More

Purefinancial

Pure’s Senior Financial Advisor, David Cook, CFP®, AIF®, provides insight into key risks of retirement and how to manage them. Outline 00:00 Intro 1:26 Why is Risk Management so Important? 3:35 Types of Risk Management 20:20 Risk Management Strategies 24:25 Asset Allocation 26:44 Diversification 28:09 Tax Diversification 35:37 Risk Management Process 36:07 Retirement Risk Zone: […]

Careful planning during the Retirement Risk Zone is critical for a healthy financial future. Pure’s Financial Advisor, Jeff Wille, CFP®, AIF®, describes what the Retirement Risk Zone is, why it matters, and what you can do to protect your hard-earned savings during this crucial stage. Transcript When it comes to retirement planning, many people focus […]

When purchasing a home, it’s often said to be one of the biggest investments you’ll make. But should you use it for your retirement? And how can rental properties contribute to your retirement goals? Pure’s Financial Planner, Jeff Brecht, CFP®, AIF®, will cover four key factors to integrate real estate investments into your retirement plan. […]

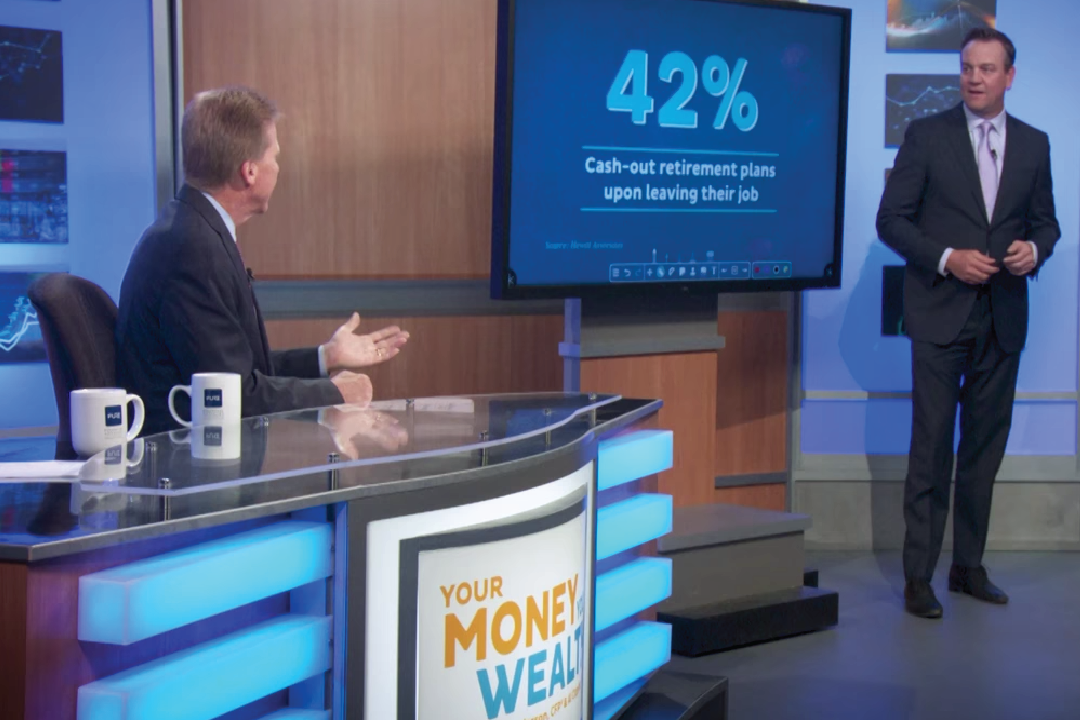

Should retirement living expenses be drawn from your stable value fund, your CD or money market, brokerage account, or FDIC insured bank accounts? Can you even trust the banks after the recent bank failures? What about sequence of returns risk? Which investments are best for long-term retirement savings when you’re early in your career? Joe and Big Al explain why your strategy for retirement savings and withdrawals should be your first step – before you consider investments, asset classes, or sectors.

For many people planning for retirement, risk is often a dirty word. But risk can be good. It can help bolster your retirement funds if it is managed properly. Financial professionals Joe Anderson and Alan Clopine guide you through risks that can help increase your retirement funds and ones that can keep you from meeting […]

Can your retirement plan stand up to some serious blows? After years of planning and saving, there are some life events that could give your financial plan a TKO or knockout. Pure Financial Advisors’ Senior Financial Advisor Jack Dugan talks about the jabs your retirement plan can take and how you can counterpunch to overcome […]

Economist Dr. Allison Schrager, author of An Economist Walks Into a Brothel and Other Unexpected Places to Understand Risk, explains how the risk management techniques of surfers, prostitutes, magicians, and soldiers might relate to our own investing and retirement planning. Plus, does it matter which assets you withdraw first from your retirement portfolio? Joe and Al dive deep on this […]

For many of us we’ve been planning – conditioning – training ourselves for retirement. What does your retirement plan look like? A fighter taking jabs and hooks at the market? One of the biggest fears and one of the biggest problems that many retirees have is running out of money. A virtual retirement knockout! Financial […]

Does it feel like sometimes you’re playing roulette with your retirement? You may not be able to control outside forces, but you can put a plan in place that will help make your retirement feel more secure. Financial professionals Joe Anderson and Alan Clopine get real about controlling what you can control and help you […]

Today’s show is about retirement myths that ruin most retirees’ plans. Find out why Baby Boomers won’t be able to have a retirement like their parents. 02:07 “40% of unmarried women have saved less than $1,000 [for retirement], according to a 2016 Retirement Confidence survey by Employee Benefits Research Institute” 05:55 “The opportunity is that we are […]