More Posts

What is an exchange fund and is it a good thing if you have a lot of capital gains, like Bryan in New York? What should be the timing and ordering of Billy Joe and Bobby Sue’s Roth conversion strategy to help them achieve 33 years of retirement income? Is Boston overspending or underspending in retirement? Should Andy keep life insurance policies for her kids with ADHD? How does the 5-year rule for Roth withdrawals apply to inherited Roth IRAs for Karen?

Can Jessie and Becky in Iowa retire now at age 52? Should Robert and his wife file their taxes separately, to pay less tax on their required minimum distributions? Can Joe and Al validate Mike in Minnesota’s retirement plan, and does a backdoor Roth make sense for him? How in the world will Mike in New York be able to retire at a reasonable age? And what will retirement income look like for Marty in San Diego? Just spitballs here, no retirement advice!

How does bonus accelerated depreciation work when it comes to commercial real estate? Is real estate a good source of retirement income, and can it take the place of safe assets like bonds in your investment portfolio?

Passive income is a great supplemental income for individuals to enhance their lifestyle both while working and in retirement. Joe Schweiger, Associate Advisor CFP®, AIF® explains the difference between passive and active income, the tax benefits, examples of passive income, and how it may fit in your overall retirement plan. DOWNLOAD | 10 Tips for […]

It’s a question we get asked a lot… and a decision that should not be made lightly until you have made sure you’re buying for the right reasons. Rental real estate can be a great asset class to own. It can provide steady streams of income, it can be tax efficient due to depreciation, and […]

Far too often, retirement funds fall short of where they should be and most people confirm they don’t know the steps to take to fast track their retirement. We want to empower you to fast-track your retirement savings regardless of how much your account balance is today. In this guide, you’ll learn about… Fast Track Basics Set a […]

If you are approaching retirement or you are already there, it is critical to think about protecting your savings to make sure you have enough income throughout your retirement years. Financial professionals Joe Anderson and Alan Clopine guide you through ways to protect your savings and help you enjoy your retirement without worrying about money. […]

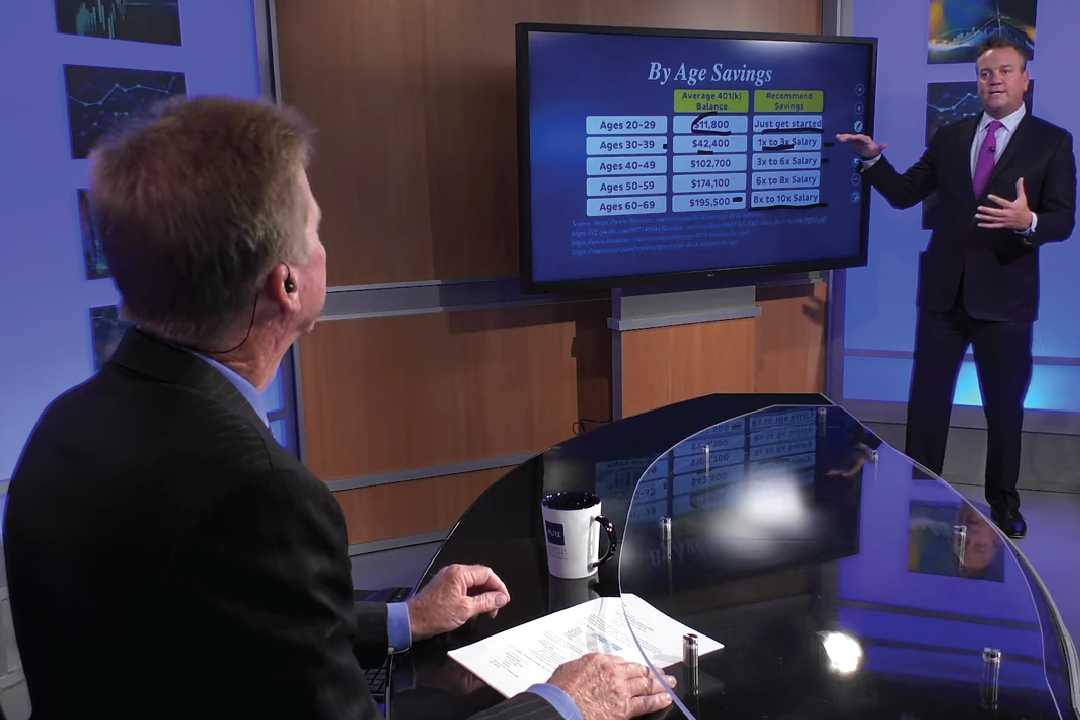

The gap between the haves and the have-nots continues to widen for retirees in the United States. Survey after survey shows people tend to underestimate how much money they will need in their golden years to maintain their lifestyle. Financial professionals Joe Anderson and Alan Clopine give you the tools to estimate how much money […]

