More Posts

You’ve been jamming money into your retirement accounts for years now. When is it okay to slow down? Joe and Big Al spitball for Ron and Veronica in Indiana. Plus, how can Scott in Illinois bridge the gap from age 55 to retirement income at 57? How should Big Juan in Texas pay for college? Should he convert his TSP to Roth? Can he retire at 55 And finally, Frank and Jane Drebin in Wisconsin are 46 and 47 and wondering if their plan for retirement in 5 years is just a pipe dream.

What are the pros and cons if Chip uses the money in his taxable brokerage account for early retirement income? Jack and Sally ask Joe and Big Al to spitball on whether they can retire around age 55 or 60, and whether they should max out their Roth or convert to Roth. Plus, April and Andy ask the fellas to spitball on their dividend investing strategy, and Don wonders if a separately managed account or SMA makes sense for his taxable account. (We’ll also find out what an SMA is.)

What is your retirement income style? Dr. Wade Pfau, CFA, RICP®, is the co-founder of RISAprofile.com, providing investors with retirement income style awareness. He returns to Your Money, Your Wealth® today on podcast number 522 to talk about four different styles of retirement income, distribution planning, and the four percent rule. Plus, what does Dr. Pfau think will happen with President Trump’s 2017 tax cuts, scheduled to sunset at the end of this year? What are Dr. Pfau’s thoughts on annuities as part of your retirement plan? Next, “Joe Anderson’s Top 5 Things” to help you manage the impact of all this market volatility on your portfolio. Also, Joe and Big Al spitball for “Al Bundy” in St. Louis: what withdrawal strategy makes sense for him, and what he should do with his IRA and 401(k) money?

Ricochet J in Colorado and her husband want to retire as soon as humanly possible. Are they on track? Should they save their surplus funds to a brokerage account or a solo 401(k)? Plus, Micah in South Dakota wonders whether having a $40,000 a year pension is basically the same as having a million dollars in bonds, according to the four percent rule. What do Joe and Big Al think? Barney and Betty will be in the 12% or 22% marginal tax bracket, but their effective tax rate will only be between 10% and 12.4%, so how much should they convert to Roth? Are they asking the right question? Finally, Joe and Big Al spitball on ways to ensure that Amir in New Mexico has the maximum possible retirement income to last him to age 90 or 95.

What is an exchange fund and is it a good thing if you have a lot of capital gains, like Bryan in New York? What should be the timing and ordering of Billy Joe and Bobby Sue’s Roth conversion strategy to help them achieve 33 years of retirement income? Is Boston overspending or underspending in retirement? Should Andy keep life insurance policies for her kids with ADHD? How does the 5-year rule for Roth withdrawals apply to inherited Roth IRAs for Karen?

Can Jessie and Becky in Iowa retire now at age 52? Should Robert and his wife file their taxes separately, to pay less tax on their required minimum distributions? Can Joe and Al validate Mike in Minnesota’s retirement plan, and does a backdoor Roth make sense for him? How in the world will Mike in New York be able to retire at a reasonable age? And what will retirement income look like for Marty in San Diego? Just spitballs here, no retirement advice!

How does bonus accelerated depreciation work when it comes to commercial real estate? Is real estate a good source of retirement income, and can it take the place of safe assets like bonds in your investment portfolio?

Passive income is a great supplemental income for individuals to enhance their lifestyle both while working and in retirement. Joe Schweiger, Associate Advisor CFP®, AIF® explains the difference between passive and active income, the tax benefits, examples of passive income, and how it may fit in your overall retirement plan. DOWNLOAD | 10 Tips for […]

It’s a question we get asked a lot… and a decision that should not be made lightly until you have made sure you’re buying for the right reasons. Rental real estate can be a great asset class to own. It can provide steady streams of income, it can be tax efficient due to depreciation, and […]

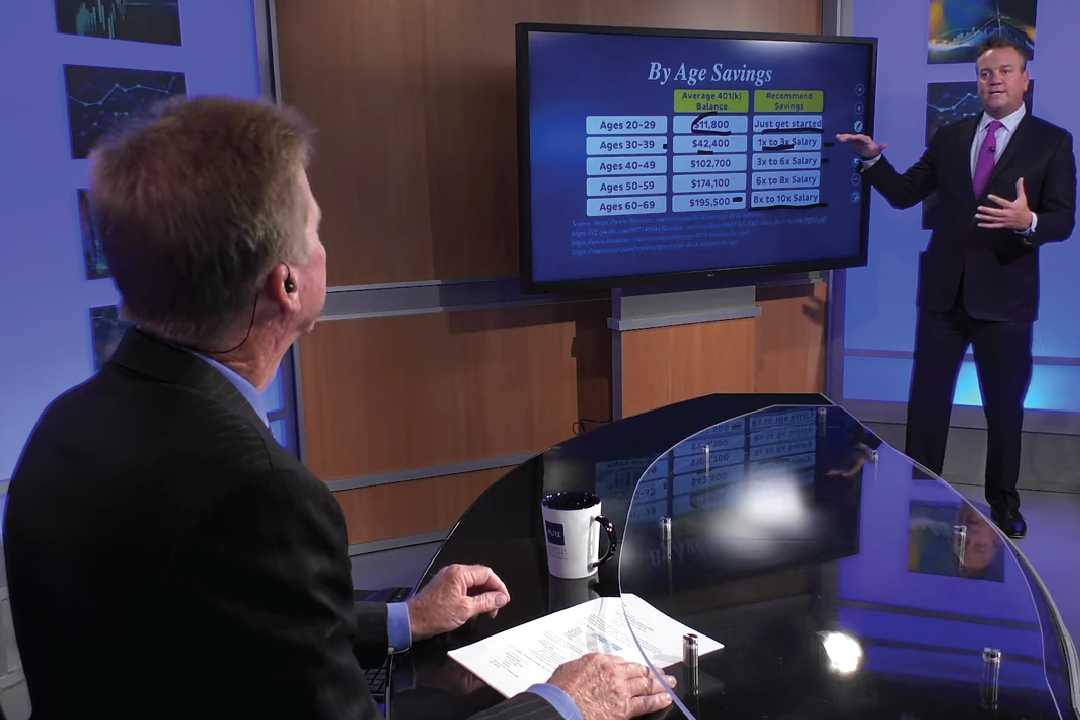

Far too often, retirement funds fall short of where they should be and most people confirm they don’t know the steps to take to fast track their retirement. We want to empower you to fast-track your retirement savings regardless of how much your account balance is today. In this guide, you’ll learn about… Fast Track Basics Set a […]

If you are approaching retirement or you are already there, it is critical to think about protecting your savings to make sure you have enough income throughout your retirement years. Financial professionals Joe Anderson and Alan Clopine guide you through ways to protect your savings and help you enjoy your retirement without worrying about money. […]

The gap between the haves and the have-nots continues to widen for retirees in the United States. Survey after survey shows people tend to underestimate how much money they will need in their golden years to maintain their lifestyle. Financial professionals Joe Anderson and Alan Clopine give you the tools to estimate how much money […]

Are you counting down the days until you retire? We asked financial professionals Joe Anderson and Alan Clopine how to make the most of your money by planning for retirement. From life insurance to Roth IRA’s they discuss ways to keep more of the money you earn. Make sure to subscribe to our channel for […]