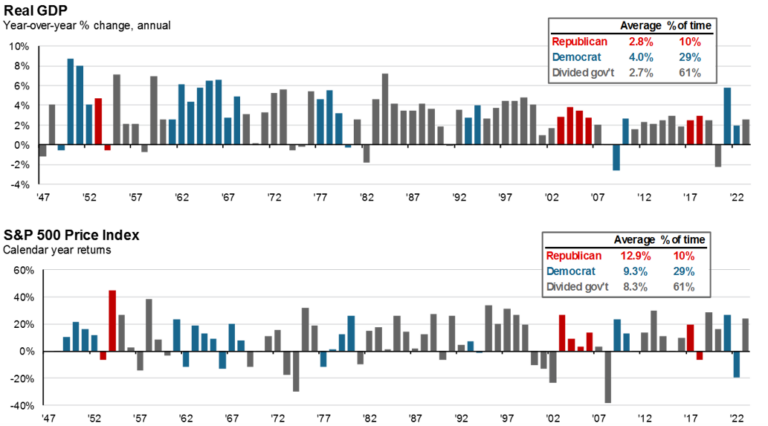

Here is another way of looking at market and economic performance across political cycles. This time, the focus is not only on who is in control of the White House, but also on which party controls Congress. As it turns out, the economy has generally grown and stocks have generally risen under three distinct scenarios:

- Republicans in control of both the White House and Congress

- Democrats in control of both the White House and Congress

- Republicans and Democrats divide control of the White House, the Senate, and the House of Representatives.

Real GDP and SP 500 Index

Based on the evidence, the bottom line is that investors have historically been rewarded for staying the course, regardless of what party is in power.

Should You Only Invest When You Like the Person in Office?

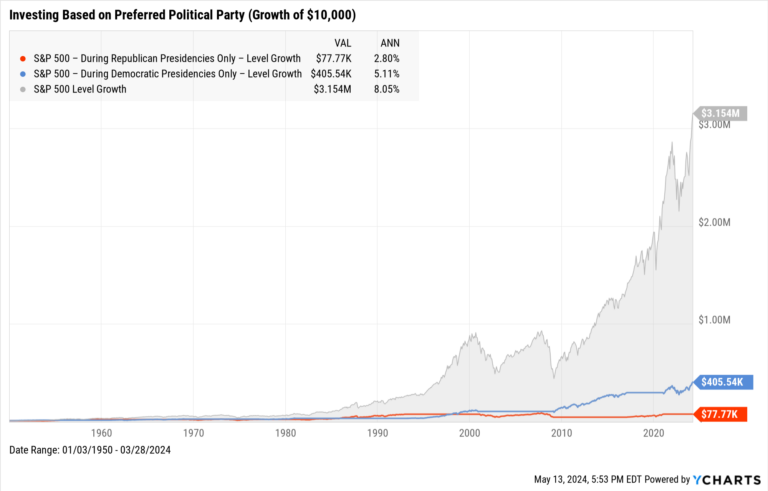

Let’s take a look at what would happen if you only invested when the party you support is in office.

Consider that if you’d invested $10,000 in 1950, and are a Republican, and only invested during times when a Republican was in the White House, you’d now have $78,000.

Consider that if you’d invested $10,000 in 1950, and are a Democrat, and only invested during times when a Democrat was in the White House, you’d now have $405,000.

But, if you’d invested $10,000 in 1950 and stayed invested regardless of what party was in the White House, you’d now have over $3,000,000.

How Would You Have Done If You Invested Only

During the Presidencies of One Political Party?

The Bottom Line

The bottom line is that there have always been differences of opinion as to how the country should be run, and that there is likely to always be a time when the candidate or party you support is out of power. But the evidence is clear that despite the immense impact the president can have, investors have been largely agnostic as to who is in office. The bottom line is that markets have tended to move higher over time, and that people who stayed invested across political cycles have been well rewarded for doing so.