Are you counting down the days until you retire? We asked financial professionals Joe Anderson and Alan Clopine how to make the most of your money by planning for retirement. From life insurance to Roth IRA’s they discuss ways to keep more of the money you earn. Make sure to subscribe to our channel for […]

Is a fixed annuity or a variable annuity a good investment for generating a retirement income stream? In this video, Matt Horsley, CFP®, Senior Financial Planner with Pure Financial Advisors, explores the pros and cons of investing in annuities in retirement as a part of your retirement income plan. Transcript: So the other day a […]

You’ve planned and saved for retirement for years but your expenses still outpace your savings. How would you like to have a steady stream of income for life without winning the lottery? Financial professionals Joe Anderson and Alan Clopine give you strategies you can use to produce additional income at any age. Click here to […]

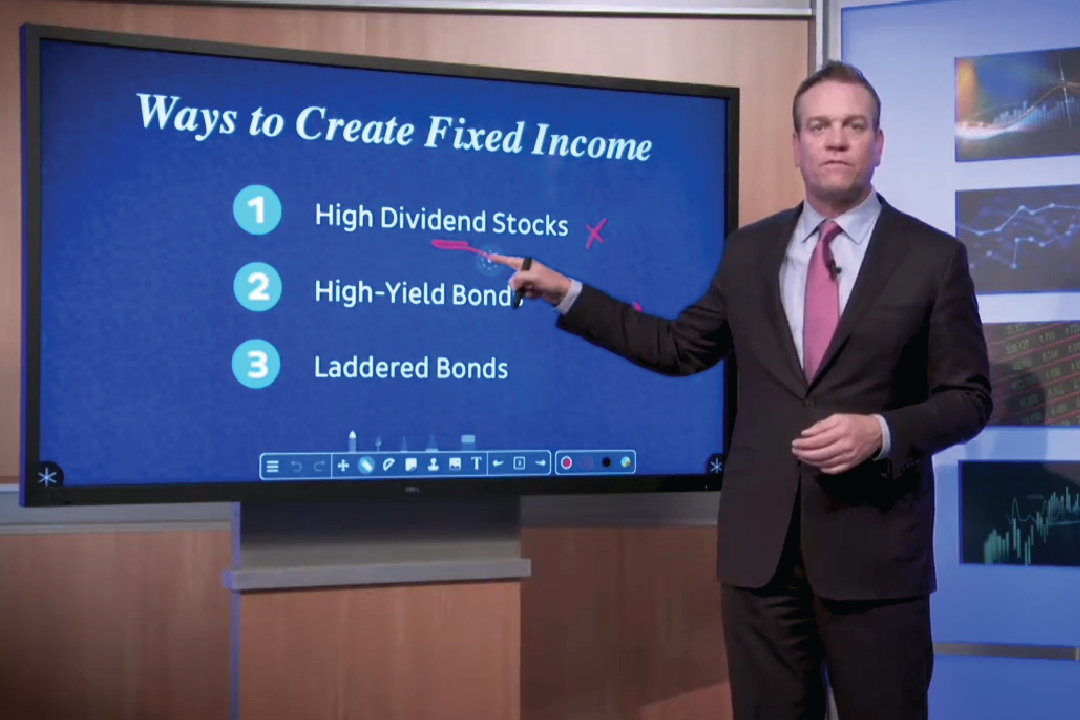

Where will your income come from in retirement? Fewer pensions are being offered and more people are relying on Social Security to provide a higher percentage of their retirement income. But what if you still need more money in your golden years? From stocks to annuities you can create a fixed income stream, but there […]

You are going to need a steady stream of income in your retirement that can span more than 30 years! How can you plan and save enough money so that you don’t run out of cash? Financial professionals Joe Anderson and Alan Clopine explain a fixed income approach using stock, bonds, and annuities to help […]

Even if you’ve procrastinated and haven’t saved much money for your retirement, you can still become a millionaire. It will take discipline and planning but it can be done without a winning lottery ticket. Financial professionals Joe Anderson and Alan Clopine give you monthly savings goals and tax strategies that can help you become one […]