More Posts

Pure’s Financial Advisor, Joey Bailey, CFP®, CPA, provides insight on how to ensure your portfolio and retirement accounts are on track to meet your financial goals. Outline 00:00 Intro 1:20 Examine your budget 3:35 Creating a Budget 6:18 Review and manage debt 7:37 Short- and long-term goals 9:45 Reassess cash flow 12:16 Portfolio review 16:30 […]

Pure’s President and CEO, Joe Anderson, CFP®, AIF®, and Executive Vice President & Chief Investment Officer, Brian Perry, CFP®, CFA® charter, AIF® provide insight into recent events and discuss strategies for navigating volatile markets. Outline 00:00 Intro 1:12 Tariffs: Who Wins a Trade War? 2:56 Markets have done fine under most Presidents 5:03 S&P 500 […]

The best investment strategy is one you can commit to long-term while achieving your goals. Pure’s Financial Advisor, Brian Wolff, CFP®, AIF®, offers practical steps to optimize your portfolio in 2025. By applying these ideas to your plan, and you’ll be on track for a more effective, streamlined investment approach. Transcript We all want better […]

Direct indexing gives investors the ability to mimic the performance of an index such as the S&P 500 by purchasing its underlying stocks to create a customized portfolio. Since you can’t invest directly in an index, most investors will buy an exchange-traded fund (ETF) or mutual fund to replicate its performance. When you own shares […]

Give yourself peace of mind and fund your passions while staying on track to meet long-term goals through charitable giving strategies. Pure’s Financial Planner, Brian Wolff, CFP®, AIF®, explains five tax-efficient and impactful strategies that can help your retirement plan while giving back to your community: Select the right asset to give When rebalancing a […]

Fulfill your retirement goals and safeguard your financial future with a well-designed income strategy to make sure your money lasts as long as you do. Pure’s Financial Planner, Tony Vu, CFP®, explores tactics for creating a highly efficient retirement income strategy that can stand the test of time. FREE GUIDE | Retirement Readiness Guide Transcript […]

If you looked at your statements late last year, you know that 2022 was tough for investors. The stock market, as measured by the S&P 500, declined nearly 20%. S&P 500 – 12 Months (as of 1/24/2023) However, what made 2022 an unusual year was that even as stocks were falling, there was almost no […]

Is it better to choose low-cost index funds or to diversify investments, even if it means paying higher fees? What causes mutual fund price fluctuation? Are mid-cap funds necessary in a balanced portfolio? Joe and Big Al also talk about real estate funds vs. real estate investment trusts (REITs), and annuities vs. bonds in a retirement portfolio. Finally, we revisit some investing strategy questions from earlier in the year that are still relevant in today’s volatile markets, on moving to cash in tough times, analyzing your asset allocation, and rebalancing your retirement portfolio.

Subscribe to the YMYW podcast Subscribe to the YMYW newsletter

LISTEN on Apple Podcasts | Google Podcasts | Stitcher | Player FM

Does your portfolio fit the financial goals you have for retirement? When you look at your portfolio does it match the goals and the risk levels you are willing to take at this point in your life, or does it look like someone much younger or even older? Just tucking money away in a retirement […]

As your life and your goals change, so will your portfolio. From your asset allocation to how much cash you have stashed away, there are guidelines to help make sure your portfolio is optimized wherever you are in life. Understanding the basics of portfolio management can help make sure you’re maximizing the potential of your […]

If you are approaching retirement or you are already there, it is critical to think about protecting your savings to make sure you have enough income throughout your retirement years. Financial professionals Joe Anderson and Alan Clopine guide you through ways to protect your savings and help you enjoy your retirement without worrying about money. […]

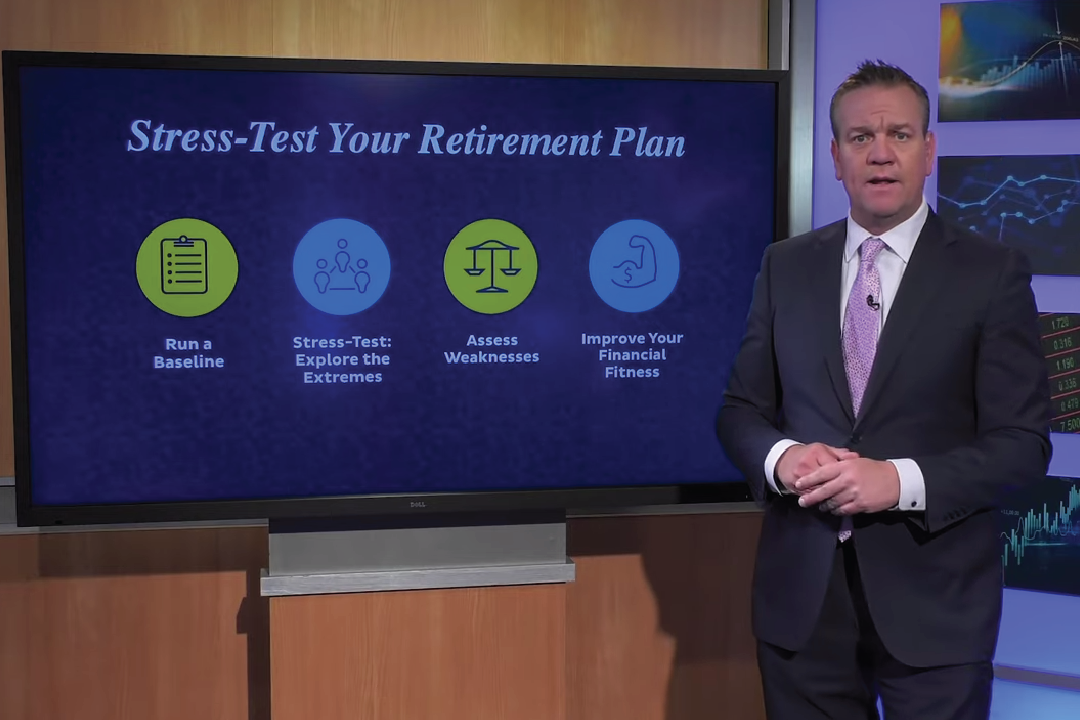

Do you know how to measure the strength of your retirement plan to see if it could weather the storm if there is a downturn in the economy? Financial professionals Joe Anderson and Alan Clopine show you how to stress-test your portfolio and give you ways to regain your financial fitness if your plan doesn’t […]

Large monetary returns are not the only thing some investors are looking for when they invest in the stock market. Some are looking to drive more money into companies that are environmentally friendly or that are working to have a positive social impact. The megatrend of developing portfolios with a purpose is given a range […]

Kyle Stacey, CFP® explains what it means to rebalance your investment portfolio and how portfolio rebalancing benefits your overall financial standing in the long run. Transcript: So today’s topic, I wanted to talk about portfolio rebalancing as well as how that affects your portfolio and how to keep the integrity of your portfolio. So when […]

Pure Financial Advisors’ Robert Canavan, CFP® explains the rationale behind deciding how many stocks you should own in your investment portfolio. As with so many financial questions, “it depends.” Transcript: Today, I’m going to answer an age-old question has dogged investors for decades. How many stocks should I have in my portfolio? The truth is, […]