More Posts

Purefinancial

Updated for 2026 Want to learn the little-known secrets to help you prepare for retirement? This Retirement Readiness Guide includes 7 important and simple plays to help you get retirement ready despite the uncertainties that we may face. Planning for your retirement is something that takes time, so start today for a bright future tomorrow. […]

2026

Hana’s mom is 92. Mom’s husband is 74, and after years of trying to help a family member, nearly a million dollars is gone. How do they stop the bleeding before it’s too late, and how much can they spend each year from what’s left? That’s today on Your Money, Your Wealth® podcast number 564 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, “Peter and Gwen” from Virginia have a pension, Roths, and a shrinking IRA. With the new tax law, IRMAA, and Social Security decisions all colliding, should they keep converting to Roth, and when should they actually collect Social Security? Also, does it make sense for “Mr. and Mrs. Scarecrow” to claim Social Security early and invest it? Finally, “Rosie and Astro” from Pennsylvania ask if they can retire in just three years with $1.3 million, and whether it’s time to hire an advisor to help them get there.

2026

If you think the biggest threat to your retirement is a market crash or picking the wrong investment, think again. Small, everyday financial pitfalls can quietly drain your wealth, add years to your working life, and cost hundreds of thousands of dollars without you even realizing it. In this episode, Joe Anderson, CFP®, and Big […]

2026

What actually mattered most to the YMYW audience in 2025? It turns out to be tax-free gains on investments, retirement timing, and claiming Social Security. In this Best of 2025 episode, Joe and Big Al break down the smartest tax moves, the biggest Roth mistakes to avoid, and how real people solve real retirement problems – with the help of some special guests. Find out when Roth conversions help or hurt, how to lower lifetime taxes for you and your heirs, what it really takes to retire confidently, even without a massive portfolio, and more. Watch or listen and steal the financial strategies that made YMYW’s most popular episodes of the year.

2026

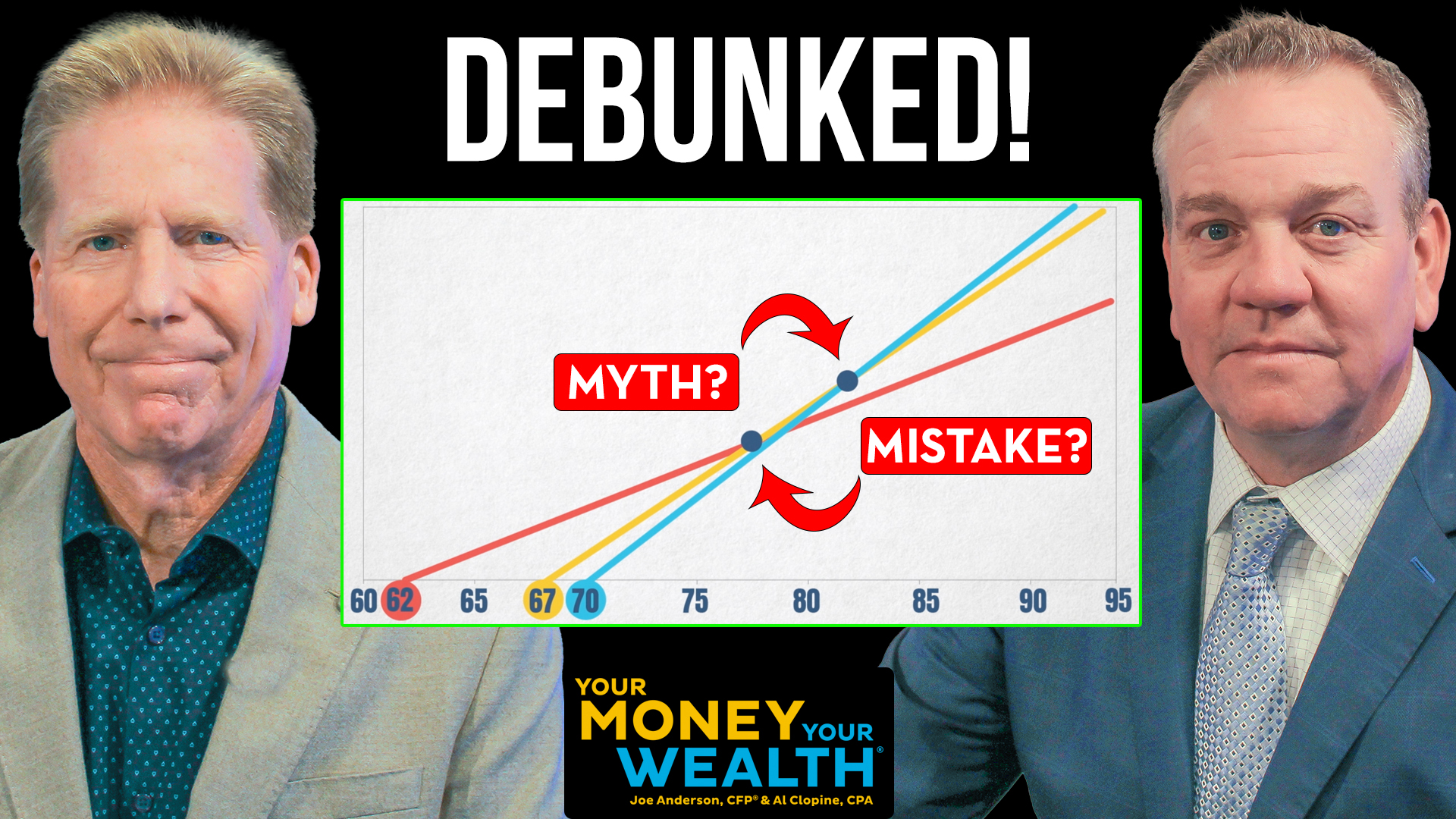

You may think you’ve got Social Security all figured out, but several common myths and mistakes quietly drain retirees out of tens of thousands of dollars. Joe Anderson, CFP® and Big Al Clopine, CPA show you how to claim smarter, keep more, and avoid a miserable retirement. Download the Social Security Handbook: Important Points: 00:00 […]

2025

Pure’s Senior Financial Advisor, Kyle Stacey, CFP®, AIF®, explores the complexities of Social Security and how your decisions can impact your long-term financial future. Discover key strategies to help you make the most of your benefits. Outline 00:00 Introduction 4:52 Important Changes to Social Security in 2025 6:47 Rules of Social Security Benefits 9:52 Expected […]

2025

Scammers are getting more sophisticated, and Social Security fraud often puts older adults at risk. Pure’s Financial Advisor, John Burkhardt, CFP® shares the top five scams to watch for and how to protect yourself. Transcript We’ve all heard the expression, hook line and sinker and all too often it sounds like we’re the catch! Seems […]

2025

Are you curious about how the One Big Beautiful Bill Act may affect the taxes on your Social Security benefits? Pure Senior Financial Advisor, Amy Cattelino, CFP®, AIF®, breaks down the recent changes and explains what they could mean for you. Transcript There’s a lot of information out recently about Social Security and the recent […]

2025

Pure’s Senior Financial Advisor, Allison Alley, CFP®, MSBA, AIF® helps you define your unique retirement vision. Outline 00:00 Intro 00:37 Retirement Expectation vs Reality 1:46 Gap Between Work and Retirement 3:48 Find Purpose in Retirement 7:50 Stay socially engaged 10:27 Sharing what you know 15:46 Q&A I may not be watching TV a lot, but […]

2025

If your pension impacted your ability to collect Social Security benefits, 2025 is a very good year for you and your spouse. The Windfall Elimination Provision and the Government Pension Offset are no more, and you’re now eligible for your full Social Security benefits AND your pension! Today on a quick Your Money, Your Wealth® podcast number 536, while Joe hangs in the North Star State, Big Al Clopine explains what the Social Security Fairness Act means for Cherilyn and her husband, and “Nuke La Loosh” and his wife, with the help of our special guest co-host, Susan Brandeis, CFP®.

2025

How do you shift from saving through your entire working life to spending and really living in retirement, while at the same time dealing the risks of inflation, rising healthcare costs, and things like tariffs? Jamie Hopkins is a CERTIFIED FINANCIAL PLANNER® professional, an attorney, and best-selling author of Find Your Freedom and Rewirement: Rewiring the Way You Think About Retirement. He returns to the show with insights on how to rewire your retirement plans. Plus, how should Fred and Ginger in Huntington Beach, California, pay for repairs on their rental properties? How can Peter Lemonjello manage taxes in his early retirement with 72(t) elections, rental income, and an installment sale? Can Calvin and Susie in Lancaster, Pennsylvania, buy an $800,000 beach house – and should they?

2025

What are the three predictors of retirement happiness? Dr. Michael Finke, CFP® from the American College of Financial Services tells us what his research shows. He also shares his insights on the four percent rule for retirement withdrawals and whether there is anything we can do to stave off the effects of aging on our cognitive abilities. Plus, Joe and Big Al do some retirement spitballing: can Jon in Pennsylvania retire early at age 56, and would it be better for him to take his pension monthly or as a lump sum? Steve and his wife in Colorado are 48 and 54 and have 3 million saved. When can they retire? Eager Eagle and his wife in Washington state have 2 million saved at ages 61 and 63. Can they retire next year?

2025

Updated for 2025: Whether you are retiring in a few months or a few years, Social Security is one of the most important decisions of your retirement. This Social Security Handbook walks you through what you will need to know for 2025 and beyond. This guide will explain… History of Social Security Recent Changes How […]

2025

What does the future hold for your Social Security under the new administration? Nationally-renowned financial thought leaders Jamie Hopkins, Jeff Levine, Eric Ludwig, and Steve Parrish share their insights with Big Al Clopine, CPA at the American College of Financial Services’ Horizons Conference in San Diego. First, the College’s President, George Nichols, gives an overview of the institution and their inaugural conference. Plus, Joe and Big Al spitball on whether Ricky and Lucy in Wisconsin even bother saving for retirement – they’re expecting to inherit about 20 million dollars. When should Tybob in Arizona collect Social Security? Are Roth conversions right for him? Should he go for Medicare or Medicare Advantage? Speedy Racer in Georgia needs a retirement spitball, and Gilligan in New York shares insight for other Gilligans trying to avoid a retirement shipwreck.

2025

Martin and Caterina in Green Bay are in their 40s and haven’t yet saved a million bucks. Are they on track to retire at age 58? Can Piggie and Kermit in California retire today at ages 50 and 57 and still build wealth for their children? Can Galahad and Zoot in Chicago retire early in their 50s, or do they need to keep working? Do Bo and Daisy have enough saved to retire now at 61 and 56? Plus, Chuck in South Carolina asks, if you can retire early, why wouldn’t you?

2025